Please download PDF from above for the following currencies.

Australian dollar // New Zealand dollar //Canadian dollar // Norwegian krone // Swedish Krona // Swiss franc // Czech koruna // Hungarian forint //Polish zloty // Romanian leu // Russian rouble // South African rand // Turkish lira // Indian rupee // Indonesian rupiah // Malaysian ringgit // Philippine peso //Singapore dollar // South Korean won // Taiwan dollar // Thai baht // Vietnamese dong // Argentine peso // Brazilian real // Chilean peso // Mexican peso // Crude oil // Saudi riyal // Egyptian pound

Monthly Foreign Exchange Outlook

DEREK HALPENNY

Head of Research, Global Markets EMEA and International Securities

Global Markets Research

Global Markets Division for EMEA

E: derek.halpenny@uk.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

E: lee.hardman@uk.mufg.jp

LIN LI

Head of Global Markets Research Asia

Global Markets Research

Global Markets Division for Asia

E: lin_li@hk.mufg.jp

MICHAEL WAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: michael_wan@sg.mufg.jp

LLOYD CHAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: lloyd_chan@sg.mufg.jp

EHSAN KHOMAN

Head of Commodities, ESG and Emerging Markets Research – EMEA

DIFC Branch – Dubai

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Analyst, ESG and Emerging Markets Research – EMEA

DIFC Branch – Dubai

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

October 2024

KEY EVENTS IN THE MONTH AHEAD

1) TURNING TO US POLITICS & G10

While the US presidential election is not until 5th November, there will obviously be a considerable pick-up in interest in the possible election outcomes and the impact on the financial markets. We see this election as incredibly tight and very difficult to predict and it really could go either way. Our official forecasts published in this October edition assume a Kamala Harris victory. But we also look to provide an alternative in the written text. For example, for G10 or the related DXY currencies we see a potential 7% divergence in US dollar performance between a Harris vs Trump victory with the dollar stronger on a Trump victory. A Trump win is much more likely to be accompanied by a clean sweep of Congress for the Republicans than a Harris victory for the Democrats. A clean sweep for Trump would therefore have fiscal expansion implications while the introduction of tariffs on a scale that may prove less than promised, but still substantial, would have a notable near-term impact on USD/CNY and USD/Asia but also USD/G10. EUR/USD by Q3 2025 under a Harris victory we have at 1.1600 (published) but under a Trump victory could feasibly be 1.0800 – nearly 7% lower. We would however add that this initial gain for the US dollar may not prove sustainable. The Fed being forced to stop monetary easing due to inflation risks could prove ultimately to be a US dollar negative scenario if economic growth is deteriorating at that point in time.

2) TURNING TO US POLITICS AND USD/ASIA

The greatest potential divergence in FX performance between a Harris and Trump victory would be for USD/CNY. Implementing 60% tariffs on all China imports to the US would be hugely significant. The current average tariff rate on China imports is 19% and to more than triple that would hit China exports severely and making other assumptions on Fed policy could see USD/CNY move to 7.8000 or higher. USD/Asia would also be impacted and move higher on the Trump trade plan to introduce a 20% tariff on all US imports. For certain individual USD/Asian currencies, the positive impact of the diversion of China trade to the US via other Asian countries would dilute part of negative impact on other Asian currencies. The extent in which Trump would follow through with these tariff promises we believe is still highly questionable given the domestic inflation impact in the US would potentially undermine Trump’s support.

3) All EYES ON THE POTENTIAL FISCAL STIMULUS IN CHINA

Since the policy announcement from the press conference held by the State Council Information Office on 24th September, the Chinese stock market has rallied sharply. The rationale behind it might already incorporate the market’s anticipation of certain fiscal support measures. The read-out of last week’s Politburo meeting and last Sunday’s State Council executive meeting all imply potential fiscal easing. The State Council executive meeting talked about deploying measures to accelerate the implementation of 102 major projects in the "14th Five-Year Plan".

Forecast rates against the US dollar - End-Q4 2024 to End-Q3 2025

|

Spot close 30.09.24 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

|

|

JPY |

143.21 |

141.00 |

139.00 |

137.00 |

135.00 |

|

EUR |

1.1146 |

1.1200 |

1.1400 |

1.1500 |

1.1600 |

|

GBP |

1.3406 |

1.3410 |

1.3570 |

1.3530 |

1.3650 |

|

CNY |

7.0176 |

6.9100 |

6.8800 |

6.8500 |

6.8200 |

|

AUD |

0.6932 |

0.7000 |

0.7100 |

0.7200 |

0.7300 |

|

NZD |

0.6361 |

0.6400 |

0.6500 |

0.6500 |

0.6600 |

|

CAD |

1.3510 |

1.3400 |

1.3200 |

1.3000 |

1.2900 |

|

NOK |

10.535 |

10.446 |

10.175 |

10.000 |

9.914 |

|

SEK |

10.144 |

10.000 |

9.912 |

9.913 |

9.828 |

|

CHF |

0.8447 |

0.8300 |

0.8250 |

0.8260 |

0.8280 |

|

|

|

|

|

|

|

|

CZK |

22.620 |

22.590 |

22.020 |

21.650 |

21.290 |

|

HUF |

356.37 |

355.40 |

352.60 |

351.30 |

350.90 |

|

PLN |

3.8423 |

3.7860 |

3.7370 |

3.7300 |

3.7330 |

|

RON |

4.4623 |

4.4460 |

4.3950 |

4.3830 |

4.3710 |

|

RUB |

92.600 |

92.980 |

93.130 |

94.610 |

96.080 |

|

ZAR |

17.263 |

16.800 |

17.000 |

17.200 |

17.300 |

|

TRY |

34.188 |

35.500 |

37.500 |

39.500 |

41.000 |

|

|

|

|

|

|

|

|

INR |

83.798 |

83.700 |

83.500 |

83.700 |

83.900 |

|

IDR |

15135 |

15150 |

15000 |

14900 |

14800 |

|

MYR |

4.1210 |

4.1200 |

4.0800 |

4.0500 |

4.0000 |

|

PHP |

56.015 |

55.500 |

55.700 |

55.800 |

56.000 |

|

SGD |

1.2826 |

1.2900 |

1.2850 |

1.2800 |

1.2800 |

|

KRW |

1314.0 |

1300.0 |

1290.0 |

1280.0 |

1270.0 |

|

TWD |

31.652 |

31.500 |

31.200 |

30.900 |

30.600 |

|

THB |

32.318 |

32.500 |

32.300 |

32.000 |

31.500 |

|

VND |

24564 |

24400 |

24400 |

24400 |

24500 |

|

|

|

|

|

|

|

|

ARS |

969.75 |

1030.00 |

1350.00 |

1450.0 |

1500.0 |

|

BRL |

5.4475 |

5.3500 |

5.4000 |

5.4500 |

5.5500 |

|

CLP |

897.30 |

880.00 |

900.00 |

880.00 |

870.00 |

|

MXN |

19.603 |

19.300 |

18.800 |

18.500 |

18.300 |

|

|

|||||

|

Brent |

72.00 |

84.00 |

80.00 |

81.00 |

84.00 |

|

NYMEX |

68.67 |

79.00 |

75.00 |

76.00 |

79.00 |

|

SAR |

3.7513 |

3.7500 |

3.7500 |

3.7500 |

3.7500 |

|

EGP |

48.260 |

48.300 |

48.100 |

47.600 |

47.500 |

Notes: All FX rates are expressed as units of currency per US dollar bar EUR, GBP, AUD and NZD which are expressed as dollars per unit of currency. Data source spot close; Bloomberg closing rate as of 4:30pm London time, except VND which is local onshore closing rate.

US dollar

|

Spot close 30.09.24 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

|

|

USD/JPY |

143.21 |

141.00 |

139.00 |

137.00 |

135.00 |

|

EUR/USD |

1.1146 |

1.1200 |

1.1400 |

1.1500 |

1.1600 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

134.00-150.00 |

132.00-148.00 |

130.00-146.00 |

128.00-144.00 |

|

|

EUR/USD |

1.0800-1.1500 |

1.0900-1.1600 |

1.1000-1.1700 |

1.1100-1.1800 |

MARKET UPDATE

In September the US dollar weakened against the euro in terms of London closing rates, from 1.1062 to 1.1146. In addition, the dollar weakened against the yen, from 145.76 to 143.21. The FOMC at its meeting in September cut the fed funds rate by 50bps to a range of 4.75% to 5.00%. It was the first cut following 525bps of rate hikes from March 2022 through to July 2023. The FOMC continued with its policy of reducing its securities holdings with QT ongoing but at a reduced rate of USD 60bn per month through a reduction in UST bond holdings from USD 60bn to USD 25bn. The pace of reduction in the holdings of MBS remains at USD 35bn per month.

OUTLOOK

The US dollar on a DXY basis dropped by 1.0% in September, more modest than the 2.3% drop in August and what is clear is that the markets had priced a larger cut from the Fed well ahead of the meeting. The lack of follow-through dollar selling may also reflect the more cautious guidance ahead with the median dot profile indicating two 25bp cuts in November and December. The median dot profile in 2025 shows a further 100bps of cuts and then 50bps more in 2026 taking the fed funds rate to the long-term estimate of 2.88%. The Summary of Economic Projections forecasts seem highly implausible with real GDP growth of 2.0% every year through to 2027 while the unemployment rate only rises a further 0.2ppt to 4.4% before declining. We believe just one weak jobs report will quickly see the markets consider the prospect of 50bp cuts in November and December and hence we see risks skewed to more cuts being priced than the 65bps today. That will likely keep the dollar at these current weaker levels without fuelling much additional dollar selling given the rest of G10 will likely also be in a position to cut by more than currently priced (BoE, RBA, ECB).

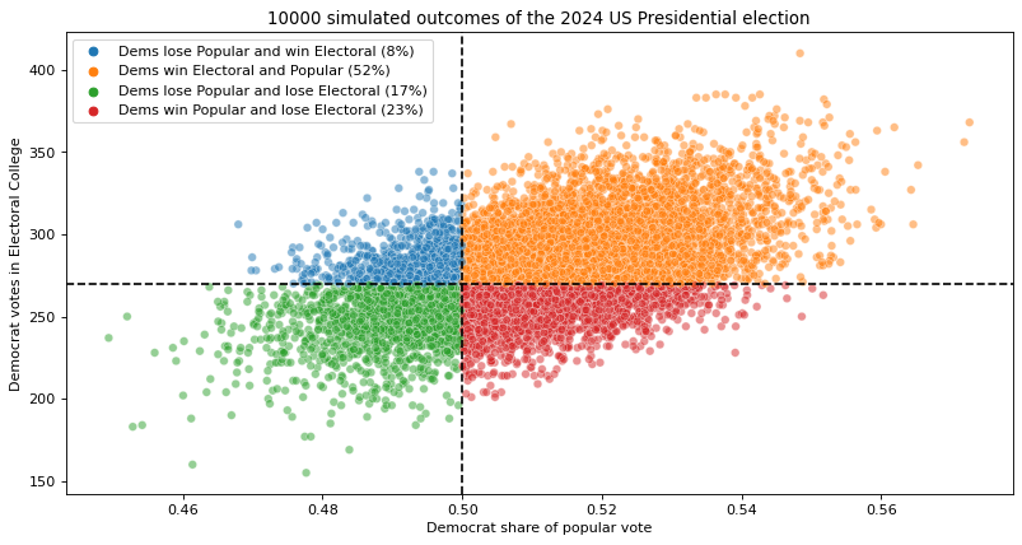

Our published forecasts assume a Harris election victory on 5th November. But that is such a close call and we put the probability split very close to 50-50. There are too many possible scenarios to go through here but based on a Republican sweep of Congress if Trump wins we would assume large tax cuts to stimulate the economy, a lift to business sentiment as a result and then the implementation of substantial tariffs and if not as widespread or as large as Trump is currently promising, still large enough to have a big impact. We see scope for the federal funds rate to be as much as 100bps higher by end-2025 under a Trump presidency and this along with the tariffs will at least over the forecast period covered here to Q3 2025 result in a stronger dollar. We estimate about a 7% difference in EUR/USD by end-Q3 2025 between the two presidencies and assume the DXY would be 7-8% stronger under a Trump presidency although whether those gains would hold further out is debatable.

Our published forecasts are based on a Kamala Harris win but this is such a close call. It is also based on a split Congress and limited bold fiscal policy measures will be implemented. The Fed continues to cut rates and the economy lands softly which means on a DXY basis the dollar drops by 3.5% by Q3 2025.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

|

|

Policy Rate |

4.83% |

4.13% |

3.63% |

3.13% |

2.88% |

|

3-Month T-Bill |

4.62% |

3.75% |

3.50% |

3.25% |

3.00% |

|

10-Year Yield |

3.78% |

3.88% |

3.88% |

3.75% |

3.75% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The Fed delivered on our long-standing and out-of-consensus call (see link) that the start of the easing cycle would begin with a larger than expected 50 basis point cut. This was a historical event because starting the easing cycle with a jumbo cut is seen as a pre-emptive move to avoid further cooling in the labour market and US economy. Overall the recent Fed rate decision seems like a catch-up for not cutting in July, and also probably driven by the acknowledgement that US jobs data has been overstated. In our view, the US labour data has been showing cracks for quite some time (and we have been documenting it as such for a better part of a year) and that eventually the Fed would need to ease quickly to address the underlying softening in such data. Meanwhile the path ahead is challenging. On the one hand, the Fed would like to get to neutral (around ~3%) as they admit to be at least 150-200bp above neutral rates, but on the other hand they were likely pushed to go 50bp for the first meeting (being that they were behind the curve). Election aside, this means that the next few NFPs into year-end will determine the size of future cuts. Overall, we think a lot is already priced-in to the bond market and thus expect range trading ahead.

(George Goncalves)

SIMULATED US ELECTION BASED ON BETTING MARKET PROBABILITIES

Source: MUFG GMR, Bloomberg, Polymarket

US EMPLOYMENT RATE VS 3MAVG

Source: Bloomberg, Macrobond

Japanese yen

|

Spot close 30.09.24 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

|

|

USD/JPY |

143.21 |

141.00 |

139.00 |

137.00 |

135.00 |

|

EUR/JPY |

159.62 |

157.90 |

158.50 |

157.60 |

156.60 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

134.00-150.00 |

132.00-148.00 |

130.00-146.00 |

128.00-144.00 |

|

|

EUR/JPY |

151.00-166.00 |

150.00-165.00 |

149.00-164.00 |

148.00-163.00 |

MARKET UPDATE

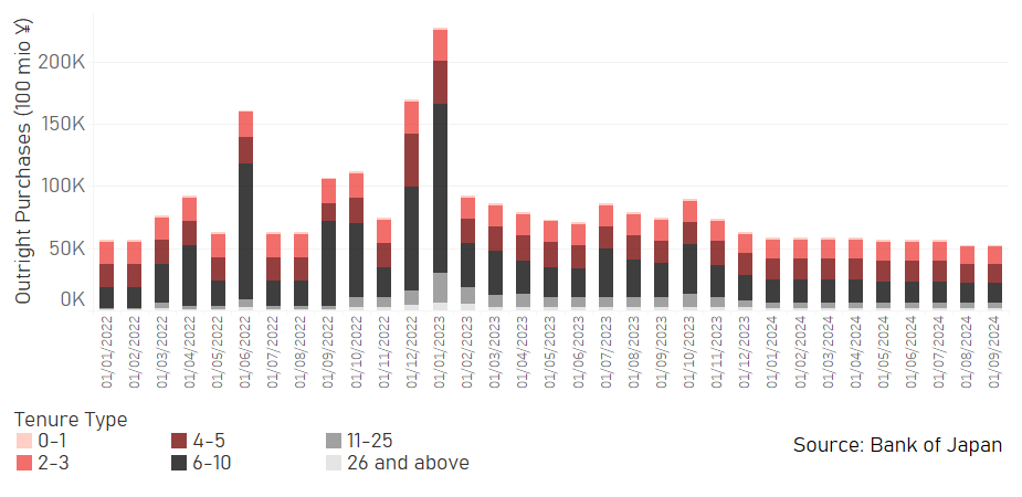

In September the yen strengthened further versus the US dollar in terms of London closing rates from 145.76 to 143.21. In addition, the yen strengthened versus the euro, moving from 161.24 to 159.62. The BoJ did not meet in August and hence the monetary stance was unchanged from the announcements in July when the BoJ cut the JGB monthly purchase rate by JPY 400bn per quarter, which is estimated to see purchases fall to around JPY 2.9trn by Q1 2026. In July, the BoJ also raised the interest rate paid on excess reserves (the Complimentary Deposit Facility) by 15bps to 0.25%, which will lift the unsecured overnight call rate close to that level.

OUTLOOK

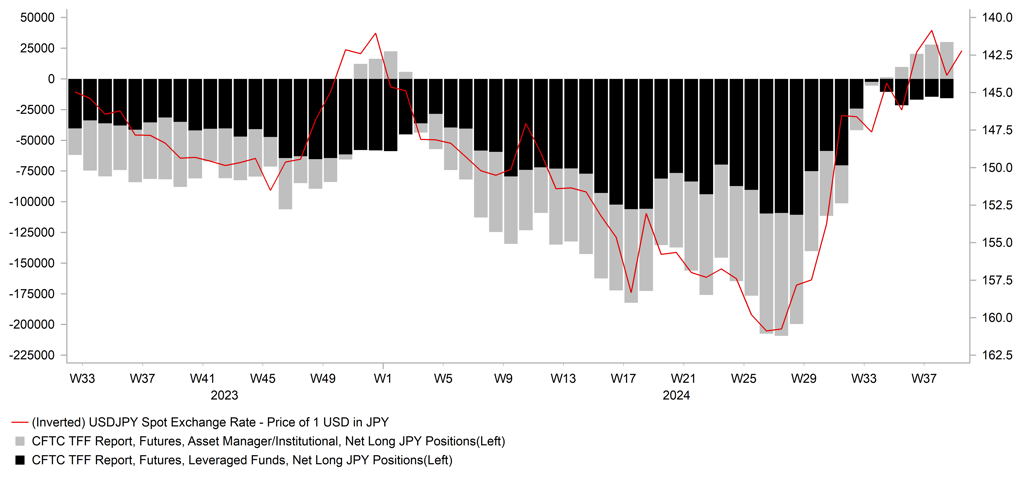

From the intra-day high on 11th July when the MoF intervened to buy yen on the day of a weak US inflation report, USD/JPY has declined by around 12% as global yields declined and the BoJ moved slowly in the other direction with a rate hike on 31st July. That dynamic helping yen demand was further fuelled toward the end of September with the LDP leadership election resulting in Shigeru Ishiba becoming Japan’s prime minister after a formal Diet vote on 1st October. The election of Ishiba could be viewed as a further step away from the policies of former PM Abe who espoused ultra-easy monetary policy and fiscal expansion. Sanae Takaichi would have pushed these policies again but lost out. Still, Ishiba’s views should not be described as the opposite of Abe’s and while they disagreed over policy direction Ishiba has stated since his victory that his primary objective was to ensure deflation has been defeated. He has promised to focus on ensuring wage growth continues, has committed to a policy stimulus plan to support households through the cost of living crisis and wants to tackle population decline and the revitalisation of rural regions.

PM Ishiba has now confirmed a general election will take place on 27th October. In theory this opens up the potential for a policy change at the meeting on 31st October but Governor Ueda in his press conference after the meeting in September indicated that upside inflation risks have subsided and therefore the BoJ has ample time. Hence, the meeting on 19th December remains a much more plausible time for the next rate increase by the BoJ. But economic and financial market conditions will be important. The surge of the yen and the decline in equities gives the BoJ that time. The size of any fiscal stimulus package under the new government could also be important in determining the timing of the next rate increase. But the pre-emptive large cut from the Fed has at the margin helped lift the prospect of a soft landing while inflation abroad looks to be falling in general more quickly than expected which will help support the BoJ in lifting rates further.

A down-trend is now in place for USD/JPY and assuming global inflation and interest rates continue to decline we see an inevitable further decline for USD/JPY as global yield spreads versus Japan continue to narrow.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

|

|

Policy Rate |

0.25% |

0.50% |

0.75% |

0.75% |

1.00% |

|

3-Month Bill |

0.03% |

0.60% |

0.80% |

0.80% |

1.10% |

|

10-Year Yield |

0.86% |

1.10% |

1.20% |

1.30% |

1.50% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year JGB yield declined modestly in September, by just 4bps to close at 0.86%. This was in contrast to the bigger declines elsewhere; 12bps in the US and 18bps in Germany. The move was also modest given the ongoing appreciation of the yen and the underperformance of Japanese equities. The guidance from the BoJ is likely helping to support yields given the message remains that further monetary tightening will be required going forward if the economy evolves as the BoJ expects. That view was expressed again at the meeting in September but Governor Ueda did also acknowledge that upside inflation risks had subsided and therefore the BoJ had time to assess the timing of the next move. Given there will be a general election on 27th October, a hike on 31st October is feasible although Governor Ueda’s caution means December is more realistic. Underlying inflation pressures have subsided but the wage data released in September for July was stronger than expected which should feed into better domestic demand conditions and provide support for underlying inflation. We expect 10-year JGB yields to drift higher.

IMM JPY POSITIONING - LEVERAGED VS ASSET MANAGEMENT

Source: Bloomberg, Macrobond

BOJ OUTRIGHT PURCHASES OF JGBs

Euro

|

Spot close 30.09.24 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

|

|

EUR/USD |

1.1146 |

1.1200 |

1.1400 |

1.1500 |

1.1600 |

|

EUR/JPY |

159.62 |

157.90 |

158.50 |

157.60 |

156.60 |

|

Range |

Range |

Range |

Range |

||

|

EUR/USD |

1.0800-1.1500 |

1.0900-1.1600 |

1.1000-1.1700 |

1.1100-1.1800 |

|

|

EUR/JPY |

151.00-166.00 |

150.00-165.00 |

149.00-164.00 |

148.00-163.00 |

MARKET UPDATE

In September the euro strengthened further versus the US dollar in terms of London closing rates, moving from 1.1062 to 1.1146. The ECB at its meeting in September cut the key policy rate by 25bps to 3.50%, the second cut after cutting by 25bps in June and reversing 50bps of the 450bps of rate hikes through to September last year. The ECB is running down APP securities and commenced PEPP run-off in July with about EUR 380bn of securities rolling off the balance sheet in 2024.

OUTLOOK

The euro advanced further in September with broader financial market conditions helping to support the euro. The OIS market is now fully priced for two 25bp cuts at the final two meetings of the year and we have altered our view from only one cut in December to the two that the market is pricing. This though has had limited impact on EUR performance we believe mainly due to the more optimistic global growth backdrop. We have argued that a muted global growth backdrop would curtail dollar selling. However, the numerous stimulus plans announced by China has helped lift global growth optimism that will likely provide support for the euro going forward. However, we suspect the influence on the markets could fade with a risk of disappointment if fiscal stimulus proves more cautious than what’s now expected.

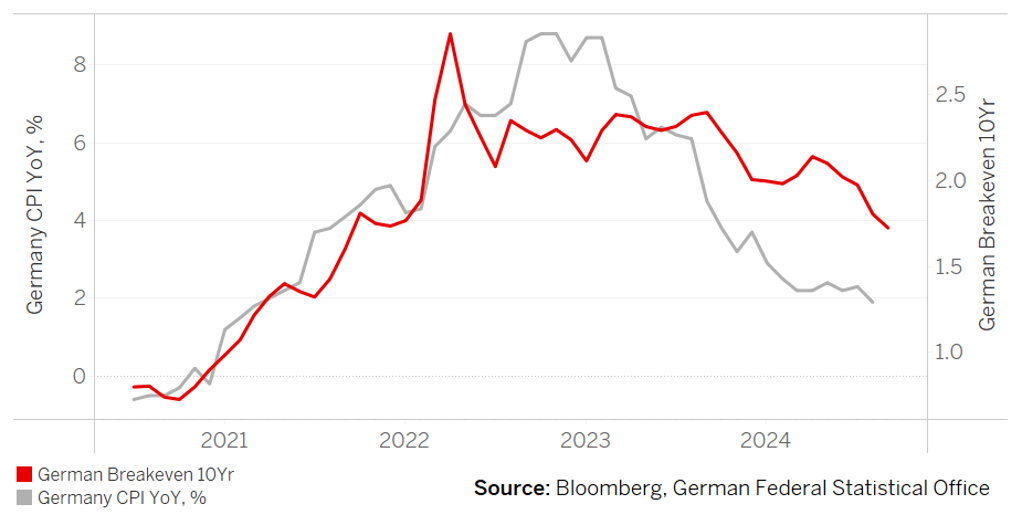

Despite the increased global growth optimism we have maintained our current EUR/USD forecasts that show limited near-term upside. Two primary factors point to the ECB becoming more active in cutting rates than we previously assumed. Firstly, the advance PMI data for France and Germany indicated still depressed growth in Germany and a sharp weakening of services activity in France. The advance services PMI fell from 55.0 to 48.3, the lowest level since March. Secondly, inflationary pressures are falling faster than expected with the flash euro-zone headline CPI released at the start of October falling from 2.2% to 1.8%, the first post-global inflation shock reading below the 2.0% target and to the lowest level since April 2021. Based on the ECB projection of 2.3% YoY in Q3 2024, the inflation in September resulted in an undershoot of the ECB’s projection.

The gridlock in France since the general election could be about to influence broader sentiment and undermine investor confidence weighing on euro performance. The OAT/Bund spread has widened out close to 81bps and a speech by PM Barnier on the budget on 1st October could fuel further selling if deemed as unlikely to garner approval. France’s budget deficit is at about 6% of GDP, well above the 3% limit and the OAT/Bund spread is now at levels not seen since the EZ debt crisis in 2012.

We see scope for EUR/USD to move higher but are maintaining our year-end level of 1.1200 to reflect our doubts over the sustainability of gains from here. The view is finely balanced but overall we believe caution over the extent of dollar selling is warranted given the high level of uncertainties and weak EZ macro backdrop

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

|

|

Policy Rate |

3.50% |

3.00% |

2.50% |

2.25% |

2.00% |

|

3-Month Bill |

3.28% |

2.90% |

2.40% |

2.15% |

1.95% |

|

10-Year Yield |

2.12% |

2.20% |

2.10% |

1.90% |

2.00% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

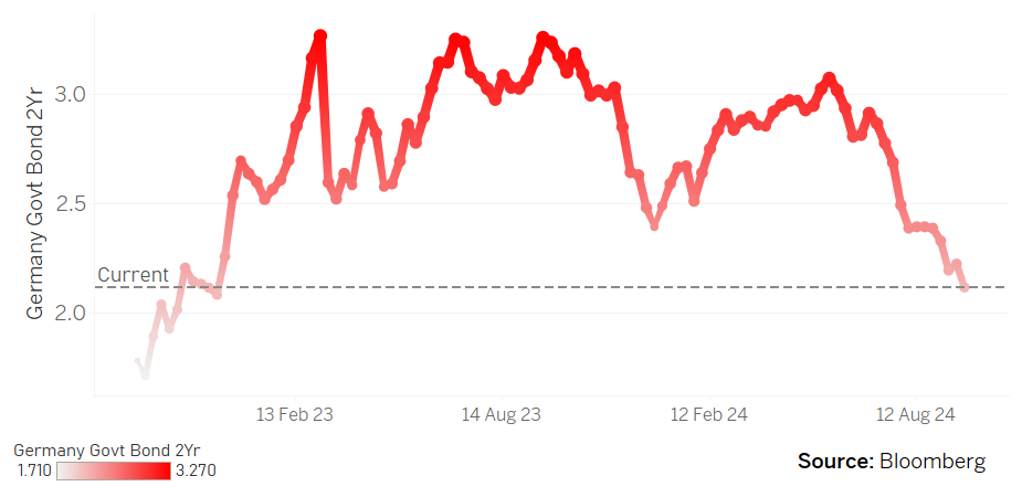

The 10-year bund yield declined in September, by 18bps to close at 2.12%. Data from the US lifted expectations of a larger rate cut by the Fed and helped drive yields in Europe lower ahead of that Fed meeting, and then yields came under moderate renewed downward pressure toward month-end given the weaker inflation data in the euro-zone. The message from the ECB is that policy decisions will be data-dependent and decisions will be taken “meeting by meeting” and hence the much weaker inflation data does point to the prospect of a 25bp cut at the next meeting on 17th October. The German bund yield could also be driven lower on any increase financial market concerns over France’s fiscal position. The OAT/Bund spread is just below the high from June (0.82%) and a break above that level will take us to levels not seen since the euro-zone debt crisis in 2012. Getting to those levels could certainly prompt increased risk aversion – a scenario that would drive German yields lower. The OIS market is now implying 150bps of rate cuts with the policy rate getting to 2.00% by June next year. We suspect the ECB will deliver marginally less than that and that should help to limit declines in 10-year bund yields going forward.

GERMAN BREAKEVEN INFLATION RATE VS. GERMANY CPI YOY,%

GERMANY GOVT BOND 2YR

Pound Sterling

|

Spot close 30.09.24 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

|

|

EUR/GBP |

0.8314 |

0.8350 |

0.8400 |

0.8500 |

0.8500 |

|

GBP/USD |

1.3406 |

1.3410 |

1.3570 |

1.3530 |

1.3650 |

|

GBP/JPY |

191.99 |

189.10 |

188.60 |

185.40 |

184.20 |

|

Range |

Range |

Range |

Range |

||

|

GBP/USD |

1.2900-1.3800 |

1.3000-1.3900 |

1.3100-1.4000 |

1.3200-1.4100 |

MARKET UPDATE

In September the pound strengthened against the US dollar in terms of London closing rates from 1.3138 to 1.3406. In addition, the pound strengthened against the euro from 0.8420 to 0.8314. The MPC at its meeting in September held the key policy rate at 5.00%, following the 25bp cut in August, the first after 14 consecutive rate increases through to August last year.

OUTLOOK

The pound was the 3rd best performing G10 currency in September and remains the top performing on a year-to-date basis. The OIS curve continues to show a more cautious rate cutting cycle from the BoE considering the current level of the policy rate. The nominal policy rate is set to fall to 3.50% in 12mths time, a level that is higher than all other G10 central bank policy rates by then. With a 2.0% inflation rate by then this translates to a real policy rate that is still very restrictive. The BoE’s MPC meeting in September continued to display a high level of caution. The vote to stay on hold was 8-1 with the biggest dove Swati Dhingra voting to cut. New MPC member, Alan Taylor voted with the majority and hence it remains to be seen how much the MPC as a whole has shifted more dovish (assuming Taylor is more dovish than Haskell – an uber-hawk). We still see scope for the BoE to pick up the pace of easing and assuming the ECB is cutting by 50bps in total and the Fed by 50-75bps, the BoE could be in a position to cut at the November and December meetings. Previously we had assumed Q1 next year would be when the pace of cuts picked up but we have now moved that forward to Q4 this year.

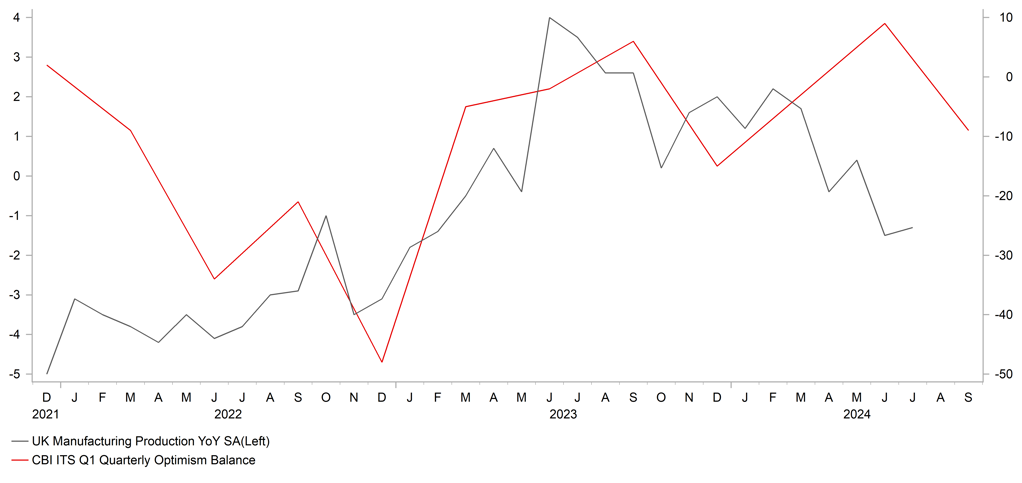

After two quarters of stronger than expected growth, there is a greater chance that the UK economy experiences some slowdown going forward. The advance PMIs for manufacturing and services slowed more than expected while the CBI manufacturing orders index also slowed to the lowest level since November 2023. The GfK Consumer Confidence Index fell sharply from -13 to -20, the lowest level since March. Real GDP for the month of July was also flat, the same as in June highlighting the fading positive momentum from earlier in the year. One factor possibly undermining consumer confidence is the fear over tax increases in the upcoming budget on 30th October. The government have warned that tough measures will be taken and tax rises through capital gains tax, inheritance tax and/or reduced tax benefits on pension savings could be announced. However, the government might also alter the definition of “debt” used under the current fiscal rule that could open up scope for increased long-term investment spending.

The pound could weaken gradually as the rates curve adjusts in the UK to a more active BoE relative to the ECB. But the moves will continue to be modest and the pound should continue to advance versus the US dollar albeit at a slower pace. GBP/USD has advanced by over 5% year-to-date and we are assuming only a further 2.0% advance through to Q3 2025.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

|

|

Policy Rate |

5.00% |

4.50% |

4.00% |

3.50% |

3.25% |

|

3-Month Bill |

4.95% |

4.40% |

3.90% |

3.40% |

3.20% |

|

10-Year Yield |

4.00% |

4.00% |

3.90% |

3.70% |

3.60% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year Gilt yield fell in the first half of September and then rebounded in the second to finish close to unchanged, down just 2bps at 4.00%. Yields in the UK continue to remain elevated relative to the US and the Gilt-UST 10yr bond yield spread widened out to 22bps at the end of September. Excluding the global inflation shock periods in which the spread was higher, the spread today is the highest since February 2012 with global investors convinced that the BoE will have to keep the policy rate higher for longer to dampen domestic inflation pressures. The BoE’s communications have been consistent with that with the focus very much on concerns over sticky underlying inflation due to higher wage growth. As global inflation continues to fall and as the economy slows after the strong first half of the year, the BoE’s confidence in bringing inflation back to target over the medium-term will rise. We expect that to open up the scope for a faster pace of easing and we now expect back-to-back rate cuts in November and December. The evidence of easing inflation and the action of the BoE should see 10-year Gilt yields decline although, like elsewhere, balance sheet contraction will curtail the scale of decline from here.

EUR/GBP VS. EZ-UK 2YR SWAPS SPREAD

Source: Bloomberg, Macrobond

CBI BUSINESS OPTIMISM VS MANUFACTURING OUTPUT

Source: Bloomberg, Macrobond

Chinese renminbi

|

Spot close 30.09.24 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

|

|

USD/CNY |

7.0176 |

6.9100 |

6.8800 |

6.8500 |

6.8200 |

|

USD/HKD |

7.7692 |

7.7800 |

7.7750 |

7.7700 |

7.7600 |

|

Range |

Range |

Range |

Range |

||

|

USD/CNY |

6.7500-7.2000 |

6.7000-7.1500 |

6.6500-7.1000 |

6.6000-7.0500 |

|

|

USD/HKD |

7.7500-7.8200 |

7.7400-7.8100 |

7.7400-7.8100 |

7.7300-7.8000 |

MARKET UPDATE

In September, USD/CNY declined from 7.0888 to 7.0176. Various policy rates were adjusted lower by the PBoC in September. The PBoC lowered the 7-day reverse repo rate by 20bps to 1.50% on 27th September, and the 1Y MLF by 30bps to 2.00% on 25th September. Loan prime rates (LPR) and deposit rates are to be guided lower by 20-25bps going forward, as planned by the PBoC. Meanwhile, the reserve requirement ratio (RRR) was also cut by 50bps on 27th September (except for those financial institutions that are already subject to 5.00% RRR) to unleash about CNY 1tn of liquidity, with potential further RRR cuts of 25bps to 50bps by the end of 2024.

OUTLOOK

There are good reasons to believe that the 3Q GDP year-over-year growth will decline further from Q2, as both July and August’s growth rates of China’s major economic indicators slowed, and the average of the PMI index levels in Q3 was lower than that of Q2. The rising surveyed unemployment rate in August also helps to strengthen this belief. Notably, the August data still showed no rebound in activities in the housing sector yet, while the divergence between resilient external demand for China’s goods and weak domestic demand remains. All that said, CNY strengthened, and this time, for the reasons we have been hoping for. While the degree of CNY’s appreciation largely mirrored the DXY’s depreciation in September, recently announced policy stimulus, including Politburo meeting’s aim to achieve targeted growth this year (i.e., 5% GDP growth) and potential fiscal expansion, all provided support for the currency.

Following the policy stimulus announcements by the State Council Information Office on 24th September, China’s stock market rallied sharply, with the Shanghai Composite Index rising 21.4% since then. The improved sentiment within and outside China, and the induced demand of foreign investors for Chinese equities also helped push the CNY stronger. This sharp rise of Chinese stock indices may imply some increased volatility, but the additional easing policies, including potential fiscal expansion, would suggest the upward trend for CNY against the dollar likely will persist. The State Council executive meeting on 29th September committed to deploying the relevant measures to accelerate the implementation of 102 major projects in the "14th Five-Year Plan", and emphasized to need to strengthen financial support and guarantee critical resources, solve difficulties and blockades, and ensure that the construction of major projects can achieve the expected results.

We do not expect CNY to continue its recent sharp appreciation trend for long, as the impact of positive sentiment still needs to be sustained by the good performance of economic fundamentals, but China’s real economy needs time to be able to reaccelerate. The PBOC wants to avoid a one-sided appreciation of CNY particularly as external demand may start to soften. “Guard against the risk of exchange rate overshooting, and maintain the basic stability of the RMB exchange rate at a reasonable and balanced level” was re-iterated in the meeting on 24th September

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q4 2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

|

|

LPR 1Y |

3.35% |

3.15% |

3.15% |

3.15% |

3.15% |

|

MLF 1Y |

2.00% |

1.70% |

1.70% |

1.70% |

1.70% |

|

7-Day Repo Rate |

1.50% |

1.30% |

1.30% |

1.30% |

1.30% |

|

10-Year Yield |

2.21% |

2.30% |

2.40% |

2.45% |

2.50% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

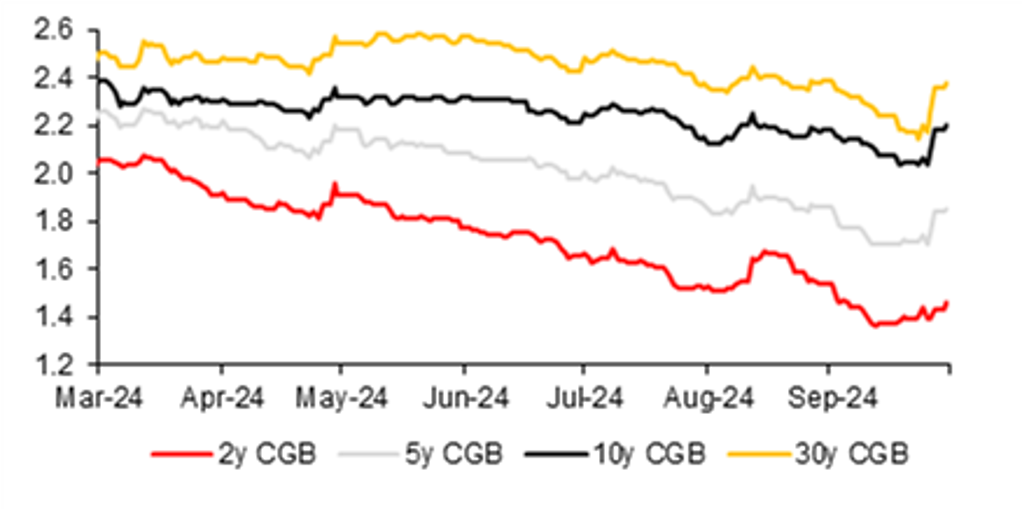

Since 24th September, China’s 10-year government bond yield has increased by 14bps. Going forward, opposing forces will influence Chinese government bond yields ahead. Fiscal expansion and improving sentiment would mean better growth and improving inflation, which would translate to the market’s preference for risky assets over assets like bonds, and in turn would lift government bond yields higher. With the property market still finding a bottom and overall domestic demand remaining weak, the Fed’s rate cut cycle brings room for the PBOC to further cut its policy rates. We expect an additional 20bps cut for the 7-day reverse repo rate and similar cut for other major policy rates as well. We expect a decline in shorter-end interest rates, and a steeper yield curve ahead. Having said that, to achieve a steeper yield curve, longer-end bond yields don’t have to rise. In China’s case, the direction of longer-term government bonds yields will largely depend on the size of fiscal policy down the road. We expect a moderate amount of fiscal stimulus to happen and to help form a moderate economic recovery. It will bring in a shift in the bond market supply-demand dynamics and help push up bond yields moderately.

CSI 300 IS BACK ABOVE 4,000 LEVEL AFTER SURGING BY 25%

Source: CEIC, MUFG GMR

LONG-TERM CGB YIELDS SURGED MORE THAN SHORT-TERM YIELDS

Source: CEIC, MUFG GMR