Key Points

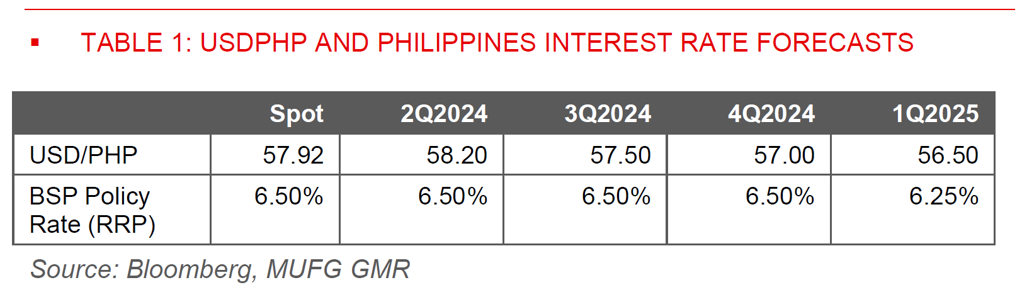

- Summary: We revise up our USDPHP forecasts to 58.20 for 2Q2024, 57.00 for 4Q2024, and 56.50 for 1Q2025 (from 56.00, 55.70 and 55.00 previously). We now think the BSP will delay the 1st policy rate cut to 1Q2025 (from our previous expectation of 3Q2024) to help guard against PHP volatility and given still sticky inflation.

- Our forecasts build in the stronger Dollar that our global team expects in the near-term, together with increased left-tail risks of geopolitical conflict, and with that the chance of oil price spikes. However, these negatives are balanced against domestic positives such as rising FDI approvals, a more manageable current account deficit of 2% of GDP, gradual growth improvement, coupled with sticky but still likely within-target inflation through our forecast horizon.

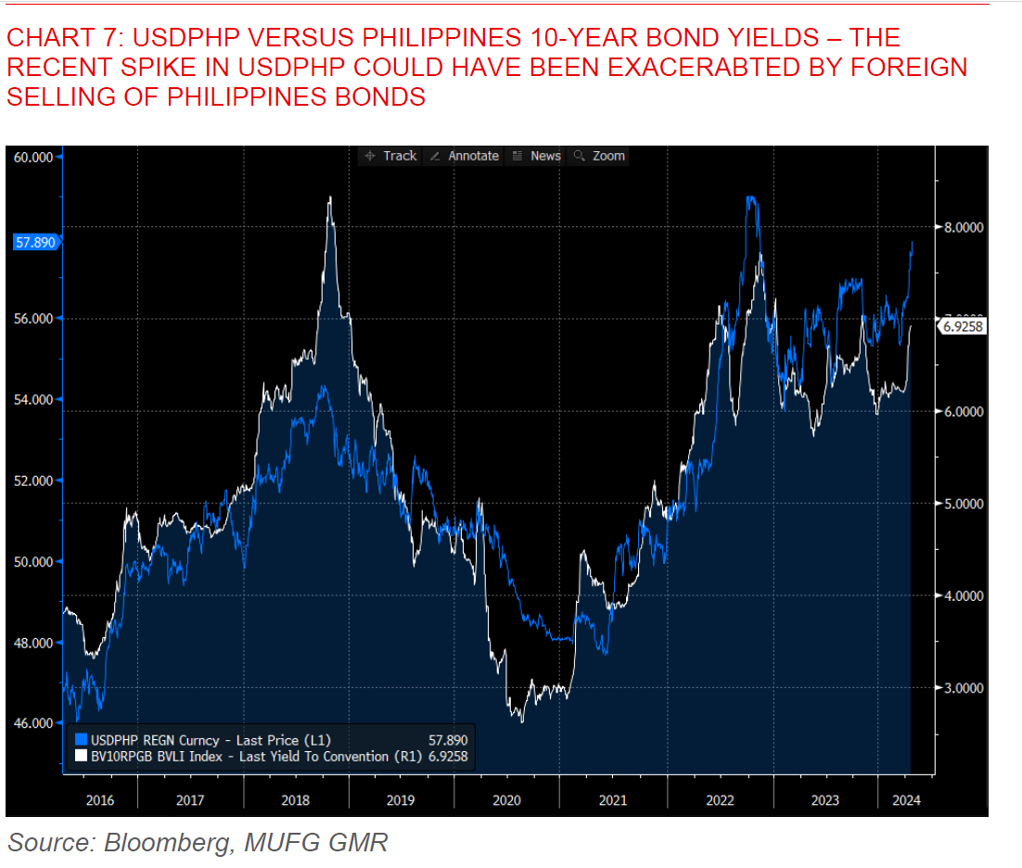

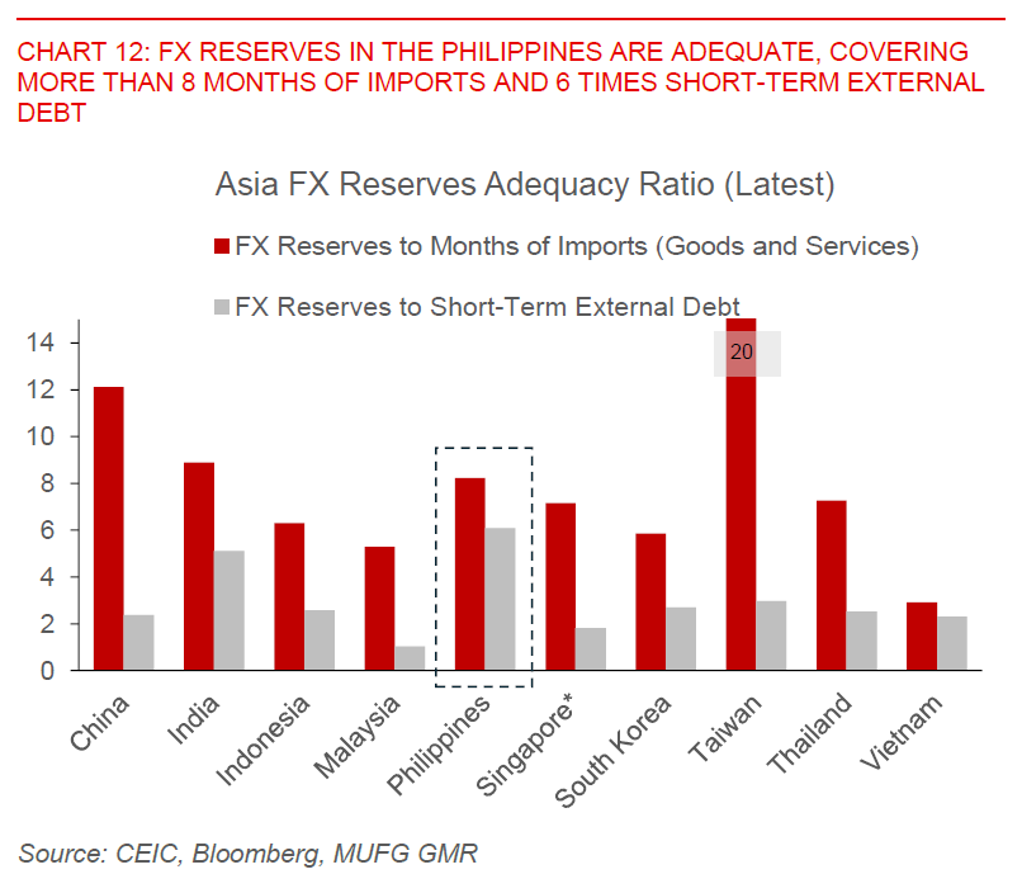

- In addition, we think the chance of more aggressive FX intervention by the BSP has risen given concerns around the possible FX pass through to inflation. The 1st levels to watch are likely around 58.00, followed by the 59.00 level. This should also cap the potential spikes to USDPHP moving forward, notwithstanding global risks.

- Part of the forecast change stems from global factors and our Dollar and Fed view. While we had previously assumed that the Fed begins its rate cut cycle over the next few months, recent macro developments including the hotter than expected US inflation numbers have raised the spectre of the Fed keeping rates high for longer. In contrast, other G10 central banks such as ECB have moved in the opposite direction by communicating more clearly on the starting path for rate cuts. Increasing geopolitical tensions in the Middle East coupled with rising oil prices have also led to a sharp rise in volatility, impacting Asian currencies including PHP.

- Our global team thinks that the Dollar has scope to rise further over the next one to two months with EURUSD possibly trading towards 1.050, although they stress this window for Dollar strength will likely close in 2H2024 especially given that markets have already meaningfully priced out Fed rate cuts into 2025 (see FX Weekly – USD has scope for further gains , FX Daily, and Chart 1 below). We will update our global FX assumptions in the next Global FX Monthly.

- Beyond global factors, we are hesitant to call for outright PHP underperformance for a couple of reasons.

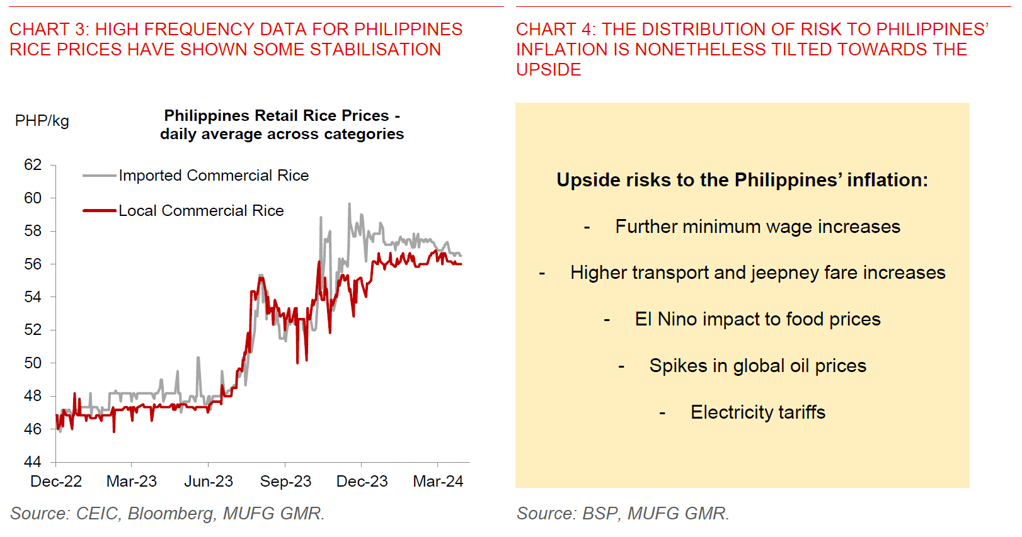

- First, while domestic inflation is expected to be sticky moving forward due to food prices and supply-side shocks, it should still remain within the central bank’s target on average through 2024 (see Chart 1 below). We are forecasting the Philippines’ inflation to average 3.7% in 2024, albeit with some months where inflation will rise above the central bank’s upper band of its inflation target. The good news as well is that President Marcos has asked the Department of Agriculture to streamline rules on farm imports including on sugar. We nonetheless remain watchful for upside risks to inflation due to factors such as further minimum wage increases, higher transport and jeepney fare increases, and increases in electricity tariffs.

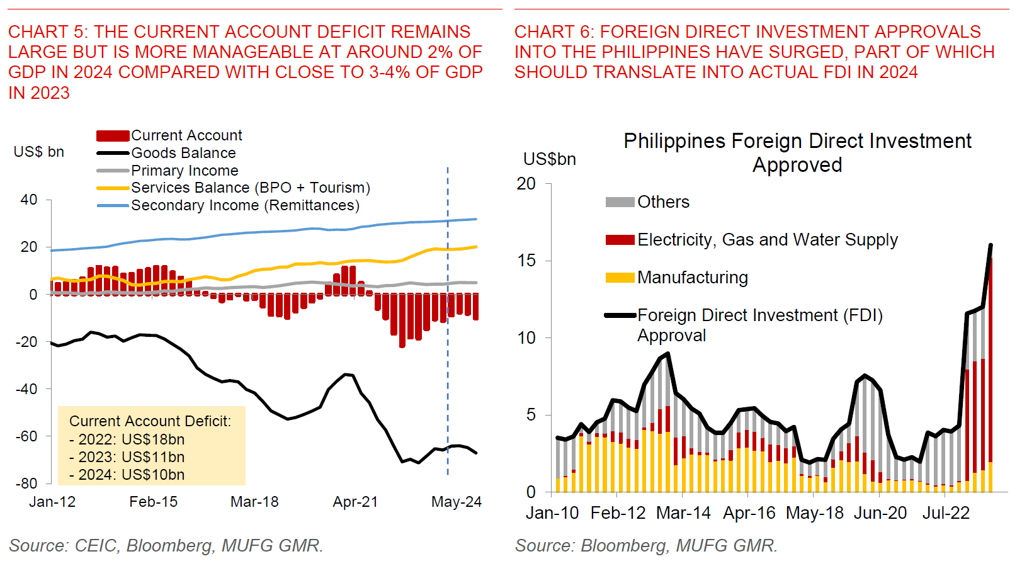

- Second, the Philippines’ current account deficit is expected to be more manageable in 2024 at around 2% of GDP (or around US$10bn). This compares with rates closer to 3-4% of GDP over the past 2 years. We expect some small widening in the goods deficit due to infrastructure import needs, but with steady BPO revenue growth, tourism improvement and remittances inflows offsetting that (see Chart 6 below).

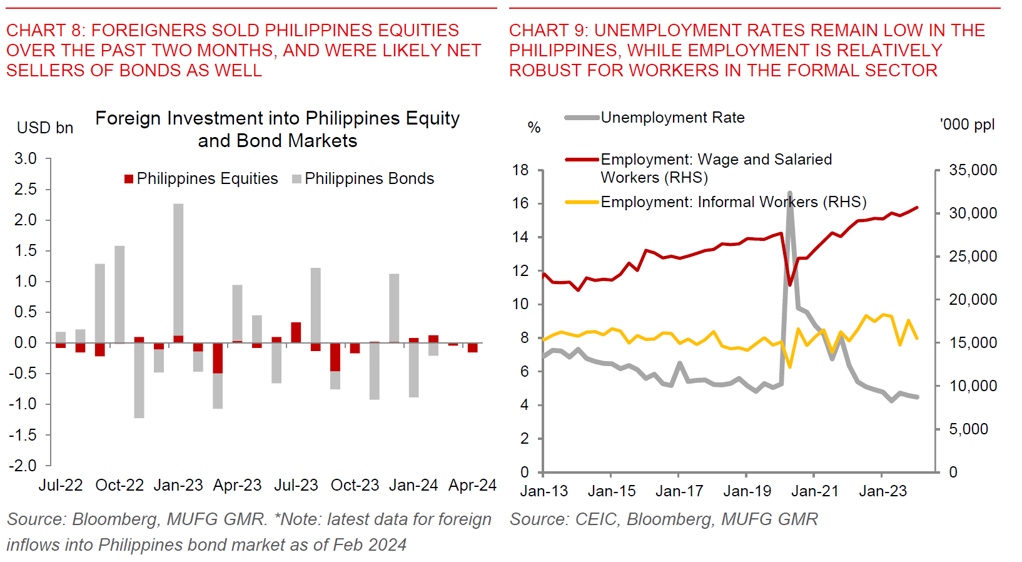

- Third, FDI approvals have surged to more than US$16bn driven by the utilities and to a smaller extent manufacturing sector (see Chart 7 below). While not all approvals will translate to actual FDI, the direction of travel should still be positive, and ultimately helping to support PHP moving forward through 2024.

- Fourth, we also expect some gradual improvement in Philippines’ GDP growth to around 6% in 2024, helped by a resilient labour market, improving tourism, more manageable inflation, coupled with the pickup in investment approvals and public infrastructure spending. This should over time support foreign equity inflows.

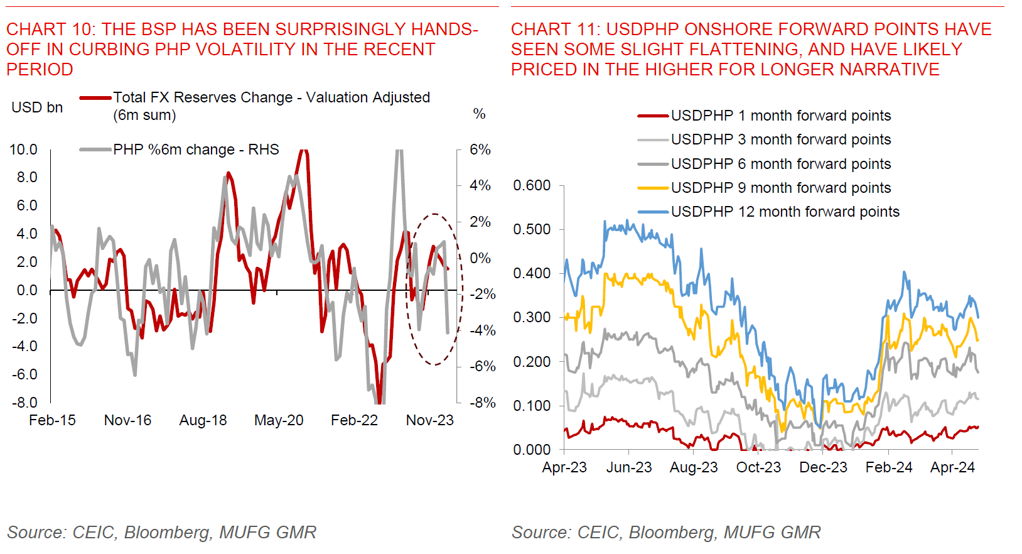

- We note that the BSP has been surprisingly hands-off in intervening to cap FX volatility in the recent period, having stepped in to curb USDPHP at around the 57 levels previously in 2H2023. We think we are much closer to levels of more aggressive BSP intervention, given concerns about the potential FX pass-through to domestic inflation. We think the 1st levels to watch are around the 58.00 levels, coupled with next levels around 59.00.