To read a full report, please download PDF

USD corrects lower ahead of FOMC meeting

FX View:

Last month’s USD rally has lost upward momentum at the start of June ahead of next week’s FOMC meeting. The loss of upward momentum reflects in part expectations amongst market participants that the Fed will stick to plans to slow down the pace of hikes and leave rates on hold at next week’s policy meeting. We share that view and expect the USD to continue correcting lower in the week ahead. However, the hawkish policy surprises from the BoC and RBA this week highlight that one can’t rule out another Fed hike as soon as next week given they share similar concerns over inflation proving more persistent. Weaker growth and inflation in the euro-zone should help to limit USD downside from the Fed leaving rates on hold as it should encourage the ECB to deliver a less hawkish policy update in the week ahead. We expect the ECB to signal that it is getting closer to the point where they are comfortable that rates have been hiked sufficiently.

USD HAS BEEN CORRECTING LOWER

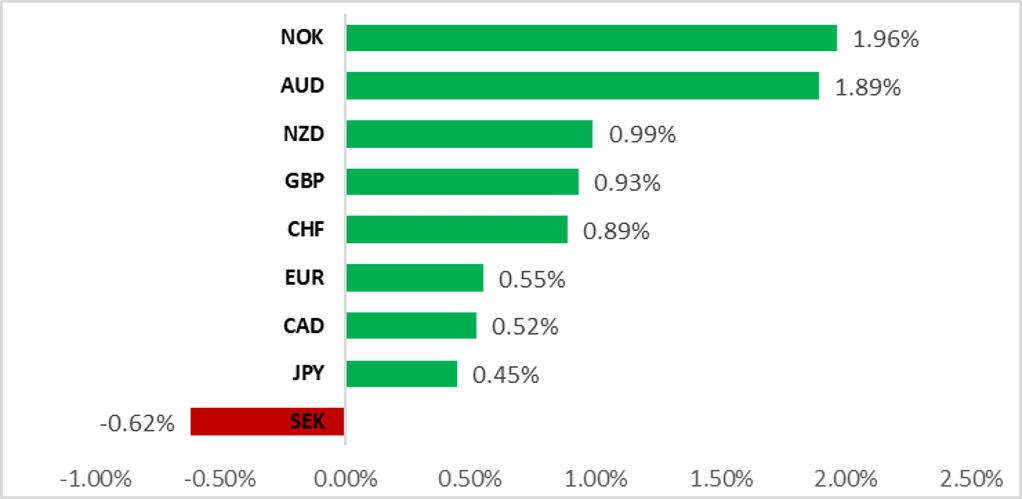

Source: Bloomberg, 14:00 GMT, 9th June 2023 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining a long AUD/NZD trade idea. The trade idea got off to a good start over the last week after the RBA delivered a hawkish policy surprise and raised rates by a further 0.25 point. The trade idea should continue to benefit from the narrowing policy divergence between the RBA & RBNZ.

JPY Flows:

Foreign investor demand for Japan bonds and equities remained robust in May. The huge surge in demand for Japanese equities in April (a record JPY 4,976bn) was followed up with another large JPY 2,745bn in May.

Short Term Fair Value Modelling:

The relationship between AUD and NZD is uncommonly weakly correlated (0.51) and represented by the lack of connection in our correlation tree. We analyse this unusual lack of relationship for FX implications.

FX Views

USD: Will the Fed follow the RBA & BoC by delivering a hawkish policy surprise?

The USD has been giving back some of its recent gains over the past week ahead of next week’s FOMC meeting. After strengthening throughout most of May that resulted in the dollar index hitting an intra-day high of 104.70, it has since fallen back towards the 103.00-level at the start of this month. USD weakness has been most evident against the NOK (+2.0% vs. USD), AUD (+1.9%) and NZD (+1.0%) over the past week. In contrast, the SEK (-0.6%) is the only G10 currency that has weakened against the USD. The USD has lost upward momentum at the start of this month as US yields have been consolidating at higher levels.

Going into next week’s FOMC meeting, market participants are expecting the Fed to slow the pace of hikes by leaving rates on hold. The Fed normally meets market expectations, and they have not released any signal over the past week to trigger the US rate market to reprice in a much higher probability of another hike as soon as next week. It leaves the impression that the Fed is comfortable with current market pricing. The pricing remains consistent with recent comments from the Fed leadership including Chair Powell and Governor Jefferson that favour slowing the pace of hikes to allow more time to assess the impact of previous aggressive rate hikes and tightening credit conditions on the US economy. A decision to leave rates on hold next week is though unlikely to accompanied by a strong signal from the Fed that is the start of an extended pause. We expect the Fed to leave the door open to further hikes as soon as at the following meeting in July if the recent run of stronger activity and inflation continues. It should help to dampen room for the USD to re-weaken further in the near-term unless much weaker US activity and inflation data begins to emerge that seriously question the need for further hikes.

Policy updates this week from the RBA and more importantly by the BoC do highlight though that a hawkish policy surprise next week from the Fed can’t be completely ruled out. The RBA and BoC both delivered surprise rate hikes driven by similar concerns that inflation is proving more persistent than expected. The RBA and BoC both felt that sticky services inflation and more resilient growth meant that they needed to raise rates further to be more confident that it will encourage a slowdown in growth and inflation in the coming years. The Fed is continuing to wrestle with similar concerns as well. The AUD has benefited more than the CAD from the hawkish repricing of RBA & BoC policy expectations over the past week. After hiking rates this week, both central banks signalled that they are open to raising rates further depending on the incoming economic data. Of the two, the RBA’s policy guidance delivered the strongest signal that further hikes are likely to be required. The two main tests for the further AUD upside in the week ahead will be provided by the releases on Thursday of: i) of the latest monthly activity data (retail sales, IP, property investment for May) from China, and ii) the latest Australian employment report for May. We continue to recommend a long AUD/NZD position to reflect the narrowing policy divergence between the RBA and RBNZ.

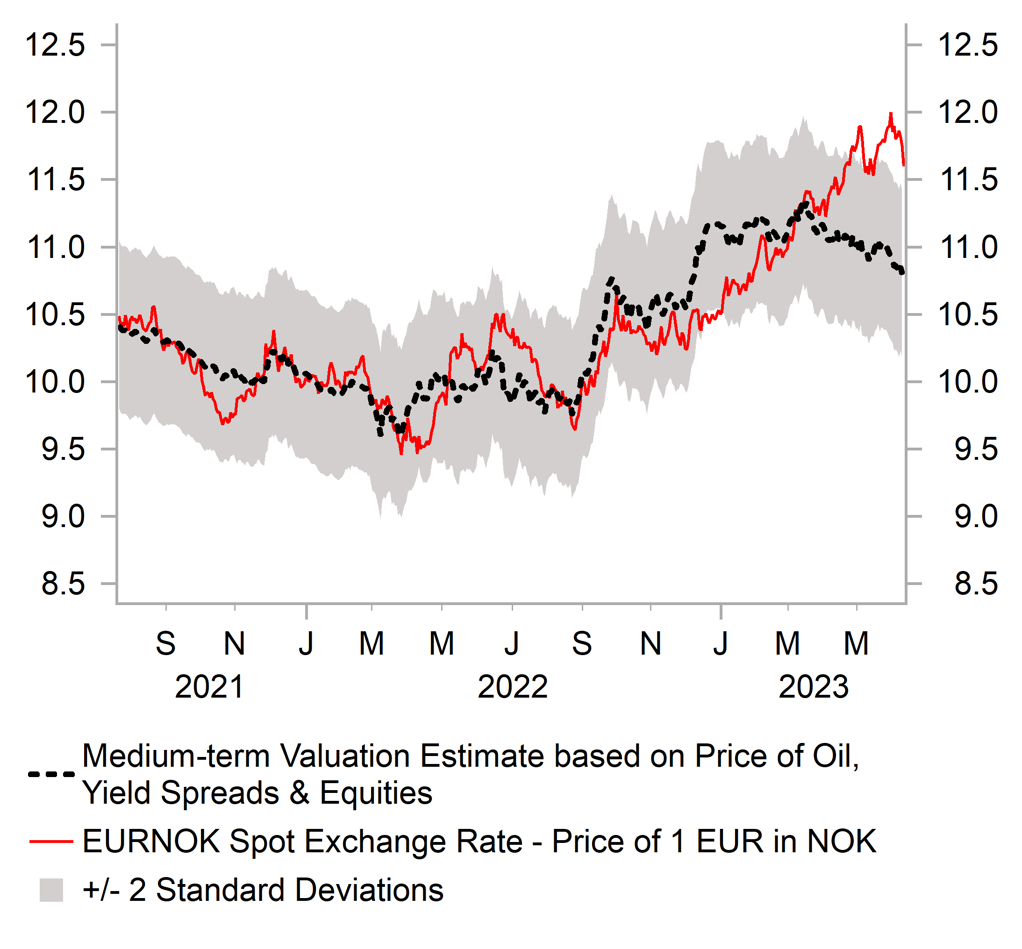

The BoC’s unexpected rate hike is one factor that is helping the CAD and oil-related currencies to rebound. Other factors include, the decision from OPEC+ members to announce further plans to cut production (click here), and the release of the much stronger than expected CPI report from Norway. The supportive developments have allowed the NOK to rebound from deeply undervalued levels. At their last policy meeting in May the Norges Bank clearly displayed more concern over upside risks to the inflation outlook from NOK weakness. Today’s CPI report will have heightened those concerns and places more pressure on the Norges Bank to respond by hiking rates further to provide more support for NOK.

The BoJ and ECB are also scheduled to provide policy updates in the week ahead. We are expecting the BoJ policy update to have limited impact on JPY performance. It has been reported that the BoJ sees little need to adjust its yield curve control program at next week’s policy meeting given improvement in the functioning of the JGB market and smoother shape of the curve. In contrast, the ECB’s policy update could have more impact on the EUR. While it is a done deal that the ECB will hike by rates further next week, the outlook for hikes beyond is more uncertain. We are forecasting one final 25bps hike in July. The ECB’s policy message could start to the transition to placing more emphasis on keeping rates at a higher level for longer and away from the ongoing need to keep raising rates. In light of the recent run of weaker activity (confirmation of technical recession) and inflation data from the euro-zone, the likelihood of a less hawkish policy update have increased which poses downside risks for the EUR.

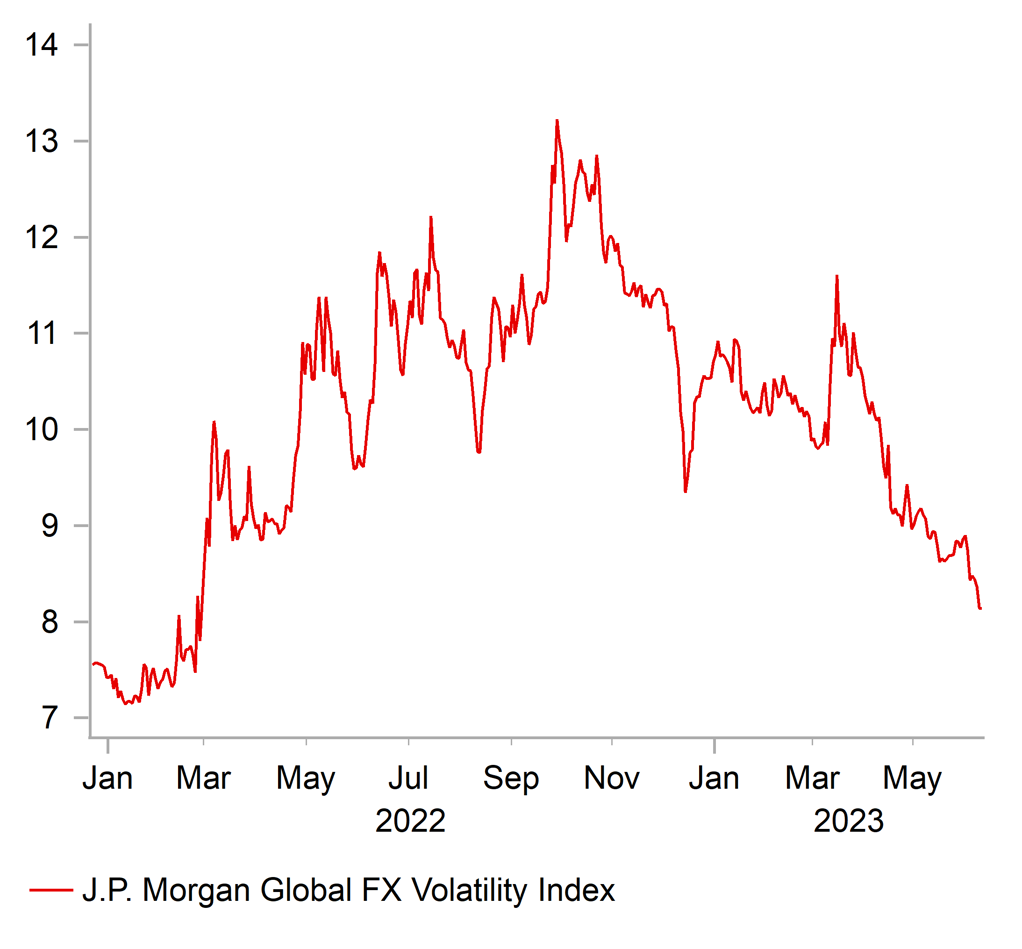

In these circumstances, we expect the correction lower for the USD to extend further in the week ahead if the Fed skips the June meeting. However, the sell-off should prove only modest as the Fed leaves the door open to resuming hikes in July, and the ECB pares back their own hawkish policy messaging. A surprise Fed rate hike will be required to inject renewed upward momentum in the USD and threaten an unwind of FX carry trades that have benefitting from falling FX volatility in the 1H of this year.

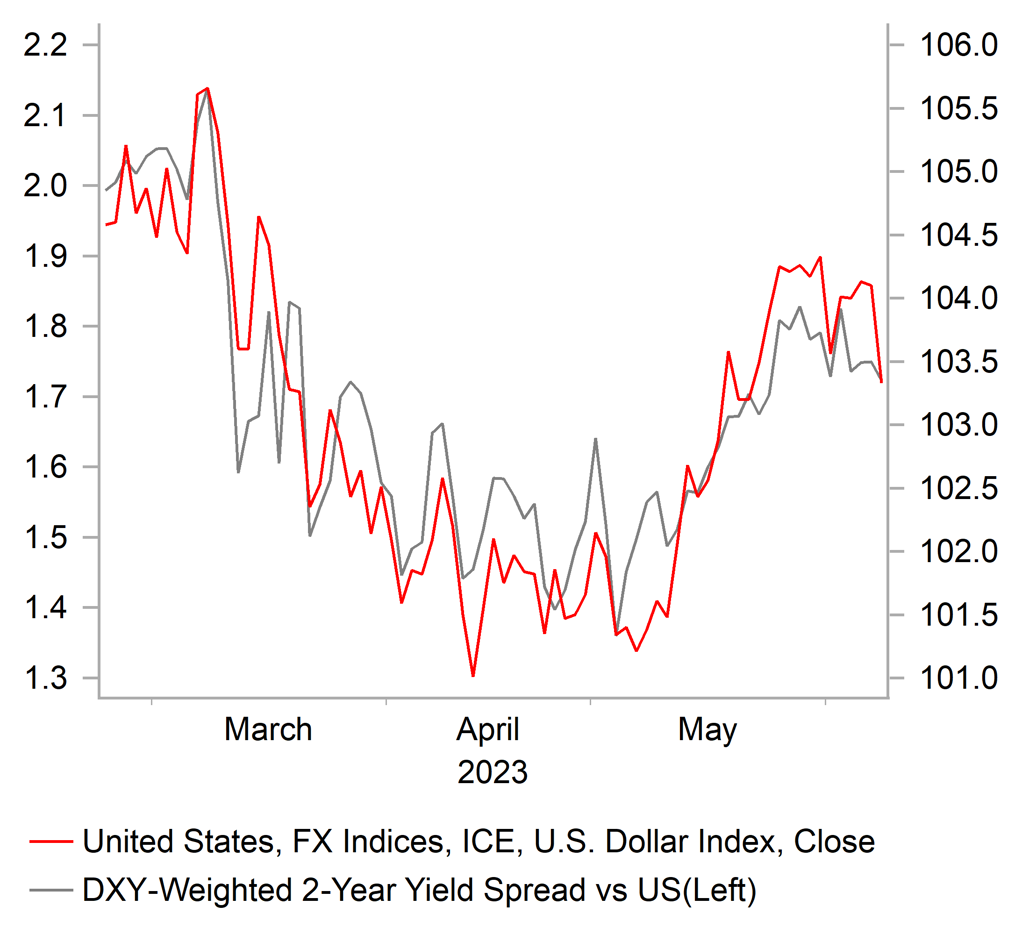

USD REBOUND HAS STALLED

Source: Bloomberg, Macrobond & MUFG Research

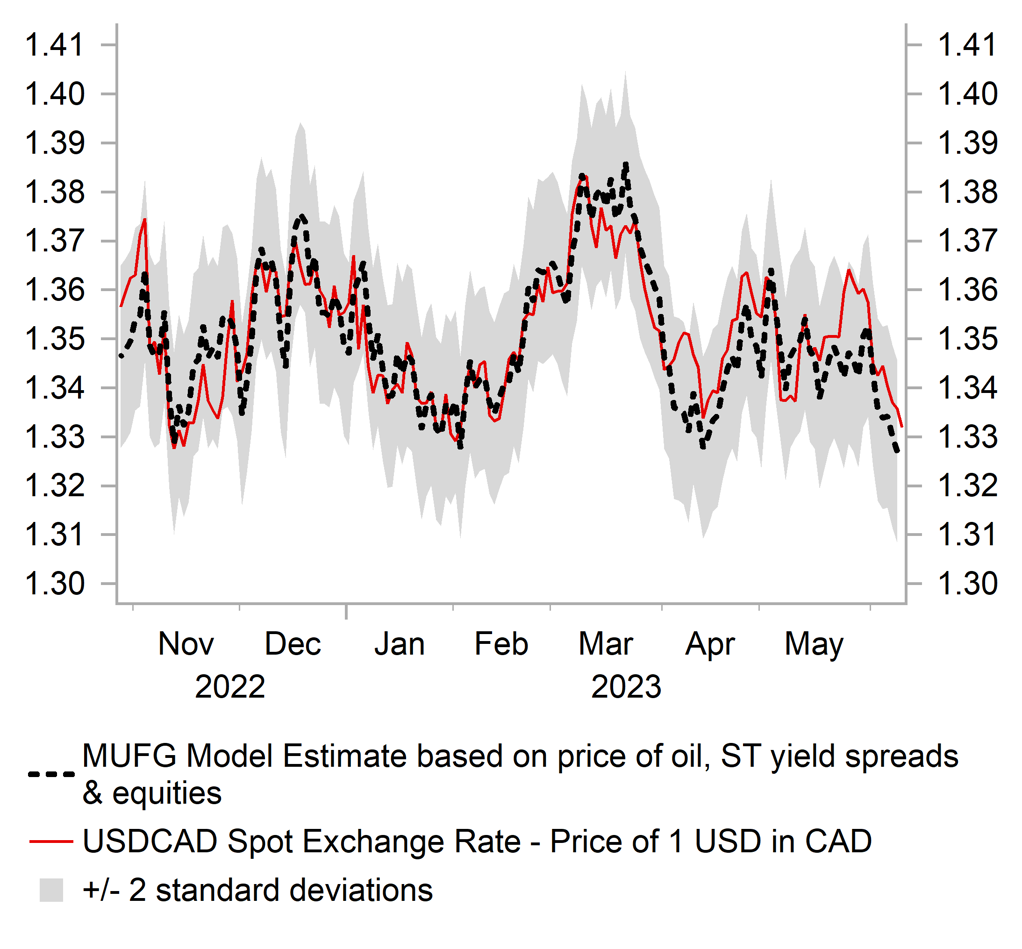

MOVE LOWER IN USD/CAD BACKED BY FUNDAMENTALS

Source: Bloomberg, Macrobond & MUFG Research

signalled that they are open to raising rates further depending on the incoming economic data. Of the two, the RBA’s policy guidance delivered the strongest signal that further hikes are likely to be required. The two main tests for the further AUD upside in the week ahead will be provided by the releases on Thursday of: i) of the latest monthly activity data (retail sales, IP, property investment for May) from China, and ii) the latest Australian employment report for May. We continue to recommend a long AUD/NZD position to reflect the narrowing policy divergence between the RBA and RBNZ.

The BoC’s unexpected rate hike is one factor that is helping the CAD and oil-related currencies to rebound. Other factors include, the decision from OPEC+ members to announce further plans to cut production (click here), and the release of the much stronger than expected CPI report from Norway. The supportive developments have allowed the NOK to rebound from deeply undervalued levels. At their last policy meeting in May the Norges Bank clearly displayed more concern over upside risks to the inflation outlook from NOK weakness. Today’s CPI report will have heightened those concerns and places more pressure on the Norges Bank to respond by hiking rates further to provide more support for NOK.

The BoJ and ECB are also scheduled to provide policy updates in the week ahead. We are expecting the BoJ policy update to have limited impact on JPY performance. It has been reported that the BoJ sees little need to adjust its yield curve control program at next week’s policy meeting given improvement in the functioning of the JGB market and smoother shape of the curve. In contrast, the ECB’s policy update could have more impact on the EUR. While it is a done deal that the ECB will hike by rates further next week, the outlook for hikes beyond is more uncertain. We are forecasting one final 25bps hike in July. The ECB’s policy message could start to the transition to placing more emphasis on keeping rates at a higher level for longer and away from the ongoing need to keep raising rates. In light of the recent run of weaker activity (confirmation of technical recession) and inflation data from the euro-zone, the likelihood of a less hawkish policy update have increased which poses downside risks for the EUR.

In these circumstances, we expect the correction lower for the USD to extend further in the week ahead if the Fed skips the June meeting. However, the sell-off should prove only modest as the Fed leaves the door open to resuming hikes in July, and the ECB pares back their own hawkish policy messaging. A surprise Fed rate hike will be required to inject renewed upward momentum in the USD and threaten an unwind of FX carry trades that have benefitting from falling FX volatility in the 1H of this year.

NOK REBOUNDS FOM DEEPLY UNDERVALUED LEVELS

Source: Bloomberg, Macrobond & MUFG Research

LOWER FX VOL BOOSTING APPEAL OF CARRY TRADES (BRL, COP, MXN HAVE ALL JUST HIT YTD HIGHS VS USD)

Source: Bloomberg, Macrobond & MUFG Research

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GBP |

06/13/2023 |

07:00 |

Average Weekly Earnings 3M/YoY |

Apr |

-- |

5.8% |

!!! |

|

GBP |

06/13/2023 |

07:00 |

Employment Change 3M/3M |

Apr |

-- |

182k |

!!! |

|

NOK |

06/13/2023 |

07:00 |

GDP Mainland MoM |

Apr |

-- |

0.5% |

!! |

|

EUR |

06/13/2023 |

07:00 |

Germany CPI EU Harmonized YoY |

May F |

6.3% |

6.3% |

!! |

|

EUR |

06/13/2023 |

10:00 |

ZEW Survey Expectations |

Jun |

-- |

- 9.4 |

!! |

|

USD |

06/13/2023 |

11:00 |

NFIB Small Business Optimism |

May |

89.0 |

89.0 |

!! |

|

USD |

06/13/2023 |

13:30 |

CPI YoY |

May |

4.2% |

4.9% |

!!! |

|

GBP |

06/13/2023 |

15:00 |

BoE Governor Bailey speaks |

!!! |

|||

|

GBP |

06/14/2023 |

07:00 |

Monthly GDP (MoM) |

Apr |

-- |

-0.3% |

!!! |

|

SEK |

06/14/2023 |

07:00 |

CPI YoY |

May |

-- |

10.5% |

!!! |

|

EUR |

06/14/2023 |

10:00 |

Industrial Production SA MoM |

Apr |

-- |

-4.1% |

!! |

|

USD |

06/14/2023 |

13:30 |

PPI Final Demand YoY |

May |

1.5% |

2.3% |

!! |

|

USD |

06/14/2023 |

19:00 |

FOMC Rate Decision (Upper Bound) |

5.25% |

5.25% |

!!! |

|

|

USD |

06/14/2023 |

19:30 |

Fed Chair Powell press conference |

!!! |

|||

|

NZD |

06/14/2023 |

23:45 |

GDP SA QoQ |

1Q |

-- |

-0.6% |

!!! |

|

JPY |

06/15/2023 |

00:50 |

Trade Balance Adjusted |

May |

-¥727.5b |

-¥1017.2b |

!! |

|

AUD |

06/15/2023 |

02:30 |

Employment Change |

May |

25.0k |

-4.3k |

!!! |

|

CNY |

06/15/2023 |

03:00 |

Industrial Production YoY |

May |

3.8% |

5.6% |

!!! |

|

CNY |

06/15/2023 |

03:00 |

Retail Sales YoY |

May |

13.9% |

18.4% |

!!! |

|

CNY |

06/15/2023 |

03:00 |

Property Investment YTD YoY |

May |

-6.7% |

-6.2% |

!!! |

|

EUR |

06/15/2023 |

07:45 |

France CPI EU Harmonized YoY |

May F |

-- |

6.0% |

!! |

|

EUR |

06/15/2023 |

13:15 |

ECB Deposit Facility Rate |

3.50% |

3.25% |

!!! |

|

|

USD |

06/15/2023 |

13:30 |

Retail Sales Advance MoM |

May |

- |

0.4% |

!!! |

|

USD |

06/15/2023 |

13:30 |

Import Price Index YoY |

May |

-- |

-4.8% |

!! |

|

EUR |

06/15/2023 |

13:45 |

ECB President Lagarde Press Conference |

!!! |

|||

|

USD |

06/15/2023 |

14:15 |

Industrial Production MoM |

May |

0.1% |

0.5% |

!! |

|

JPY |

06/16/2023 |

Tbc |

BOJ 10-Yr Yield Target |

0.00% |

0.00% |

!!! |

|

|

EUR |

06/16/2023 |

10:00 |

CPI YoY |

May F |

6.1% |

6.1% |

!! |

|

EUR |

06/16/2023 |

10:00 |

Labour Costs YoY |

1Q |

-- |

5.7% |

!!! |

|

EUR |

06/16/2023 |

11:00 |

ECB's Villeroy speaks |

!! |

|||

|

USD |

06/16/2023 |

15:00 |

U. of Mich. Sentiment |

Jun P |

60.0 |

59.2 |

!! |

Key Events:

- The main focus in the week ahead will be the latest policy update from the Fed. We expect the Fed to leave rates on hold but acknowledge that it is a close call. Recent stronger US activity and inflation data have encouraged expectations for further Fed rate hikes. Comments from the Fed leadership have signaled that they favour slowing the pace of hikes but will not signal an end to their hiking cycle. We expect the updated DOT plot to show that the median forecasts for the Fed funds rate to remain largely unchanged remaining at 5.1% for the end of this year and then falling to 4.3% by the end of next year.

- The ECB has signaled clearly that it plans to raise rates further by 0.25 point in the week ahead despite the recent run of weaker activity and inflation data from the euro-zone. The downward revision to GDP in Q1 has confirmed that the euro-zone economy fell into technical recession at the start of this year and growth has remained weak at the start of Q2. The updated staff projections are likely show downward revisions to GDP and inflation forecasts for this year. However, the revisions are unlikely to prevent the ECB from signaling that they plan to deliver at least one more 0.25 point hike in July. The outlook beyond the July policy meeting is more uncertain going into next week’s policy meeting.

- The BoJ is expected to leave their policy stance unchanged. Recent communication from the BoJ has signalled that they are not in a rush to adjust policy settings in the near-term, and want to more evidence that inflation can be sustained at close to their target before tightening policy. However, some market participants have still not ruled the possibility of a further adjustment in YCC policy settings at the following meeting in July.