Key Points

Please click on download PDF above for full report

- The Bank of Thailand cut its policy rate by 25bps to 2.00% this month, given weaker than expected CPI inflation and economic recovery. This is in line with our out-of-consensus view for a policy rate cut as early as at this policy meeting. The monetary policy committee voted 6-1 to reduce the policy rate, while policymakers said the rate cut will help support the economy and ease financial constraints. BoT assesses that this rate adjustment is consistent with current economic conditions and remains robust to economic risks going forward.

- We think there will be less pressure for the Bank of Thailand to ease its policy further for now. Policymakers have said that the rate cut is not an easing cycle. In addition to that, Trump has so far only imposed 10% tariffs on Chinese imports and 25% on steel and aluminium imports, less aggressive than the 60% on China that he had threatened to impose during his election campaign. Today’s policy rate cut will likely help the Thai economy to better cope with increasing economic risks stemming from US trade policies and weakening domestic credit growth.

- Policymakers have been concerned about a slower than expected economic recovery in 2024, and they expect the growth recovery will continue to be dragged down by ongoing structural problems in the manufacturing sector and intense competition from imported goods, especially in automotive, petrochemicals, and construction materials. Notably, credit growth for SMEs in the manufacturing sector fell 4.2%yoy in December, marking the 10 straight months of contraction, given increased competition and heightened credit risks.

- Thailand is also particularly vulnerable to President Trump’s reciprocal tariff hike. Based on World Bank’s latest available data in 2022, Thailand imposed 6.2% tariffs on US products on a weighted average basis, higher than the 0.9% that US imposed on Thailand’s products. As such, Thailand’s economy faces the risk of around 5ppt hike in US tariffs on weighted average basis. We estimate that this could cut Thailand’s GDP growth by up to 0.2ppt.

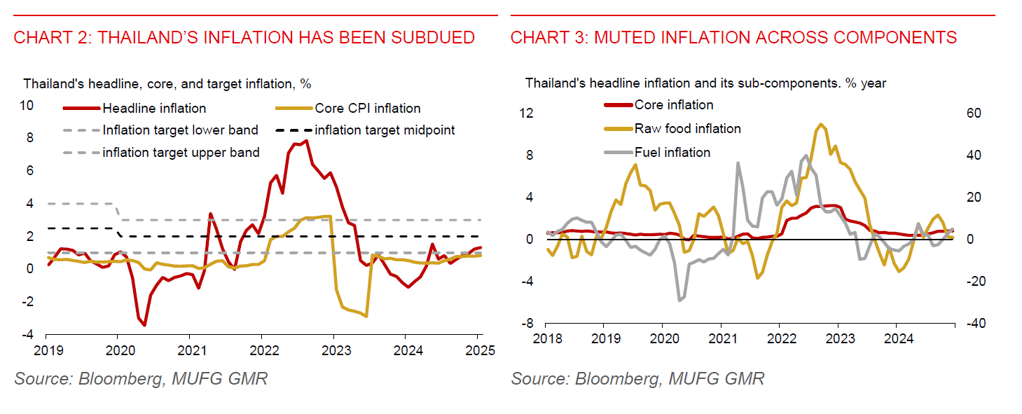

- Meanwhile, BoT expects headline inflation will stabilize at the lower bound of its 1.0%-3.0% inflation target range due to softening Brent prices and intense price competition from imported goods. Indeed, Thailand’s headline CPI inflation has been quite subdued, at just 1.3%yoy in January, despite a modest uptick since Q4 2024. As such, headline inflation has hovered near the lower bound of the Bank of Thailand (BoT)’s 1.0%-3.0% inflation target range in December-January. Notably, Thailand’s core inflation was lacklustre at just 0.8%yoy in January, likely reflecting sluggish domestic demand. We forecast Thailand’s core inflation will only rise to about 1%yoy in 2025 from 0.6%yoy in 2024, amid subdued underlying inflationary pressures.

- In terms of our USDTHB outlook, we maintain our outlook for it to rise to 35.30-level in Q1 and 36.00 in Q2. We think markets are currently under-pricing the risk of more US tariff actions in the coming months. For now, Trump has ordered his administration to conduct a study of US trade relations with trading partners, which is set to conclude on 1 April. There could still be more tariff actions from April onwards.