To read a full report, please download PDF

Is the USD rebound running out of steam?

FX View:

The US dollar has continued to rebound over the past week as it moves further above the year to date low recorded in the middle of July. The USD has derived more support over the past week from the ongoing adjustment higher in long-term US yields and more risk-off trading conditions that have weighed more heavily on popular EM carry currencies. The recent surprise decision from the BoJ to adjust YCC and Fitch’s decision to downgrade the US credit rating have triggered a pick-up in FX market volatility at the start of the summer period. While these recent developments have helped the USD to rebound, we are not convinced the move will prove sustainable. The release today of the weaker NFP report for July and release next week of the US CPI report for July should solidify expectations that the Fed will not need to raise rates further this year and help to re-weaken the US dollar.

USD HAS CONTINUED TO REBOUND OVER PAST WEEK

Source: Bloomberg, 14:10 GMT, 4th August 2023 (Weekly % Change vs. USD)

Trade Ideas:

We have closed our long EUR/USD and long AUD/NZD trade ideas.

JPY Flows:

This week we cover the high frequency flow data from Japan which has revealed further buying of foreign bonds by Japanese investors. Relative stability in global rates is helping improve demand. Foreign investors continued buying Japan stocks – the 12th consecutive week to total nearly JPY 10 trillion.

G10 Labour Market analysis:

Our analysis of the Indeed datasets identify a stagnation in total job listing across UK, US and major European domestic labour markets. We also highlight while wage growth across EZ and US economies has since plateaued or fallen considerably as early as November-22, UK wage growth reached new highs in March-23, and has only recently started to stagnate

FX Views

FX market impact from surprise decisions by BoJ & Fitch

Hopes for a quiet summer in financial markets have been disrupted over the past week by the BoJ’s surprise decision to adjust yield curve control (YCC) policy settings and then by the unexpected decision from Fitch this week to downgrade the US credit rating. It has triggered a pick-up in financial market volatility that had spilled over in to FX market performance at the start of August. The main implication so far has been that the developments have triggered a setback for popular FX carry trades that has weighed more heavily on EM FX performance. Over the past week, the worst performing currencies have been the COP (-5.8% vs. USD), ZAR (-5.7%), BRL (-3.7%), and MXN (-3.5%). In contrast, the spill-over impact on G10 FX has been more modest. The USD has continued to rebound after hitting year to date lows in the middle of July with strength most evident over the past week against the high beta currencies of the AUD (-1.4% vs. USD), SEK (-1.4) and NZD (-1.3%).

The BoJ’s surprise decision to make YCC more flexible and the Fitch’s decision to downgrade the US sovereign credit rating have had two clear impacts on financial markets so far. Firstly, it is encouraging an adjustment higher in long-term yields in Japan and in other major developed bond markets. The BoJ is now allowing the 10-year JGB yield to rise above the previous cap of 0.5% and up to a new cap at 1.0%. The 10-year JGB yield has already increased by around 22bps from the low in late July prior the BoJ’s policy update up to 0.66% which is the highest level since the start of 2014. At the same time, the 10-US Treasury yield has increased by just over 30bps as it has risen back up towards the cyclical highs from late last year at 4.34% in October.

It has meant that long-term yield spreads have actually widened more in favour of a higher USD/JPY after the BoJ YCC policy tweak. It helps to partly explain the JPY’s failure to sustain initial gains after the BoJ meeting last week when USD/JPY fell closer to the 138.00 before fully reversing that move. The BoJ’s policy guidance has also proven effective at downplaying the importance of the YCC policy tweak for any future decisions to tighten monetary policy. Governor Ueda emphasized that the YCC tweak was to help sustain loose policy settings, and that conditions for tighter policy are not yet in place. The BoJ is not yet confident that inflation can be sustained at their 2.0% target as evident by the updated inflation forecasts that show Japanese style core inflation falling back to 1.6% at the end of the forecast period. Our analysts in Tokyo expect the BoJ to bring an end to YCC through the rest of this year if the JGB yields begin to stabilize between 0.5% and 1.0%, and then they expect the BoJ to more seriously consider raising rates during the 1H of next year. We have pencilled in the first rate hike to be delivered in Q2 2024 when we expect the BoJ to be more confident that inflation can be sustained at 2.0% supported by building evidence of stronger wage growth. The next labour cash earnings report for June is released in the week ahead (Tuesday). The shift to tighter BoJ policy supports our outlook for the JPY to rebound from deeply undervalued levels in the year ahead (click here), although the recent policy update is not sufficient to trigger a reversal of JPY weakness in the near-term. After sharply cutting back JPY positions towards the end of last month ahead of the BoJ’s policy meeting, it is likely speculators have been re-building short JPY positions over the past week after the JPY failed to hold on to initial gains.

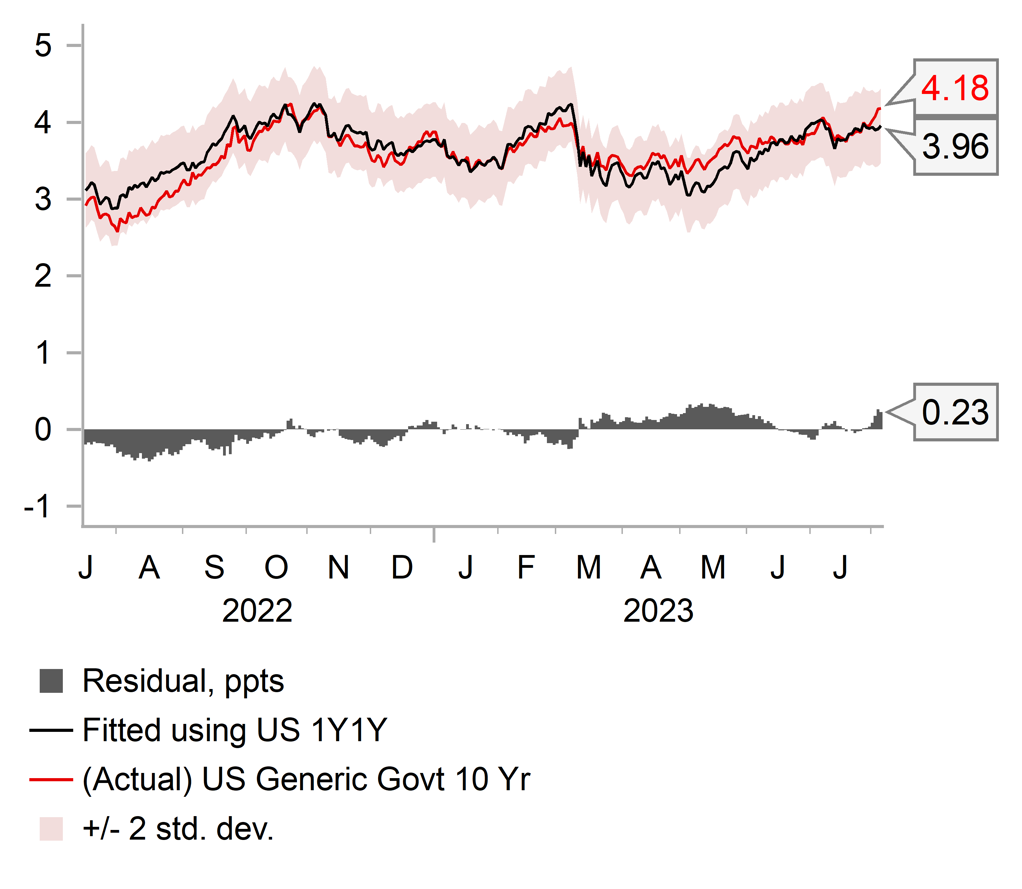

RECENT MOVE HIGHER IN LONG-TERM US YIELDS NOT DRIVEN BY SHORT-END

Source: Bloomberg, Macrobond & MUFG GMR

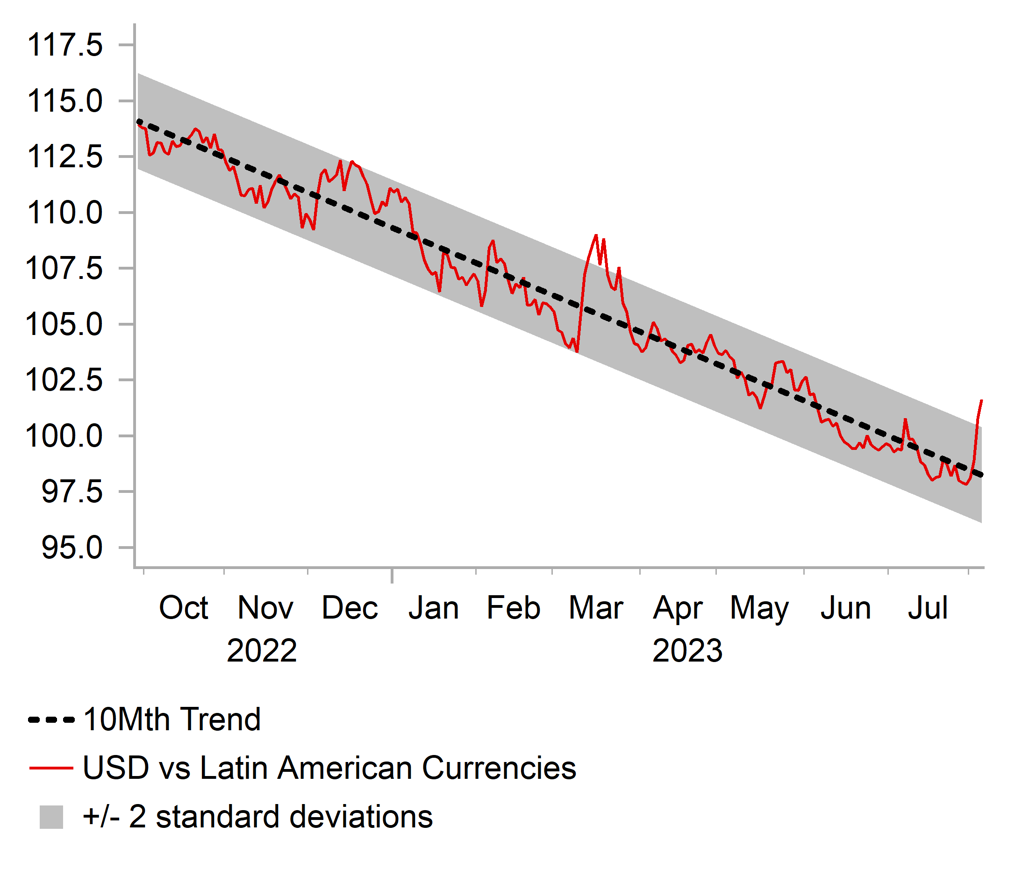

BULLISH TREND FOR LATAM FX SUFFERS A SETBACK

Source: Bloomberg, Macrobond & MUFG GMR

The recent adjustment higher in long-term yields in Japan and other major economies could also reflect: i) the easing of fears over a harder landing for the global economy, and ii) the combination of rising US bond supply which has coincided with the unexpected sovereign downgrade by Fitch. The US Treasury just announced their quarterly refunding plan in which they increased the size of bond sales for the first time in 2.5 years to help rebuild reserves and finance the budget deficit. The US Treasury expects to sell USD1 trillion of bonds and bills in the coming three months. The step up in supply comes at a time when our US rate strategist is wary that there could less demand from Japanese investors following the BoJ’s YCC policy tweak. The recent move higher in long-term yields has not been driven by a hawkish shift in Fed rate hike expectations. The short-end of the US curve has remained more anchored by expectations that the Fed will soon end their hiking cycle and then will consider lowering rates next year if inflation continues to slow towards their 2.0% target. The recent move higher in long-term US yield appears to be offering more support for the USD in the near-term while short-term US yields have been consolidating.

The second impact for the BoJ YCC policy tweak and Fitch credit downgrade has been that it has triggered a sell-off for risk assets. MSCI’s global equity index has declined by around -2.5% since the end of last month. It does though follow on from strong gains for risk assets during June and July when market participants have become more optimistic over a softer landing for the global economy. The downgrade from Fitch has understandably prompted market participants to look back to what happened following the last downgrade from S&P back in August 2011. On that occasion it marked a volatile period for financial markets in the summer of 2011. Global equity markets fell sharply and there was a strong safe haven bid into bonds although the impact on the USD was more muted. While we don’t expect a repeat, it has raised the risk of more volatile market conditions this summer that poses a threat to popular FX carry trades.

After trending lower throughout most of this year, global FX volatility has picked up modestly after hitting a year to date low in early June. At the same time, appeal of EM FX carry trades is being undermined by domestic central banks embarking on rate cut cycles ahead of major central banks. The National Bank of Hungary started to reverse last autumn’s emergency rate hike from May by lowering the one-day deposit rate from 18.00% to 15.00% which has contributed to the reversal of HUF strength over the past month or so. The Central Bank of Chile and Brazilian Central bank have also started to lower rates. The Central Bank of Chile cut rates sharply by 1.00ppt to 10.25% and the Central Bank of Brazil by 0.50ppt to 13.25%. While we don’t expect rate cuts on their own to trigger a sustained reversal of the bullish trend that have been in place for Latam FX this year, it does highlight alongside the recent pick-up in volatility that current conditions are becoming relatively less favourable for carry trades.

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

08/07/2023 |

07:00 |

Germany Industrial Production SA MoM |

Jun |

-- |

-0.2% |

!! |

|

EUR |

08/07/2023 |

09:30 |

Sentix Investor Confidence |

Aug |

-- |

-22.5 |

!! |

|

USD |

08/07/2023 |

13:30 |

Fed's Bowman speaks at Fed Listens Event |

!! |

|||

|

GBP |

08/07/2023 |

17:00 |

BoE's Huw Pill speaks |

!!! |

|||

|

JPY |

08/08/2023 |

00:30 |

Labor Cash Earnings YoY |

Jun |

2.9% |

2.5% |

!!! |

|

JPY |

08/08/2023 |

00:50 |

BoP Current Account Balance |

Jun |

¥1148.4b |

¥1862.4b |

!! |

|

CNY |

08/08/2023 |

Tbc |

Exports YoY |

Jul |

-12.6% |

-12.4% |

!! |

|

CNY |

08/08/2023 |

Tbc |

Imports YoY |

Jul |

-5.0% |

-6.8% |

!! |

|

EUR |

08/08/2023 |

07:00 |

Germany CPI YoY |

Jul F |

-- |

6.2% |

!! |

|

USD |

08/08/2023 |

11:00 |

NFIB Small Business Optimism |

Jul |

-- |

91.0 |

!! |

|

USD |

08/08/2023 |

13:30 |

Trade Balance |

Jun |

-$65.0b |

-$69.0b |

!! |

|

CNY |

08/09/2023 |

02:30 |

CPI YoY |

Jul |

-0.5% |

0.0% |

!! |

|

GBP |

08/10/2023 |

00:01 |

RICS House Price Balance |

Jul |

-- |

-46.0% |

!! |

|

JPY |

08/10/2023 |

00:50 |

PPI YoY |

Jul |

3.6% |

4.1% |

!! |

|

AUD |

08/10/2023 |

02:00 |

Consumer Inflation Expectation |

Aug |

-- |

5.2% |

!! |

|

SEK |

08/10/2023 |

07:00 |

Household Consumption YoY |

Jun |

-- |

-1.1% |

!! |

|

NOK |

08/10/2023 |

07:00 |

CPI YoY |

Jul |

-- |

6.4% |

!! |

|

USD |

08/10/2023 |

13:30 |

CPI YoY |

Jul |

3.2% |

3.0% |

!!! |

|

USD |

08/10/2023 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

GBP |

08/11/2023 |

07:00 |

Monthly GDP (MoM) |

Jun |

-- |

-0.1% |

!!! |

|

GBP |

08/11/2023 |

07:00 |

Industrial Production MoM |

Jun |

-- |

-0.6% |

!! |

|

GBP |

08/11/2023 |

07:00 |

Trade Balance GBP/Mn |

Jun |

-- |

-£6578m |

!! |

|

GBP |

08/11/2023 |

07:00 |

GDP QoQ |

2Q P |

-- |

0.1% |

!!! |

|

EUR |

08/11/2023 |

07:45 |

France CPI YoY |

Jul F |

-- |

4.3% |

!! |

|

USD |

08/11/2023 |

13:30 |

PPI Final Demand YoY |

Jul |

-- |

0.1% |

!! |

|

USD |

08/11/2023 |

15:00 |

U. of Mich. Sentiment |

Aug P |

-- |

71.6 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- There is a lighter calendar of economic data releases and events for the week ahead. The main economic data release will be the latest US CPI report for July. The last two CPI report provided clear evidence of a slowdown both in headline and core inflation pressures in Q2. It has helped to encourage speculation that the Fed is close to ending their rate hike cycle. Another softer core inflation reading would help to reinforce expectations that the Fed has delivered their last hike in July. Fed Chair Powell signaled clearly at the last FOMC meeting that the upcoming policy decision will be data dependent which places even more importance on next week’s CPI report for July. The Fed will also have seen the CPI report for August ahead of the next FOMC meeting on 20th

- The release of the latest labour cash earnings report from Japan will also attract market attention in the week ahead. After making YCC policy settings more flexible at their last policy meeting, the BoJ still emphasized that they are not confident that inflation can be sustained at their 2.0% target in the coming years. As a result, the BoJ is signaling that it is not yet ready to tighten policy by raising interest rates. The BoJ would like to see more evidence of stronger wage growth I Japan to give them more confidence that higher inflation can be sustained. The previous labour cash earnings report for June provided evidence that the stronger wage negotiations at the start of this year are starting to feed through to the official wage data.

- The release of the UK GDP report for Q2 is expected to confirm that the UK economy expanded modestly through he first half of this year. While growth remains weak, the UK economy has performed better than feared late last year when it was widely expected to have already fallen into recession at the start of this year. The resilience of the UK economy to the cost of living crisis is placing more pressure on the BoE to keep raising rates to dampen the risk of more persistent inflation in the UK.