Please download PDF from the button above for all other contents for the following currencies.

Australian dollar // New Zealand dollar //Canadian dollar // Norwegian krone // Swedish Krona // Swiss franc // Czech koruna // Hungarian forint //Polish zloty // Romanian leu // Russian rouble // South African rand // Turkish lira // Indian rupee // Indonesian rupiah // Malaysian ringgit // Philippine peso //Singapore dollar // South Korean won // Taiwan dollar // Thai baht // Vietnamese dong // Argentine peso // Brazilian real // Chilean peso // Mexican peso // Crude oil // Saudi riyal // Egyptian pound

Monthly Foreign Exchange Outlook

DEREK HALPENNY

Head of Research, Global Markets EMEA and International Securities

Global Markets Research

Global Markets Division for EMEA

E: derek.halpenny@uk.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

E: lee.hardman@uk.mufg.jp

LIN LI

Head of Global Markets Research Asia

Global Markets Research

Global Markets Division for Asia

E: lin_li@hk.mufg.jp

JEFF NG

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: Jeff_ng@sg.mufg.jp

MICHAEL WAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: michael_wan@sg.mufg.jp

EHSAN KHOMAN

Head of Commodities, ESG and Emerging Markets Research – EMEA

DIFC Branch – Dubai

E: ehsan.khoman@ae.mufg.jp

CARLOS PEDROSO

Chief Economist

Banco MUFG Brasil S.A.

E: cpedroso@br.mufg.jp

MAURICIO NAKAHODO

Senior Economist

Banco MUFG Brasil S.A.

E: mnakahodo@br.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

May 2023

KEY EVENTS IN THE MONTH AHEAD

1) TIME FOR PAUSE OR NOT?

May will be an important month for the financial markets with the Fed, ECB, BoE and three other G10 central banks (RBA, Norges Bank, RBNZ) all meeting this month. The key meetings will be early in the month with the FOMC on 3rd May and the ECB the following day. As of the end of April, OIS pricing implied a probability of 85% of a 25bp hike by the FOMC and a 100% probability of 25bps by the ECB and a 16% probability of a larger 50bp hike. We think the FOMC should be pausing and see the justification for hiking based on rear-view mirror analysis of economic conditions. We see this hike as the last in the cycle and expect the FOMC to be cutting rates by year-end. The case for an ECB hike is stronger mainly because it started later and from a negative starting point. We now expect 75bps of additional rate hikes – assuming the hike in May is 25bps, the hiking will continue through to the July meeting. These scenarios are largely priced in the OIS market and 2yr and 10yr spreads as a result have moved to levels not seen since 2015 and 2014 respectively. The levels are certainly consistent with further moves to the upside for EUR/USD. Overall on a DXY basis, we forecast about a 5% drop in DXY by the end of the year.

2 ) X-DATE WATCH AS DEBT CEILING RISKS RISE

US debt ceiling risks have returned with House Leader Kevin McCarthy pushing through a bill to extend the ceiling but only if government spending cuts are implemented. The Democrats and the White House are refusing to negotiate and the face-off looks like taking us right to the point of which the US Treasury has exhausted its extraordinary measures. US Treasury Secretary Yellen provided an update of x-date citing early June or even the 1st June as the true deadline date before the Treasury would have to commence payment suspensions in order to prioritise coupon payments. President Biden has invited Congressional leaders to the White House on 9th May to discuss resolving the issue. This will become a hugely important issue during the month of May if no resolution is found. We view this event as a US dollar downside risk event versus core G10, like JPY, CHF and possibly EUR. Higher beta G10 FX would underperform due to the increased risk aversion and global growth consequences.

3 ) MORE POLICIES AIMING TO BOOST CHINA’S RECOVERY

The five-day May Day holidays start on 29th April likely offer a boost to China’s consumption, as domestic travel bookings for the holidays exceeded pre-pandemic levels of 2019. More notably, the Chinese Foreign Ministry announced that in-bound air travels entering China may choose to take RAT test taken within 48 hours prior to boarding, and do not need a negative PCR test result starting from 29th April. In late April, both China’s State Council and NDRC rolled out policies aiming to support exports and small enterprises, and promote consumption.

Forecast rates against the US dollar - End-Q2 2023 to End-Q1 2024

|

Spot close 28.04.23 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

JPY |

136.09 |

131.00 |

129.00 |

127.00 |

125.00 |

|

EUR |

1.1041 |

1.1200 |

1.1400 |

1.1600 |

1.1400 |

|

GBP |

1.2574 |

1.2660 |

1.2670 |

1.3180 |

1.3100 |

|

CNY |

6.9120 |

6.7500 |

6.6500 |

6.5500 |

6.4500 |

|

AUD |

0.6610 |

0.6600 |

0.6800 |

0.7000 |

0.6900 |

|

NZD |

0.6179 |

0.6150 |

0.6300 |

0.6400 |

0.6300 |

|

CAD |

1.3557 |

1.3700 |

1.3600 |

1.3300 |

1.3200 |

|

NOK |

10.653 |

10.268 |

9.8250 |

9.3970 |

9.4740 |

|

SEK |

10.246 |

10.089 |

9.825 |

9.483 |

9.4740 |

|

CHF |

0.8900 |

0.8840 |

0.8770 |

0.8710 |

0.8770 |

|

|

|

|

|

|

|

|

CZK |

21.286 |

20.980 |

20.530 |

20.090 |

20.260 |

|

HUF |

338.00 |

334.80 |

337.70 |

340.50 |

350.90 |

|

PLN |

4.1538 |

4.1070 |

4.0790 |

4.0520 |

4.1230 |

|

RON |

4.4621 |

4.4200 |

4.3510 |

4.3020 |

4.4040 |

|

RUB |

80.037 |

79.700 |

80.900 |

82.090 |

83.730 |

|

ZAR |

18.285 |

18.250 |

18.000 |

17.750 |

17.750 |

|

TRY |

19.449 |

20.250 |

21.750 |

23.000 |

23.500 |

|

|

|

|

|

|

|

|

INR |

81.830 |

81.500 |

80.500 |

79.500 |

79.000 |

|

IDR |

14671 |

15000 |

14800 |

14600 |

14400 |

|

MYR |

4.4600 |

4.4000 |

4.3000 |

4.2000 |

4.1000 |

|

PHP |

55.365 |

55.300 |

55.000 |

54.800 |

54.400 |

|

SGD |

1.3335 |

1.3400 |

1.3200 |

1.3000 |

1.2900 |

|

KRW |

1338.7 |

1310.0 |

1275.0 |

1250.0 |

1225.0 |

|

TWD |

30.740 |

30.500 |

30.200 |

29.900 |

29.600 |

|

THB |

34.090 |

34.250 |

33.250 |

32.250 |

31.250 |

|

VND |

23464 |

23500 |

23400 |

23300 |

23200 |

|

|

|

|

|

|

|

|

ARS |

222.57 |

255.00 |

310.00 |

378.00 |

475.00 |

|

BRL |

5.0064 |

5.2300 |

5.3400 |

5.4000 |

5.4200 |

|

CLP |

802.10 |

820.00 |

830.00 |

840.00 |

850.00 |

|

MXN |

18.005 |

18.300 |

18.500 |

18.700 |

18.700 |

|

|

|||||

|

Brent |

79.48 |

85.00 |

93.00 |

91.00 |

92.00 |

|

NYMEX |

76.34 |

81.00 |

88.00 |

86.00 |

87.00 |

|

SAR |

3.7506 |

3.7500 |

3.7500 |

3.7500 |

3.7500 |

|

EGP |

30.867 |

32.200 |

33.800 |

34.500 |

34.900 |

Notes: All FX rates are expressed as units of currency per US dollar bar EUR, GBP, AUD and NZD which are expressed as dollars per unit of currency. Data source spot close; Bloomberg closing rate as of 4:30pm London time, except VND which is local onshore closing rate.

US dollar

|

Spot close 28.04.23 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

USD/JPY |

136.09 |

131.00 |

129.00 |

127.00 |

125.00 |

|

EUR/USD |

1.1041 |

1.1200 |

1.1400 |

1.1600 |

1.1400 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

124.00-140.00 |

122.00-138.00 |

120.00-136.00 |

118.00-134.00 |

|

|

EUR/USD |

1.0600-1.1500 |

1.0800-1.1700 |

1.1000-1.1900 |

1.0800-1.1800 |

MARKET UPDATE

In April the US dollar weakened against the euro in terms of London closing rates, moving from 1.0863 to 1.1041. However, the dollar strengthened versus the yen, from 132.90 to 136.09. The FOMC did not meet in April and hence the fed funds rate remained at 4.75%-5.00%, following 475bps of hikes since March of last year. The FOMC has also continued with its policy of reducing its securities holdings with QT ongoing at a pace of USD 95bn worth of UST bonds (USD 60bn) and MBS (USD 35bn) of balance sheet reduction each month. However, this was dramatically offset by balance sheet expansion to provide loans and liquidity for the banking sector

OUTLOOK

After weakening by 2.3% in February, the US dollar (DXY) depreciated further in April, by 0.8% as concerns over weakening economic activity and recession fears increased. The banking sector uncertainty played a role in this and after a quick resolution to the crisis stemming from SVB in March, April saw those uncertainties persist with the collapse of First Republic. The KBW Regional Bank Index tumbled 21% in March and then stabilised but at the close in April had fallen a further 3.7%. Credit contraction is likely to intensify further. Other economic data also pointed to increased risks of a broader economic slowdown. The Fed’s justification for rate hikes stems from labour market strength but certain indicators point to a softening market. The weekly initial claims data, the Challenger job cut announcements, the JOLTS report and hiring plans reported in the NFIB survey all show weakening labour market conditions. Real GDP expanded by 1.1% in Q1 on a SAAR basis (from 2.6% in Q4) and much of that strength was in consumer spending in January and the momentum of the economy is clearly weakening.

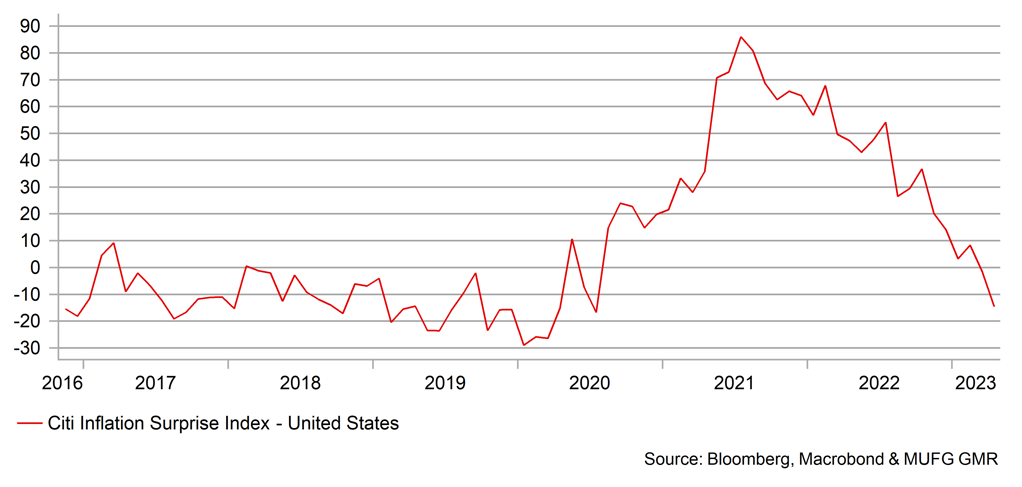

But the FOMC is set to hike rates by 25bps on 3rd May with FOMC members concerned over second round effects through wage inflation. We think those concerns are not justified and there is an element of rear-view mirror analysis behind the Fed hiking next week. Based on a MoM CPI rate increase of 0.3% over the next three months (reasonable based on recent energy price moves) the annual CPI is set to fall below 3.0% by June. A 0.2% average for core (possible if rents slow) will see the core annual rate at 4.4%. Wage growth (AHE) is already slowing on a 3mth and 6mth annualised pace and with labour demand slowing, the risk of second round effects appear to us to be diminishing.

The weakening economy could be further undermined if the debt ceiling fiasco worsens to the point of forgoing certain payments to ensure UST security coupon payments are made. The estimated deadline date is now closer to early June following the lower than expected tax receipts in April. If this was to develop into a bad case scenario, it would mean our current forecast levels for US dollar depreciation would be even lower. Given recent developments and the risks ahead, we have lowered our DXY levels further, by between 1-2%.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

Policy Rate |

4.83% |

5.13% |

4.63% |

4.13% |

3.63% |

|

3-Month T-Bill |

5.01% |

5.00% |

4.38% |

4.00% |

3.50% |

|

10-Year Yield |

3.57% |

3.50% |

3.13% |

3.50% |

3.38% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The May FOMC rate decision, which will likely be an increase of 25bps – bringing the range of the Fed Funds rate to 5-5.25%, could ultimately be the last hike of what was one of the most aggressively quick Fed hiking cycles in recent memory. The Fed will probably want to keep some optionality and say that they remain data dependent, but overall, we view this cycle as coming to an end now. That said, the path from here on out is fraught with many challenges. We expect the Fed to push back on the market pricing of rate cuts and hold the line as long as possible – conveying that they are planning to hold rates “higher for longer” to ensure that their inflation fighting job has done its work at wrestling inflation closer to their 2% target. The tricky part will be that these even higher rates than current levels will likely expose further weakness in the banking system and potentially the private credit sector as well. It’s the non-banking financial institutions that are the most difficult to read and potentially the sector with the biggest danger to a sudden re-pricing of underlying collateral while funding costs remain elevated. It’s for these reasons and others (like a weakening economy) that we still see the Fed cutting rates in 2H23. (George Goncalves, US Macro Strategy)

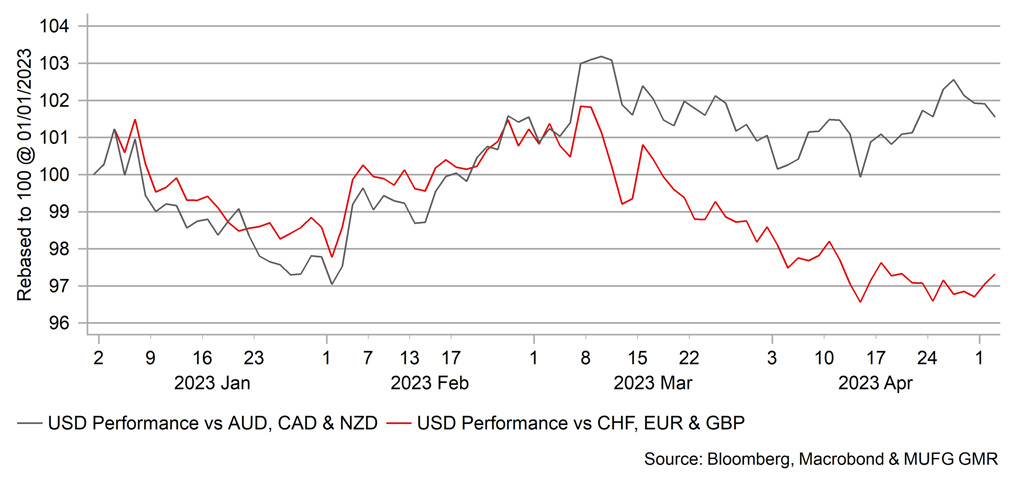

USD PERFORMANCE VS. COMMODITY FX & EUROPEAN FX - USD performance has been mixed recently

US INFLATION SURPRISES - Upside inflation risks have eased in the US

Japanese yen

|

Spot close 28.04.23 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

USD/JPY |

136.09 |

131.00 |

129.00 |

127.00 |

125.00 |

|

EUR/JPY |

150.26 |

146.70 |

147.10 |

147.30 |

142.50 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

124.00-140.00 |

122.00-138.00 |

120.00-136.00 |

118.00-134.00 |

|

|

EUR/JPY |

138.00-153.00 |

138.50-153.50 |

139.00-154.00 |

137.00-152.00 |

MARKET UPDATE

In April the yen weakened substantially versus the US dollar in terms of London closing rates from 132.90 to 136.09. The yen weakened more notably versus the euro, from 144.37 to 150.26. The BoJ at its meeting in April maintained its current monetary stance with the key policy rate at -0.10% and YCC maintained, restraining the 10-year yield within a range of +/-50bps around zero percent. The 10-year JGB yield retreated from the 0.50% upper limit following Governor Ueda dovish remarks. The bias of BoJ guidance favouring lower rates was removed from the statement.

OUTLOOK

The yen weakened sharply at the end of April following the BoJ policy meeting – the first for Governor Ueda after commencing his tenure on 9th April. There has been much speculation about possible changes to the policy stance under new leadership but Governor Ueda squashed those expectations by stating the stance was appropriate and by forecasting a drop in core annual CPI in 2025, adding a downside risk bias to the forecast for good measure. A full policy assessment was launched that could take up to a year and a half to complete as the BoJ acknowledged its failings in battling deflation forces that first emerged around 25yrs ago. As Governor Ueda stated though, this does not imply no policy change over this period and we maintain that YCC will likely be abandoned later this year. It is not necessarily linked to developments in inflation and more to the fact that as a policy tool it is no longer serving a purpose. The guidance at keeping rates at “present levels or lower” was dropped which provides flexibility to the BoJ if and when required.

The communications from Governor Ueda do suggest a change in YCC is not imminent and the weakness of the yen reflects the push-back in expectations. A snap election could also be called before the Diet ends on 21st June and take place in July which would push YCC changes to late summer or autumn. By then the risk of a disorderly end to YCC may be diminishing as yields globally will likely be declining as inflation declines and increased evidence of US recession emerges. Then YCC as a policy becomes less relevant as JGB yields will decline also and that’s when YCC could well be scrapped. We may also see Japan investors favouring domestic investments given hedging costs will remain expensive. Japan Life Insurance companies investment plans, which were released in April, revealed increased appetite for JGBs with an eye on the timing of YCC ending to avail of the opportunity of higher yields while unhedged foreign bond purchases could emerge as a flow but potentially at lower levels for USD/JPY.

The very sharp sell-off of the yen at the end of April is unlikely to last. To us this may have reflected a short-term position squeeze and to us much of what Governor Ueda stated was not surprising. Policy changes from the BoJ are still likely but in any case, falling inflation and global yields and Fed rate cuts by year-end all point to another turn lower for USD/JPY through to year-end and beyond.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

Policy Rate |

-0.10% |

-0.10% |

-0.10% |

-0.10% |

-0.10% |

|

3-Month Bill |

-0.18% |

-0.15% |

-0.15% |

-0.10% |

-0.05% |

|

10-Year Yield |

0.41% |

0.40% |

0.60% |

0.50% |

0.40% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year JGB yield increased modestly in April, by 4bps to close at 0.39%. The rise was larger but Governor Ueda’s first policy meeting at month-end resulted in speculation on an end to YCC being pushed back. The inflation forecasts suggested scepticism over inflation in Japan being sustained with the 2025 core CPI annual rate at 1.6%, down from 2.0% in 2024 and 1.8% in 2023. The statement did remove the bias to lower rates and the launch of a policy assessment does still suggest changes in policy approach are afoot. The BoJ could therefore change its stance later this year despite the assessment taking up to one and a half years. With the ‘shunto’ wage negotiated wage increase estimated at 2.33%, the actual overall change will lower taking into account smaller firms that award lower wage increases. While the level is higher than in 2022 (0.63%) it is not convincingly strong enough to be confident of sustained inflation at the 2.0% inflation target. We have pushed back the ‘hump’ in our 10yr yield forecast profile to show YCC change taking place in Q3 but still expect yields to then decline in line with the global move.

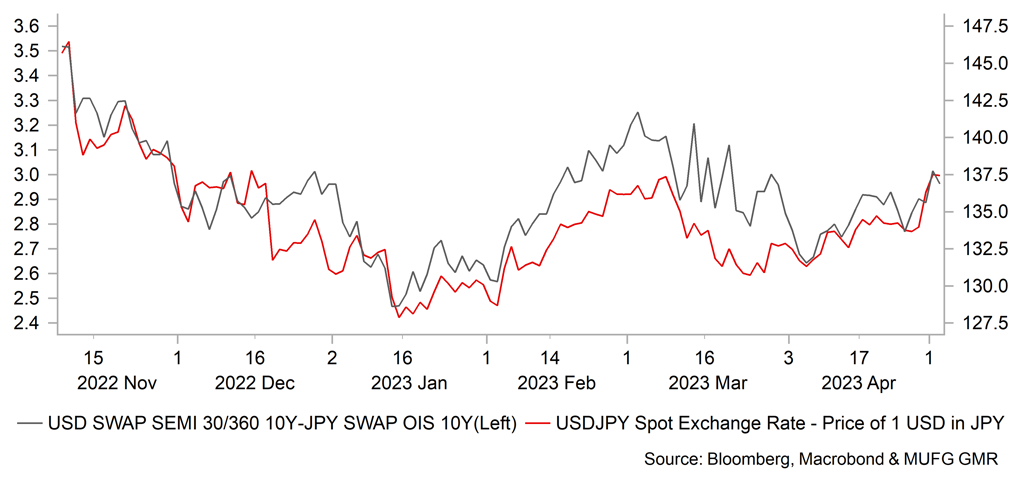

USD/JPY VS. JAPAN’S 10-YEAR SWAP RATE - BoJ pushes back against speculation over imminent tightening

PERFORMANCE OF USD/JPY VS. DOLLAR INDEX - Recent sharp move higher in USD/JPY driven by weaker JPY

Euro

|

Spot close 28.04.23 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

EUR/USD |

1.1041 |

1.1200 |

1.1400 |

1.1600 |

1.1400 |

|

EUR/JPY |

150.26 |

146.70 |

147.10 |

147.30 |

142.50 |

|

Range |

Range |

Range |

Range |

||

|

EUR/USD |

1.0600-1.1500 |

1.0800-1.1700 |

1.1000-1.1900 |

1.0800-1.1800 |

|

|

EUR/JPY |

138.00-153.00 |

138.50-153.50 |

139.00-154.00 |

137.00-152.00 |

MARKET UPDATE

In April the euro strengthened versus the US dollar in terms of London closing rates, moving from 1.0863 to 1.1041. The ECB did not meet in April and hence the key policy rate remained at 3.00%, following 350bps of tightening since last year. That was the most aggressive tightening in a year by the ECB and will be augmented by QT going forward. The ECB commenced QT in March with a EUR 15bn per month reduction in APP planned through to June.

OUTLOOK

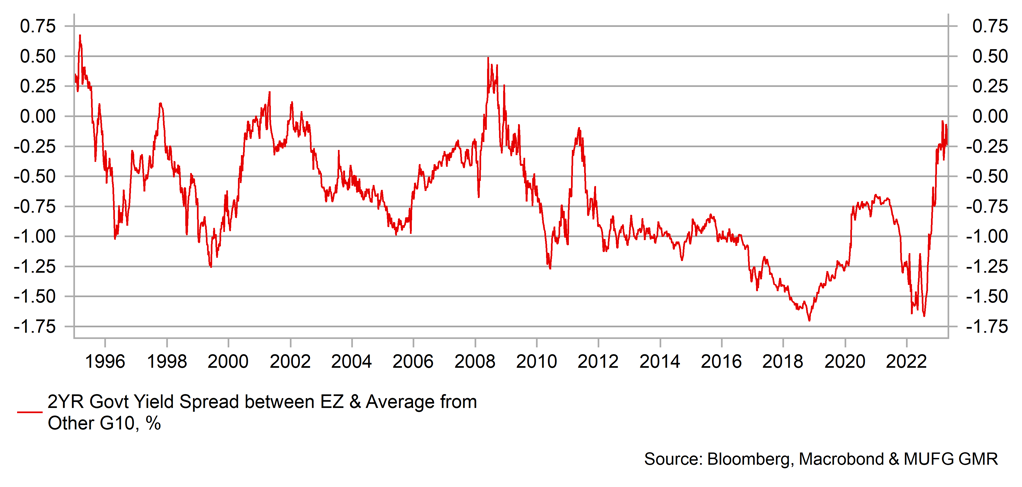

The euro advanced further in April with the reduction of banking sector fears resulting in a shift back to the prospect of the ECB having to hike for longer than most other G10 central banks. The euro was the 3rd best performing currency in April and on a year-to-date basis. There are a number of factors behind this but the most apparent is the continued move in rate spreads in favour of the euro. The 2yr swap spread moved further in favour of the euro in April and indeed the spread reached its narrowest since 2015 (when covid period is excluded). That takes us back to levels prevailing just as the ECB embarked on QE and after negative rates the previous year. The 10-year spread move tells an even more compelling story with the level dropping to 100bps in April, the narrowest since 2014 before the start of negative rates in the euro-zone. Based on historic spread moves, the EUR/USD equivalent suggests further upside scope from here with a move to around the 1.1500 level very plausible if these rate moves hold.

The move higher in spreads reflects the clear message from the ECB that more hiking needs to be done. ECB Chief Economist Philip Lane has left open the prospect of a 50bp hike in May and with the market priced for 28bps it appears less likely we see a larger hike at the May meeting. We now expect the policy rate to peak at 3.75% with a risk of 4.00% if the ECB hikes by 50bps in May. While the annual inflation rate is beginning to decelerate, the focus is very much on wage inflation risks that could undermine the speed in which inflation returns to target. The annual rate of increase in labour costs reached 5.7% in Q4 last year, a record rate and the ECB will want to see some deceleration before being content with the idea of pausing. Another German union – Verdi – reached an agreement with 2.5mn public sector workers that equated to about a 5.0% wage increase. Euro-zone GDP growth is also proving more resilient helped by the continued decline in natural gas prices. The euro-zone PMI Composite index increased to 54.4, the fourth month above the 50-level. Real GDP accelerated marginally from 0.0% in Q4 to 0.1% in Q1.

The reversal of the huge negative terms of trade energy shock is now benefitting the euro-zone and helping to support growth despite the uncertainties and the mixed global growth backdrop. This will encourage the ECB to tighten further in contrast to the Fed, which we believe will pause after hiking in May. The fundamental backdrop continues to point to EUR/USD moving further higher this year.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

Policy Rate |

3.00% |

3.50% |

3.75% |

3.75% |

3.25% |

|

3-Month Bill |

3.03% |

3.35% |

3.30% |

3.20% |

2.70% |

|

10-Year Yield |

2.31% |

2.50% |

2.40% |

2.20% |

2.00% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year German bund yield jumped in April, by just 2bps to close at 2.31%. The move therefore failed to reverse most of the drop in March as the fears over banking sector turmoil receded and the focus shifted back to growth and inflation risks. The general tone of the ECB rhetoric in April was hawkish with more of a focus on wage inflation risks as annual inflation begins to slow. The domestic upside inflation risks mean more rate hikes are coming although the risks globally have begun to recede somewhat. The data from the US points to increased recession risks, EUR continues to advance notably on a TWI basis, reducing imported inflation risks while the optimism over China growth receded with commodity prices turning lower to differing degrees. Brent crude oil has more than fully reversed the bounce following the OPEC+ production cut announcement. We see wage inflation risks receding too and hence see the window for rate hikes by the ECB as closing over the summer. 50-75bps of tightening seems plausible from here but with inflation receding and global growth remaining mixed, we believe the 10-year yield is currently peaking out before turning lower through the rest of the year.

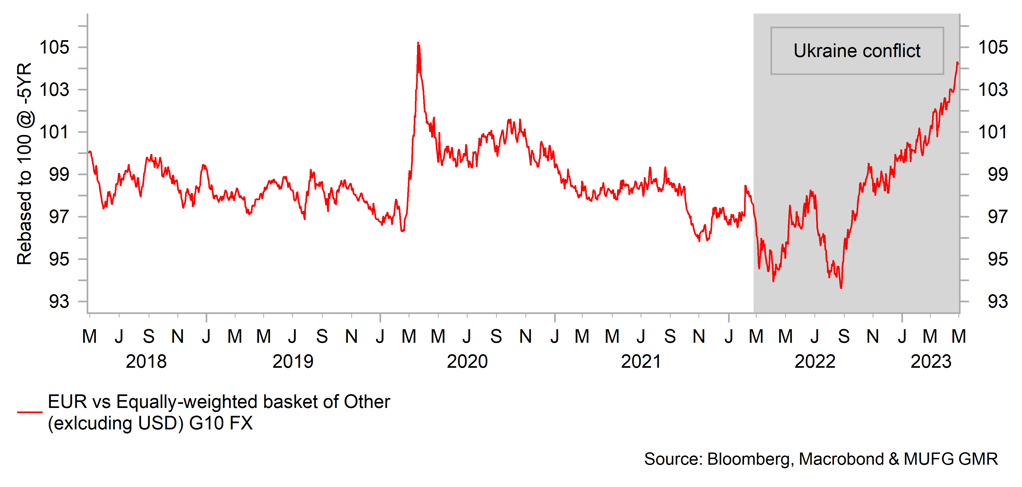

PERFORMANCE OF EUR VS. NON-USD G10 FX - EUR has strengthened sharply since last summer

YIELD SPREADS BETWEEN EURO-ZONE & OTHER G10 ECONOMIES - Yield spreads have not been as favourable for EUR in over a decade

Pound Sterling

|

Spot close 28.04.23 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

EUR/GBP |

0.8781 |

0.8850 |

0.9000 |

0.8800 |

0.8700 |

|

GBP/USD |

1.2574 |

1.2660 |

1.2670 |

1.3180 |

1.3100 |

|

GBP/JPY |

171.12 |

165.80 |

163.40 |

167.40 |

163.80 |

|

Range |

Range |

Range |

Range |

||

|

GBP/USD |

1.2000-1.3000 |

1.2200-1.3200 |

1.2400-1.3500 |

1.2300-1.3400 |

MARKET UPDATE

In April the pound strengthened against the US dollar in terms of London closing rates from 1.2370 to 1.2574. However, the pound was basically unchanged against the euro, moving from 0.8782 to 0.8781. The BoE did not meet in April and hence the official Bank rate remained at 4.25%, following 415bps of rate hikes in this tightening cycle. The BoE commenced QT in November last year and completed in January the sales of Gilts purchased under the emergency purchase program following the turmoil last year when a poorly delivered fiscal plan caused a crisis of confidence

OUTLOOK

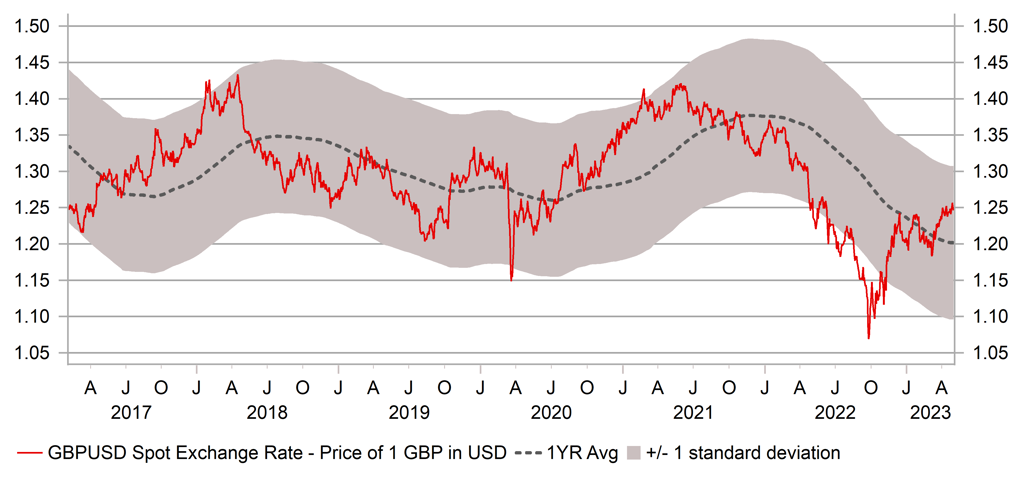

The pound advanced versus the US dollar in April but was more or less unchanged versus the euro with moves revealing an outperformance versus most of G10 as the markets priced for more BoE rate hikes as inflation risks persist. The best reflection of pound performance is versus G10 excluding the US dollar and on that basis, the pound is close to multi-year highs indexed over a 5-year period. We view this performance as partly a reflection of reaching extreme low levels last year due to the political turmoil in the UK and the elevated fears over the depth of the recession due to the surge in energy prices. The political climate has improved relative to last year and the substantial drop in natural gas prices has eased the negative consequences on the real economy. Indeed, inflation is set to fall sharply from here which will help support real incomes later in the year. The government also just confirmed a better fiscal position than expected with the deficit GBP 13.2bn smaller than the OBR forecast only in March when the Chancellor presented his budget.

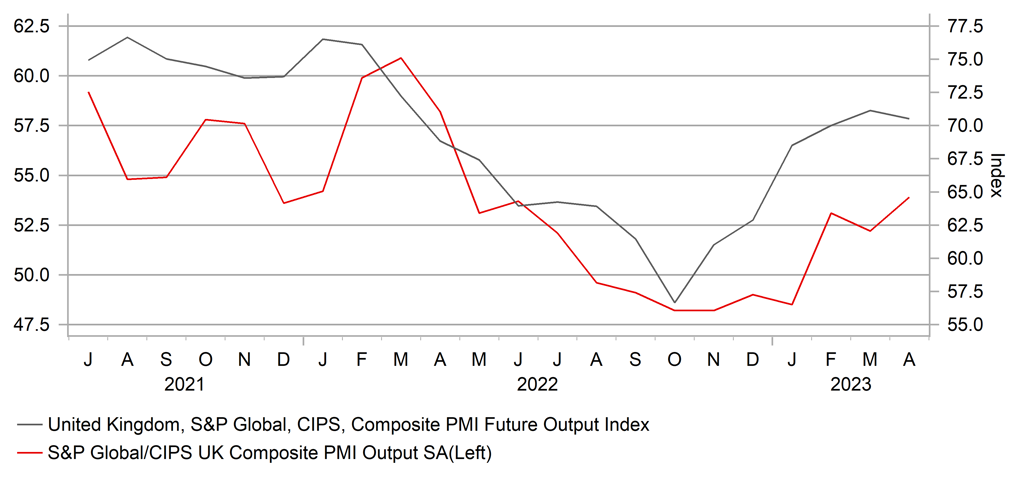

The BoE has made clear that it is focused on economic developments that will influence the risks of “inflation persistence”. The labour market and services inflation are two aspects that could undermine price stability through wage growth generating domestic inflation at a time when external inflation pressures are receding. Data in March revealed a smaller than expected drop in inflation but services inflation was in line with BoE expectations. However, wage growth was stronger and in of itself will be enough to see another rate hike in May. The one-month annual growth in wages accelerated from 5.9% to 7.0%, matching the 2022 high. Real wages remain negative but based on reasonable MoM projections and on BoE expectations, inflation will quickly fall, helping to improve real wage growth. That could in the view of BoE Chief Economist Huw Pill result in a “positive demand shock” for the UK economy later in the year. There is a risk of a further 25bp rate hike in June if wage and CPI data released in May are again stronger than expected.

The broader view of the US dollar means GBP/USD is set to move higher and our forecast levels imply GBP outperformance not just against the dollar but against most other G10 currencies too. Economic resilience helped by the improved energy terms of trade will help provide support and improve the UK’s trade and fiscal position which will further help provide support for the pound.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

Policy Rate |

4.25% |

4.75% |

4.75% |

4.75% |

4.25% |

|

1-Year Yield |

4.34% |

4.50% |

4.20% |

3.80% |

3.40% |

|

10-Year Yield |

3.72% |

3.80% |

3.60% |

3.30% |

3.00% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

We have had to raise our assumption of the peak rate for the UK after assuming that the hike in March would be the last. We now assume another rate hike in May for sure and just about lean to one final hike in June taking the Bank Rate to 4.75%. The June hike is very finely balanced but we assume the wage data released in May and June will not be enough to reach a consensus to pause. However, the BoE inflation report in May will also be an important guide on whether or not there has been a shift in thinking or not. Whether the BoE hikes or not in June, we see the rates market as being close to a peak and maintain our view that the 10-year Gilt yield will grind lower through the remainder of the year. The BoE hiking once or twice more doesn’t really change the fact that the BoE is at or approaching over-tightening territory and this will ensure the BoE is cutting rates in Q1 2024 when global growth is impacted by Fed tightening and weaker China growth momentum. If energy prices remain contained, annual CPI in the UK will be far closer to target, possibly in the 3’s by year-end. The scale of improvement given the scale of inflation increases in the UK was generally larger than elsewhere, hence our lean toward the BoE tightening by 50bps more.

GBP/USD VS. 1-YEAR AVERAGE - GBP has outperformed at start of this year as pessimism has eased

UK COMPOSITE PMI MEASURES - UK economy is strengthening at start of Q2

Chinese renminbi

|

Spot close 28.04.23 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

USD/CNY |

6.9120 |

6.7500 |

6.6500 |

6.5500 |

6.4500 |

|

USD/HKD |

7.8497 |

7.8300 |

7.8100 |

7.8000 |

7.8000 |

|

Range |

Range |

Range |

Range |

||

|

USD/CNY |

6.6000-6.9500 |

6.5000-6.8500 |

6.4000-6.7500 |

6.3000-6.6500 |

|

|

USD/HKD |

7.7900-7.8700 |

7.7700-7.8500 |

7.7600-7.8400 |

7.7600-7.8400 |

MARKET UPDATE

In April the Chinese yuan depreciated by 0.6% against the US dollar to close at 6.9120. The PBOC kept its 1-year MLF rate unchanged at 2.75% on 17th April, and held 1-year and 5-year LPRs at 3.65% and 4.30% respectively on 20th April.

OUTLOOK

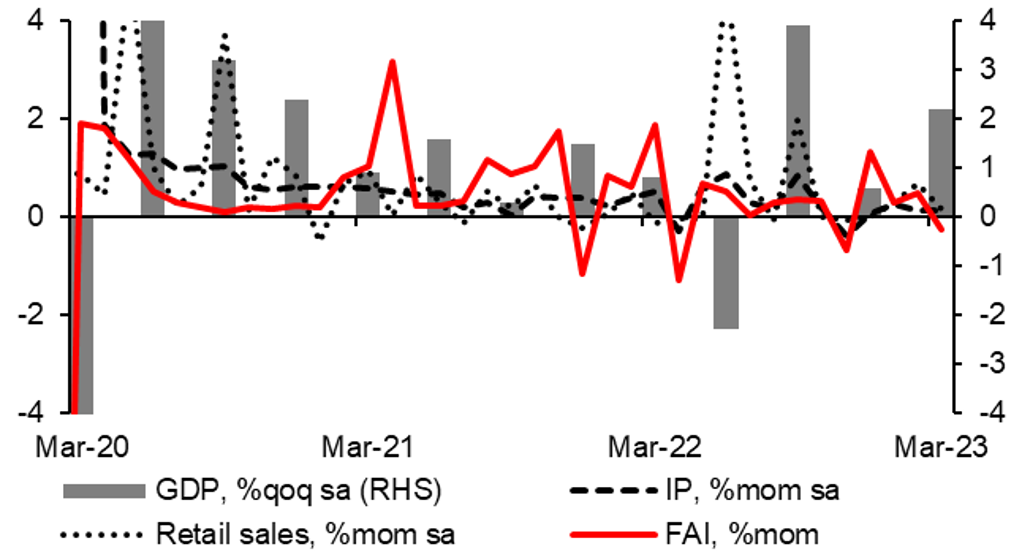

Against the dollar’s near-1% depreciation, the yuan depreciated last month largely on a set of mixed China March data, despite stronger-than-expected 1Q23 GDP growth (Asia Macro Notebook - China: Revising 2023 GDP growth to 5.5%). Although data showed that the Chinese economy was still on a path of expansion in Q1 and March, market concerns increased over the weaker pace of China’s growth momentum in March and the challenges facing the economy including still weak property investment and new floor space. Also the 19.6% unemployment rate of the youth (year 16-24) dampened the prospects of consumption recovery. Benchmark CSI 300 index dropped around 1.5% in April following a mild 0.5% loss in March, foreign investors delivered a net sell of Chinese equities in April.

Recently, we saw a series of government actions in promoting domestic economic activities. China's State Council on 25th April announced 18 specific measures to stabilize the country's foreign trade, including increasing financial support, optimizing cross-border settlement services, supporting exports of automobiles, and facilitating visas for foreign businesspeople. China’s National Development and Reform Commission (NDRC) said on 19th April that China is speeding up on drafting policies on the recovery and expansion of consumption, mainly focusing on key areas such as stabilising big-ticket consumption, enhancing service consumption and expanding rural consumption, according to the needs of different consumer groups. Also, China's State Council on 26th April outlined 15 specific measures to stabilize and expand employment, including providing at least 1 million youth internship positions and increasing financial support for small businesses.

We believe that Chinese economic recovery will continue to expand with a gradual pick-up in speed towards the end of this year, due to these policy initiatives, and the lagged effect of previous fiscal expansion. The recent expansion of money and credit point to continued economic recovery, as they often are reliable leading indicators for the real economy, specifically, medium and long-term loans of enterprises lead production by about one quarter. With the potentially higher broad fiscal deficit (to GDP ratio), structural monetary tools, and infrastructure funds, we see a recovery in endogenous credit demand, and subsequently stronger growth.

We see dissipating depreciation pressure on CNY ahead. With the Fed’s rate hiking cycle coming to an end, the rising probability of US economic recession, a weaker USD would provide a favourable background for CNY against the dollar. We maintain our call of 6.7500 by the end of Q2 for USD/CNY

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

|

Loan Prime Rate 1Y |

3.65% |

3.65% |

3.65% |

3.65% |

3.65% |

|

MLF 1Y |

2.75% |

2.75% |

2.75% |

2.75% |

2.75% |

|

7-Day Repo Rate |

2.00% |

2.00% |

2.00% |

2.00% |

2.00% |

|

10-Year Yield |

2.78% |

2.95% |

3.00% |

3.05% |

3.10% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

China’s 10-year government bond yield fell 7bps to 2.79% at the end of April, the lowest closing level since last November, as China’s lower CPI print for March (0.7%yoy vs. 1.0%yoy in February) caused market’s increasing worries on deflation and expectations that the central bank will further ease monetary policy. That said, at the central bank's Q1 financial statistics press conference on 20th April, Zou Lan, head of the monetary policy department of PBOC said consumer price inflation will gradually return to the average level of previous years with a U-shaped trend, adding that there is no basis for long-term deflation or inflation in China. That reduced the need for imminent monetary easing to bolster growth, which will likely cap government bond gains. Rather than cutting benchmark rates, the PBOC is more likely to make use of structural policy tools to support the economy, as Zou said to implement a prudent monetary policy, maintain the stability of long-term tools such as re-lending and rediscounting, and provide continuous support for key areas and weak links. Balancing these, we expect CGBs to trade in a range in the near term

GROWTH MOMENTUMS OF KEY MACRO INDICATORS SLOWED IN MARCH - March data shows that the growth momentums of several key macro variables were slower in March than February

Source: CEIC, MUFG GMR

CHINESE YUAN WEAKENED ALONG WITH LOCAL STOCK MARKET IN APRIL - Underperformance in stock market suggested market sentiment remained weak after the release of March data

Source: Bloomberg, MUFG GMR