To read a full report, please download PDF

Powell sticks to script at Jackson Hole

FX View:

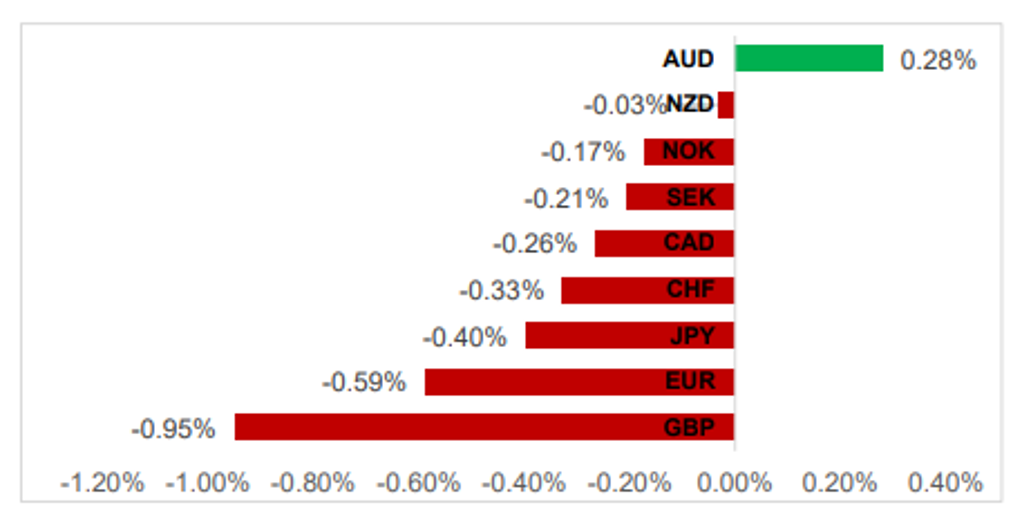

The USD has strengthened further over the past week helping to lift the dollar index back above the 104.00-level. The USD is continuing to benefit from heightened investor concerns over slowing growth outside of the US especially in China and Europe. The release of weaker PMI surveys from Europe has reinforced the USD’s upward momentum. It stands in contrast to the resilience of the US economy which was acknowledged by Fed Chair Powell in his keynote speech at Jackson Hole. However, Chair Powell stated only that further hikes would be required if above trend growth is sustained. The Fed still expects growth and inflation to slow in response to tighter policy. We expect the Fed to leave rates on hold in September unless there is significant upside surprises from the latest US PCE deflator and/or NFP reports in the week ahead.

USD CONTINUES TO STRENGHTEN

Source: Bloomberg, 14:14 GMT, 25th August 2023 (Weekly % Change vs. USD)

FX View:

The USD has strengthened further over the past week helping to lift the dollar index back above the 104.00-level. The USD is continuing to benefit from heightened investor concerns over slowing growth outside of the US especially in China and Europe. The release of weaker PMI surveys from Europe has reinforced the USD’s upward momentum. It stands in contrast to the resilience of the US economy which was acknowledged by Fed Chair Powell in his keynote speech at Jackson Hole. However, Chair Powell stated only that further hikes would be required if above trend growth is sustained. The Fed still expects growth and inflation to slow in response to tighter policy. We expect the Fed to leave rates on hold in September unless there is significant upside surprises from the latest US PCE deflator and/or NFP reports in the week ahead.

Trade Ideas:

We are recommending a new long USD/SEK trade idea, and closing our short EUR/USD trade idea after the target was hit.

Short-term Regression Modelling:

This week we monitor the relationship between spot and fair value for our JPY, GBP and EUR short-term regression models. We identify a convergence in the relationship between GBP/USD and fair value where our model calculates a slight 0.1% undervaluation of spot. While USD/JPY remains overvalued at 2.07% and EUR/USD undervalued at -1.10%.

FX correlations:

G10 FX rates have recently become more strongly correlated to US yields. EUR/USD, GBP/USD and USD/CHF have had the strongest correlations over the past month on average. The recent adjustment higher in US yields driven mainly by the long end of the curve has helped to encourage a stronger USD. In contrast, the correlations between USD/JPY and US yields have remained at relatively weaker levels which has been similar for USD/CAD.

FX Views

Will the USD continue to rebound?

The USD rebound has extended over the past week resulting the dollar index moving back above the 104.00-level for the first time since early in June and moving closer to the intra-day high from the end of May at 104.70. As a result the dollar index has moved back towards the top of this year’s trading range between 99.578 and 105.88. After hitting a year to date low of 99.578 on 14th July, the dollar index has rebounded sharply by around +4.8%. It has been the USD’s strongest performance since between February and March. The USD has staged a broad-based rally since hitting the year to date low on 14th July. The commodity-related G10 currencies of the NZD (-7.6% vs. USD) and AUD (-6.8%) alongside the Scandi currencies of the SEK (-7.5%) and NOK (-7.1%) have since weakened the most against the USD.

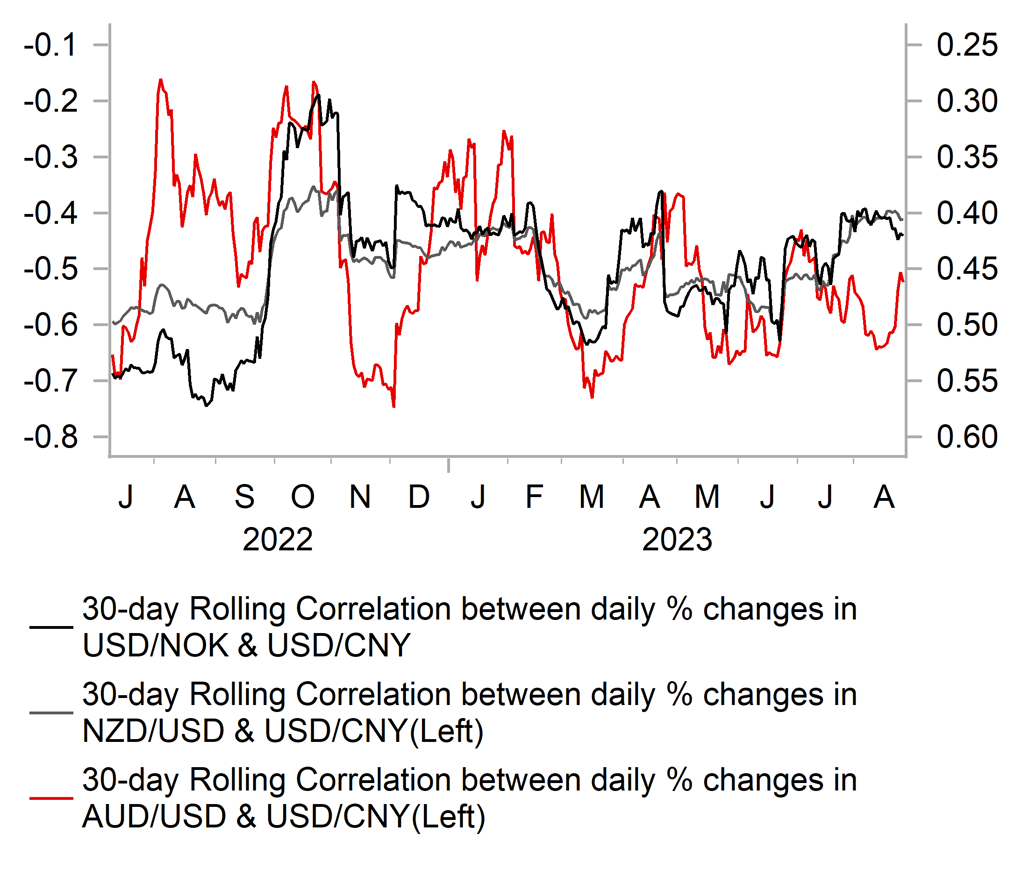

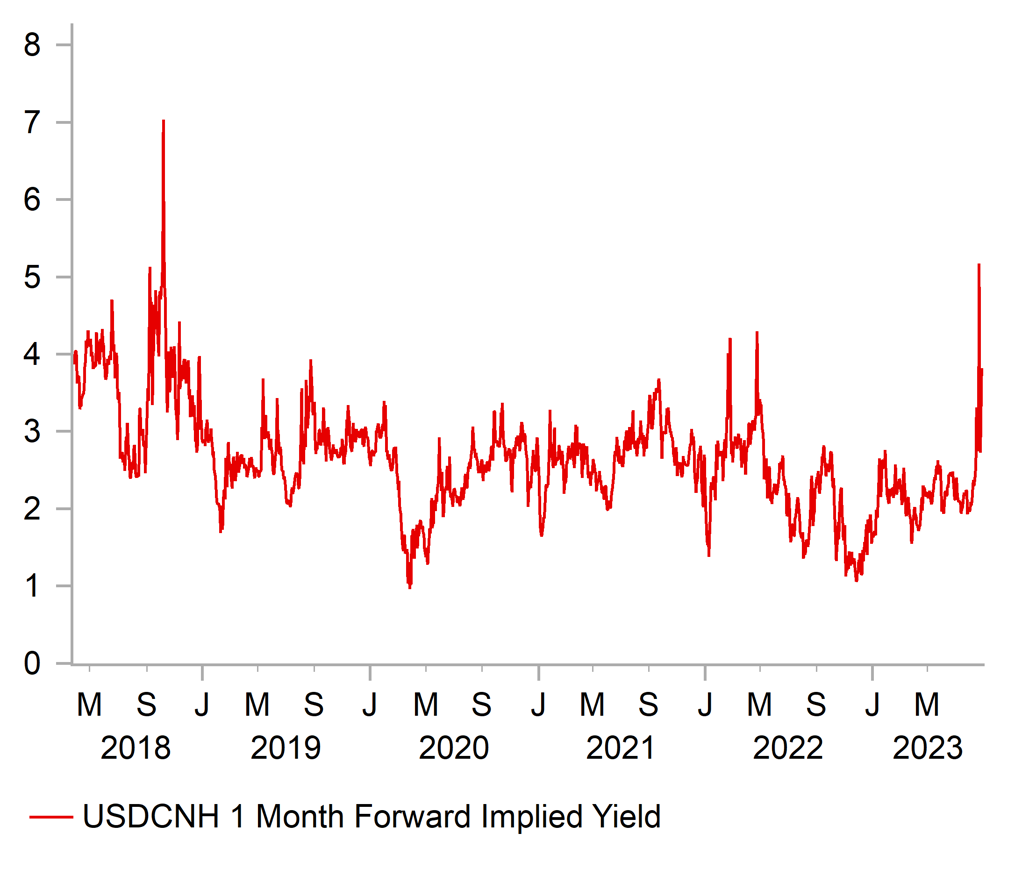

The USD has become relatively more attractive in the near-term driven by heightened investor concerns over the weakening outlook for growth outside of the US while at the same time the US economy is proving more resilient than expected to higher rates this year. Slowing growth in China has attracted more market attention over the summer contributing to the sharp sell-off for commodity related currencies. China’s economy is continuing to slow in Q3 which is prompting market participants to scale back expectations for a pick-up in growth in the second half of this year. Additional stimulus measures rolled out by Chinese policymakers including rate cuts in recent weeks have so far failed to restore investor confidence in the outlook for China’s economy. Domestic policymakers have also stepped up support for the CNY over the past week as USD/CNY moves back to within touching distance of last year’s high at 7.3274 from November. The cost of funding in the offshore CNH has increased significantly over the past week which makes it more expensive to hold short positions.

At the same time, the economic data from the euro-zone has continued to disappoint expectations although the scale of downside surprises has become smaller recently. It provides a tentative indication that the softer growth outlook for the euro-zone is better priced in now. Nevertheless, the release of the PMI surveys from the euro-zone for August in recent days provided a timely reminder that the activity in the euro-zone appears on course to contract again in Q3 after expanding by 0.3% in Q2. The sharp drop in the services PMI was of particular concern as it dropped back below the 50.0- level for the first time this year and fell to the weakest level since February 2021. The drop in business confidence challenges expectations for growth in the euro-zone to pick-up in the second half of this year as the hit to disposable incomes from higher inflation eases. It should encourage the ECB to be more cautious over delivering further rate hikes. The weak PMI surveys could already be an indication that the ECB’s aggressive tightening of monetary policy is already beginning to have more of negative impact on economic growth in the euro-zone. Recent developments support our call for the ECB to leave rates on hold at the September policy meeting after the ECB indicated that rates have now risen to sufficiently restrictive levels in July. The release in the week ahead of the euro-zone CPI report for August could yet prove pivotal in determining the ECB’s policy decision for September. Market participants have already scaled back expectations for one final ECB hike this year with the euro-zone rate market currently pricing in around 13bps of hikes by September and 19bps by December. It leaves scope for further euro-zone yields and the EUR to decline further in the coming weeks if the ECB leaves rates on hold.

G10 FX CORRELATIONS WITH USD/CNY

Source: Bloomberg, Macrobond & MUFG GMR

INCREASE IN OFFSHORE CNH FUNDING COSTS

Source: Bloomberg, Macrobond & MUFG GMR

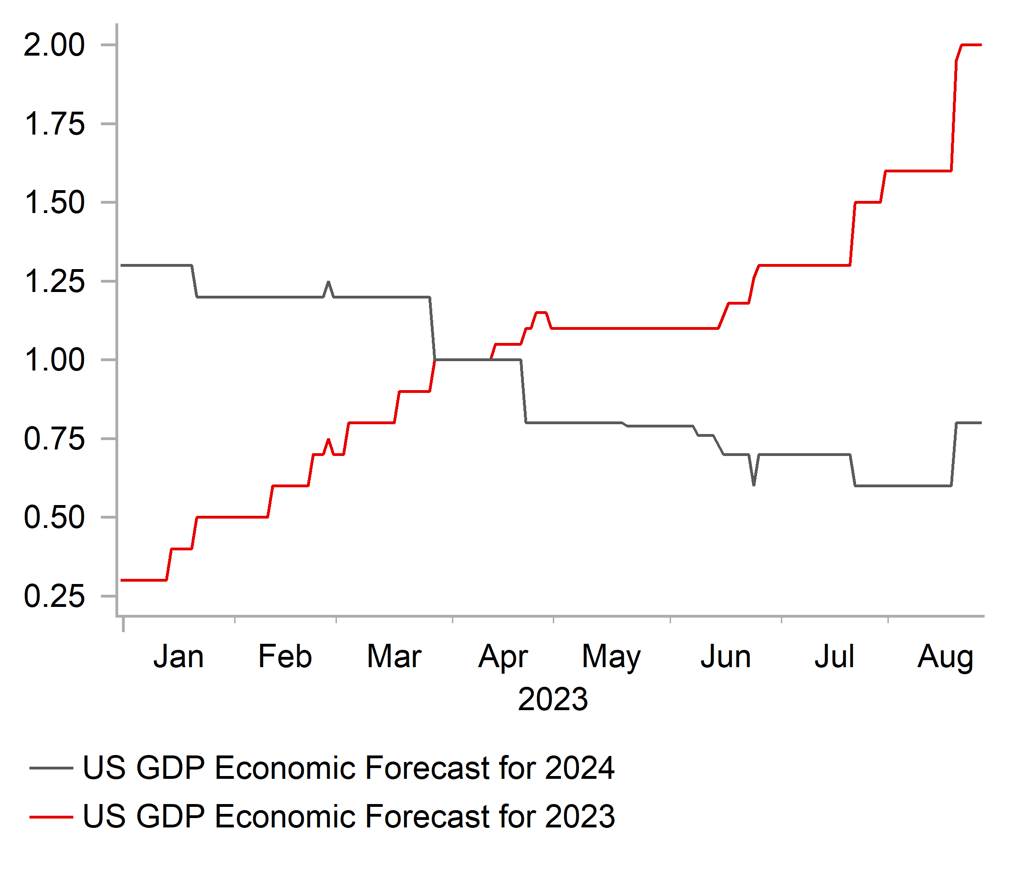

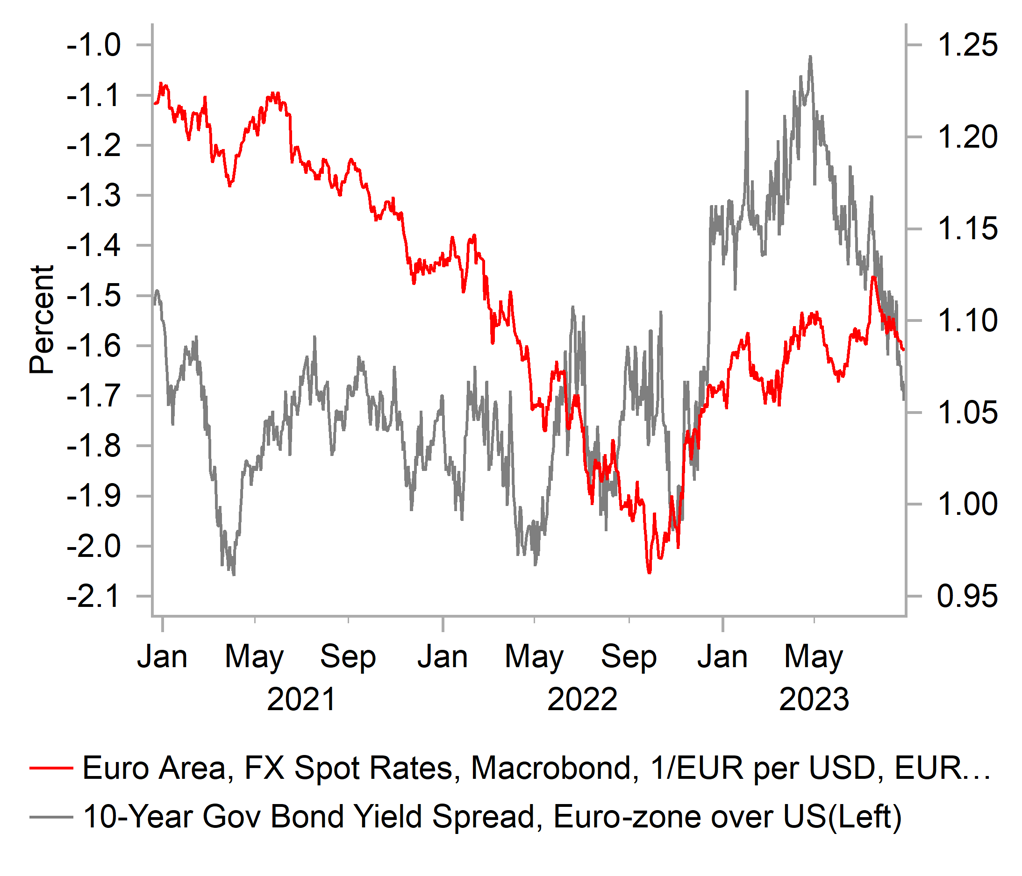

The relative appeal of the USD has been reinforced by the surprising resilience of the US economy to higher rates. After expanding by an annualized rate of 2.2% in the first half of this year, early indicators are that economic activity has picked up in Q3. It has resulted in the Bloomberg consensus for GDP growth this year being revised significantly higher up to 2.0% up from as low as 0.3% at the start of this year. Even as recently as back in May, the consensus for growth this year was closer to 1.0%. Market participants have been pushing out expectations for the slowdown in US growth into next year. The consensus forecast for GDP growth in 2024 has been revised lower and currently stands at 0.8%. The resilience of the US economy has contributed to the recent uplift for US yields. The 10-year US Treasury yield hit a fresh cyclical high earlier this week at 4.36%. The USD has benefitted from US yields spreads moving back in favour of the US. The yields spread between the 10-year German and US government bonds has re-widened back out towards -1.7% after narrowing briefly to just below 1.0% in April. The yield spread has now returned to wider levels that were in place between 2021 and 2022.

In these circumstances, we still believe that risks are skewed in favour of further USD gains in the near-term. The keynote speech from Fed Chair Powell today at Jackson Hole did not rock the boat, and mainly repeated Fed’s recent policy message that upcoming policy decisions will be data dependent as it moves close to the end of their hiking cycle. He did acknowledge that the US economy is proving more resilient than expected but only stated that it could justify further hikes if stronger growth is sustained. We still expect the Fed to leave rates on hold in September assuming that inflation and employment growth slows further. With the US rate market already expecting the Fed to remain on hold in September, it is unlikely derail the USD’s recent rally.

US GDP FORECASTS FOR 2023 ARE BEING REVISED UP

Source: Bloomberg, Macrobond & MUFG GMR

YIELD SPREADS MOVING BACK IN FAVOUR OF US

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

AUD |

08/28/2023 |

02:30 |

Retail Sales MoM |

Jul |

0.3% |

-0.8% |

!! |

|

SEK |

08/29/2023 |

07:00 |

GDP QoQ |

2Q |

-- |

0.6% |

!! |

|

USD |

08/29/2023 |

15:00 |

JOLTS Job Openings |

Jul |

-- |

9582k |

!! |

|

USD |

08/29/2023 |

15:00 |

Conf. Board Consumer Confidence |

Aug |

116.9 |

117.0 |

!! |

|

AUD |

08/30/2023 |

02:30 |

CPI YoY |

Jul |

5.2% |

5.4% |

!!! |

|

EUR |

08/30/2023 |

13:00 |

Germany CPI EU Harmonized YoY |

Aug P |

-- |

6.5% |

!!! |

|

USD |

08/30/2023 |

13:30 |

Advance Goods Trade Balance |

Jul |

-$90.3b |

-$87.8b |

!! |

|

USD |

08/30/2023 |

13:30 |

GDP Annualized QoQ |

2Q S |

2.4% |

2.4% |

!! |

|

JPY |

08/31/2023 |

00:50 |

Industrial Production MoM |

Jul P |

-1.0% |

2.4% |

!! |

|

CNY |

08/31/2023 |

02:30 |

Composite PMI |

Aug |

-- |

51.1 |

!! |

|

EUR |

08/31/2023 |

07:45 |

France Consumer Spending MoM |

Jul |

-- |

0.9% |

!! |

|

EUR |

08/31/2023 |

07:45 |

France GDP QoQ |

2Q F |

-- |

0.5% |

!! |

|

GBP |

08/31/2023 |

08:15 |

BoE's Chief Economist Pill speaks |

!!! |

|||

|

EUR |

08/31/2023 |

08:55 |

Germany Unemployment Change (000's) |

Aug |

-- |

-4.0k |

!! |

|

EUR |

08/31/2023 |

10:00 |

CPI Estimate YoY |

Aug |

-- |

5.3% |

!!! |

|

EUR |

08/31/2023 |

12:30 |

ECB Account of July Policy Meeting |

!!! |

|||

|

EUR |

08/31/2023 |

12:30 |

ECB's Schnabel Speaks |

!! |

|||

|

CAD |

08/31/2023 |

13:30 |

Payroll Employment Change - SEPH |

Jun |

-- |

129.9k |

!!! |

|

CAD |

08/31/2023 |

13:30 |

Current Account Balance |

2Q |

-- |

-$6.17b |

!! |

|

USD |

08/31/2023 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

08/31/2023 |

13:30 |

PCE Core Deflator YoY |

Jul |

4.2% |

4.1% |

!!! |

|

JPY |

09/01/2023 |

00:50 |

Capital Spending YoY |

2Q |

-- |

11.0% |

!! |

|

CHF |

09/01/2023 |

07:30 |

CPI YoY |

Aug |

-- |

1.6% |

!! |

|

EUR |

09/01/2023 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Aug F |

-- |

43.7 |

!! |

|

GBP |

09/01/2023 |

09:30 |

S&P Global/CIPS UK Manufacturing PMI |

Aug F |

-- |

42.5 |

!! |

|

USD |

09/01/2023 |

11:00 |

Fed's Bostic speaks |

!!! |

|||

|

CAD |

09/01/2023 |

13:30 |

Quarterly GDP Annualized |

2Q |

-- |

3.1% |

!!! |

|

USD |

09/01/2023 |

13:30 |

Change in Nonfarm Payrolls |

Aug |

163k |

187k |

!!! |

|

USD |

09/01/2023 |

13:30 |

Average Hourly Earnings MoM |

Aug |

0.3% |

0.4% |

!!! |

|

USD |

09/01/2023 |

15:00 |

ISM Manufacturing |

Aug |

47.0 |

46.4 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The week ahead should be important for market participants to reassess expectations for the Fed’s next policy meeting on 20th The two important US economic data releases will be the PCE deflator report for July released on Thursday followed by the non-farm payrolls report for August on Friday. It would require a significant upside surprise from the latest PCE deflator and/or CPI reports to significantly alter expectations for the Fed to remain on hold in September. Recent US inflation and employment data have both showed slowing momentum helping to ease pressure on the Fed to keep hiking rates further into restrictive territory.

- The week ahead could also prove important in setting market expectations for the ECB’s next policy meeting on 14th The release this week of the weaker than expected euro-zone PMI surveys for August have increased the likelihood of the ECB leaving rates on hold in September unless inflation surprises significantly to the upside in the week ahead. The “minutes” from the July policy meeting could provide more clarity over how close the ECB is pausing their rate hike cycle.

- Other potential market moving events and economic data releases in the week ahead include: i) the latest Australian CPI report for July, and ii) China PMI surveys for August. Slowing growth in China is attracting more market attention and could even encourage the RBA to shift to less hawkish policy stance sooner if growth continues to prove weaker than expected.