Key Points

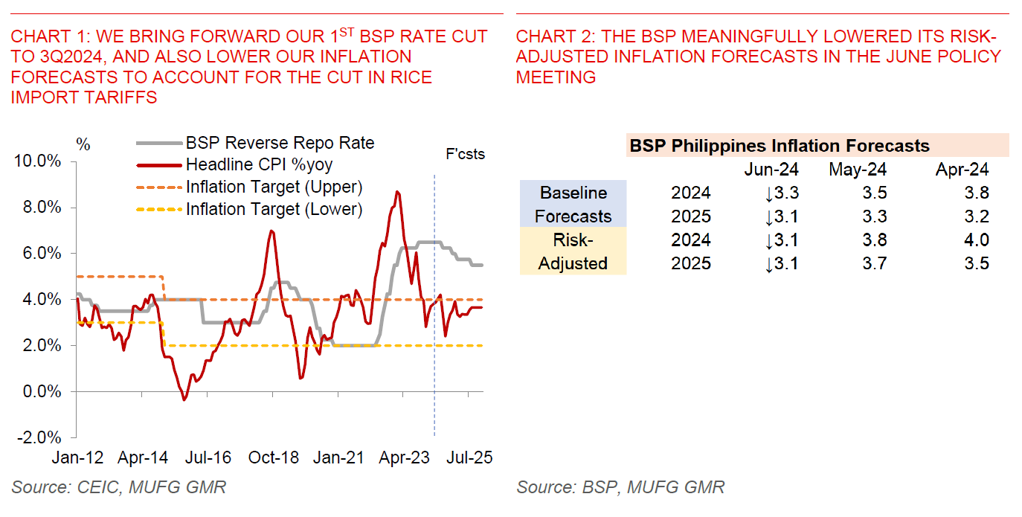

- The Philippines central bank kept its key policy rate unchanged at 6.50% in its June 2024 meeting.

- More importantly, the BSP has turned more confident on a rate cut for the August meeting, with the balance of risks to inflation tilting to the downside due largely to recently announced lower rice import tariffs.

- We raise our USDPHP forecasts to 59.00 for 3Q2024 (from 58.50 previously) and to 58.00 for 2Q2025 to account for a more dovish BSP, and bring forward our 1st BSP rate cut forecast to 3Q2024 from 4Q2024 previously. We think BSP could cut rates by 50bps this year, and perhaps by another 50bps next year bringing the policy rate to 5.50% by end-2025.

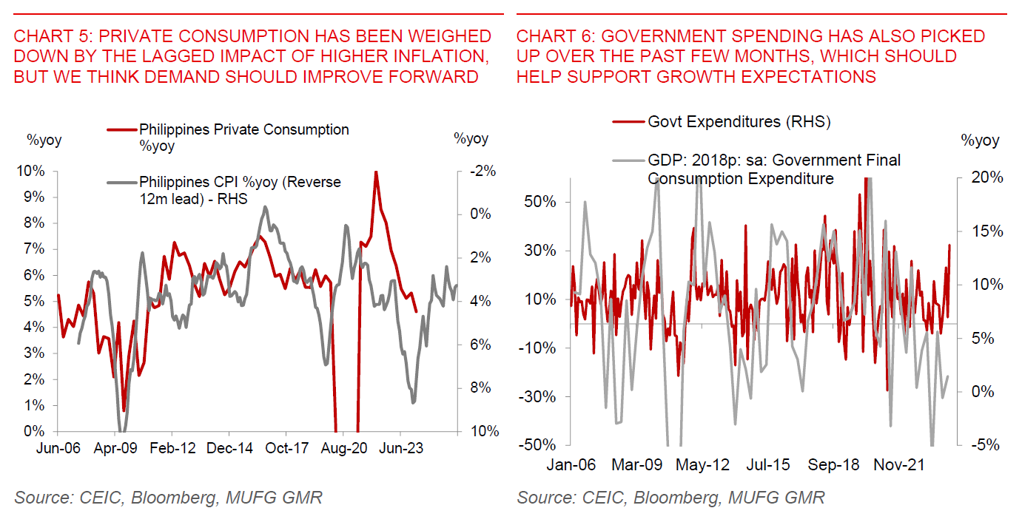

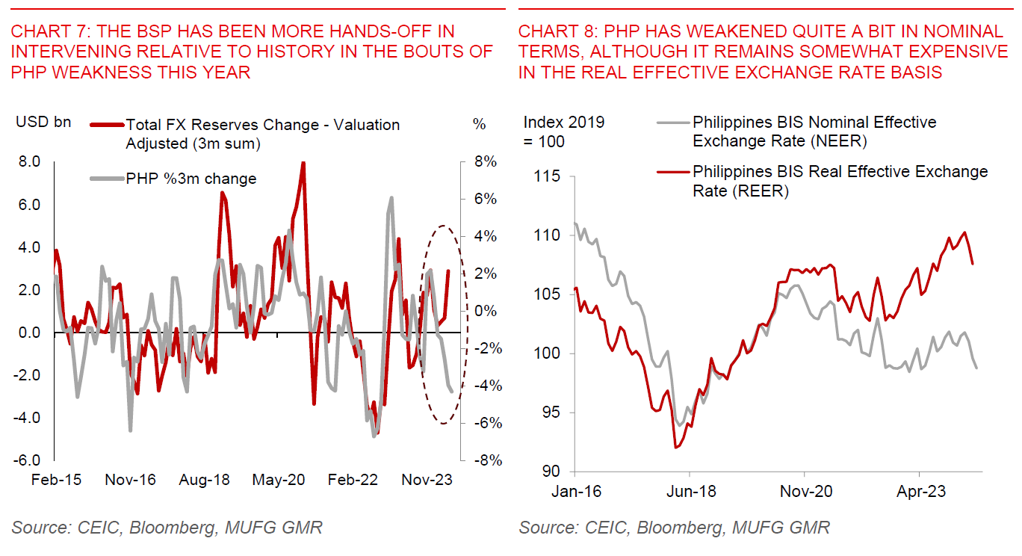

- We are not overly bearish on PHP at current levels, given offsetting domestic supports for the currency such as rising FDI, a manageable current account deficit, coupled with a likely pickup in growth expectations and with that equity and bond inflows. From a global perspective, there are increasing signs that the US economy is softening somewhat and with that we think the Fed will likely start to cut rates later this year to recalibrate its restrictive stance.

- Nonetheless, we note our forecasts are fraught with far more uncertainty than usual, with PHP and Asian FX more generally caught between multiple crosswinds.

- For one, the outcome of the French Elections next month could weigh on EURUSD, possibly boosting the Dollar and negatively impacting global risk appetite. We are effectively assuming that we have a muddle through scenario in France but an outcome which sees the far-right party gain more strength than expected could further increase the perception of fiscal risks in Europe.

- Second, markets could also increasingly try to price for the US Presidential Elections. As a general observation we note the impact of a possible Trump Presidency is more uncertain this time given lower fiscal space for tax cuts in the US and unclear sequencing on the implementation of tariffs.

- Third, the recent increase in geopolitical tensions between the Philippines and China may pose some downside risks to growth in the Philippines, if it escalates more broadly to impact trade, which we stress is not our base case.

- As such, the distribution of risks to our forecasts tilt towards a weaker PHP, even as we currently forecast a downward sloping profile for USDPHP.

Additional details from the June 2024 BSP meeting:

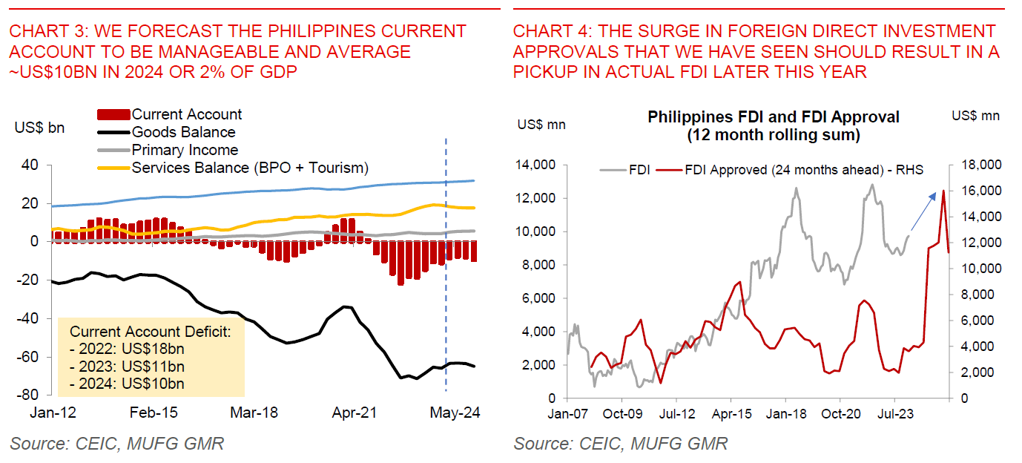

- The balance of risks to inflation has shifted to the downside for 2024 and 2025, with the BSP cutting their risk adjusted inflation forecast to 3.1% for 2024 (from 3.8% previously), and 3.1% for 2025 (from 3.7%).

- The impact of the cut in rice import tariffs from 35% to 15% is estimated at around 0.2pp in the central bank’s baseline forecasts. The BSP considers the cut in rice tariffs to be an important macro development, given that rice is a very salient factor in forming inflation expectations in the Philippines.

- The impact of weak PHP to inflation is quite small so far. The BSP estimates that every 1% depreciation in the PHP leads to 0.036% rise in inflation. The cumulative impact of PHP weakness thus far is as such estimated at 0.1-0.2pp.

- The BSP has been sporadically active in intervening in the FX market, but when it sees stress, coming in to slow sharp moves in PHP.