Please download PDF from above for the following currencies.

Australian dollar // New Zealand dollar //Canadian dollar // Norwegian krone // Swedish Krona // Swiss franc // Czech koruna // Hungarian forint //Polish zloty // Romanian leu // Russian rouble // South African rand // Turkish lira // Indian rupee // Indonesian rupiah // Malaysian ringgit // Philippine peso //Singapore dollar // South Korean won // Taiwan dollar // Thai baht // Vietnamese dong // Argentine peso // Brazilian real // Chilean peso // Mexican peso // Crude oil // Saudi riyal // Egyptian pound

Monthly Foreign Exchange Outlook

DEREK HALPENNY

Head of Research, Global Markets EMEA and International Securities

Global Markets Research

Global Markets Division for EMEA

E: derek.halpenny@uk.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

E: lee.hardman@uk.mufg.jp

LIN LI

Head of Global Markets Research Asia

Global Markets Research

Global Markets Division for Asia

E: lin_li@hk.mufg.jp

MICHAEL WAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: michael_wan@sg.mufg.jp

LLOYD CHAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: lloyd_chan@sg.mufg.jp

EHSAN KHOMAN

Head of Commodities, ESG and Emerging Markets Research – EMEA

DIFC Branch – Dubai

E: ehsan.khoman@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

September 2024

KEY EVENTS IN THE MONTH AHEAD

1) A BUSY SEPTEMBER WITH POTENTIAL VOLATILITY

After the turmoil at the start of August risk appetite rebounded sharply and we start September with the dollar at weaker levels – the DXY index fell by 2.3% in August as US yields fell notably on expectations that the FOMC will commence its easing cycle this month. Whether the FOMC starts this cycle by cutting by 50bps will depend on the jobs report for August and we believe there is a much higher risk of a 50bp cut than currently priced in the market. We have lowered our US dollar levels throughout the forecast period reflecting the scale of weakness in August and the potential for more Fed rate cuts than priced. But we do also remain cautious over the scope for dollar selling given the backdrop globally is not conducive to a large depreciation of the dollar. Our dollar forecasts now imply a drop in the dollar (DXY basis) of just over 4.0% by mid-2025. September will be a busy month for central bank meetings with every G10 central bank meeting bar the RBNZ. The BoC, the FOMC, the ECB, the SNB and the Riksbank are likely to cut their key policy rates with the RBA, Norges Bank and the BoE likely to keep their policy rates unchanged. If incoming data in the US was to be weaker than expected, investor fears over a hard-landing for the US economy will likely result in increased risk aversion, declines in equities and a broader pick-up in financial market volatility.

2) BOJ FOCUS REMAINS THE OTHER WAY

We also expect the BoJ to keep its policy rate unchanged but the focus for the BoJ is not on whether to cut but whether to hike. We believe market pricing for another rate hike is too low and the communications from senior BoJ officials in August made clear the intention is to hike again if the BoJ’s forecasts are realised. We suspect caution over hiking due to the financial market turmoil toward the end of July and early August will fade and a 25bp hike in Q4, probably in December is likely. The BoJ at its meeting in September will likely reiterate this stance given both the wage and inflation data have been consistent with their forecasts. The appreciation of the yen while disinflationary will not notably alter the inflation projections ahead.

3) FOCUS IS STILL ON CHINA’S FURTHER POLICY EASING

China’s macroeconomic data for July still shows persistent downward pressure on the economy, and the poor sentiment is reflected by the continued downward trend for the CSI 300 index. Against this backdrop, we have revised down our GDP growth forecast for 2024 from 5.0% to 4.8%, while keeping our forecast 2025 at 4.8%. We think further policy easing is needed to reverse slowing growth momentum, and the government authorities are aware of that. The latest policy news is that the government is reportedly considering allowing homeowners to refinance their mortgage loans earlier, which would help them save costs and indirectly stimulate consumption (mortgage outstanding stands at RMB 38tn).

Forecast rates against the US dollar - End-Q3 2024 to End-Q2 2025

|

Spot close 30.08.24 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

JPY |

145.76 |

143.00 |

141.00 |

139.00 |

137.00 |

|

EUR |

1.1062 |

1.1200 |

1.1200 |

1.1400 |

1.1500 |

|

GBP |

1.3138 |

1.3410 |

1.3290 |

1.3410 |

1.3450 |

|

CNY |

7.0888 |

7.1000 |

7.0500 |

7.0000 |

6.9500 |

|

AUD |

0.6770 |

0.6800 |

0.6800 |

0.7000 |

0.7100 |

|

NZD |

0.6245 |

0.6300 |

0.6300 |

0.6400 |

0.6400 |

|

CAD |

1.3496 |

1.3500 |

1.3300 |

1.3000 |

1.3000 |

|

NOK |

10.606 |

10.446 |

10.357 |

10.088 |

9.9130 |

|

SEK |

10.259 |

10.268 |

10.357 |

10.088 |

9.9130 |

|

CHF |

0.8492 |

0.8300 |

0.8390 |

0.8330 |

0.8350 |

|

|

|

|

|

|

|

|

CZK |

22.627 |

22.500 |

22.320 |

21.750 |

21.480 |

|

HUF |

354.64 |

352.70 |

355.40 |

352.60 |

353.00 |

|

PLN |

3.8675 |

3.8130 |

3.7770 |

3.7540 |

3.7650 |

|

RON |

4.4961 |

4.4460 |

4.4730 |

4.4210 |

4.4090 |

|

RUB |

90.080 |

90.130 |

91.080 |

92.190 |

93.680 |

|

ZAR |

17.763 |

18.000 |

17.800 |

17.500 |

17.300 |

|

TRY |

34.069 |

34.500 |

36.500 |

38.500 |

40.000 |

|

|

|

|

|

|

|

|

INR |

83.868 |

83.950 |

83.700 |

83.500 |

83.700 |

|

IDR |

15450 |

15450 |

15550 |

15660 |

15755 |

|

MYR |

4.3185 |

4.3400 |

4.3300 |

4.3000 |

4.2800 |

|

PHP |

56.130 |

56.500 |

56.000 |

56.300 |

56.500 |

|

SGD |

1.3041 |

1.3000 |

1.2900 |

1.2850 |

1.2800 |

|

KRW |

1335.3 |

1325.0 |

1315.0 |

1300.0 |

1290.0 |

|

TWD |

31.942 |

31.800 |

31.500 |

31.200 |

30.900 |

|

THB |

33.996 |

34.100 |

33.800 |

33.600 |

33.900 |

|

VND |

24870 |

24900 |

24800 |

24700 |

24600 |

|

|

|

|

|

|

|

|

ARS |

950.68 |

970.00 |

1030.00 |

1450.0 |

1550.0 |

|

BRL |

5.6510 |

5.6500 |

5.7000 |

5.6000 |

5.4500 |

|

CLP |

916.36 |

925.00 |

935.00 |

900.00 |

875.00 |

|

MXN |

19.632 |

20.000 |

19.500 |

18.750 |

18.000 |

|

|

|||||

|

Brent |

78.83 |

82.00 |

87.00 |

89.00 |

91.00 |

|

NYMEX |

73.60 |

77.00 |

82.00 |

84.00 |

86.00 |

|

SAR |

3.7526 |

3.7500 |

3.7500 |

3.7500 |

3.7500 |

|

EGP |

48.581 |

48.400 |

48.300 |

48.100 |

47.600 |

Notes: All FX rates are expressed as units of currency per US dollar bar EUR, GBP, AUD and NZD which are expressed as dollars per unit of currency. Data source spot close; Bloomberg closing rate as of 4:30pm London time, except VND which is local onshore closing rate.

US dollar

|

Spot close 30.08.24 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

USD/JPY |

145.76 |

143.00 |

141.00 |

139.00 |

137.00 |

|

EUR/USD |

1.1062 |

1.1200 |

1.1200 |

1.1400 |

1.1500 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

136.00-150.00 |

134.00-150.00 |

132.00-148.00 |

130.00-146.00 |

|

|

EUR/USD |

1.0800-1.1300 |

1.0900-1.1500 |

1.1000-1.1700 |

1.1100-1.1800 |

MARKET UPDATE

In August the US dollar weakened against the euro in terms of London closing rates, from 1.0820 to 1.1062. In addition, the dollar weakened against the yen, from 150.46 to 145.76. The FOMC did not meet in August and hence the fed funds rate was unchanged in a range of 5.25% to 5.50%. The FOMC continued with its policy of reducing its securities holdings with QT ongoing but at a reduced rate of USD 60bn per month through a reduction in UST bond holdings from USD 60bn to USD 25bn. The pace of reduction in the holdings of MBS remains at USD 35bn per month.

OUTLOOK

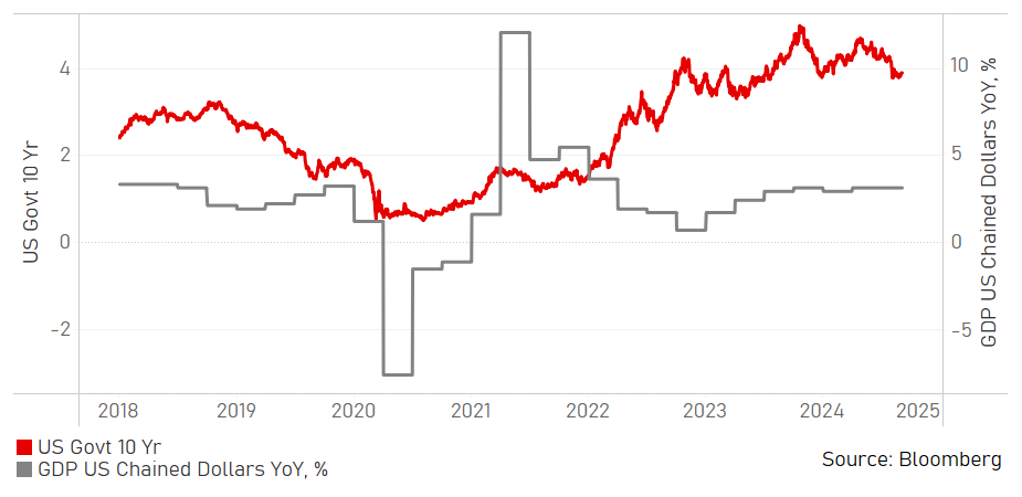

The US dollar on a DXY basis dropped 2.3% in August, the largest monthly drop since November last year with the month-end closing level close to the lowest close since the dollar surged in March 2022 when the global inflation shock began to reverberate through the rates and FX markets. A further retracement of that rally seems apt given the Fed in August explicitly signalled a shift in risks away from the achievement of the price stability goal and to the achievement of the full employment goal. This was conveyed by Fed Chair Powell in his Jackson Hole speech in August and near-on confirmed the start of the rate cutting cycle in September. The speech conveyed a notable increase in the sense of concern over the jobs market and certainly raises the prospect of the first cut being 50bps rather than 25bps. The increased concern was likely partially fuelled by the 818k downward revision to payrolls for the year to March 2024 – a substantial monthly downgrade of 68k. The revisions perhaps help explain the large forecast misses by the Fed. In June, the Fed was forecasting the unemployment rate at 4.0% in Q4 this year and core PCE inflation at 2.8%. The next set of forecasts in September will see a higher unemployment rate and lower inflation that will be the basis for commencing the rate cutting cycle. The median dots will rise from one cut to possibly three or four.

We have lowered our US dollar forecasts, taking account of the scale of the spot move in August and seeing more compelling evidence of an imminent slowdown in the US labour market. However, we are likely to see more financial market volatility with uncertainties over the scale of downturn in the US and uncertainties over economic policy in the US after the election in November. A Harris victory might be better for markets from a global trade perspective but considerable tax increases could hit US equities. Broader geopolitical risks, continued weak growth in China and weak growth in Germany at the heart of Europe will curtail the scale of US dollar depreciation against the euro and G10 and key EM currencies.

We have revised our US dollar forecasts weaker. The Q2 2025 EUR/USD forecast has been raised from 1.1200 to 1.1500. Our other DXY basket currencies have also been adjusted to imply a DXY decline of just over 4.0% and from the end-June 2024 level would imply an annual drop of 8% for the dollar by mid-2025, which we believe is a reasonable reflection of the impact of narrowing spreads as the Fed cuts faster.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

Policy Rate |

5.33% |

4.88% |

4.13% |

3.63% |

3.13% |

|

3-Month T-Bill |

5.11% |

4.63% |

3.88% |

3.50% |

3.13% |

|

10-Year Yield |

3.90% |

4.00% |

3.88% |

3.88% |

3.75% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

In light of recent developments on the jobs front, we expect the first Fed cut to be 50bps. In essence, we believe they should go sooner and faster by larger cuts versus waiting and running the risk of doing more later. Post the Jackson Hole pivot speech, it’s nice to see Chair Powell coming around to our long-standing view that it’s all about the jobs data, and that the strength of the labour market has been overstated for well over a year (as we have been chronicling via our strategy notes). We realize that the Fed will be data dependent at the start of easing, but given it is behind the curve and only now realizing it (and several were thinking of cutting in July anyhow), they can make up for lost time in September with a larger 50bp cut in an attempt to shield the labour market from further deterioration. Furthermore, if August’s NFP is weak, especially in the private sector job count, that will give the Fed all the more reason to start with larger cuts, especially if stocks decline on bad news is viewed as bad news. The question is how deep does the Fed go (above, at, or through neutral of 2.75%) and when will they attenuate the pace of cuts to “only” 25bp? Overall, we still think they could pause once Fed Funds is at 4%, but eventually will likely go down to 3%.

(George Goncalves)

US GOVT 10YR YIELD VS. US GDP YOY, %

INDEED JOBS POSTINGS VS. US EMPLOYEES NONFARM PAYROLLS

Japanese yen

|

Spot close 30.08.24 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

USD/JPY |

145.76 |

143.00 |

141.00 |

139.00 |

137.00 |

|

EUR/JPY |

161.24 |

160.20 |

157.90 |

158.50 |

157.60 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

136.00-150.00 |

134.00-150.00 |

132.00-148.00 |

130.00-146.00 |

|

|

EUR/JPY |

152.00-166.00 |

151.00-165.00 |

150.00-164.00 |

149.00-163.00 |

MARKET UPDATE

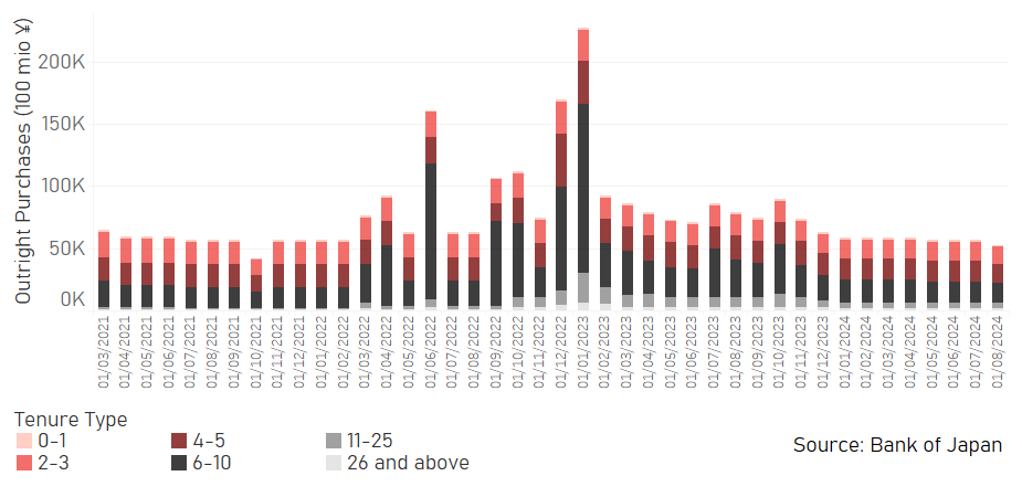

In August the yen strengthened further versus the US dollar in terms of London closing rates from 150.46 to 145.76. However, the yen gain was modest versus the euro, moving from 162.80 to 161.24. The BoJ did not meet in August and hence the monetary stance was unchanged from the announcements in July when the BoJ cut the JGB monthly purchase rate by JPY 400bn per quarter, which is estimated to see purchases fall to around JPY 2.9trn by Q1 2026. In July, the BoJ also raised the interest rate paid on excess reserves (the Complimentary Deposit Facility) by 15bps to 0.25%, which will lift the unsecured overnight call rate close to that level.

OUTLOOK

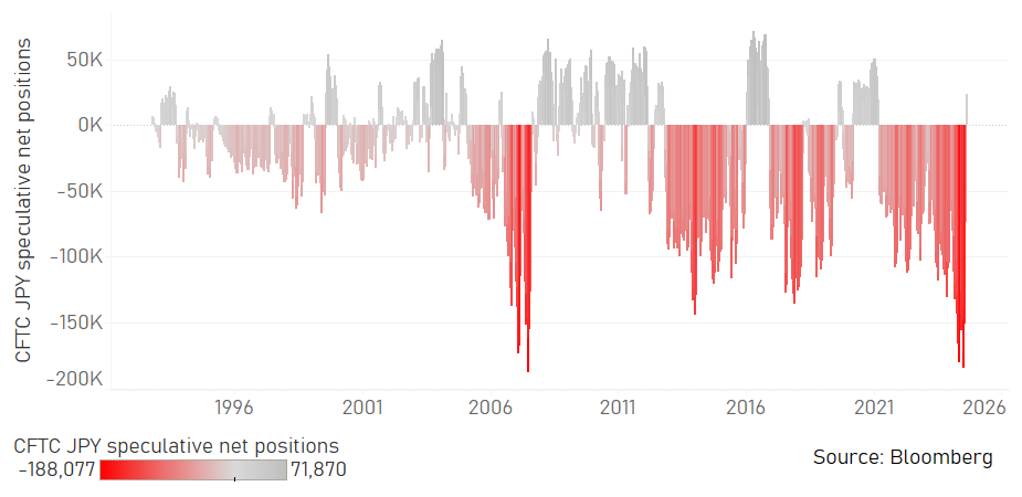

After strengthening notably in July, the yen advanced further in August with numerous factors combining to trigger a further liquidation of yen carry positions that took USD/JPY down 20-big figures from the high when intervention took place on 10th July. The speed of the move lower to the 5th August was the largest since 2007 heading into the GFC. The BoJ rate hike on 31st July and the communication from Governor Ueda of more to come was part of the catalyst for this but the Fed also signalled a willingness to start cutting rates and there was a weak US jobs report which all combined to fuel the move. Our view is that the scale of this move should be viewed as a ‘gamechanger’ for USD/JPY and the move is now altering the risk dynamics and changing expectations which means USD/JPY is turning from a market in which there was appetite to buy on dips to now sell on rallies. We suspect we may see increased market volatility in the coming months as investors swing back and forth between fears of a hard landing in the US to optimism of a soft landing.

The surge of the yen coincided with the biggest liquidation of yen short positions by Leveraged Funds since 2007 so ‘fast money’ or speculative positioning has been greatly reduced. However, there remains more structural yen shorts – for example loans denominated in yen that cannot simply be paid back. But the holders of yen liabilities as a foreign currency will likely be looking to increase hedging. In addition, foreign investors may now be over-hedged given the plunge in Japanese equities has not fully reversed like in the US and may need to buy yen to reduce hedging. The plunge in USD/JPY has prompted a huge increase in foreign securities purchases by Japanese investors – in the four weeks to 23rd August foreign bond purchases totalled JPY 5.6trn, a record going back to the start of the data series in 2001. Foreign equity purchases were the largest since the start of 2023. The fact that USD/JPY has not risen much suggests the flows are from investors with available foreign currency (banks) or that these flows were more hedged and/or that other market participants have remained USD/JPY sellers.

As stated last month, a permanent turn in USD/JPY has never looked so compelling and the sharp drop coinciding with the commencement of the Fed easing cycle will see USD/JPY sustain these moves and continue to decline from here.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

Policy Rate |

0.25% |

0.25% |

0.50% |

0.75% |

0.75% |

|

3-Month Bill |

0.10% |

0.30% |

0.60% |

0.80% |

0.80% |

|

10-Year Yield |

0.90% |

1.00% |

1.20% |

1.30% |

1.40% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year JGB yield closed down 16bps at 0.90% in August which reflected the sharp upturn in financial market turmoil at the beginning of the month – the surge of the yen coincided with a sharp drop in yields. The drop in JGB yields was in fact similar to the decline in the US. But over a three-month period, the JGB yield is down 17bps in contrast to the much larger 60bps drop in US yields. We think this divergence is set to continue given our view of further BoJ rate hikes going forward. While Deputy Governor Uchida suggested the BoJ would not hike in periods of financial market turmoil, both Governor Ueda and Deputy Governor Himino signalled toward month-end that additional rate hikes were likely if the BoJ forecasts are realised. While yen appreciation will depress import prices the source of inflation pressures are domestically generated and yen strength is more likely to balance the inflation risks as opposed to the BoJ view at the meeting on 31st July that risks were to the upside. Given our US yield forecasts have been lowered, we have lowered the JGB yield levels as well but still expect yields to drift higher.

YEN NET NON-COMMERCIAL FUTURES POSITIONS

BOJ OUTRIGHT PURCHASES OF JGBs

Euro

|

Spot close 30.08.24 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

EUR/USD |

1.1062 |

1.1200 |

1.1200 |

1.1400 |

1.1500 |

|

EUR/JPY |

161.24 |

160.20 |

157.90 |

158.50 |

157.60 |

|

Range |

Range |

Range |

Range |

||

|

EUR/USD |

1.0800-1.1300 |

1.0900-1.1500 |

1.1000-1.1700 |

1.1100-1.1800 |

|

|

EUR/JPY |

152.00-166.00 |

151.00-165.00 |

150.00-164.00 |

149.00-163.00 |

MARKET UPDATE

In August the euro strengthened further versus the US dollar in terms of London closing rates, moving from 1.0820 to 1.1062. The ECB did not meet in August and hence the key policy rate was unchanged at 3.75%, after cutting by 25bps in June, the first cut after 450bps of rate hikes through to September last year. The ECB is running down APP securities and commenced PEPP run-off in July with about EUR 380bn of securities rolling off the balance sheet in 2024.

OUTLOOK

The euro advanced in August with the broader US dollar sell-off on rising Fed rate cut expectations lifting EUR/USD to the 1.1200-level for the first time since July 2023. Still, within the G10 space, the euro was the worst performer gaining just 2.1% versus the dollar. The break above 1.1000 in August was the fourth notable period since the EUR recovery from the energy price shock after Russia’s invasion of Ukraine and we see this break higher as having a much higher chance of proving more sustained than the three previous occasions. We have raised our EUR/USD forecast profile to take account the recent faster than expected move higher.

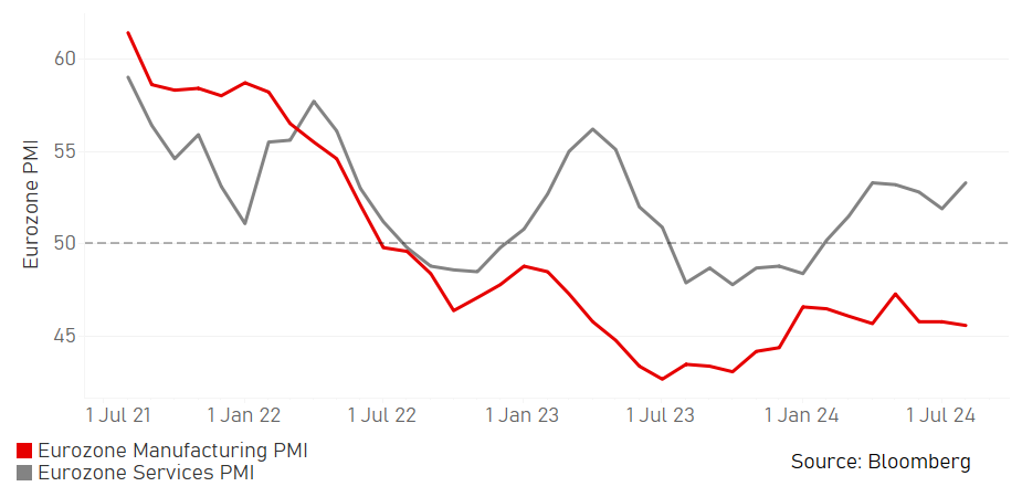

The easing cycle ahead for the ECB will be an unusual one in that economic growth is picking up after nearly two years of weakness due to the unprecedented energy price shock. The services PMI jumped in the advance readings for August although some of this reflected one-off benefits from the Olympics in Paris. But services activity elsewhere in the euro-zone continues to show improvement in general while manufacturing activity lags behind. Money supply data from the euro-zone also shows some easing in the contraction in credit. Real GDP is now expected to accelerate from 0.7% this year to 1.4% in 2025. Advance inflation readings for August revealed good news and were lower than expected underlining the high probability of another 25bp rate cut in September. Nonetheless, given the OIS forward curve now implies a 2.25% policy rate in 12mths, we see risks that some of this degree of easing could be taken out of market pricing given this implies close to a zero percent real policy by mid-2025, which looks on the excessive side to us.

Our EUR/USD forecast levels still imply caution ahead. We see high risks of increased uncertainties and volatility through the remainder of this year – soft vs hard landing in the US, the US elections and with that global trade uncertainties while China growth is expected to remain weak. Global factors still argue against any sustained sell-off of the dollar and DXY is already down close to 5% since the end of June and hence we don’t expect further sharp dollar selling for now.

This break higher in EUR/USD looks more sustainable to us and hence we see EUR/USD as having entered a new trading range of between 1.1000 and 1.1500 as the Fed cuts rates notably. Improving growth in euro-zone should also help support EUR/USD with risks skewed toward the ECB cutting by less than expected.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

Policy Rate |

3.75% |

3.50% |

3.25% |

3.00% |

2.75% |

|

3-Month Bill |

3.47% |

3.45% |

3.15% |

2.90% |

2.70% |

|

10-Year Yield |

2.30% |

2.35% |

2.25% |

2.20% |

2.10% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year bund yield was unchanged in August remaining at 2.30%. The relative stability of the bund yield was in marked contrast to the 10-year UST bond yield which fell by 13bps. As cited above, there are some positive signs for growth and as before the services sector continues to outperform manufacturing with falling inflation helping to boost real incomes and spending. But the relative stability of yields in core Europe in our view reflects the more realistic pricing of the yield curve to the downside with the 2-year yield close to the forward OIS implied policy rate. There seems to us to be better scope for 2-year yields to fall in the US. The release of the flash inflation estimates at the end of August highlighted the fact that yields did not move very much because the curve is already priced for substantial cuts and the lower inflation data now merely endorses the current pricing. We expect the ECB to cut at each forecast meeting implying four rate cuts by June 2025 which would take the policy rate to 2.75%. The OIS market implies a further 35bps of cuts on top of this which we feel is excessive and see scope for some of that easing to be taken out of market pricing. For this reason we see limited downside scope for 10-year yields.

EUROZONE PMI SURVEYS

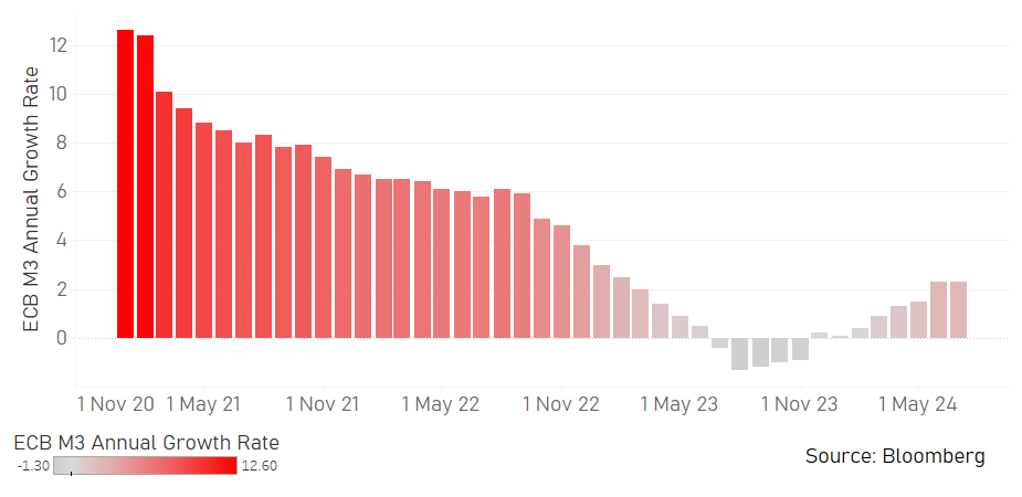

ANNUAL GROWTH OF M3 MONEY SUPPLY

Pound Sterling

|

Spot close 30.08.24 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

EUR/GBP |

0.8420 |

0.8350 |

0.8425 |

0.8500 |

0.8550 |

|

GBP/USD |

1.3138 |

1.3410 |

1.3290 |

1.3410 |

1.3450 |

|

GBP/JPY |

191.50 |

191.80 |

187.40 |

186.40 |

184.30 |

|

Range |

Range |

Range |

Range |

||

|

GBP/USD |

1.2800-1.3500 |

1.2900-1.3700 |

1.3000-1.3900 |

1.3100-1.4000 |

MARKET UPDATE

In August the pound strengthened against the US dollar in terms of London closing rates from 1.2840 to 1.3138. The pound strengthened marginally against the euro, from 0.8427 to 0.8420. The MPC at its meeting on 1st August cut the key policy rate by 25bps to 5.00%, the first cut following 14 consecutive rate increases through to August last year. The decision was finely balanced in a 5-4 vote.

OUTLOOK

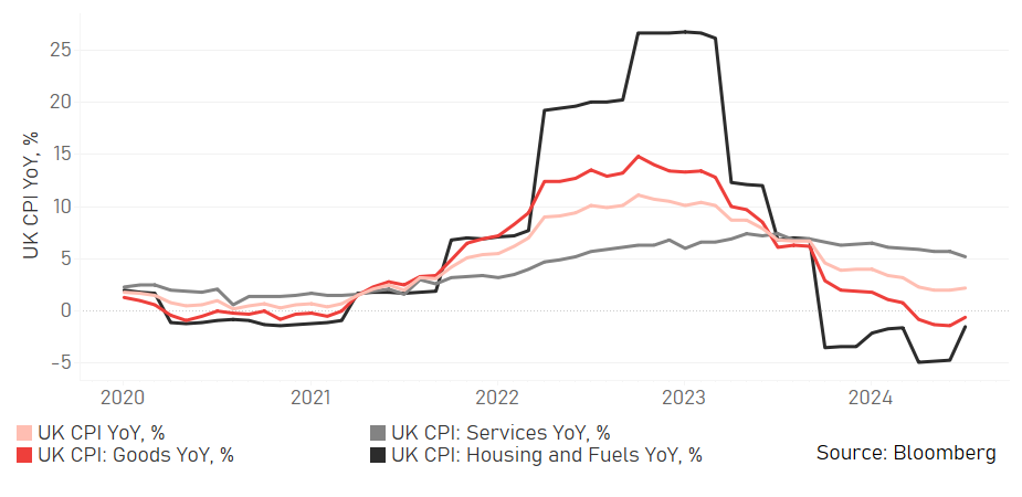

The pound advanced notably in August versus the dollar but gains versus the euro were more marginal given the BoE split 5-4 vote to cut in August plus the communications from BoE officials reinforcing the expectations of a cautious easing path ahead. The pound remains the stand-out performer in G10 on a year-to-date basis, up 3.1% versus the dollar with the euro the only other G10 currency that has managed to eke out a gain (0.1%) versus the dollar this year. BoE Governor Bailey provided an update on BoE thoughts at Jackson Hole in August and while stressing caution ahead (as you’d expect given the 5-4 vote) he did express optimism over the inflation outlook. In particular, Bailey was clear that progress was being made and the concerns over the “intrinsic persistence” of inflation was receding. This was in reference to the sticky domestically generated inflation. The wage data in August for June helped ease these concerns with headline earnings dropping to 4.5%, the lowest level since November 2021. Annual CPI also increased by less than expected in July with services CPI falling by more – from 5.7% to 5.2%. BRC data released in August also revealed deflation on the high street with shop prices down 0.3%.

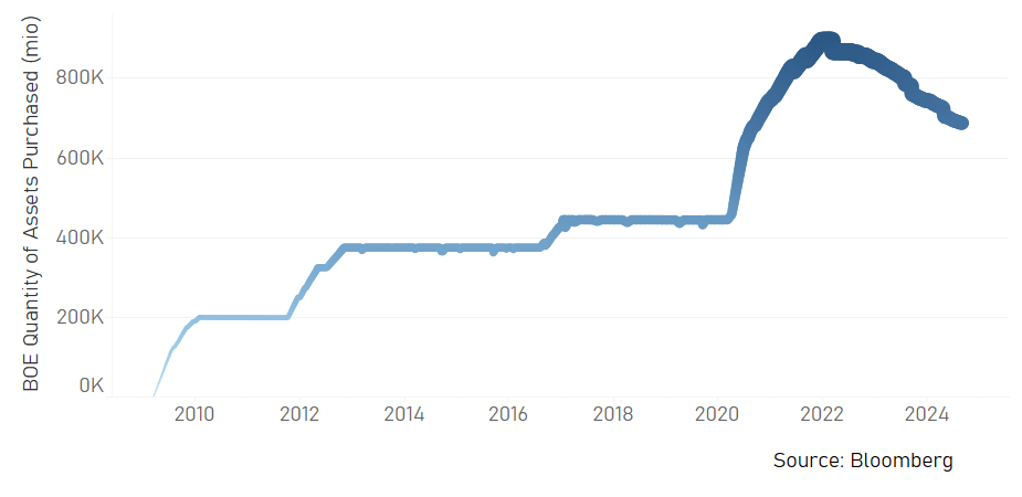

We understand given the split 5-4 vote to cut in August and the better than expected GDP growth in H1 2024 why continued caution is assumed over the speed of rate cuts ahead. However, when we project forward to mid-2025, current OIS market pricing and the inflation consensus at that point implies a real BoE policy rate of 1.75%, the highest level across G10 and about 50bps higher than the Fed. Over that timeframe we see risks now that the BoE could deliver more than currently priced – that’s certainly where we believe the risks lie. Bailey’s comments suggesting reduced concerns over “intrinsic persistence” could be an early indication of the MPC being more comfortable about easing. In addition, in September we expect the BoE to confirm a continuation of QT at the current pace of GBP 100bn per year which will open up scope for potentially more easing at the front-end of the curve. Finally, while a large wage increase has been agreed for train drivers and doctors, this will be offset by tax increase to be announced in October by Chancellor Reeves.

These developments could allow for the OIS curve to adjust and we see scope for the BoE hiking one additional time beyond our previous expectations of four cuts by mid-2025 which has led us to slightly adjust higher our EUR/GBP level but given our larger downward revision to our US dollar levels, this still implies a higher GBP/USD forecast for Q2 2025 than previously (1.3450 vs 1.3180 previously).

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

Policy Rate |

5.00% |

5.00% |

4.75% |

4.25% |

4.00% |

|

3-Month Bill |

5.02% |

4.95% |

4.65% |

4.15% |

3.95% |

|

10-Year Yield |

4.02% |

4.00% |

3.90% |

3.70% |

3.65% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year Gilt yield fell through most of the month but fully retraced those declines to close higher by 5bp at 4.02%. The initial decline was helped by the BoE rate cut and the turmoil in the markets as yen carry positioning was lightened. Softer inflation and wage data also eased fears over sticky inflation risks in the UK. Finally, the messaging from the government made clear that the budget scheduled for 30th October would be “painful” and therefore include tax raising measures to offset a GBP 20bn fiscal hole the Labour government claim was left by the Conservatives (although surely the public sector wage increases account for much of this). September will also be important given the BoE is likely to confirm the continuation of QT at the current pace of GBP 100bn per year which will act as a form of monetary tightening that may provide space for easing as GDP growth slows and sticky inflationary pressures ease. Given our estimate for the implied forward real policy rate is considerably higher than the rest of G10, we see scope for the BoE to cut more than current market pricing implies (125bps vs 100bps) and that backdrop should mean 10-year Gilt yields can drift modestly lower from here.

UK CPI COMPONENTS YOY, %

BOE QUANTITY OF ASSETS PURCHASED (HOLDINGS)

Chinese renminbi

|

Spot close 30.08.24 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

USD/CNY |

7.0888 |

7.1000 |

7.0500 |

7.0000 |

6.9500 |

|

USD/HKD |

7.7975 |

7.7850 |

7.7800 |

7.7750 |

7.7700 |

|

Range |

Range |

Range |

Range |

||

|

USD/CNY |

6.9000-7.2800 |

6.8500-7.2500 |

6.8000-7.2000 |

6.7500-7.1500 |

|

|

USD/HKD |

7.7600-7.8300 |

7.7500-7.8200 |

7.7500-7.8200 |

7.7400-7.8100 |

MARKET UPDATE

In August, USD/CNY declined from 7.2199 to 7.0888. The PBoC lowered various policy rates in July, with the 7D reverse repo rate lowered down by 10bps to 1.70%, both 1Y LPR and 5Y LPR rates lowered by 10bps to 3.35% and 3.85% respectively on 22nd July, meanwhile, the 1Y MLF was cut by 20bps to 2.30% on 25th July.

OUTLOOK

The tide seems to have turned for CNY to appreciate, but not for all the reasons we are hoping for. Against a backdrop of a weaker DXY, CNY had followed suit to appreciate against US dollar, albeit to a lesser extent compared to other regional currencies. With July’s macroeconomic data pointing to persistent downward pressure on the economy, CNY appreciation was mostly driven by external factors. We also observed a strong divergence trend between CNY and the CSI 300 equity index, with the latter still trending downward and recorded a 3.5% drop in August. As a result of the weaker US dollar, USD/CNY is now trading around the fixing level at 7.1299. While the wide gap between the Bloomberg survey USD/CNY fixing and the PBoC USD/CNY fixing had closed, we noticed an uncommon development that the PBoC fixings have been lower than the Bloomberg fixing in recent two weeks. It implies that the PBoC does not prefer a one-sided downward movement for USD/CNY in current circumstances.

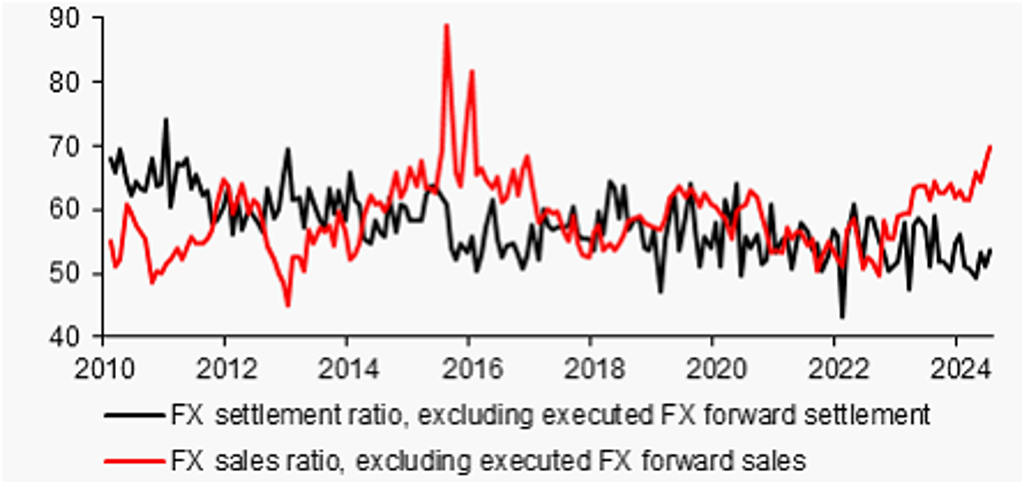

External factors will likely exert continued downward pressure on USD/CNY, however, the weak Chinese economic performance, and market’s focus on the divergence between the stock market (domestic sentiment) and CNY’s strength, will constrain the currency’s performance against the dollar in the near term. We see USD/CNY reaching 7.1000 by the end of Q3 this year and to be volatile in September. In the medium term, the beginning of Fed’s rate cutting cycle, coupled with a possible 4% decline of the dollar’s value by Q2 2025 would provide favorable conditions for Asian FX including CNY against the dollar. Although we are expecting a relatively modest 4.8% GDP growth for China in 2025, it is relatively stronger than a clear growth deceleration. In the medium term, we expect returning portfolio inflows due to relatively better fundamentals and low valuations of China stocks. And there exists upside risk for the currency: data shows that importers/exporters and multinationals have a stronger preference for USD instead of CNY, judging by the increasing FX sales rate and somewhat decreasing FX settlement rate by the banks on behalf of clients. Large amount of conversion from USD to CNY cannot be ruled out if the trend US dollar depreciation continues and negative yield spread narrows sharply. As for our economic forecast, we lowered our GDP growth forecast for 2024 to 4.8% from previous 5.0% and we have kept the 4.8% estimate for 2025 unchanged. The downward revision reflects the worse-than-expected domestic economic development, and while some fiscal policies have been rolled out, we think further policy steps are needed (Revising USD/CNY lower to 7.0500 by year end).

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

LPR 1Y |

3.35% |

3.35% |

3.25% |

3.15% |

3.15% |

|

MLF 1Y |

2.30% |

2.30% |

2.15% |

2.00% |

2.00% |

|

7-Day Repo Rate |

1.70% |

1.70% |

1.60% |

1.50% |

1.50% |

|

10-Year Yield |

2.18% |

2.20% |

2.30% |

2.35% |

2.50% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

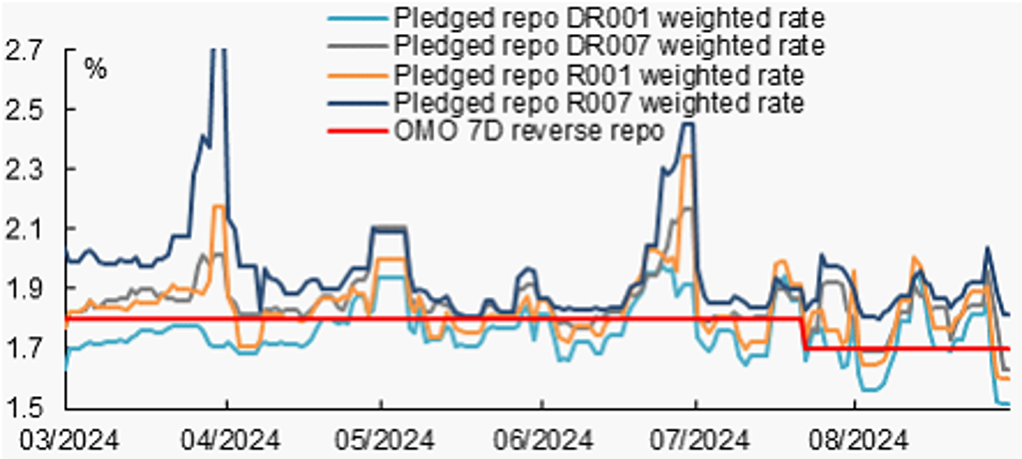

Chinese government bond yields seem to have found support levels this month, as the regulatory authorities stepped up efforts such as frequent compliance checks on bond trading, to curb one-sided downward movements in government bond yields. As a result, 10-year government bond yields rose from the low of 2.13% in early August to 2.25% in mid-August, before inching back down again to 2.17% as July’s weak macroeconomic data pointed to the need for further monetary easing. Following the rate cuts in July, we observe that ultra short-end money market rates have not moved down meaningfully and remain elevated through most of August. It means that interbank liquditiy remains tight, and if it remains so for longer, it may tame the demand for borrowing short-term funds and buying government bonds especially for leveraged investors, and that would provide support for bond yields. Looking ahead, we think further monetary policy easing and exporter’s conversion of USD into RMB wil increase interbank liquidity and push short-end yields lower and result in a healthier steepened yield curve. The PBoC’s increasing involvement in long-end CGBs would also help support that.

STRONGER PREFERENCE TO HOLD USD INSTEAD OF CNY

Source: CEIC, MUFG GMR

SHORT-TERM MONEY MARKET RATES VS PBOC’S REVERSE REPO RATE

Source: CEIC, MUFG GMR