To read a full report, please download PDF

USD strength looks unsustainable

FX View:

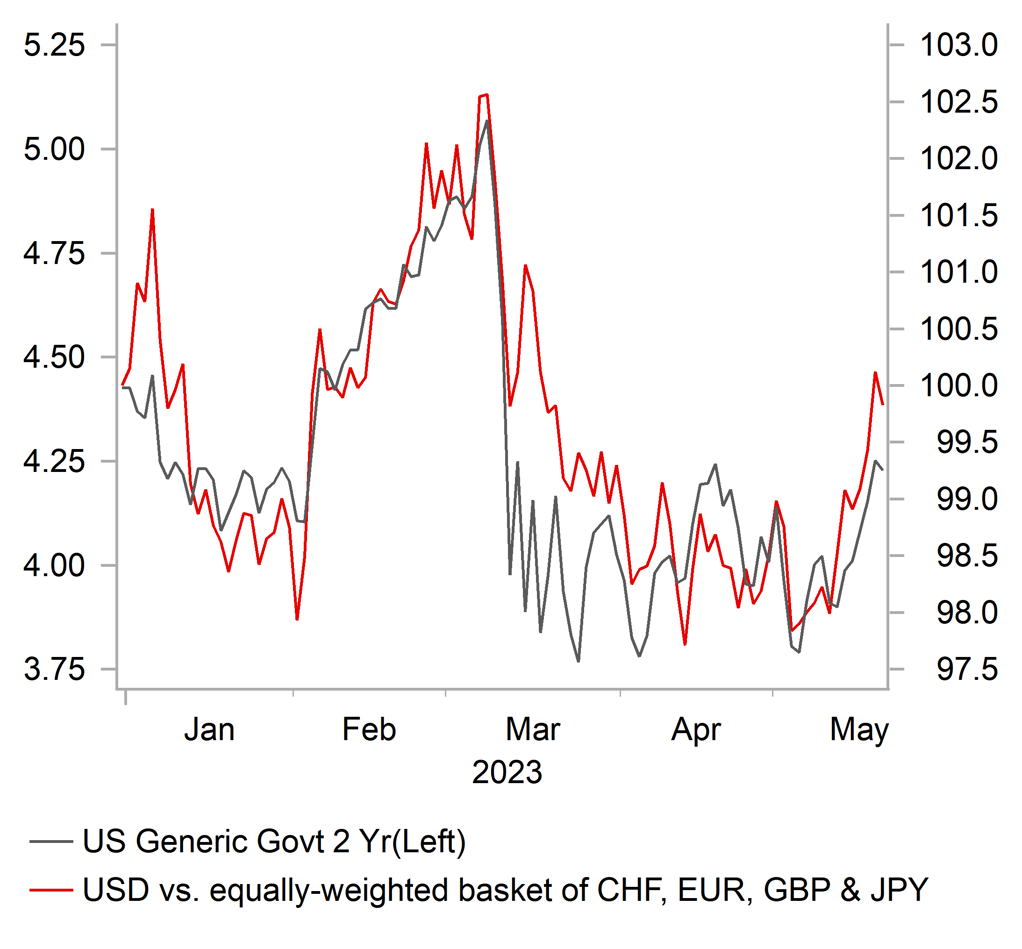

The US dollar has recovered somewhat this week as market participants reassess the outlook for Fed policy with rates grinding higher on the back of some increased pricing of another rate hike in June and less monetary easing by year-end. The 2yr yield is up over 30bps this week and we suspect a deal on the debt ceiling next week is nearly fully priced. With economic data unlikely to be a catalyst for further moves higher in short-term yields, we are sceptical of short-term rates moving much higher and hence the positive momentum for the dollar may start to fade. Technically, the dollar has breached some key levels and hence our conviction on renewed dollar depreciation is not high. But we still maintain that the Fed will pause in June, the data will point to further weakening economic activity which will weigh on the dollar. UK inflation will be in focus next week and our GBP bias has turned more neutral too given scope for lower inflation than the BoE expects.

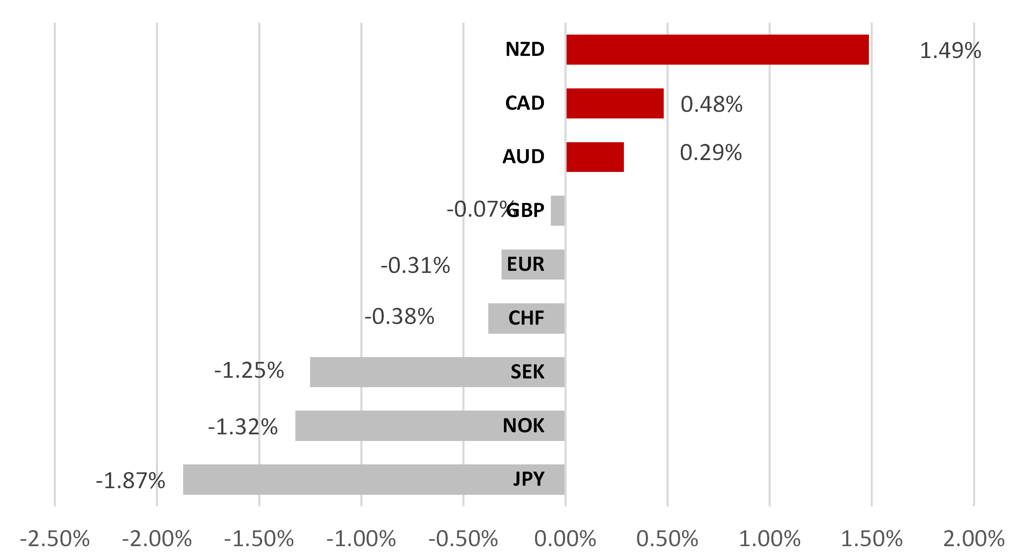

HIGH-BETA G10 OUTPERFORMS THE US DOLLAR THIS WEEK

Source: Bloomberg, 13:30 GMT, 19th April 2023 (Weekly % Change vs. USD)

Trade Ideas:

We are closing our short USD/JPY trade idea and maintaining a short USD/NOK trade idea.

JPY Flows:

The MoF in Japan released the Balance of Payments statistics for March last week and we highlight this week the ongoing improvement in Japan’s external position, not just due to energy but also services trade and a jump in the investment income surplus helped by a weaker yen.

G10 Labour Market analysis:

The Indeed jobs postings index identifies Australia, Canada and Great Britain as the worst performing labour market (amongst G10) since the start of this year. What are the monetary policy implications?

FX Views

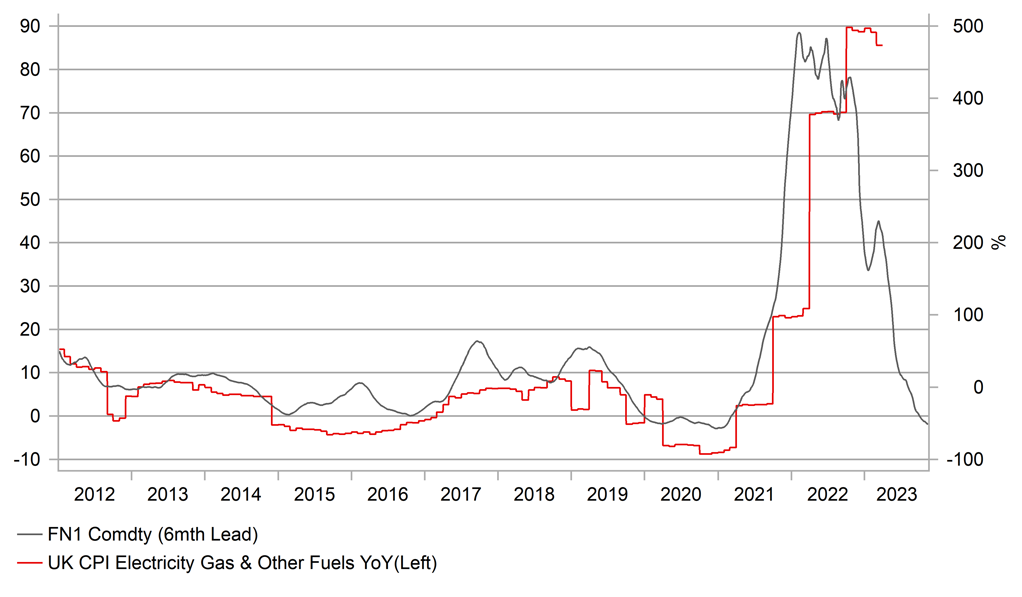

GBP: UK inflation should now start offering BoE scope for pause

The pound has corrected weaker this week versus the US dollar driven by the repricing of Fed policy rate expectations fuelled by continued hawkish Fed rhetoric and speculation that debt-ceiling negotiations will conclude with a deal next week. The pound did outperform the euro but underperformed some of the higher-beta G10 currencies like NZD, AUD and CAD. The underperformance of the pound could persist over the short-term. The rates market looks priced excessively for BoE rate hikes and we see risks of the markets paring back some of those rate hike expectations. The focus next week in the UK will be on the inflation data released on Wednesday. The data next week will be telling in revealing for the first time the start of the energy base effect. The delay in this unfolding in the UK is one the reasons inflation in the UK has been described as “sticky”. Energy inflation in the UK currently stands at 40.5%. In the euro-zone, energy inflation was actually negative at -0.9% YoY in March before increasing to just 2.4% in April. In the US, energy inflation has also turned to deflation, at -5.1% in April. While it is not completely inaccurate to cite “sticky” inflation when referring to the UK, it does not entirely reflect the reality.

The energy inflation delay in the UK relates to the OFGEM utility price cap. The cap jumped 54% in April 2022 and by 27% in October 2022. Adjustments are now every three months and with the cap remaining unchanged in April 2023, the 54% increase from 2022 will fall out of the annual CPI rate. Based on current natural gas prices, the current estimate is that the OFGEM cap from July could fall by 20% from June and bringing it down sharply toward unchanged from a year earlier. The ‘household gas electricity and other fuels’ component in CPI is currently at 85.6% with the weighting in CPI at 4.9% (up from 3.6% last year) which implies something between 3.0-3.5ppts impact on overall CPI comes from utility bill price changes. That is set to fully unwind between April and July.

The consensus for the YoY CPI rate in April is currently showing a drop from 10.1% to 8.2% which is consistent with our calculations. The BoE forecast for Q2 CPI was put at 8.2%, falling to 7.0% in Q3 and 5.1% in Q4. The implication of the BoE forecasts for Q2 and Q3 is that the annual decline in CPI outside of energy will be limited. We see the BoE’s estimate as very pessimistic with a realistic prospect of annual CPI coming in weaker than the BoE anticipates. Indeed, based on our calculations and calculating the annual change through April-June 2023 based on an average 1.0% MoM change we only get the Q2 YoY CPI rate at about 7.1%-7.2%, so we fail to see how the BoE manages to get to such a high level of 8.2% for Q2.

UK UTILITY PRICE INFLATION SET TO PLUNGE

Source: Bloomberg, Macrobond & MUFG GMR

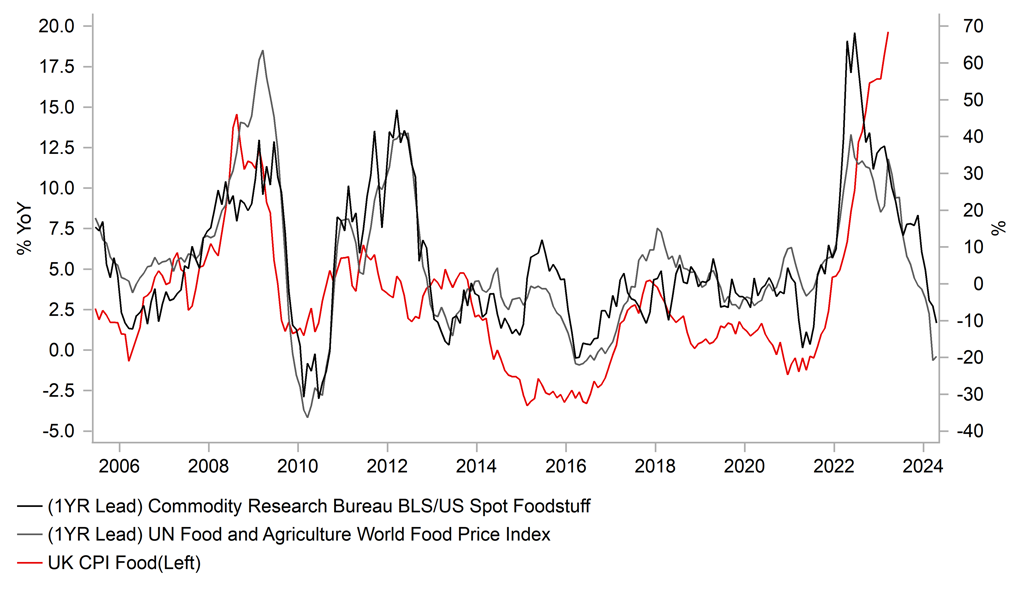

UK FOOD INFLATION SET TO MOVE LOWER TOO

Source: Bloomberg & MUFG Calculations

The BoE does cite one source of near-term upside risk being food prices. Food inflation is at a cyclical high and the BoE in fact cites inflation as an inflation shock in itself. Bad weather in Europe resulted in more fruit and veg being grown in more energy-intensive greenhouses which helped fuel a price surge. A lag from the energy price surge is also playing a role while there are also accusations of food companies widening margins to compensate for a hit to margins last year. Nonetheless, it is clear from wholesale prices now that the food inflation surge is set to unravel also. The fact that food inflation is as high in euro-zone CPI does suggest the UK food inflation problem is not Brexit relate

The start of more dramatic declines in annual CPI next week will follow labour market data this week, which certainly point to diminishing wage-inflation risks going forward. While the headline 3mth YoY wage data remained strong other elements pointed to an easing of labour market tightness. The headline 3mth YoY weekly wage growth rate remained at 5.8% while the ex-bonus measure increased from 6.6% to 6.7%. But the PAYE payroll employment report showed 136k of job losses, the largest since the initial covid shock while vacancy rates continue to trend lower. If you look forward to our G10 Labour Market Analysis section you can see that the Indeed Job Advertisements data analysis is also pointing to UK labour market softening.

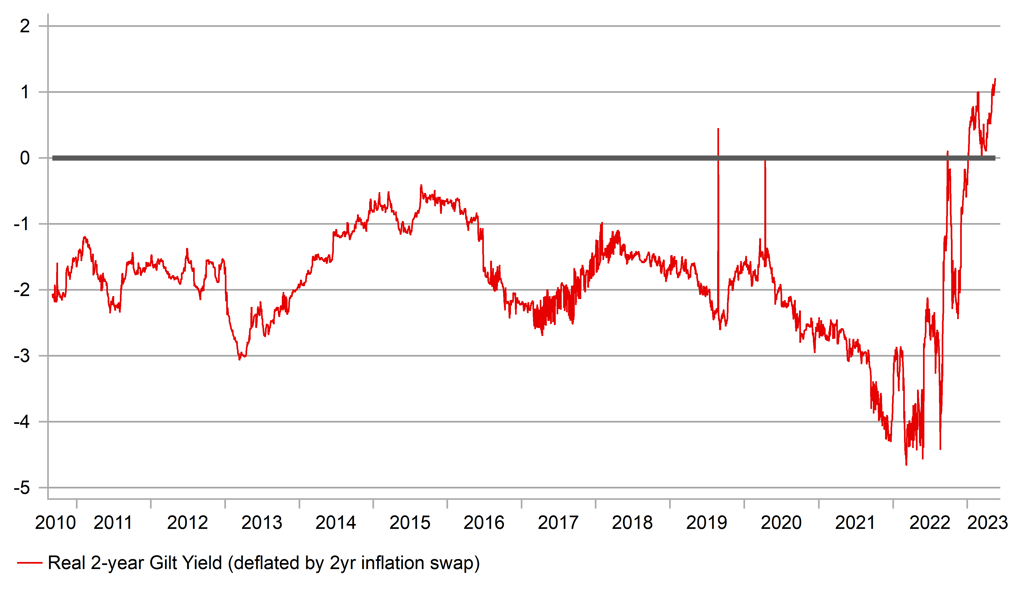

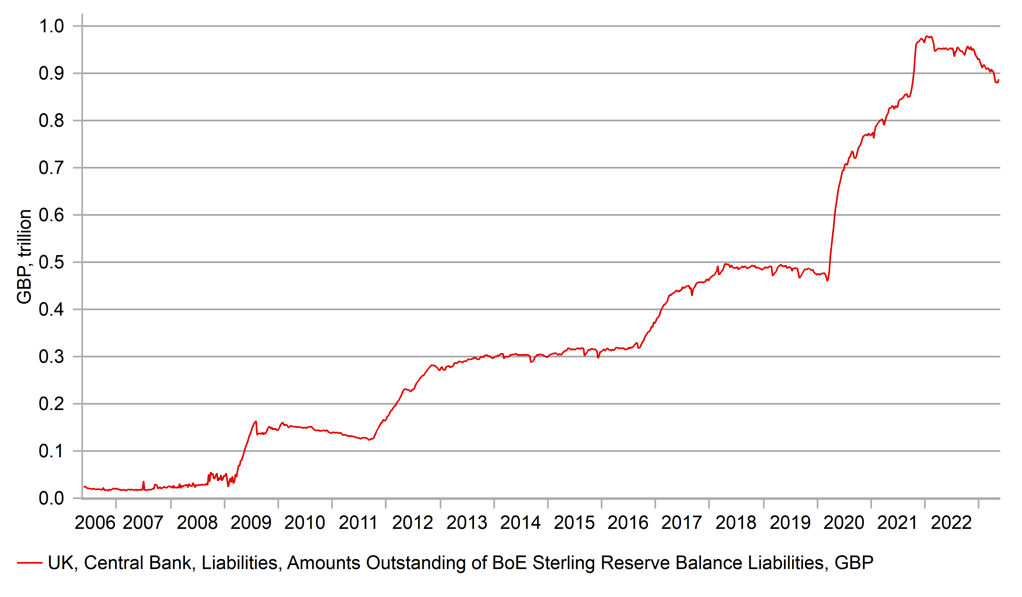

Expectations on BoE rate hikes have remained broadly stable of late with the BoE communications this week consistent with the guidance from the MPC statement from the meeting earlier in May. The guidance remains skewed to another rate hike if the BoE sees signs of “inflation persistence” as has been mentioned by numerous MPC members. The OIS market indicates two 25bps hikes remain nearly fully priced. Our view is for only one further hike suggesting scope for yields to adjust lower. Our GBP/USD target was to reach around 1.2600 this quarter with the catalyst for further mvoes higher only coming toward year-end as the Fed begins to cut rates. We have held a bullish GBP bias since the start of the year but with inflation potentially now about to start undershooting BoE forecasts, our bias is now turning more neutral. The BoE may turn to faster balance sheet shrinkage as an offset as they move to a pause on lifting rates. Deputy Governor Dave Ramsden stated that there was a potential to “go up a little bit” in terms of pace of shrinkage. BoE staff previously estimated the markets could take GBP 100bn worth of shrinkage without causing market dislocations and hence to “go up a little bit” possibly refers to increasing the pace within that amount. We doubt such a change would have a marked impact on long-term rates. GBP direction will continue to be dictated by policy divergence expectations and that could see GBP/USD underperforming further over the short-term.

UK 2YR REAL YIELD HIGHEST SINCE GFC

Source: Bloomberg, Macrobond & MUFG Research

BOE BALANCE SHEET SHRINKAGE VERY GRADUAL

Source: Bloomberg, Macrobond & MUFG Research

USD: US debt ceiling optimism & slower China growth supporting rebound

The USD is on course to strengthen for the second consecutive week. It has been the longest run of USD gains since the second half of February. The USD has strengthened the most over the past week against the JPY (-2.0% vs. USD), NOK (-1.7%) and SEK (-1.6%). At the other end of the spectrum, the NZD (+1.5% vs. USD) and CAD (+0.3%) have been the best two performing G10 currencies. The price action is more consistent with risk-on trading over the past week. The USD has benefitted against the JPY and European currencies from the hawkish repricing of Fed rate hike expectations. The US rate market has moved to price in a higher probability (36%) of another 25bps hike next month. The hawkish repricing of Fed rate hike expectations has been encouraged by a combination of reassuring US economic data releases (US retail sales, IP & housing data) that has eased fears over a sharper slowdown/recession, and the improving mood music coming from US debt negotiations. Comments from Congressional leaders have suggested that the structure of an agreement is coming together. A timely deal to raise the debt ceiling would limit financial market disruption and lower the hurdle for another Fed rate hike, although we still believe that it would be prudent for the Fed to pause to assess the lagged impact of past rate hikes in light of tightening credit conditions and easing inflation pressures.

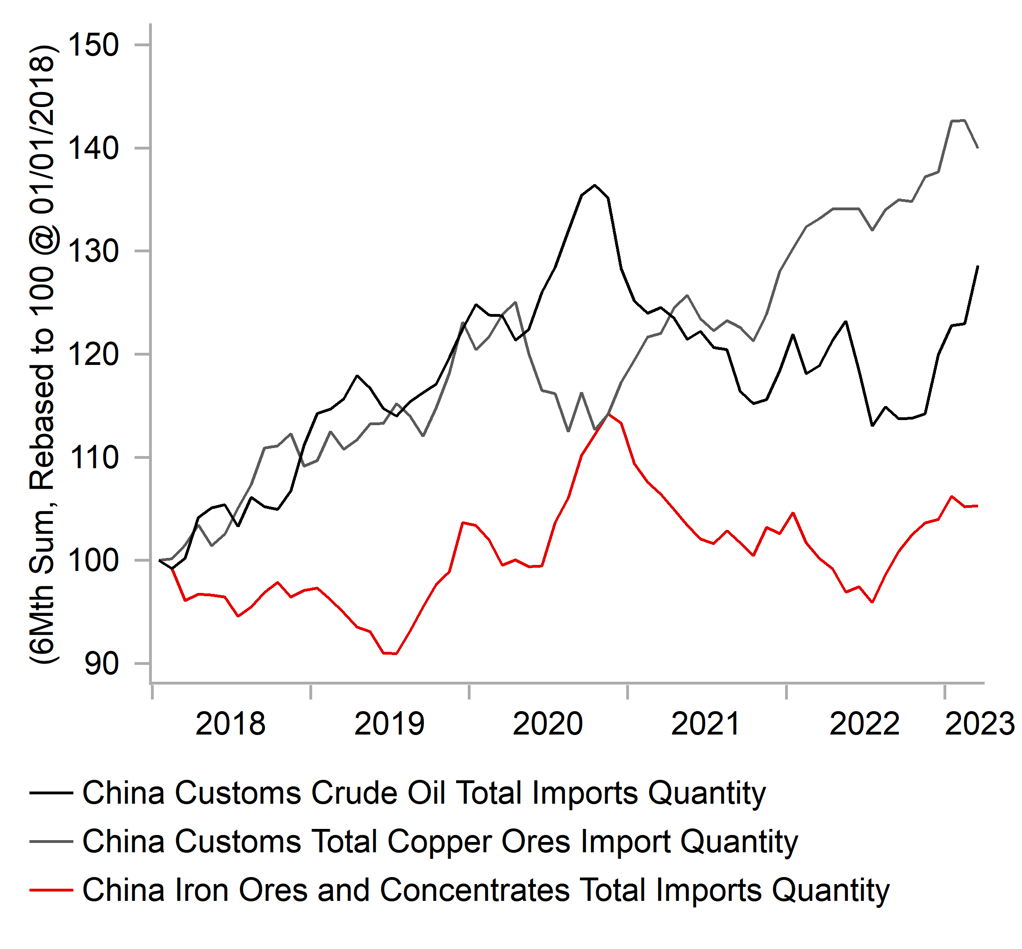

At the same time, the USD has been deriving more support from the recent run of softer growth outside of the US. The main economic data highlight over the past week was the release of the latest monthly activity data from China (click here) that revealed a loss of growth momentum at the start of Q2. The souring of investor sentiment towards China has been most evident in the FX market this week by the move higher in USD/CNY that closed above the 7.0000-level for the first time since the start of December. It has prompted the PBoC and SAFE to state that they will curb speculation in the FX market when necessary. In contrast, the negative impact on G10 commodity currencies has been limited this week. The recovery in China has been driven mainly by consumption and the service sector while IP and the housing market that are important for commodity demand have remained weak. One area where China demand is coming in stronger is for oil which hit a record in March at 16mb/d according to the IEA. It has prompted the IEA to revise up their global demand forecasts. They now expect global demand to outstrip supply by almost 2mb/d in 2H of this year. The tightening physical market supports our forecast (click here) for the price of oil to rebound back towards USD90/barrel later this year.

In these circumstances, the recent shift in fundamentals are helping to trigger a rebound for the USD up from close to year to date lows. However, we remain sceptical that the recent move higher in both US yields and the USD can be sustained.

HIGHER US YIELDS LIFT USD VS. OTHER MAJORS

Source: Bloomberg, Macrobond & MUFG

STRENGTH OF CHINA REBOUND IN FOCUS

Source: Bloomberg, Macrobond & MUFG

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

05/22/2023 |

10:00 |

Construction Output MoM |

Mar |

-- |

2.3% |

!! |

|

EUR |

05/22/2023 |

15:00 |

Consumer Confidence |

May P |

- 16.8 |

-17.5 |

!! |

|

EUR |

05/22/2023 |

15:15 |

ECB's Lane Speaks |

!!! |

|||

|

EUR |

05/22/2023 |

15:15 |

ECB's Villeroy speaks |

!! |

|||

|

GBP |

05/23/2023 |

07:00 |

Public Sector Net Borrowing |

Apr |

-- |

20.7b |

!! |

|

EUR |

05/23/2023 |

09:00 |

HCOB Eurozone Manufacturing PMI |

May P |

46.3 |

45.8 |

!!! |

|

EUR |

05/23/2023 |

09:00 |

HCOB Eurozone Services PMI |

May P |

55.7 |

56.2 |

!!! |

|

EUR |

05/23/2023 |

09:00 |

ECB Current Account SA |

Mar |

-- |

24.3b |

!! |

|

GBP |

05/23/2023 |

09:30 |

S&P Global/CIPS UK Manufacturing PMI |

May P |

-- |

47.8 |

!!! |

|

GBP |

05/23/2023 |

09:30 |

S&P Global/CIPS UK Services PMI |

May P |

-- |

55.9 |

!!! |

|

USD |

05/23/2023 |

14:45 |

S&P Global US Composite PMI |

May P |

-- |

53.4 |

!! |

|

USD |

05/23/2023 |

15:00 |

New Home Sales |

Apr |

660k |

683k |

!! |

|

EUR |

05/23/2023 |

16:00 |

ECB's Villeroy Speaks |

!!! |

|||

|

EUR |

05/23/2023 |

18:50 |

ECB's Nagel Speaks |

!!! |

|||

|

NZD |

05/23/2023 |

23:45 |

Retail Sales Ex Inflation QoQ |

1Q |

-- |

-0.6% |

!! |

|

NZD |

05/24/2023 |

03:00 |

RBNZ Official Cash Rate |

5.50% |

5.25% |

!!! |

|

|

GBP |

05/24/2023 |

07:00 |

CPI YoY |

Apr |

8.0% |

10.1% |

!!! |

|

EUR |

05/24/2023 |

09:00 |

Germany IFO Business Climate |

May |

93.0 |

93.6 |

!!! |

|

GBP |

05/24/2023 |

14:00 |

BoE Governor Bailey speaks |

!!! |

|||

|

USD |

05/24/2023 |

19:00 |

FOMC Meeting Minutes |

-- |

-- |

!!! |

|

|

EUR |

05/25/2023 |

07:00 |

Germany GDP SA QoQ |

1Q F |

-- |

-- |

!!! |

|

SEK |

05/25/2023 |

07:00 |

Unemployment Rate SA |

Apr |

-- |

7.2% |

!! |

|

GBP |

05/25/2023 |

11:00 |

CBI Retailing Reported Sales |

May |

-- |

5.0 |

!! |

|

EUR |

05/25/2023 |

11:30 |

ECB's Nagel Speaks |

!!! |

|||

|

USD |

05/25/2023 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

05/25/2023 |

13:30 |

GDP Annualized QoQ |

1Q S |

1.1% |

1.1% |

!!! |

|

JPY |

05/26/2023 |

00:30 |

Tokyo CPI YoY |

May |

3.5% |

3.5% |

!! |

|

GBP |

05/26/2023 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

Apr |

-- |

-0.9% |

!!! |

|

USD |

05/26/2023 |

13:30 |

PCE Core Deflator YoY |

Apr |

4.5% |

4.6% |

!!! |

|

USD |

05/26/2023 |

13:30 |

Advance Goods Trade Balance |

Apr |

-$85.6b |

-$84.6b |

!! |

|

USD |

05/26/2023 |

13:30 |

Durable Goods Orders |

Apr P |

-1.0% |

3.2% |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The G7 leaders Summit is taking place this weekend in Japan. US President Biden will then head back to Washington to continue talks in the week ahead to raise the US debt ceiling. Talks are entering a more intense phase ahead of the so-called X date that the US Treasury has warned could come as soon as 1st The release of the minutes from the latest FOMC meeting will be scrutinized closely in the week ahead to further assess the likelihood of the Fed pausing rate hikes in June. The release of the latest US PCE deflator report for April is expected to provide further confirmation that inflation pressures are easing.

- The next G10 central bank to update their policy outlook will be the RBNZ in the week ahead. The RBNZ is expected to deliver one further 25bps hike and lift their key policy rate to 5.50%. The RBNZ will be updating their economic outlook, and market participants will be watching to see if they lift their growth forecasts after the Treasury revised away their forecasts for recession in the latest budget with growth deriving more support from reconstruction demand.

- The release of the latest UK CPI report is expected to reveal a sharp drop in headline inflation driven primarily by disinflation in the energy price component after the government extended the energy price guarantee. The drop in energy price inflation is well anticipated, and market participants will be more closely watching food price inflation and core inflation measures to assess the likelihood of the BoE delivering another 25bps hike at the June MPC meeting. Governor Bailey will be speaking in the week ahead and is expected to repeat current policy guidance that they are prepared to raise rates further if they judge that risk have increased for more persistent inflation.