To read a full report, please download PDF

Hawkish Fed hold reinforces USD rally

FX View:

It has been a busy week for G10 FX central bank updates. The USD’s upward momentum has been reinforced by the Fed’s increased confidence in the outlook for a soft landing for the US economy, and the US rate market’s willingness to price in higher for longer outlook for next year. The main challenge to that view in the week ahead will be posed by the release of revisions to US GDP data and the US PCE deflator report for August. In contrast, the BoE has followed the ECB and provided a stronger indication that their rate hike cycle is close to or at an end. When combined with slowing growth momentum in Europe, domestic currencies remain under downward pressure against the USD. The BoJ was wary of further encouraging expectations for earlier rate hikes which places more pressure on the government to prevent/slowdown JPY weakness through intervention.

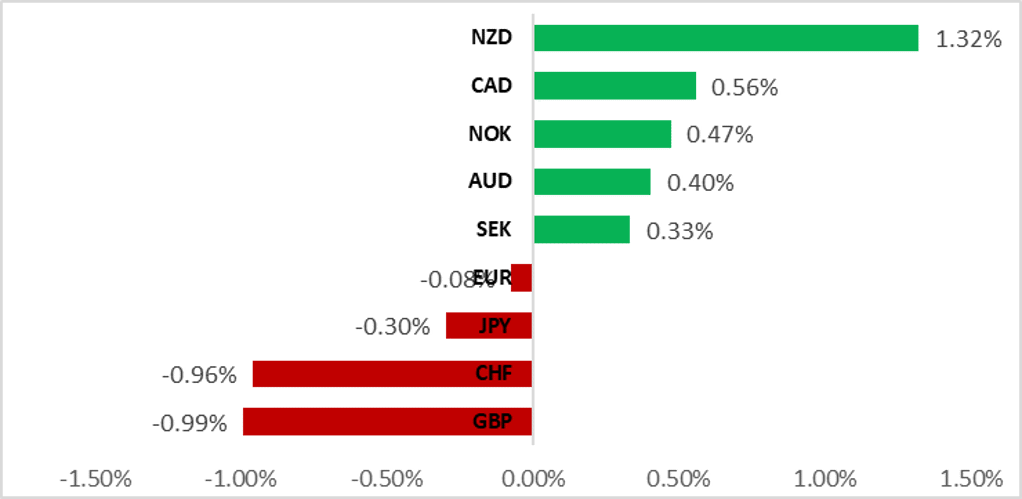

G10 COMMODITY FX CONTINUES TO OUTPERFORM

Source: Bloomberg, 14:30 GMT, 22nd September 2023 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining a short GBP/CAD and long USD/SEK trade ideas.

IMM Positioning:

The latest IMM weekly positioning data covering the week to 12th September revealed that Leveraged Funds cut short USD positions for the third consecutive week. The biggest short USD positions were held against the GBP and MXN,. Those positions were partly offset by the long USD positions held against the JPY and ZAR

Central Bank Price Action Analysis:

Our back testing analysis reveals that the GBP sell off after the BoE’s dovish policy surprise is likely to continue in the week ahead. Similarly, we found that the USD’s gains after the Fed’s policy meeting are likely to continue in the week ahead.

FX Views

Fed & US rate market buying into US soft landing & higher for longer

The USD has continued to extend its advance over the past week as US yields hit new cyclical highs both at the short and long end of the curve. The 10-year US Treasury yield has just hit 4.50% for the first time since November 2007 as it moves closer to the pre-Global Financial Crisis peak of 5.32% from June 2007. The 10-year US Treasury yield has now risen by around 1.25 ppts since the low in April which has been encouraging a stronger USD. The ongoing adjustment higher in US yields and the USD has been reinforced this week by Fed’s hawkish hold (click here). The Fed has displayed more confidence in their outlook for a softer landing for US economy.

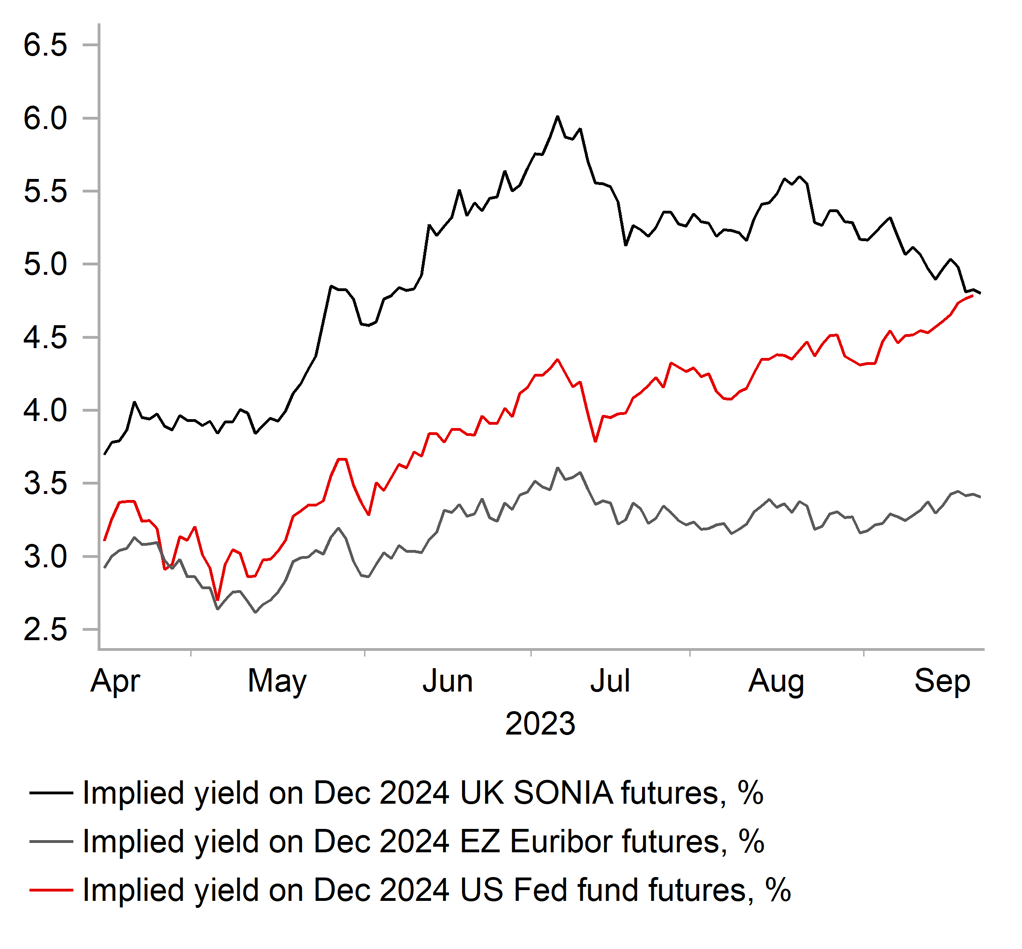

The Fed’s updated projections revealed a more moderate slowdown for the US economy when GDP is expected to slow to 1.5% in 2024 down from 2.1% this year. The more moderate growth slowdown means that less spare capacity is now expected to open up resulting in the unemployment rate rising to a lower peak of 4.1% and making the Fed more wary about lowering rates next year. FOMC participants median projection for the policy rate at the end of next year has been raised to signal only 50bps of cuts compared to 100bps in the June projections. The US rate market has bought into the Fed’s higher longer view this week even though it appears almost too good to be true. The unemployment rate has already risen by 0.4ppts from the low in January and over the next couple of years is expected to rise by only a further 0.3ppt. We still expect the Fed to deliver larger rate cuts next year than planned on the back of inflation falling more quickly and weaker growth, although the recent resilience of the US economy is currently challenging that view. The near-term outlook for US growth also faces challenges from i) the restart of student loan repayments with the 1st October deadline that is fast approaching, ii) the risk of another government shutdown from 1st October if Congress fails to pass legislation next week to renew funding, and iii) the United Auto Workers strike that could be a noticeable drag on Q4 GDP and negatively impact the NFP report for October. Those downside risks to growth support our outlook for the Fed to leave rates on hold rather than following through on plans to deliver one last hike later this year.

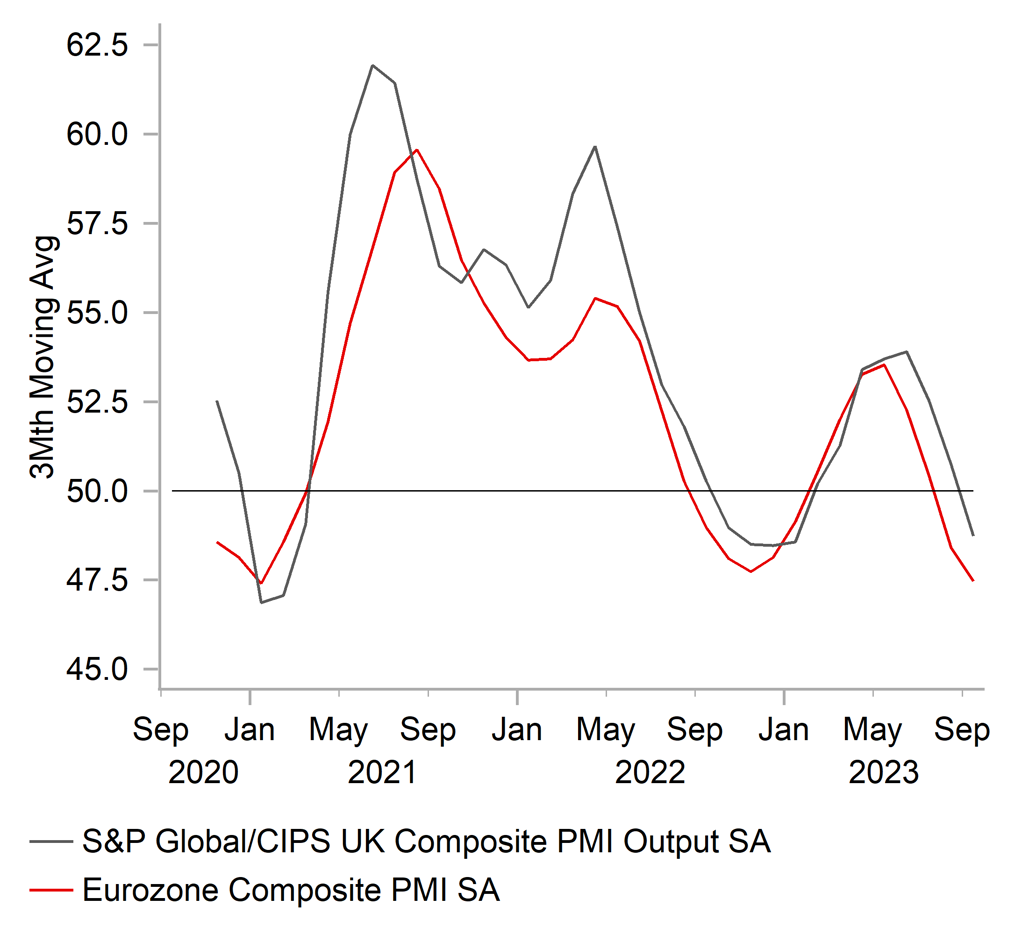

The move higher in US yields has been placing more upward pressure on the USD against European currencies and the JPY. The release of the latest European PMI surveys for September have signalled that weak growth has continued in Q3. The euro

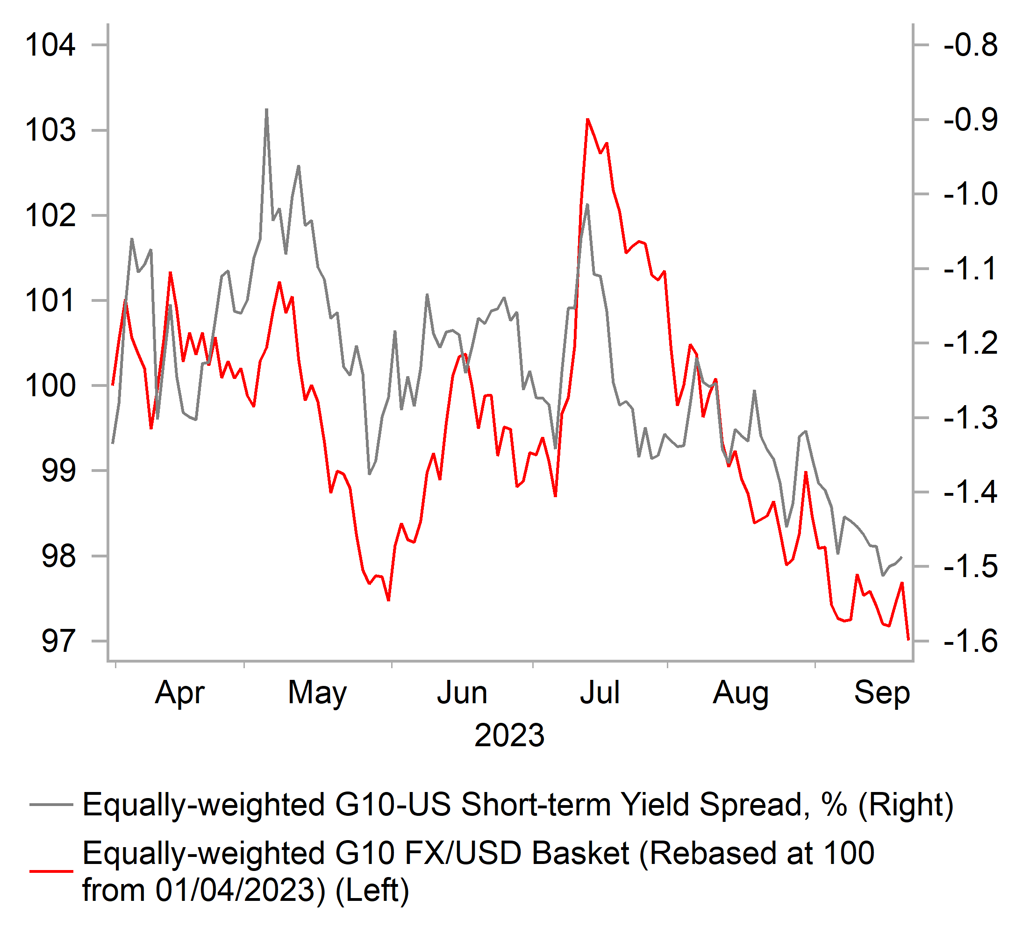

YIELD SPREADS MOVING IN FAVOUR OF USD

Source: Bloomberg, Macrobond & MUFG GMR

SCALING BACK EXPECTATIONS FOR FED CUTS IN 2024

Source: Bloomberg, Macrobond & MUFG GMR

zone composite PMI survey reading improved slightly by 0.4 point to 47.1 in September driven by improving sentiment in the German service sector (49.8) which offset more acute weakness in the French services sector (43.9). For the quarter as a whole, the euro-zone composite PMI has averaged 47.5 in Q3 which is a marked step down from 52.3 in Q2 and highlights the risk of another quarter of negative growth. A similar picture is evident in the UK where the composite PMI fell to 46.8 in September and averaged 48.7 in Q3 down from 53.9 in Q2. The European PMI surveys are now at levels which historically are more consistent with the BoE and ECB cutting rates. It supports our view that the BoE (click here) and ECB (click here) have now reached the end of their rate hike cycles. The combination of weakening cyclical momentum and the peaking rate hike cycles, leaves EUR and GBP vulnerable to further weakness in the near-term if rate cut speculation continues to build heading into next year. The euro-zone rate market is currently pricing in around -60bps of ECB cuts by the end of next year and UK rate market around -39bps of cuts.

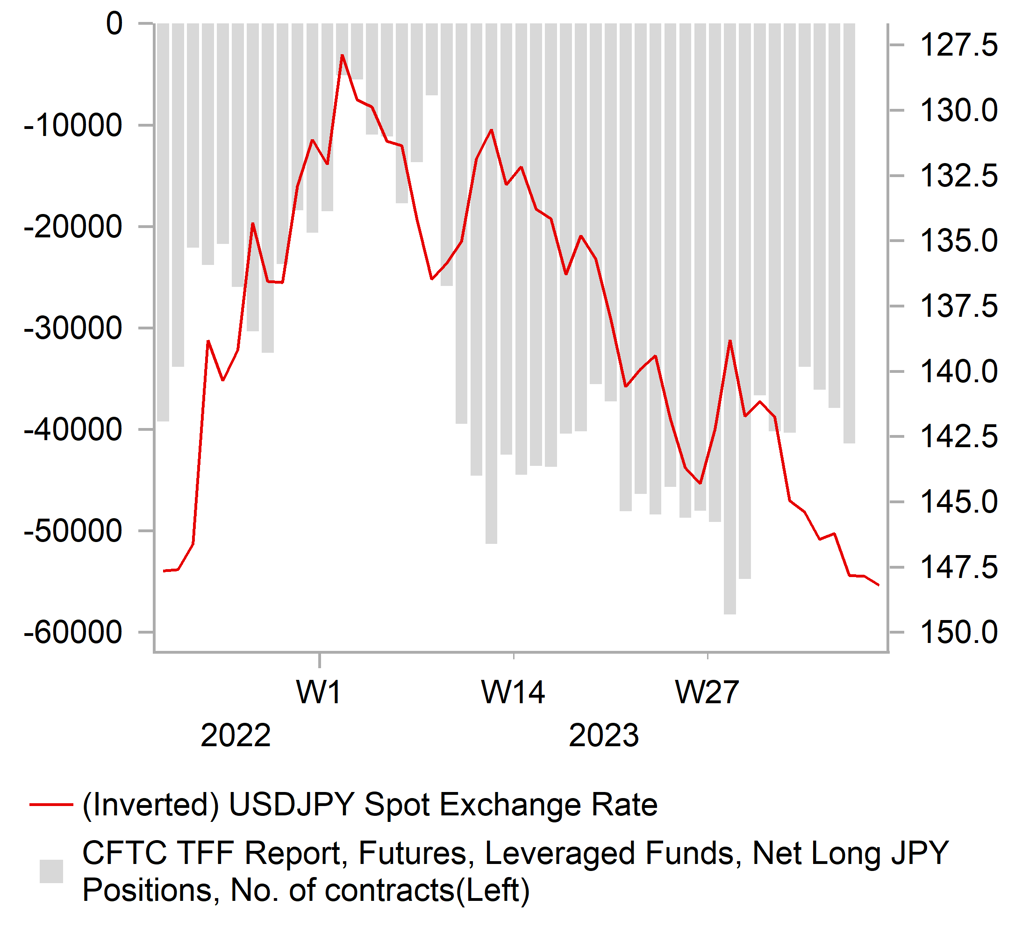

While the EUR and GBP have fallen to fresh lows against the USD over the past week, the JPY has remained relatively more stable supported by the heightened risk of intervention from Japan. It has helped to keep USD/JPY trading close to the 148.00-level even as US yields hit fresh cyclical highs and the BoJ choose not to push back more strongly against JPY weakness. At today’s policy meeting the BoJ left their policy settings unchanged as widely expected but the comments from Governor Ueda in the accompanying press conference were non-committal over plans to tighten policy further. He stated only that the BoJ will mull adjusting policy if the price goal is in sight although he can’t say when that will happen. He does not believe that that the distance to ending negative rates has changed much. The tone of the comments suggests that Governor Ueda was keen not to further encourage market participants to bring forward expectations for the timing of the first rate hike. There is currently around 10bps of BoJ hikes priced in by Q1 of next year. The lack of pushback from the BoJ leaves the JPY vulnerable to further weakness heading into next week, and places the onus more on the Japanese government if they want to prevent/slow the pace of JPY weakness. Comments from Prime Minister Kishida and Finance Minister Suzuki ahead of the BoJ’s policy meeting highlight that the risk of intervention to support the JPY remains elevated. They both stated that they would take necessary action against excessive currency moves without excluding any option.

In these circumstances, we believe that upward momentum continues to favour further USD upside vs. FX majors while the US economy is still outperforming. The heightened risk of intervention should though remain a dampener for USD/JPY upside.

WEAKENING GROWTH OUTLOOK IN EUROPE

Source: Bloomberg, Macrobond & MUFG GMR

INTERVENTION RISK IS DISCOURAGING JPY SELLING

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

09/25/2023 |

09:00 |

German IFO Business Climate |

Sep |

-- |

85.7 |

!! |

|

EUR |

09/26/2023 |

08:00 |

ECB's Lane speaks |

!!! |

|||

|

USD |

09/26/2023 |

15:00 |

New Home Sales |

Aug |

700k |

714k |

!! |

|

USD |

09/26/2023 |

15:00 |

Conf. Board Consumer Confidence |

Sep |

106.5 |

106.1 |

!! |

|

AUD |

09/27/2023 |

02:30 |

CPI YoY |

Aug |

-- |

4.9% |

!!! |

|

EUR |

09/27/2023 |

09:00 |

M3 Money Supply YoY |

Aug |

-- |

-0.4% |

!! |

|

USD |

09/27/2023 |

13:30 |

Durable Goods Orders |

Aug P |

-0.4% |

-5.2% |

!! |

|

AUD |

09/28/2023 |

02:30 |

Retail Sales MoM |

Aug |

-- |

0.5% |

!! |

|

NOK |

09/28/2023 |

07:00 |

Retail Sales W/Auto Fuel MoM |

Aug |

-- |

-0.8% |

!! |

|

EUR |

09/28/2023 |

10:00 |

Consumer Confidence |

Sep F |

-- |

-- |

!! |

|

EUR |

09/28/2023 |

13:00 |

German CPI EU Harmonized YoY |

Sep P |

-- |

6.4% |

!!! |

|

CAD |

09/28/2023 |

13:30 |

Payroll Employment Change - SEPH |

Jul |

-- |

47.7k |

!! |

|

USD |

09/28/2023 |

13:30 |

GDP Annualized QoQ |

2Q T |

2.4% |

2.1% |

!!! |

|

USD |

09/28/2023 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

09/28/2023 |

15:00 |

Pending Home Sales MoM |

Aug |

-- |

0.9% |

!! |

|

USD |

09/28/2023 |

21:00 |

Fed's Powell speaks |

!!! |

|||

|

JPY |

09/29/2023 |

00:30 |

Tokyo CPI YoY |

Sep |

2.9% |

2.9% |

!! |

|

JPY |

09/29/2023 |

00:30 |

Jobless Rate |

Aug |

2.6% |

2.7% |

!! |

|

JPY |

09/29/2023 |

00:50 |

Retail Sales MoM |

Aug |

0.9% |

2.1% |

!! |

|

JPY |

09/29/2023 |

00:50 |

Industrial Production MoM |

Aug P |

-0.7% |

-1.8% |

!! |

|

GBP |

09/29/2023 |

07:00 |

GDP QoQ |

2Q F |

-- |

0.2% |

!!! |

|

EUR |

09/29/2023 |

07:45 |

France CPI EU Harmonized YoY |

Sep P |

-- |

5.7% |

!!! |

|

EUR |

09/29/2023 |

07:45 |

France Consumer Spending MoM |

Aug |

-- |

0.3% |

!! |

|

EUR |

09/29/2023 |

08:55 |

Germany Unemployment Change (000's) |

Sep |

-- |

18.0k |

!! |

|

GBP |

09/29/2023 |

09:30 |

M4 Money Supply YoY |

Aug |

-- |

-0.9% |

!! |

|

EUR |

09/29/2023 |

10:00 |

CPI Estimate YoY |

Sep |

-- |

5.2% |

!!! |

|

CAD |

09/29/2023 |

13:30 |

GDP MoM |

Jul |

-- |

-0.2% |

!!! |

|

USD |

09/29/2023 |

13:30 |

PCE Deflator YoY |

Aug |

-- |

3.3% |

!!! |

|

USD |

09/29/2023 |

15:00 |

U. of Mich. Sentiment |

Sep F |

67.7 |

67.7 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- After the busy week of central bank updates, the week ahead should be a quieter one for the FX market. There are no G10 central bank updates. Instead market participants will be listening closely to comments from ECB and Fed officials as they look to reinforce the updated messages from their latest policy meetings. Fed Chair Powell is scheduled to speak on Thursday although it is not clear he will cover the outlook for monetary policy. In Europe, ECB Chief Economist Lane is scheduled to speak on Tuesday on monetary policy and macroeconomics. At recent policy meetings, both the ECB and Fed signaled that they plan to keep rates at high levels to bring inflation down to target.

- The main economic data releases in the week ahead are: i) the latest Australian CPI report for August, ii) US GDP report for Q2 including the comprehensive update of the National Economic Accounts, iii) euro-zone CPI report for September, iv) Canadian GDP report for July and v) US PCE deflator report for August.

- Headline inflation in Australian has slowed more quickly than expected in recent months which has dampened expectations for further RBA rate hikes this year. A significant upside inflation surprise would be required to change market expectations back in favour of another hike and to offer more support for the AUD in the week ahead.

- In the US, the latest PCE deflator report is expected to provide further evidence that core inflation has slowed in recent months. The Fed acknowledged recent developments by modestly lowering their core PCE forecast for this year, but is less convinced that core inflation will continue to slow closer to their 2.0% if the US economy continues to remain resilient to higher rates. The GDP revisions could show a downward adjustment to bring GDP growth more in line with much weaker GDI growth.