Key Points

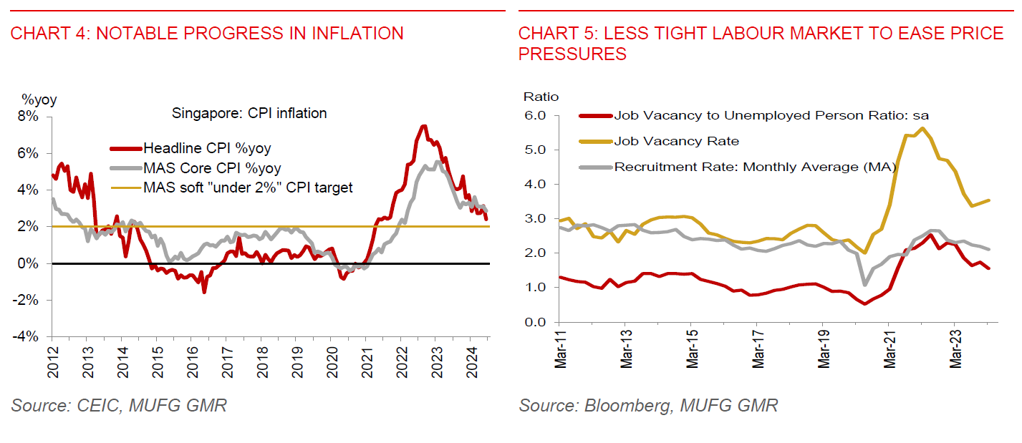

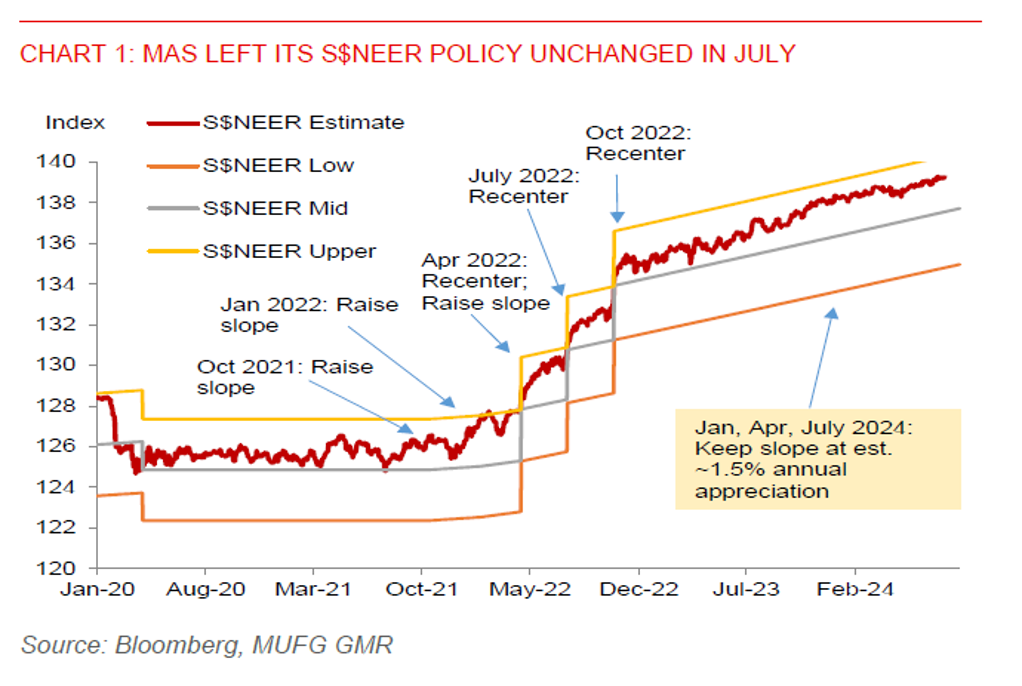

- The MAS left its monetary policy setting unchanged in July, as widely expected. There is no change to the slope, width, or level of the S$NEER policy band. Given our outlook for the policy setting to remain tight this year, we expect the SGD nominal effective exchange rate will continue to move in the upper half of the policy band (Chart 1). We maintain our forecast for SGD to gain modestly to 1.3200 per USD level by end-2024 (Table 1).

- With the Fed potentially easing monetary policy this year, which could possibly weigh on the US dollar, there's scope for Singapore rates (3m SORA) to move lower towards the later part of this year. We maintain our forecast for 3m SORA to end 2024 at 3.3%. But with the Fed staying patient thus far, US GDP growth still robust, there is a risk that the Fed could ease slower than market expects, implying a slower pace of decline in SORA than what we currently expect.

- The MAS is likely in no rush to ease policy yet, with growth momentum improving while the fight against inflation is still not completely over yet. Our base case is still for the MAS to start loosening its policy setting in early 2025, when we think core inflation will return to the MAS soft target of 2%. But with the MAS appearing to adopt a balanced view with regard to both upside and downside risks to growth and inflation, we think MAS is leaving optionality to loosen policy setting in October if warranted, especially if export growth weakens substantially inducing a sharp decline in price pressures. And it’s unlikely for the MAS to tighten policy further from here.

- In our view, the central bank has become relatively more optimistic about the outlook for Singapore’s economy in H2, as it now expects GDP growth this year to come in closer to the city-state’s potential growth of around 2%-3% vs. its previous wider forecast range of 1%-3%. This follows from advance estimates showing Singapore’s GDP growth picking up to 0.4%qoq (2.9%yoy) in Q2, from 0.3%qoq (3%yoy) in Q1, driven by services and electronics manufacturing. Policymakers think global demand should gain from an anticipated decline in global interest rates and further tech related investments.

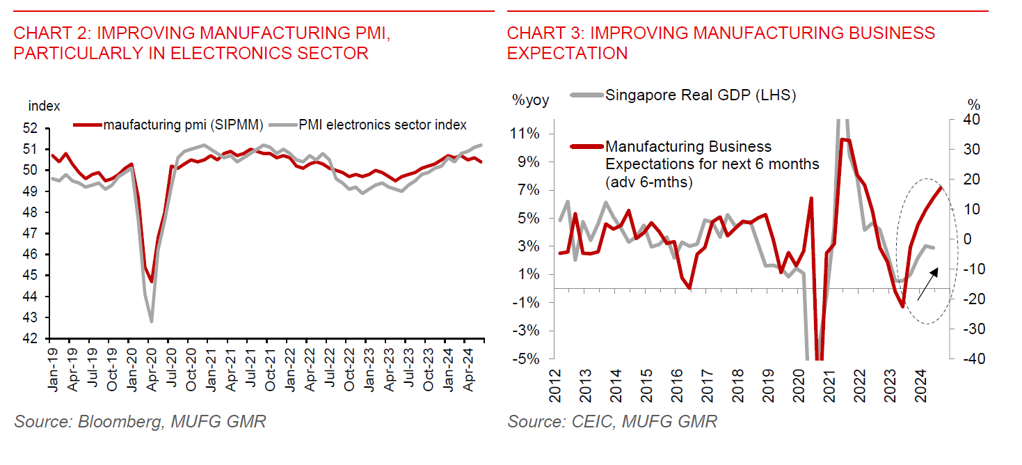

- MAS has also lowered its headline inflation forecast to 2%-3% in 2024, from its previous forecast of 2.5%-3.5%. This has mainly been due to falling private transport prices, driven by the government increasing the supply of Certificate of Entitlement (COE). But, very crucially, the central bank has left its core inflation forecast unchanged at 2.5%-3.5%, possibly due to the impact of several administrative price hikes including the 1ppt GST hike at the start of the year. Policymakers expect MAS core inflation will only step down more discernibly in Q4 before falling further to around 2% in 2025.

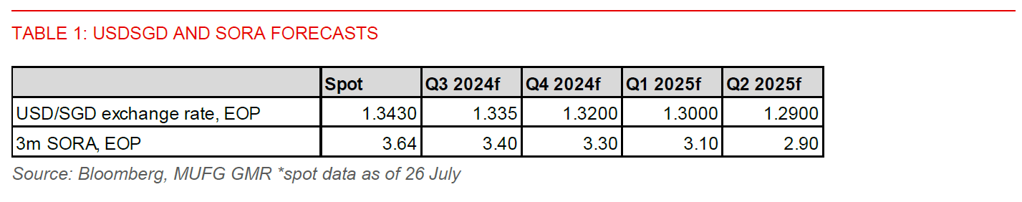

- We remain positive about the outlook for Singapore’s economy. There is no change to our 2.4% GDP growth forecast for 2024 vs. 1.1% growth in 2023. Leading indicators suggest sequential growth momentum is set to gather pace. Key growth drivers of Singapore’s economy include improvement in manufacturing and trade-related sectors, continued resilience in services activity, and tourism (Charts 2 and 3).

- Inflation will likely continue to cool, given a strong SGD, labour market becoming more balanced, and external price pressures (from food and oil) stabilising or moderating (Charts 4 and 5). Moreover, we think the inflationary impact of the 1ppt GST hike will fade towards later part of this year and into 2025. Singapore has made notable progress in the fight against inflation so far, with prices for a range of goods and services moderating. Singapore’s headline inflation slowed to 2.4%yoy in June, from 3.1%yoy in May, mainly driven by transport inflation (+0.3%yoy from +2.9%yoy in May). MAS core inflation (ex-private transport and accommodation) also eased to 2.9%yoy vs. 3.1%yoy in May. But there’s still near-term upside risk to inflation from rising global freight costs and geopolitical tensions. Medium-term price pressures could also stem from structural shifts in global supply chains, including from geopolitical tensions and rising protectionism, slower labour supply growth, and climate change, which could constrain supply putting upward pressure on inflation over the medium term.