To read a full report, please download PDF

USD downside risks persist

FX View:

The US dollar weakened sharply again this week – the second week in three with the dollar dropping 1.6% on a DXY basis. Weak inflation adds further credence to the view that inflationary pressures are receding notably, and possibly faster than central bankers expected. US CPI was only marginally weaker than expected but the details pointed to scope for further declines ahead. We now believe the window for renewed US dollar strength that we have been referring to may now have closed. US data and global growth conditions will remain key for the scope for further dollar weakness ahead. There is limited key economic data next week with eyes now on the jobs data, released in early December. That suggests from a technical and momentum perspective that we could see further dollar weakness over the short-term.

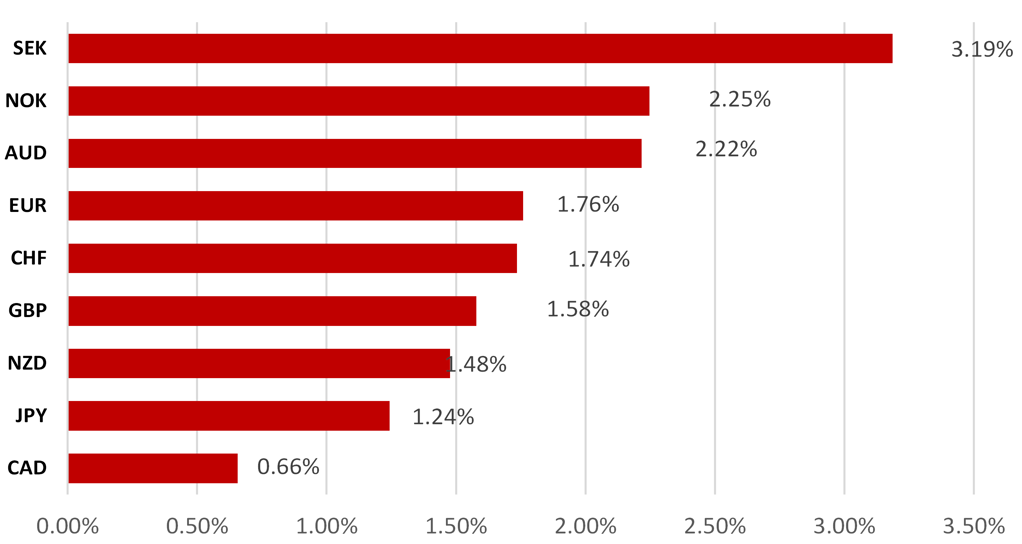

USD WEAKENS ACROSS G10 WITH SEK THE TOP PERFORMER

Source: Bloomberg, 14:15 GMT, 17th November 2023 (Weekly % Change vs. USD)

Trade Ideas:

We have closed our short USD/SEK trade idea after our profit target was hit, and we have established a short USD/JPY trade idea.

JPY Flows:

The monthly Balance of Payments statistics from the MoF were released last week and the data for September continued to show evidence of an improving external position for Japan.

FX Volatility – Price Action Analysis:

FX implied volatility has fallen to its lowest level since January-2022 according to the J.P. Morgan Global FX Volatility Index. We calculate that current levels of volatility (7.32) lie firmly in the low-volatility range (less than 7.76) and are decelerating. This week we analyse how G10 currencies have performed in prior periods of low and falling volatility.

FX Views

USD: Sharp sell-off this week could mark turning point

On a DXY basis, the US dollar is currently down 1.6% this week and has now dropped sharply in two of the last three weeks with this week’s drop the largest since July. DXY broke below the 100-day moving average this week with the next key technical level the 200-day moving average, currently at 103.60. This week EUR/USD broke above both the 100-day and 200-day moving averages with the technical picture now firmly pointing to the potential for further gains going forward. We made a call not long after DXY corrected lower from the high in September last year that the US dollar bull-run was over and that the September high would mark the cyclical high. We have a lot more confidence in that view now and see scope for a clearer move to the downside for the US dollar in 2024. DXY would be considerably lower were it not for the huge underperformance of the yen with USD/JPY still 14% stronger on a year-to-date basis in sharp contrast to the other currencies that make up the DXY basket.

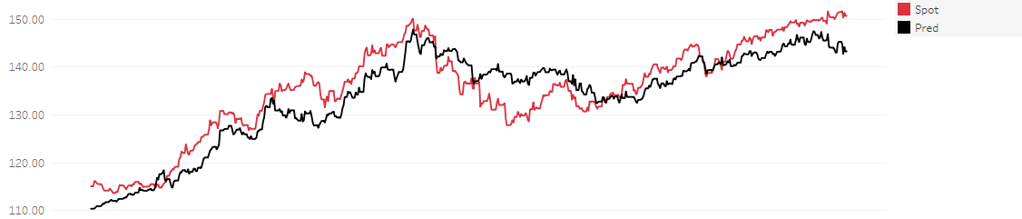

A bigger move lower in USD/JPY could certainly be a catalyst for a further drop in DXY. JPY makes up just 13.6% of the DXY index but given USD/JPY is still significantly higher year-to-date, if conviction on a turn in US dollar grows we may well see some catch-up and some bigger declines in USD/JPY. Key to USD/JPY will also be the US economic outlook. While that’s key for the dollar in general, the USD/JPY rate is usually more sensitive to Fed policy expectations and further evidence of weaker data will increasingly pressure USD/JPY. The Q/Q US real GDP growth consensus for the coming three quarters are all below 1.0% underlining the scope for slowdown. If that consensus is endorsed by hard data, it will reinforce downside pressure. Our internal short-term regression model for USD/JPY shows increasing divergence between valuation and the current spot rate. Our regression model is estimate fair-value is currently at 143.30.

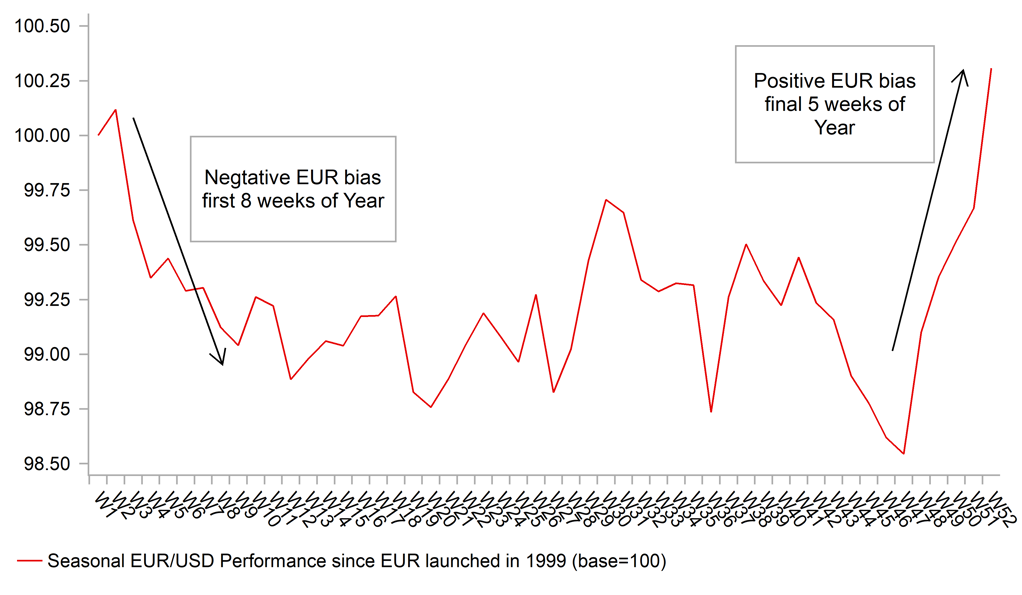

Our initial forecast for the dollar in Q4 was for strength to persist through possibly to the FOMC meeting in December before then the dollar beginning to weaken. We had argued that there was scope for the dollar to continue strengthening on continued economic resilience before possibly the FOMC communication in December and a seasonal bias favouring higher EUR/USD kicking in. That window for US dollar strength may now have already come to an end. The seasonal bias still stands and hence there is scope for this advance to possibly extend further into the end of the

USD/JPY VALUATION MODEL SIGNALLING DOWNSIDE

Source: Bloomberg, Macrobond & MUFG GMR

SEASONALS FAVOUR STRONGER EUR INTO YEAR END

Source: Bloomberg, Macrobond & MUFG GMR

year. Covering the entire period of EUR trading since 1999, EUR/USD on average gains 1.8% in the final five weeks of the year. There is no clear consensus on why this bias exists with differing reasonings provided by market participants. Certainly some form of position squaring into the end of the years seems quite likely. Looking at the history of Leveraged Funds’ positioning in EUR for example does show a far greater proportion of the time positioning is short EUR. Roughly two-thirds of the time since the IMM Leveraged Funds data began in 2006, positioning has been short. Two caveats are therefore worth mentioning in regard to this year. Firstly, the sharp rebound in EUR/USD in November could take away some of the scope for EUR upside in December and positioning right now shows modest long EUR.

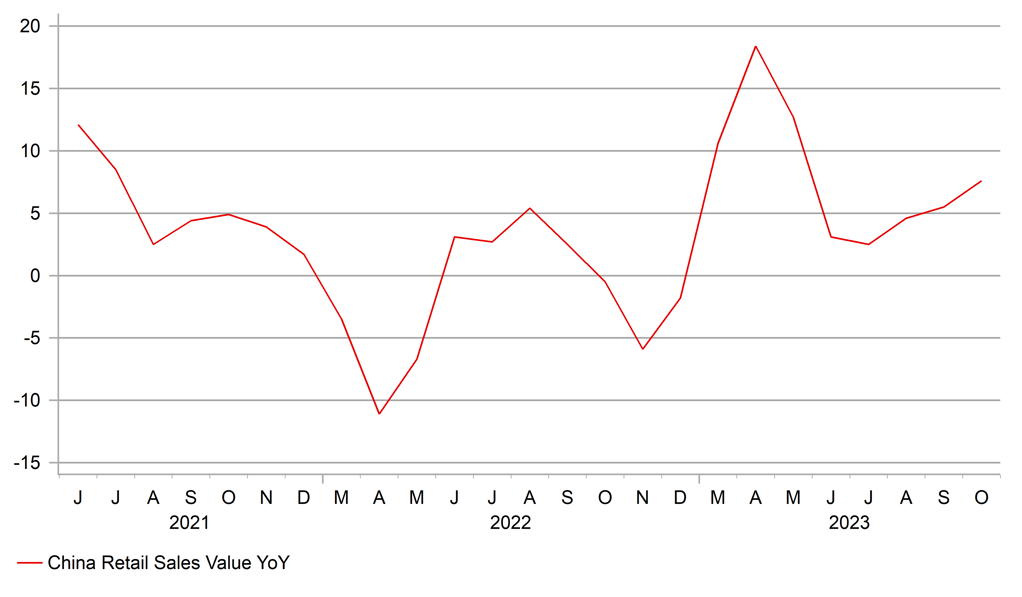

Other recent developments also look like potentially reinforcing US dollar downside scope. Since the dollar began rebounding in July, the strengthening of the dollar has coincided with increased pessimism in relation to China. There are now clear signs that policy steps that have been taken over the last few months are beginning to have an impact with data released this week showing a pick-up in industrial production and retail sales. Property-related data remains weak and that area will continue to weigh on growth. The CNY 1 trillion increased sovereign debt issuance to finance further infrastructure spending and plans to address the indebtedness in the local government sector will help to improve sentiment going forward. While China will continue with structural challenges to growth that will likely mean continued gradual decelerating growth, policy stimulus could at least help reduce the level of pessimism over the outlook for growth that all-else-equal will help non-dollar currency performance, especially in the Asia region. Our second FX View piece (see below) covers another positive development with Taiwan political developments this week potentially helping reduce the geopolitical tensions related to China-Taiwan relations.

This earlier and sharper sell-off of the dollar does open scope for the dollar reaching weaker levels than we currently forecast. However, we remain cautious over the scope for dollar selling. While the China backdrop may be somewhat better than a few weeks/months ago, the global growth picture will remain a constraint on dollar selling. The euro-zone and the UK economies remain close to recession and hence there will be limits to non-dollar currency appreciation.

The price action this week for the US dollar certainly reinforces our belief that last year’s high will be the high of the cycle and next year will see the dollar weaken further. With tightening cycles likely complete and inflation coming down faster than expected, the fundamental drivers of FX will be increasingly less favourable for the US dollar.

CHINA RETAIL SALES GROWTH PICKING UP MODESTLY

Source: Bloomberg, Macrobond & MUFG GMR

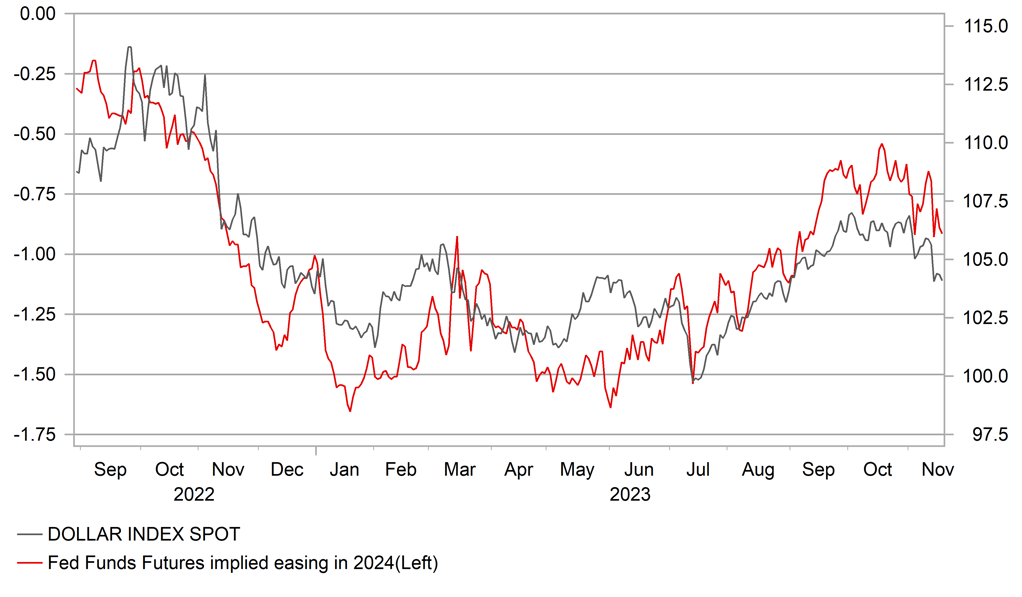

2024 FED RATE CUT EXPECTATIONS BUILDING AGAIN

Source: Bloomberg, Macrobond & MUFG GMR

Asia FX: Are the stars aligning for a repeat of last year’s Asia FX rally?

It has been a good week for Asian currencies. Bloomberg’s Asia dollar index is on course for a fourth consecutive day of gains. After hitting a year to date low of 89.971 at the end of last month, the Asia dollar index has rebounded by around +1.8%. It is the strongest performance for Asian currencies since 1H July when the Asia dollar index increased by around +2.2%. The best performing Asian currencies over the past week have been the THB (+2.3% vs. USD), TWD (+1.6%), KRW (+1.6%), IDR (+1.3%) and JPY (+1.3%) while the INR has lagged behind (+0.1%)

Asian currencies have benefitted from the broad-based USD sell-off but there have also been positive domestic developments as well. As we highlighted in our first view piece (see above), the USD has been undermined more broadly by the sharp decline in US yields reflecting building confidence amongst market participants that the Fed’s tightening cycle has come to an end. Further evidence of slowing US inflation and tentative evidence that US growth is moderating at the start of Q4 is encouraging US rate market participants to bring forward expectations for the first Fed rate cut next year (a 0.25 point hike is now almost fully priced in by the May FOMC meeting). The price action has brought back memories of the same time last year when Asian currencies embarked upon a powerful rally resulting in the Asia dollar index rising by almost 9% between November 2022 and February 2023. One similarity was that US rates peaked in October of last year before correcting lower. History appears to be repeating with the 10-year UST yield have fallen by around 0.6 point since hitting a high of 5.02% in October which is again encouraging a reversal of USD strength.

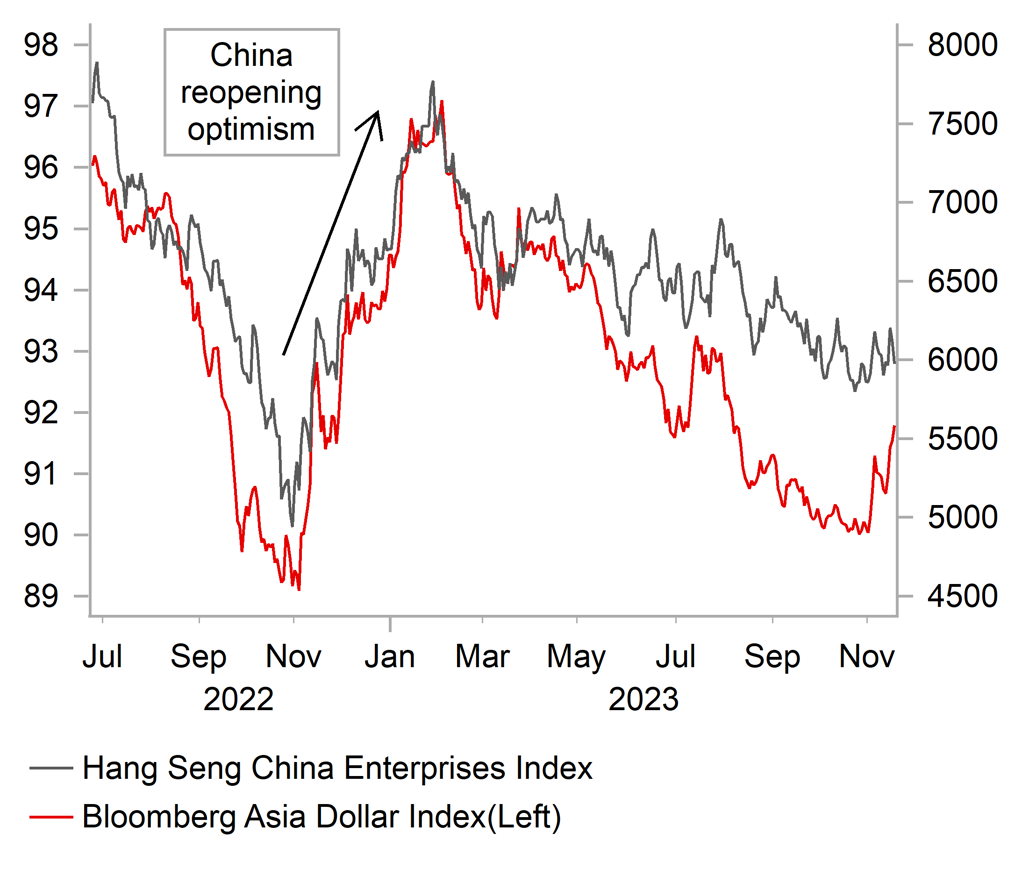

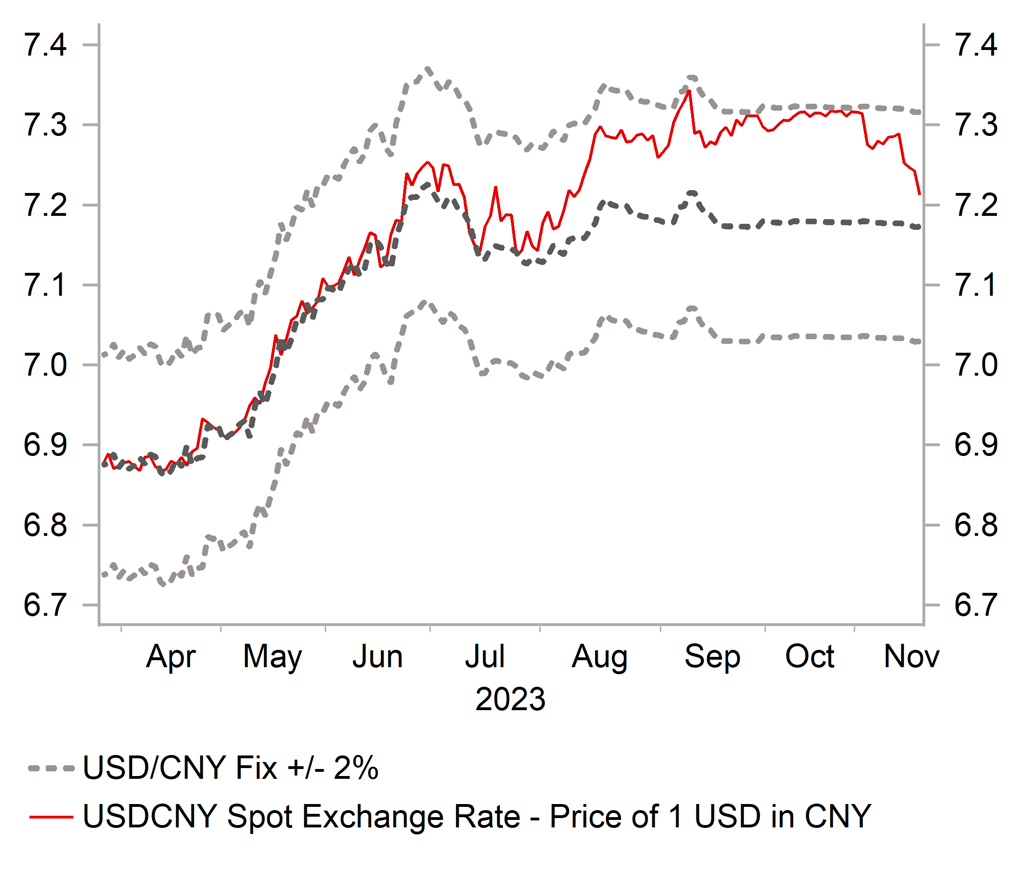

The other main catalyst that triggered the powerful rally for Asian currencies towards the end of last year was building investor optimism over the outlook for a strong economic rebound in China after the government decided to remove COVID restrictions. The Hang Seng China Enterprises equity index surged higher by almost 60% between November and January of last year. While there has been evidence of strengthening growth momentum in China in recent months (retail sales & IP surprised to the upside in October) prompting the IMF to raise their GDP forecasts for this year and next by 0.4 point to 5.4% and 4.6% respectively on the back of policy stimulus, it has been notable that it has not triggered a similar bout of investor optimism like last year. The Hang Seng China Enterprises equity index remains close to year to date lows. The negative market reaction to the deepening decline for new home prices in October highlights that market participants remain concerned by headwinds to growth from persistent weakness in the housing market. The lack of investor enthusiasm over economic growth in China cautions against expecting a repeat of last year’s powerful Asia FX rally heading into early next year. The weaker USD is though helping to ease pressure on policymakers in China to maintain a stable USD/CNY rate. After bumping up against the top of the +/-2.0% daily trading band since late September, USD/CNY has fallen back towards the daily fix this month. The daily fix has remained largely unchanged since mid-September between 7.1700 and 7.1800 indicating that policymakers had tightened control of the CNY in recent months to prevent it from weakening further against the USD.

Recent political developments in Taiwan have also provided a positive trigger for Asian currencies. The TWD has staged its’ biggest weekly gain since February. Taiwan’s main opposition parties announced on 15th November that they had struck an electoral pact less than ten days before the deadline to register candidates for the election. Hou Yu-ih of the National Party, or KMT, and Ko Wen-je of the Taiwan People’s Party (TPP) have said they will now run on a joint ticket although have not agreed which of them will be the presidential candidate. Both parties are far friendlier towards China than the ruling Democratic Progressive Party (DPP), and the increased likelihood of a victory for the joint opposition parties in upcoming elections in January could lead to a significant relaxation of Taiwan’s defiant posture towards China.

According to the latest opinion polls, the ruling DPP’s candidate, William Lay, was leading the race in late October securing support from 33% of those who were polled. By comparison Mr Ko was on 24% and Mr Hou on 22%. If the opposition parties can succeed in pooling their vote share, it suggests that they are in the lead heading into the campaign period. While they have not yet issued a joint policy platform, both opposition candidates have previously promised to reset cross-strait relations by reopening dialogue with China. The KMT wants to return to the “1992 consensus”. Mr Ko has proposed a similar formulation that the “two sides of the strait are one family”. A victory for the opposition parties should thus lower tensions with mainland China. It sets the stage for a scaling back of geopolitical tensions in the region that should help Asian currencies to extend their recent rebound heading into early next year.

In these circumstances, we expect Asian currencies to strengthen further in the near-term. The broad-based USD sell-off and correction lower for US yields is helping to ease the downward pressure on Asian currencies that has been in place for most of this year. Recent political developments in Taiwan which are encouraging investors to scale back geopolitical risks related to the region is further supportive development for Asian currencies as well. However, the lack of investor enthusiasm over the recent improvement in cyclical momentum in China suggests that it will remain challenging for Asian currencies to extend their rebound. We do not expect a repeat of the powerful Asian currency rally that took place late last year.

WILL LAST YEAR’S ASIA FX RALLY BE REPEATED?

Source: Bloomberg, Macrobond & MUFG GMR

USD/CNY DROPS BACK TOWARD DAILY FIX

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CNY |

11/20/2023 |

01:15 |

1-Year Loan Prime Rate |

!! |

|||

|

USD |

11/20/2023 |

15:00 |

Leading Index |

Oct |

-0.6% |

-0.7% |

!! |

|

GBP |

11/20/2023 |

18:45 |

BoE Governor Bailey speaks |

!!! |

|||

|

EUR |

11/20/2023 |

19:00 |

ECB's Villeroy speaks |

!! |

|||

|

AUD |

11/20/2023 |

23:00 |

RBA's Bullock-Panel |

!!! |

|||

|

AUD |

11/21/2023 |

00:30 |

RBA Minutes of Nov. Policy Meeting |

!! |

|||

|

GBP |

11/21/2023 |

07:00 |

Output Per Hour YoY |

3Q P |

-- |

0.3% |

!! |

|

GBP |

11/21/2023 |

07:00 |

Public Sector Net Borrowing |

Oct |

-- |

13.5b |

! |

|

CAD |

11/21/2023 |

13:30 |

CPI YoY |

Oct |

3.3% |

3.8% |

!!! |

|

USD |

11/21/2023 |

15:00 |

Existing Home Sales |

Oct |

3.90m |

3.96m |

!! |

|

EUR |

11/21/2023 |

16:00 |

ECB's Lagarde Speaks |

!!! |

|||

|

EUR |

11/21/2023 |

17:00 |

ECB's Schnabel Speaks |

!! |

|||

|

USD |

11/21/2023 |

19:00 |

FOMC Meeting Minutes |

-- |

-- |

!!! |

|

|

USD |

11/22/2023 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

11/22/2023 |

13:30 |

Durable Goods Orders |

Oct P |

-3.2% |

4.6% |

!! |

|

USD |

11/22/2023 |

15:00 |

U. of Mich. Sentiment |

Nov F |

60.7 |

60.4 |

!! |

|

GBP |

11/22/2023 |

12:00 |

Autumn Statement |

!!! |

|||

|

NOK |

11/23/2023 |

07:00 |

GDP Mainland MoM |

Sep |

-- |

-0.2% |

!!! |

|

SEK |

11/23/2023 |

08:30 |

Riksbank Policy Rate |

4.25% |

4.00% |

!!! |

|

|

EUR |

11/23/2023 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Nov P |

-- |

43.1 |

!!! |

|

EUR |

11/23/2023 |

09:00 |

HCOB Eurozone Services PMI |

Nov P |

-- |

47.8 |

!!! |

|

GBP |

11/23/2023 |

09:30 |

S&P Global/CIPS UK Manufacturing PMI |

Nov P |

-- |

44.8 |

!!! |

|

GBP |

11/23/2023 |

09:30 |

S&P Global/CIPS UK Services PMI |

Nov P |

-- |

49.5 |

!!! |

|

EUR |

11/23/2023 |

12:30 |

Account of October ECB Policy Meeting |

!! |

|||

|

NZD |

11/23/2023 |

21:45 |

Retail Sales Ex Inflation QoQ |

3Q |

-0.6% |

-1.0% |

!! |

|

JPY |

11/23/2023 |

23:30 |

Natl CPI YoY |

Oct |

3.4% |

3.0% |

!!! |

|

EUR |

11/24/2023 |

07:00 |

Germany GDP SA QoQ |

3Q F |

-- |

-0.1% |

!! |

|

EUR |

11/24/2023 |

09:00 |

Germany IFO Business Climate |

Nov |

-- |

86.9 |

!! |

|

CAD |

11/24/2023 |

13:30 |

Retail Sales MoM |

Sep |

- |

-0.1% |

!! |

|

USD |

11/24/2023 |

14:45 |

S&P Global US Composite PMI |

Nov P |

-- |

50.7 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The “minutes” of the latest ECB, Fed and RBA policy meetings will be released in the week ahead. Of the three central banks, the RBA is currently judged as having the higher likelihood of raising rates further while market participants have become more confident that the ECB and Fed have now ended their hiking cycles. The minutes from the last ECB and Fed policy meetings are unlikely to significantly alter current market expectations. The recent data flow from the euro-zone and US since the last policy meeting will continue to discourage rate hike expectations. On other hand we are not expecting the minutes to provide any encouragement to bring forward/price in more rate cuts into next year. Keynote central bank speakers in the week ahead include: BoE Governor Bailey, RBA Governor Bullock, and ECB President Lagarde.

- The Riksbank is the only G10 central bank to hold a policy meeting in the week ahead. In September, the Riksbank signaled that it was likely to hike again by a further 0.25 point to 4.25% in November although it is not a done deal. Even if the Riksbank delivers a rate hike, we expect the updated policy guidance to signal then that it plans to leave rates on hold brining it more into line with major central banks such as the ECB.

- The UK government will present their Autumn Statement in the week ahead. The UK public finances have been better than expected so far this fiscal year which is estimated to create fiscal room for the government of around GBP10 billion. However, the government is expected to remain cautious over announcing measures to loosen fiscal policy at the current juncture with inflation still well above the BoE’s target. Next year’s budget could prove a better point in time for bigger fiscal giveaways ahead of the upcoming general election.