Key Points

Please click on download PDF above for full report

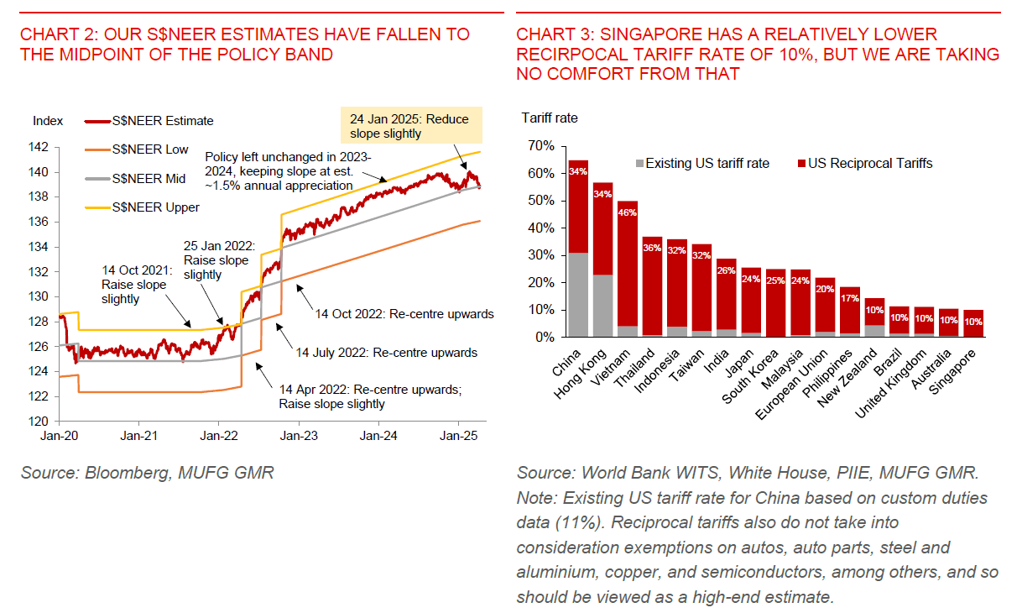

- We expect the MAS to further loosen its policy setting at the upcoming quarterly meeting on 14 April, following the policy easing move in January, as global trade policy uncertainty has risen since the January monetary policy review. The central bank can do so via slightly reducing the slope of the S$NEER to 0.5% per annum, from an estimated 1% currently. Indeed, the balance of risks has shifted towards growth while the disinflationary trend has been entrenched. There’s still a risk that MAS could do a jumbo-sized 100bps cut to the S$NEER slope, given the hefty 125% tariffs imposed on China.

- The downside risks to growth are still significant, despite US President Trump abruptly pausing reciprocal tariffs for 90 days on trade partners that have not retaliated. Apart from China, other Asian economies have not retaliated against the US, so they should receive this temporary tariff relief. For Singapore, it won’t make a difference, as it is “reciprocally” being taxed at the lower 10%. But it’s a big deal for other Asian economies, where reciprocal tariffs are up to 50%. Nonetheless, a minimum 10% blanket tariffs will still apply during this period of time. And it remains unclear what will happen after the 90-day pause. In addition, US has raised import levies on China to 125%, punishing China for retaliating. The Singapore government could lower its 2025 growth outlook of 1%-3%.

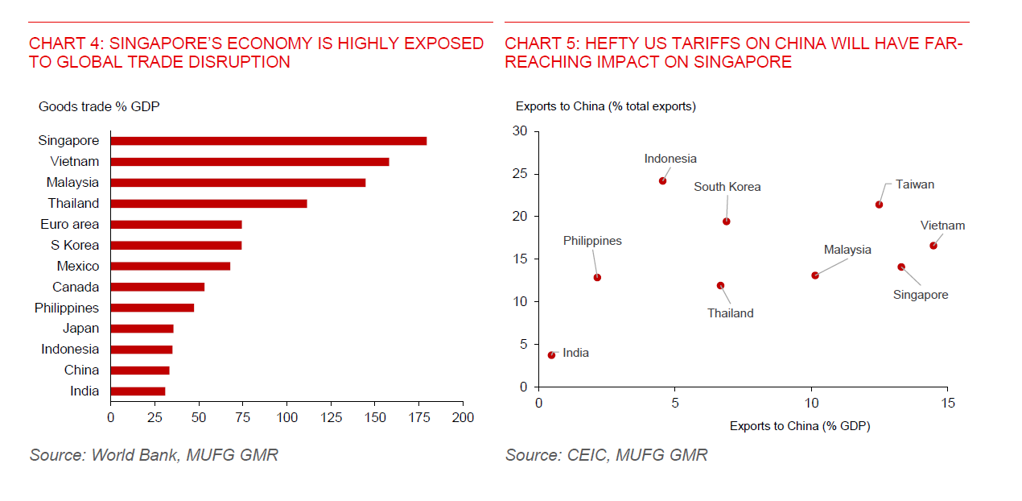

- Export weakness has emerged, and the outlook for external trade could weaken over the coming months amid higher US tariffs. Re-exports fell 1.7%mom on average in January-February, from a 4.3%mom expansion on average in October-December 2024. In addition to that, industrial production fell 7.5%mom in February, following a 2.8%mom rise in January. Assuming a price elasticity of 1, a 10% tariffs on Singapore could reduce its exports to the US as a share of its GDP by about 0.8ppt. Also, there will be negative spillover effects on Singapore’s exports from the 125% US tariffs on China. The total negative impact could be larger, given Singapore’s trade openness and reliance on trade servicing, making the city-state highly vulnerable to a global trade slowdown.

- Notably, inflation is no longer a major concern for policymakers, which should allow policymakers to pre-emptively loosen its policy to help support growth. We have lowered our forecasts for headline inflation to 1.1%yoy from 1.5% previously, and core inflation to 0.9% from 1.5%yoy previously. Singapore’s core inflation has undershot the MAS soft target of “under 2%”, at just 0.6%yoy in February, the lowest since July 2021. And there will likely be a disinflationary drag from the tariff induced hit to domestic economic growth. External sources of inflation will likely stay benign, as we anticipate weak global demand conditions ahead. Notably, Brent prices have slumped, reflecting concerns about a global growth slowdown.

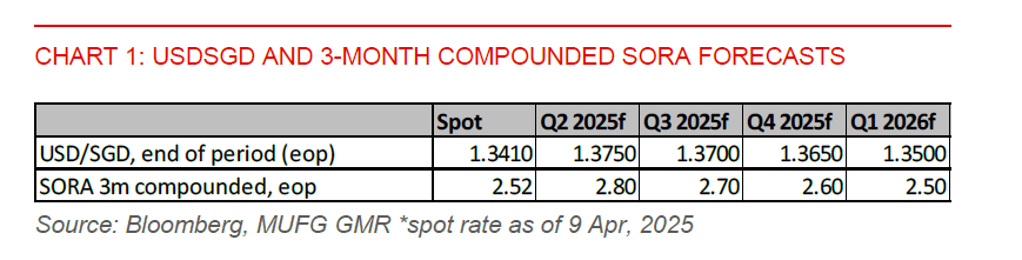

- Given higher US tariffs and potential trade disruption in the months ahead, we are biased towards further SGD weakness in the near term. The PBOC has also set a higher USDCNY daily fixing rate at above the 7.2000-level, signalling it will allow for further CNY depreciation, which could have spillover effects on SGD. The risks to our SGD outlook remain tilted to the downside, especially given rising odds of escalation in US-China trade tensions. We note that our USDSGD forecast is currently subject to high level of uncertainty.