Please download PDF from above for the following currencies.

Australian dollar // New Zealand dollar //Canadian dollar // Norwegian krone // Swedish Krona // Swiss franc // Czech koruna // Hungarian forint //Polish zloty // Romanian leu // Russian rouble // South African rand // Turkish lira // Indian rupee // Indonesian rupiah // Malaysian ringgit // Philippine peso //Singapore dollar // South Korean won // Taiwan dollar // Thai baht // Vietnamese dong // Argentine peso // Brazilian real // Chilean peso // Mexican peso // Crude oil // Saudi riyal // Egyptian pound

Monthly Foreign Exchange Outlook

DEREK HALPENNY

Head of Research, Global Markets EMEA and International Securities

Global Markets Research

Global Markets Division for EMEA

E: derek.halpenny@uk.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

E: lee.hardman@uk.mufg.jp

LIN LI

Head of Global Markets Research Asia

Global Markets Research

Global Markets Division for Asia

E: lin_li@hk.mufg.jp

MICHAEL WAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: michael_wan@sg.mufg.jp

LLOYD CHAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: lloyd_chan@sg.mufg.jp

EHSAN KHOMAN

Head of Commodities, ESG and Emerging Markets Research – EMEA

DIFC Branch – Dubai

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Analyst, ESG and Emerging Markets Research – EMEA

DIFC Branch – Dubai

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

February 2025

KEY EVENTS IN THE MONTH AHEAD

1) TRUMP & TARIFFS

The US dollar advanced modestly further in January following the near 8% gain in Q4 last year. The dollar did weaken during January as President Trump failed to announce any tariffs on inauguration. However, the strengthening of the dollar into month-end reflected the fact that the Trump administration was planning to implement a 25% trade tariff on Canada and Mexico and a 10% tariff on China. The moves in CAD and MXN, given the size of the tariffs, were modest highlighting a high degree of scepticism that these tariffs will be implemented. However, the confirmation of these tariffs being implemented came at the tail-end of trading on the final day of January and we have seen an understandable reaction at the start of trading in February with USD/CAD, USD/MXN up sharply, USD/CNY up more modestly and the dollar more generally stronger. We expect this initial move to extend and our US dollar forecasts suggest scope for gains through Q1 and into Q2 before some modest reversal by mid-year. The financial market reaction will be contained to some degree by expectations that the US, Canada and Mexico will reach a deal on border crossings of illegal immigrants and narcotics that sees this particular episode deescalate. But even if this is what happens, the actions point to tariff policies being heavily used with more announcements possibly focused on Europe set to follow. More China specific action will also likely follow. So the setting of FX forecasts based on US trade policies will likely require additional flexibility until we get greater clarity but further US dollar appreciation is likely.

2) BoE, RBA & RBNZ ALL TO CUT

This month there are three G10 central bank meetings scheduled – the BoE (6th); the RBA (18th); and the RBNZ (19th) and all three are expected to cut their policy rates. For the RBA it will be the first cut (-25bps) with easing inflationary pressures likely to be compelling enough for easing to begin. However, the RBA is unlikely to strongly signal scope for substantial cuts. For the RBNZ, a 50bp cut is priced but the RBNZ may well signal an intention to slow the pace going forward as the neutral rate comes into sight. The BoE’s MPC will likely cut by 25bps, which again is fully priced. The decision is unlikely to be unanimous with Catherine Mann set to dissent. We see scope for the MPC to signal increased confidence on receding inflation risks that will signal more cuts to come that may lower yields but with limited FX impact.

3) RISKS OF FURTHER TARIFFS INCREASE ON CHINA AND CHINA’S RETALIATIONS EXIST

The announcement of a 10% additional tariff on China’s goods (effective on February 4th) marks the beginning of the US-China trade war 2.0. With tariffs being an important tool of Trump’s foreign policy toolkit, further development is likely. The market is keen on outcomes of upcoming NPC in early March. We still expect the government to set a 5% growth target and a larger budget deficit for 2025. The US trade review due on April 1st likely matters.

Forecast rates against the US dollar - End-Q1 to End-Q4 2025

|

Spot close 31.01.25 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

JPY |

154.91 |

154.00 |

152.00 |

150.00 |

148.00 |

|

EUR |

1.0395 |

0.9900 |

1.0200 |

1.0500 |

1.0800 |

|

GBP |

1.2429 |

1.1960 |

1.2360 |

1.2800 |

1.3010 |

|

CNY |

7.2424 |

7.4000 |

7.5000 |

7.5000 |

7.4000 |

|

AUD |

0.6237 |

0.5900 |

0.6000 |

0.6200 |

0.6400 |

|

NZD |

0.5657 |

0.5350 |

0.5400 |

0.5600 |

0.5800 |

|

CAD |

1.4472 |

1.5200 |

1.4700 |

1.4500 |

1.4200 |

|

NOK |

11.293 |

12.020 |

11.863 |

11.429 |

11.019 |

|

SEK |

11.051 |

11.717 |

11.569 |

11.143 |

10.741 |

|

CHF |

0.9093 |

0.9390 |

0.9020 |

0.8860 |

0.8700 |

|

|

|

|

|

|

|

|

CZK |

24.217 |

25.560 |

24.900 |

24.290 |

23.700 |

|

HUF |

391.94 |

418.20 |

409.80 |

400.00 |

390.70 |

|

PLN |

4.0536 |

4.2930 |

4.1670 |

4.0950 |

4.0280 |

|

RON |

4.7855 |

5.0300 |

4.8920 |

4.7710 |

4.6670 |

|

RUB |

98.496 |

102.46 |

104.06 |

107.58 |

115.83 |

|

ZAR |

18.656 |

19.250 |

19.500 |

19.200 |

19.000 |

|

TRY |

35.848 |

37.250 |

39.250 |

41.500 |

43.500 |

|

|

|

|

|

|

|

|

INR |

86.613 |

86.800 |

87.500 |

88.000 |

88.500 |

|

IDR |

16300 |

16400 |

16450 |

16250 |

16200 |

|

MYR |

4.4550 |

4.5700 |

4.5500 |

4.5200 |

4.4800 |

|

PHP |

58.346 |

59.700 |

59.300 |

59.000 |

58.800 |

|

SGD |

1.3554 |

1.3800 |

1.3750 |

1.3700 |

1.3650 |

|

KRW |

1453.4 |

1475.0 |

1495.0 |

1495.0 |

1475.0 |

|

TWD |

32.664 |

33.300 |

33.600 |

33.500 |

33.400 |

|

THB |

33.567 |

35.300 |

36.000 |

35.700 |

35.500 |

|

VND |

25069 |

25800 |

25900 |

25800 |

25700 |

|

|

|

|

|

|

|

|

ARS |

1050.8 |

1075.0 |

1105.0 |

1140.0 |

1425.0 |

|

BRL |

5.8403 |

5.9500 |

6.1000 |

6.2000 |

6.3000 |

|

CLP |

981.60 |

1010.0 |

1030.0 |

1050.0 |

1040.0 |

|

MXN |

20.645 |

22.000 |

21.500 |

21.250 |

20.750 |

|

|

|||||

|

Brent |

76.78 |

73.00 |

69.00 |

74.00 |

77.00 |

|

NYMEX |

72.76 |

68.00 |

64.00 |

69.00 |

72.00 |

|

SAR |

3.7504 |

3.7500 |

3.7500 |

3.7500 |

3.7500 |

|

EGP |

50.202 |

49.700 |

49.300 |

49.100 |

48.700 |

Notes: All FX rates are expressed as units of currency per US dollar bar EUR, GBP, AUD and NZD which are expressed as dollars per unit of currency. Data source spot close; Bloomberg closing rate as of 4:30pm London time, except VND which is local onshore closing rate.

US dollar

|

Spot close 31.01.25 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

USD/JPY |

154.91 |

154.00 |

152.00 |

150.00 |

148.00 |

|

EUR/USD |

1.0395 |

0.9900 |

1.0200 |

1.0500 |

1.0800 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

145.00-160.00 |

143.00-158.00 |

141.00-156.00 |

139.00-154.00 |

|

|

EUR/USD |

0.9700-1.0600 |

0.9900-1.0700 |

1.0100-1.0900 |

1.0300-1.1100 |

MARKET UPDATE

In January the US dollar strengthened very marginally further against the euro in terms of London closing rates, from 1.0400 to 1.0395. However, the dollar weakened against the yen, from 156.78 to 154.91. The FOMC at its meeting in January left the range for the federal funds rate unchanged at 4.25% to 4.50%, following 100bps of cuts last year. The FOMC continued with its policy of reducing its securities holdings with QT ongoing but at a reduced rate of USD 60bn per month through a reduction in UST bond holdings from USD 60bn to USD 25bn. The pace of reduction in the holdings of MBS remains at up to USD 35bn per month.

OUTLOOK

The US dollar was basically around unchanged in January after a substantial gain in Q4 last year. The gain in January was modest and incorporated an initial correction weaker after President Trump’s inauguration was not followed immediately by trade tariff announcements. However, the confirmation of tariffs of 25% on Canada and Mexico and a 10% tariff on China will provide strong support for the dollar in general. Scepticism over these tariffs remaining in place for a long period may contain dollar buying to some degree but the actions opens scope for further strength in Q1. Numerous members of Trump’s economics team have indicated strong support for tariffs as has Trump himself and hence even if these specific tariffs are reversed at some stage, more actions are likely. Expect the trade tariff driver to be in constant flux with verbal threats, implementations, carve-outs, and reversals as Trump negotiates with key trading partners. Trade tariff uncertainties are likely to be higher and actions taken are likely to be more focused in H1 this year and hence the peak for the US dollar we maintain will be in H1 before the dollar corrects weaker in H2.

The FOMC policy meeting in January contained few surprises and Chair Powell’s communication was consistent with a wait-and-see mode to assess the impact of Trump’s trade tariffs. The statement dropped the reference to progress on lowering inflation suggesting some increased concerns over achieving the final leg of getting inflation back to the 2.0% target. Powell in the press conference was more balanced which may reflect genuine uncertainty over the impact of tariffs in the real economy. Transcripts released in January from FOMC meetings in 2019 revealed views within the FOMC of trade tariff policies then creating “headwinds” for the economy due to increased uncertainty. We believe this points to an increased chance of our view of more rate cuts coming in H2 materialising with a risk the Fed cuts more than what’s currently priced.

We continue to expect the dollar to strengthen further over the coming months. An aggressive approach to trade tariff policies seems likely and tariff actions will help strengthen the dollar before we see weaker economic growth allowing more Fed easing that leads to some reversal of US dollar strength in H2 2025.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

Policy Rate |

4.33% |

4.38% |

4.13% |

3.88% |

3.88% |

|

3-Month T-Bill |

4.28% |

4.26% |

4.01% |

3.80% |

3.83% |

|

10-Year Yield |

4.54% |

4.75% |

4.75% |

4.63% |

4.63% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

As we discussed in our Fed recap (see link) the FOMC left rates unchanged at the 4.25-4.50% range at their January meeting, the first skip after a series of rate cuts in late 2024. The overall sentiment from the press conference indicated the Fed is in no hurry to cut and will continue to be data dependent, signalling rates remain restrictive and well-calibrated. In terms of balance sheet policy, Powell said the most recent data suggests that reserves are still abundant and are roughly as high as when runoff began, providing no specific time period for any changes in QT policy. Since publishing our 2025 outlook (see link) , we have changed our Fed view (see link) to only expecting two cuts this year, matching the Fed’s projections. In our view, “not in a hurry” means the Fed will skip at least two meetings in a row, including March. May and June are on the table for rate adjustments, as Powell said policy is still in restrictive territory. As for the rates outlook, further out the curve long term rates have settled into range after initial concerns around the new administration’s policies, and we expect this trend to continue in the near term.

(George Goncalves)

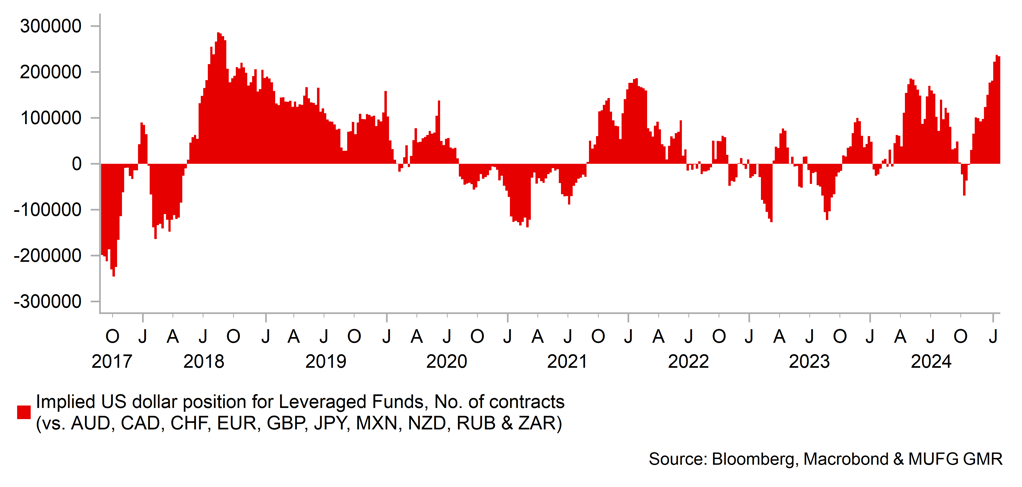

IMM POSITIONING FOR USD HELD BY LEVERAGED FUNDS

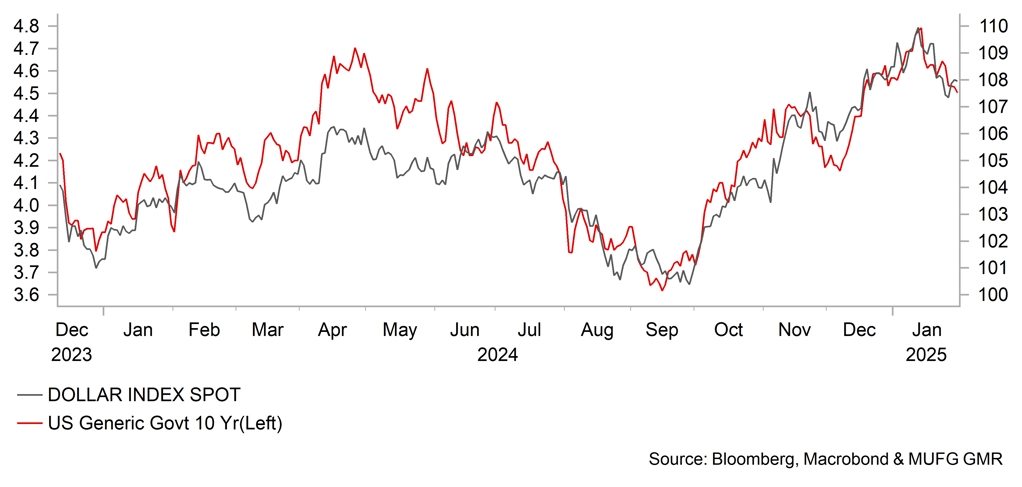

PERFORMANCE OF USD & LONG-TERM US YIELDS

Japanese yen

|

Spot close 31.01.25 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

USD/JPY |

154.91 |

154.00 |

152.00 |

150.00 |

148.00 |

|

EUR/JPY |

161.03 |

152.50 |

155.00 |

157.50 |

159.80 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

145.00-160.00 |

143.00-158.00 |

141.00-156.00 |

139.00-154.00 |

|

|

EUR/JPY |

151.00-166.00 |

152.00-167.00 |

153.00-168.00 |

154.00-169.00 |

MARKET UPDATE

In January the yen strengthened versus the US dollar in terms of London closing rates from 156.78 to 154.91. In addition, the yen strengthened versus the euro from 163.05 to 161.03. The BoJ at its meeting in January raised the key policy rate by 25bps to 0.50%, the first 25bp rate hike since before the GFC in 2007. The BoJ is also continuing with the policy of cutting JGB purchases that was announced last July that will see purchases cut by JPY 400bn per quarter that will result in the BoJ’s balance sheet being reduced by 7-8% by Q1 2026

OUTLOOK

The yen strengthened in January on two clear factors. Firstly, the Trump administration did not confirm tariff action until the final hours of trading in January so the dollar had generally been weaker. But this looks now like a false hope and we maintain the dollar will strengthen more broadly and vs CNY. Upward pressure on USD/CNY could fuel yen selling and we may now see some upside momentum although we suspect JPY will weaken by less than other G10 currencies especially if the Chinese authorities closely manage CNY. The second factor was the decision of the BoJ to hike its key policy rate by 25bps to 0.50% - the biggest rate increase since 2007. We continue to see much bigger downside risks for USD/JPY ahead. The global inflation surge, higher global yields and ultra-low rates in Japan were the primary factors that took USD/JPY from 115.00 in 2022 to the highs around 160.00. Those factors have clearly reversed and will help prompt JPY strength ahead.

The message from Governor Ueda at the policy meeting was clear – the BoJ’s inflation objective is increasingly being met – the updated projections showed forecasts at or over 2.0% in each of the three forecast periods with the core nationwide CPI for FY25 revised higher by 0.5ppt to 2.4%. The information from regional BoJ offices also confirmed another positive year for wage negotiations was likely. Following the BoJ rate hike Deputy Governor Himino gave a speech (30th Jan) and repeated many of the comments he made in a speech before the BoJ meeting. His message was also clear – that outside of times of crisis or period of deflation shocks, there is limited need for the policy rate in real terms to be negative. Himino argued that given Japan is now close to achieving price stability, it is less justified to need negative policy rates. Many assume the R* (based on BoJ references previously) to be in a range of -1.0% to +0.5% but Himino appears to believe the bottom of that range is too low. It suggests the nominal terminal rate could well be higher than 1.0% implying scope for notably more hikes than currently priced.

Forward OIS pricing implies a terminal rate of 1.00%. We see risks of the BoJ doing more than this and two further rate hikes this year (while not our formal view) is possible. The yen will continue to come under further upward pressure and we expect to see a steady orderly decline lower.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

Policy Rate |

0.50% |

0.50% |

0.50% |

0.75% |

0.75% |

|

3-Month Bill |

0.32% |

0.60% |

0.70% |

0.85% |

0.90% |

|

10-Year Yield |

1.25% |

1.20% |

1.25% |

1.40% |

1.45% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

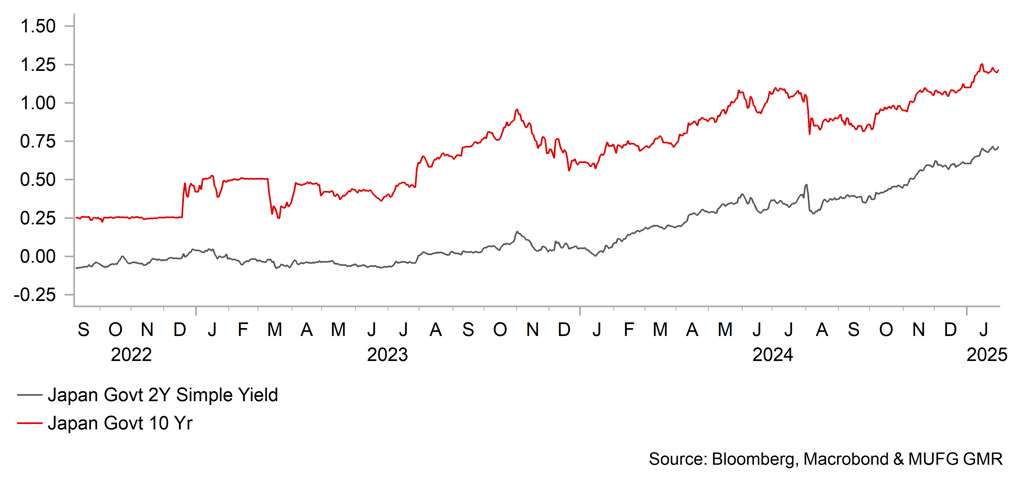

The 10-year JGB yield increased by 15bps in January to close at 1.25%. The 10-year yield closed at a high of 1.26% during January which was the highest close since April 2011 and underlines the shift in investor expectations over monetary policy and inflation in Japan. The move higher in yields was helped by the decision of the BoJ to hike by 25bps, the biggest hike since 2007. We believe the communications from Governor Ueda at the meeting, the inflation forecasts, and the comments in two speeches by Deputy Governor Himino all point to increased confidence of achieving the BoJ inflation goal. A positive round of ‘shunto’ wage negotiations and a relatively limited move for the yen could mean we get another hike sooner than anticipated – by July. If that happens, while not our view, we see an increased risk of another hike before year-end. The 10-year JGB yield would therefore also be higher while the trade tariff policies of President Trump could also influence JGB yields. Finally, cheaper hedging costs for Japanese investors could see increased outflows on a hedged basis at the expense of JGBs that would further support JGB yields.

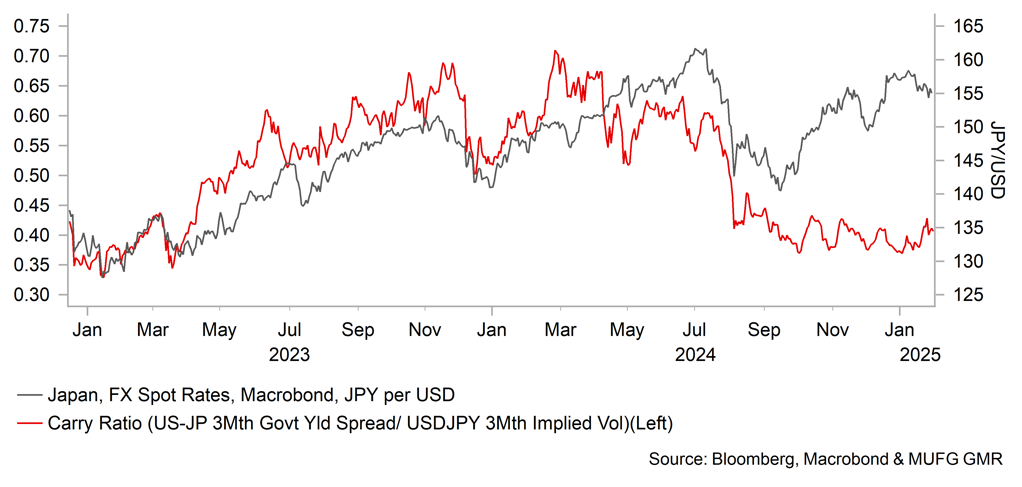

USD/JPY vs. CARRY ATTRACTIVENESS

2-YEAR & 10-YEAR JGB YIELDS

Euro

|

Spot close 31.01.25 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

EUR/USD |

1.0395 |

0.9900 |

1.0200 |

1.0500 |

1.0800 |

|

EUR/JPY |

161.03 |

152.50 |

155.00 |

157.50 |

159.80 |

|

Range |

Range |

Range |

Range |

||

|

EUR/USD |

0.9700-1.0600 |

0.9900-1.0700 |

1.0100-1.0900 |

1.0300-1.1100 |

|

|

EUR/JPY |

151.00-166.00 |

152.00-167.00 |

153.00-168.00 |

154.00-169.00 |

MARKET UPDATE

In January the euro weakened very slightly versus the US dollar in terms of London closing rates, moving from 1.0400 to 1.0395. The ECB at its meeting in January announced a 25bp cut to the key policy rate to 2.75% and followed 100bps of cuts last year. The ECB is running down APP securities and started PEPP run-off in July with about EUR 425bn of securities rolling off the balance sheet in 2025.

OUTLOOK

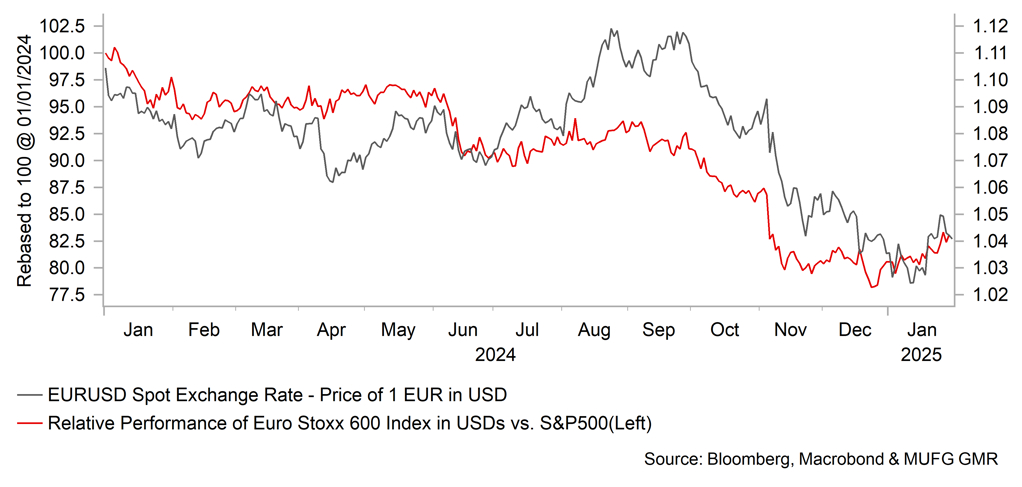

EUR/USD broke below the 1.0200-level in January for the first time since November 2022 but then rebounded in response to the lack of day one tariffs by President Trump after his inauguration. The confirmation of tariffs on Canada, Mexico and China, effective 4th February means we can now expect EUR/USD top drop further below the recent low (1.0178) quite quickly as investors reassess the US approach to tariff policies. Europe could well be the next target to be hit. The euro-zone economy as a whole exports an equivalent of a little under 20% of GDP although Germany’s export size is much larger. Euro-zone exports to the US alone are equivalent to close to 3.5% of GDP. A deterioration in global trade, if tariffs are now to be widely implemented, would certainly impact the euro-zone economy that is already weak. Q/Q real GDP in Q4 flat-lined in Q4, a sharp slowdown from the 0.4% growth rate in Q3. Escalating trade frictions would only reinforce the headwinds for the euro-zone economy. President Trump stated on 1st February when formally announcing his tariffs that something “very substantial” was forthcoming and this threat will likely see the FX markets pricing in imminent tariff action against the euro-zone.

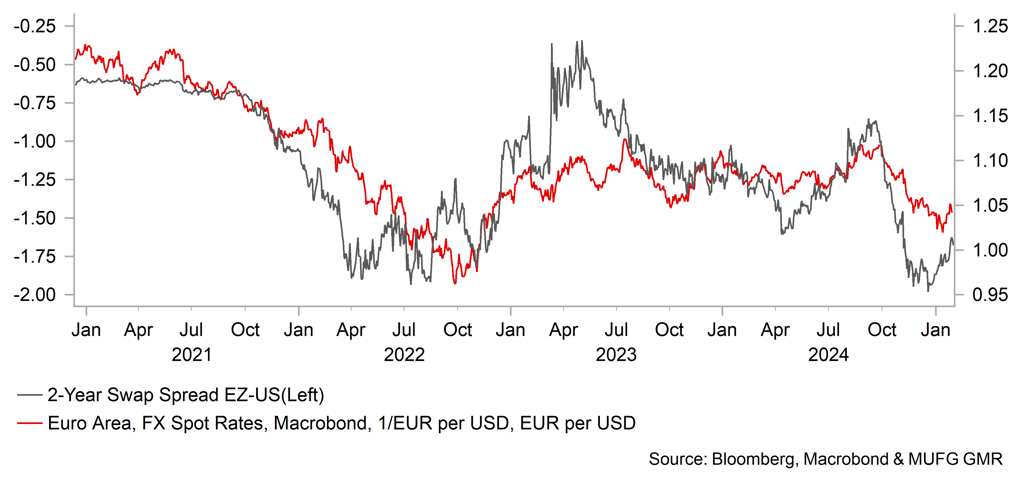

The ECB at its meeting in January emphasised downside risks to growth, citing “headwinds” that reinforced expectations of more cuts to come. President Lagarde described the idea of discussing a pause in the easing cycle as “premature” and cited the disinflation process as “well on track”. The ECB message was clear – we have more easing to do which we believe underlined the prospect of the ECB continuing to cut to the 2.00% level – a possible estimate for the neutral rate. The ECB staff are scheduled to release an update analysis of the estimate neutral rate on 7th February. There is certainly a risk that the ECB may need to take the policy rate back into accommodative territory. Action by the Trump administration to implement tariffs on the euro-zone would certainly see the rates market move to price that scenario in. The ECB meeting has already seen a move in that direction with the potential for more aggressive cuts being priced. Tariff risks will ensure the rate spread driver for FX keeps EUR/USD under downward pressure over the coming months.

The squeeze higher in EUR/USD in January on a lack of tariff action was brief and risks remain high of action to come that will keep EUR/USD under downward pressure. A 5% further drop is likely. Weaker growth in the US later this year and the prospect of renewed Fed easing should then allow for some EUR/USD recovery.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

Policy Rate |

2.75% |

2.50% |

2.00% |

2.00% |

2.00% |

|

3-Month Bill |

2.55% |

2.20% |

1.80% |

1.90% |

1.90% |

|

10-Year Yield |

2.46% |

2.30% |

2.10% |

2.20% |

2.30% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year bund yield increased in January, by 9bps to close at 2.46%. The move in German bunds was in contrast to the decline in yields in the US and the UK and may reflect in part the fact that through most of January the markets had pared back the extent of ECB easing. But a bigger factor was likely the easing of political risks in France that saw the OAT/Bund spread narrow. Progress was made on a budget for this year with President Macron also agreeing to a period for renegotiation of his flagship pension reform policies that has diminished the risk of another collapse of government. Still, the ECB meeting toward the end of January saw the pace of yield decline pick up as expectations of more substantial ECB rate cuts intensified. The weak GDP data and the prospect of trade tariffs from the US will keep substantial rate cut expectations intact. The release of an ECB staff analysis on the estimated neutral monetary policy rate will be important in shaping expectations of the potential terminal rate. We assume the updated estimate will be close to the 2.00% level assumed by the market. Bond supply concerns globally will continue to curtail the scope for yields to decline notably from current levels.

EUR/USD VS. SHORT-TERM YIELD SPREAD

EUR/USD VS. RELATIVE PERFORMANCE OF EZ OVER US EQUITIES

Pound Sterling

|

Spot close 31.01.25 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

EUR/GBP |

0.8364 |

0.8275 |

0.8250 |

0.8200 |

0.8300 |

|

GBP/USD |

1.2429 |

1.1960 |

1.2360 |

1.2800 |

1.3010 |

|

GBP/JPY |

192.54 |

184.20 |

187.90 |

192.10 |

192.60 |

|

Range |

Range |

Range |

Range |

||

|

GBP/USD |

1.1800-1.2700 |

1.2000-1.2900 |

1.2200-1.3200 |

1.2400-1.3400 |

MARKET UPDATE

In January the pound weakened further against the US dollar in terms of London closing rates from 1.2538 to 1.2429. In addition, the pound weakened against the euro from 0.8295 to 0.8364. The MPC did not meet in January and hence the key policy rate was unchanged at 4.75%. The MPC cut the key policy rate twice last year – by 25bps in August and November.

OUTLOOK

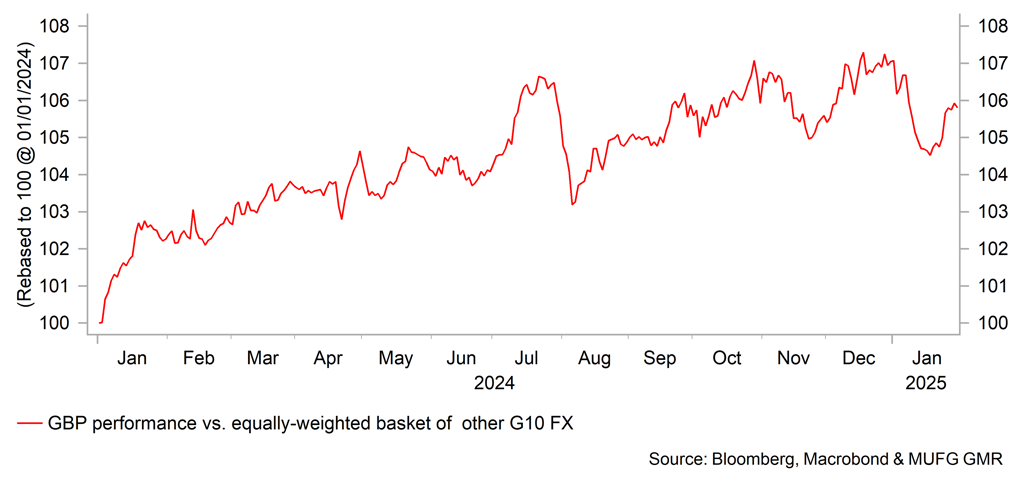

The pound was the 2nd worst performing G10 currency in January, weakening marginally versus the US dollar. There was certainly some increased focus on the UK fiscal outlook that prompted some underperformance of Gilts relative to US Treasuries that undermined GBP performance. The 10-year Gilt yield saw a 10bp larger move than Treasuries when yields peaked prior to Trump’s inauguration but that gap narrowed by month-end. We understand there are some increased risks for Gilts given the UK must compete with many other developed economies who are also running large deficits. But the UK government has made efforts to tackle this and OBR forecasts show the UK running a balanced primary budget followed by a surplus over the final three years of the forecast profile. The government have also strongly reiterated adherence to the self-imposed fiscal rules and are committed to government spending cuts if required. Increased Gilt supply due to the budget and QT from the BoE mean Gilt market risks are higher but we do not see a crisis-type scenario that would see GBP suffer notably.

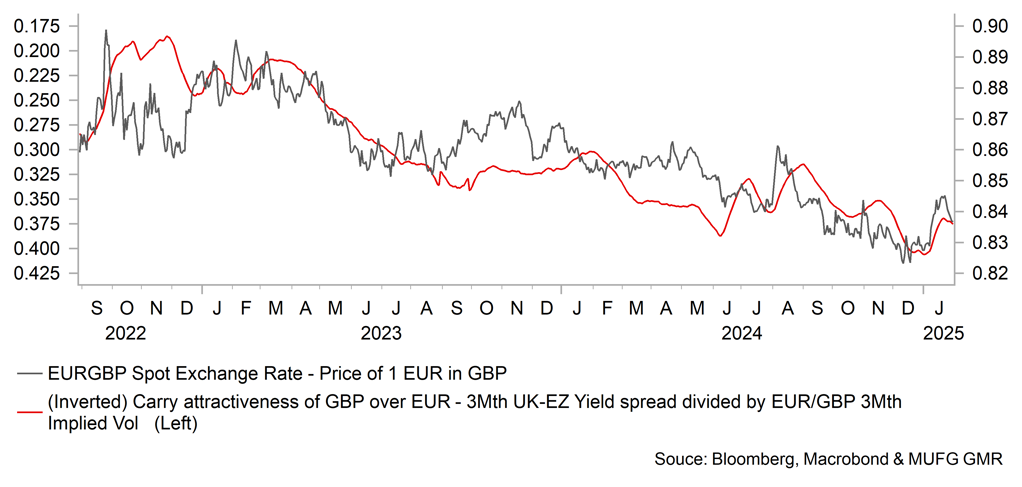

We believe investor concerns over rising Gilt yields should ease given the outlook for wages and inflation. Labour demand is clearly weakening. The PAYE (tax) measure of employment shows a near 80k drop in jobs in the last two months, and four declines in the last five months. The trend over the last 18mths is clearly trending weaker. The 3mth annual average weekly earnings level remains elevated at 5.6% but the jobs data will translate into slower wage growth ahead. The KPMG/REC jobs survey data shows a clear slowdown in full-time and part-time wage growth. Underlying inflation is slowing with service CPI falling sharply from 5.0% to 4.4% - the BoE was expecting 4.8%. We expect the BoE to cut by 25bps on 6th February and to cut by 100bps this year, more than the current market pricing of 70bps.

The BoE cutting rates more than expected in theory should mean GBP underperformance. But given the risks associated with the sustainability of fiscal policy, falling yields will ease those concerns and curtail negative implications for GBP. Given our bearish USD view in 2H (and the fiscal outlook is arguably worse in the US) we expect GBP/USD to advance with those gains similar to the gains in EUR/USD which would mean EUR/GBP moves are contained. Lower wages and inflation in the UK would clearly help provide some general positive sentiment. Trump’s comments on tariffs suggest the UK is not a target priority.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

Policy Rate |

4.75% |

4.50% |

4.00% |

3.75% |

3.75% |

|

3-Month Bill |

4.57% |

4.40% |

3.80% |

3.60% |

3.60% |

|

10-Year Yield |

4.54% |

4.40% |

4.10% |

4.20% |

4.30% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year Gilt yield ultimately fell in January, but by just 4bps to close at 4.53%. However, the drop by month-end did follow a substantial jump in yields with the 10-year surging to a closing high of 4.89%, reflecting a similar move in the US as the markets positioned for the inflationary risks related to trade tariffs. Those tariffs did not initially come and yields retraced lower. The move in Gilts prompted increased fears over another debt crisis similar to what happened under Liz Truss’ leadership in 2022. However, we see the backdrop now as quite different and more led by US developments. The fiscal outlook and the supply of Gilts do increase risks of bond market instability but ultimately we expect inflation risks in the UK to recede as labour demand has eased that will likely translate to weaker wage growth. The government have also stressed its commitment to their self-imposed fiscal rules. We continue to expect this better inflation backdrop this year to result in the BoE cutting rates more than expected – by 100bps, starting with a 25bp cut on 6th February. Another sell-off in the US Treasury bond market is the biggest risk for the Gilt market but assuming that is avoided we see the 10-year Gilt yield drifting lower this year.

PERFORMANCE OF GBP VS. OTHER G10 FX

EUR/GBP VS. CARRY ATTRACTIVENESS OF GBP

Chinese renminbi

|

Spot close 31.01.25 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

USD/CNY |

7.2424 |

7.4000 |

7.5000 |

7.5000 |

7.4000 |

|

USD/HKD |

7.7917 |

7.7900 |

7.7800 |

7.7700 |

7.7700 |

|

Range |

Range |

Range |

Range |

||

|

USD/CNY |

7.1000-7.6000 |

7.2000-7.7000 |

7.2000-7.7000 |

7.1000-7.6000 |

|

|

USD/HKD |

7.7600-7.8400 |

7.7500-7.8300 |

7.7500-7.8300 |

7.7400-7.8200 |

MARKET UPDATE

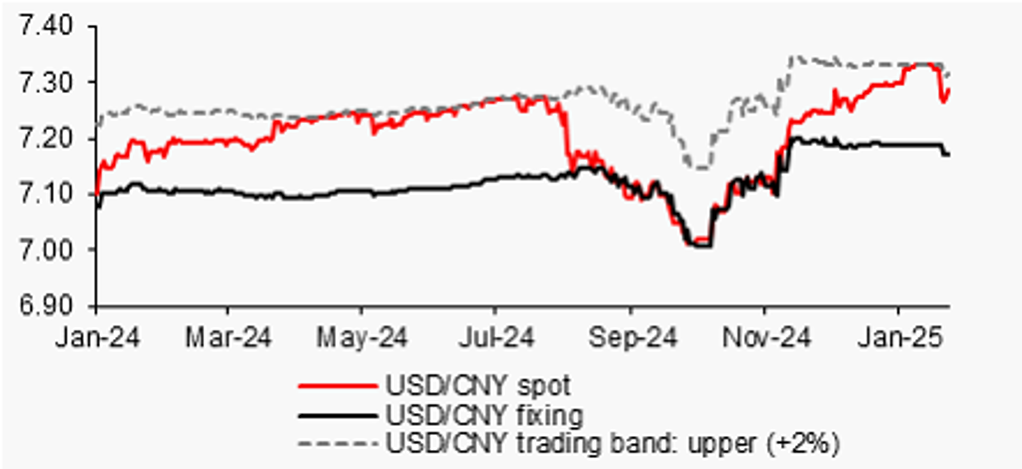

In January, USD/CNY moved from 7.2993 to 7.2424. On 20th January, the PBoC kept the 1Y and 5Y LPR at 3.10% and 3.60% respectively. The PBoC also kept 1Y MLF rate steady at 2%. On 14th January, PBoC deputy Governor Xuan Changneng said that the PBoC will adopt a mix of monetary policy tools, such as interest rates and RRR, to keep liquidity ample and maintain an accommodative social financing environment.

OUTLOOK

China’s 2024 growth target of 5% has been achieved thanks to a strong Q4 GDP print, but there are headwinds in 2025 to achieve a similar growth. It was a positive surprise that China’s GDP grew by 5.4%yoy in Q4. As with the previous quarter, net exports played a big role in driving growth with 2.5ppts contribution, accounting for 46% of Q4 growth. Domestic consumption remained weak, contributing merely 1.6ppts. Sequentially, the economy expanded by 1.6%qoq in Q4, compared to an upwardly revised 1.3%qoq growth in Q3. December’s economic data was rather mixed, with external demand from front-loading activities supporting better-than-expected IP/ exports growths and a slightly better retail sales growth, but slower than expected FAI and property investment YTD growths. December CPI and PPI inflations still indicated continued insufficient domestic demand. The rapid cooldown of activities in January, with composite PMI declining from 52.2 to 50.1, was more than a seasonal drop (due to Chinese New Year). The decline in PMI was broad-based across manufacturing (from 50.1 to 49.1), service (from 52.0 to 50.3) and construction (from 53.2 to 49.3) sectors.

We expect the government to deploy more resources to support growth and sentiment going forward. The expansion of large-scale equipment upgrades and consumer goods trade-in program announced on 8th January and the guidance for local mutual funds and insurers to boost A-share investment announced on 23rd January are among the first to come. For USD/CNY, a more benign approach last month by Trump on imposing tariffs on China post his inauguration, especially only mentioning an additional 10% tariff on China’s goods, once pushed the pair lower. With Trump signing the executive orders Saturday imposing tariffs on Canada, Mexico and China, likely push USD/CNY higher when China market reopens after Chinese New Year holidays. We think that US-China competition, American first, and reviving US manufacturing could mean further tariff increases on China goods, as the tariffs become a key tool of Trump’s foreign policies and a negotiation strategy. We still maintain a view of phased 20% increase of US tariffs on China goods. One key thing to watch is the trade practices review he ordered on his day one, which is set to be concluded by 1st April. China’s NPC meeting will commence early March, key economic targets including growth targets for 2025 and budget deficit ratio to GDP and etc., will be announced. Net, positive domestic developments are likely to be overwhelmed by tariffs and long-process of property sector recovery.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

LPR 1Y |

3.10% |

2.90% |

2.70% |

2.70% |

2.70% |

|

MLF 1Y |

2.00% |

1.70% |

1.50% |

1.50% |

1.50% |

|

7-Day Repo Rate |

1.50% |

1.30% |

1.10% |

1.10% |

1.10% |

|

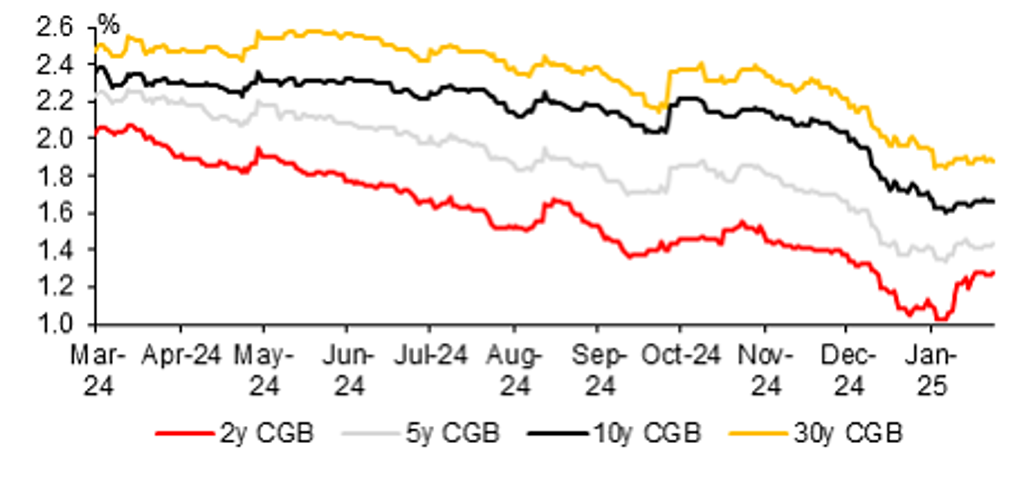

10-Year Yield |

1.63% |

1.60% |

1.60% |

1.70% |

1.80% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

One highlight of the month was the PBOC’s announcement of suspending the purchase of government bonds, citing insufficient bond supply to match the demand. While it helped support the 10y CGB yield to end the month roughly flat as prior month (-4bps to 1.63%), short-end CGB yields such as 2-year CGB was up by 18bps to 1.28%. It resulted in a flattening of the curve. The spike in short-end yields could be linked to market dialling back expectations of more aggressive rate cuts given the PBoC’s explicit intention to maintain a stable CNY. Looking ahead, we see some moderate upside risk for the 10yr CGB yield as the government would likely resume the operation and steepen the curve given the PBoC’s preference to maintain an upward sloping curve. With rate cuts well priced in, any positive surprise from the March NPC would pose upside risks for long-end yields. For the interest rates path, given the PBoC’s intention to ease the monetary stance, we think that recent CNY appreciation due to Trump’s softer tone on China may have provided a good opportunity for the PBoC to ease in February/Q1. For 2025, we still expect a total of 40bps of rate cuts on the 7-day reverse repo rate – 20bps each in Q1 and Q2.

USD/CNY SPOT FINALLY CAME OFF FROM THE UPPER END OF THE BAND

Source: : Bloomberg, MUFG GMR

2Y CGB YIELD SPIKE CAUSING THE CURVE TO FLATTEN

Source: : Bloomberg, MUFG GMR