Key Points

Please click on download PDF above for full report

- The Bank of Thailand could resume cutting its policy rate again this month, given subdued CPI inflation and a slower than expected domestic economic recovery. Moreover, the Thai government has been piling more pressure on the central bank to lower interest rates. We reiterate our view that the BoT will reduce the policy rate by 25bps to 2.00% as early as at the upcoming 26 February monetary policy meeting.

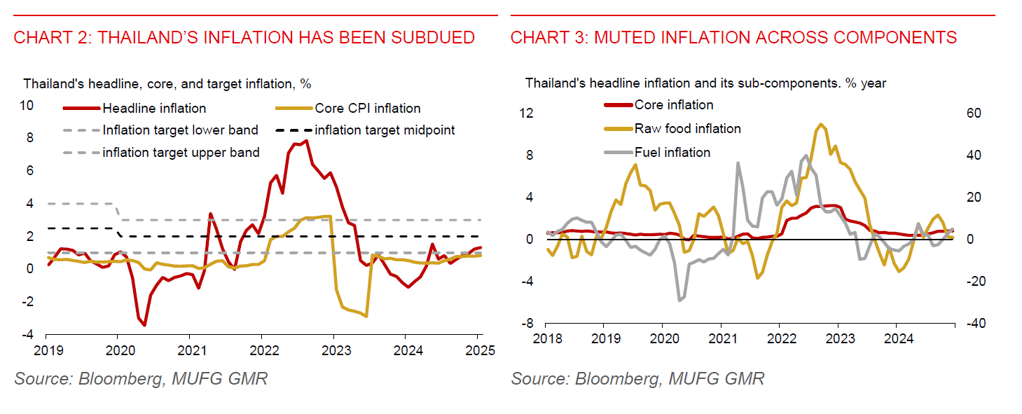

- Thailand’s headline CPI inflation has been quite subdued, at just 1.3%yoy in January, despite a modest uptick since Q4 2024. As such, headline inflation has hovered near the lower bound of the Bank of Thailand (BoT)’s 1.0%-3.0% inflation target range in December-January. Notably, Thailand’s core inflation was lacklustre at just 0.8%yoy in January, likely reflecting sluggish domestic demand.

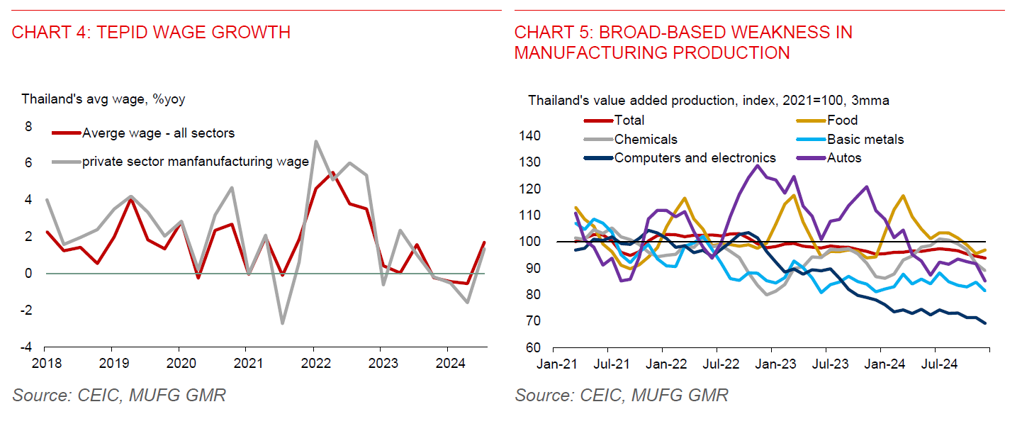

- We forecast Thailand’s core inflation will only rise to about 1%yoy in 2025 from 0.6%yoy in 2024, amid subdued underlying inflationary pressures. Overall employment fell 0.4%yoy in Q4 2024. This was mainly dragged down by a decline in employment in the agriculture (-3.5%yoy) and wholesale and retail trade sectors (-1.6%yoy), offsetting increases seen in the manufacturing (+0.8%yoy) and accommodation and food services sector (+8.4%yoy). In addition to that, Thailand’s average wage growth was modest at 1.7%yoy in Q3 2024, while private sector manufacturing wage only grew by 1.3%yoy during the same period of time.

- Thailand’s GDP growth slowed to 0.4%qoq in Q4, from 1.2%qoq in Q3. This was dragged down by lacklustre domestic demand and a negative contribution from net exports. From a year ago, GDP grew 3.2%yoy in Q4, up from 3.0%yoy in Q3, but missing Bloomberg consensus of 3.8%yoy. This brings full-year GDP growth to 2.5%yoy in 2024, higher than 1.9%yoy growth in 2023, but missing market expectations of 2.7%yoy.

- While the tourism sector has been a key driver of growth, Thailand’s manufacturing sector has been a major drag on the economic recovery. We see broad-based declines in manufacturing production across key sectors, including food, chemicals, basic metals, computers & electronics, as well as autos. Thailand’s manufacturing PMI also slipped into contraction in January for the first time since April 2024.

- Thailand commercial banks’ overall credit growth fell 0.4%yoy in December, marking 4 straight months of contraction. Notably, credit growth in the accommodation and food services sector fell 1.8%yoy in December, staying in a prolonged decline. Credit growth for SMEs in the manufacturing sector fell 4.2%yoy in December, marking the 10 straight months of contraction, given increased competition and heightened credit risks. The government has rolled out its “Khun Soo, Rao Chuay” (You Fight, We Help) programme to help provide debt relief for borrowers of housing and SME loans under THB5mn and auto loans of below THB800k. Under this programme, debts will be restructured, while interest payments will be suspended in next 3 years.

- Thailand is also particularly vulnerable to President Trump’s reciprocal tariff hike. Based on World Bank’s latest available data in 2022, Thailand imposed 6.2% tariffs on US products on a weighted average basis, higher than the 0.9% that US imposed on Thailand’s products. As such, Thailand’s economy faces the risk of around 5ppt hike in US tariffs on weighted average basis. We estimate that this could cut Thailand’s GDP growth by up to 0.2ppt.

- Thailand’s policy rate adjusted for inflation currently stands at 0.9%. This is lower than the 1.2% average during the pre-Covid period of 2015-2019, suggesting that the policy stance is about neutral. However, the 2.5% GDP growth pace in 2024 is well below the 3.4% average pace seen in 2015-2019. Subdued inflation, along with lacklustre economic growth, should give scope for the central bank to lower its policy rate. Moreover, the Thai baht has been relatively resilient against the US dollar.

- In terms of our USDTHB outlook, we still look for it to rise to 35.30-level in Q1, in anticipation of the BoT rate cut and potential market pricing of renewed tariff risks heading into Q2. For now, Trump has ordered his administration to conduct a study of US trade relations with trading partners, which is set to conclude on 1 April. There could still be more tariff actions from April onwards.