Week in review

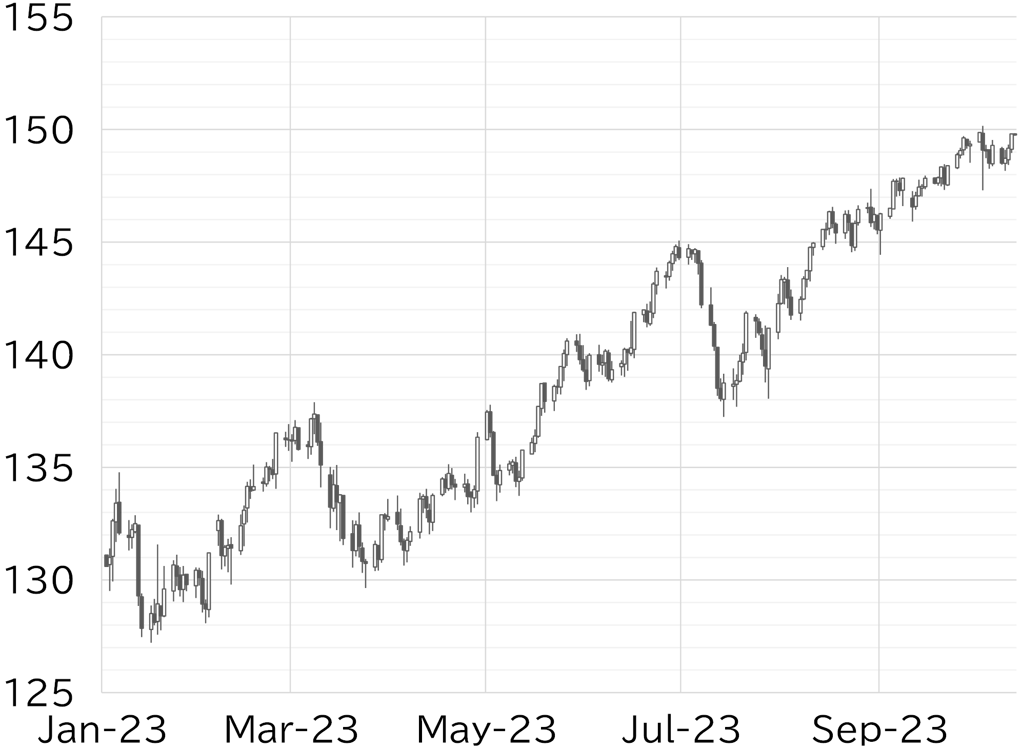

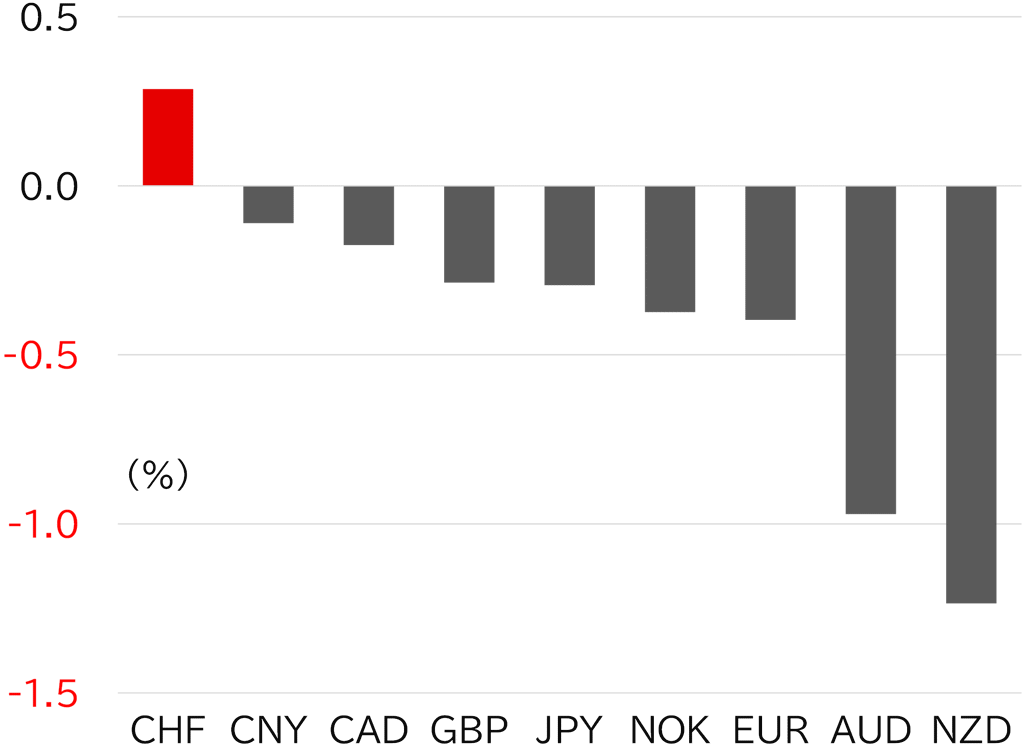

The USD/JPY opened the week at 149.14. Price movement was static on 9 October, which was a holiday in both Japan and the US, but comments from Fed Vice Chair Philip Jefferson and Dallas Fed President Lorie Logan, who is seen as a hawk, that the recent rise in long-term UST yields could reduce the need for additional rate hikes, and a shift to risk off after war broke out in the Middle East, sparked moves to sell the dollar and buy yen. As a result, the USD/JPY fell back to below 148.50 early on 10 October. However, stocks in Japan and the rest of Asia performed well overall on the 10th, possibly buoyed by the decline in long-term UST yields. The shift to risk-off was short-lived, and the USD/JPY recovered to around 149. The dollar then continued to soften as comments by Fed Governor Christopher Waller that the Fed should take the rise in long-term rates into consideration put downward pressure on UST yields, and the USD/JPY moved in a range between the upper 148 level and below 149.50. The pair became entrenched above 149 as the dollar strengthened slightly after the September PPI beat market expectations on 11 October (US time), and eyes turned toward the September CPI report. The CPI also exceeded market expectations, and UST yields rose sharply due to accelerated growth in non-housing-related service prices, causing the dollar to strengthen across the board. The USD/JPY rose past 149.50. However, as of the time of writing this report on the 13 October, the pair has not tested 150, perhaps due to concerns about foreign exchange intervention by the Japanese authorities (Figure 1). The dollar was soft this week, but it strengthened across the board following the strong CPI report. Meanwhile, among G10 currencies, the Swiss franc and the yen, which are seen as safe havens, were stable due to the worsening conflict in the Middle East (Figure 2).

FIGURE 1: USD/JPY

Note: Through 13:00 JST on 13 October

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 13:00 JST on 13 October

Source: Bloomberg, MUFG

CPI prevents Fed officials from correcting course

Comments by Cleveland Fed President Loretta Mester and San Francisco Fed President Mary Daly last week about the need for the Fed to take the rise in long-term rates into consideration were picked up by other senior Fed officials this week. On 9 October, Fed Vice Chair Philip Jefferson said "I will remain cognizant of the tightening in financial conditions through higher bond yields and will keep that in mind as I assess the future path of policy," and on 11 October, Fed Governor Waller said "the financial markets are tightening up and they are going to do some of the work for us." The minutes of the September FOMC meeting released on 11 October did not indicate that a rise in long-term interest rates was an issue for policy decisions, meaning the subsequent rise was probably somewhat unexpected. In any case, we expect Fed Chair Jay Powell's speech on 19 October (just before the blackout period ahead of the FOMC meeting) will be in line with the views expressed by both top officials. At the least, we expect he will signal that the Fed will likely hold off on a rate hike at the upcoming FOMC meeting.

Indeed, the dovish shift in tone from Fed officials has raised speculation in some quarters of the market that the Fed will abandon its previous outlook for one more hike within the year. The CPI result probably made waves in this regard. The prevailing view is that inflation is decelerating, but there are signs of a re-acceleration of inflation in service prices amid the extremely slow pace of easing in labor market supply/demand conditions. Boston Fed President Susan Collins summed this up by saying that the "CPI release is a reminder that restoring price stability will take time." From the perspective of curbing inflation, the latest CPI result increases the need for further interest rate hikes and for maintaining high interest rates for the time being. However, based on the argument from some Fed officials that the rise in long-term interest rates is essentially doing the work of rate hikes, the sharp rise in interest rates following the CPI announcement has acted as a substitute for the need to hike rates, meaning that the situation is the same as it was before the CPI announcement. We therefore think it would be wise not to rule out the possibility of one more hike. The market seems to be increasingly waiting on Chair Powell's comments next week. The rise in UST yields following the CPI announcement could also be a reaction to this week's sharp drop in yields following the lackluster 30y UST auction. We therefore do not expect a further rise in rates or strengthening of the dollar.

Top-heavy on fears of intervention

Japanese officials refrained from jawboning the market after the USD/JPY adjusted from the second half of last week but concerns of intervention are growing as the pair approaches 150 again. We expect worries about intervention to hold down USD/JPY upside in the near term. Furthermore, amid pressing issues such as the situation in the Middle East, the final section of the statement from the G7 Finance Ministers and Central Bank Governors meeting on 12 October said "We reaffirm our May 2017 exchange rate commitments." On this point, the Nikkei Shimbun quoted a source at the MOF as saying "We reaffirmed the basic idea that excessive fluctuations are a problem." In addition, Kyodo News reported that the meeting of G20 Finance Ministers and Central Bank Governors, that started on 12 October, would note the impact of rapid rate hikes in Europe and the US on the global economy. Considering that Japan intervened in the foreign exchange markets after the G20 meeting in October last year, we think Japanese authorities could use this series of international talks to again build cooperation with overseas counterparts.

Forecast range

USD/JPY: 148.00 - 150.50