Week in review

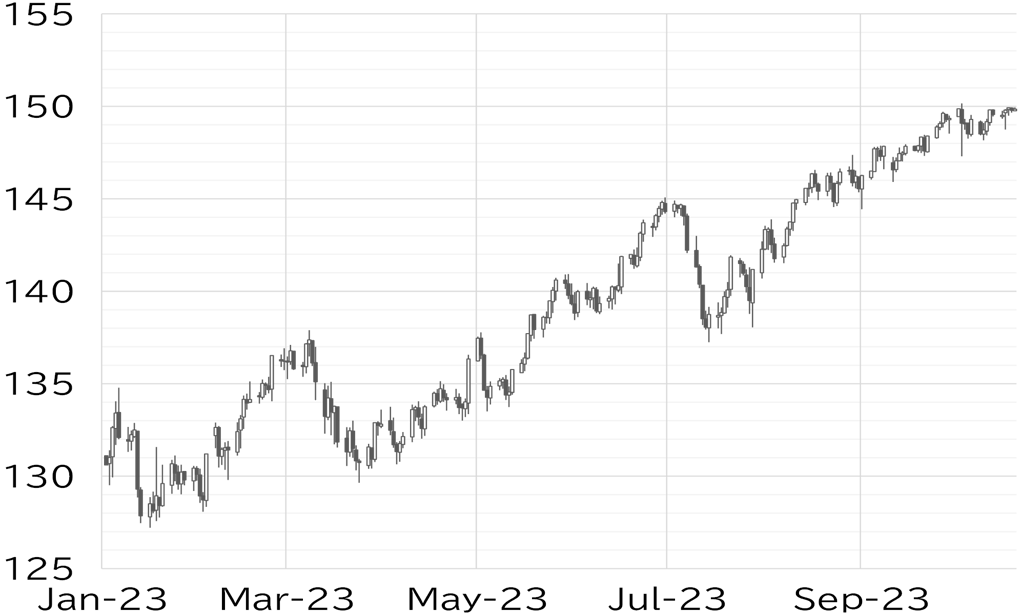

The USD/JPY opened the week at 149.55. It was top heavy and moved in a narrow range on 16 October, partly due to jawboning by Vice Finance Minister for International Affairs Masato Kanda, amid a slow rise in long-term UST yields. It remained at the same level on 17 October, but fell sharply to 148.75 in the evening following speculative reports that the BOJ would raise its inflation forecast for FY24 to 2% or higher. However, it quickly rebounded to around 149.5 and then inched higher to the upper 149 level following the release of unexpectedly strong US retail sales data for September. However, the pair became gridlocked again after that. The Chinese yuan and Australian dollar strengthened against the greenback on 18 October due to improved data from China, and the USD/JPY also fell slightly to around 149.50, but then rose to 149.94 in US trading hours after a senior Fed official showed concern about inflation. However, the pair became top-heavy on the cusp of 150, and fell back to the upper 149 range. Fed Chair Jay Powell's speech grabbed the spotlight on 19 October, but the USD/JPY ultimately stopped at a high of 149.95. The USD/JPY moved on headlines during the week, but as of the time of writing this report on the 20 October, it had not broken out of a narrow range around the upper 149 level (Figure 1).

Turmoil in the Middle East weighs on financial markets

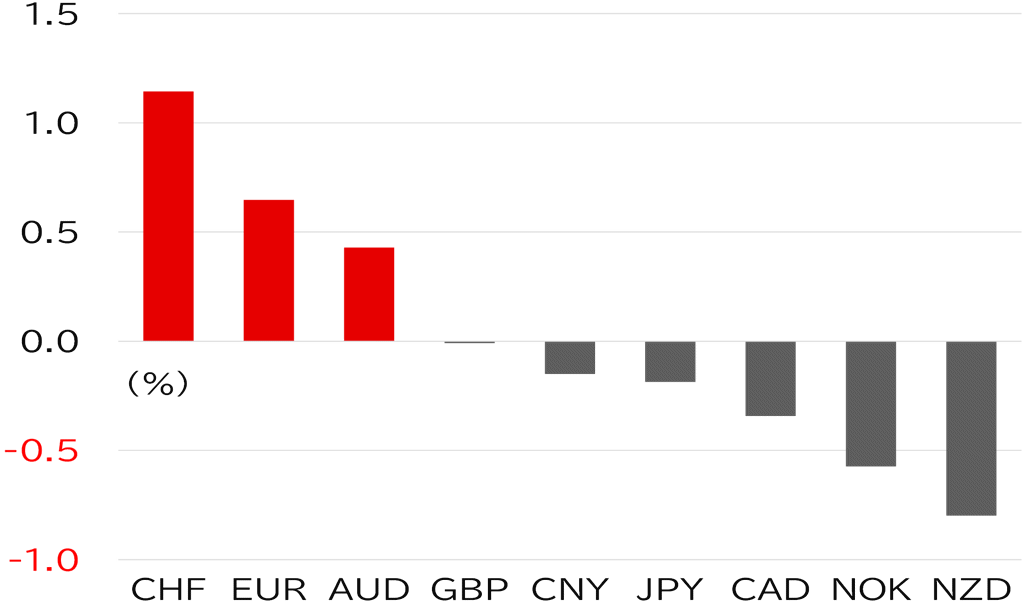

Meanwhile, the situation in the Middle East has been gradually escalating. In the financial markets, the price of oil and gold rose and share prices declined in typical moves to risk off during periods of tension in the Middle East. In the foreign exchange market, the Swiss franc rose notably, while emerging nation currencies softened (Figure 2). However, at this point, the war has not spread through the region or escalated into a religious or ethnic conflict. The outlook is highly uncertain, and we should be careful about being optimistic, but the dollar's position in the middle of G10 currencies means the market has not seen a panic-driven shift to risk aversion and emergency dollar buying. Under these circumstances, the USD/JPY has become increasingly gridlocked at the 149 level amid smoldering concerns of intervention by Japanese authorities. We expect the USD/JPY will continue to lack a sense of direction as it will be hard to gain momentum ahead of domestic and overseas monetary policy meetings scheduled for next week.

FIGURE 1: USD/JPY

Note: Through 12:00 JST on 20 October

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 12:00 JST on 20 October

Source: Bloomberg, MUFG

Consensus expects FOMC to stay put, but pay attention to indicators

Several Fed officials have said they will take the impact of the continued rise in US long-term rates into account, which has led to expectations that the Fed will stop raising rates. On 19 October, just ahead of the blackout period before the FOMC meeting, Chair Jay Powell said that the Fed is "proceeding carefully" in considering the need for further rate hikes. The financial markets took this as a signal that the FOMC would keep rates on hold, but Powell also said that growth trends and labor market supply/demand conditions "could warrant further tightening of monetary policy." Regarding the recent rise in long-term interest rates, he said that financial conditions had tightened but were not too tight. At the very least, we think his comments did not meet rising expectations of an end to rate hikes. On this point, data scheduled to be announced next week, including the US preliminary 3Q GDP report and the PCE deflator for September, could impact policy decisions. We do not expect the data to undermine recent suggestions that a rate hike will be postponed, but it could dispel expectations of an end to rate hikes. In that case, the USD/JPY is likely to face upside pressure.

Speculation about BOJ's monetary policy meeting

Media reports have speculated that the BOJ will raise its inflation forecast in the Outlook Report at its monetary policy meeting at the end of October. The Japanese Trade Union Confederation also announced that it will demand a wage increase of "5% or more" next year. Furthermore, there have been reports that some large companies are already considering raising wages beyond this amount. This suggests a trend of sustained wage increases that the BOJ has set as a condition for policy normalization is likely to come into view before the new year. Meanwhile, Prime Minister Fumio Kishida has said he wants to pass a supplementary budget at the extraordinary Diet session that begins on 20 October. Given the view that it will be difficult to hold a snap election before the end of the year, the BOJ could find it hard to act if a general election is pushed back to 2024. Our main scenario is for a change in monetary policy in January next year, but the political calendar suggests we should also consider an early move to normalize monetary policy. Long-term interest rates continue to rise in Japan, due in part to rising interest rates in the US. The interest rate differential is widening, but this sense of caution about the BOJ's meeting is acting as a deterrent to a further weakening of the yen.

Regarding this point, Vice Finance Minister for International Affairs Masato Kanda said on 16 October that a country could respond to a significant depreciation of its currency either by stopping capital outflows by raising interest rates, or countering excessive fluctuations by intervening in the foreign exchange market. He may have just been speaking in general terms, but such comments could also be interpreted as an intentional step into monetary policy. In fact, Kanda's comments in July that prices and wage data were better than expected and that a shared understanding is emerging in Japan and overseas seemed aimed at encouraging a shift in monetary policy. Immediately after this statement, the BOJ decided to make the YCC more flexible.

Unlike the Fed, the BOJ's blackout period begins two business days before the policy meeting. Speculative reports on monetary policy decisions over the weekend and after could result in a yen-driven breakout of the USD/JPY gridlock.

Forecast range

USD/JPY: 147.00 - 150.50