Key Points

- The Philippines central bank cut rates by 25bps in its August policy meeting, bringing the key reverse repo rate to 6.25% from 6.50% previously, and in line with our expectations. This move marks the 1st central bank in Asia to start the rate cut cycle in the global inflation shock, putting aside China and Vietnam who are in a different part of the cycle due to issues such as a real estate slowdown.

- The key message we got from the statement and the post-policy press conference is that gradual BSP rate cuts into 2025 is the path of least resistance.

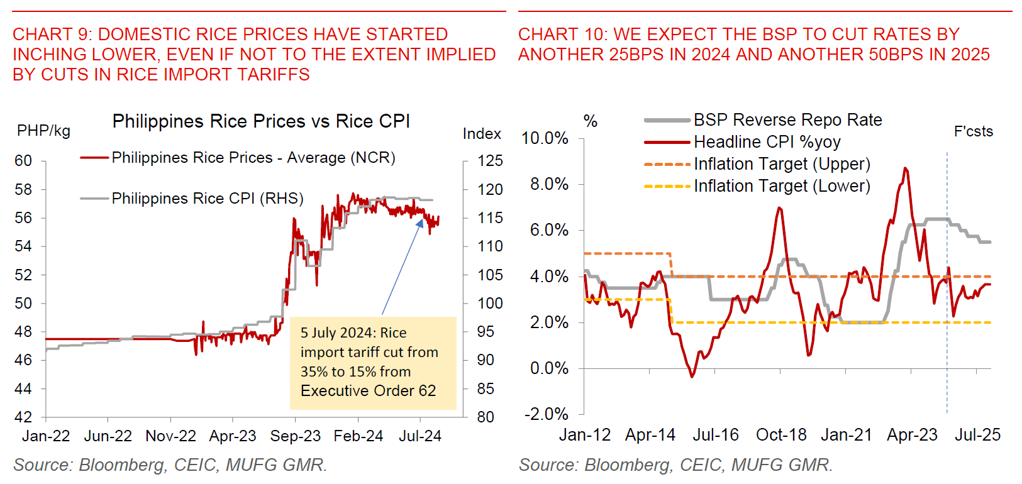

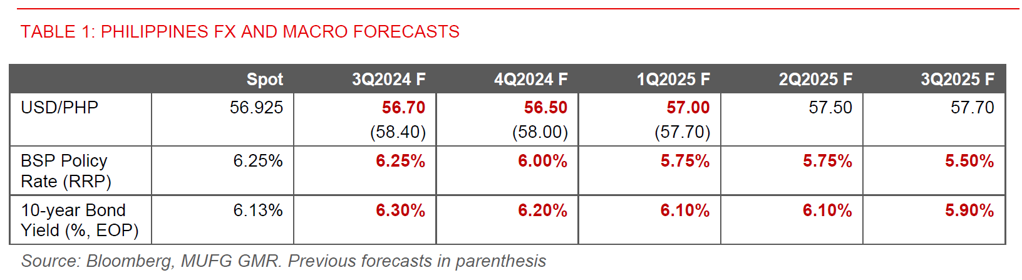

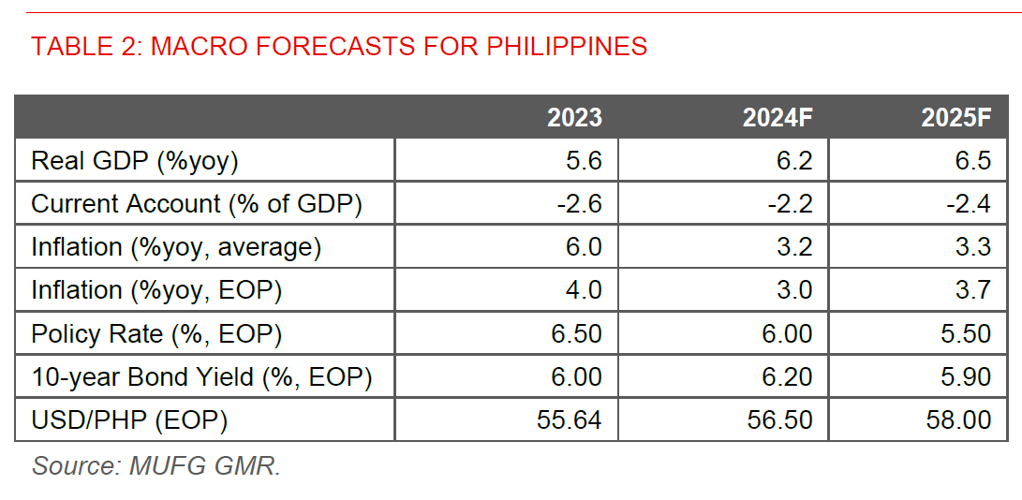

- Moving forward, we continue to expect the BSP to cut rates by another 25bps this year (likely in the December meeting), and by another 50bps in 2025.

- From an FX perspective, USD/PHP has already moved down quite meaningfully to 56.925, and below our 2Q2025 forecast of 57.50, in part due to global factors. It’s nonetheless important to stress that these moves are in line with our directional views that USD/PHP had diverged from its fundamentals, and as such had some space for a modest downward bias, even if these shifts came earlier and faster than we had forecasted (see Philippines: USD/PHP – From Divergence to Convergence?)

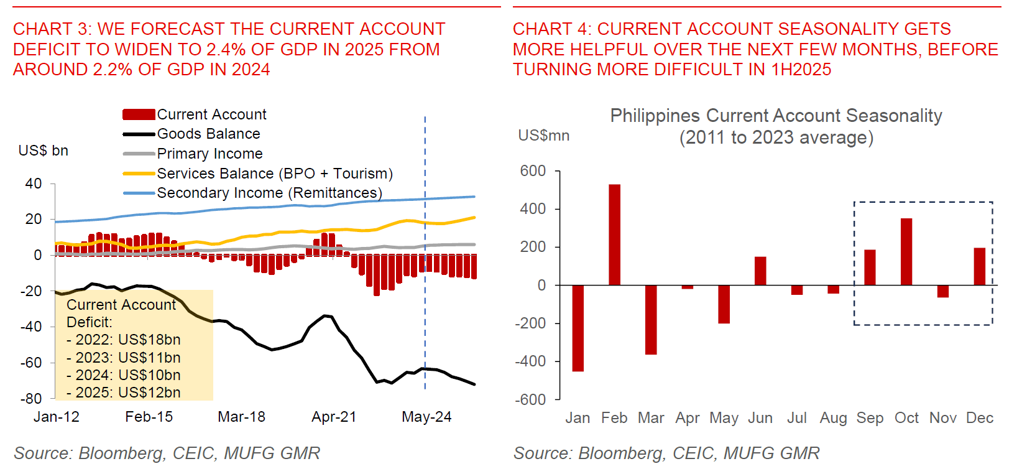

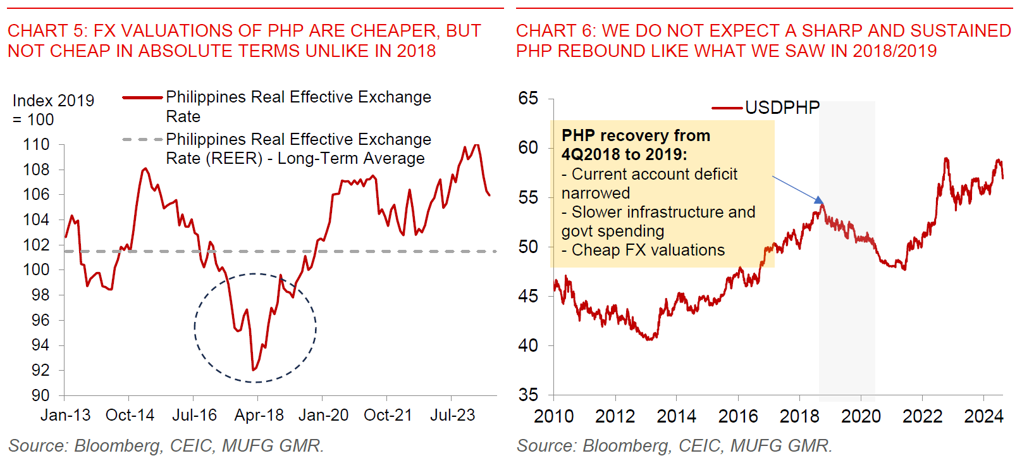

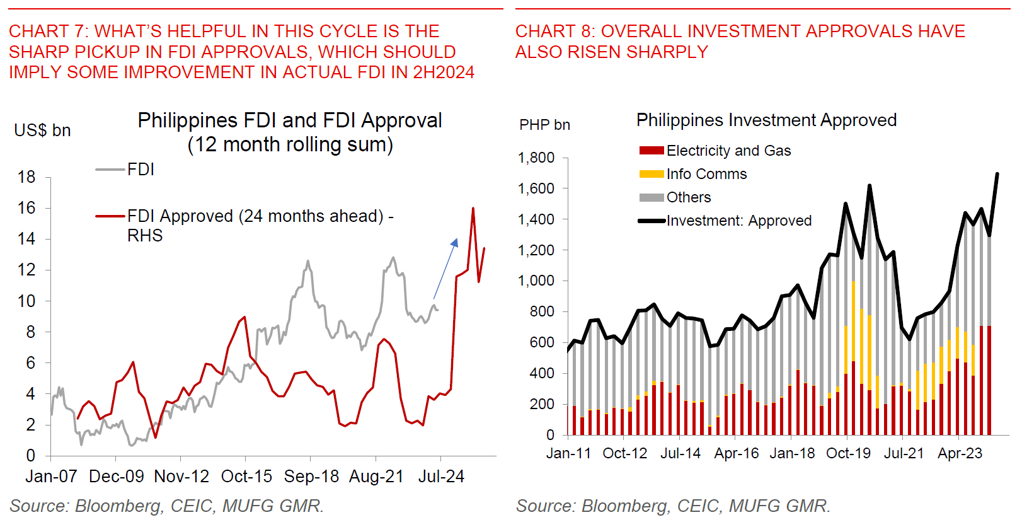

- Overall, we lower our end-year USD/PHP forecast to 56.50 but keep our 2Q2025 forecast at 57.50. In the near-term, there is probably some space for PHP to strengthen modestly further against the Dollar towards the 56.00-56.50 handle with helpful current account and remittances seasonality in 4Q, expectations for FDI to improve, and as the Fed cuts rates.

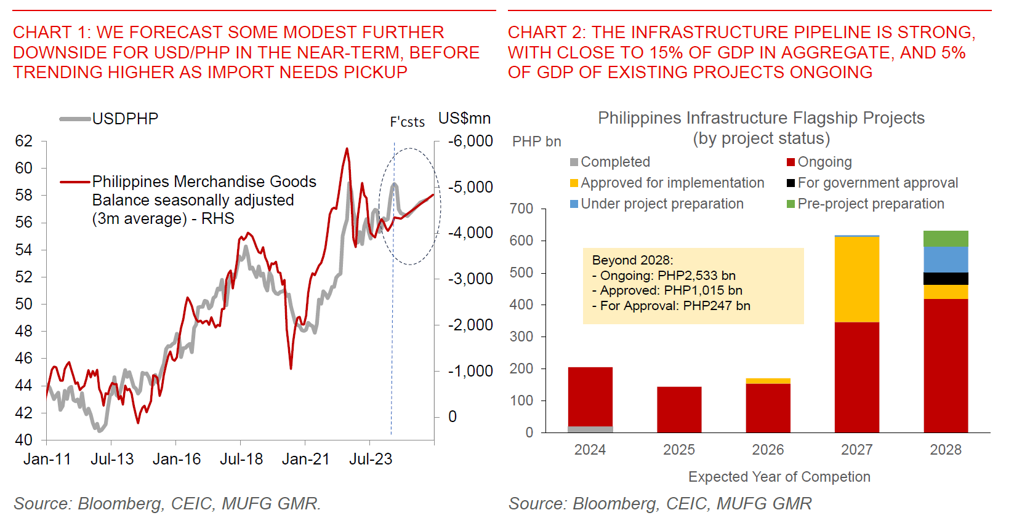

- Nonetheless, a sharp and sustained PHP rebound akin to what we saw from 4Q2018 to 2019 is unlikely as we look into 2025. First, we expect the current account deficit to widen as infrastructure and import needs pickup. Second, PHP FX valuations as denoted by REER deviation from long-term averages are not cheap in absolute terms. Third, we still expect the BSP to deliver 100bps of rate cuts in total through 2025, with the bias of risks potentially towards more cuts. Fourth, there are left-tail risks to growth including from Typhoon Carina and the recent ban on Philippines Offshore Gaming Corporations (POGOs).

Some details from the BSP August policy decision:

- The consensus for the BSP meeting was extremely split this time around, with 13 out of 23 economists (including ourselves) calling for a 25bps rate cut.

- The central bank cut its risk-adjusted inflation forecasts for 2025 to 2.9% (from 3.1%), even as it raised the near-term 2024 forecasts to 3.3% from 3.1%. It also added in the 2026 CPI forecasts for the 1st time at 3.3%.

- The policy statement highlighted that the BSP will continue to take a “measured” (emphasis mine) approach in ensuring price stability conducive to balanced and sustainable growth of the economy and employment. To my mind, this seems to suggest a data dependent stance but also gradual rate cuts as a path of least resistance.

- There were some comments in the question and answer session about how growth in 2Q was somewhat slower than expected especially in private consumption, and I think that may have tilted the balance towards a rate cut. The BSP does not announce the vote within the Monetary Policy Board publicly and I imagine it was a finely balanced call internally this time around. Moving forward, I think BSP will pause and take stock, and as such October is unlikely for another cut.

- Another 50bps of rate cuts is unlikely to happen in 2024 unless something “pretty bad” happens.

- The BSP continues to expect the economy to operate at a negative output gap in the near-term, while the risk to inflation outlook continues to be tilted towards the downside. Upside risks to inflation could come from higher electricity rates and external factors, while downside risks are mainly linked to lower import tariffs on rice.

- The BSP is expecting 50bps of rate cuts by the Fed in 2024, and another 100bps of cuts in 2025, while the BSP Governor was at pains to highlight that its actions are not tied by fate to the Fed. It’s not the 1st time that BSP has cut ahead of the Fed (this last happened in the 2019 cycle), but it’s important to note that the Philippines current account deficit was narrowing quite substantially back then, something which we are not forecasting in this cycle.

- The BSP views the Reserve Ratio Requirement as being “ridiculously high”, and will look to reduce it over time, with the Governor preferring to standardise the rate across banks and different deposit liabilities