Key Points

- Our analysis shows PHP weakness can be attributed to three factors. First, the rise in oil prices due to oil supply cuts. Second, the increase in long-end US Treasury yields, and third, the stronger US Dollar.

- Moving forward, we think the recent FX decline may be overdone. On the global front, we are expecting global yields to trend lower and the US Dollar to weaken. On the domestic front, inflation is coming off faster than we initially expected, the trade deficit is narrowing (albeit still wide), while FDI should pickup from here.

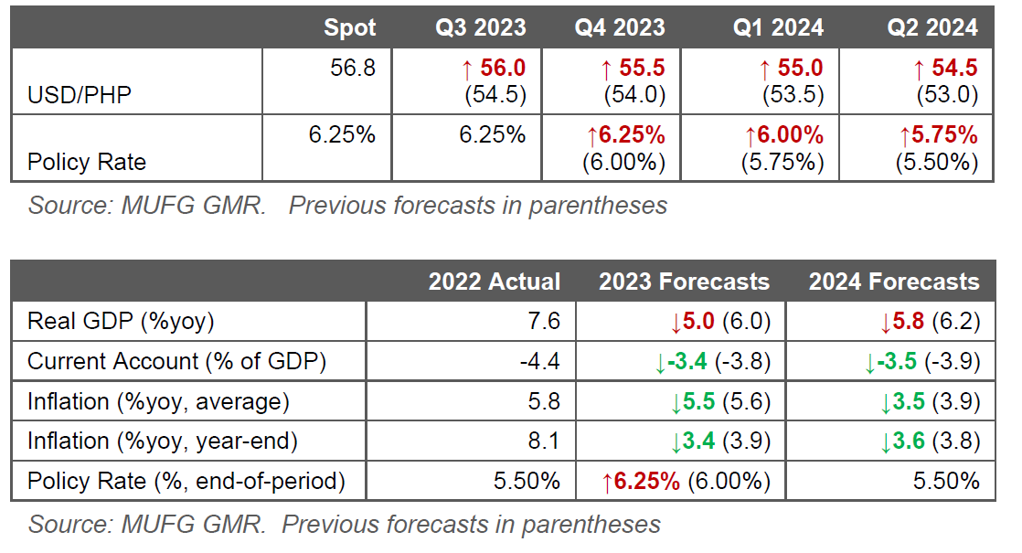

- We raise our USDPHP forecast to 56.0 in 3 months and 54.5 in 12 months (from 54.5 and 53.0 previously). In retrospect, our PHP forecasts were too strong, but we still think that the direction is still for USDPHP to be lower from here.

- We now see the BSP cutting rates by 75bps starting from 1Q2024 (from 4Q2023 previously), given uncertainties on global interest rates and commodity prices. We also lower our growth, inflation and current account deficit forecasts.

- Where will we be wrong? Sharp oil and food price spikes, further US yield increases, and a sharp China slowdown, all of which are not our base case.

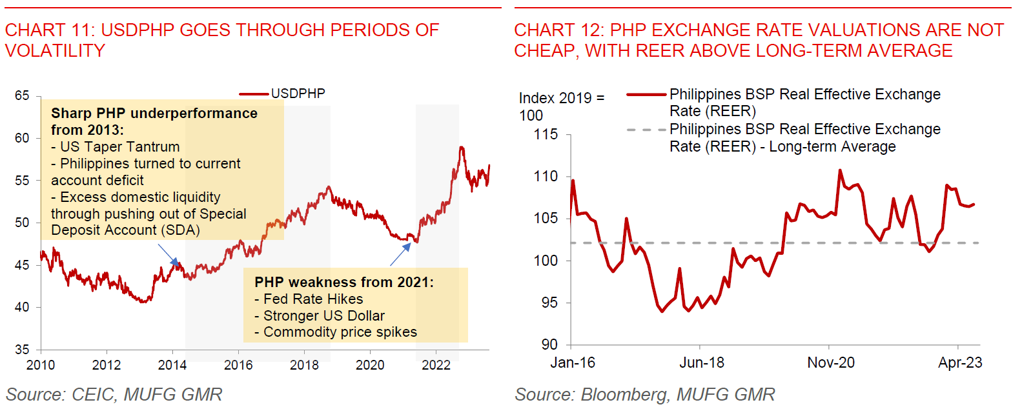

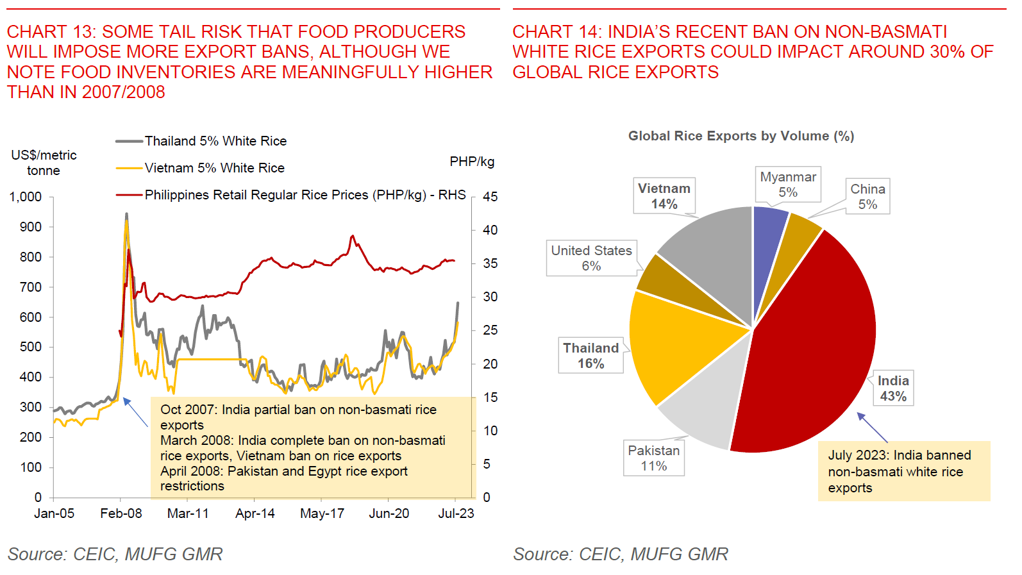

The Philippines Peso was one of the worst performers in Asia FX since July, although its performance is somewhat better when viewed year-to-date: USDPHP rose closer to the 57 levels, and has declined by 4.4% since the middle of last month, much weaker than other Asian FX crosses (see Chart 1). Nonetheless, PHP’s performance was more middle of the pack when viewed from a longer-term perspective, declining 3% over the last 6 months.

We think three key factors drove recent PHP weakness: 1) the rise in oil prices due to oil production cuts, 2) the increase in long-end US Treasury Yields, and 3) the stronger US Dollar: Over the past 3 months, PHP has been highly negatively correlated with the US Dollar, US long-end yields, and higher oil prices driven by supply side cuts (see Chart 2 above). We analysed oil price increases separately by demand-side and supply-side factors, as they can have very different economic implications. Put differently, higher oil prices driven by weaker supply is more negative for PHP compared to if it were driven by up stronger global growth.

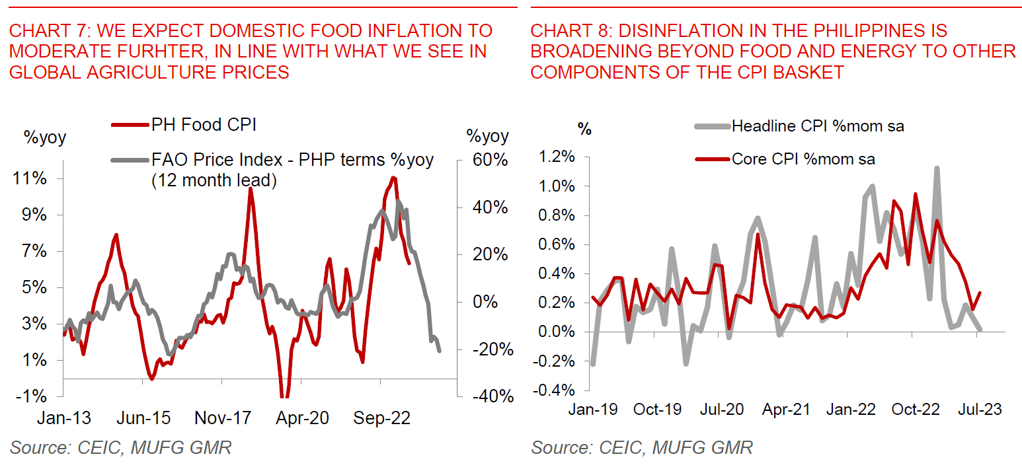

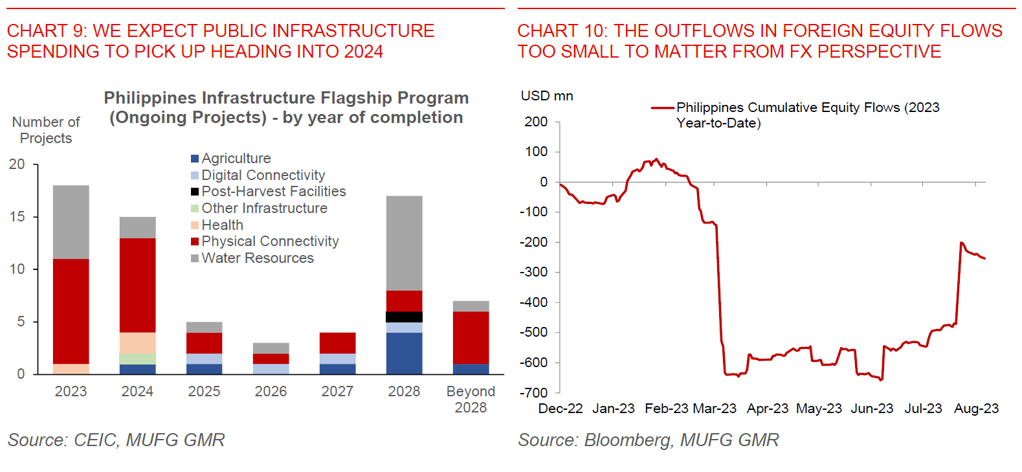

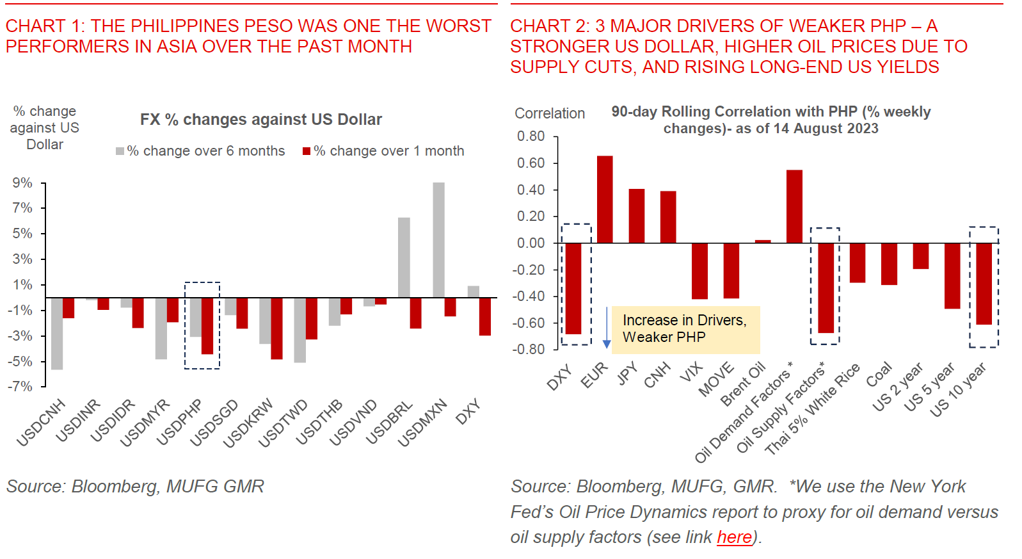

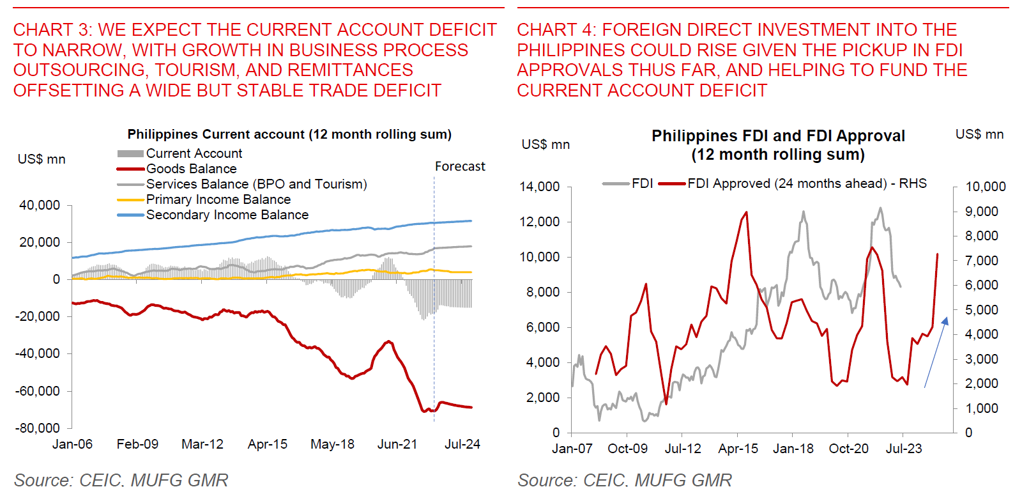

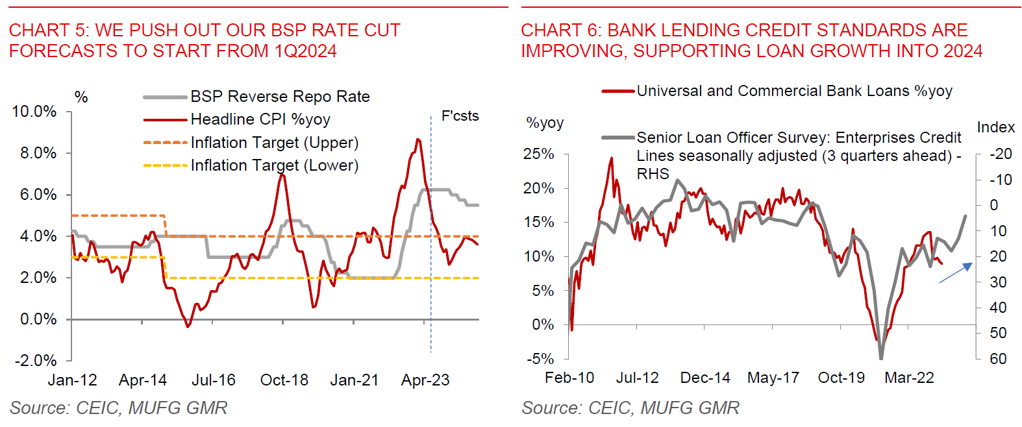

Recent sharp PHP weakness may be overdone. The Philippines’ inflation is coming off faster than we initially expected, the trade deficit is narrowing in part due to softer domestic demand, while FDI is likely to pickup from here: We continue to see USDPHP declining from here for a few key reasons (PHP stronger). First, our expectation is for the US Dollar to weaken over the next 6-12 months as US inflation moderates, the Fed pauses and cuts rates gradually, and China pushes out more stimulus to support its economy. Second, the Philippines’ inflation should fall within the central bank’s inflation target range at a faster pace than we initially expected (by October 2023), notwithstanding uncertainty on global food and energy prices. This means that real rates will turn increasingly positive, which will make Philippines bonds look attractive to foreign investors. Third, the current account deficit remains large but is likely to be narrower at around 3.4% of GDP in 2023 (from 4.4% of GDP in 2022), given the improvements in the trade deficit thus far. Fourth, we see Foreign Direct Investment (FDI) improving given the pickup that we’ve already seen in FDI approvals, which will bring more Dollar inflows and help fund the current account deficit (see Chart 4).

We now see USDPHP at 56.0 in 3months and 54.5 in 12 months (from 54.5 and 53.0 previously): In retrospect, our forecasts for PHP were too strong, and we were certainly caught off-guard by the sharp spike recently.

We lower our growth, inflation and current account deficit forecasts, but note that these are also subject to assumptions on oil and food prices: We lower our forecasts for growth, given the sharp downside surprise to the 2Q GDP numbers. More importantly, we think that the second quarter was probably the weakest point, and expect slowing inflation, lagged impact of rates pause, coupled with improvements in the government’s infrastructure spending program to support growth into 2024. Meanwhile, we also think that inflation should come in lower than we initially forecast, and now see CPI ending the year at 3.4% (from 3.9%yoy previously). We already build in some pickup in food prices due to the El Nino impact and recent pickup in global rice prices, but assume that oil prices remain roughly around current levels at US$86/bbl as we head into 2024.

We push out our rate cut forecasts and now see BSP cutting rates by 75bps starting 1Q2024 (from 4Q2023 previously): We think that the central bank under new Governor Eli Remolona should be cautious in cutting rates, especially given the uncertainties on the global front and the Fed’s trajectory. He was recently quoted warning against “sudden reversals” of monetary policy when asked about the possibility of a rate cut. We also think BSP will continue to be in the market to intervene and cap PHP FX volatility, although it will not aggressively target specific levels in USDPHP.

We will be wrong if oil and rice prices spike sharply from here, US yields rise further, and China slows down sharply: Our forecasts are nonetheless subject to significant uncertainties, especially on global commodity prices, US interest rates, and China’s growth trajectory.