To read a full report, please download PDF

Limited room for USD rebound

FX View:

The USD has staged a modest rebound over the past week after hitting fresh year to date lows earlier this month. Slowing US inflation alongside resilient US activity data is proving to be a negative mix for USD as the Fed moves closer to ending their hiking cycle. We expect the Fed to deliver a final hike in the week ahead but it is likely too soon for the Fed to drop plans for a second hike later this year. At best it would provide only temporary support for the USD. Similarly, we expect the ECB to deliver another hike in the week ahead and leave the door open to a further hike later this year. The EUR could come under some selling pressure in the week ahead if the commitment to a further hike is viewed as weak. In comparison, the BoJ has been reluctant to tighten policy. The JPY has re-weakened over the past week as expectations for a change in BoJ policy next week have been cut. A surprise decision to adjust YCC would trigger a powerful rally for the JPY.

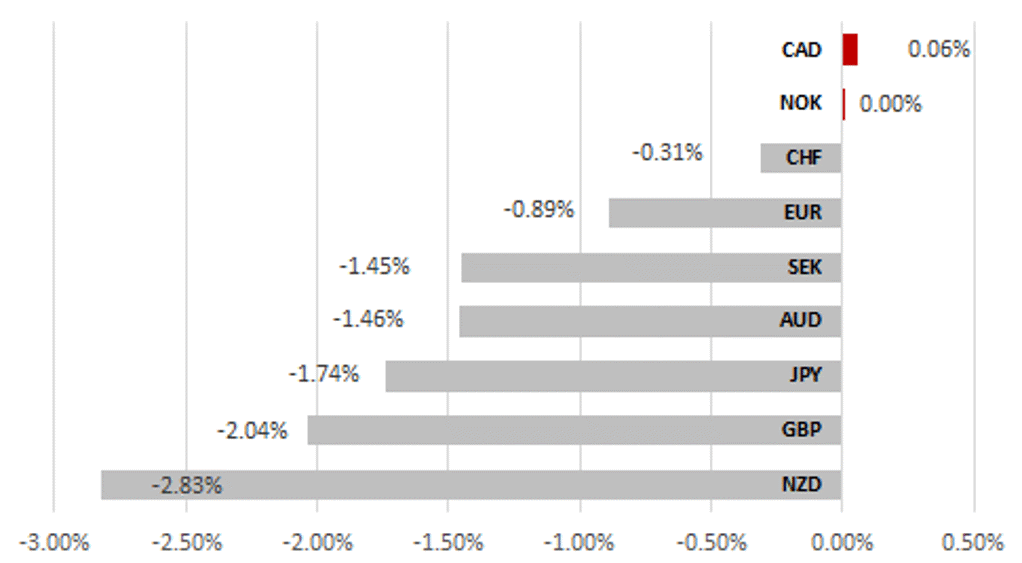

USD REBOUNDS ACROSS MOST OF G10 FX

Source: Bloomberg, 13:50 BST, 21st July 2023 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining our long EUR/USD and AUD/NZD trade ideas.

JPY Flows:

This week we look at the monthly Balance of Payments data with the May data released last week. Japan’s external position is improving notably – on the trade side due to a narrowing energy deficit and on the investment income side with an all-time record portfolio interest income surplus.

Short Term Fair Value Modelling:

Over the past week our signals identify an exhaustion of positive momentum across some of G10 FX. EUR, GBP and CHF (USD base) are currently signalling strong long-term positive momentum. However, their short-term (30-day) momentum is already trending towards the downside signalling exhaustion. We recommend paring back long EUR, GBP and CHF positions.

FX Views

EUR/USD: Will upcoming ECB & Fed policy updates prove decisive?

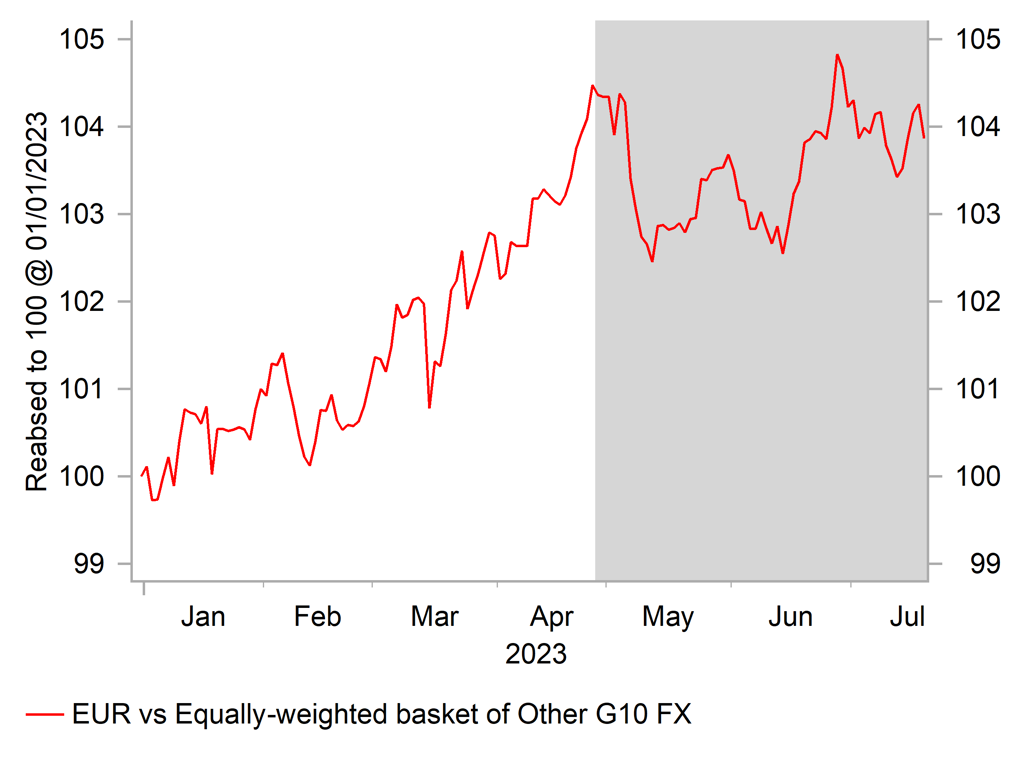

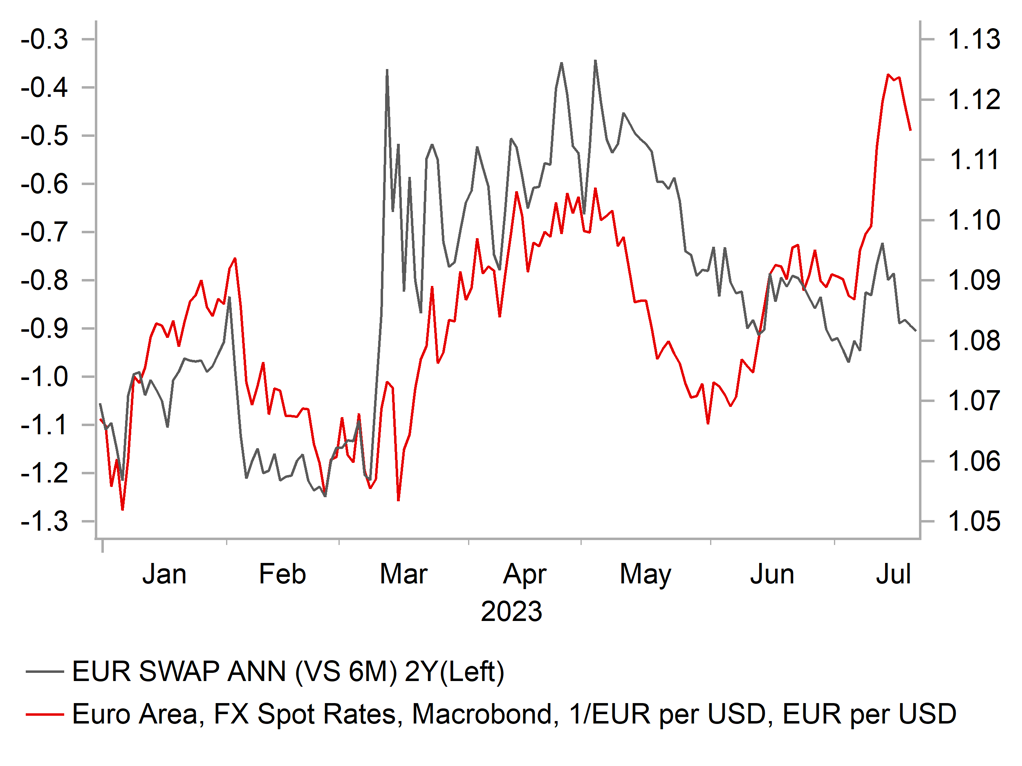

The EUR has corrected modestly lower against the USD over the past week. After hitting an intra-day high of 1.1276 on 18th July, EUR/USD has fallen back towards the 1.1100-level. It has been driven mainly by a broad-based rebound for the USD following last week’s heavy sell-off triggered by weaker US inflation reports that resulted in the dollar index falling to a fresh year to date low of 99.578 on 14th July. In contrast, the EUR has been consolidating at higher levels against our equally-weighted basket of other G10 currencies in recent months. It follows the period of EUR outperformance between February and April. In light of recent price action, we are confident now that EUR/USD has moved into a new higher trading between 1.1000 and 1.1500 after spending the majority of the time trading between 1.0500 and 1.1000 during the 1H of this year.

The USD has staged a modest rebound over the past week supported by a pick-up in US yields. The 2-year US Treasury bond yield has risen by just over 20bps since last week’s low. It mainly reflects US rate market participants scaling back expectations for how much the Fed is likely to cut rates next year while there has been little change to expectations for the Fed to deliver one final hike this month. The implied yield on the December 2024 Fed Fund futures contract has increased by around 30bps since the recent low from 13th July to around 4.09%. Even after the adjustment higher over the past week, the US rate market is still expecting the Fed to cut rates by over 100bps next year to lower the policy rate to less restrictive levels. Those expectations for Fed rate cuts next year are proving sensitive to incoming economic data at the current juncture as market participants anticipate that we are approaching a turning point for Fed policy.

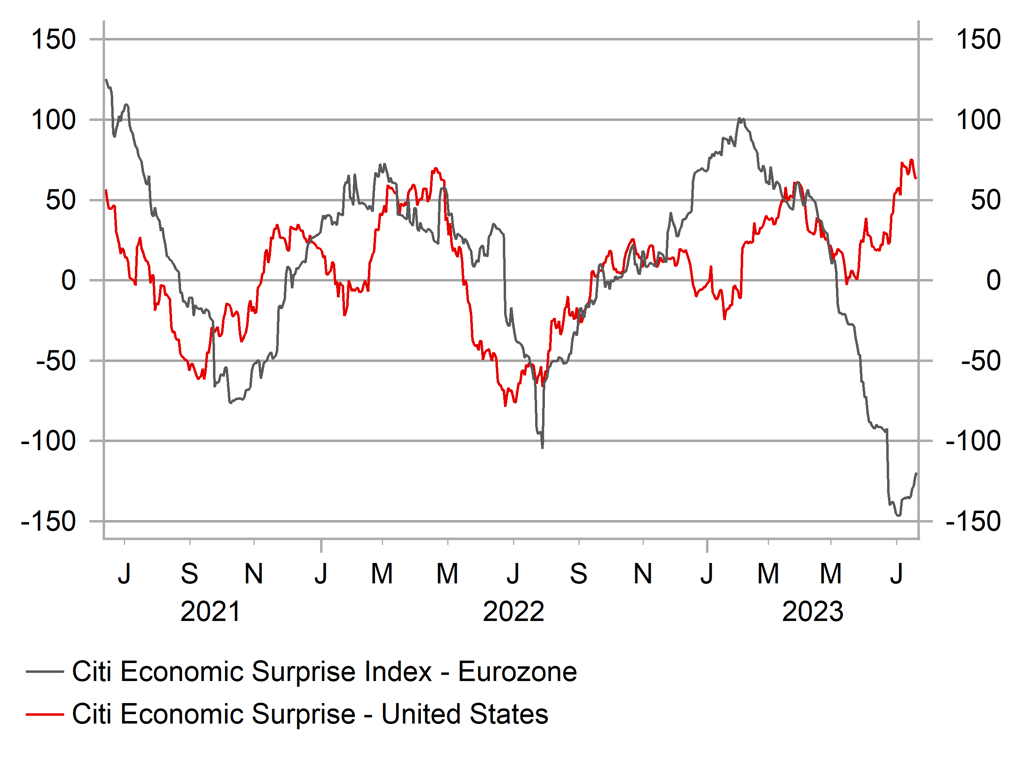

The case for lower rates next year has been driven by building evidence of slowing US inflation which has been more important the recent run of stronger of US economic data releases. According to Bloomberg, it has been the strongest run of positive US economic data surprises since in early 2021. The Atlanta Fed’s GDPNow Forecast has risen up to 2.4% which is defying prior expectations for the US economy to have expanded well below potential through the 1H of this year. It poses upside risks to Bloomberg’s current consensus forecast for GDP growth in Q2 of 1.3%.

EUR HAS BEEN CONSOLIDATING AT STRONGER LEVELS

Source: Bloomberg, Macrobond & MUFG GMR

CYCLICAL DIVERGENCE FAILED TO DRAG EUR LOWER

Source: Bloomberg, Macrobond & MUFG GMR

The resilience of the US economy to higher rates will make the Fed reluctant to prematurely signal the end to their rate hike cycle. As a result, the Fed will want to see more evidence that inflation continues to slow. In these circumstances, we expect the Fed to deliver one more 25bps hike at next week’s FOMC meeting but we doubt the Fed will feel confident enough at this stage to drop their current plans for one further hike later this year. The biggest downside risk for the USD in the week ahead would if the Fed signalled clearly that rates have reached sufficiently restrictive levels although that is not our base scenario. Instead, we expect the Fed to deliver that policy signal at either the Jackson Hole Symposium in late August and/or at the September FOMC meeting when it has received further evidence that inflation has continued to slow in the coming months. If the Fed sticks to their plans for a second rate hike later this year it could trigger an extension of the USD’s rebound over the past week although it should prove short-lived. US rate market participants are likely to remain sceptical over the need for further hikes beyond next week in light of slowing US inflation. We expect US yields to adjust lower as US inflation slows further even if fears over a sharper slowdown in US growth continues to ease. A softer landing for the US economy alongside slowing US inflation is the worst outcome for the US dollar.

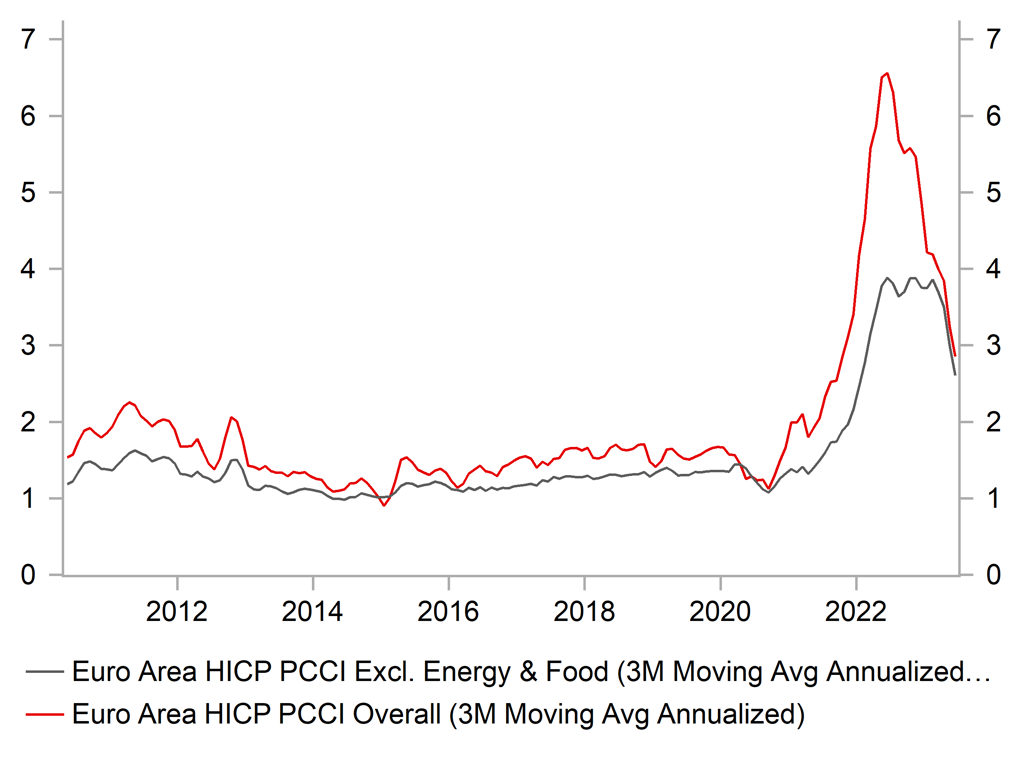

The ECB is also scheduled to hold their policy meeting in the week ahead. We expect a similar outcome to the Fed’s policy update. The ECB has signalled clearly that they are highly likely to deliver another 25bps hike in the week ahead. While headline inflation in the euro-zone is slowing more sharply, the ECB has turned its attention to core inflation when setting monetary policy by emphasising that it is more important for assessing the risk of inflation proving more persistent. Headline inflation has already fallen sharply by 5.1ppts from the peak to 5.5% in June. Yet core inflation remains elevated and was only 0.2ppt lower than the peak at 5.5% in June. As a result, we expect the ECB to leave the door open to delivering one more 25bps hike in September or Q4. However, we are not expecting the ECB to strongly commit to another hike at this stage by emphasising that future decisions will be data dependent. It could trigger some initial disappointment given the euro-zone rate market is pricing in around 39bps of hikes by September and 47bps by December. It poses some modest downside risk for the EUR in the week ahead.

In these circumstances, we continue to believe that EUR/USD has moved into a new higher trading range between 1.1000 and 1.1500. On balance, we believe that risks for the pair are skewed to the downside in the week ahead from the ECB and Fed’s policy updates. Assuming that the Fed does not signal that next week’s hike is the last in the cycle and the ECB does not strongly commit to one more hike later this year. However, support at 1.1000 should hold and provide an opportunity to build long positioning in anticipation of a move towards the top of the range in the coming months.

USD WEAKNESS FRONT-RUNNING YIELD SPREADS

Source: Bloomberg, Macrobond & MUFG

EZ INFLATION PERSISTENCE MEASURES ROLLING OVER

Source: Bloomberg, Macrobond & MUFG

JPY: An update on our BoJ YCC policy change view

In this publication two weeks ago (here) we outlined our reasoning for the BoJ announcing a policy change at the meeting next Friday. On that day and for the following week speculation had been increasing but that speculation is now reversing. The 10-year swap rate from 6th July through to 14th July advanced 16bps from a low of 0.55%. That move higher started to reverse this week and a big drop today has seen a near full retracement of the move higher with the rate back at 0.58% today. Do we hold the same level of conviction of a change in YCC next week as we held before? No, is the honest answer although we do not believe it is correct for the entire more in rates to have fully reversed. USD/JPY is 1.2% higher today.

Newswire headlines on Tuesday reported Governor Ueda as stating that the price stability goal was still “some distance away”. This prompted the first leg of easing speculation on a YCC change. However, the comment was made in the context of that being the “premise” of the current monetary stance. He did then add that this “premise” or assumption is assessed at every meeting. Today both Bloomberg and Reuters has quoted “BoJ sources” as stating that the BoJ sees no need for a YCC change at this point. The sharp retracement of yields and yen strength means market participants are giving this a lot of credibility. That seems reasonable and as stated above, it lowers our conviction of a move. However, the “sources” do repeat what Governor Ueda implied – that the final assessment and decision will be made at the meeting. While Reuters and Bloomberg can be used to feed information to the markets, it is more common for the ECB than the BoJ. It is interesting that there has been no similar news coming from the Japanese newswires that are more commonly used by the BoJ.

We were surprised to see today’s sourced comments. Given the YCC framework is essentially a form of a fixed rate regime, offering guidance on its end is unwise at it would merely fuel speculation and force the BoJ into increased JGB purchases. Providing guidance on YCC not ending is also unwise and creates a ‘rod for its own back’ going forward possibly compelling the BoJ to more guidance. Developments of late do provide an opportunity for a shift. Full-time scheduled wage growth jumped to 2.2% in data this month, consistent with price stability according to Governor Ueda. Falling inflation and long-term yields globally would be helpful in moving away from YCC with risks of a disruptive move higher in JGB yields lower.

We admit that our conviction on a change to YCC is lower today although we still cannot rule out a move given the inevitable surprise likely involved in shifting away from YCC. Our current end-Q3 of 136.00 incorporated our view of a YCC change and implies a big drop on a surprise YCC change. The JPY risk is certainly now skewed to a bigger JPY gain than a JPY loss on an unchanged YCC announcement.

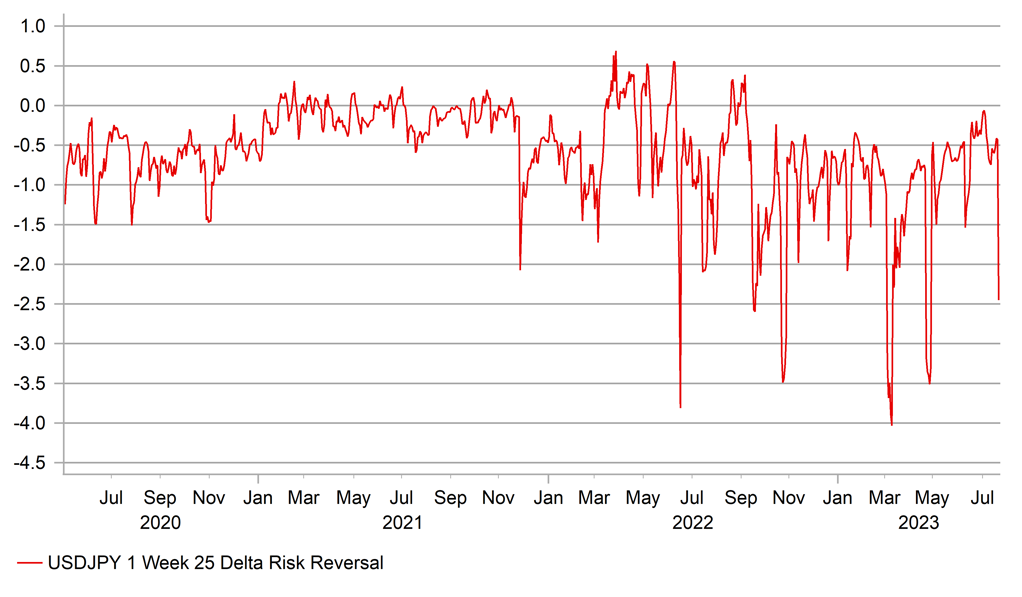

USDJPY RR STILL SHARPLY SKEWED PUTS OVER CALLS

Source: Bloomberg, Macrobond & MUFG

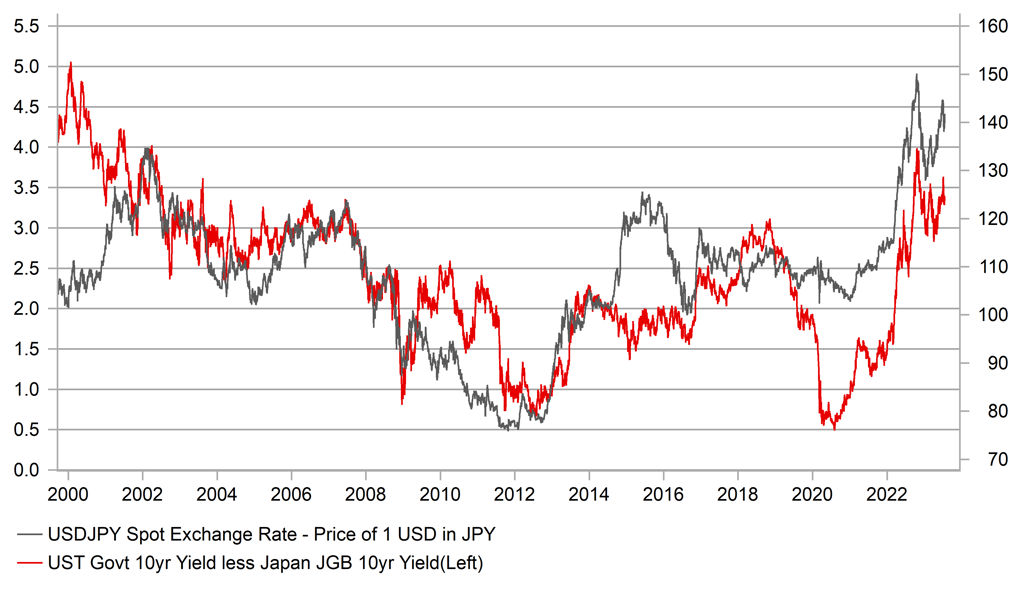

10YR US-JP SPREAD ALREADY POINTS TO LOWER $/JPY

Source: Bloomberg, Macrobond & MUFG

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

07/24/2023 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Jul P |

-- |

43.4 |

!!! |

|

EUR |

07/24/2023 |

09:00 |

HCOB Eurozone Services PMI |

Jul P |

-- |

52.0 |

!!! |

|

GBP |

07/24/2023 |

09:30 |

S&P Global/CIPS UK Manufacturing PMI |

Jul P |

-- |

46.5 |

!!! |

|

GBP |

07/24/2023 |

09:30 |

S&P Global/CIPS UK Services PMI |

Jul P |

-- |

53.7 |

!!! |

|

USD |

07/24/2023 |

14:45 |

S&P Global US Composite PMI |

Jul P |

-- |

53.2 |

!! |

|

EUR |

07/25/2023 |

09:00 |

Germany IFO Business Climate |

Jul |

-- |

88.5 |

!! |

|

EUR |

07/25/2023 |

09:00 |

Euro Area Bank Lending Survey |

!! |

|||

|

USD |

07/25/2023 |

14:00 |

S&P CoreLogic CS 20-City YoY NSA |

May |

-- |

-1.7% |

!! |

|

USD |

07/25/2023 |

15:00 |

Conf. Board Consumer Confidence |

Jul |

112.0 |

109.7 |

!! |

|

AUD |

07/26/2023 |

02:30 |

CPI YoY |

Jun |

5.5% |

5.6% |

!!! |

|

USD |

07/26/2023 |

15:00 |

New Home Sales |

Jun |

721k |

763k |

!! |

|

CAD |

07/26/2023 |

18:30 |

BoC Releases Summary of Deliberations |

!!! |

|||

|

USD |

07/26/2023 |

19:00 |

FOMC Rate Decision (Upper Bound) |

5.50% |

5.25% |

!!! |

|

|

USD |

07/26/2023 |

19:30 |

Fed Chair Powell holds press conference |

||||

|

EUR |

07/27/2023 |

13:15 |

ECB Deposit Facility Rate |

3.75% |

3.50% |

!!! |

|

|

USD |

07/27/2023 |

13:30 |

GDP Annualized QoQ |

2Q A |

1.8% |

2.0% |

!!! |

|

USD |

07/27/2023 |

13:30 |

Durable Goods Orders |

Jun P |

0.4% |

1.8% |

!! |

|

USD |

07/27/2023 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

07/27/2023 |

13:30 |

Advance Goods Trade Balance |

Jun |

-$91.5b |

-$91.1b |

!! |

|

EUR |

07/27/2023 |

13:45 |

President Lagarde Holds Press Conference |

!!! |

|||

|

JPY |

07/28/2023 |

00:30 |

Tokyo CPI YoY |

Jul |

2.9% |

3.1% |

!! |

|

JPY |

07/28/2023 |

Tbc |

BOJ 10-Yr Yield Target |

-- |

0.0% |

!!! |

|

|

AUD |

07/28/2023 |

02:30 |

Retail Sales MoM |

Jun |

- |

0.7% |

!! |

|

EUR |

07/28/2023 |

06:30 |

France GDP QoQ |

2Q P |

-- |

0.2% |

!!! |

|

NOK |

07/28/2023 |

07:00 |

Retail Sales W/Auto Fuel MoM |

Jun |

-- |

1.2% |

!! |

|

EUR |

07/28/2023 |

07:45 |

France CPI EU Harmonized YoY |

Jul P |

-- |

5.3% |

!!! |

|

EUR |

07/28/2023 |

13:00 |

Germany CPI EU Harmonized YoY |

Jul P |

-- |

6.8% |

!!! |

|

USD |

07/28/2023 |

13:30 |

Employment Cost Index |

2Q |

1.1% |

1.2% |

!!! |

|

CAD |

07/28/2023 |

13:30 |

GDP MoM |

May |

-- |

0.0% |

!! |

|

USD |

07/28/2023 |

13:30 |

PCE Deflator YoY |

Jun |

3.1% |

3.8% |

!!! |

|

USD |

07/28/2023 |

15:00 |

U. of Mich. Sentiment |

Jul F |

72.6 |

72.6 |

!! |

Key Events:

- It will be an important week for central bank policy updates. The Fed (Wed), ECB (Thurs) and BoJ (Fri) are all scheduled to hold their latest policy meetings. We expect the Fed to deliver one final 25bps rate hike in the week ahead. However, we do not expect the Fed to signal that it is the final hike in the cycle. The Fed will want to see more evidence that inflation is continuing to slow before pausing their hiking cycle in September. The release of the latest US Employment Cost Index for Q2 and PCE deflator report for June will be important to assess if upside risks to the inflation outlook are continuing to ease.

- Similarly, we expect the ECB to deliver another 25bps hike in the week ahead to lift the deposit rate to 3.75% We expect the ECB to continue to express concern that core inflation remains elevated which increases the risk of inflation proving more persistent. The forward guidance is likely to leave the door open to another hike in September but we do not expect a strong signal to indicate that a hike is more likely than not at the current juncture.

- Our analysts in Tokyo expect the BoJ to make changes to YCC policy settings in the week ahead. We believe it is a close call between widening the band from +/-0.5% to +/-1.0% or completely abandoning YCC that allows the 10-year JGB yield to move the current cap at 0.5%. A decision from the BoJ to adjust YCC would still be accompanied by a message from the BoJ that it is not in a rush to remove negative rates as well until they are confident that inflation can be sustained at their 2.0% target.