To read a full report, please download PDF

USD sustained strength unlikely

FX View:

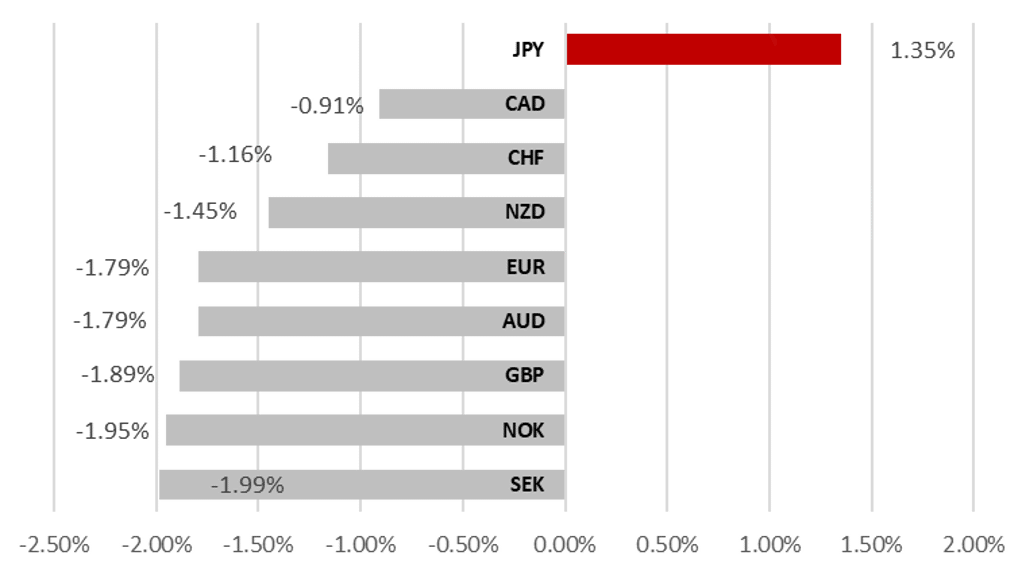

The US dollar has rebounded today and is stronger over the week as well following weakness against most G10 currencies last week. This pattern of moves back and forth between strength and weakness may well persist going forward. We have arrived at a point in tightening cycles where determining how much further tightening is required is more difficult to know and hence central banks and markets will be more sensitive to incoming economic data. Today is a case in point with sharp EUR depreciation following weak PMIs. But data in the US could also start to weaken and we maintain it is more likely than not that the FOMC will continue with its pause in tightening – if we are correct we see that as an influence in weakening the dollar, assuming we do not get a dramatic deterioration in growth outside of the US. So US dollar gains could reverse if upcoming economic data from the US backs up the case for the FOMC extending its pause in tightening policy further.

USD REBOUNDS FROM MONTHLY LOWS

Source: Bloomberg, 13:30 GMT, 23rd June 2023 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining long EUR/USD and AUD/NZD trade ideas.

JPY Flows:

This week we cover the high frequency flow data from Japan which has revealed further buying of foreign bonds by Japanese investors. Relative stability in global rates is helping improve demand. Foreign investors continued buying Japan stocks – the 12th consecutive week to total nearly JPY 10 trillion.

GMR Recession modelling:

Our US recession indicator identifies a 78.1% probability of the US entering a recession in the next 12 months. While our preliminary UK and Eurozone recession models give a rough estimate of 93.3% and 59.9% respectively.

FX Views

EUR: Policy transition will result in FX swings

The drop in EUR/USD by close to 1% today highlights the greater FX sensitivity to incoming economic data that increasingly influence short-term rate expectations. Central banks have now arrived at a point of transition from hiking whatever the incoming data revealed to being much more influenced by the strength/weakness of data given the greater level of policy tightening now in place. Our EUR/USD higher view is not based on a positive macro view in Europe – we expect close to flat growth – but more signs of resilience relative to weakening growth in the US. But that resilience certainly may not be as apparent as expected. The France Services PMI drop from 52.5 to 48.0 is indicative of a contraction in real GDP in the second quarter.

Even before today’s PMI data we thought the GDP forecast updates last week from the ECB looked optimistic. 0.9% growth in 2023 followed by a pick-up to 1.5% next year seems unrealistic to us. Yes, real household incomes will improve due to the sharp reversal of the energy price spike and by the general easing of inflationary pressures going forward, but tightening financial conditions will also increasingly weigh on activity. The latest Bank Lending Survey by the ECB shows a sharp drop in demand for loans from NFCs that is consistent with a contraction in credit growth, which would be the first time since the euro-zone debt crisis. Household demand for loans for house purchases has also collapsed underlining the impact from tightening already.

While the data today certainly raises some doubt over the resilience of the euro-zone economy to avoid further contractions in growth, the market focus could equally shift to questions over growth and policy expectations elsewhere. The US labour market is in our view on the cusp of weakening while the 50bp hike by the BoE yesterday has resulted in the rates market pricing the BoE policy rate creeping over 6%, which we think is unrealistic and will correct once the market absorbs the shock 50bp hike.

We suspect that incoming economic data will increasingly dictate FX moves now that we are approaching the end of tightening cycles. In that context, the PCE inflation, ISM, NFP and CPI data from the US in the coming weeks will determine whether this EUR/USD drop extends further or recovers. Other data suggests weak data is plausible allowing the FOMC to maintain its pause, which would imply an end to the Fed’s tightening cycle – a much more important development than today’s PMI data.

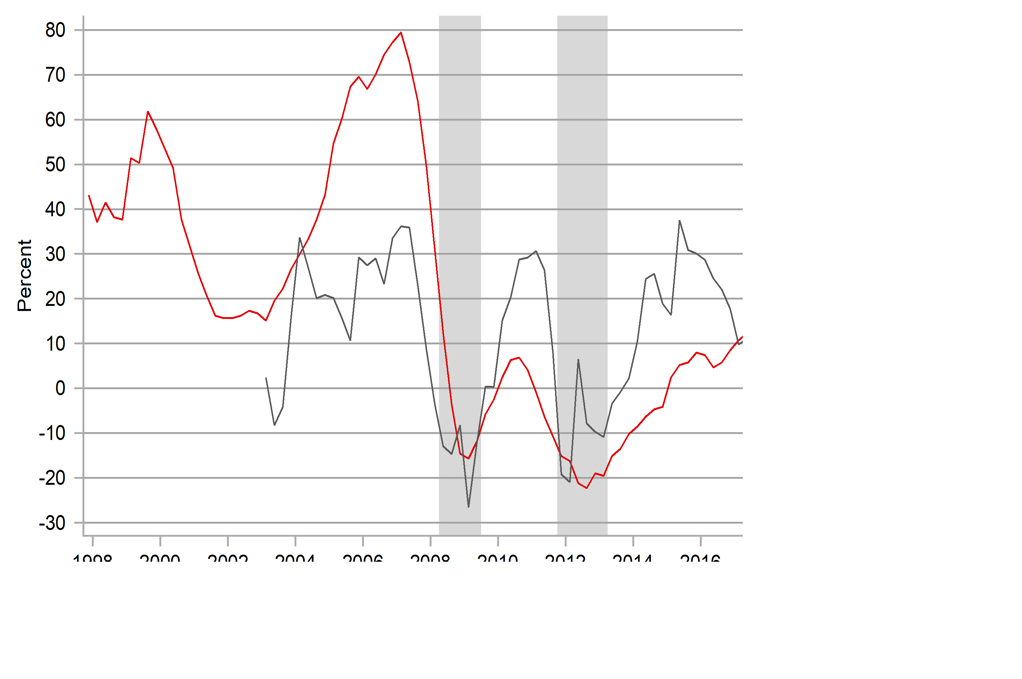

CONTRACTING CREDIT TO NFCS LOOKS LIKELY

Source: Bloomberg, Macrobond

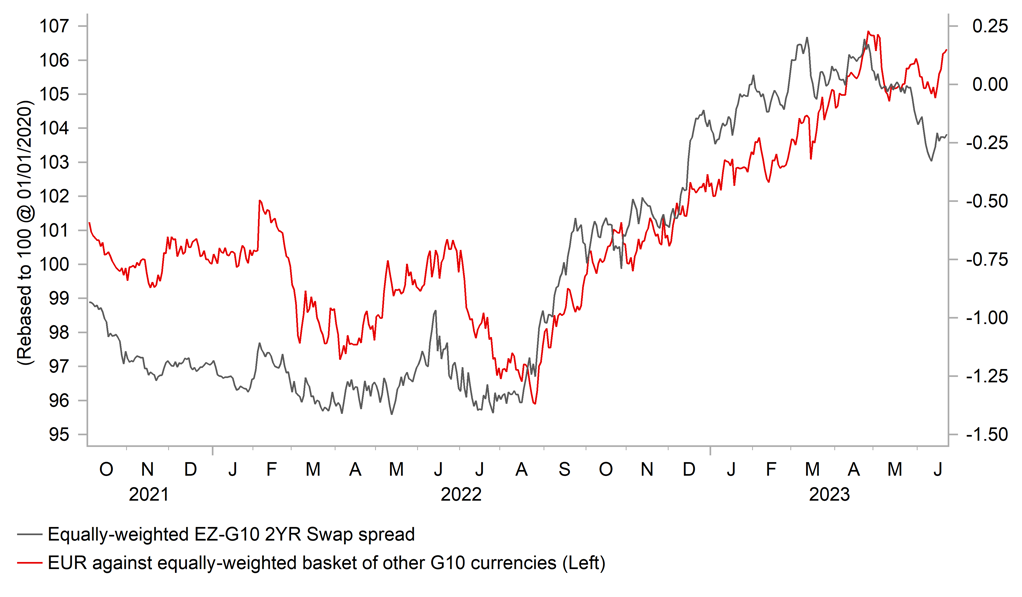

EZ-G10 10YR YIELD SPREAD LIMITING EUR UPSIDE

Source: Bloomberg, Macrobond & MUFG GMR

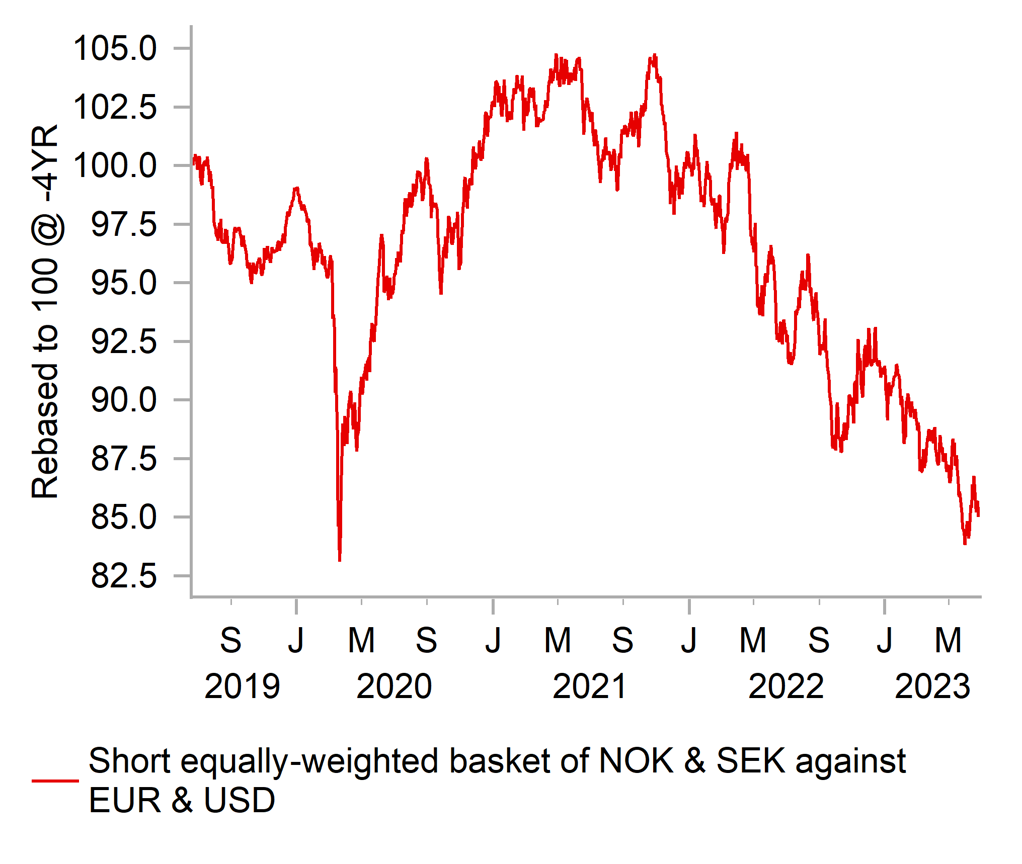

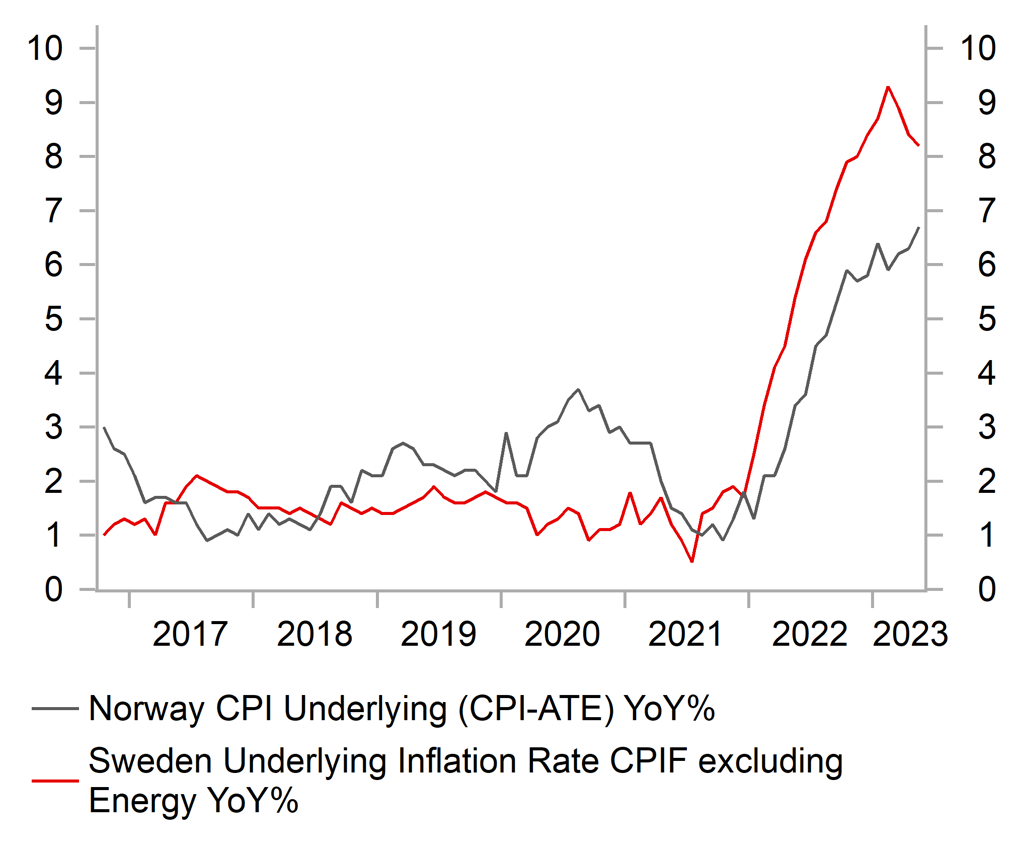

Scandi FX: Hawkish central bank updates failing to turn the tide

After staging a strong rebound through the first half of this month, the NOK has corrected sharply lower again over the past week. EUR/NOK and USD/NOK failed to break below strong support at 11.500 and 10.500-levels respectively in the middle of the month and have since rebounded. The price action over the past week highlights that it remains difficult for the NOK to stage a sustainable rebound in the near-term even after the Norges Bank acted decisively this week to provide more support for the NOK. The Norges Bank backed up their hawkish guidance over the past month by delivering a larger 50 bps hike that lifted the key policy rate to 3.75%. It marked a step up in the pace of rate hikes after two consecutive 25bps hikes at the start of this year. The Norges Bank previously delivered a larger 50bps hike in September of last year. The decision to raise rates by 50bps reflects the Norges Bank’s heightened concern that higher inflation could become “entrenched”. The recent run of markedly higher inflation, higher wage growth and a weaker NOK have reinforced those concerns. The Norges Bank reiterated that if the NOK turns out to be weaker than assumed, a higher than projected policy rate may be needed to bring inflation down to target. The updated projections revealed that the Norges Bank is already planning to raise the policy to a higher peak of 4.25% by the autumn with the next hike likely in August. The Norges Bank did caution though that the full effect of past hikes are not yet fully evident.

The Riksbank is the next G10 central bank scheduled to update policy in the week ahead (Thurs). Market participants will be watching closely to see if the Riksbank follows the Norges Bank by delivering a larger 50bps hike. The Swedish rate market is not convinced that they will deliver a larger hike next week with around 32bps of hikes priced in and 70bps of hikes by the end of this year. While inflation has surprised to the upside recently in Sweden, the scale of the upside surprise is more modest. Core inflation came in at 8.2% in May which was just 0.1ppt higher than the Riksbank’s forecast. More concerning for the Riksbank will be the continued weakening of the SEK which hit a new record low this week against the EUR after EUR/SEK moved above the Global Financial Crisis peak of 11.790 from March 2009. In response to SEK weakness we expect the Riksbank to raise their forecast profile for the policy rate to signal that they plan to deliver at least one more 25bps hike at their next meeting in September. While a hawkish policy update could trigger some initial gains for the SEK, it is unlikely to be sufficient to reverse the current weakening trend on its own.

In these circumstances, the Scandi currencies of the NOK and SEK both remain vulnerable to further weakness in the near-term. The hawkish policy updates from the Norges Bank and Riksbank are not sufficient on their own to trigger a sustained reversal of the weakening trends that have driven both currencies to deeply undervalued levels this year.

SCANDI FX BACK AT COVID SHOCK LOWS

Source: Bloomberg, Macrobond & MUFG

FX PASS THROUGH POSES UPSIDE RISK TO CORE CPI

Source: Bloomberg, Macrobond & MUFG

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

06/26/2023 |

08:15 |

ECB's Villeroy speaks in Paris |

!! |

|||

|

EUR |

06/26/2023 |

09:00 |

Germany IFO Business Climate |

Jun |

90.0 |

91.7 |

!! |

|

EUR |

06/27/2023 |

09:00 |

ECB's Lagarde Speaks in Sintra |

!!! |

|||

|

CAD |

06/27/2023 |

13:30 |

CPI YoY |

May |

-- |

4.4% |

!!! |

|

USD |

06/27/2023 |

13:30 |

Durable Goods Orders |

May P |

-0.9% |

1.1% |

!! |

|

USD |

06/27/2023 |

15:00 |

New Home Sales |

May |

657k |

683k |

!! |

|

USD |

06/27/2023 |

15:00 |

Conf. Board Consumer Confidence |

Jun |

104.0 |

102.3 |

!! |

|

AUD |

06/28/2023 |

02:30 |

CPI YoY |

May |

6.1% |

6.8% |

!!! |

|

EUR |

06/28/2023 |

09:00 |

M3 Money Supply YoY |

May |

-- |

1.9% |

!! |

|

GBP |

06/28/2023 |

11:30 |

BOE's Huw Pill Speaks in Sintra |

!!! |

|||

|

USD |

06/28/2023 |

13:30 |

Advance Goods Trade Balance |

May |

-$92.0b |

-$96.8b |

!!! |

|

EUR |

06/28/2023 |

14:30 |

Fed's Powell, ECB's Lagarde, BOJ's Ueda, & BOE's Bailey speak in Sintra |

!!! |

|||

|

JPY |

06/29/2023 |

00:50 |

Retail Sales MoM |

May |

0.8% |

-1.2% |

!! |

|

AUD |

06/29/2023 |

02:30 |

Retail Sales MoM |

May |

0.1% |

0.0% |

!! |

|

SEK |

06/29/2023 |

08:30 |

Riksbank Policy Rate |

-- |

3.5% |

!!! |

|

|

EUR |

06/29/2023 |

09:00 |

ECB Publishes Economic Bulletin |

!! |

|||

|

EUR |

06/29/2023 |

13:00 |

Germany CPI EU Harmonized YoY |

Jun P |

6.7% |

6.3% |

!!! |

|

USD |

06/29/2023 |

13:30 |

GDP Annualized QoQ |

1Q T |

1.5% |

1.3% |

!! |

|

USD |

06/29/2023 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

JPY |

06/30/2023 |

00:30 |

Tokyo CPI YoY |

Jun |

3.4% |

3.2% |

!! |

|

CNY |

06/30/2023 |

02:30 |

Manufacturing PMI |

Jun |

49.00 |

48.80 |

!!! |

|

CNY |

06/30/2023 |

02:30 |

Non-manufacturing PMI |

Jun |

-- |

54.50 |

!!! |

|

GBP |

06/30/2023 |

07:00 |

GDP QoQ |

1Q F |

-- |

0.1% |

!! |

|

GBP |

06/30/2023 |

07:00 |

Current Account Balance |

1Q |

-- |

-2.5b |

!! |

|

EUR |

06/30/2023 |

07:45 |

France CPI EU Harmonized YoY |

Jun P |

-- |

6.0% |

!! |

|

EUR |

06/30/2023 |

10:00 |

CPI Estimate YoY |

Jun |

5.5% |

-- |

!!! |

|

CAD |

06/30/2023 |

13:30 |

GDP MoM |

Apr |

-- |

- |

!!! |

|

USD |

06/30/2023 |

13:30 |

PCE Deflator YoY |

May |

-- |

4.4% |

!!! |

|

USD |

06/30/2023 |

15:00 |

U. of Mich. Sentiment |

Jun F |

63.9 |

63.9 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The ECB’s conference on central banking at Sintra will attract market attention in the week ahead. The main event will be a policy panel including ECB President Lagarde, BoE Governor Bailey, Fed Chair Powell and BoJ Governor Ueda on Wednesday. With the exception of BoJ Governor Ueda, we expect policymakers to share concerns over the risk of more persistent inflation that has been a key focus at recent BoE, ECB and Fed policy meetings. We are not expecting any significant shift in policy communication.

- The release on Friday of the latest US PCE deflator report for May and euro-zone CPI report for June are likely to be more important in shaping expectations for further Fed and ECB policy rate hikes. The Fed has been expressing optimism recently that measures of underlying inflation pressures in the PCE deflator report have proven sticky supporting their plans to deliver two more hikes this year. In contrast, headline and core measures of inflation in the euro-zone surprised to the downside in May, but the ECB remains concerned that core inflation will remain higher for longer. Core inflation is expected to pick back up heading into the summer tourist season.

- The Riksbank is expected to deliver a 25bp hike in the week ahead. Inflation surprised to the upside in May and the SEK has just fallen to record low against the EUR. Similar to the Norges Bank the unfavourable developments are increasing pressure on the Riksbank to deliver a larger 50bps hike and/or signal more extended hiking cycle.

- The release of the latest PMI surveys from China for June will be watched closely to assess if the economic recovery has continued to slow in Q2. Domestic policymakers have started to cut rates to provide more support for growth, which is expected to be backed up by looser fiscal policy support as well in the coming months.