To read a full report, please download PDF

USD bullish bias remains intact

FX View:

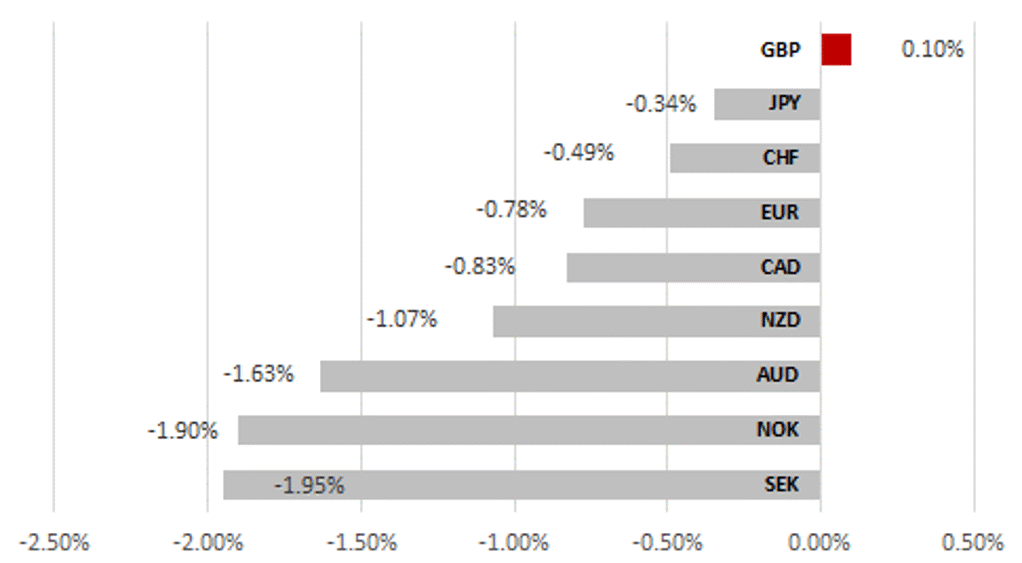

The US dollar has recorded another week of gains – only GBP has outperformed and that was only just. US yields remain supportive for the dollar – the 10year yield hit a new high and has now been above 4.00% for the longest period in this tightening cycle. The 10-year real yield is just below 2%, the highest level since December 2008. We don’t see the yield support for the dollar changing and maintain our short-term bullish bias. The Jackson Hole symposium is the key event next week with Fed Chair Powell speaking on Friday afternoon. The Atlanta GDPNow is now tracking 5.8% GDP growth underlining the limited scope for Powell to pivot more dovishly at this juncture. With China uncertainties in focus and unlikely to recede, it adds further to the argument of continued US dollar strength.

MORE USD STRENGTH WITH ONLY GBP OUTPERFORMING

Source: Bloomberg, 12:20 BST, 18th August 2023 (Weekly % Change vs. USD)

Trade Ideas:

We have maintained our short EUR/USD trade idea to reflect the potential bias favouring yield and hence the dollar over the short-term.

JPY Flows:

This week we cover the monthly Balance of Payments statistics, released last week. The current account recorded its first goods surplus since October 2021 underlining the benefits for the yen as the energy price shock recedes. The CA surplus in Q2 2023 was more than double the size compared to Q2 2022.

FX Correlation Heatmaps:

The correlations within G10 highlight the strength of correlation with US yields which remain close to year-to-date highs. CNY correlations are also strengthening highlighting increased focus on China.

Text Analysis on FOMC Minutes:

The recent Fed meeting minutes capture a cautious but increasingly optimistic Fed outlook. Our text analysis captures a fall in references to both inflation and financial conditions related terminology.

FX Views

Jackson Hole in focus with USD/JPY in ‘danger zone’

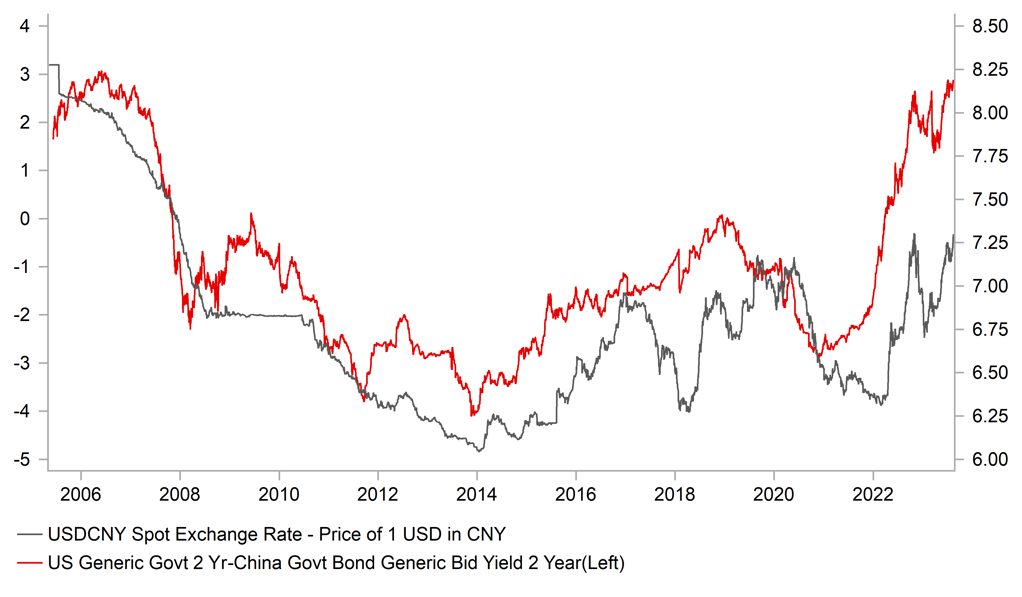

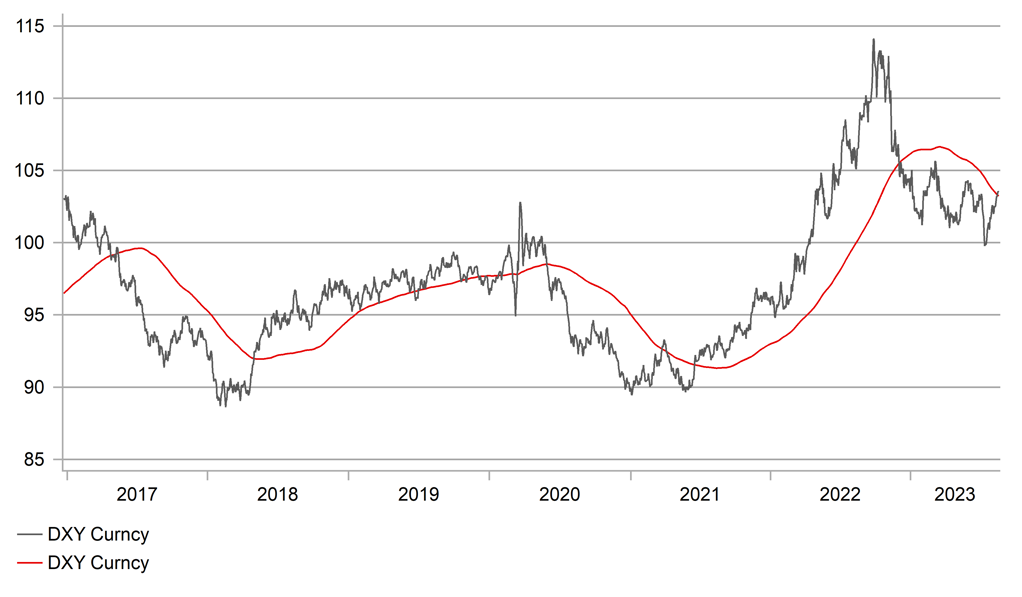

Last week the dollar advanced versus all G10 currencies and this week it has been nearly a repeat of that with only GBP outperforming very modestly. That outperformance reflects the strong wage data in the UK and inflation data that fell less than expected. The 2yr Gilt yield has jumped 19bps this week – the US equivalent is up 2bps. While the Fed and the ECB may be in a position to pause and probably end their tightening cycles the BoE still has some work to do. But notwithstanding the resilience of GBP this week, we still see scope for the dollar to strengthen further. The speed of USD strength has slowed today which is in part due to the evidence of greater opposition in China to USD/CNY gains. The PBoC fixing today was set at the widest divergence from the market estimated level since that estimate started being published by Bloomberg in 2018. Reports of increased USD selling by China’s state banks also helped contain the USD/CNY move higher. But given the heightened uncertainty over China’s property sector problems and the lack of any clear policy strategy, we suspect further increases in USD/CNY is likely. The PBoC cut rates again and the 2yr spread vs the US is approaching 300bps, the widest since July 2007 when USD/CNY was trading at around 8.0000. DXY this week broke above its 200-day moving average and a close above 103.23 today would be the third consecutive close above the key technical level and provides a positive technical backdrop for the dollar as well.

The key event next week will be the Jackson Hole symposium, being held from 24th-26th August. The title of this year’s symposium is “Structural Shifts in the Global Economy”. The Fed confirmed yesterday that Chair Powell will speak at the event at 15:05 BST on Friday 25th August. This will be a crucial speech for the markets given the history of this symposium shows this platform has often been used to relay key communications to the markets. There will be other speakers of course as well but currently we only have confirmation of Fed President Harker (voter) speaking to the media on Thursday (CNBC 17:00); and Friday (Bloomberg TV 14:00 and Yahoo Finance 14:40).

We have previously stated that Jackson Hole could well have been used by the Fed to give a clearer signal of a pause in the tightening cycle and while that is still possible it seems less likely now given the continued resilience of the economy. The Atlanta NowGDP is tracking at 5.8% currently and given the limited evidence of any slowdown in the labour market, Powell’s speech may be similar to the contents of the FOMC minutes of the July meeting that were released this week. Our text analysis piece below of the Fed minutes reveals the mentioning of inflation aspects came down in the minutes this week to the lowest total since the February meeting. So it seems the anxiety within the FOMC has certainly come down a touch and hence it could be argued this could be reflected more explicitly in the Jackson Hole speech. But again given developments since the meeting with the limited evidence of weaker economic activity this seems unlikely. A repeat of the emphasis of possibly needing to hike further due to “significant” upside inflation risks could be expanded on given the resilience of the economy. The other notable conclusion from our text analysis of the FOMC minutes was the drop in focus on references to financial conditions to the lowest since September last year. If that is a reflection of reduced concerns over tighter financial conditions it could well encourage a continue hawkish message next week.

2YR US-CHINA SPREAD BACK AT 2007 LEVELS

Source: Bloomberg, Macrobond & MUFG GMR

DXY – BREAKING BACK ABOVE THE 200-DAY MAV

Source: Bloomberg, Macrobond & MUFG GMR

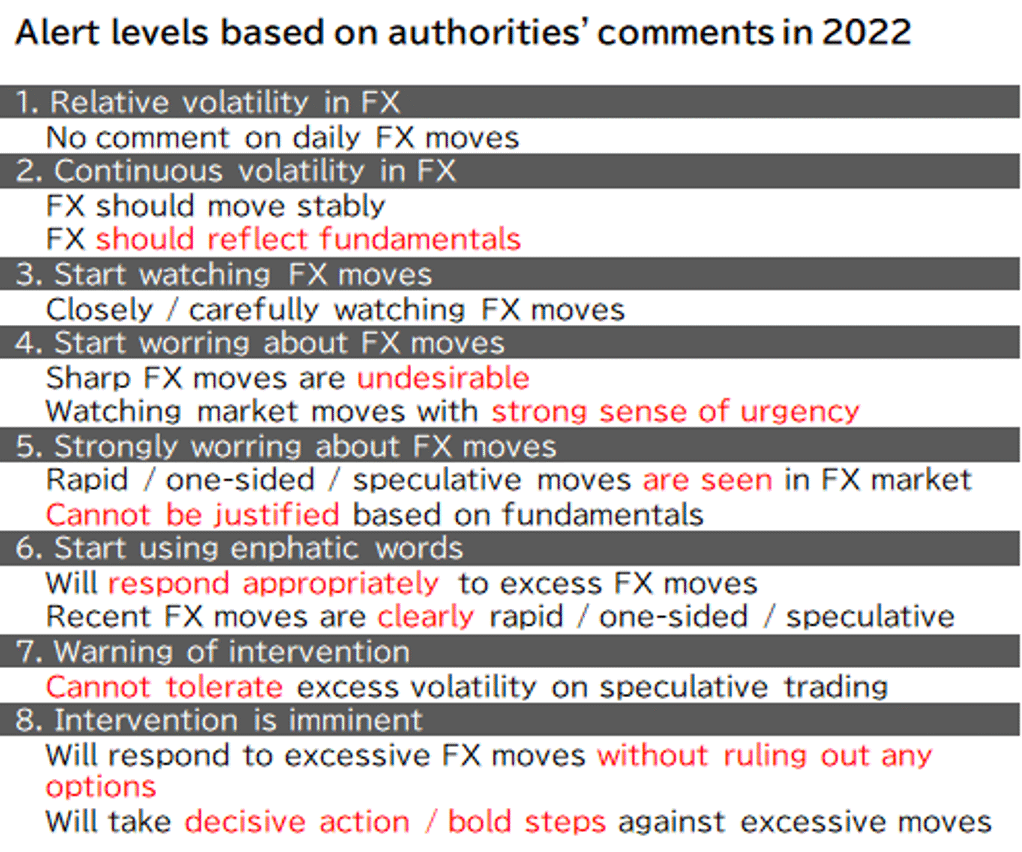

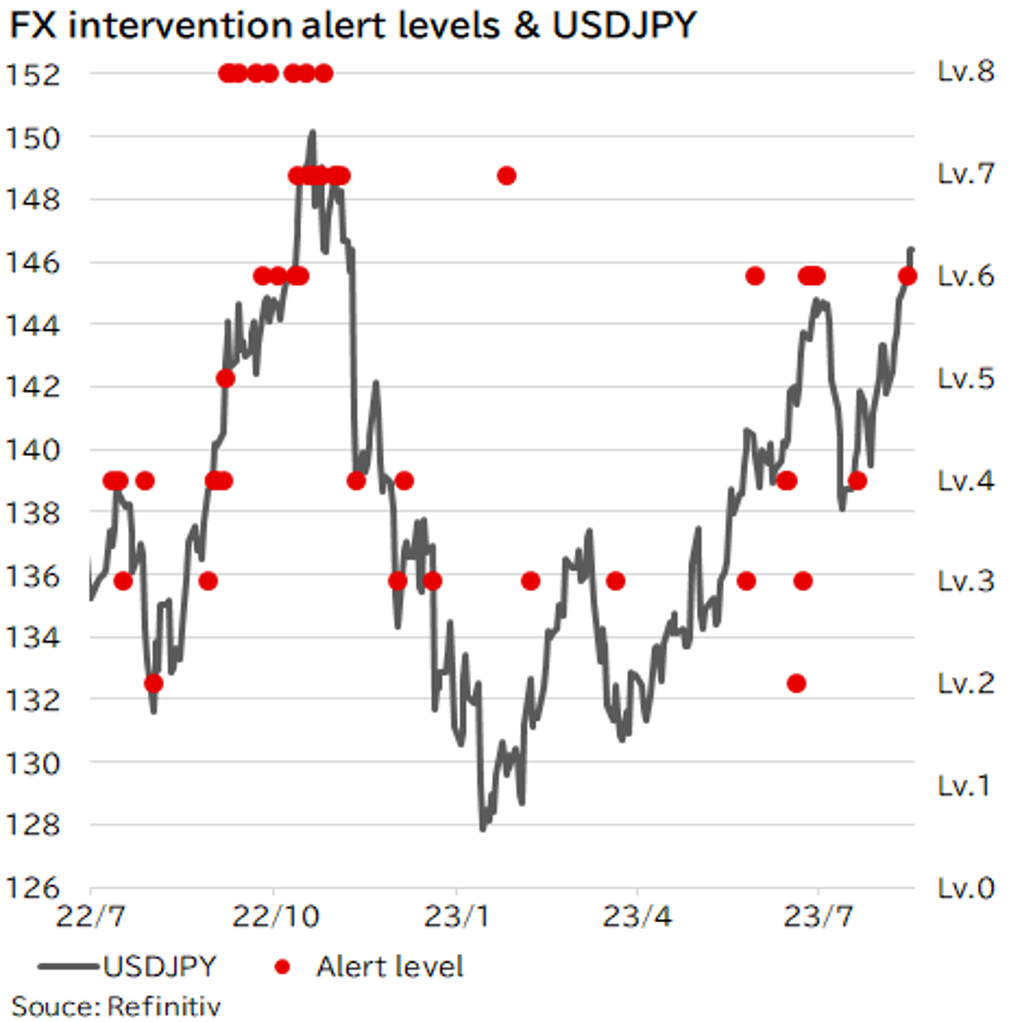

A hawkish speech by Powell could create problems for Tokyo. The scale of the move higher in USD/JPY since the BoJ policy meeting in July when YCC was tweaked is certainly on a scale consistent with the moves ahead of intervention in September and October last year. But our sense currently is that the rhetoric from Tokyo has yet to reach the fevered levels that usually precedes actual intervention. Our Tokyo colleagues have translated from Japanese language prior comments when intervention took place last year and created an “Alert Scale” to provide a gauge for where we are now. We estimate based on an “Alert Scale” of 1-8, to be currently at about 6 suggesting there is a bit more to go before we reach an equivalent level of urgency prior to actual intervention.

With Jackson Hole at the end of next week we may well see some increased urgency in the tone of rhetoric from Tokyo ahead of the Jackson Hole symposium. The authorities in Japan are in a difficult positions of wanting to keep JGB yields in check but limit JPY weakness. If the dollar surges further next week, something may have to give. We could see a combination of higher JGB yields, especially if US yields continue higher, and increased rhetoric. USD/CNY moves will be important also and the correction lower in USD/CNY on much lower PBoC fixings has helped cap USD/JPY.

We are maintaining our view of further US dollar strength over the short-term. We see limited scope for a dovish pivot by Fed Chair Powell at Jackson Hole and the dollar and yields will remain supported for now. With USD/JPY now in the danger zone we expect increased rhetoric from Tokyo that could mean USD/JPY lags.

WE ESTIMATE TO BE AT LEVEL 6 ON 1-8 ALERT SCALE

Source: MUFG Research Tokyo

USD/JPY & PRIOR ALERT LEVELS

Source: MUFG Research Tokyo

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

08/21/23 |

07:00 |

German PPI MoM |

Jul |

-- |

-0.30% |

!! |

|

EUR |

08/21/23 |

07:00 |

German PPI YoY |

Jul |

-- |

0.10% |

!! |

|

GBP |

08/22/23 |

07:00 |

Public Finances (PSNCR) |

Jul |

-- |

12.0b |

! |

|

EUR |

08/22/23 |

09:00 |

ECB Current Account SA |

Jun |

-- |

9.1b |

! |

|

GBP |

08/22/23 |

11:00 |

CBI Trends Total Orders |

Aug |

-- |

-9 |

!! |

|

USD |

08/22/23 |

13:30 |

Philly Fed Non-Manufacturing Activity |

Aug |

-- |

1.4 |

!! |

|

USD |

08/22/23 |

15:00 |

Existing Home Sales |

Jul |

4.15m |

4.16m |

!! |

|

USD |

08/22/23 |

19:30 |

Fed Goolsbee speaks |

!! |

|||

|

EUR |

08/23/23 |

08:30 |

HCOB Germany Manufacturing PMI |

Aug P |

-- |

38.8 |

!!! |

|

EUR |

08/23/23 |

08:30 |

HCOB Germany Services PMI |

Aug P |

-- |

52.3 |

!!! |

|

EUR |

08/23/23 |

08:30 |

HCOB Germany Composite PMI |

Aug P |

-- |

48.5 |

!!! |

|

EUR |

08/23/23 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Aug P |

-- |

42.7 |

!!! |

|

EUR |

08/23/23 |

09:00 |

HCOB Eurozone Services PMI |

Aug P |

-- |

50.9 |

!!! |

|

EUR |

08/23/23 |

09:00 |

HCOB Eurozone Composite PMI |

Aug P |

-- |

48.6 |

!!! |

|

GBP |

08/23/23 |

09:30 |

S&P Global/CIPS UK Manufacturing PMI |

Aug P |

-- |

45.3 |

!!! |

|

GBP |

08/23/23 |

09:30 |

S&P Global/CIPS UK Services PMI |

Aug P |

-- |

51.5 |

!!! |

|

GBP |

08/23/23 |

09:30 |

S&P Global/CIPS UK Composite PMI |

Aug P |

-- |

50.8 |

!!! |

|

CAD |

08/23/23 |

13:30 |

Retail Sales Ex Auto MoM |

Jun |

-- |

0.00% |

!! |

|

USD |

08/23/23 |

14:45 |

S&P Global US Manufacturing PMI |

Aug P |

-- |

49 |

!! |

|

USD |

08/23/23 |

14:45 |

S&P Global US Services PMI |

Aug P |

-- |

52.3 |

!! |

|

USD |

08/23/23 |

14:45 |

S&P Global US Composite PMI |

Aug P |

-- |

52 |

!! |

|

USD |

08/23/23 |

15:00 |

New Home Sales |

Jul |

710k |

697k |

!! |

|

EUR |

08/24/23 |

07:45 |

France Business Confidence |

Aug |

-- |

100 |

! |

|

EUR |

08/24/23 |

07:45 |

France Manufacturing Confidence |

Aug |

-- |

100 |

! |

|

GBP |

08/24/23 |

11:00 |

CBI Total Dist. Reported Sales |

Aug |

-- |

-17 |

!! |

|

USD |

08/24/23 |

13:30 |

Initial Jobless Claims |

Aug-19 |

-- |

-- |

! |

|

USD |

08/24/23 |

13:30 |

Durable Goods Orders |

Jul P |

-4.00% |

4.60% |

!!! |

|

USD |

08/24/23 |

Jackson Hole Symposium 24th-26th |

!!!!! |

||||

|

JPY |

08/25/23 |

00:30 |

Tokyo CPI Ex-Fresh Food YoY |

Aug |

2.90% |

3.00% |

! |

|

JPY |

08/25/23 |

00:30 |

Tokyo CPI Ex-Fresh Food, Energy YoY |

Aug |

4.00% |

4.00% |

!! |

|

EUR |

08/25/23 |

07:00 |

German GDP SA QoQ |

2Q F |

-- |

0.00% |

!! |

|

EUR |

08/25/23 |

09:00 |

German IFO Business Climate |

Aug |

-- |

87.3 |

!!! |

|

USD |

08/25/23 |

15:00 |

U. of Mich. Sentiment |

Aug F |

71.2 |

71.2 |

!!! |

|

USD |

08/25/23 |

15:00 |

U. of Mich. 1 Yr Inflation |

Aug F |

-- |

3.30% |

!!! |

|

USD |

08/25/23 |

15:05 |

Fed Chair Powell Jackson Hole speech |

!!!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- Chicago Fed President Goolsbee will make some opening remarks at a ‘Fed Listens’ event which is all we have scheduled. However, the main event next week will be the Jackson Hole Symposium taking place between 24th26th August. The title of this year’s symposium is “Structural Shifts in the Global Economy”. Chair Powell will speak on Friday.

- In addition, but less important will be the economic data releases. After the move higher in US yields this week following more solid economic data releases, next week’s schedule is much lighter suggesting no reason to see yields retrace this week’s moves. Durable goods data is probably the most significant release on Thursday. The advance PMIs in Europe will be most in focus.

- The highlight of the week will be the advance PMI data in Europe taking place on Wednesday. The data from Europe has been terrible and if that is confirmed again next week it will likely help drive the US dollar further stronger.