Please download PDF from above for the following currencies.

Australian dollar // New Zealand dollar //Canadian dollar // Norwegian krone // Swedish Krona // Swiss franc // Czech koruna // Hungarian forint //Polish zloty // Romanian leu // Russian rouble // South African rand // Turkish lira // Indian rupee // Indonesian rupiah // Malaysian ringgit // Philippine peso //Singapore dollar // South Korean won // Taiwan dollar // Thai baht // Vietnamese dong // Argentine peso // Brazilian real // Chilean peso // Mexican peso // Crude oil // Saudi riyal // Egyptian pound

Monthly Foreign Exchange Outlook

DEREK HALPENNY

Head of Research, Global Markets EMEA and International Securities

Global Markets Research

Global Markets Division for EMEA

E: derek.halpenny@uk.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

E: lee.hardman@uk.mufg.jp

LIN LI

Head of Global Markets Research Asia

Global Markets Research

Global Markets Division for Asia

E: lin_li@hk.mufg.jp

KHANG SEK LEE

Associate

Global Markets Research

Global Markets Division for Asia

E: khangsek_lee@hk.mufg.jp

MICHAEL WAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: michael_wan@sg.mufg.jp

LLOYD CHAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: lloyd_chan@sg.mufg.jp

EHSAN KHOMAN

Head of Commodities, ESG and Emerging Markets Research – EMEA

DIFC Branch – Dubai

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Analyst, ESG and Emerging Markets Research – EMEA

DIFC Branch – Dubai

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

March 2025

KEY EVENTS IN THE MONTH AHEAD

1) TRUMP & TARIFFS & UKRAINE

The US dollar weakened modestly in February, on a DXY basis, by 0.7%. The decline was larger but the dollar strengthened into the end of the month as President Trump repeated his intention to implement the postponed 25% tariffs on Canada and Mexico and 10% on China. These tariffs are scheduled to go live on 4th March. One possible step to avert some of these tariffs going live is a commitment by Mexico to match US import tariffs on China. Scott Bessent has called for Canada to replicate Mexico’s proposal to create a “Fortress North America” against China. Our forecasts this month assume these tariffs will not be implemented. But this remains finely balanced and difficult to predict. If the tariffs do go live, we would then assume a sharp sell-off of CAD and MXN but would also expect the tariffs to not last long before a deal was done. China’s position could be different. Steel and aluminium tariffs of 25% are also scheduled to go live on 12th March. Most other planned tariffs are scheduled for April. The other focus in relation to Trump will be on the prospect of a ceasefire in Ukraine with energy prices and European equities indicating some market optimism on a deal being reached. The public spat in the White House between President Trump and Zelinskyy was bad but the momentum for a deal could persist and with more involvement from Europe, progress could still continue. EUR can derive modest support from this especially given the upward pressure on yields that could come from the need for increased defence spending in Europe.

2) EIGHT G10 CENTRAL BANKS TO MEET

March will be a busy month for G10 central bank meetings. The ECB is up first on 6th March followed by the BoC on 12th March. The FOMC and the BoJ meet on the same day (19th) with the Riskbank, the SNB and the BoE all meeting the following day (20th). Norges Bank then meets in the final week (27th). OIS market pricing implies a strong probability of a rate cut from the ECB, the SNB and the Norges Bank with 25bp cuts expected. For the BoC it is a 50-50 call on another cut while the FOMC, BoE and the Riksbank are all likely to keep their policy stances unchanged. Guidance from Fed Chair Powell will of course be key given there is building evidence of slowing economic growth while inflation on a PCE basis has been favourable. However, we doubt the FOMC will indicate any shift in thinking and will likely suggest scope for the pause in policy easing to continue.

3) ALL EYES ON THE OUTCOME OF MARCH NPC MEETING

While optimism around China tech has boosted sentiment, the positive spill-over to the broader China’s macro environment is still limited. The NPC meeting commencing on 5th March will be the key to watch in addressing the challenges that domestic economy is currently facing. We expect a growth target of around 5%, a budget deficit ratio of 4~4.8% to GDP, with an increase in ultra-long special CGBs and special LGBs. Measures on stimulating demand such as increasing the size of consumer goods program, increasing pension pay-outs or subsidies to special groups, as well as any hints on the “special campaign dedicated to stimulating consumption” flagged in December CEWC meeting, are worth paying attention to.

Forecast rates against the US dollar - End-Q1 to End-Q4 2025

|

Spot close 28.02.25 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

JPY |

150.27 |

152.00 |

152.00 |

150.00 |

148.00 |

|

EUR |

1.0400 |

1.0200 |

1.0200 |

1.0500 |

1.0800 |

|

GBP |

1.2583 |

1.2360 |

1.2440 |

1.2730 |

1.3010 |

|

CNY |

7.2778 |

7.4000 |

7.5000 |

7.5000 |

7.4000 |

|

AUD |

0.6208 |

0.6100 |

0.6000 |

0.6200 |

0.6400 |

|

NZD |

0.5598 |

0.5450 |

0.5400 |

0.5600 |

0.5800 |

|

CAD |

1.4429 |

1.4600 |

1.4700 |

1.4500 |

1.4200 |

|

NOK |

11.242 |

11.569 |

11.765 |

11.429 |

10.926 |

|

SEK |

10.731 |

11.078 |

11.275 |

10.952 |

10.556 |

|

CHF |

0.9016 |

0.9120 |

0.9020 |

0.8860 |

0.8700 |

|

|

|

|

|

|

|

|

CZK |

24.104 |

24.610 |

24.900 |

24.290 |

23.700 |

|

HUF |

384.69 |

392.20 |

397.10 |

390.50 |

384.30 |

|

PLN |

3.9952 |

4.0690 |

4.1180 |

4.0480 |

3.9350 |

|

RON |

4.7838 |

4.8820 |

4.8920 |

4.7710 |

4.6570 |

|

RUB |

89.225 |

91.180 |

94.150 |

97.800 |

101.35 |

|

ZAR |

18.588 |

18.900 |

19.300 |

19.200 |

19.000 |

|

TRY |

36.518 |

37.000 |

39.000 |

40.500 |

42.500 |

|

|

|

|

|

|

|

|

INR |

87.495 |

86.800 |

87.500 |

88.000 |

88.500 |

|

IDR |

16591 |

16560 |

16625 |

16410 |

16200 |

|

MYR |

4.4600 |

4.5000 |

4.5500 |

4.5200 |

4.4800 |

|

PHP |

57.973 |

59.000 |

58.800 |

58.500 |

58.200 |

|

SGD |

1.3492 |

1.3800 |

1.3750 |

1.3700 |

1.3650 |

|

KRW |

1459.9 |

1475.0 |

1495.0 |

1485.0 |

1480.0 |

|

TWD |

32.897 |

33.200 |

33.500 |

33.600 |

33.500 |

|

THB |

34.242 |

35.300 |

36.000 |

35.700 |

35.500 |

|

VND |

25554 |

25800 |

25900 |

25900 |

25900 |

|

|

|

|

|

|

|

|

ARS |

1061.8 |

1075.0 |

1105.0 |

1140.0 |

1425.0 |

|

BRL |

5.8726 |

5.9500 |

6.0500 |

6.1500 |

6.2500 |

|

CLP |

958.31 |

980.00 |

1000.0 |

1010.0 |

1000.0 |

|

MXN |

20.523 |

20.750 |

21.000 |

20.750 |

20.500 |

|

|

|||||

|

Brent |

73.15 |

73.00 |

69.00 |

74.00 |

77.00 |

|

NYMEX |

69.57 |

68.00 |

64.00 |

69.00 |

72.00 |

|

SAR |

3.7504 |

3.7500 |

3.7500 |

3.7500 |

3.7500 |

|

EGP |

50.615 |

49.700 |

49.300 |

49.100 |

48.700 |

Notes: All FX rates are expressed as units of currency per US dollar bar EUR, GBP, AUD and NZD which are expressed as dollars per unit of currency. Data source spot close; Bloomberg closing rate as of 4:30pm London time, except VND which is local onshore closing rate.

US dollar

|

Spot close 28.02.25 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

USD/JPY |

150.27 |

152.00 |

152.00 |

150.00 |

148.00 |

|

EUR/USD |

1.0400 |

1.0200 |

1.0200 |

1.0500 |

1.0800 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

145.00-156.00 |

143.00-158.00 |

141.00-156.00 |

139.00-154.00 |

|

|

EUR/USD |

0.9900-1.0700 |

1.0000-1.0800 |

1.0100-1.0900 |

1.0300-1.1100 |

MARKET UPDATE

In February the US dollar weakened very marginally against the euro in terms of London closing rates, from 1.0395 to 1.0400. The dollar weakened more notably against the yen, from 154.91 to 150.27. The FOMC did not meet in February and hence the range for the federal funds rate was unchanged at 4.25% to 4.50%, following 100bps of cuts last year. The FOMC continued with its policy of reducing its securities holdings with QT ongoing but at a reduced rate of USD 60bn per month through a reduction in UST bond holdings from USD 60bn to USD 25bn. The pace of reduction in the holdings of MBS remains at up to USD 35bn per month.

OUTLOOK

A more pragmatic approach to the implementation of trade tariffs by the Trump administration continued in February with the dollar weakening broadly after the postponement of a 25% tariff on Canada and Mexico imports and a more modest 10% tariff being activated on China imports. The threats of more tariffs kept coming however and that has helped to curtail the sell-off of the dollar. Is Trump all talk and no action? Or are the financial markets becoming complacent to the risks? We certainly don’t believe Trump is all talk and do expect tariffs to be activated. This will unlikely be all of what has been communicated and perhaps China and the EU will end up being the primary targets in tariffs going forward. Even then, for the EU, the tariffs could well be sector-specific with the auto sector and possibly agricultural goods in focus. We have lowered our Q1 US dollar forecasts to reflect the changing timetable of tariff announcements with April looking like a more plausible timeframe for a pick-up in tariff action. Assuming some but not all suggested tariffs are implemented we assume the dollar strengthens and remains strong in Q1 and Q2.

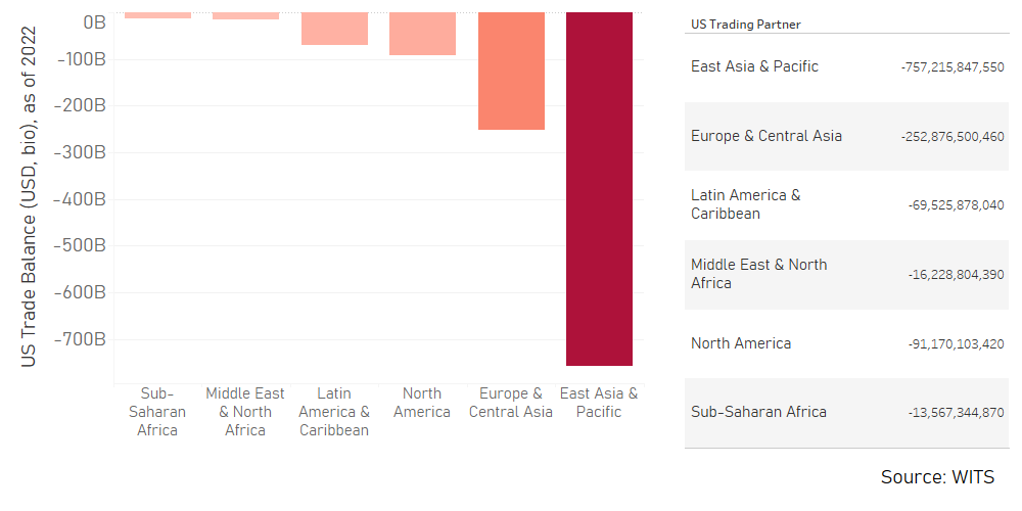

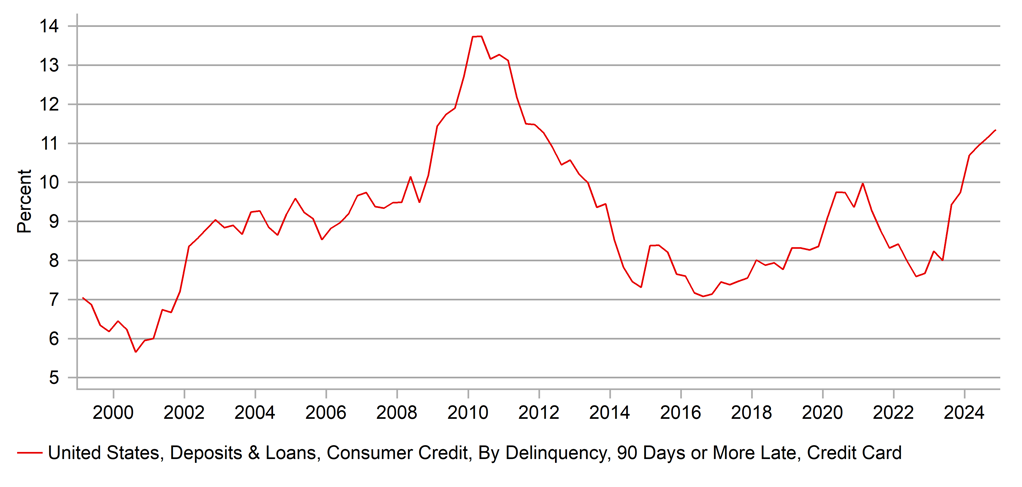

The impact on the dollar from the threat of tariffs is being diluted by the signs of slowing US economic growth. Retail sales in January, consumer confidence and the ISM and PMI services indices all point to less impetus from consumer spending going forward. Data already points to a sharp slowdown in GDP growth in Q1 after the 4.2% consumer spending Q/Q SAAR in Q4. US households look to be turning more negative on the labour market as well perhaps given the widespread reporting of Federal government job losses ahead under the actions from DOGE. The new Philly Fed employment survey released in February revealed rising concerns over being fired from employment. With the Quit rate also indicating declining confidence in the labour market we may well start to see Trump-related policy uncertainties undermining consumer confidence further especially with covid savings largely depleted. Credit card delinquency rates (over 11%) are back at GFC levels.

Given these circumstances, we see near-term dollar strength being relatively modest followed by a more sustained turn weaker. By summertime we see scope for the FOMC to commence monetary easing again with two, and possibly three rate cuts feasible in 2H, reinforcing the prospect of a period of dollar depreciation in 2H 2025.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

Policy Rate |

4.33% |

4.38% |

4.13% |

4.13% |

3.88% |

|

3-Month T-Bill |

4.29% |

4.25% |

4.00% |

4.00% |

3.75% |

|

10-Year Yield |

4.21% |

4.50% |

4.25% |

4.50% |

4.50% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

We recently updated our Fed funds forecast expectations, keeping the 2 cuts but spreading apart the timing of each cut. We still expect the Fed to cut rates in June and then the second cut in December (previously we had back to back cuts in June and September). In many regards the Fed is not in the driver seat for the rates market, its all about fiscal policy. Given our expectation for two Fed cuts this year, we still expect the terminal rate for 2025 to break under 4%. We think that long-term rates has probably made the high for the year at 4.79% last seen in January. That said the market has quickly shifted from inflation concerns to fearing growth expectaitons too quickly. We still expect rates to remain in the range we forecasted in our 2025 outlook of 4-4.75% for the 10-year Treasury yield. Overall we expect most of the curve to remain above 4% in 2025 (the front-end like the 2yr has recently traded under 4% into February month-end). Uncertainty remains high around the various budget bills which if passed without protest could see rates sell-off from the local lows now seen in markets. Meanwhile the risk-reward setup is not great and we recommend to buy dips in the front-end and hold steepeners.

(George Goncalves)

US TRADE BALANCE VS. REGIONS (USD) AS OF 2022

US CONSUMER DELINQUENCY RATES

Source: Bloomberg, Macrobond

Japanese yen

|

Spot close 28.02.25 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

USD/JPY |

150.27 |

152.00 |

152.00 |

150.00 |

148.00 |

|

EUR/JPY |

156.28 |

155.00 |

155.00 |

157.50 |

159.80 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

145.00-156.00 |

143.00-158.00 |

141.00-156.00 |

139.00-154.00 |

|

|

EUR/JPY |

150.00-160.00 |

151.00-162.00 |

152.00-164.00 |

153.00-165.00 |

MARKET UPDATE

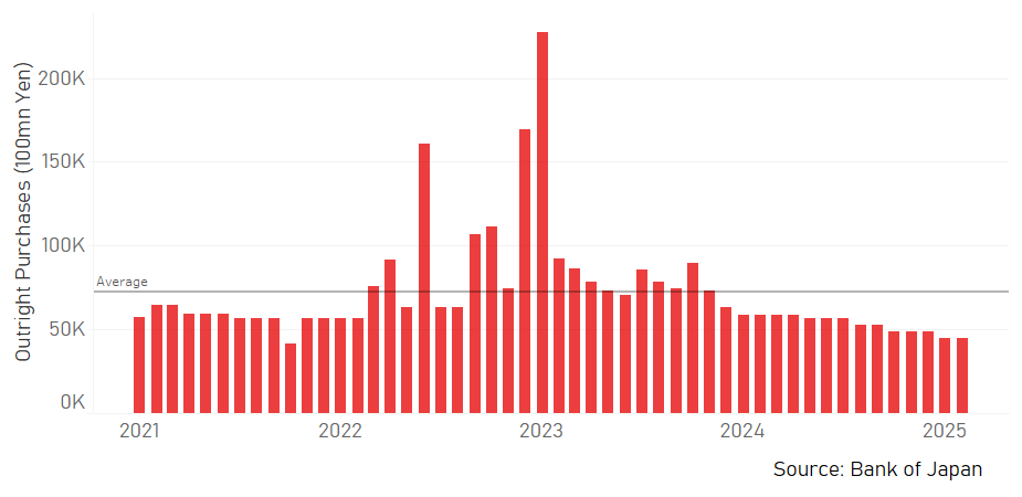

In February the yen strengthened versus the US dollar in terms of London closing rates from 154.91 to 150.27. In addition, the yen strengthened versus the euro from 161.03 to 156.28. The BoJ did not meet in February and hence the key policy rate was unchanged at 0.50%, following the 25bp hike in January, the first 25bp rate hike since before the GFC in 2007. The BoJ is also continuing with the policy of cutting JGB purchases that was announced last July that will see purchases cut by JPY 400bn per quarter that will result in the BoJ’s balance sheet being reduced by 7-8% by Q1 2026.

OUTLOOK

The yen was the second best performing G10 currency in February and is the top performing on a year-to-date basis. The dollar has weakened more broadly due to signs of a slowdown in the US and a more pragmatic approach to trade tariffs. The outperformance of the yen likely reflects positioning to some degree given the speculative market had been short JPY due to Trump economic policy expectations. The drop in UST bond yields has seen those positions squeezed. In addition, the communications from the BoJ have been more hawkish than expected given the BoJ just raised rates in January. Last year, rate hikes were followed by more cautious rhetoric to ensure financial market stability. A hawkish speech by policy board member Hajime Takata reinforced the move higher in rates suggesting a faster pace of rate hikes could be required. The OIS market implied investors readjusted their estimate of the terminal rate in Japan by about 15bps in February which prompted a big move in JGB yields. Only after comments from BoJ Governor Ueda that it would act if JGB yields move too abruptly did yields retrace lower and stabilise. The BoJ nominal effective exchange rate level of the yen reached the strongest level since October of last year.

We see risks of the BoJ hiking twice more this year, which would certainly provide further support for JPY. OIS market pricing implies a 50/50 chance of that. If the US economy holds up and there is no large asset price correction, two hikes is more plausible. Aggressive tariff actions and increased market turmoil, and then the BoJ may be more reserved. On the face of it Trump tariff action is USD bullish and points to higher USD/JPY. However, there is a slightly different risk specifically for JPY. Trump has cited currency misalignment as a justification for tariffs. If this became a factor for JPY then it could turn to a bullish JPY driver. USD/JPY is still over 45% higher from when Trump left office and complaints about excessive JPY weakness from Washington could see JPY outperform in circumstances of wider USD gains.

Short-term yield spread compression means hedging costs are becoming cheaper for Japan’s USD-based securities investments and increased JPY buying should gradually pick up while appetite for speculative JPY selling should gradually diminish allowing for a steady grind lower in USD/JPY.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

Policy Rate |

0.50% |

0.50% |

0.50% |

0.75% |

0.75% |

|

3-Month Bill |

0.33% |

0.40% |

0.50% |

0.70% |

0.80% |

|

10-Year Yield |

1.38% |

1.30% |

1.40% |

1.50% |

1.60% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year JGB yield increased by a further 13bps in February to close at 1.38%. Since the beginning of the year, the 10-year yield is now 28bps higher and during February the 10-year yield hit an intra-day high of 1.47%, the highest level since November 2009. There was less of a move at the very front-end of the yield curve and having lifted rates in January, there is little expectation of another rate hike over the coming two meetings. By year-end the market pricing implies a 50% probability of a second rate hike, only marginally higher than at the start of February. However, the pricing for the implied terminal rate has jumped by close to 15bps. The rhetoric from BoJ officials suggest a rethink on the terminal rate with BoJ policy board member Takata indicating uncertainty over where the neutral rate is while also expressing hawkish views. Food inflation remains very elevated and renewed energy subsidies are depressing energy inflation which suggests inflation remains robust. Wage growth is set for another year of strong growth based on the expected ‘shunto’ wage negotiations. We have raised our JGB yield forecasts given the year-to-date gains.

SHORT & LONG-TERM YIELD SPREADS

Source: Bloomberg, Macrobond

BOJ’S OUTRIGHT JGB PURCHASES

Euro

|

Spot close 28.02.25 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

EUR/USD |

1.0400 |

1.0200 |

1.0200 |

1.0500 |

1.0800 |

|

EUR/JPY |

156.28 |

155.00 |

155.00 |

157.50 |

159.80 |

|

Range |

Range |

Range |

Range |

||

|

EUR/USD |

0.9900-1.0700 |

1.0000-1.0800 |

1.0100-1.0900 |

1.0300-1.1100 |

|

|

EUR/JPY |

150.00-160.00 |

151.00-162.00 |

152.00-164.00 |

153.00-165.00 |

MARKET UPDATE

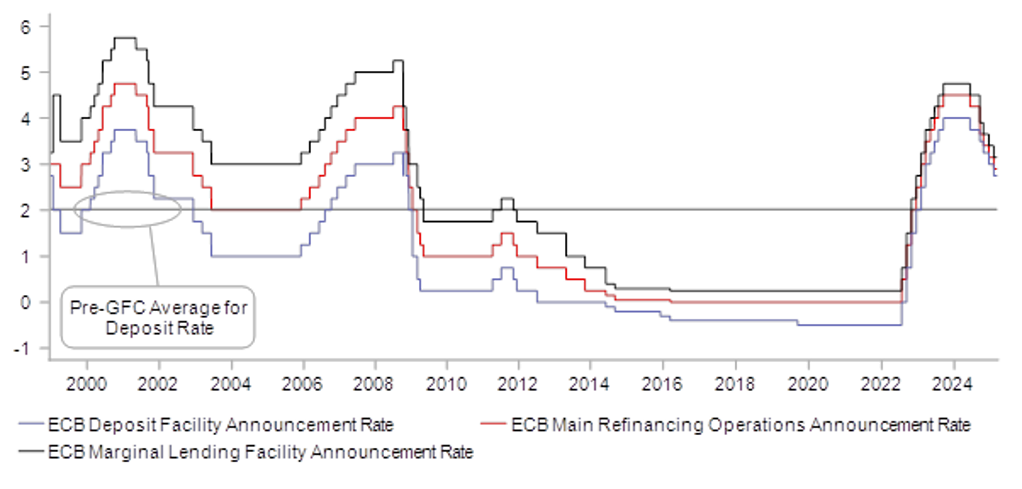

In February the euro was close to unchanged versus the US dollar in terms of London closing rates, moving from 1.0395 to 1.0400. The ECB did not meet in February and hence the key policy rate was unchanged at 2.75%, following the 25bp cut in January which followed 100bps of cuts last year. The ECB is running down APP securities and started PEPP run-off in July last year with about EUR 425bn of securities estimated to roll off the balance sheet in 2025.

OUTLOOK

The euro was close to unchanged in February underlining more solid support than expected given the backdrop of trade tariff threats from President Trump. Market participants appear more relieved of Trump’s initial more pragmatic approach to tariffs given only a 10% tariff on China has been implemented. But the downside risks have not gone away. Trump has repeatedly cited his plans to implement tariffs complaining of the barriers to the EU market for the US auto and agricultural sectors. Reciprocal tariffs, now scheduled for 2nd April could therefore see the EU auto sector get hit with notable increases in tariffs on those goods imported by the US. As a result, we have raised our end-Q1 EUR/USD forecast from 0.9900 to reflect the fact that tariff action now looks more like a Q2 rather than Q1 scenario. But we are no longer showing EUR/USD forecasts below parity given our view that by end-Q2 the US economic slowdown will be more apparent and by then the Fed will have possibly cut the fed funds rate again.

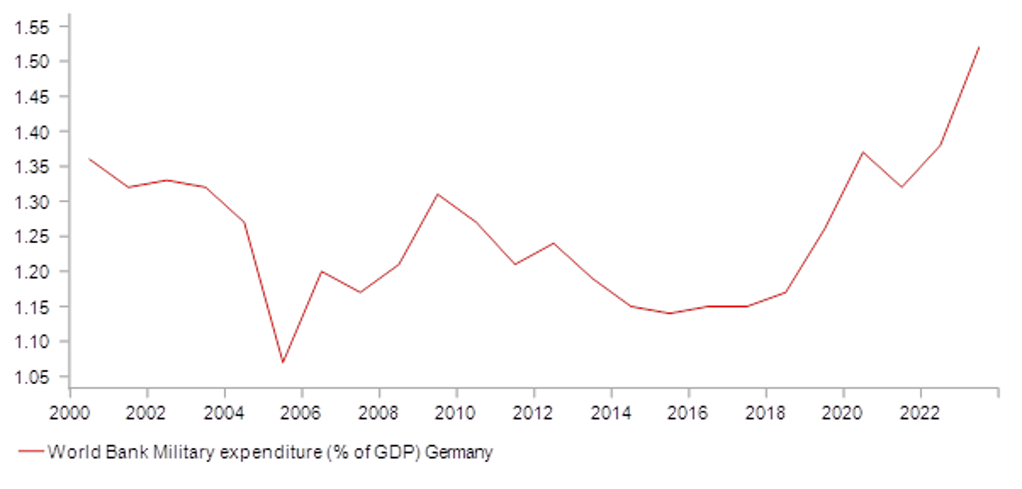

Other EUR-specific factors could also play a role in supporting the euro sooner than we anticipated. The speed in which political momentum is moving toward a possible ceasefire and peace-deal in Ukraine is certainly a positive. TTF natural gas prices fell 17% in February and Brent crude oil was down 5% but down a larger 11% from the high in January. Of course any deal needs to be credible and lasting but this factor can play a supportive role. Linked to that is the increased pressure on Europe to play a bigger role in peacekeeping and effectively containing Russia going forward. Countries are under pressure to notably increase defence spending. Moving NATO EU members defence spending from 2% to 3% would equate to nearly EUR 200bn of additional financing that will add support to long-term yields. Finally, the German election result will likely result in a leaner two-party coalition between the CDU/CSU and the SPD. This coalition is likely to try and negotiate a deal to alter the constitutional debt brake with Die Linke or seek an emergency suspension which only requires a simple majority. New economic policies will at least be more pro-growth, pro-business that should help improve the economic outlook in Germany.

Hence, the downside risks to EUR/USD have certainly diminished but have not gone away. Predicting Trump’s actions is fraught with risks but as the year unfolds we believe cyclical forces will come to the fore and the US economy will slow while the euro-zone economy can stabilise. EUR/USD can then gradually recover.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

Policy Rate |

2.75% |

2.50% |

2.25% |

2.00% |

2.00% |

|

3-Month Bill |

2.40% |

2.20% |

2.05% |

1.90% |

1.90% |

|

10-Year Yield |

2.41% |

2.30% |

2.10% |

2.20% |

2.30% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year bund yield declined in February, by 5bps to close at 2.41%. The move lower in German bund yields in the second half of the month reflected the decline in UST bond yields as US growth slowed and US equity markets came under downward pressure. Overall yields in the US declined by more and the US spread over Bunds narrowed with some of the factors mentioned above possibly curtailing the downside pressure on yields (defence spending expectations & German election consequences). But the rhetoric from the ECB may also have played a role. We have certainly seen an uptick in comments from those on the hawkish side of the Governing Council suggesting greater caution is warranted and that ECB rate cuts should not be viewed as on “autopilot” with greater care needed as we approach the range for the neutral rate (mid-point still put at around 2%). We still expect the ECB policy rate to fall to 2.00% by year-end but see an increased risk that the ECB will skip some meetings on the path to that level. So following a rate cut in March, the ECB will skip April and cut in June and skip July and cut in September thus extending further out the time taken to get to the 2.00% year-end level.

ECB KEY POLICY RATES

Source: Bloomberg, Macrobond

MILITARY EXPENDITURE (% OF GDP) FOR GERMANY

Source: Bloomberg, Macrobond

Pound Sterling

|

Spot close 28.02.25 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

EUR/GBP |

0.8265 |

0.8250 |

0.8200 |

0.8250 |

0.8300 |

|

GBP/USD |

1.2583 |

1.2360 |

1.2440 |

1.2730 |

1.3010 |

|

GBP/JPY |

189.08 |

187.90 |

189.10 |

190.90 |

192.60 |

|

Range |

Range |

Range |

Range |

||

|

GBP/USD |

1.2200-1.3000 |

1.2100-1.3000 |

1.2200-1.3200 |

1.2400-1.3400 |

MARKET UPDATE

In February the pound strengthened against the US dollar in terms of London closing rates from 1.2429 to 1.2583. In addition, the pound strengthened against the euro from 0.8364 to 0.8265. The MPC at its meeting in February cut the key policy rate by 25bps to 4.50%, the third 25bp cut in this easing cycle. The MPC also cut the key policy in August and November last year.

OUTLOOK

The pound was the 3rd best performing G10 currency in February, advancing against both the dollar and the euro. The specific outperformance periods in February centred around the middle of the month when inflation and employment data helped fuel gains and then closer to month-end when PM Starmer visited Washington to meet with President Trump. The meeting appeared to go well with Trump suggesting the US and UK are planning to engage in negotiations on a trade deal that could therefore mean the UK could escape the widespread plans for tariffs. The cordial reception was helped by the announcement of increased defence spending with the UK cutting its foreign aid budget by 0.2% of GDP to finance the increase. King Charles extended a second state-visit to President Trump which further lifted investor optimism that the UK can avoid the worst of planned tariff action.

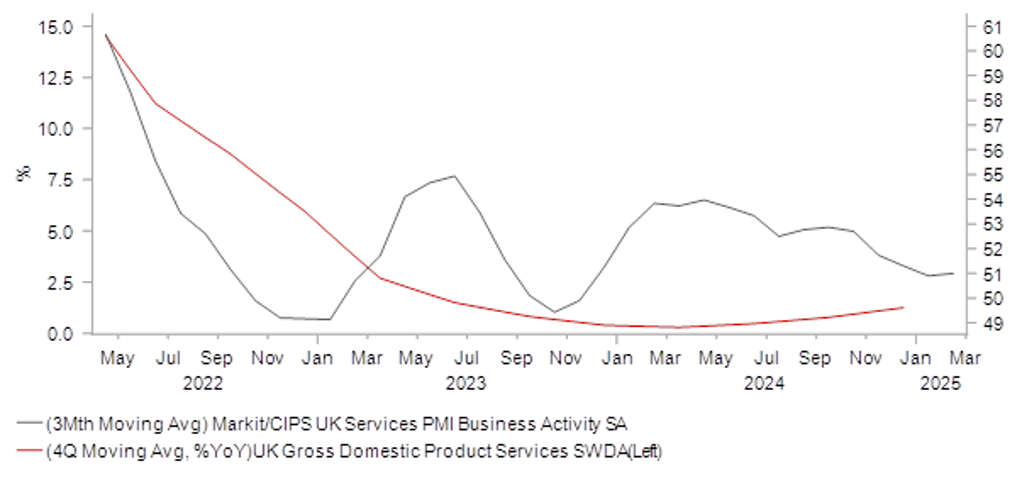

The pound hit its weakest closing level of the month versus the euro on the day of the BoE meeting (6th Feb) with the initial reaction fuelled by the surprise vote split of 7-2 with two MPC members voting for a 50bp cut, including the previously most hawkish MPC member, Catherine Mann. For the majority though the view was that signs of gradual disinflation pressures continued to be evident justifying continued gradual monetary easing. The GDP forecast for 2025 was halved to 0.75% and the unemployment rate was revised higher by 0.4ppts to 4.5% by Q4 this year. However, inflation was expected to rise to a higher 3.7% level this year and remain above the 2.0% target for longer. This meant the MPC would take a “gradual and careful approach” to further monetary easing. The BoE expected GDP to contract 0.1% in Q4 but in fact expanded 0.1% and then the employment data and the CPI data released after the meeting were stronger. The data underlined the likelihood of a continued gradual approach to monetary easing rather than a pick-up in the pace of easing that was initially anticipated based on the surprise 7-2 vote.

We had previously assumed back-to-back rate cuts in May and June by the BoE but the data in February and the added reference to the MPC needing to be “careful” in removing monetary accommodation has led us to assume a slower pace of monetary easing this year. We expect the next rate cut to be in May and then August and November, given over the coming months we are likely to see inflation moving higher curtailing scope for more aggressive action. We also slowed the pace of cuts from the ECB so do not expect much movement in EUR/GBP with GBP/USD set to rise in line with the broader depreciation of the US dollar during 2H 2025.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

Policy Rate |

4.50% |

4.50% |

4.25% |

4.00% |

3.75% |

|

3-Month Bill |

4.51% |

4.40% |

4.15% |

3.85% |

3.65% |

|

10-Year Yield |

4.48% |

4.40% |

4.20% |

4.20% |

4.30% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

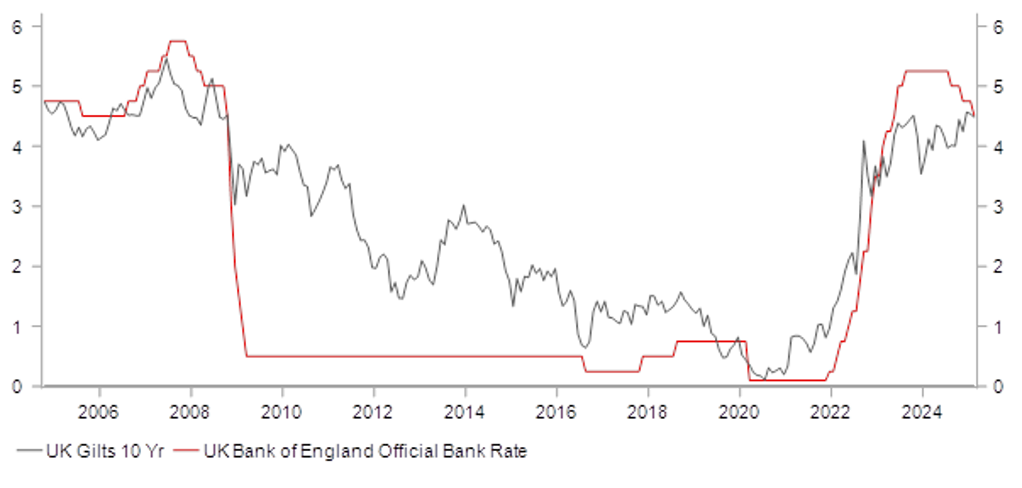

The 10-year Gilt yield fell in February, by 6bps to close at 4.48%. The yield did move higher during the middle of the month as the stronger UK data pushed yields higher but the momentum faded with UST bond yields falling with equity markets correcting lower. The inflation backdrop in the UK continues to be uncertain with near-term risks to the upside as utility prices move higher. Wage growth also remains elevated and has not seen the slowdown that other countries have seen. Average weekly earnings on a 3mth YoY basis jumped from 5.5% to 6.0% in December, the highest rate since November 2023. Annual services inflation also rebounded from 4.4% in 5.0%. The data provides justification for the BoE’s caution. Deputy Governor Ramsden is one key MPC member whose views appear to have shifted more hawkish. He no longer sees inflation risks being to the downside as evidence points to wage growth (BoE Agents survey) being stronger than anticipated. Still, we expect the inflation backdrop to justify a gradual quarterly pace of 25bp cuts that if delivered likely means the 10-year Gilt yield will gradually decline as well. With UST bond yields unlikely to hit fresh highs and uncertainty set to remain elevated it should dampen long-term Gilt yields.

BOE POLICY RATE VS UK GILTS 10YR YIELD

Source: Bloomberg, Macrobond

UK PMI VS. GDP YOY, %

Source: Bloomberg, Macrobond

Chinese renminbi

|

Spot close 28.02.25 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

USD/CNY |

7.2778 |

7.4000 |

7.5000 |

7.5000 |

7.4000 |

|

USD/HKD |

7.7773 |

7.7900 |

7.7800 |

7.7700 |

7.7700 |

|

Range |

Range |

Range |

Range |

||

|

USD/CNY |

7.1000-7.4500 |

7.2000-7.7000 |

7.2000-7.7000 |

7.1000-7.6000 |

|

|

USD/HKD |

7.7600-7.8400 |

7.7500-7.8300 |

7.7500-7.8300 |

7.7400-7.8200 |

MARKET UPDATE

In February, USD/CNY moved from 7.2424 to 7.2778. On 20th February, the PBoC kept the 1Y and 5Y LPR at 3.10% and 3.60% respectively. The PBoC also kept the 1Y MLF rate unchanged at 2%. On 16th February, Governor Pan reiterated that the government would adopt a proactive fiscal policy and an accommodative monetary policy, and strengthen counter-cyclical policy adjustments at the Third China-Gulf Cooperation Council (GCC) Central Bank Governors’ meeting in Al Ula, Saudi Arabia.

OUTLOOK

Two key highlights in February for China were the optimism around China tech and the US tariff threat towards China. For China tech, China’s top leaders led by President Xi sent out a strong positive signal to the prominent tech entrepreneurs at a private sector symposium held on 17th February. President Xi called it a “prime time for private enterprises and entrepreneurs to give full play to their capabilities”. The government recognized the private sector’s role in driving tech innovation, creating jobs and supporting sentiment, and vowed to help the private sector to resolve some of the difficulties such as their ability to obtain affordable financing, which the PBoC followed up on 20th February pledging to enhance the financing channel (stock, bond and loan) for the private enterprises, among others. We see the supportive policy stance beyond symbolic, but this is unlikely to revert the downward pressure on the overall macro environment, with insufficient domestic demand being the top concern along with the risk of additional tariffs. Trump’s sudden announcement of imposing an additional 10% tariff on China’s goods on 27th February (to be implemented on 4th March), highlighted the uncertainty over Trump’s trade policy. It seems likely that the US wants to force China’s hand to negotiate over a new trade deal, an idea floated by Trump on 20th February. In regard to key data releases, we saw a pick-up in consumer inflation to 0.5%yoy in January from a recent low of 0.1%yoy the previous month, but it was likely caused by the seasonal impact from the Chinese New Year holiday.

The main focus ahead will be the NPC meeting on 5th March. We expect a growth target of around 5%, a budget deficit ratio of 4~4.8% to GDP, with a likely increase in ultra-long special CGB to RMB2tn (from RMB1tn), as well as special LGB issuance to support a housing sector recovery (e.g., purchasing existing commodity houses). On stimulating domestic demand, the increased support for a consumer goods program (RMB 150bn in 2024), increase in pension pay-outs or subsidies to special groups would be key to watch, as well as hints on the “special campaign dedicated to stimulating consumption” flagged in December CEWC meeting, among others. We maintain our call for USD/CNY to reach 7.4000 by Q1 2025 and 7.5000 by Q2 though uncertainty over Trump’s trade policy with China has increased (e.g., limiting investment from China on strategic US sectors). The recent rise in interbank rates and liquidity tightness suggest that the PBoC may continue to conduct actions to reduce large one-sided CNY depreciation pressure and dampen USD/CNY volatility.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q1 2025 |

Q2 2025 |

Q3 2025 |

Q4 2025 |

|

|

LPR 1Y |

3.10% |

2.90% |

2.70% |

2.70% |

2.70% |

|

MLF 1Y |

2.00% |

1.70% |

1.50% |

1.50% |

1.50% |

|

7-Day Repo Rate |

1.50% |

1.30% |

1.10% |

1.10% |

1.10% |

|

10-Year Yield |

1.78% |

1.75% |

1.75% |

1.80% |

1.90% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

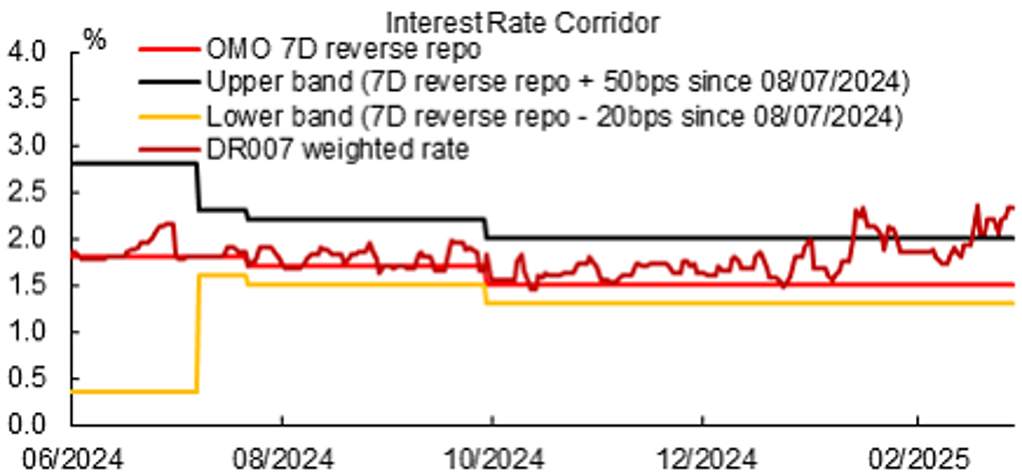

The 7-day interbank repo rate increased by 46bps to 2.33%, a sharp deviation from the benchmark 7-day reverse repo rate. While seasonality factors contributed to the liquidity tightness in the interbank markets, the main reason was the PBOC’s prudent approach in liquidity injection. The PBOC likely wanted to reduce some pressure on CNY after a period of weakening in Q4. The rise in interbank rates and the rally in China tech equities tamed the appeal of buying long-term CGB in February, pushing the 10Y CGB yield to 1.78%. That said, recent tight liquidity condition doesn’t mean that the PBOC’s “moderately loose monetary policy” has changed. The persistent weak domestic demand, particularly in facing the tariffs and its uncertainties, implies that the center of funding rates may move lower, as will short-term rates. Overall, the financing demand from the real economy this year likely remains weak, and the demand from institutional investors’ bond allocation could still be strong. If fiscal support kicks in, the pace of monetary easing by the PBOC could appear more significant. We expect policy rate cuts in the near-term, driving long-term rates to edge slightly lower.

CURRENT FIXING GAP BETWEEN SURVEY AND PBOC FIXING IS ELEVATED

Source: : Bloomberg, MUFG GMR

7-DAY INTERBANK REPO RATE OVERSHOT THE UPPER BAND RECENTLY

Source: : Bloomberg, MUFG GMR