Philippines: Upside surprise to Q4 GDP but BSP likely to hold in 1H22

Key Points

- The Philippines’ real GDP growth exceeded expectations with a 7.7% y/y jump in Q4 from Q3’s revised 6.9% y/y

- As stronger growth comes from a low base, a negative output gap remains, rendering policy tightening premature at this stage

- We continue to expect policy tightening by the BSP to begin in 2H22 when the negative output gap has narrowed and economic growth picks up steam

- 00 is a new key level to watch for USD/PHP as USD strength and wider trade deficits continue to weigh on the PHP

Summary

The Philippines’ real GDP growth rose by 5.6% in 2021, higher than Bloomberg consensus at 5.1% and 2020’s -9.6% slump. Stronger private consumption has been the key driver of this recovery and is likely to remain so this year. The current Omicron variant surge and decline in retail mobility pose downside risks to growth in the near term, but we think the impact is likely to be temporary with the rate of infections likely to have peaked. Even with a stronger-than-expected real GDP growth rate in Q4, we think it will be premature for the BSP the hike in 1H22 as the economy is still below pre-pandemic levels and a negative output gap persists. We still have the BSP starting policy tightening in 2H22 as our base case scenario but acknowledge risks of an earlier start should policy tightening by the Fed be more aggressive than anticipated. A consumption-led economic recovery is expected to result in larger trade and current account deficits this year. This, alongside near term USD strength, is expected to keep the PHP under pressure this year. The 52.00 mark is now a key level to watch for USD/PHP.

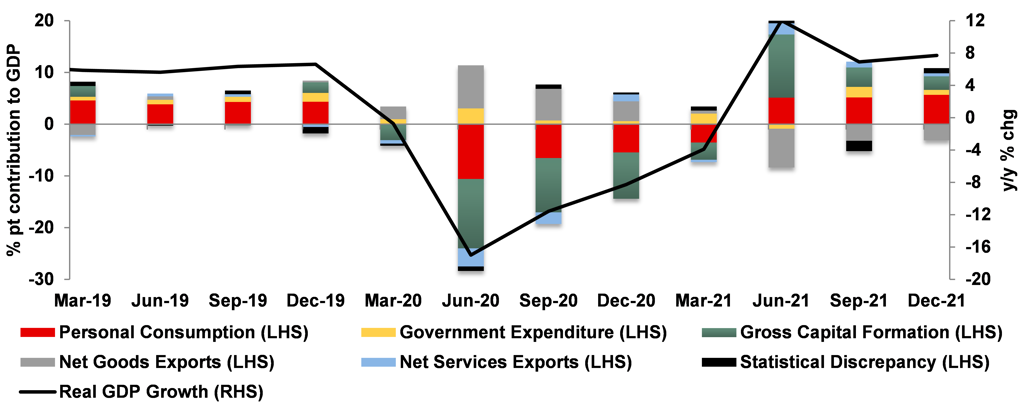

PCT point contribution to the Philippines' real GDP growth

Sources: CEIC & MUFG GMR

Private consumption the main driver of growth in 2021

Economic rebound in 2021 driven by stronger private consumption and low base effects

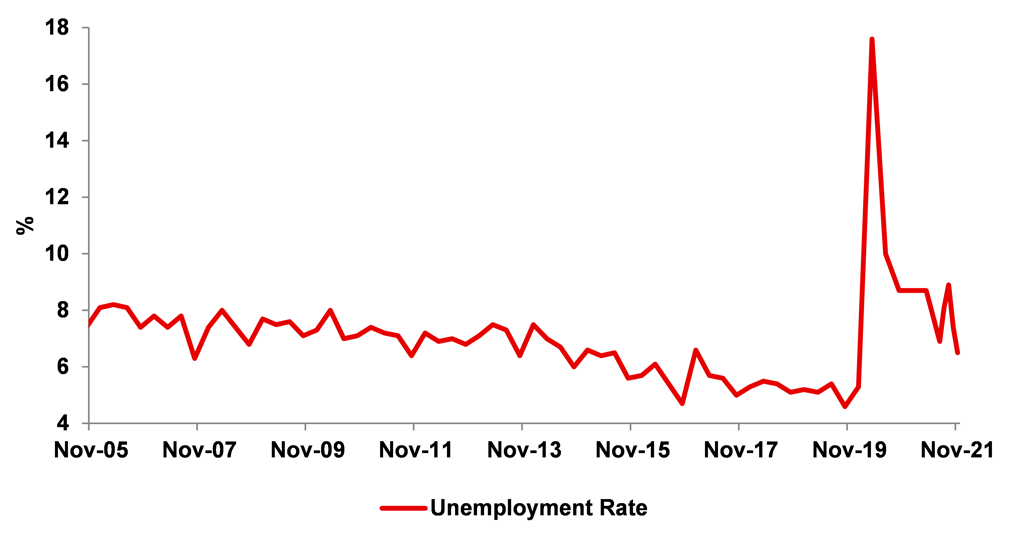

Real GDP growth in Q4 rose by 7.7 % y/y, exceeding Bloomberg consensus at 6.3% y/y and Q3’s revised 6.9% y/y. Private consumption and investments were the key drivers of the economy. In Q4, private consumption added 5.7 percentage points to real GDP growth from 5.2 percentage points in Q3, and gross fixed capital formation added 2.6 percentage points to real GDP growth in Q4 from 3.8 percentage points in Q3. As expected, net goods exports was the main drag on growth and shaved off 3.1 percentage points from real GDP growth in Q4 after a 3.2 percentage point reduction in Q3. Note though that these growth rates come after a very low base in 2020 – real GDP growth averaged -6.0% in 2H20. This means that real GDP growth is still below its pre-pandemic peak and a negative output gap remains. As such, the BSP is likely to maintain an accommodative monetary policy stance in 1H22 with the benchmark overnight reverse repo rate to be kept at 2.00%. Our view is also premised on BSP Governor Diokno’s recent comments that a rate hike in 1H22 is unlikely as the central bank wishes to adopt a wait-and-see approach before starting to tighten monetary policy. The BSP would like to see four to six quarters of steady growth and an unemployment rate of about 5% before it would consider hiking rates. Latest available data show the unemployment rate moderated to 6.5% in November, which is the lowest since January 2020.

Private consumption and government spending to spur economic growth in 2022

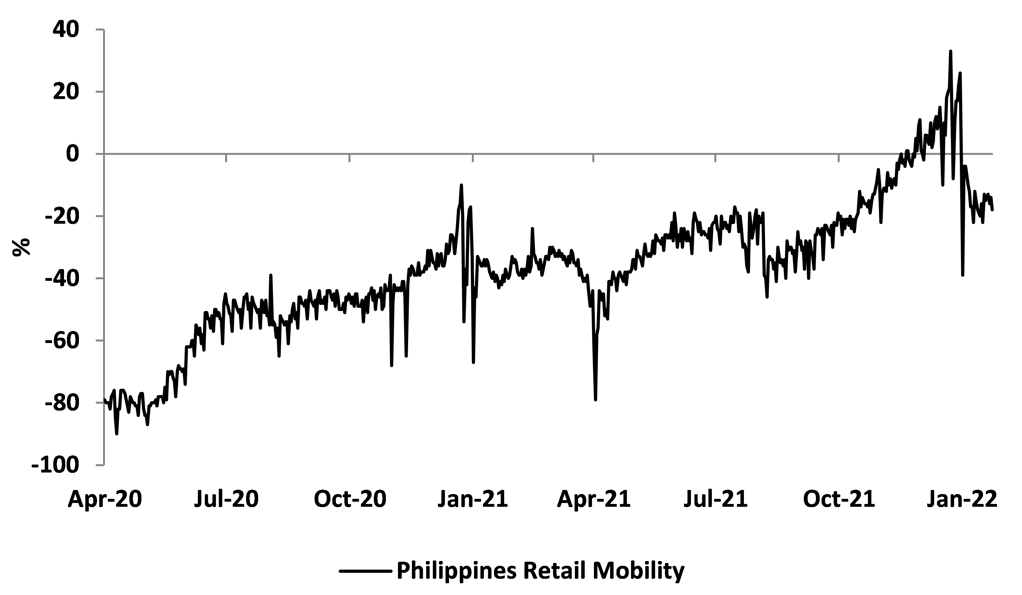

The surge in the Omicron variant and stricter mobility measures pose downside risks to growth in the near term. But we anticipate this to be temporary as new infections seemed to have peaked and the authorities signalled possible relaxations in mobility measures in the coming weeks. Retail mobility seemed to have hit a trough on 16 January based on data provided by Google. As such, on a sequential basis, we are only expecting a modest deceleration in real GDP growth in Q1 from Q4’s 3.1% q/q s.a. Real GDP growth in Q1 is also expected to be propped up by election pump-priming, but that is expected to fade in Q2 when the 45-day pre-election spending ban kicks in. Real GDP growth is expected to be stronger in 2H22, barring emergences of new COVID-19 variants and tightening of mobility restrictions. This is premised on a pick-up in government spending as the new administration is likely to keep outgoing President Duterte’s ‘Build, Build, Build’ infrastructure programme. The Philippine economy is expected to get back to pre-pandemic levels by then. This is one of the reasons why it would be more appropriate for the BSP to hike in 2H22, likely by a magnitude of 50bps which would take the benchmark overnight reverse repo rate to 2.50% by year end.

The Philippines’ retail mobility

Sources: Google & MUFG GMR

The Philippines’ unemployment rate

Source: CEIC, MUFG GMR

52.00 to form a new level of topside resistance for USD/PHP

PHP to remain weak in 2022

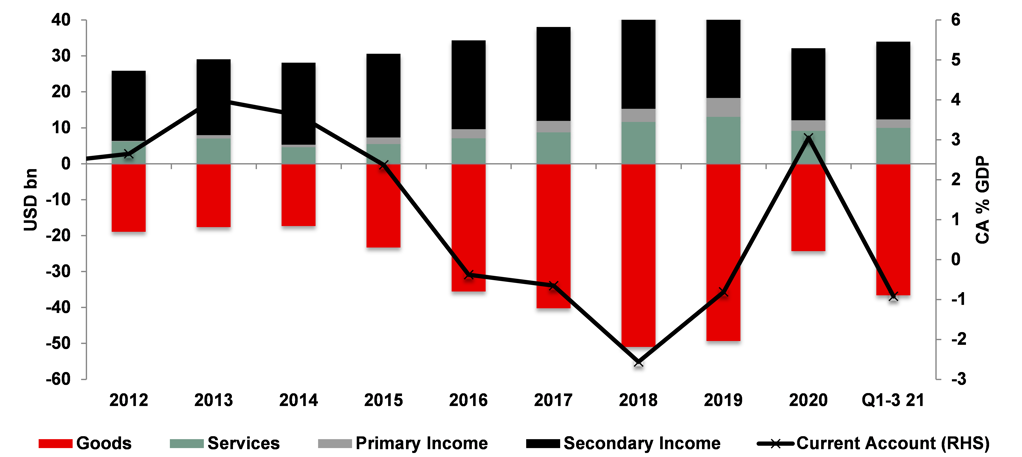

There are factors that are likely to keep the PHP under pressure in the near term and year ahead. The most important factor behind our outlook is the PHP’s structural depreciation from a wider current account deficit as seen prior to the onset of the pandemic in 2020. As import growth accelerates this year on the back of stronger private consumption and government spending on infrastructure projects, this is likely to exceed the increase in export growth and lead to wider trade deficits, and ultimately larger current account deficits. Our projection for the current account deficit this year is at 2.0% of GDP versus an estimated 1.0% of GDP in 2021. In the near term, the PHP will be affected by the current USD heft, particularly in view of rising market expectations of a more aggressive Fed following last night’s hawkish FOMC meeting. Elevated oil prices amid geopolitical risks in Europe are also expected to weigh down the PHP. Year-to-date, the PHP has depreciated by 0.9% to 51.44 against the USD, which is a faster pace of depreciation than we initially expected at the start of the year. For now, we see the 52.00 mark to be the next level of topside resistance for USD/PHP.

Current account breakdown

Sources: CEIC & MUFG GMR