Key Points

- Singapore’s economy slowed in Q1, and growth was uneven across different sectors. But several leading indicators suggest growth momentum is set to gather pace. We think the growth uptick will be driven by modest improvement in manufacturing and trade-related sectors, along with continued resilience in services activity. We keep our 2.4% GDP growth forecast for 2024 vs. 1.1% growth in 2023. With the growth outlook set to brighten in the coming quarters, coupled with core inflation likely to remain sticky, we think MAS won’t be in a rush to loosen policy setting. We expect SGD to remain resilient, keeping our end-2024 forecast of 1.32 per US dollar.

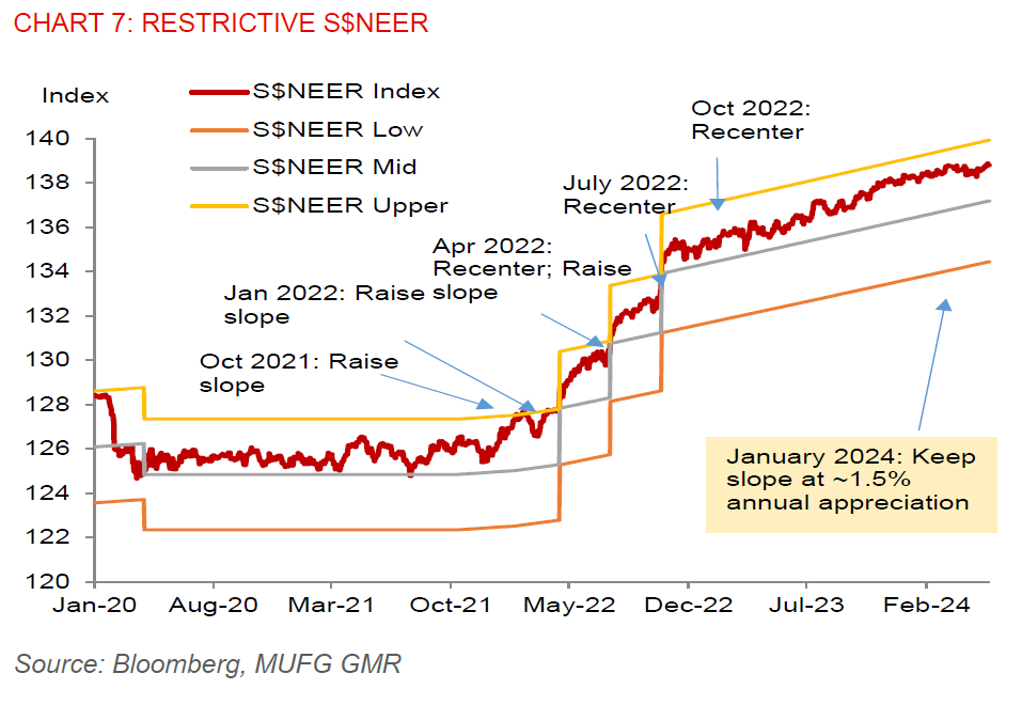

- Singapore’s sequential GDP growth cooled to 0.1%qoq sa in Q1 from 1.2%qoq sa in Q4 2023, marking the weakest print since a year ago (Chart 1). Manufacturing fell 5.4%qoq while construction declined by 2%qoq, largely offsetting a 1.9%qoq increase in services. Within services, sequential growth was seen in several key categories, such as wholesale trade (1.3%qoq vs. -0.6% prior), retail trade (2.8%qoq vs. -1.9% prior), transport and storage (3.2%qoq vs. 1.1% prior), accommodation (10.1%qoq vs. -3.1% prior), and food and beverage services (3%qoq vs. -1.5% prior). However, information and communications fell 0.1%qoq while finance and insurance sector stagnated in the quarter. Yet on a year-on-year basis, GDP growth picked up to 2.7% in Q1 vs. 2.2% prior, partly due to favourable base effects.

- Looking ahead, we expect sequential growth will pick up in the coming quarters, and we maintain our 2.4% GDP growth forecast for 2024. We think the growth recovery will be underpinned by a continued improvement in exports, given the upturn in the electronics cycle and improving number of tourist arrivals. But downside risks in the global economy remains, stemming from Middle East tensions, a potentially slower pace of global disinflation leading to higher for longer rates, and desynchronisation of monetary policy cycle putting emerging markets at risk of volatile capital flows. Our forecast lies within the Ministry of Trade and Industry (MTI)’s 1%-3% GDP growth projection range.

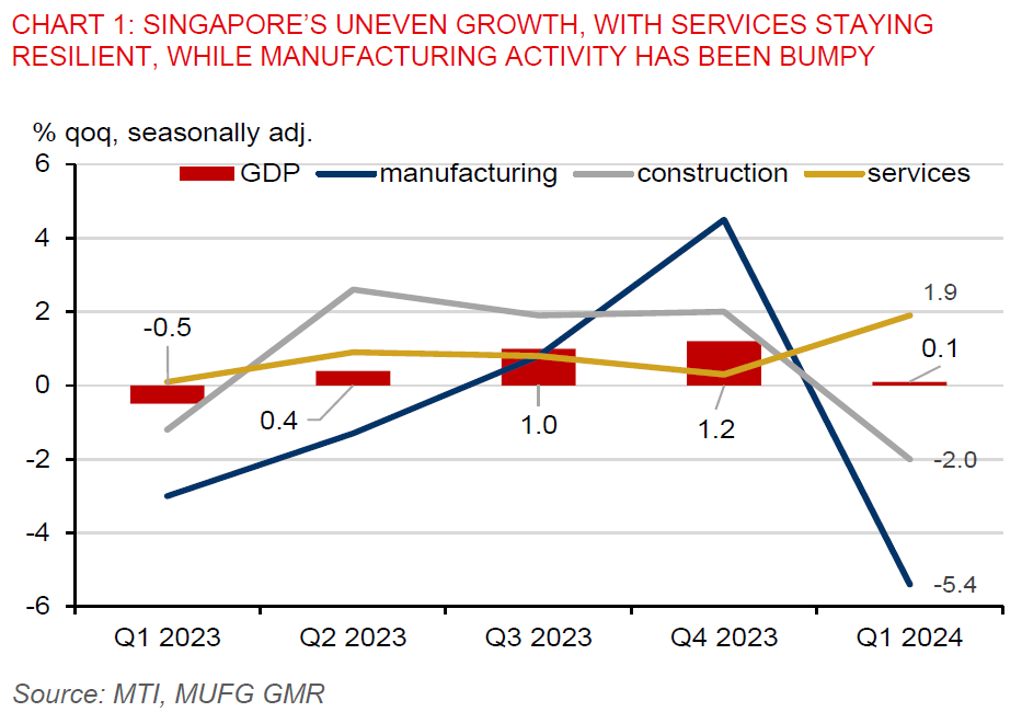

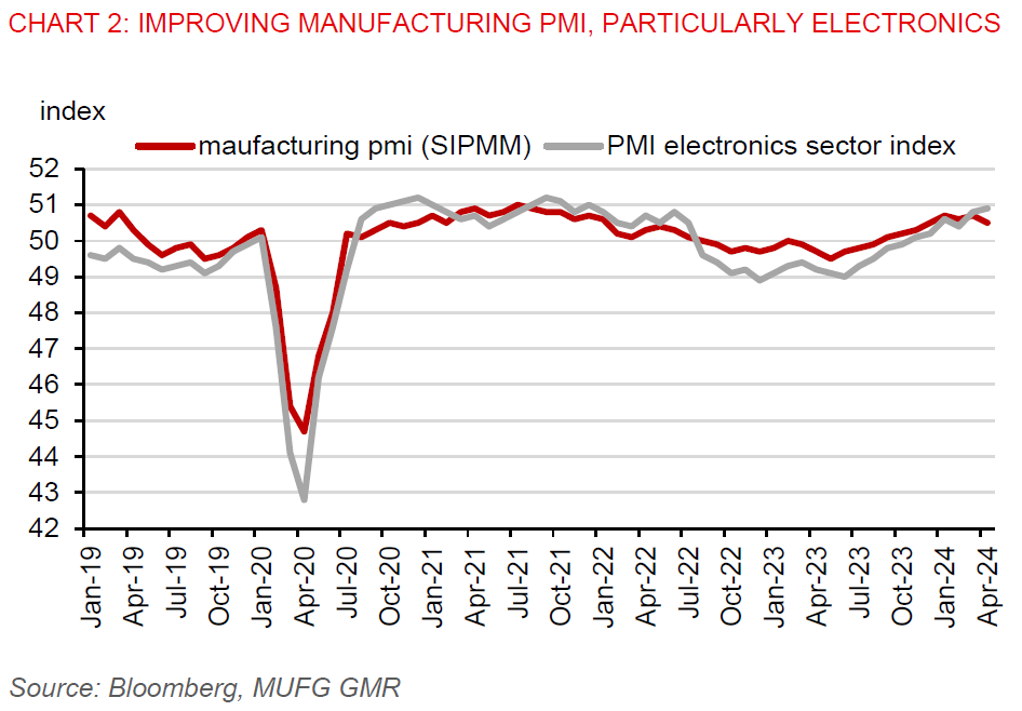

- Singapore’s manufacturing sector recovery has been rather bumpy so far. Factory activity fell by 5.4%qoq vs. 4.5% growth in Q4 2023. On an annual basis, factory activity fell 1.8%yoy from 1.4% growth prior. Biomedical manufacturing, electronics, and the general manufacturing clusters continued to be a drag. However, an improving outlook for global growth, along with our anticipation for lower global rates, inform our expectation for a modest pickup in factory activity in the coming months. Singapore’s manufacturing PMI has also expanded in April for the 8 straight month, albeit easing somewhat to 50.5 from 50.7 in March. The electronics sector PMI has continued to gain traction, rising to 50.9 in April from a Jun 2023 low of 49.0 (Chart 2). In addition, manufacturing business expectations for next 6 months have continued to climb higher, pointing to strengthening economic growth in H2 2024 (Chart 3).

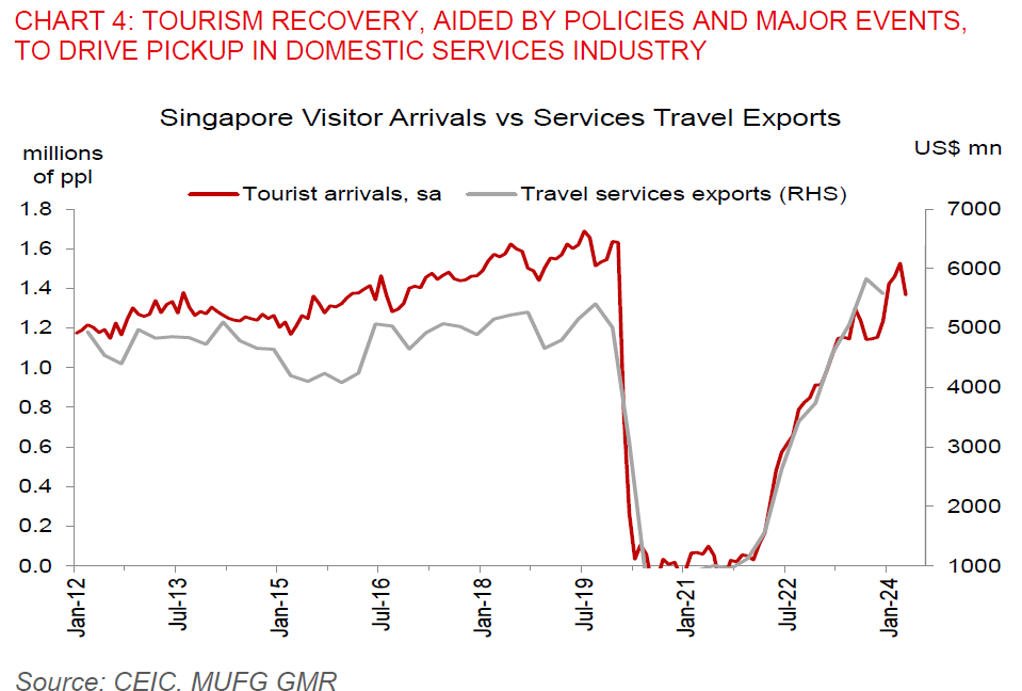

- Singapore’s economic recovery will also be helped by its diversified services sector. Overall, the services sector continued to expand in Q1, increasing by 1.9%qoq from 0.3% growth in Q4 2023. We expect the tourism sector will continue to recover strongly (Chart 4), supporting growth of tourism related industries including accommodation and consumer-facing sectors like retail and F&B services. The finance sector could also benefit from higher tourist spending boosting payments. The tourism recovery will be supported by the visa-free travel policy for China, with effect from 9 February, major sporting, lifestyle, music, arts, and cultural event pipelines, and Singapore Tourism Board (STB)’s global marketing campaign to fortify the nation’s status as an attractive destination for MICE (Meetings, Incentives, Conventions and Exhibitions) events. Over the medium term, the government also plans to transform the 12,000-capacity Singapore Indoor Stadium to a “best-in-class” indoor arena, which will provide an alternative option for hosting concerts and music festivals.

- The information and communications segment saw a marginal fall in sequential growth, but this may not persist ahead. We remain cautiously optimistic about the outlook of the sector, as tech firms are likely to continue to seek opportunities in ASEAN’s growing digital economy, including Singapore’s, by using the city-state as a base. Moreover, the government is focused on attracting foreign investment in areas of tech as well as promoting local tech investment. In the FY2024 budget, Prime Minister Lawrence Wong (who took over the premiership on 15 May) announced a S$1bn investment in the national AI strategy 2.0 over next 5 years and launching a new refundable investment credit – a tax credit scheme with refundable cash feature - to support expansion of manufacturing facilities, innovation, and green transition.

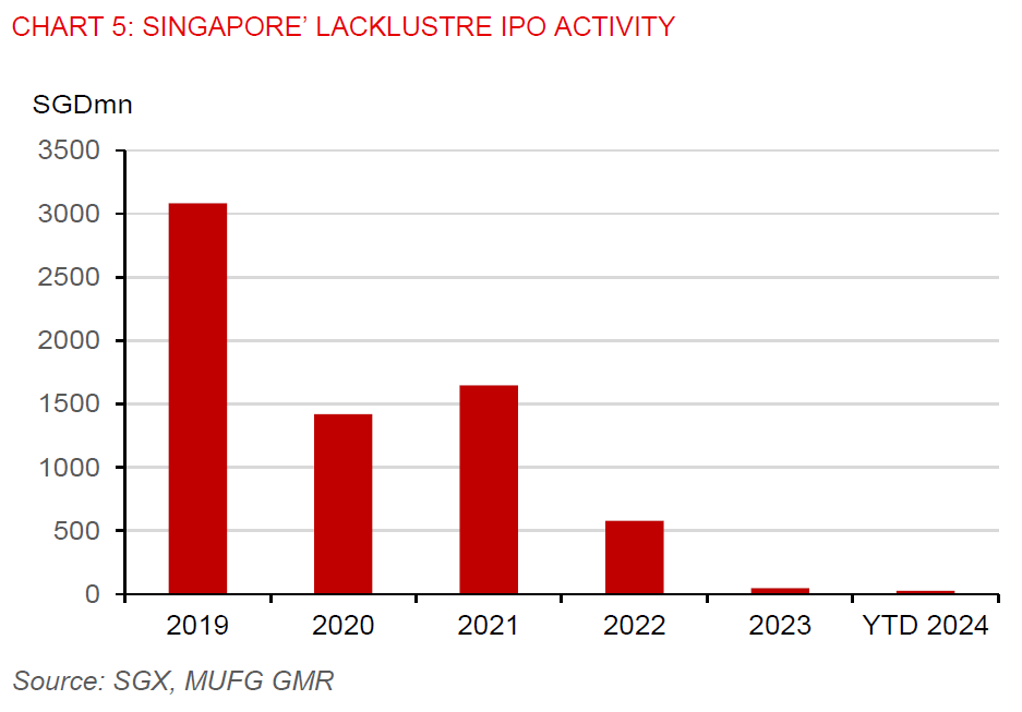

- With global policy interest rates likely at their peak already and are set to decline, this will help support the banking and fund management segments. Indeed, lower interest rates should lead investors to reallocate funds away from money-market funds and government bonds into riskier products, supporting higher banking commissions and fees. Meanwhile, local authorities have been discussing about making policy changes with the Singapore Exchange to help capture more new company listings bolstering activity in the stock market. Indeed, IPO activity was lacklustre in 2023, with only about S$47mn IPO amount raised, vs. about S$580mn in 2022 and S$1.6bn in 2021 (Chart 5).

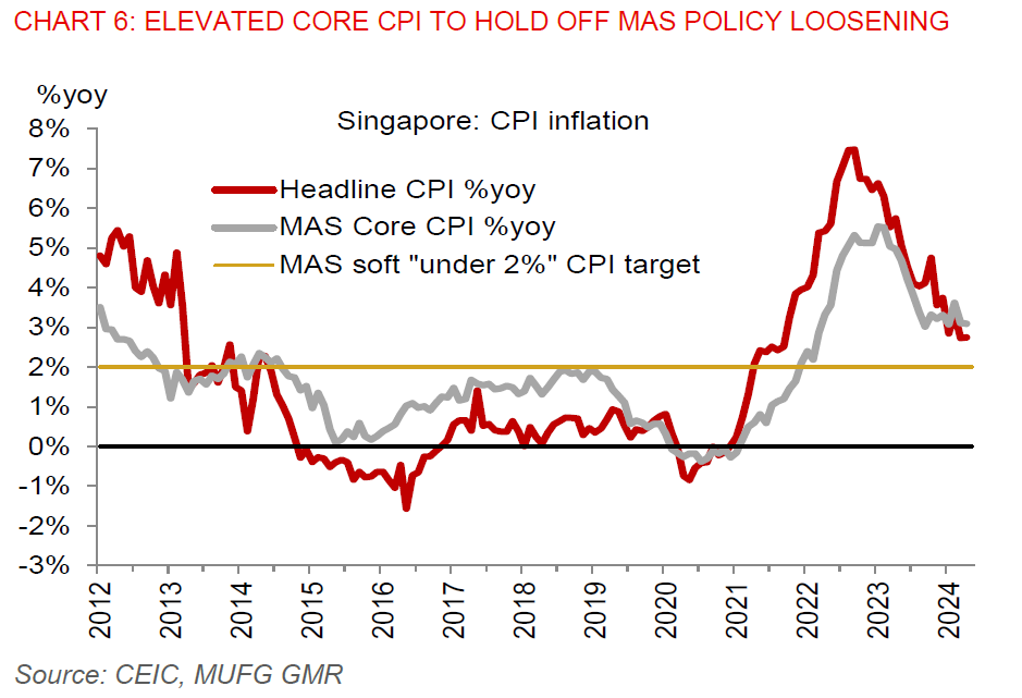

- Latest inflation data showed Singapore’s headline inflation steadied at 2.7%yoy in April, unchanged from the pace in March, despite softer oil prices. Meanwhile, core inflation (excluding private transport and accommodation) stayed elevated at 3.1%yoy in April, which is above the Monetary Authority of Singapore (MAS)’s soft “under 2%’ inflation target (Chart 6). The inflation battle has not been won yet, given the passthrough of several administrative hikes on core prices, such as the 1ppt increase at start of year, water tariff hikes in April, along with increases in public transport fares and carbon taxes. The MAS expects core inflation will only step down in Q4 2024 before moderating further into 2025.

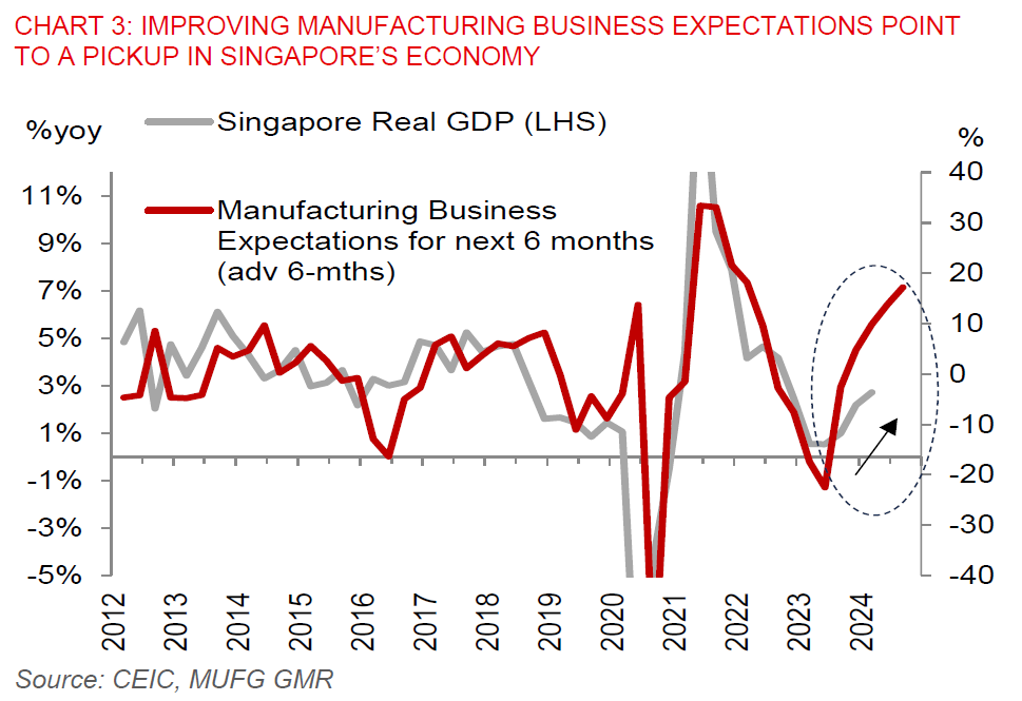

- With economic growth set to improve and core inflation likely to stay elevated for most part of this year, we think the MAS will likely maintain its tight S$NEER policy setting this year to contain imported inflation (Chart 7). Moreover, commodity prices and container freight rates have increased, while there’s also upside risk to inflation from Middle East tensions. Meanwhile, the Fed has been signalling for interest rates to stay high for longer. Notably, the latest Fed minutes showed rate hikes are still on the table. Various Fed officials have expressed a willingness to raise rates further if needed. We keep our forecast for SGD to stay resilient against the US dollar, ending the year at 1.3200.