Summary

Rising US interest rates continue to put upward pressure on the USD/JPY. Concerns about currency intervention by the Japanese authorities have kept the USD/JPY from becoming entrenched at the psychologically significant 150 mark, but this level looks likely to be reached following the closely watched BOJ monetary policy meeting. The BOJ revised its interest rate control policy again, essentially dismantling YCC. We see this as a steppingstone toward policy normalization, but BOJ failed to covey its true intentions to the foreign exchange market. We expect yen sellers will remain reassured until the next policy meeting in December, meaning the USD/JPY could rise further.

October in review

The USD/JPY opened the month at 149.52. The pair tested the psychologically significant 150 mark after the US job openings and labor turnover survey released on 3 October exceeded market expectations amid a continued rise in UST yields and dollar strength. It rose to 150.16 driven partly by yen selling and dollar buying to realize losses, then plummeted to 147.30 before quickly recovering to above 149. The USD/JPY then lost direction, hovering around 149 as concerns of intervention by Japanese authorities held back upside. It rose past 149.5 after the US CPI for September announced on 12 October beat market expectations amid dollar strength across the board but became top-heavy again before reaching 150. The pair briefly fell to the upper 148 level following media reports on 17 October speculating that the BOJ would revise up its FY24 inflation forecasts in the Outlook Report scheduled to be released at the policy meeting at the end of October, but quickly rebounded back to above 149.50. On Sunday 22 October, the Nikkei reported that the Bank was considering another revision of its yield curve control policy, and the USD/JPY rose to 150 on 23 October. It did not become entrenched at this level but remained directionless in the upper 149 range. UST yields rose following a lackluster result to the 5y UST auction on 25 October, sending the USD/JPY to above 150 for the third time in the month. After breaking past this key level, the pair continued to rise intermittently from Tokyo through European trading hours on 26 October and reached a high of 150.78. However, 3Q US core PCE announced on the same day missed market expectations and inflation concerns subsided. As a result, US interest rates fell, the dollar was sold, and the USD/JPY also declined. The pair continued to slide on 27 October, softening to 149.47. It moved around the 149.5 level on 30 October as the market waited on the BOJ and FOMC meetings but fell to the upper 148 level after the Nikkei again reported that the BOJ would revise its yield curve control policy. However, the USD/JPY rebounded from the start of the Tokyo session on 31 October, before the end of the BOJ meeting. The Bank subsequently announced revisions to its yield curve control policy. The USD/JPY rose sharply in response, recovering to above 150 because the market perceived the revisions as being in line with previous reporting. As of writing this report, the USD/JPY was trading below 150.50 following BOJ Governor Kazuo Ueda's press conference (Figure 1).

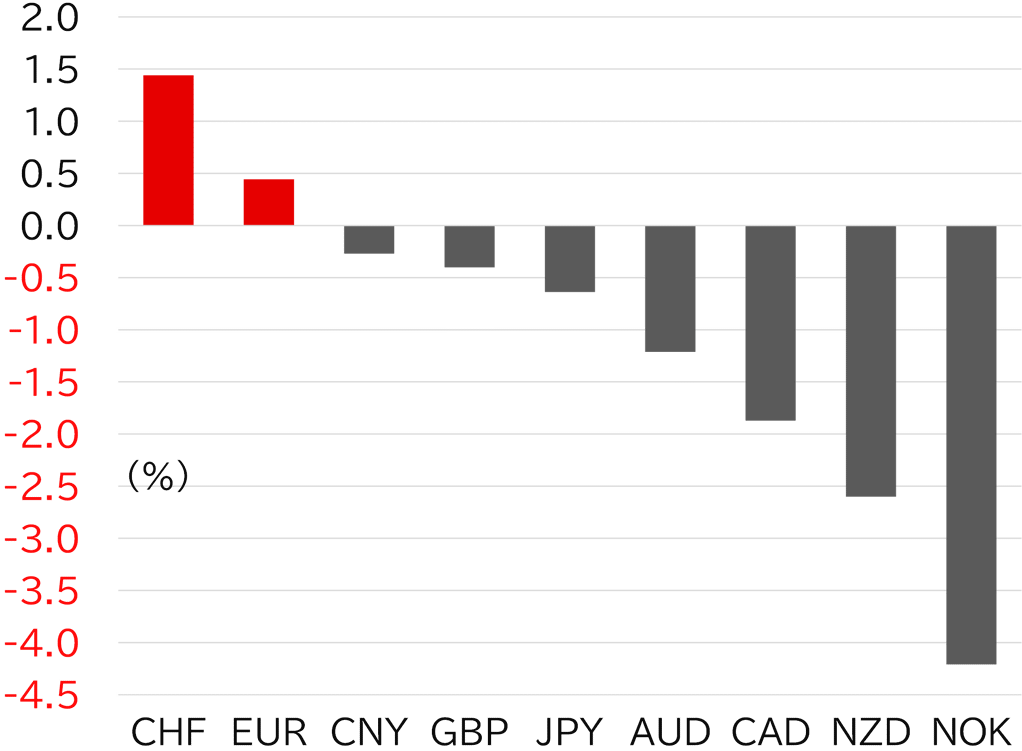

Major currencies neutral, resources and emerging countries weak

The increase in tensions in the Middle East following the attack by Hamas on Israel has not spread into a broader regional or religious/ethnic conflict. Israel is continuing to perform retaliatory strikes, and it is uncertain whether this will bring neighboring countries into the conflict. As a result, major currencies such as the Swiss franc, euro, dollar, sterling, and yen were relatively strong in October, while currencies of resource-producing countries and emerging countries were weak, although the market was not overwhelmed by a state of emergency dollar buying. It can be said that the market has broadly priced in geopolitical risks. (Figure 2).

FIGURE 1: USD/JPY (DAILY)

Note: As at 17:00 JST on 31 October

Source: EBS, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD IN OCTOBER

Note: As at 17:00 JST on 31 October

Source: Bloomberg, MUFG

View that rise in long-term yields has made rate hikes unnecessary

Eventually the USD/JPY traded in a broadly flat range, but 10y UST yields were in the spotlight again in October. The strong US economy and deteriorating UST supply/demand has created an environment that is likely to encourage bond selling (a rise in yields). UST yields have been rising intermittently across a wide range of maturities since July, with each maturity rising above last year's levels and approaching pre-financial crisis levels.

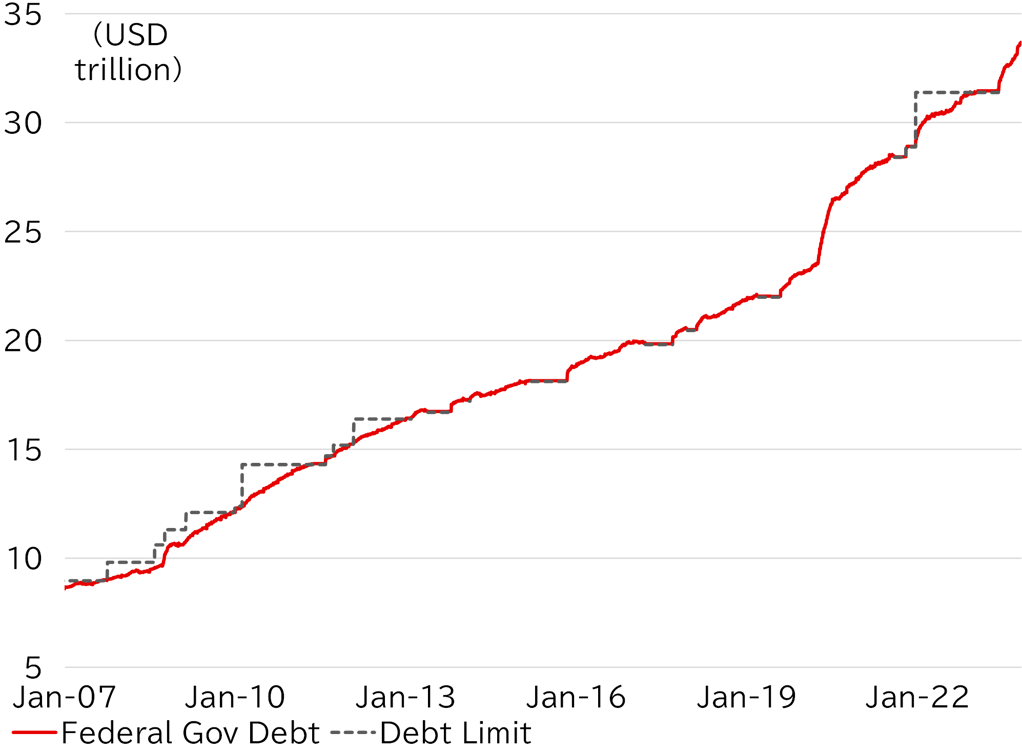

Issuance of US debt has accelerated since the US government suspended the debt ceiling in June (Figure 3). In addition, the US is relying on a stopgap spending bill set to expire on 17 November because it was unable to pass a budget for the new fiscal year starting 1 October. This means Congress will have to wrangle over the budget again, but the political situation is in a state of flux after the Speaker of the House was ousted over the stopgap spending bill, and there is a looming risk of a government shutdown due to stalled talks on a spending bill. In addition to the fiscal uncertainties, we expect a continued increase in issuance of government bonds to support the economy in the run-up to the presidential election in November 2024. Furthermore, the Fed's continued hawkish stance means US interest rates are likely to keep rising. The dollar has strengthened more than we had expected and is likely to strengthen further for now.

In these circumstances, share prices have been adjusting, partly because prices have increasingly been looking relatively expensive. Bank credit balances are also declining, albeit slowly. This suggests the impact of monetary tightening is gradually increasing, resulting in the view that further rate hikes are unnecessary. Senior Fed officials have also repeatedly said that the rise in long-term interest rates is a substitute for further monetary tightening. The FF interest rate futures market has priced in about an 80% possibility that the Fed will leave rates on hold at the next meeting in December. In other words, the market outlook continues to be weaker than the forecast in the dot plot published at the September FOMC meeting. At the least, it is likely that the FOMC will decide to leave the policy rate unchanged at the meeting held on 31 October through 1 November.

Meanwhile, on 18 October, Fed Governor Christopher Waller that if inflation appears to stabilize or reaccelerate, more policy tightening is likely to be needed despite the recent run up in longer term rates. Fed Chair Jay Powell in a speech on 19 October said continued strong growth and tight labor market conditions "could warrant further tightening of monetary policy." US newspapers have reported that Powell is satisfied with the recent slowdown in inflation, but neither official seems to think this is enough to rule out the one additional rate hike suggested by the dot plot. Rather, we see the possibility that the one extra rate hike could be pushed back to next year. The 3Q core PCE deflator, released after Powell's speech, showed a slowdown in inflation. This probably did not come as a surprise. However, Governor Waller has indicated that he wants to confirm inflation data across multiple reports, and Chair Powell is likely to maintain his stance that further hikes are possible at his press conference on 1 November. This may curb the view that rate hikes are unnecessary but is unlikely to build a consensus. We will therefore need to wait on the release of major economic indicators for October, such as employment statistics and the CPI, following the FOMC meeting to assess the outlook for a short-term decline in US rates and a weaker dollar.

FIGURE 3: US FEDERAL GOVERNMENT'S DEBT BALANCE AND STATUTORY DEBT LIMIT

Source: US Treasury, MUFG

FIGURE 4: CORE PCE AND CORE CPI YOY GROWTH

Source: BEA, Bureau of Labor Statistics,

MUFG

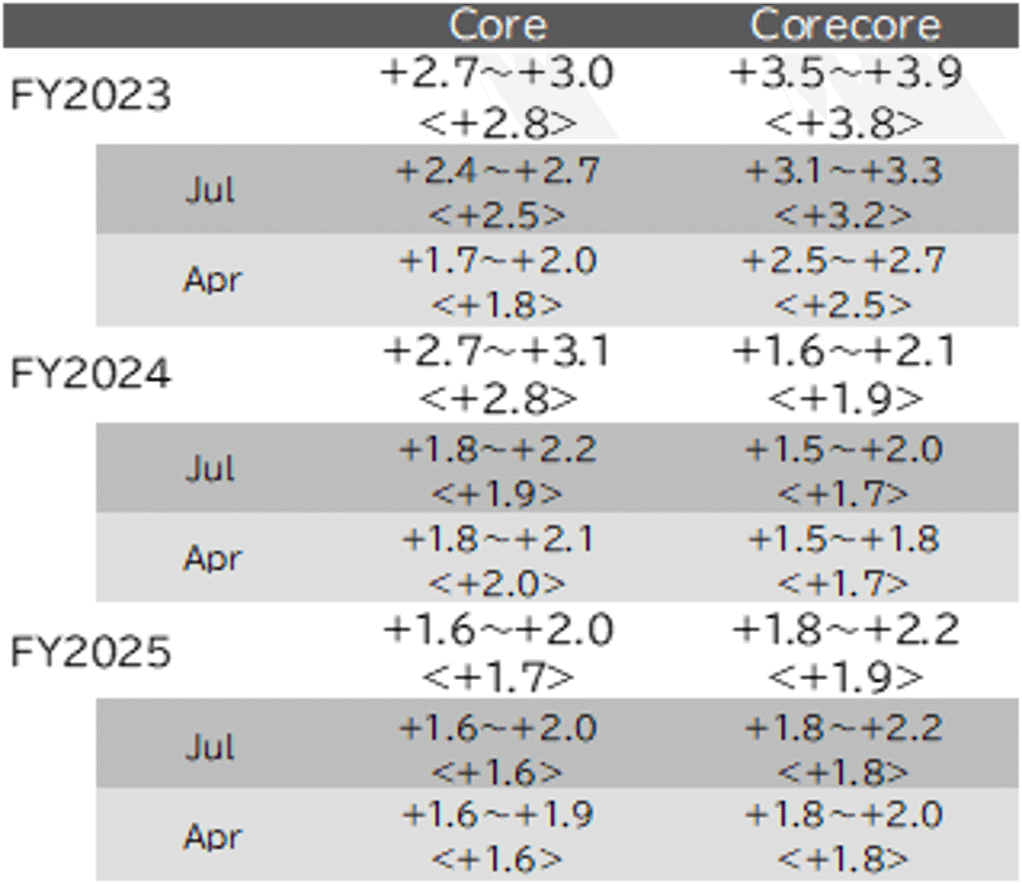

BOJ takes steps towards normalization

The growing interest rate differential due to the rise in US rates has been putting upward pressure on the USD/JPY. Jawboning by Japanese authorities has kept the USD/JPY from a sustained rise above the psychologically significant 150 mark. However, with the rise in US rates, long-term JGB yields are also approaching the upper limit of 1.00%, which Governor Ueda positioned as a safeguard, meaning the BOJ policy meeting on 31 October drew attention as a key event in determining the direction of the USD/JPY. The forex market priced in the possibility of policy revisions after reports about a revision of inflation forecasts in the Outlook Report were followed by a Nikkei article on 22 October saying that the BOJ was considering another revision of its yield curve control policy. However, this amounted to allowing long-term rates room to rise while keeping the YCC framework in place, which worked to curb a rise in the USD/JPY but was not enough to encourage a strong move to buy back yen. Ultimately, the BOJ voted to further increase the flexibility of YCC, largely in line with prior reporting. Specifically, it removed the approximately ±0.5% fluctuation range as a target for long-term interest rates in the conduct of yield curve control and set the upper limit at 1.0%. It also ended its policy to conduct fixed-rate purchase operations in principle on every business day up to 1%, effectively allowing interest rates to rise above 1%. Meanwhile, the Outlook Report released at the same time showed the inflation forecast (core basis) for both FY23 and FY24 had been raised well above 2%, and the forecast for FY25 was also slightly revised upward (Table 1).

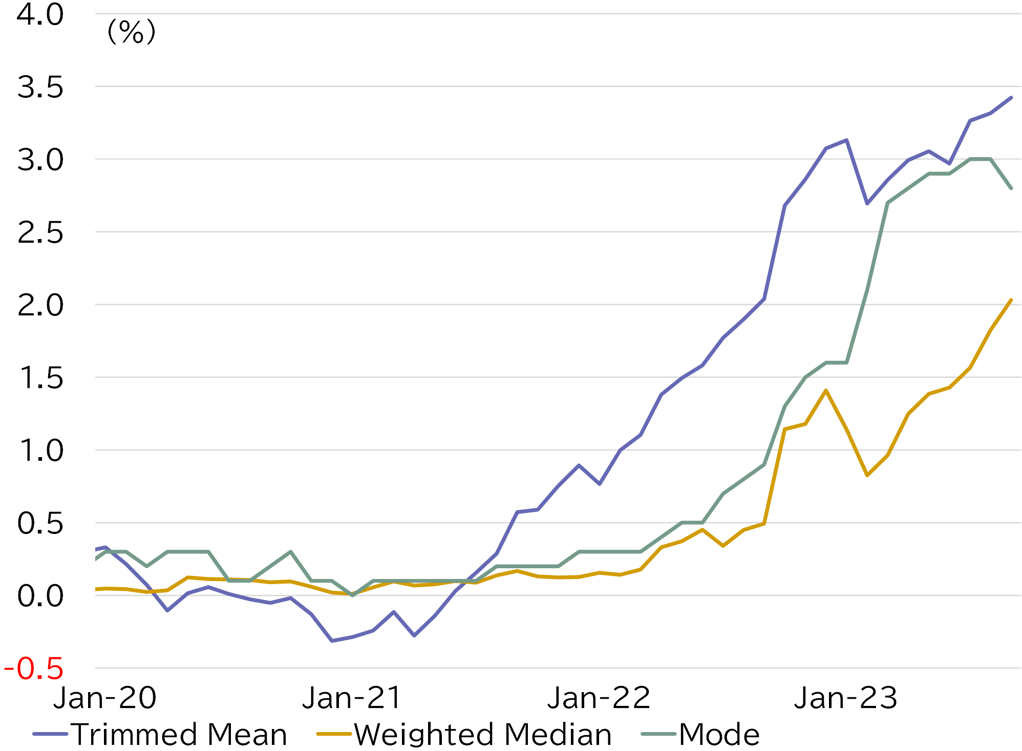

We surmise that the YCC has become even more of a facade, and that the outlook for inflation suggests the BOJ is just one step away from achieving the price stability target, meaning the Bank has broadly laid the groundwork for policy normalization. In fact, of the three values used by the BOJ as measures of underlying inflation, the weighted median, which was the most laggard, reached +2% YoY in September (Figure 5). Furthermore, Governor Ueda indicated that services prices were an important indicator at his press conference, and we note that the services producer price index rose by over 2% YoY in both August and September. The forecasts in the Outlook Report suggest that the BOJ should finally be able to start normalizing policy if wage growth in FY24 is confirmed. Our main scenario continues to see a policy shift in January next year but considering the political schedule with the possibility of a snap election being called, we also need to consider the possibility of a change in policy at the December meeting.

However, the essence of policy revisions again not communicated

However, we regard the BOJ's latest policy decision as inadequate since we had seen the possibility of a surprise shift to normalization. We do not think the financial markets factored this into a large extent, but the sharp rise in the USD/JPY following the statement announcement was inevitable in our view. As was the case when the BOJ increased the flexibility of YCC in July, we think the decision shows the Bank was being careful not get market participants overly optimistic about a shift to policy normalization. This makes it difficult for the BOJ to get its message across, especially to overseas investors, resulting in the markets viewing the decision as dovish in some cases. At the least, participants in the foreign exchange market are unlikely to view this as a shift in monetary policy aimed at curbing yen weakness. Governor Ueda was asked about this at his press conference, but he declined to give a straight answer. In addition, the fact that the BOJ did not indicate an upper limit on long-term yield targets can also be interpreted as pushing back on expectations that the upper limit would be raised. Overall, the Ueda's press conference is unlikely to have encouraged the yen to weaken, but in any case, the BOJ's monetary policy meeting temporarily sparked yen selling.

In that respect, we think the primary focus is on normalization and a change in short-term interest rates (removal of negative interest rates). Until this comes into view, which is likely to be in December at the earliest, we expect yen sellers will continue to feel reassured given the disparity in monetary policy. We have slightly revised up our forecast range given the unexpected strengthening of the dollar and the continued sense of security for yen sellers following the BOJ's recent monetary policy decision.

TABLE 1: OUTLOOK REPORT INFLATION FORECASTS

Source: BOJ, MUFG

FIGURE 5: BOJ'S MEASURES OF UNDERLYING INFLATION

Note: The CPI figures exclude the effects of the consumption tax hikes, policies concerning the provision of free education, and travel subsidy programs. The figures from April 2020 onward are estimated by the BOJ's research and statistics department and exclude the effects of measures such as free higher education introduced in April 2020.

The trimmed mean is obtained by excluding the upper and lower tails (here, the 10 percent tails) of the price change distribution adjusted for item's weight in the CPI. The weighted median is the weighted average of the inflation rates of the items at around the 50th percentile point of the distribution. The mode is the inflation rate with the highest density in the distribution.

Source: BOJ, MUFG

Japanese authorities continue to check yen weakness

After this report is published, the MOF will announce the results of foreign exchange intervention in October. Some people have been wondering whether Japan intervened during the sharp decline on 3 October. This is because 150 level has been deemed as a key defense line for the authorities. We expect the USD/JPY will continue to face upward pressure due to interest rate differentials and monetary policy disparities for the time being, countered by wariness of intervention by the Japanese authorities. We still expect any sharp moves could trigger intervention in the currency market, although no specific level has been set. We have been closely watching international conferences, such as the G20 in October, and although no word on specific cooperation has come to light, some emerging countries have intervened in the currency market in response to the recent rise in US interest rates and the strength of the dollar, with some unexpectedly moving to raise rates. In this environment, we think it would be easy to gain understanding for foreign exchange intervention if the market moved suddenly.

QUARTERLY FORECAST RANGE AND PERIOD-END FORECAST

|

Nov-Dec 2023 |

Jan-Mar 2024 |

Apr-Jun |

Jul-Sep |

|

|

USD/JPY |

141.0~155.0 |

134.0~150.0 |

132.0~148.0 |

130.0~146.0 |

|

Period-end forecast |

145.0 |

138.0 |

136.0 |

134.0 |

Our forecast range estimates the high and low for each quarter. The period-end forecast is our forecast for USD/JPY at 17:00 New York time at the end of each quarter.