Summary

Dollar strength gained momentum after the September FOMC suggested that it would delay the start of rate cuts next year. In the US, the autoworker union's strike and rising oil prices have increased the risk of a reacceleration of inflation, and a growing sense that monetary tightening will be prolonged means the dollar is likely to remain strong. The USD/JPY rose close to 150 for a time, heightening concerns that Japanese authorities could intervene. The BOJ has its eye on normalizing monetary policy, but the main scenario is that a shift in policy will come at the start of 2024 and that any adjustments until then are unlikely to be game changers.

September in review

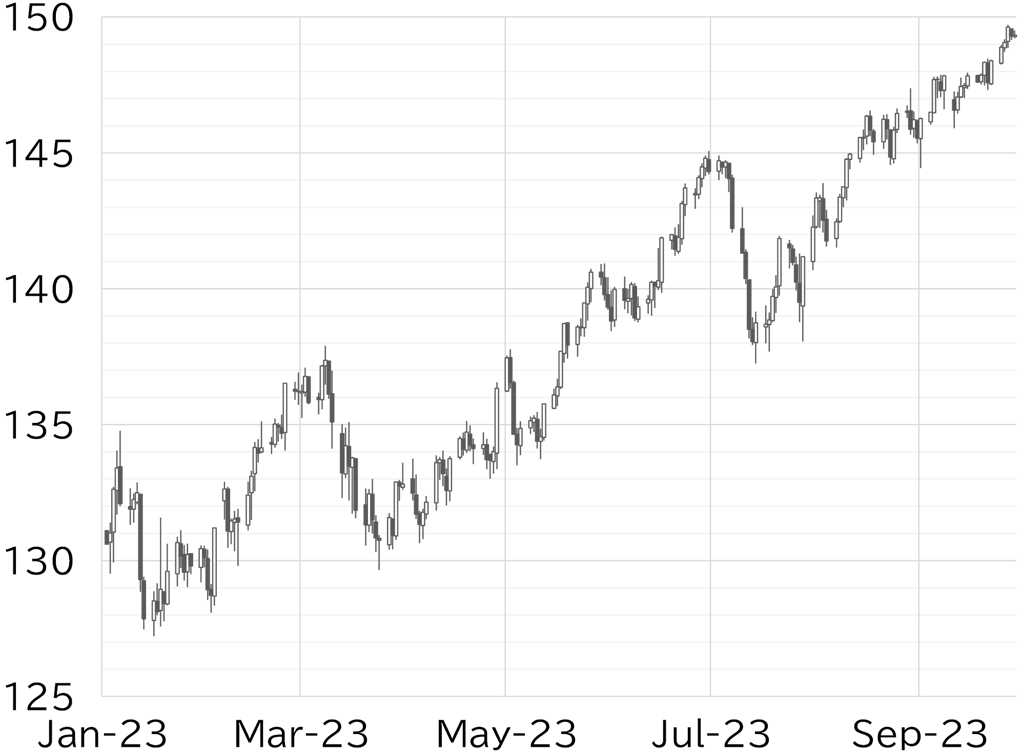

The USD/JPY opened the month at 145.48. It briefly dropped to 144.44 after the release of mixed US employment data on 1 September, although this turned out to be the low for the month. The ISM Manufacturing Index released straight after this beat market expectations and the USD/JPY quickly recovered to the 146 level. A rise in UST yields on 5 September after the long weekend in the US and a weakening of the yuan due to concerns about the Chinese economy supported dollar strength, and the USD/JPY rose above 147. The yen strengthened on Monday 11 September and the USD/JPY fell back to the 145 level after an interview with BOJ Governor Kazuo Ueda published in the Yomiuri Shimbun on Saturday 9 September was seen as hawkish. However, yen buying was not sustained, and the USD/JPY recovered to the 147 level on the 12th, intermittently pushing past 147.5. The pair became top heavy just below 148 due in part to concerns about intervention by the Japanese authorities but rose past 148 as the dollar strengthened across the board after the FOMC meeting on 19-20 September was judged as hawkish because the Fed kept rates on hold but raised its forecast for the federal funds rate in 2024. The market expected the BOJ to take some kind of action at its policy meeting on 21-22 September in light of Governor Ueda's interview with the Yomiuri Shimbun and the FOMC decision, but the meeting was uneventful and this encouraged the dollar to continue strengthening against the yen. The USD/JPY rose past 149 on 26 September as speculators tested upside and reached a high for the month of 149.71 on the 27th. This was the highest level since October 2022, and the pair remained at a standstill just below the watershed 150 level from 28 September amid repeated warnings of intervention from Japanese authorities (Figure 1).

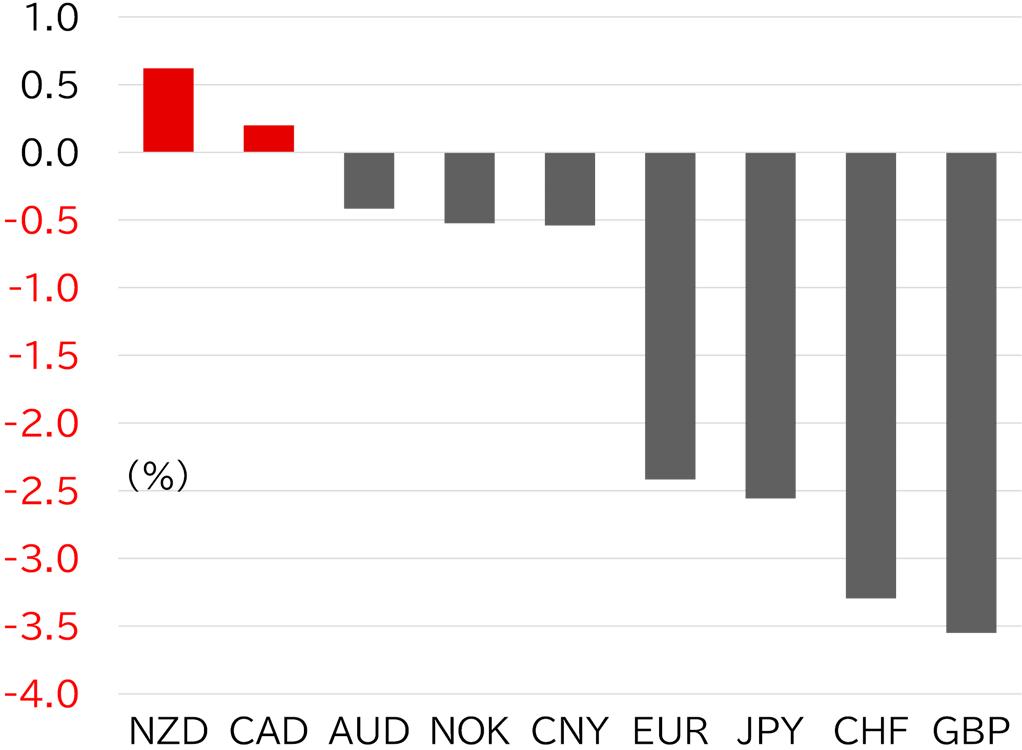

Dollar strength and rise in resource prices shape currency landscape

The dollar continued to strengthen in September, but some commodity currencies strengthened against the dollar due to a rise in the price of oil and other resources (Figure 2). European currencies and the yen, which are reliant on energy imports, are weak heading into winter.

FIGURE 1: USD/JPY (DAILY)

Note: As at 14:00 JST on 29 September

Source: EBS, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD IN SEPTEMBER

Note: As at 14:00 JST on 29 September

Source: Bloomberg, MUFG

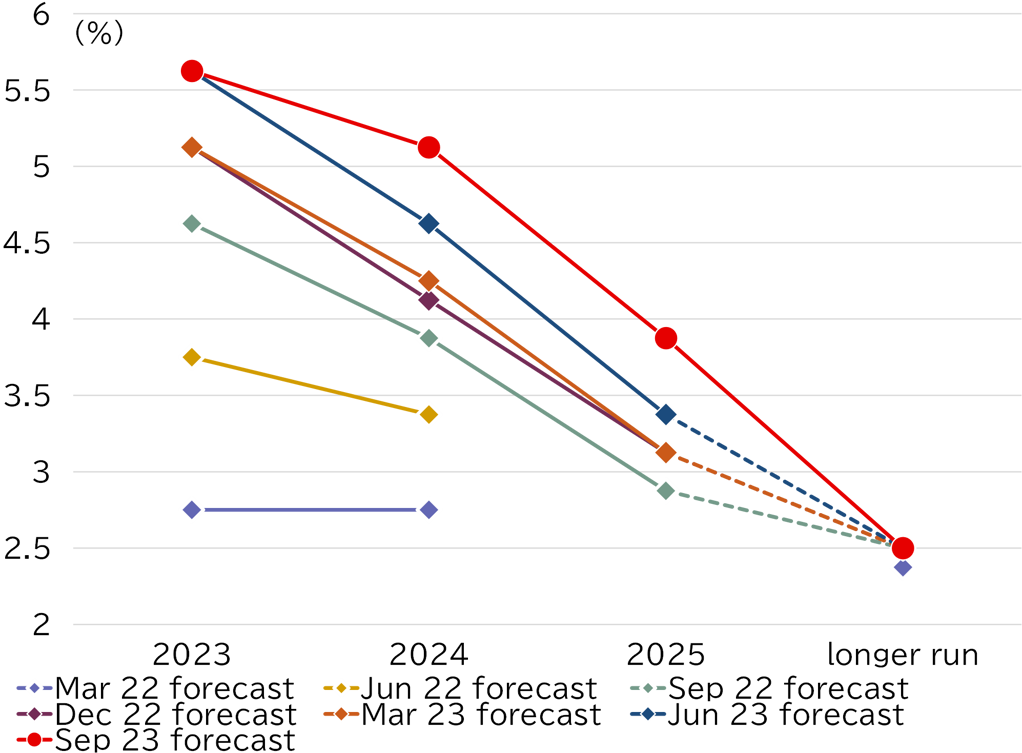

September FOMC's hawkish surprise

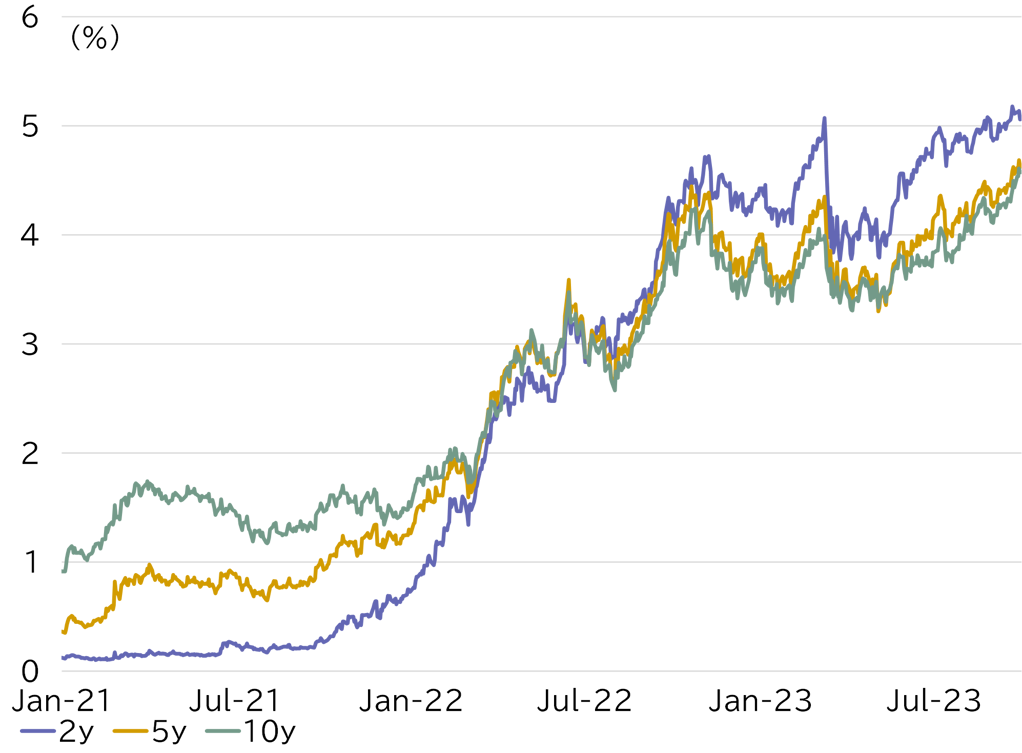

The FOMC held off on raising rates in September. It continued to signal one more hike within the year and revised its forecast for rate cuts in 2024. The dot plot's median forecast for the federal funds rate at end-2023 remained at 5.50%-5.75%, but the outlook for end-2024 was revised to 5.00%-5.25%, which is 50bp higher than the previous forecast in June (Figure 3). With only the November and December meetings left in 2023, maintaining the outlook for one more hike within the year is a serious show of intent. However, the revision from a 100bp to a 50bp cut in 2024 suggests the Fed will start cutting rates later than had been expected. The revision was a hawkish surprise because both our forecast and the market consensus had assumed that the median outlook on the dot plot would remain unchanged or be adjusted slightly higher. As a result, UST yields rose across a wide range of maturities, with the 10y yield reaching 4.86% for the first time since August 2007 (Figure 4). In the foreign exchange market, the dollar strengthened after the FOMC meeting, and the dollar index has risen to the highest point since November 2023.

Long-term interest rates rose by 50bp in September, but it is important to note that this was probably not just because of the FOMC's hawkish surprise. The US Congress is having trouble passing a spending bill ahead of the new fiscal year starting 1 October. A deal was struck in June on the scale of spending next fiscal year but demands for major spending cuts by House Republicans have made it difficult to pass the budget bill before the end of the current fiscal year. The Biden administration is continuing to negotiate a stopgap spending bill, but a deal does not look likely to be reached by the end of the fiscal year as of writing this report. As we saw under the Trump administration, a failure to pass a spending bill would have a major economic impact, including the shutdown of government agencies and suspended wage payments to many federal employees. In this case, the September jobs report, scheduled to be announced on 6 October, would probably be delayed, which could impact monetary policy decisions. Major ratings agencies have warned that failure to reach a deal could result in a US sovereign-debt rating downgrade and concerns are growing about a deterioration in UST supply/demand.

Meanwhile, in the private sector, the United Auto Workers union (UAW) is on strike demanding significant wage increases. In the short term, a decline in production could hurt the economy, but some companies have proposed a 20% wage increase and the introduction of an inflation-linked cost-of-living adjustment system in the face of reports that the UAW is targeting a 30% wage rise. Large wage increases in the auto industry could accelerate wage inflation given that the labor market remains tight. In addition, oil prices are rising rapidly, mainly because oil producing countries have signaled plans to reduce output. US gasoline prices are also rising, meaning that the risk of higher inflation, which had subsided, could reemerge.

Debate about the need for more than one more rate hike has not gained traction to date given the downside economic risks posed by a potential government shutdown. Furthermore, amid growing uncertainty about the economy, we see the risk that the release of economic indicators, which the Fed uses as the basis for its monetary policy decisions, could be delayed. This means the market will not be able to fully factor in a rate hike at the FOMC meeting to be held from 31 October to 1 November. However, we see a growing view that the federal funds rate will remain high for the time being (the outlook for rate cuts pushed back), with expectations running counter to this losing support. We therefore do not expect UST yields to decline, even though they have limited room to rise, meaning the dollar is likely to continue strengthening.

FIGURE 3: FOMC PARTICIPANTS' MEDIAN FED FUNDS RATE OUTLOOK

Source: Fed, MUFG

FIGURE 4: UST YIELDS

Source: Bloomberg, MUFG

Changes in the BOJ's stance, focus on the Outlook Report in October

To date, we had expected a shift in US monetary policy would trigger a reversal in the USD/JPY rise that started last year. However, with the timing of this likely to be delayed, we think the BOJ's monetary policy could now be key.

The BOJ decided to conduct yield curve control with greater flexibility at its monetary policy meeting in July, and board members have had the opportunity to speak on numerous occasions since then, starting with Deputy Governor Shinichi Uchida's speech to business leaders on 2 August. Six out of the nine board members had voiced their opinions in some way by the time the Yomiuri Shimbun published its interview with Governor Ueda on 9 September. Naturally, there was a mix of hawkish and dovish views expressed depending on the board member, but on balance it appears that the groundwork for a shift toward policy normalization in the near future has already started. In particular, Governor Ueda's comment that the Bank could get enough information and data by the end of the year regarding the achievement of its price stability target raised expectations that the BOJ could start normalizing policy within the year. Ueda reined in expectations of policy normalization within the year at his subsequent press conference but did not walk back his view that the BOJ could have the necessary data by the end of the year.

Data on trends in next fiscal year's wage increases will be key for policy decisions because sustainable wage increases are vital to achieving the price stability target. Regarding this, Governor Ueda said the outlook for wage revisions at large companies should come into view from January through March, followed by other companies, and that the BOJ to some extent knows the factors impacting each company. He also said that the Bank can continuously make an overall assessment along with the incoming data of variables that drive wage revisions.

This suggests the BOJ does not think it is necessary to wait for the actual data on wage increases in FY24. Large companies with a March fiscal year end should have largely finalized their FY3/25 budgets by the end of the year, which is probably what Ueda had in mind when he said, "by the end of the year." In that case, the January Outlook Report should be able to say that the BOJ is on track to achieving the price stability target, which would make it possible to move to normalize monetary policy.

In addition, questions on methods to move toward policy normalization are no longer just written off with answers such as it is "too early." Governor Ueda's statements suggest that the first options for normalization would be to end YCC, remove negative interest rates, and lose the overshooting commitment. Governor Ueda does not directly answer questions about what measures would be prioritized, but therefore, we may need to doubt our common sense. For example, with regard to the current directive on interest rate control, the prevailing view is that the BOJ should first end YCC and then remove negative rates due to the circumstances surrounding the introduction of these policies and other factors. Exiting the negative interest rate policy is generally accepted to be a high hurdle given the impact on housing loans. Deputy Governor Uchida's remarks in August also included a discussion of the two policies separately, and in particular, he expressed the idea that lifting negative interest rates would be monetary tightening. In contrast, Governor Ueda has only said that the BOJ would exit the negative interest rate policy if it judged it was possible to achieve the price stability target and has not positioned this as subordinated to ending YCC. This suggests that the BOJ could move to exit negative short-term rates (an area it can control), while maintaining YCC as a safeguard to put an upper limit on long-term rates, which are usually hard to control.

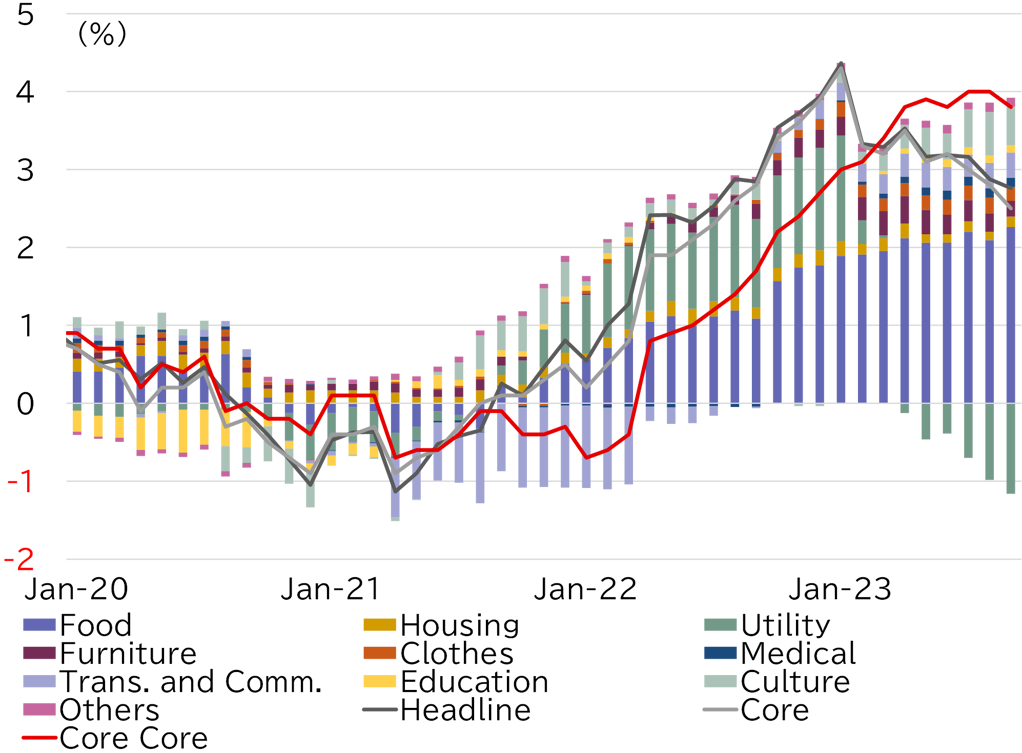

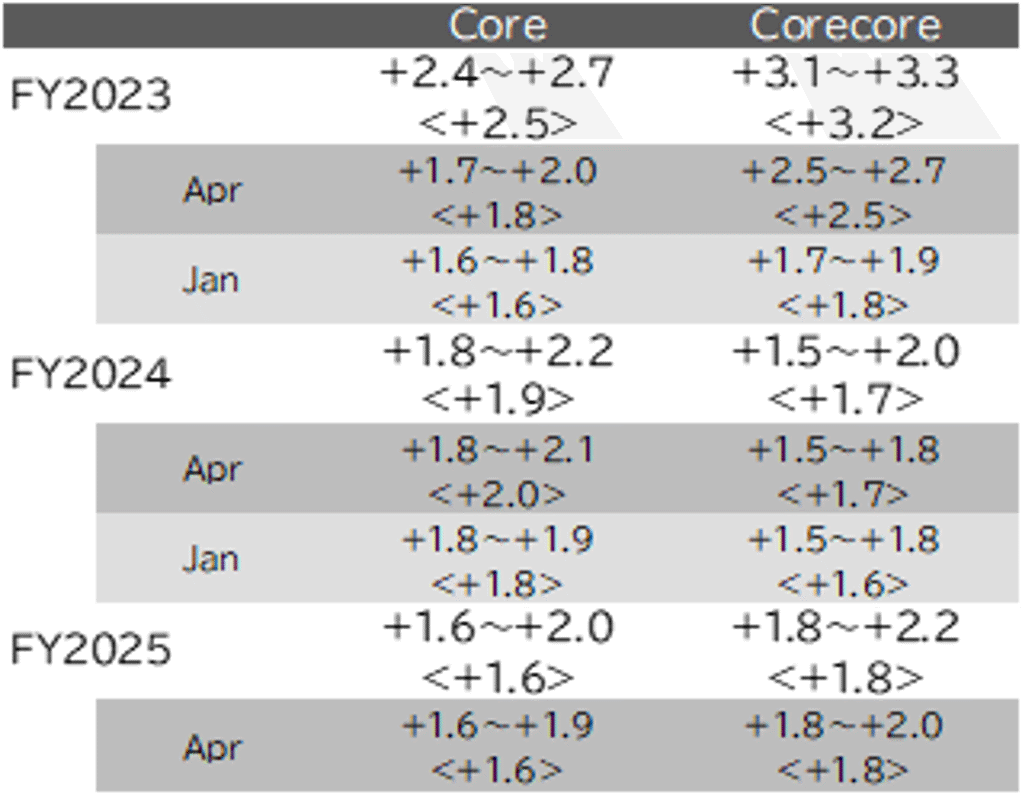

Regarding the near-term outlook for monetary policy, we will be watching the Outlook Report published at end-October and changes in the BOJ's stance based on this. The Tokyo CPI for September, a leading indicator of nationwide price trends, confirmed a slowdown in inflation, as the BOJ had expected (Figure 5). However, the slowdown is not as fast as expected in the previous Outlook Report published in July. In addition, the yen has weakened further over the past two months, and oil prices have risen significantly. A report written in the current environment is unlikely to present an outlook based on the same assumptions used in July. We therefore see the possibility of an upward revision in the outlook for both FY23 and FY24. Risks are tilted to the upside, meaning the outlook for FY24 could exceed +2.0% again (Table 1). This would bring awareness of a shift to policy normalization at an early date back into view. In addition to the change in the BOJ's stance seen to date, the rise in JGB yields has slightly eroded the prevailing sense of security among yen sellers, and we expect pressure on the yen to weaken would subside if the BOJ moves further toward policy normalization.

Meanwhile, the recent rise in the prices of oil and other resources will worsen Japan's trade balance by increasing the value of imports. However, a simple calculation of the impact of imports based on current energy prices suggests that the deterioration in the balance of payments would come to around JPY200bn to JPY300bn per month. If we consider the constant improvement in the trade deficit of about JPY1,000bn per month compared to last year and the travel balance surplus of about JPY300bn per month due to an increase in inbound tourism (which was absent last year), it will appear that yen selling due to real demand, as seen last year, is not increasing. Naturally, the story will change if energy prices rise further, so we view risk as being in the direction of a weaker yen.

FIGURE 5: TOKYO CPI (YOY)

Source: MIC, MUFG

FIGURE 6: JJULY OUTLOOK REPORT FORECASTS

Source: BOJ, MUFG

Japanese authorities on high alert to check yen weakness

The USD/JPY has risen close to 150 for the first time since last year with dollar strength becoming dominant amid the short-term easing of downward pressure on the yen and dollar advances. We remain cautious of upside risks for the USD/JPY in light of domestic and overseas factors as a whole.

Given this, the Japanese authorities have been taking an increasingly vigilant stance toward the yen's depreciation. Government officials remain on high alert, commenting on successive days that the government will not rule out any options to counter excessive currency moves. Finance Minister Shunichi Suzuki on 29 September said that the authorities have not set a "defense line" beyond which they would act, but that he felt yen weakness had progressed considerably.

In addition, US Treasury Secretary Janet Yellen said that foreign exchange intervention was understandable during times of undue volatility. Japan has made progress in smoothing the diplomatic pathway for this, with Finance Minister Suzuki repeatedly mentioning cooperation with overseas authorities. On this point, the strengthening of the dollar and weakening of the yuan has fueled growing concerns of currency depreciation in emerging Asian countries in particular, prompting some central banks to announce interventions in the foreign exchange market to protect their currencies. The meeting of G20 finance ministers and central bank governors will be held in October, and we think communication with overseas authorities is deepening beforehand. We think cooperation on this matter will not be confined to the US alone. Japanese authorities say they have not set a defense line, but we see the possibility that Japan will move to intervene in the currency markets if the USD/JPY passes 150 and tests last year's high.

QUARTERLY FORECAST RANGE AND PERIOD-END FORECAST

|

Oct-Dec 2023 |

Jan-Mar 2024 |

Apr-Jun |

Jul-Sep |

|

|

USD/JPY |

138.0~152.0 |

132.0~148.0 |

130.0~146.0 |

128.0~144.0 |

|

Period-end forecast |

145.0 |

138.0 |

136.0 |

134.0 |

Our forecast range estimates the high and low for each quarter. The period-end forecast is our forecast for USD/JPY at 17:00 New York time at the end of each quarter.