To read a full report, please download PDF

Building disinflation evidence hits USD

FX View:

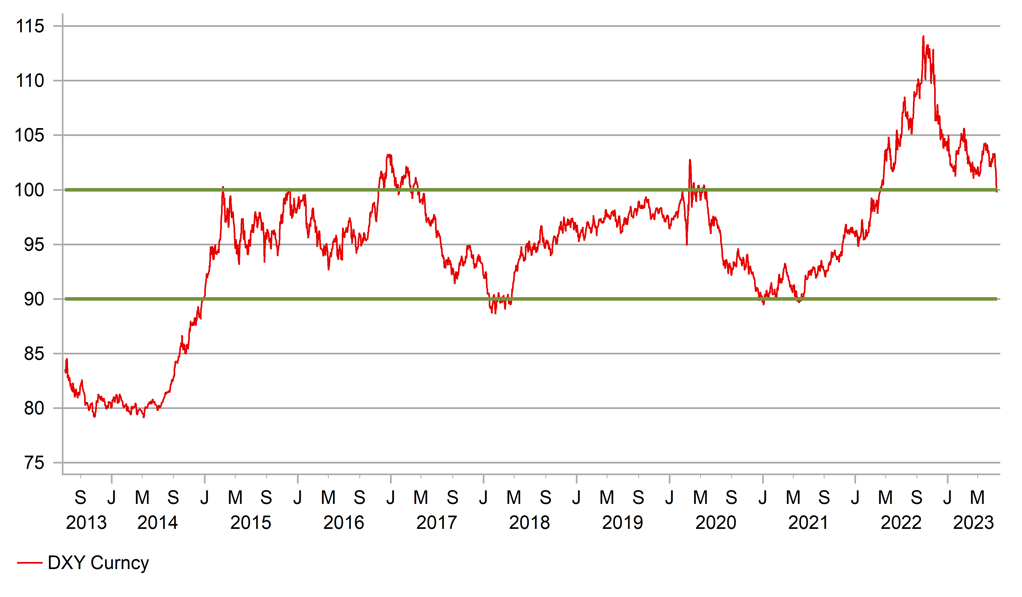

The US dollar suffered significant losses this week as weak CPI and PPI data underline expectations that the Fed’s battle to bring inflation back under control is nearly won. While expectations remain high that the FOMC will hike this month that hike is likely the last and market participants have increased positioning for rate cuts in 2024 with the mid-2024 3mth SOFR futures contract showing an implied drop in yields of 50bps since 6th July. The DXY index and EUR/USD are back at levels not seen since March 2022 when the global inflation surge prompted a surge in rates and the dollar. We suspect that the DXY index may be returning to its pre-inflation shock range of 90-100.00 and EUR/USD to 1.1000-1.1500. Further dollar selling is feasible with little in the way of event risk on the horizon next week.

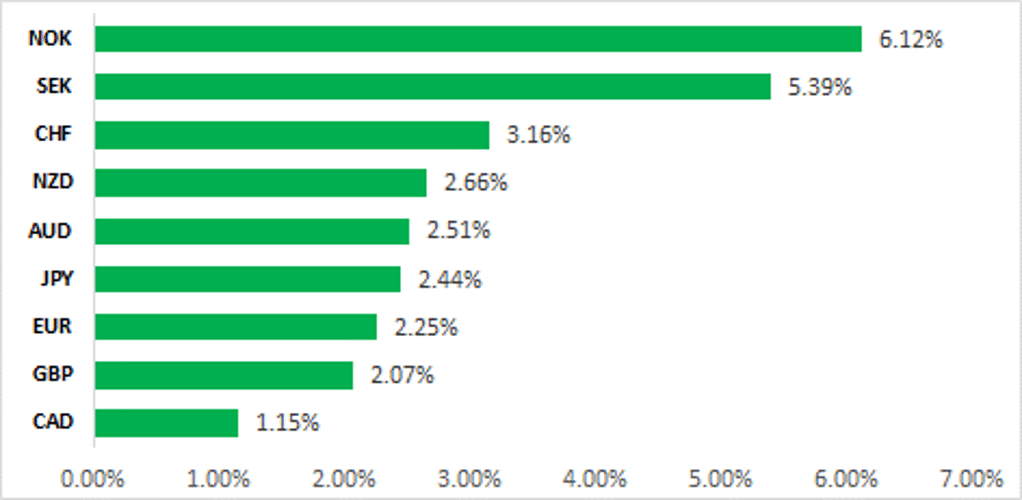

EXTENSIVE & BROAD-BASED USD SELL-OFF

Source: Bloomberg, 13:40 BST, 14th July 2023 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining long EUR/USD and AUD/NZD trade ideas. We have closed our short USD/JPY trade idea after the target was hit.

JPY Flows:

This week we cover the MoF data on International Transactions in Securities which was released on Monday. Foreign bond buying by Japanese investors continues to recover after record sales last year although that buying is very isolated to just Japanese banks.

Short Term Fair Value Modelling:

This week we monitor the relationship between spot and fair value for our JPY, GBP and EUR regression models. We identify a dramatic convergence in the relationship between USD/JPY and fair value where our model calculates a -0.34% undervaluation of spot. While GBP/USD and EUR/USD remain overvalued at 1.12% and 0.67% respectively.

FX Views

EUR: How high can this move go?

We have had a very significant move in FX this week and the US dollar sell-off has extended substantially further despite the market still widely expecting the FOMC to hike again at the next meeting on 26th July. On a number of occasions this year EUR/USD has broken above the 1.1000-level but momentum then faded with corrections lower so this break is meaningful and could mark the entry into a new higher trading range. For some time both short-term and long-term EZ-US spreads had been signalling a break higher and the weaker than expected US CPI data was the catalyst for this move. Is there a EUR element to the break higher in EUR/USD? So far this break is really only a US dollar move. Indeed, our equally-weighted G10 index excluding the US dollar shows that the euro has in fact weakened by about 1.0% over the same period in which EUR/USD has advanced by 3.5% (7 trading days to today).

While there is nothing to suggest EUR positives driving this move higher in EUR/USD there are still reasons to believe solid fundamental support that points to further upside over the medium-term. The fact that EUR has weakened modestly versus non-US dollar G10 is to a degree a reflection of catch-up for some of those currencies rather than any negative EUR reflection. The likes of NOK, SEK and JPY have been deeply under-valued and the broad US dollar sell-off has allowed some justified catch-up in circumstances of higher investor confidence over a decline in global inflationary pressures. Currencies with central bank policy rates deeper in negative territory, in real terms, have outperformed given high inflation has weighed more on performance in the past. NOK, SEK and JPY are three of the top four performing G10 currencies in this USD sell-off in July.

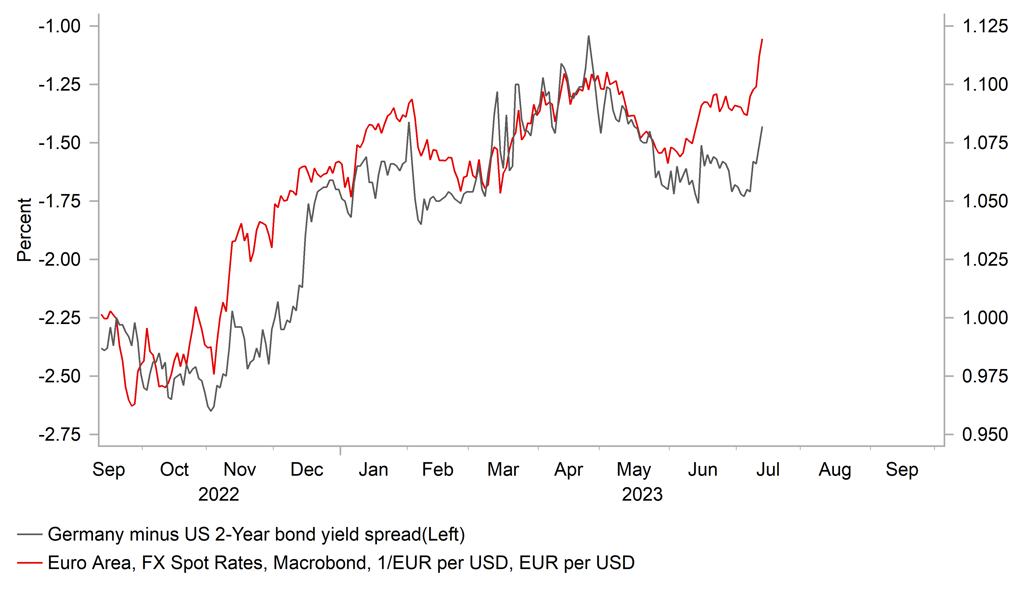

The consequence of the Fed’s continued hawkish rhetoric of continuing to hike, possibly two more times, as inflation falls more notably than expected, is for the market to price rate cuts in 2024 more aggressively. The 3mth US SOFR future-implied yield has dropped by 50bps since 6th July while the equivalent in Europe has declined by just 10bps as investors continue to see the more cautious approach from the ECB as reducing the risk of any sharp reversal in policy in 2024. As a result, the 2-year government bond yield spread has moved 25bps in favour of the euro-zone. While euro-zone growth remains subdued at a growth rate not much above zero percent, investors continue to anticipate a sharper slowdown in US GDP growth. The FOMC

EUR/USD VS EUR/G10 EXCLUDING USD

Source: Bloomberg, Macrobond & MUFG GMR

EUR/USD VS 2Y GOVERNMENT BOND YIELD SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

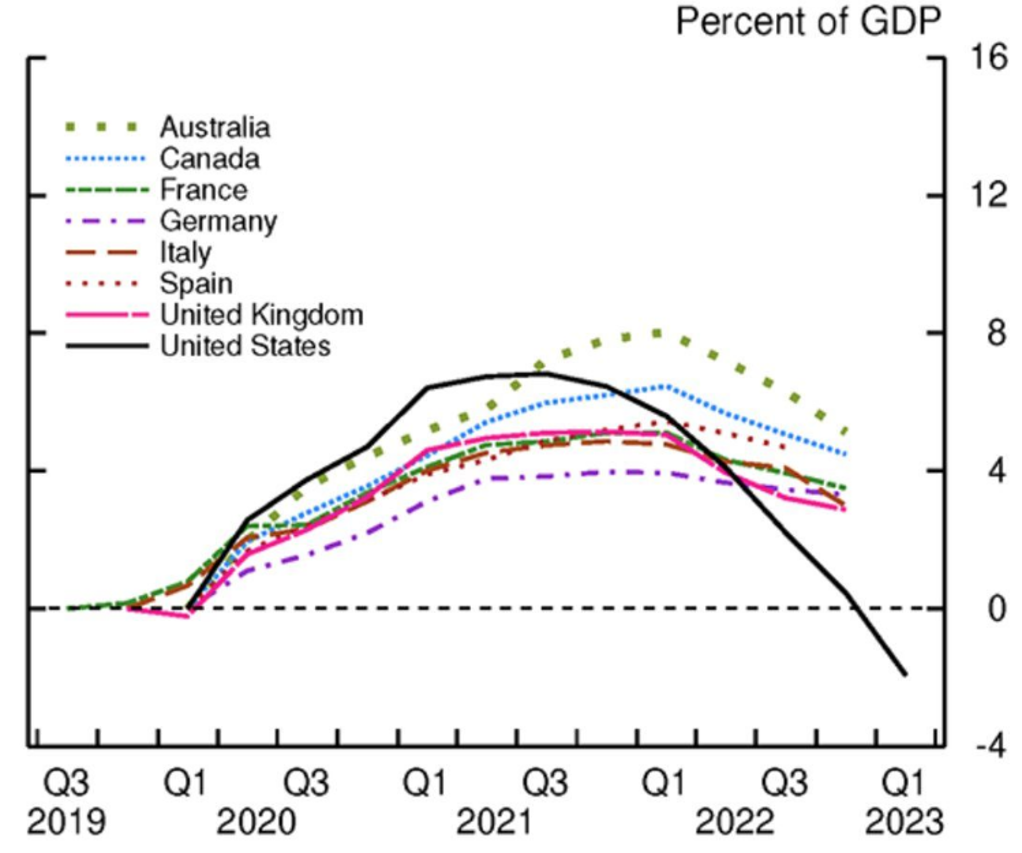

does not appear to have altered its positive outlook for the US economy despite Fed research released in late June that analysed the level of US consumers’ excess savings and concluded that this cushion that has helped support growth was now been completely run down. This is in contrast to still more elevated levels of excess savings in Europe and other major developed economies. Furthermore, the Supreme Court decision to reverse Biden’s student debt write-off and the recommencement of interest payments on student debt agreed as part of the deal to extend the debt ceiling will weigh further on consumer spending. 27mn borrowers with USD 1.1trn worth of student loans will start servicing payments from 1st October. These factors will reinforce the negative lagged effects of Fed tightening as the remainder of the year unfolds.

The minutes from the ECB meeting on 15th June were released this week and similar to the Fed’s rhetoric indicated a consensus to keep raising rates until inflation subsides further. The ECB stance is in our view more understandable and credible given inflation is notably higher. The core CPI rate is picking up also with upside risks over the summer months as tourism-related services inflation accelerates. The minutes stated that the ECB Governing Council agreed that it was “essential to communicate that monetary policy had still more ground to cover” and there was scepticism over underlying inflation being on a downward trend. While inflation expectations have turned lower this week, the 5yr/5yr inflation swap rate remains elevated (above 2.50%) from a historic perspective which will encourage the ECB to maintain a hawkish stance.

The OIS market has 50bps of further tightening priced by the end of the year and 40bps over the coming two meetings. We would view that pricing as reasonable given the balance of risks ahead. Certainly, while there are well-known hawks that will push for a September hike no matter what, there are some starting to voice concerns over the weakening growth outlook. The minutes suggested a growing belief that the transmission of monetary tightening was having a bigger impact and that credit contraction was larger than the historic norm. Interestingly, there were some doubts expressed over the ECB inflation forecasts (we questioned the core inflation forecast increase for 2024 from 2.5% in March to 3.,0% in June) given the evidence of weakening growth. As it stands, we see risks that both the 2024 GDP and inflation forecasts could be revised lower in September. If the US economy slows and global inflationary pressures eased further, that could mean the ECB refrains from hiking in September. That is the risk at this juncture which could be the catalyst for some EUR/USD correction as we approach that meeting.

There are good reasons to believe this move higher for EUR/USD could mark a break into a new higher trading range – say between 1.1000-1.1500. Further gains though could become more constrained given still weak euro-zone growth and the potential for the ECB to refrain from hiking in September.

FED ANALYSIS SHOWS US EXCESS SAVINGS RUNDOWN

Source: Bloomberg, Macrobond & MUFG

DXY INDEX BACK BELOW THE 100-LEVEL THIS WEEK

Source: Bloomberg, Macrobond & MUFG

CAD: Near-term fundamentals supportive for stronger CAD but for how long?

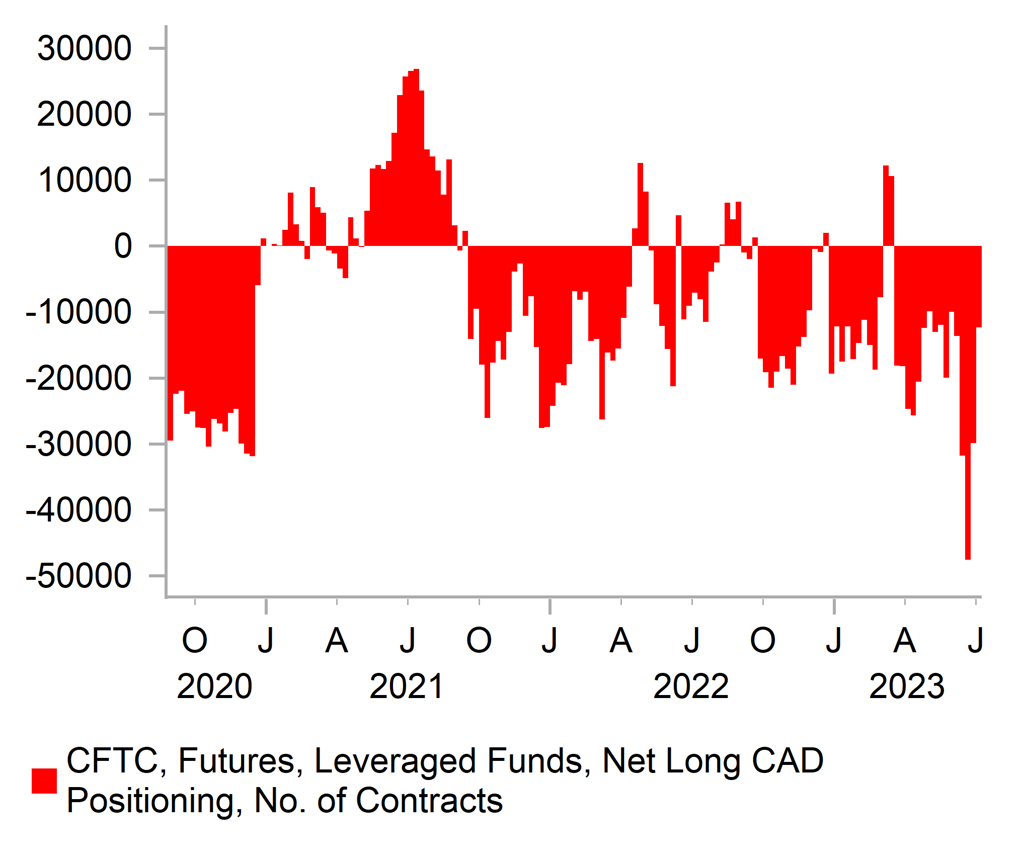

The CAD has extended its recent advance against the USD resulting in USD/CAD falling to a fresh year to date low this week at 1.3093. The pair is moving to within touching distance of the 1.3000-level for the first time since September of last year. It has been driven mainly by the ongoing reversal of last year’s USD rally that was encouraged by: i) the Fed’s aggressive rate hike cycle, ii) the negative terms of trade shock from the Ukraine conflict and iii) COVID lockdowns in China. The reversal of last year’s USD rally is well advanced. The dollar index is currently only around 4% higher than levels recorded in early 2022 prior to the start of the Ukraine conflict. Similarly, USD/CAD currently stands around 3% above those levels. A full reversal would be consistent with USD/CAD falling back between 1.2500 and 1.2800. Building evidence of slowing US inflation (CPI & PPI report for June) over the past week have given market participants more confidence that Fed will deliver a final hike this month, and is opening the door for rate cuts next year if inflation falls closer to target. A faster than expected slowdown in US inflation is also helping to support high beta currencies like the CAD by boosting investor optimism over a soft landing for the US economy.

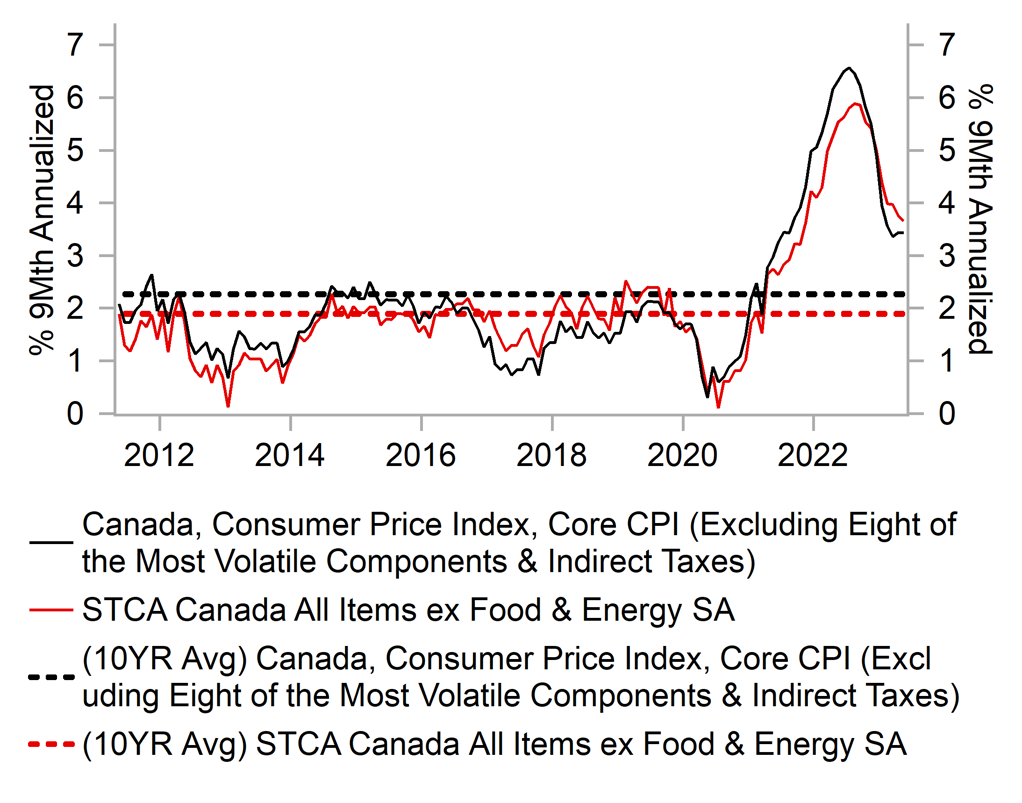

At the same time, the CAD is continuing to benefit from the surprising resilience of Canada’s economy to higher rates. In their latest Monetary Policy Report (MPR) released this week, the BoC upgraded their outlook for growth this year by 0.4ppt to 1.8% to reflect much stronger growth in the 1H of this year. GDP is now expected to expand by an annualized rate of 1.5% in Q2 following growth of 3.1% in Q1. Consumer spending on interest rate sensitive goods has been surprisingly strong, and the housing market is beginning to improve both in terms of activity and prices. As a result, the BoC now expects inflation to fall back more slowly to their target of 2.0% in the middle of 2025 which is around 6 months later than previously forecast. After delivering back to back 25bps hikes in June and July, the BoC’s updated forward guidance has left open the possibility of delivering another hike in September depending on the incoming data. The release in the week ahead the of the latest CPI report from Canada will be important for BoC rate hike expectations. The BoC has signalled concern that core inflation has been running at around 3.5-4.0% since September. A weaker core CPI print poses the main downside risk to the CAD’s current bullish trend.

In these circumstances, we expect USD/CAD to fall back below the 1.3000-level encouraged by: i) broader USD weakness, ii) the price of Brent rising back above USD80/barrel and iii) improving investor risk sentiment. Beyond the near-term, we still expect the negative impact of higher rates on Canada’s highly indebted households to become more evident and eventually trigger a reversal of the CAD’s current bullish trend. A break below 1.3000, would provide more attractive levels to sell CAD.

BOC DISAPPOINTED BY PACE OF SLOWDOWN SO FAR

Source: Bloomberg, Macrobond & MUFG

CAD SHORTS HAVE BEEN CUT BACK SHARPLY

Source: Bloomberg, Macrobond & MUFG

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CNY |

07/17/2023 |

03:00 |

GDP SA QoQ |

2Q |

0.8% |

2.2% |

!!! |

|

CNY |

07/17/2023 |

03:00 |

Industrial Production YoY |

Jun |

2.5% |

3.5% |

!! |

|

CNY |

07/17/2023 |

03:00 |

Retail Sales YoY |

Jun |

3.1% |

12.7% |

!! |

|

CNY |

07/17/2023 |

03:00 |

Property Investment YTD YoY |

Jun |

-7.4% |

-7.2% |

!! |

|

EUR |

07/17/2023 |

09:15 |

ECB's Lagarde speaks |

!!! |

|||

|

EUR |

07/17/2023 |

09:30 |

ECB's Lane speaks |

!!! |

|||

|

AUD |

07/18/2023 |

02:30 |

RBA Minutes of July Policy Meeting |

!!! |

|||

|

CAD |

07/18/2023 |

13:15 |

Housing Starts |

Jun |

-- |

202.5k |

!! |

|

USD |

07/18/2023 |

13:30 |

Retail Sales Advance MoM |

Jun |

0.5% |

0.3% |

!!! |

|

CAD |

07/18/2023 |

13:30 |

CPI YoY |

Jun |

-- |

3.4% |

!!! |

|

USD |

07/18/2023 |

14:15 |

Industrial Production MoM |

Jun |

0.0% |

-0.2% |

!! |

|

USD |

07/18/2023 |

15:00 |

NAHB Housing Market Index |

Jul |

-- |

55.0 |

!! |

|

NZD |

07/18/2023 |

23:45 |

CPI YoY |

2Q |

5.9% |

6.7% |

!!! |

|

GBP |

07/19/2023 |

07:00 |

CPI YoY |

Jun |

-- |

8.7% |

!!! |

|

GBP |

07/19/2023 |

07:00 |

PPI Output NSA YoY |

Jun |

-- |

2.9% |

!! |

|

EUR |

07/19/2023 |

10:00 |

CPI YoY |

Jun F |

-- |

6.1% |

!!! |

|

USD |

07/19/2023 |

13:30 |

Housing Starts |

Jun |

1450k |

1631k |

!! |

|

GBP |

07/19/2023 |

17:00 |

BOE's Ramsden speaks |

!! |

|||

|

JPY |

07/20/2023 |

00:50 |

Trade Balance |

Jun |

-- |

-¥1372.5b |

!! |

|

AUD |

07/20/2023 |

02:30 |

Employment Change |

Jun |

-- |

75.9k |

!!! |

|

EUR |

07/20/2023 |

07:00 |

Germany PPI YoY |

Jun |

-- |

1.0% |

!! |

|

EUR |

07/20/2023 |

08:00 |

ECB's Villeroy speaks |

!! |

|||

|

EUR |

07/20/2023 |

09:00 |

ECB Current Account SA |

May |

-- |

3.6b |

!! |

|

USD |

07/20/2023 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

07/20/2023 |

15:00 |

Existing Home Sales |

Jun |

4.21m |

4.30m |

!! |

|

GBP |

07/21/2023 |

00:01 |

GfK Consumer Confidence |

Jul |

-- |

- 24.0 |

!! |

|

JPY |

07/21/2023 |

00:30 |

Natl CPI YoY |

Jun |

-- |

3.2% |

!!! |

|

GBP |

07/21/2023 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

Jun |

-- |

0.3% |

!!! |

|

GBP |

07/21/2023 |

07:00 |

Public Sector Net Borrowing |

Jun |

-- |

19.2b |

!! |

|

CAD |

07/21/2023 |

13:30 |

Retail Sales MoM |

May |

-- |

1.1% |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The release of the latest GDP report and monthly activity data from China are expected to confirm that the pace of economic recovery slowed in Q2. It has already prompted policymakers in China to provide more policy stimulus to support growth. Market participants are now eagerly awaiting the Politburo meeting set to take place later this month in anticipation of further stimulus measures.

- The release of the latest UK CPI report for June will attract more attention than normal in light of the ongoing hawkish repricing of BoE rate hike expectations. The UK rate market has moved to price in a higher probability of the BoE delivering a second larger 50bps hike at their next policy meeting in August. Headline inflation has surprised to the upside in the last four CPI reports adding to concerns over the persistence of higher inflation in the UK. Deputy Governor Ramsden is scheduled to speak later in the day following the CPI report release on quantitative tightening.

- The latest CPI reports from Canada, New Zealand, the euro-zone and Japan will also be released in the week ahead. The BoC has expressed disappointment recently that core inflation is coming down more slowly than expected with three-month rates running at around 3.5%-4.0% since last September which encouraged back to back rate hikes in recent months. In contrast, the RBNZ has just paused their hiking cycle. Further evidence of slowing inflation alongside recessionary conditions in New Zealand would reinforce expectations that the hiking cycle is over and bring forward rate cuts expectations. The latest CPI report from Japan is unlikely to materially alter expectations ahead of the BoJ’s upcoming policy meeting on 28th The BoJ is already expected to raise their inflation forecast for this year.