Key Points

Please click on download PDF above for full report

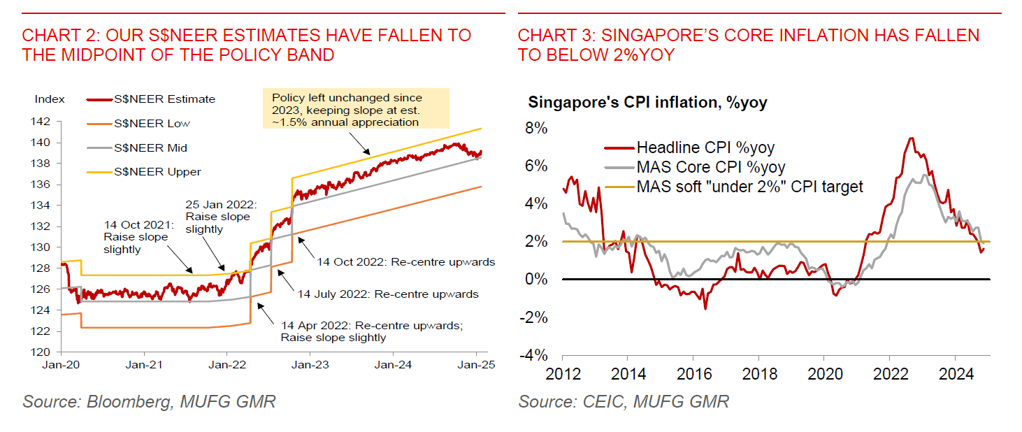

- The window has opened for MAS policy easing, given Singapore’s disinflationary trend has been well entrenched. We expect MAS to ease its tight S$NEER policy setting as early as at the upcoming January quarterly meeting. The central bank could do so via slightly reducing the slope of the S$NEER to 1% per annum, from an estimated 1.5% currently. However, given there’re no China tariff announcement by the Trump administration, there’s still a risk that the MAS could choose to wait for clarity about Trump’s tariff plans, delaying a potential policy easing move till later this year.

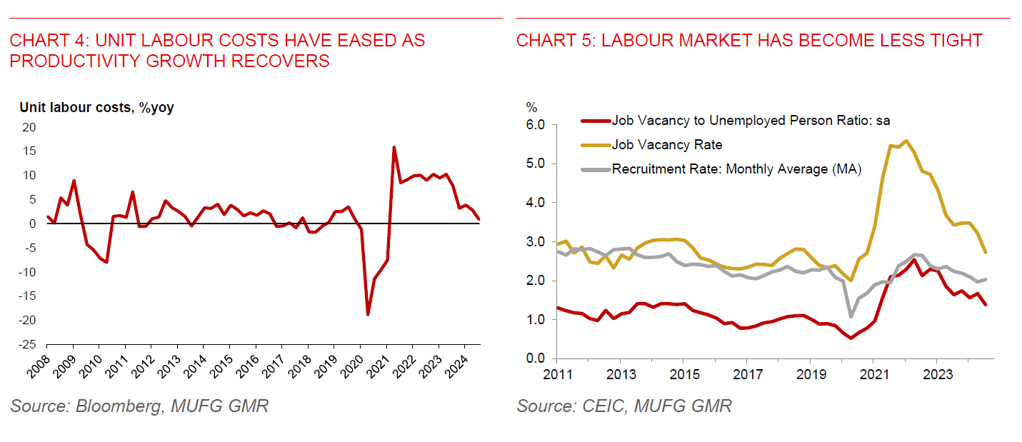

- We expect policy easing in January, partly because several price indicators we track are already showing that inflation is easing in Singapore. The MAS preferred inflation gauge – core inflation (excluding accommodation and private transportation components) –had declined to 1.9%yoy in November. This is below the central bank’s soft target of “under 2%”. The seasonally adjusted 3m/3m annualized rate of core inflation also fell to 0.3% in November, from a peak of 5.8% in February 2024, reflecting a slower pace of increase in prices of food and household durable goods including furniture. While core inflation could pick up to 0.4%mom in December, following declines in October-November, the implied year-on-year rate is likely to step down further to 1.7%yoy, or possibly lower, on the back of high base effects from a year ago. This would notably be lower than MAS expectation for core inflation to end 2024 at around 2%yoy.

- We forecast Singapore’s core inflation will ease to an average of 1.5% this year, from an estimated 2.7% in 2024, amidst moderating underlying inflationary pressures. The labour market has become less tight, with the ratio of job vacancy to unemployed people falling to 1.4 in Q3 2024, from 2.5 in Q2 2022. This should help keep nominal wage growth in check. Growth in unit labour costs has also slowed to 0.9%yoy in Q3 2024, from slightly more than 10% in mid-2023, partly reflecting a broad-based recovery in labour productivity growth across different sectors. Productivity in goods producing sector rose 8.6%yoy in Q3, while productivity growth in services producing sector has a relatively moderate pickup to 2.5%yoy. In addition, mineral fuel import costs could also be stable in anticipation of an unwinding of OPEC+ production cuts, strong growth in oil production in non-OPEC+ oil producing countries, and below pre-pandemic pace of growth in global oil consumption.

- We think the MAS has shifted away from its hawkish stance in the October policy meeting. Comparing the policy statement in October with that in April, the central bank omitted the phrase “The prevailing rate of appreciation of the policy band will keep a restraining effect on imported inflation as well as domestic cost pressures”. Officials have also appeared to be confident the last mile of disinflation can be achieved, warranting a dovish shift in policy stance.

- The latest good news is that there’re no tariff hikes on Trump’s Day 1 in office. This has helped provided some reprieve for regional currencies. Nonetheless, we think tariffs are delayed, but not cancelled. Ultimately, Trump will likely look to narrow the trade deficits that US have with other trading partners, notably China. A slowdown in the global economy in response to tariffs could lead to a faster pace of disinflation than what we expect for this year.

- While Singapore’s economy rebounded sharply in 2024, this year will likely be more challenging. US has a trade surplus with Singapore, so the city-state likely won’t be directly targeted with tariffs. Moreover, Singapore has free trade agreements with the US. However, in the ASEAN region, Singapore is one of the most vulnerable economies to US tariffs on China, given its high trade openness and exposure to the Chinese economy. For every 10% tariff increase on China, we estimate that the potential spillover impact on Singapore’s growth is a 0.2ppt decline, mainly via lower net exports and fixed investment.

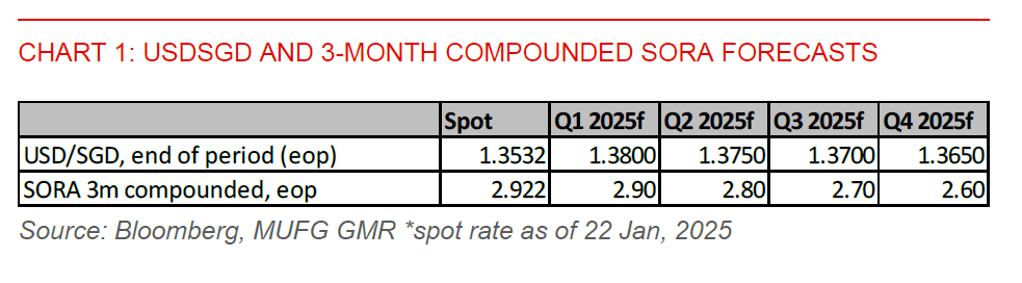

- Given global trade uncertainties are set to persist this year, we think the latest decline in USDSGD may be contained. This, along with MAS likely to ease policy this month, lead us to maintain our forecast for USDSGD to rise to 1.3800 by end-Q1. In anticipation of the US dollar staying firm, coupled with the MAS likely to ease its S$NEER policy, we also see scope for Singapore’s 3-month compounded SORA to end the year at 2.6%, versus current rate at 2.9%.