Key Points

- The Philippines central bank raised its key policy rate by 25bps in an off-cycle announcement, bringing it to 6.50% from 6.25%.

- In its post policy press conference, BSP Governor Eli Remolona kept alive the possibility of further rate hikes at its 16 Nov meeting, with the central bank prepared for “follow-through” policy action.

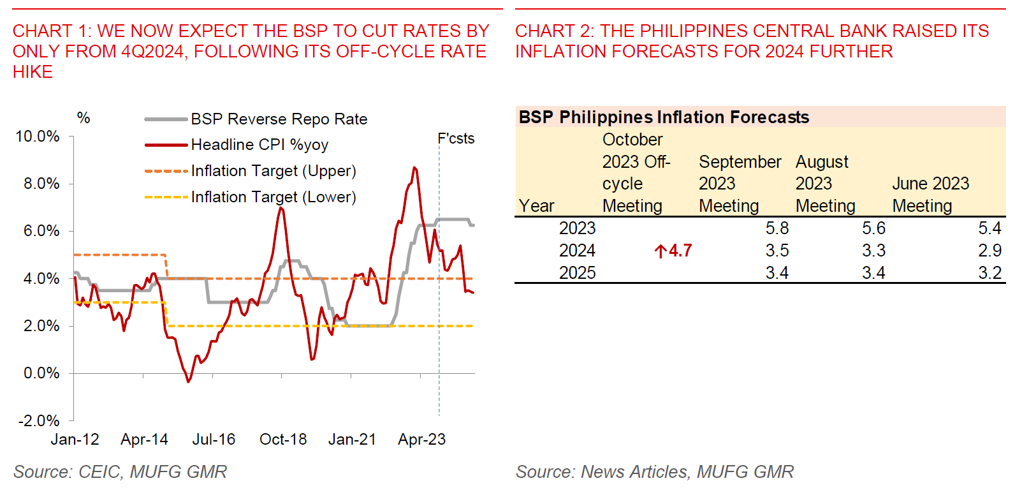

- The BSP raised its 2024 inflation forecast to 4.7% (from 3.5%), while also saying indicators point to second-round effects to inflation broadening even as demand is moderating.

- While an off-cycle rate hike was previously flagged as a possibility by the BSP Governor, we find it interesting that the Governor managed to achieve consensus among the BSP Monetary Board. In recent weeks, we had comments from senior officials including the Finance Secretary and NEDA Secretary, saying that supply-side inflation shocks may not need a policy response.

- The Philippines’ central bank move also follows on from Bank Indonesia’s recent surprise rate hike (see Bank Indonesia Oct – A surprise rate hike to stem Rupiah weakness). All these highlights the increasing spillover impact of Dollar strength and higher US yields on Asian central banks and their ability to support growth into 2024, even as they push back against currency weakness.

- The key difference for the Philippines compared with other high-yielding Asian FX such as India and Indonesia is that growth in the Philippines is already slowing, while inflation seems to be much stickier, even if quite a bit of it is due to rice price shocks outside of the central bank’s control.

- As such, the policy trade-offs for the BSP are becoming increasingly difficult, even as the central bank is hiking while intervening in the FX market to manage inflation expectations and to prevent the currency from weakening too much.

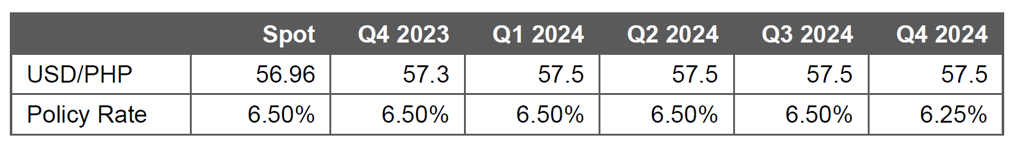

- We forecast USDPHP at 57.3 in 3 months and 57.5 in 12 months, implying underperformance of PHP against Asian currencies.

- We now see the BSP cutting rates only from 4Q2024 (from 3Q2024 in our previous expectation), given that inflation is only likely to fall within the BSP’s inflation target range from 3Q2024 onwards, and with the assumption that the Fed will start cutting rates next year. Nonetheless, we note the risks are tilted towards the BSP hiking rates perhaps by once more from here, depending on how inflation pressures pan out.