Monthly Foreign Exchange Outlook Update

DEREK HALPENNY

Head of Research, Global Markets EMEA and International Securities

Global Markets Research

Global Markets Division for EMEA

E: derek.halpenny@uk.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

E: lee.hardman@uk.mufg.jp

LIN LI

Head of Global Markets Research Asia

Global Markets Research

Global Markets Division for Asia

E: lin_li@hk.mufg.jp

MICHAEL WAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: michael_wan@sg.mufg.jp

LLOYD CHAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: lloyd_chan@sg.mufg.jp

EHSAN KHOMAN

Head of Commodities, ESG and Emerging Markets Research – EMEA

DIFC Branch – Dubai

E: ehsan.khoman@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

FX forecast update following Trump’s election win

In the Foreign Exchange Outlook report published on the 1st November we included FX forecasts based on a Kamala Harris win in the US elections but outlined assumed divergent levels for the US dollar if Donald Trump won. Today, we are publishing our full new set of FX and commodity forecast levels following the election victory for Trump. As was outlined on 1st November, we are publishing forecasts that show significantly stronger US dollar levels compared to before. As we indicated then, in the G10 space we have forecasts that are on average around 8% stronger than our previous Kamala Harris forecasts.

The profile of our new forecasts show for many currencies, the peak US dollar point will be during the 1H of next year as Trump officially confirms the implementation of key policies communicated during the election – increased tariffs, deportations of illegal immigrants and expansionary fiscal policies. Given the scale of the election victory we assume an aggressive start to tariffs although not in one step to the levels mentioned by Trump – 60% on China and 10%-20% on all other imports. However, Trump verbalises his intentions to act aggressively further and the financial markets respond to this with the US dollar reaching highs in Q1 2025 or early in Q2. Fiscal policy gets focus with a push to extend the TCJA 2017 tax cutting measures.

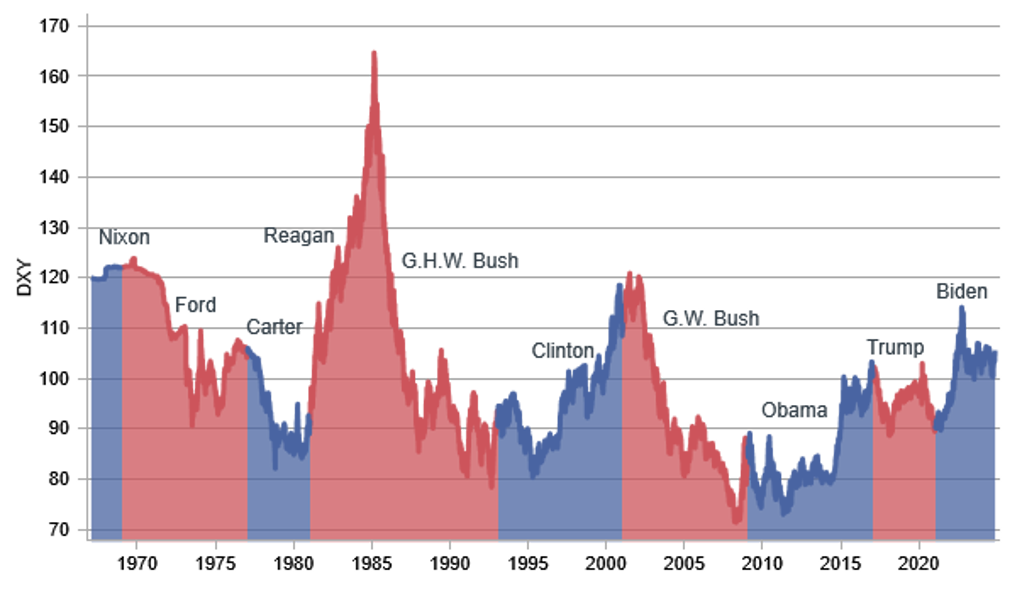

However, the macro backdrop is very different to Trump’s first term and the economy is in the late-cycle stage with the Fed cutting rates while the fiscal measures will not have the fiscal impulse of 2018-19. The OIS curve shows just 60bps of cuts by the Fed and a 140bps of cuts by the ECB. We see scope for some moderate weakening of the dollar from strong levels during the 2H 2025. The US dollar in REER terms at a presidential election time is at a level not seen since the 1984 election and that will constrain the appreciation of the dollar at higher levels.

USD PERFORMANCE (DXY) UNDER DIFFERENT US PRESIDENTS

Source: Bloomberg, Macrobond & MUFG GMR

Forecast rates against the US dollar - End-Q4 2024 to End-Q3 2025

|

|

Spot close 12.11.24 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

|

JPY |

154.12 |

152.00 |

154.00 |

152.00 |

150.00 |

|

EUR |

1.0611 |

1.0400 |

1.0200 |

1.0500 |

1.0800 |

|

GBP |

1.2813 |

1.2683 |

1.2515 |

1.2805 |

1.3012 |

|

CNY |

7.2320 |

7.3000 |

7.4000 |

7.5000 |

7.5000 |

|

AUD |

0.6544 |

0.6400 |

0.6300 |

0.6500 |

0.6700 |

|

NZD |

0.5945 |

0.5850 |

0.5800 |

0.6000 |

0.6150 |

|

CAD |

1.3951 |

1.4200 |

1.4300 |

1.3800 |

1.3400 |

|

NOK |

11.057 |

11.538 |

11.961 |

11.524 |

11.019 |

|

SEK |

10.884 |

11.346 |

11.863 |

11.429 |

10.926 |

|

CHF |

0.8813 |

0.8942 |

0.9020 |

0.8857 |

0.8704 |

|

|

|

|

|

|

|

|

CZK |

23.942 |

24.519 |

25.294 |

24.667 |

23.796 |

|

HUF |

387.29 |

398.08 |

409.80 |

401.90 |

388.89 |

|

PLN |

4.1048 |

4.2115 |

4.3529 |

4.2476 |

4.0926 |

|

RON |

4.6896 |

4.7885 |

4.9118 |

4.8000 |

4.6944 |

|

RUB |

97.924 |

100.20 |

103.07 |

104.65 |

105.21 |

|

ZAR |

18.079 |

18.500 |

19.000 |

19.000 |

18.750 |

|

|

|

|

|

|

|

|

TRY |

34.385 |

35.250 |

37.500 |

40.000 |

41.000 |

|

INR |

84.394 |

84.800 |

85.200 |

85.300 |

85.400 |

|

IDR |

15780 |

15900 |

16250 |

16210 |

16170 |

|

MYR |

4.4383 |

4.4500 |

4.5700 |

4.5500 |

4.5200 |

|

PHP |

58.830 |

59.200 |

59.700 |

59.300 |

58.800 |

|

SGD |

1.3386 |

1.3450 |

1.3800 |

1.3750 |

1.3700 |

|

KRW |

1407.7 |

1420.0 |

1450.0 |

1460.0 |

1460.0 |

|

TWD |

32.435 |

32.600 |

33.100 |

33.300 |

33.200 |

|

THB |

34.800 |

34.700 |

36.100 |

36.000 |

35.700 |

|

VND |

25349 |

25500 |

25800 |

25900 |

25800 |

|

|

|

|

|

|

|

|

ARS |

998.19 |

1030.0 |

1110.0 |

1200.0 |

1500.0 |

|

BRL |

5.7854 |

5.9000 |

6.2000 |

6.4000 |

6.3000 |

|

CLP |

985.32 |

1000.0 |

1050.0 |

1070.0 |

1050.0 |

|

MXN |

20.422 |

21.500 |

22.500 |

22.000 |

20.500 |

|

|

|

|

|

|

|

|

Brent |

72.160 |

75.000 |

73.000 |

69.000 |

74.000 |

|

NYMEX |

68.340 |

70.000 |

68.000 |

64.000 |

69.000 |

|

SAR |

3.7568 |

3.7500 |

3.7500 |

3.7500 |

3.7500 |

|

EGP |

49.200 |

48.700 |

48.300 |

48.100 |

47.700 |

Notes: All FX rates are expressed as units of currency per US dollar bar EUR, GBP, AUD and NZD which are expressed as dollars per unit of currency. Data source spot close; Bloomberg closing rate as of 12:50pm London time, except VND which is local onshore closing rate.

FX Views

G10 FX: USD forecast profile stronger by around 7-8%

In our scenario analysis on a Trump victory ahead of the US elections we estimated that the US dollar could advance by about 2-3% in the first 24/48hrs. There was some position liquidation that meant this scale of strength did not materialise in that timescale but the dollar in DXY terms is now 2.3% stronger since the close on 5th November. We still see scope over time for our longer-term views on a Trump win unfolding – that the dollar will reach levels of around 7-8% stronger than the forecasts we assumed under a Harris victory. That implies further gains for the dollar ahead of President-elect Trump’s inauguration on 20th January with his cabinet picks and rhetoric likely to reinforce market expectations of Trump delivering on his campaign promises. A clean sweep of the seven swing states and a win in the popular vote will only embolden Trump to deliver those key campaign promises.

We are updating our forecasts today and are assuming a House victory for the Republicans and therefore a clean sweep. Looking at the undeclared House seats and leanings to Republicans, a House seat total of 220-221 looks likely giving a marginal 2-3 seat majority. Such a small majority may mean the Trump administration gives more focus to tax and fiscal policies given how precarious the majority is. His strong election mandate means limited opposition to Trump’s wishes at this early stage. Scott Bessent is the current favourite for Treasury Secretary while Robert Lighthizer is reported to have been offered his old role of US Trade Representative. The other picks (Marco Rubio – Secretary of State; Linda McMahon Secretary of Commerce) point to staunch, loyal Trump supports gaining senior positions that suggest strong momentum in delivering on campaign promises from the beginning. Scott Bessent spoke about trade tariffs as a negotiating tool but suggested a strategy of “escalate to de-escalate” which points to a more aggressive start to tariffs. That’s the risk and this would fuel increased FX volatility and scope for continued US dollar appreciation. We certainly do not expect trade tariffs to take the back-seat under the first administration when the first tariffs were not delivered until January 2018.

While we expect a sooner start to trade tariffs than during Trump’s first term, media reports in the US suggest Trump’s primary initial focus could be on immigration. Trump has promised mass-deportations which we believe will be difficult to achieve. The primary goal in tax and fiscal policy will be extending the Tax Cuts & Jobs Act of 2017 in order to avoid expiry which is scheduled from 31st December 2025. This is a very expensive part of Trump’s plans that only ensures status quo and will not have the fiscal impulse the TCJA 2017 measures had on growth in 2018-19.

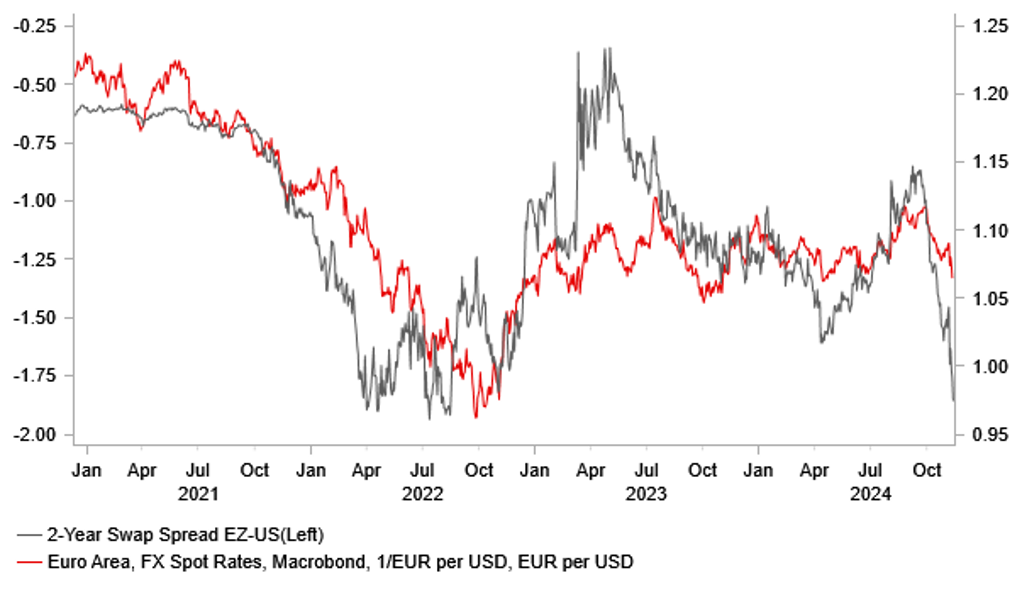

On the face of it, increasing tariffs on all imports, embarking on a program of mass-deportations and expanding fiscal policy and tax cuts are all inflationary. Given Trump’s mandate after delivering a strong election result, it is reasonable to assume some degree of all policies will be delivered. Therefore, the Fed will cut less than previously expected (now we assume one 25bp cut per quarter by end-2025) and the UST bond 10-year yield will be higher. But inflation is much higher today than in 2016 (12mth avg to election 3.1% versus 0.9% headline CPI) and inflation expectations are less anchored. One big initial difference in 2024 vs 2016 initial market reaction is the fact that real yields today have barely changed. In the first three trading days in 2016, real yields jumped 27bps. There also appears to be a higher risk of interference in Fed policy and Trump will be in a position to replace Powell in 2026. Trump wants a greater say in Fed decision making and this could be a recipe for dollar selling later in Trump’s term. The US economy is also slowing and the Fed will still likely be cutting. So while we are adjusting our US dollar levels stronger, we expect the peak the dollar to peak during the 1H of next year before modest depreciation unfolds going forward.

EUR/USD VS 2-YEAR EZ-US SWAP SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

10-DAY CHANGE IN REAL YIELDS AFTER ELECTIONS

Source: Bloomberg, Macrobond & MUFG GMR

Asia FX: Depreciation of Asia currencies likely persists into 2025

While many of Trump’s policies likely impact Asia FX directly and indirectly, tariff stands out as one of key factors which will drive Asia FX movements in this remaining year and the next. To evaluate the size and the timing of tariff, in addition to the angle of rebalancing US’s trade account, we need to factor in Trump’s aim to use the Tariff as a tool to push US MNCs to move some of their productions back to US, to create more domestic jobs. For a less disorderly transition of US MNCs companies (moving equipment back to US and etc), an announcement of front-loaded significant tariff increase on China, tariff increase on selective countries and selective products, and a phased schedule of implementation dates, soon after Trump takes office, seems a “proper” approach. We expect a jump of US tariff on China products, our new Asia FX forecasts price in a 20ppts increase of US’s average tariff on China products, from current 19% to 40% during next couple quarters. For the rest, we assume targeted tariffs on selective industries and/or selective countries. For the extreme scenario of 60% tariff on China products, our estimation shows that a 10~12% CNY depreciation against the Dollar is needed to counter the negative impact caused by the high tariff, everything else being equal (see Asia FX – The impact of Trump’s potential tariffs).

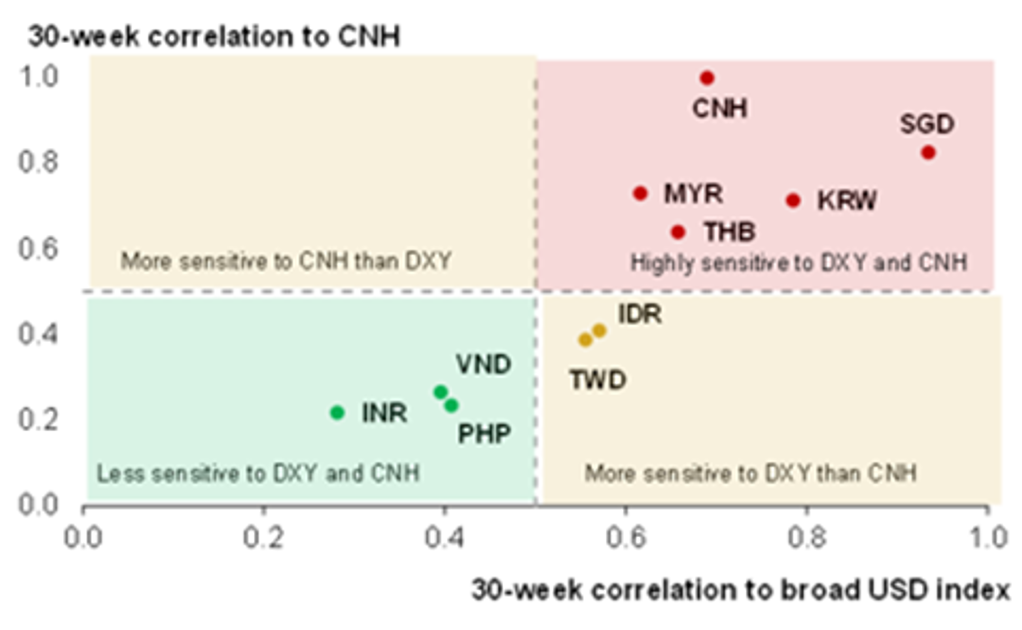

With our base-case assumptions of tariffs, we expect the likes of CNY, KRW, MYR, SGD, and THB to be more pressured and underperform, and for INR and PHP to outperform, relatively. USD/CNY likely continues to climb up and reach 7.5000 in Q2 2025, before US dollar’s softness in the 2H 2025 helps to relieve some pressure on CNY. The associated negative shock will weaken exports and stress on overall Chinese economy, which in turn will impact the rest of Asia and Asian currencies. We expect KRW, MYR, SGD, and THB to be more vulnerable because they are more export-oriented and leveraged to Chinese end-demand with higher sensitivity to the Chinese yuan. In Malaysia, while the domestic outlook is positive, driven by investments and fiscal consolidation, a potential tariff hike could still dominate, weakening the MYR. In Singapore, the MAS is likely to ease its tight exchange rate policy in January 2025 as the balance of risks shifts to growth. Meanwhile, the Thai baht is facing a double whammy from potential tariff hikes and the likely appointment of Finance Minister Kittiratt Na-Ranong as the new BoT chairman, who’s looking for a lower policy rate. And while Indonesia’s economy is more domestic oriented, the IDR is vulnerable to a strong US Dollar and high US yields.

On the flipside, we think INR and PHP should be relatively more insulated to tariff increases. In India’s case, an additional support for the currency comes from RBI FX intervention to continue capping USD/INR volatility. Vietnam would be more in the cross hairs of Trump this time given the sharp rise in bilateral trade deficit with the US and may face targeted tariffs on its electronic exports to the US. As such, VND could be more vulnerable relative to the 1st Trump Presidency.

Beyond tariffs, Asian currencies are to be impacted by other channels such as Fed’s rate cut cycle into 2025, domestic economic development, and country specific policies and factors. We think that Bank Indonesia and BSP will likely slow the pace of rate cuts somewhat next year. Some countries such as Philippines and Vietnam may be vulnerable through a remittance slowdown with increased scrutiny on unauthorised immigrants. Our initial assessment is that the impact should be manageable, both because it’s difficult to achieve what Trump has mentioned on deportation, and also because the vast majority of immigrants from the Philippines and Vietnam are legal permanent residents. Last but not least, we think that ASEAN and India continue to be well placed to benefit from supply chain reallocation and diversification over the medium-term (see Asia FX – Tariffs hurt growth but may benefit ASEAN over medium-term).

Nonetheless, there are huge downside risks from potentially more onerous tariff hikes and retaliation from trade partners. Upside risk could be China policy stimulus.

ASIA FX CORRELATIONS WITH CNH MOVEMENTS

Source: Bloomberg, CEIC, & MUFG GMR

STRONG SPILLOVERS FROM US-CHINA TRADE WAR

Source: Bloomberg, CEIC, & MUFG GMR

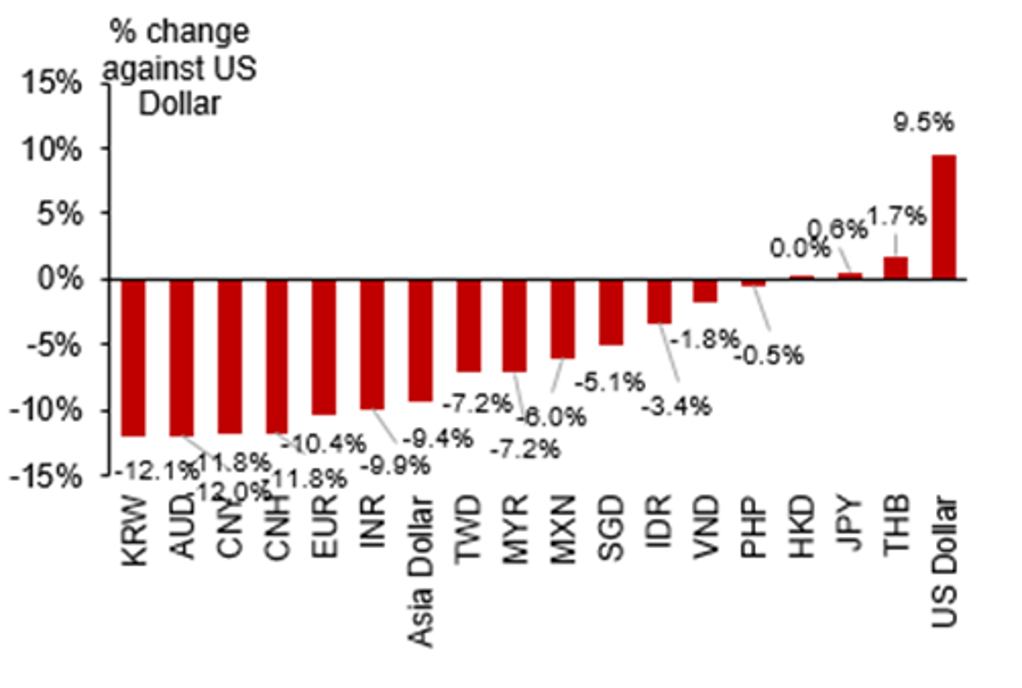

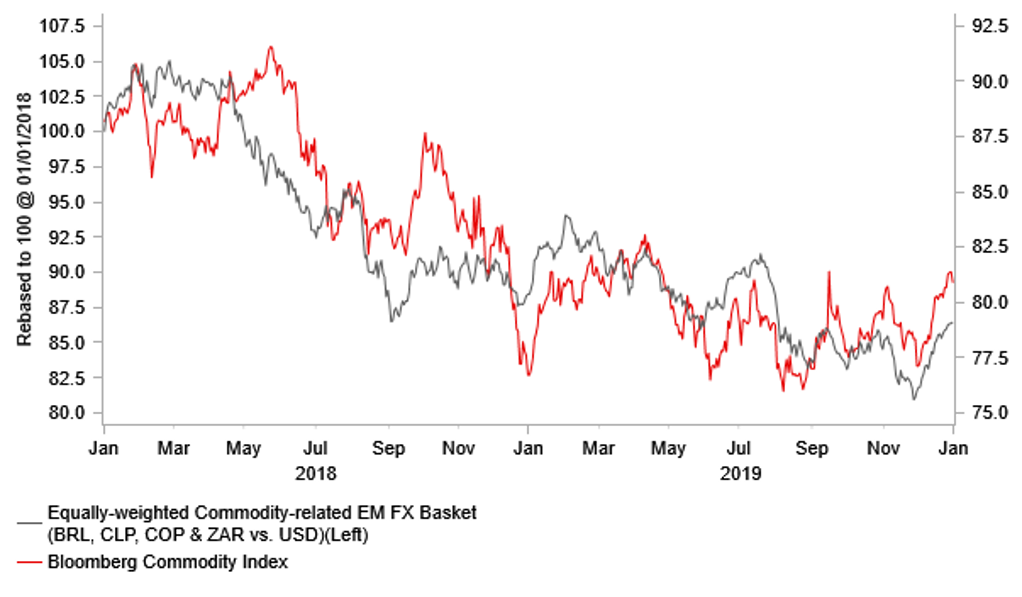

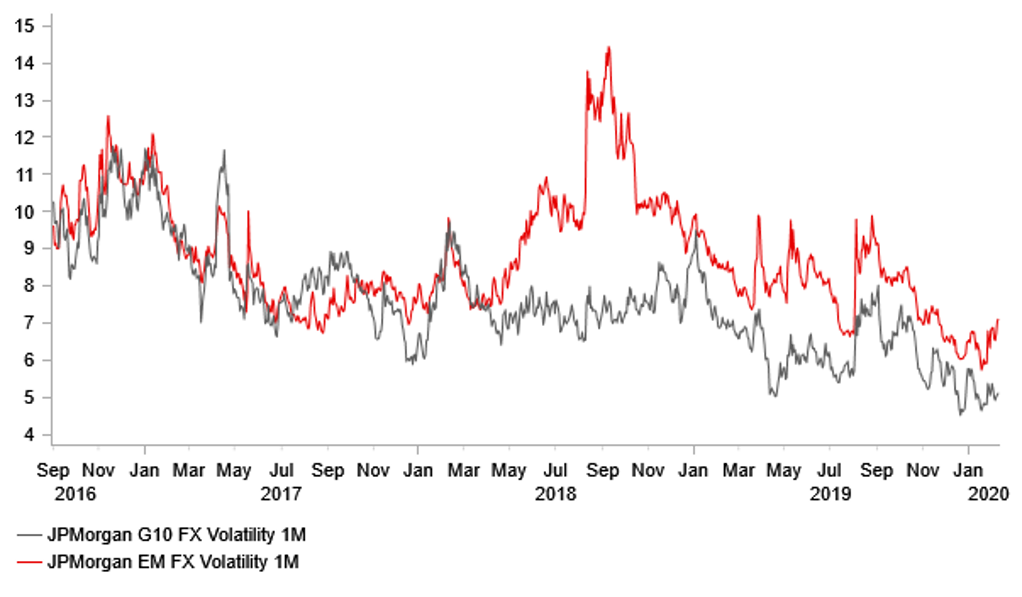

EM FX: Trade war & strong USD reinforces headwinds for emerging markets

Emerging market currencies have weakened against the USD following the US election. A Trump victory and likely Red Sweep is the most bullish outcome for the USD and will reinforce downward pressure on emerging market currencies in the year ahead. We expect Donald Trump to implement higher trade tariffs more quickly during his second term as President. Threats to raise import tariffs of up to 60% on China and to impose a 10% import tariff on all of the major trading partners of the US would represent a significant step up compared to the trade war started during Trump’s first term as President. Major trading partners would likely retaliate by imposing higher tariffs on imports from the US adding to downside risks for the global growth outlook. Those risks will only be partially offset by plans to step up fiscal stimulus in countries that are hit hardest by tariffs such as in China. The weakening global growth outlook and lower commodity prices should result in commodity-related emerging market currencies underperforming. Two of the worst performing emerging market currencies during the start of Trump’s first trade war between 2018 and 2019 (tariffs were first raised on China in early 2018) were the Latam currencies of the BRL and CLP as both declined by almost 20% against the USD. Not far behind were the ZAR and COP which declined by almost 15% and 12% respectively.

In contrast, the MXN strengthened modestly between 2018 and 2019. Instead weakness in the MXN was more front-loaded. USD/MXN hit a peak at just above the 22.000-level at the start of Trump’s first term in January 2017, and then never revisited those highs again until the COVID shock first hit in March 2020. The MXN appears to be following the same initial path after the US election with market participants again fearful that the Donald Trump will impose higher tariffs on Mexico as he seeks to crack down on Chinese goods being imported into the US through Mexico, and on illegal immigrants entering the US across the Mexican border. Mexican imports into the US have increased by almost 70% since the start of Tump’s first term as President with Mexico surpassing China as the biggest trading partner of the US. During his first term as President, the US, Mexico and Canada formally agreed and signed off the USMCA trade deal in October and November of 2018 which came into effect in July 2020. The trade agreement is set for its first review on 1st July 2026. The US, Mexico and Canada will need to decide whether to continue, identify or withdraw from the agreement. Heightened trade policy uncertainty is set to remain a headwind for Mexico’s economy and the MXN during the first half of Trump’s second term as President.

While direct trading links to the US are more limited for EMEA EM economies. We still expect the CZK, HUF and PLN to weaken alongside the EUR against the USD. There is a much higher probability that Donald Trump will impose higher tariffs on the EU that would be met with retaliatory tariffs adding to downside risks to the already weak growth outlook in Europe. Market participants have already become concerned that the ruling government in Hungary will act to overstimulate growth next year ahead of the Presidential election scheduled by April 2026. Current NBH Governor Matolcsy’s term ends in spring 2025 and he could be replaced by Prime Minister Orban with someone who is more open to lower rates. It leaves the HUF vulnerable to further weakness in the year ahead unless the NBH acts to implement emergency rate hikes to stabilize the HUF like in the autumn of 2022. One additional uncertainty for Central European currencies will be how the election of Donald Trump will impact geopolitical tensions in the region. He reportedly wants to bring a quick end to the Ukraine conflict. In contrast, the TRY still appears well placed to continue to outperform on a total return basis after taking into consideration carry returns and the slower pace of nominal depreciation. We are expecting the slower pace of TRY depreciation to continue in the year ahead with risks tilted in favour of a bigger sell-off amidst EM weakness.

EM FX PERFORMANCE DURING TRUMP’S TRADE WAR

Source: Bloomberg, Macrobond & MUFG GMR

EM FX VOLATILITY SPIKED HIGHER IN 2018

Source: Bloomberg, Macrobond & MUFG GMR

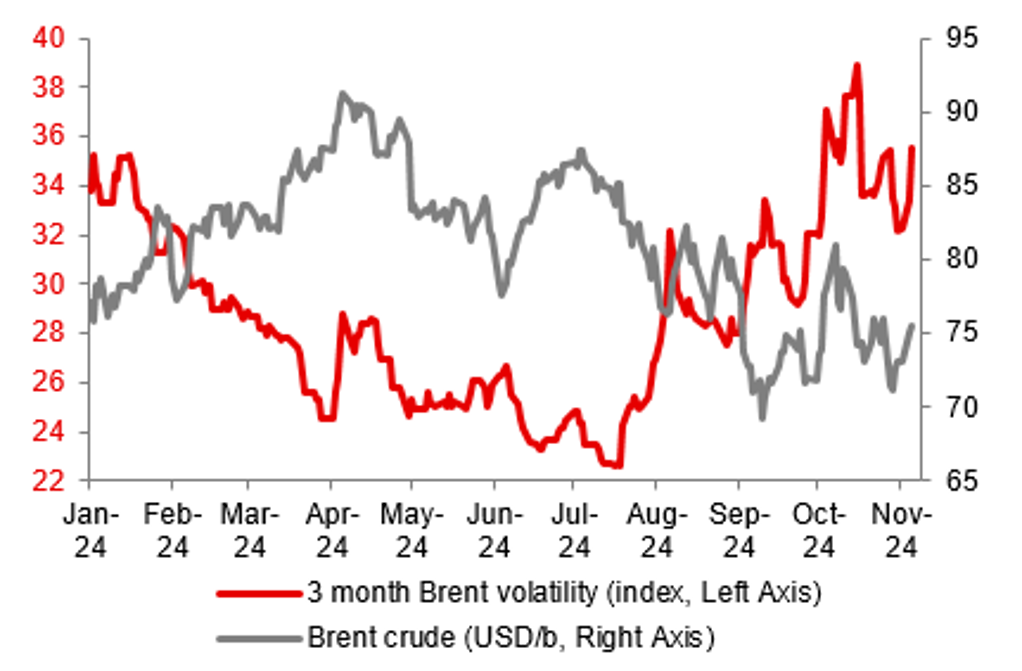

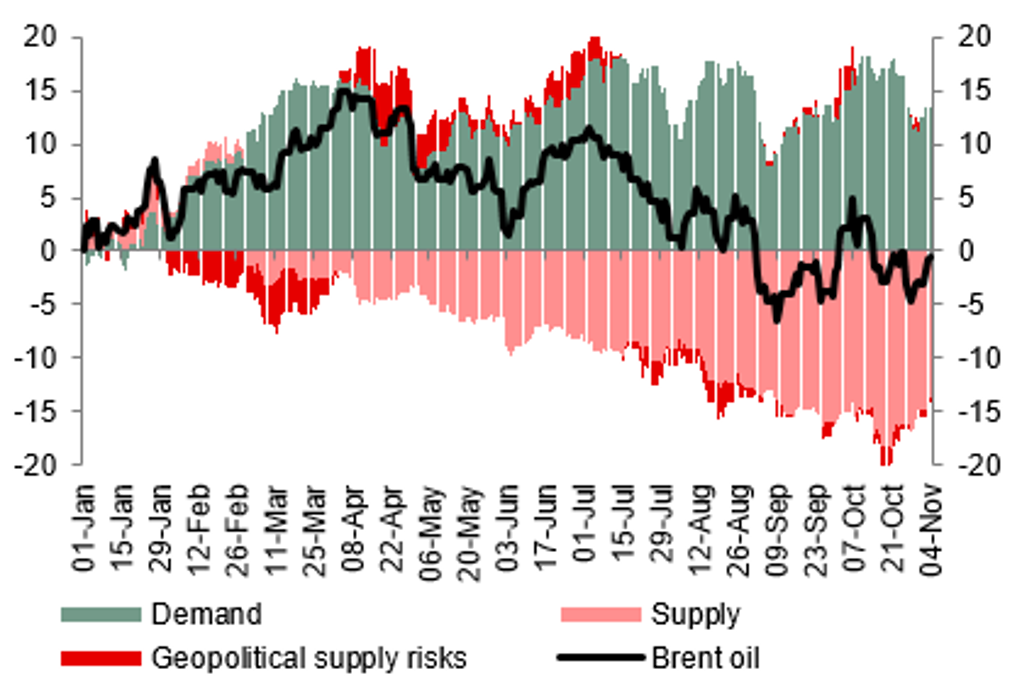

Crude oil: Gravitational tilt for oil prices is to the downside until Trump 2.0

Oil’s rally in the days leading up to the US election on renewed geopolitical tensions in the Middle East and an additional one month delay to OPEC+ production increases has been tempered as traders zero in on the realities of a Trump 2.0 administration. At face value, Trump policies bring with it oil price tailwinds through (1) crude production supportive policies, (2) weaker crude demand through higher tariffs, and (3) a stronger US dollar. It was telling that Trump riffed on energy in his acceptance speech, declaring “leave the oil to me, we have more liquid oil and gas than any country in the world”.

Whilst there may be value in long oil positions given portfolio hedging benefits against lingering geopolitical shocks – especially during the lame duck US presidential period (between 5 November and inauguration day on 20 January 2025) – investor attention has markedly shifted back to the bearish prices risks of significant oversupply in 2025. Consequently, positioning (as measured by net managed money) and valuation (as measured versus an inventory-based fair value model) in oil remain at extremely low levels. This is thus not leaving much in the way of price support given the risks of oversupply in 2025 coming into view, which could mean a stronger US dollar ahead, and with it another headwind for oil prices.

From a pricing perspective, we recognise that 2025 oversupply apprehensions will continue to weigh on pricing levels, and thus we are reducing our range for Brent prices to a USD65-80/b corridor (from USD70-85/b earlier), reflecting a lower fair value estimate for long-dated prices. We thus now look for Brent to average USD75/b in Q4 2024 (from USD84/b prior) and, average USD73/b for 2025 (from USD80/b prior).

On balance, we believe that risks to our new lower oil price forecasts are skewed further to the downside, given healthy ~6m b/d of OPEC+ spare capacity, potential trade tensions and the possibility that OPEC+ may bring its lost barrels back to market in 2025. Indeed, in the scenario that Chinese oil demand stays flat, the US imposes an across-the-board tariff of 10% on goods imports and/or OPEC+ fully reverses its 2.2m b/d of extra production cuts through November 2025, then we could witness Brent crude testing the low USD60s/b handle. Furthermore, whilst not our base case and we assign a low probability to a moderate recession scenario wherein OPEC+ responds by curbing production further, Brent crude may sink to the USD50s/b range.

OIL’S IMPLIED VOLATILITY INDEX IS EDGING HIGHER ON TRUMP 2.0 RISKS WITH UNCERTAINTIES ABOUND

Source: Bloomberg, Macrobond & MUFG GMR

MODELLING ESTIMATES PUT ONLY A NEGLIGIBLE QUANTUM TO TODAY’S GEOPOLITICAL SUPPLY RISKS

Source: Bloomberg, Macrobond & MUFG GMR