Please download PDF from the button above for all other contents for the following currencies.

Australian dollar // New Zealand dollar //Canadian dollar // Norwegian krone // Swedish Krona // Swiss franc // Czech koruna // Hungarian forint //Polish zloty // Romanian leu // Russian rouble // South African rand // Turkish lira // Indian rupee // Indonesian rupiah // Malaysian ringgit // Philippine peso //Singapore dollar // South Korean won // Taiwan dollar // Thai baht // Vietnamese dong // Argentine peso // Brazilian real // Chilean peso // Mexican peso // Crude oil // Saudi riyal // Egyptian pound

Monthly Foreign Exchange Outlook

DEREK HALPENNY

Head of Research, Global Markets EMEA and International Securities

Global Markets Research

Global Markets Division for EMEA

E: derek.halpenny@uk.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

E: lee.hardman@uk.mufg.jp

LIN LI

Head of Global Markets Research Asia

Global Markets Research

Global Markets Division for Asia

E: lin_li@hk.mufg.jp

JEFF NG

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: Jeff_ng@sg.mufg.jp

MICHAEL WAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: michael_wan@sg.mufg.jp

EHSAN KHOMAN

Head of Commodities, ESG and Emerging Markets Research – EMEA

DIFC Branch – Dubai

E: ehsan.khoman@ae.mufg.jp

CARLOS PEDROSO

Chief Economist

Banco MUFG Brasil S.A.

E: cpedroso@br.mufg.jp

MAURICIO NAKAHODO

Senior Economist

Banco MUFG Brasil S.A.

E: mnakahodo@br.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

June 2023

KEY EVENTS IN THE MONTH AHEAD

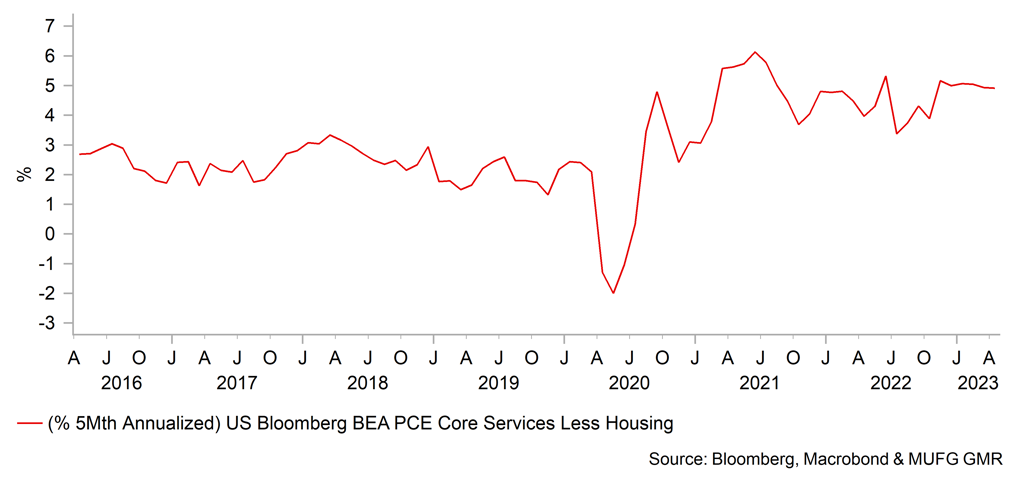

1) APPROACHING PEAK POLICY RATES

For the first time since the Federal Reserve commenced its tightening cycle in March 2022, we enter the month of an FOMC meeting with the market only partially priced for another rate hike. That makes for an interesting FOMC meeting on 13th/14th June and of course the economic data between now and that meeting will be crucial in determining expectations. Despite the stronger performance of the dollar in May, we are maintaining most of the scale of dollar depreciation we forecast last month. We believe the US economy is a lot weaker than is implied by current rate expectations and see the rates market reverting to expecting rate cuts by the end of the year. We believe the FOMC will pause in June and will cut rates in Q4. In our view disinflationary forces are building and provide ample justification for a pause. The ECB, the BoE and every other G10 central bank (bar the RBNZ) will meet in June and most still have work to do and are likely to hike (except the BoC possibly). With global disinflationary forces building there is an increasing prospect of central banks hitting the pause button over the summer

2) JAPAN SNAP ELECTION COULD BE CONFIRMED

Speculation continues to swirl over whether PM Kishida will call a snap election. His approval ratings over recent months have shown improvement. However, that trend was halted toward the end of May when a scandal involving his son hosting a party at the PM’s official residence undermined his ratings. A Nikkei poll saw his approval rating drop by 5ppt. A decision to hold a snap election over the summer will have to be taken before the current Diet session ends on 21st June. If a snap election is called before then, it would likely take place in July, before the scheduled BoJ meeting on 28th July, which would keep alive the speculation of a change to YCC policy at that meeting. If no announcement is made, the speculation could persist and an election after the summer would still be a possibility that may see any policy changes being pushed further into the future. We still expect YCC changes this year – either a widening of the range or a complete scrapping. With peak rates globally emerging, we see USD/JPY turning lower on a more sustained basis.

3) CHINA STEPS UP TO BOOST YOUTH EMPLOYMENT

State Council in May announced a raft of supportive policies to boost employment of young people, college graduates in particular, including subsidies to employers to hire more graduates and guaranteed loans for young entrepreneurs. Also, China's Ministry of Human Resources and Social Security and another nine government agencies jointly issued a circular last month on increasing trainee jobs for young people, offering not less than 1 million trainee posts to college graduates not employed within two years of graduation, and other young people aged 16 to 24. These actions are working in the right direction, and more stimulus policies are needed to revive sentiment and the economy’s recovery pace.

Forecast rates against the US dollar - End-Q2 2023 to End-Q1 2024

|

Spot close 31.05.23 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

JPY |

139.68 |

138.00 |

133.00 |

131.00 |

129.00 |

|

EUR |

1.0659 |

1.0900 |

1.1300 |

1.1500 |

1.1400 |

|

GBP |

1.2397 |

1.2600 |

1.2910 |

1.2990 |

1.2670 |

|

CNY |

7.1100 |

6.9000 |

6.8000 |

6.7000 |

6.6000 |

|

AUD |

0.6472 |

0.6600 |

0.6700 |

0.6800 |

0.6900 |

|

NZD |

0.5996 |

0.6050 |

0.6100 |

0.6200 |

0.6300 |

|

CAD |

1.3580 |

1.3700 |

1.3600 |

1.3300 |

1.3200 |

|

NOK |

11.149 |

11.009 |

10.3540 |

9.8260 |

9.6490 |

|

SEK |

10.889 |

10.734 |

10.177 |

9.826 |

9.7370 |

|

CHF |

0.9138 |

0.8940 |

0.8720 |

0.8780 |

0.8770 |

|

|

|

|

|

|

|

|

CZK |

22.261 |

21.830 |

20.880 |

20.350 |

20.440 |

|

HUF |

347.54 |

339.40 |

336.30 |

339.10 |

350.90 |

|

PLN |

4.2497 |

4.1740 |

4.0270 |

4.0000 |

4.0790 |

|

RON |

4.6564 |

4.5690 |

4.4250 |

4.3740 |

4.4390 |

|

RUB |

80.962 |

80.730 |

81.250 |

82.440 |

84.670 |

|

ZAR |

19.750 |

20.000 |

19.500 |

19.000 |

18.750 |

|

TRY |

20.701 |

22.000 |

25.000 |

27.000 |

28.000 |

|

|

|

|

|

|

|

|

INR |

82.725 |

81.500 |

80.500 |

79.500 |

79.000 |

|

IDR |

14988 |

15000 |

14800 |

14600 |

14400 |

|

MYR |

4.6105 |

4.5000 |

4.4000 |

4.3000 |

4.2000 |

|

PHP |

56.165 |

55.300 |

55.000 |

54.800 |

54.400 |

|

SGD |

1.3548 |

1.3400 |

1.3200 |

1.3000 |

1.2900 |

|

KRW |

1325.3 |

1310.0 |

1285.0 |

1260.0 |

1240.0 |

|

TWD |

30.770 |

30.500 |

30.250 |

30.000 |

29.750 |

|

THB |

34.689 |

34.250 |

33.250 |

32.250 |

31.250 |

|

VND |

23485 |

23500 |

23400 |

23300 |

23200 |

|

|

|

|

|

|

|

|

ARS |

239.35 |

255.00 |

310.00 |

378.00 |

475.00 |

|

BRL |

5.0958 |

5.0000 |

5.0800 |

5.2000 |

5.2200 |

|

CLP |

811.22 |

800.00 |

810.00 |

800.00 |

780.00 |

|

MXN |

17.718 |

17.800 |

18.000 |

18.200 |

18.200 |

|

|

|||||

|

Brent |

72.74 |

85.00 |

93.00 |

91.00 |

92.00 |

|

NYMEX |

68.65 |

81.00 |

88.00 |

86.00 |

87.00 |

|

SAR |

3.7504 |

3.7500 |

3.7500 |

3.7500 |

3.7500 |

|

EGP |

30.842 |

32.200 |

33.800 |

34.500 |

34.900 |

Notes: All FX rates are expressed as units of currency per US dollar bar EUR, GBP, AUD and NZD which are expressed as dollars per unit of currency. Data source spot close; Bloomberg closing rate as of 4:30pm London time, except VND which is local onshore closing rate.

US dollar

|

Spot close 31.05.23 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

USD/JPY |

139.68 |

138.00 |

133.00 |

131.00 |

129.00 |

|

EUR/USD |

1.0659 |

1.0900 |

1.1300 |

1.1500 |

1.1400 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

135.00-145.00 |

129.00-145.00 |

127.00-143.00 |

125.00-141.00 |

|

|

EUR/USD |

1.0400-1.1200 |

1.0700-1.1600 |

1.0800-1.1800 |

1.0700-1.1700 |

MARKET UPDATE

In May the US dollar strengthened against the euro in terms of London closing rates, moving from 1.1041 to 1.0659. In addition, the dollar strengthened versus the yen, from 136.09 to 139.68. The FOMC at its meeting in May raised the fed funds rate by 25bps to 5.00%-5.25%, following 475bps of hikes since March of last year. The FOMC has also continued with its policy of reducing its securities holdings with QT ongoing at a pace of USD 95bn worth of UST bonds (USD 60bn) and MBS (USD 35bn) of balance sheet reduction each month. However, this was dramatically offset by balance sheet expansion to provide loans and liquidity for the banking sector.

OUTLOOK

The lingering uncertainty over the debt ceiling negotiations and the potential for a default were removed toward the end of May after a deal was reached between the White House and the Republican party. The deal was met with relief by the markets, not just because it avoided the potential for default but also because the scale of fiscal consolidation was smaller than had been expected. The CBO estimates the hit to GDP in the fiscal year starting in October to be 0.26% of GDP. We deal is set to pass through Congress with the debt ceiling then suspended through to 1st June 2025. While the impact is modest, the fiscal restraint will still be impacting at a time when substantial monetary tightening will also be feeding through to the real economy. It will strengthen expectations of weak recessionary economic conditions emerging later in the year. Short-term rates volatility is also set to emerge with the US Treasury set to embark on large T-bill issuance to finance spending and increase the balance of the Treasury General Account. The expected issuance would total USD 1 trillion by the end of the third quarter. Where that liquidity comes from will determine how disruptive this might be for financial market conditions.

Our renewed dollar weakness forecast for end-Q2 reflects our assumption that the FOMC will pause its tightening cycle at the June meeting. With the decision priced at close to 50-50, the May jobs and CPI reports will be key. Still, the debt ceiling deal that confirms modest fiscal consolidation, the ongoing tightening of credit conditions and the better progress on fighting inflation than elsewhere should be enough to persuade the Fed the pause. We still expect much clearer evidence of slowdown to emerge in H2 that sees the market re-price monetary easing by year-end. This will likely start to emerge in Q3 fuelling a more pronounced period of US dollar selling.

The increased expectation of another rate hike in June has seen the US dollar extend beyond our expectations. We have raised our US dollar forecasts somewhat and mostly at the very front-end (1.0900 vs 1.1200 prior in Q2) but we still expect the dollar to weaken as the Fed pauses and the US economy weakens more markedly. US yields in those circumstances will be notably lower. We also see scope for global growth fears to ebb given our view that China economic activity is set to pick up in the second half of the year.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

Policy Rate |

5.08% |

5.13% |

4.88% |

4.50% |

3.88% |

|

3-Month T-Bill |

5.39% |

5.13% |

5.00% |

4.25% |

3.63% |

|

10-Year Yield |

3.64% |

3.63% |

3.38% |

3.50% |

3.38% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

We think the Fed will be on a short-lived pause. In addition, our rates path is driven by two scenarios, where both paths see cuts, but the difference is by how much and what will be the catalyst to see them start to ease. If inflation declines continue, real rates (r-star) will turn very positive versus a Fed on hold at 5 plus percent rates. An “immaculate disinflation” along with clearer signs of economic weakness (job losses) could see the Fed cut by 50bps in late 2H23. If macro conditions worsen in tandem with FCI tightening/more credit accidents (base case), they could cut by 100bps or more. Timing of cuts also matters versus just the magnitude. To capture this we split the difference, expecting the Fed to end the year anywhere between 4.25-4.75%. Meanwhile an eventual resolution of the US debt ceiling is likely in the coming week, so in the months that follow, the US Treasury will need to issue hundreds of billions of dollars of T-bill notes to replenish the TGA and pay back the funds used from the tapping of extraordinary measures across Federal agencies. This deluge of T-bills will mop up liquidity in the broader banking and money market system too. This should keep a discount in front-end rates. (George Goncalves, US Macro Strategy)

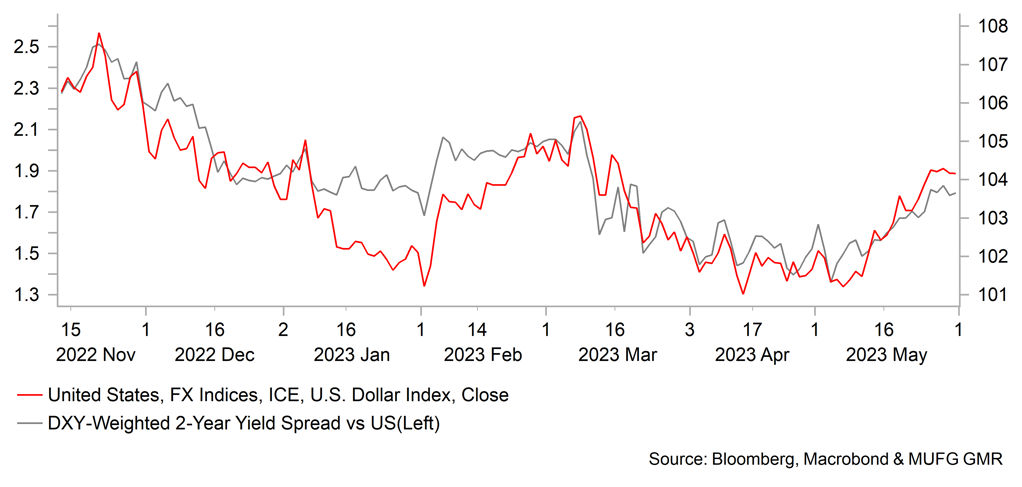

DOLLAR INDEX VS. SHORT-TERM YIELD SPREAD

US CORE SERVICES INFLATION

Japanese yen

|

Spot close 31.05.23 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

USD/JPY |

139.68 |

138.00 |

133.00 |

131.00 |

129.00 |

|

EUR/JPY |

148.88 |

150.40 |

150.30 |

150.70 |

147.10 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

135.00-145.00 |

129.00-145.00 |

127.00-143.00 |

125.00-141.00 |

|

|

EUR/JPY |

144.00-156.00 |

143.00-157.00 |

141.00-155.00 |

140.00-154.00 |

MARKET UPDATE

In May the yen weakened further versus the US dollar in terms of London closing rates from 136.09 to 139.68. However, the yen strengthened versus the euro, from 150.26 to 148.88. The BoJ did not meet in May and hence its current monetary stance was unchanged with the key policy rate at -0.10% and YCC restraining the 10-year yield within a range of +/-50bps around zero percent. The 10-year JGB yield retreated from the 0.50% upper limit as speculation on an end to YCC receded. The bias of BoJ guidance favouring lower rates was dropped from the statement in April.

OUTLOOK

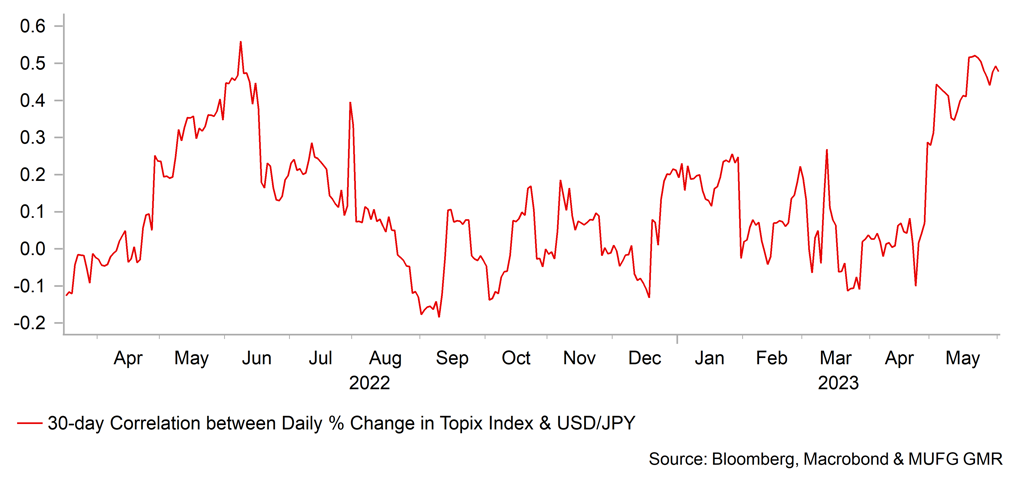

The yen weakened further in May with a number of factors helping to fuel selling. Firstly, the reassessment of the outlook for monetary tightening by the Fed helped lift the dollar in general in May and that helped propel USD/JPY higher. From close to a zero probability, OIS pricing now indicates around a 50% probability of another rate hike by the Fed. Rate cuts by year-end have been nearly completely removed. But the yen was the fourth worst performing G10 currency so other Japan-specific factors were at play as well. Real yields have been falling sharply in Japan with inflation expectations jumping. The 10yr breakeven jumped 20bps in May and reached close to 1.00%, the highest since June 2022. Underlying nationwide CPI has continued to hit new highs while asset price inflation is reinforcing the move. The Topix Index surged 3.6% in May in contrast to a 0.2% gain in the S&P 500. Property prices and land prices are also moving higher in Japan. Land prices jumped 1.6% in 2022 after a 0.6% gain the previous year. Rural residential land prices gained 0.4%, the first increase in 28yrs.

Adding to yen selling is the clear sense of a lack of urgency from Governor Ueda to change the current monetary stance. Governor Ueda spoke in the Diet toward the end of May and repeated that the BoJ would continue with monetary easing “patiently” to achieve the price stability goal. However, he also conducted an interview with the Wall Street Journal and suggested there were signs emerging of sustainable inflation and wouldn’t hesitate to act if warranted. We suspect the BoJ could pivot quickly and alter YCC without much warning. The meeting in May between the FSA, MoF and BoJ, the first since 17th March, also was an indication that Tokyo is not indifferent to yen depreciation. With a possible snap election to be called, the government wants to show its concern over inflation, especially given the government’s gasoline subsidy will end on 1st June. The nationwide core-core CPI YoY rate accelerated to 4.1% in April, the highest since August 1981.

The sense that this time could be different is certainly building in Japan. Foreign investors are buying Japan equities aggressively – buying JPY 7 trillion in just seven weeks. Broader inflation pressures may not slow in H2 as the BoJ expects and the signs of resistance to JPY selling could build further from here. With the Fed set to pause in June, we see limited scope for USD/JPY to move higher from here.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

Policy Rate |

-0.10% |

-0.10% |

-0.10% |

-0.10% |

-0.10% |

|

3-Month Bill |

-0.18% |

-0.15% |

-0.15% |

-0.10% |

-0.05% |

|

10-Year Yield |

0.44% |

0.40% |

0.60% |

0.50% |

0.40% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year JGB yield increased modestly further in May, by 5bps to close at 0.44%. The 10-year yield continues to remain below the levels that prevailed in April up to Governor Ueda’s first policy meeting when he sent a strong message to the markets of status quo in regard to the policy stance. That rhetoric did not change in May and in both a Wall Street Journal article and in comment made in the Diet, Governor Ueda repeated the same message – that the BoJ would “patiently” continue with the current policy stance. Japan’s Diet will end for the summer break on 21st June and if no election is called, the uncertainty over a snap election could extend into the autumn and curtail the BoJ’s ability to make big policy changes. A scandal involving his son means PM Kishida may now delay. In the meantime, inflationary pressures continue to build and Japan equity markets outperform. Yen depreciation is also back on the radar following the BoJ/FSA/MoF meeting on 30th May and we see all of this as grounds for altering YCC. That could mean yields bounce (Q3 YCC change possibly) before global disinflation dampens JGB yields once again.

USD/JPY VS. US-JAPAN 5-YEAR REAL YIELD SPREAD

CORRELATION BETWEEN USD/JPY & JAPANESE EQUITIES

Euro

|

Spot close 31.05.23 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

EUR/USD |

1.0659 |

1.0900 |

1.1300 |

1.1500 |

1.1400 |

|

EUR/JPY |

148.88 |

150.40 |

150.30 |

150.70 |

147.10 |

|

Range |

Range |

Range |

Range |

||

|

EUR/USD |

1.0400-1.1200 |

1.0700-1.1600 |

1.0800-1.1800 |

1.0700-1.1700 |

|

|

EUR/JPY |

144.00-156.00 |

143.00-157.00 |

141.00-155.00 |

140.00-154.00 |

MARKET UPDATE

In May the euro weakened versus the US dollar in terms of London closing rates, moving from 1.1041 to 1.0659. The ECB at its meeting in May raised the key policy rate by 25bps to 3.25%, following 350bps of tightening since last year. That was the most aggressive tightening in a year by the ECB. The ECB confirmed that under its QT policy, the roll-off rate per month would pick up from July with all maturities rolling off. The ECB’s balance sheet has shrunk by EUR 1.1trn from the peak in June 2022.

OUTLOOK

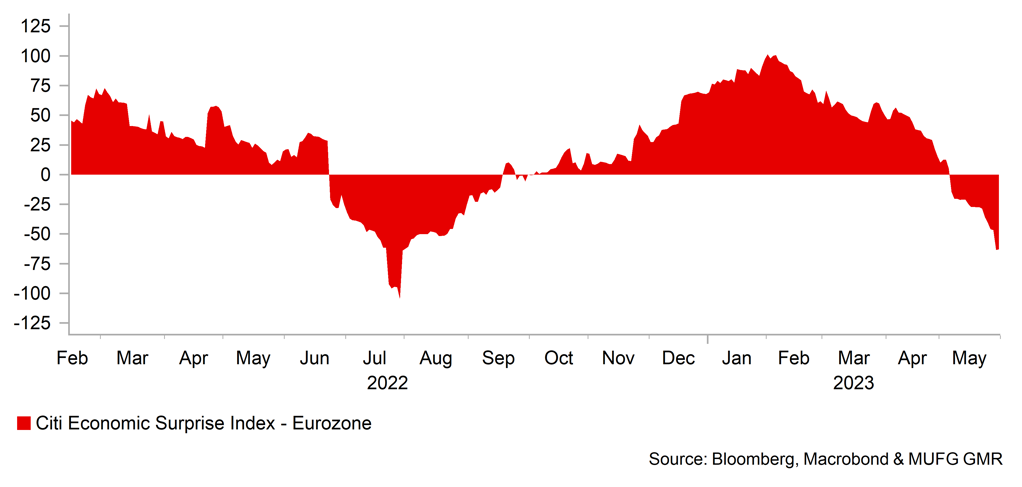

The euro underperformed in May and was the third worst performing G10 currency with a number of factors contributing to the reversal. Firstly, optimism over the economic outlook deteriorated with German GDP weaker than expected in Q1 – the Q1 contraction (-0.3% Q/Q) confirmed official recession in Germany. This decline in optimism was reflected in a more subdued rise in short-term yields relative to most other G10 countries. Increased speculation of a June FOMC rate hike, higher inflation in the UK, and big jumps in yields in Australia and New Zealand saw the rate spread support for EUR fade. China growth expectations also worsened which reinforced the perception of downside risks to global growth that would have a bigger impact on economies like Germany. Initial readings for May CPI show some softening in inflation pressures (Spain core CPI 6.1% vs 6.6% prior and in France headline CPI 5.1% from 5.9% prior) while M3 money supply growth continues to slow. Loan growth to NFCs continued to slow (3.8% vs 4.5% prior) with six EZ countries now recording a contraction in credit growth.

The rhetoric from the ECB continues to show a determination to hike at least twice more. We maintain our view of two further 25bp hikes, taking the key policy rate to 3.75%. The ECB has also leaned more on the hawkish side in regard to balance sheet policy. There will be no bridge loan to avoid the sudden removal of close to EUR 500bn from the maturing TLTRO from 2020 while the ECB confirmed also that it would allow a 100% roll-off of maturing bonds from APP from July. That equates to a pick-up in pace from the current EUR 15bn per month to around EUR 27bn. The end of negative rates and the QT-related rise in the term premium has helped underpin yields in the euro-zone and shift the capital flow dynamic from substantial net debt outflows to moderate net debt inflows. The removal of negative rates we believe is somewhat under-appreciated by the markets and at these lower levels in EUR/USD we suspect strong support will emerge. It would take a notable shift in relative macro expectations for EUR/USD to break further lower towards parity.

May was a testing month in which global growth expectations deteriorated and Fed rate hike expectations picked up again. We doubt this backdrop is sustainable and see euro-zone growth resilience helped by lower energy prices and a gradual pick-up in growth in China. The ECB is set to remain hawkish while we see a Fed pause in June opening up a renewed decline in US yields and a rebound in EUR/USD.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

Policy Rate |

3.25% |

3.50% |

3.75% |

3.75% |

3.50% |

|

3-Month Bill |

3.19% |

3.40% |

3.60% |

3.50% |

3.10% |

|

10-Year Yield |

2.28% |

2.50% |

2.40% |

2.30% |

2.25% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year German bund yield decreased in May by 3bps to close at 2.28%. The yield dropped toward month-end with some economic data coming in weaker than expected. Preliminary inflation data for May was softer than expected with both the annual and core CPI rates dropping more than the consensus estimate to 6.1% and 5.3% respectively (6.3% and 5.5% expected). M3 money supply growth also slowed with the lending data showing a broadening of the contraction of credit to NFCs. Six countries now have annual lending to NFCs in negative territory. The surprise contraction in German GDP in Q1 that confirmed technical recession has also lowered expectations going forward although we still expect growth to flat-line around zero percent over the coming quarters as the positive impact of falling energy prices is offset by the increasing impact of monetary tightening. Lower yields will also be shaped by global conditions and we expect the US economy to slow and the Fed to pause its tightening cycle. That will open up the prospect of a pause by the ECB too, especially if EUR appreciation resumes as we expect. Forward inflation contracts indicate investor expectations of annual CPI falling below 3% by March 2024.

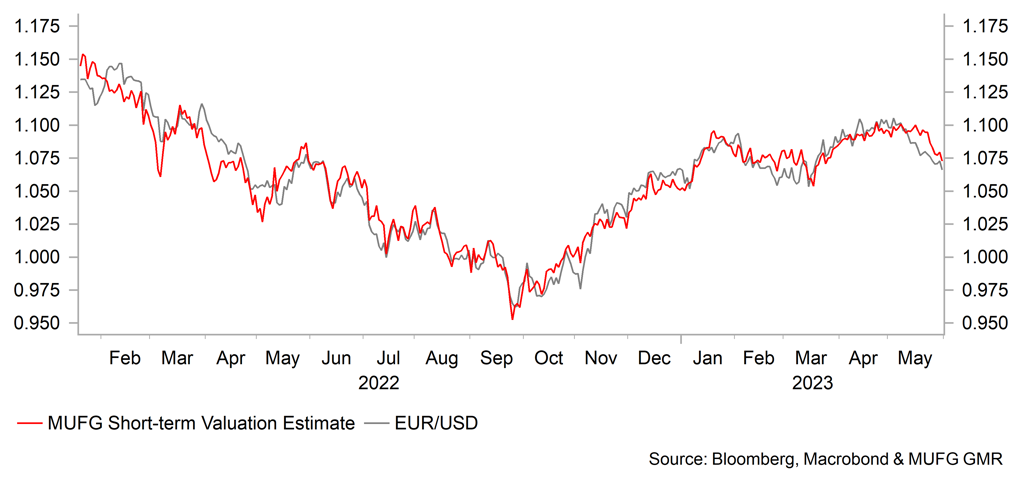

EURO-ZONE ECONOMIC SURPRISE INDEX

EUR/USD VS SHORT-TERM VALUATION MODEL ESTIMATE

Pound Sterling

|

Spot close 31.05.23 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

EUR/GBP |

0.8598 |

0.8650 |

0.8750 |

0.8850 |

0.9000 |

|

GBP/USD |

1.2397 |

1.2600 |

1.2910 |

1.2990 |

1.2670 |

|

GBP/JPY |

173.16 |

173.90 |

171.80 |

170.20 |

163.40 |

|

Range |

Range |

Range |

Range |

||

|

GBP/USD |

1.2000-1.2800 |

1.2300-1.3300 |

1.2200-1.3200 |

1.2000-1.3000 |

MARKET UPDATE

In May the pound weakened against the US dollar in terms of London closing rates from 1.2574 to 1.2397. However, the pound strengthened against the euro, from 0.8781 to 0.8598. The BoE at its meeting in May raised the official Bank rate by 25bps to 4.50%, following 415bps of rate hikes in this tightening cycle. The BoE commenced QT in November last year and completed in January the sales of Gilts purchased under the emergency purchase program. The BoE implied in May that it could consider quickening the pace at some stage going forward.

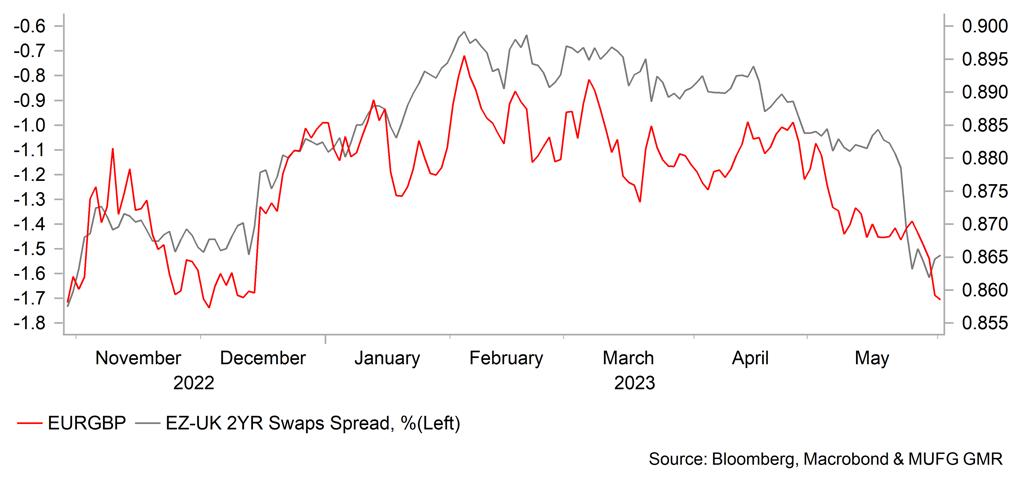

OUTLOOK

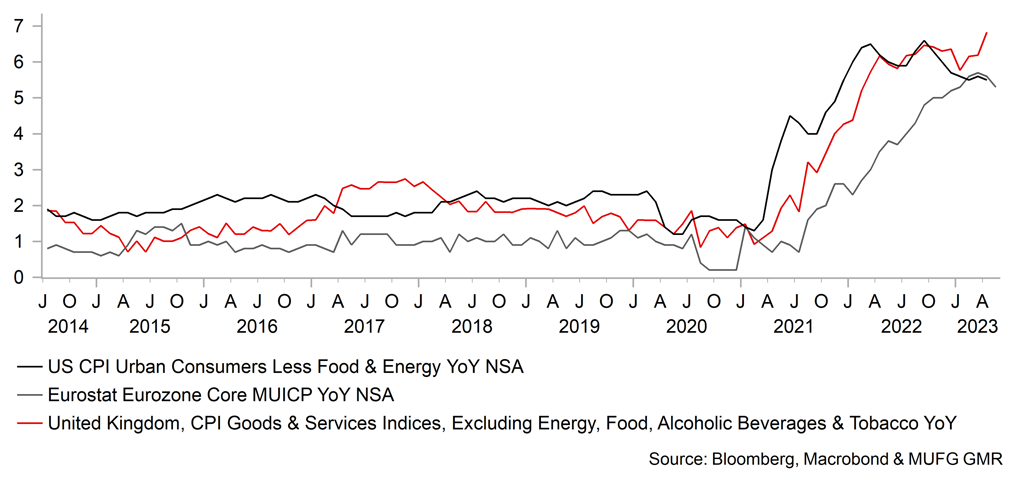

The pound depreciated against the dollar in May but was the fourth best performing G10 currency with yield perhaps helping to support the pound. The 2yr Gilt yield surged 54bps in May, outstripping the 39bps gain in the UST note yield increase. A good portion of this gain followed the very disappointing inflation data for April. While the overall CPI YoY rate declined from 10.1% to 8.7%, the drop was much less than expected. The utility bill base effect related to energy prices was well flagged but many other areas of the economy revealed a further acceleration in inflation. The YoY rate surpassed the pessimistic projection of the BoE, which was put at 8.4%. Food inflation remained elevated and tax changes played a part as well but core CPI YoY picked up from 6.2% to 6.8%. The YoY rates for rents, transportation, communications, recreation and miscellaneous all accelerated highlighting the broadening of inflation pressures beyond food and energy. The scale of the UK’s inflation problem is diverging from the US and the euro-zone.

The sense that the UK has a bigger inflation problem is creating downside risks for the pound that may see a period of underperformance if the evidence continues to suggest this. That risk was made worse by the BoE acknowledging that its forecasting model is broken. BoE Governor Bailey stated that it was no longer following the information from the model which will only exacerbate risks of policy errors and the potential for a bigger inflation problem in the UK. Brexit trade-related frictions and weak labour market participation (given the level of vacancies), mainly due to long-term sick, that has kept the labour market tight. Weekly average earnings ex-bonuses on a YoY basis averaged 6.7% over the three months to March with public sector pay accelerating from 5.3% to 5.6%. Public sector pay disputes and strikes continue with no end in sight and if deals are reached, it could mean public sector wage growth remains stronger for longer. Nearly 100bps of rate hikes by the BoE are priced which we believe is much too excessive. A further two hikes is what we expect and market rates are set to decline notably.

A weaker US dollar will help support GBP/USD and while higher rates to fight inflation could prove supportive for the pound, there are risks going forward that this could create concerns over growth. With UK yields set to ease as the BoE underdelivers current expectations, GBP weakness could be evident versus EUR.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

Policy Rate |

4.50% |

4.75% |

5.00% |

5.00% |

4.75% |

|

1-Year Yield |

4.74% |

5.00% |

5.10% |

4.80% |

4.30% |

|

10-Year Yield |

4.18% |

4.30% |

4.40% |

4.20% |

3.90% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

We have under-estimated the stickiness of inflation in the UK and while we still maintain that inflation will fall quite sharply through the remainder of the year, the risks are clearly skewed toward a slower drop. The BoE may now push rates to a peak of 5.00%, 25bps higher than our previous call. The 10-year Gilt yield jumped notably, by 46bps to close at 4.18%. A lot of tightening has yet to hit the economy. As the BoE Monetary Policy Report in May pointed out, only around 70bps of the 415bps of tightening (before May’s hike) had fed through in the mortgage market and the feed-through will accelerate as more fixed rate mortgages re-set over the coming months. The fact that inflation in the UK is slower to retrace lower, we believe the BoE will feel compelled to act again in June and possibly in August. June is practically a done-deal August is a close call. Jobs and wage data will determine the August decision. Nonetheless, whether its 25bps or 50bps more of tightening, we see longer-term rates as declining in H2 as investors’ concerns shift from high inflation to weak growth. Weak demand for credit, early signs of weakening employment and sharp falls in energy prices will all help shift the focus and help push yields lower.

CORE INFLATION IN UK VS EZ & US

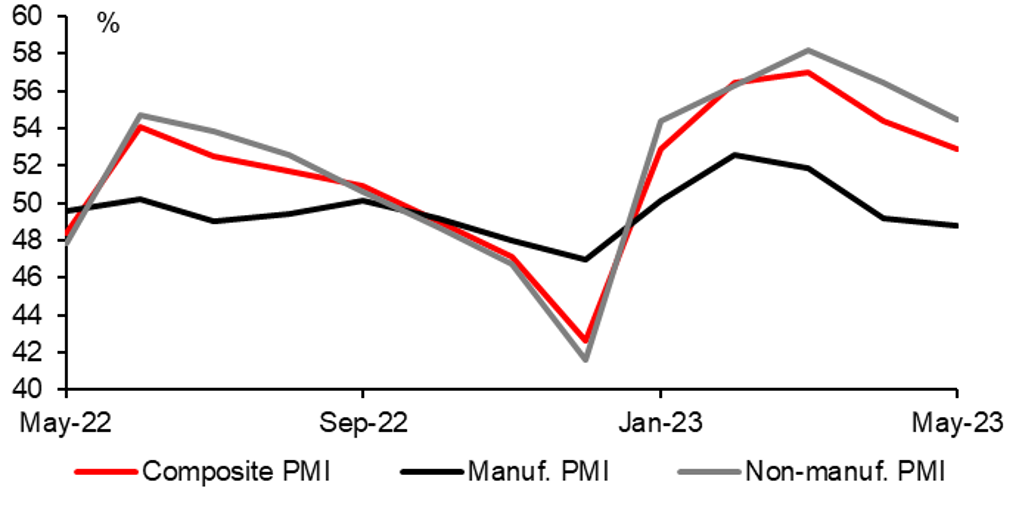

UK COMPOSITE PMI MEASURES - UK economy is strengthening at start of Q2

Chinese renminbi

|

Spot close 31.05.23 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

USD/CNY |

7.1100 |

6.9000 |

6.8000 |

6.7000 |

6.6000 |

|

USD/HKD |

7.8298 |

7.8300 |

7.8100 |

7.8000 |

7.8000 |

|

Range |

Range |

Range |

Range |

||

|

USD/CNY |

6.8000-7.2000 |

6.7000-7.1000 |

6.6000-7.0000 |

6.5000-6.9000 |

|

|

USD/HKD |

7.7900-7.8700 |

7.7700-7.8500 |

7.7600-7.8400 |

7.7600-7.8400 |

MARKET UPDATE

In May the Chinese yuan depreciated by 2.8% against the US dollar to 7.1064. PBOC kept its 1-year MLF rate unchanged at 2.75% on 15th May, and held 1-year and 5-year LPRs unchanged at 3.65% and 4.30% respectively on 22nd May.

OUTLOOK

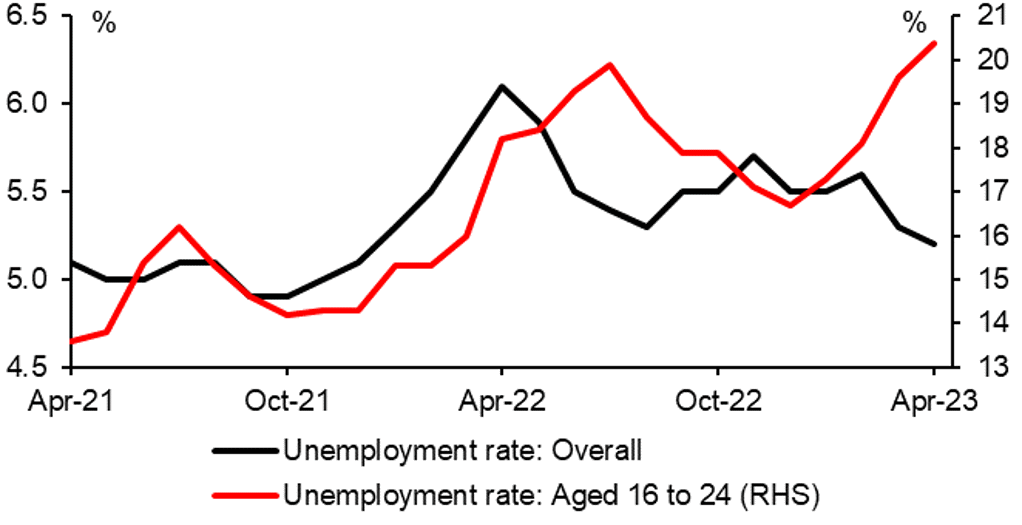

Yuan depreciation extended in May as market participants digested a slew of weaker-than-expected macroeconomic indicators including industrial production, retail sales, fixed assets investment and property investment for April pointing to an uneven and weak economic recovery, along with a record high of youth (aged 16-24) jobless rate of 20.4% in May, nearly four times the national unemployment rate. (Asia Macro Notebook - China: In transition to an endogenous demand driven growth mode). Meanwhile, China’s industrial firms' profits declined by 20.6% in the first four months of the year due to weak demand and deepening producer price deflation. A large industrial profit contraction echoed the challenges that China faced, suggested by data released for China’s key macro indicators in April.

Equities declined in May, with the benchmark CSI 300 index slumping by 5.7%, USD/CNY went higher, and the pair hit 7.1000 on May 30th. The government voiced its concerns on currency weakness, the PBOC and the State Administration of Foreign Exchange said in a joint statement on 19th May that efforts will be made to correct pro-cyclical and one-way market behaviours when necessary to curb speculation, calling for efforts to better guide expectations in the country’s FX market and resolutely prevent any drastic fluctuations in exchange rates. But, PBOC still set the daily USD/CNY fixing largely in line with market expectations and set the yuan fixing at the weakest level since December 2022 on 24th May. The lack of strong defensive actions by the government encouraged the market to bid up USD/CNY.

A disappointing cyclical recovery and structural pressures including weak a property sector also pressured CNY. To halt the current pessimistic sentiment and revive demand for investment and consumption, at a time with near-zero CPI inflation, a -20.4%yoy drop in YTD industrial profits, and other weak April macro indicators, we see both the need and scope for the government to act. As it takes a lot longer for consumer sentiment to be recover given the current elevated youth unemployment rate, the government’s counter cyclical measures that improve the investment environment and stabilize entrepreneurial expectations, through the issuance of additional long-term bonds to finance strategic projects and urbanization would be the more effective way to shore up the activities in near term. Also, the Ministry of Education led a 100-day sprint operating from May to August this year to expand the job market, and improve employment monitoring mechanisms; the Communist Youth League of China launched an employment campaign in assisting college students in their job searches, yielding job offers of 897k positions so far. We see CNY recovery emerging in H2 and hence expect this CNY weakness to reverse.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

Loan Prime Rate 1Y |

3.65% |

3.65% |

3.65% |

3.65% |

3.65% |

|

MLF 1Y |

2.75% |

2.75% |

2.75% |

2.75% |

2.75% |

|

7-Day Repo Rate |

2.00% |

2.00% |

2.00% |

2.00% |

2.00% |

|

10-Year Yield |

2.70% |

2.75% |

2.85% |

2.95% |

3.00% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

China’s government bonds extended its rally in May, with 10-year government bond yield falling 6bps to 2.715% at the end of May. It was a reflection of increased risk aversion, the decline in yield happened despite Chinese government’s continued efforts in issuing government bond. As of 23rd May, the new issuance of local government special bonds was about RMB2 trillion, nearly 80% of the pre-approved quota for mainly financing the construction of key areas and major projects. Market pessimism and expectation for monetary easing to bloster growth weighed on bond yields. Looking ahead, near-term recovery pace likely remains moderate, monetary environment will remain loose and liquidity conditions remain ample, so, demand for credit will likely remain insufficient compared with the credit supply. Also the decline in bank deposit rates means lower cost of capital for banks, and amid still lukewarm demand for loans, banks will likely increase its allocation of government bonds, and hence we expect government bond yields to remain low in near ter

CHINA’S MANUFACTURING SECTOR CONTINUED TO CONTRACT IN MAY

Source: CEIC, MUFG GMR

YOUTH UNEMPLOYMENT HITS NEW HIGH

Source: CEIC, MUFG GMR