Key Points

Please click on download PDF above for full report

- We maintain our positive outlook for the Thai baht, though gains versus the US dollar will be relatively more modest from current levels compared to the sharp 10% appreciation we have seen so far in H2. We forecast the Thai baht will end this year at THB32.5/USD before reaching THB31.50/USD by end-2025, versus spot price of THB32.95/USD at the time of writing.

- The outlook for Thailand’s growth will improve, underpinned by the digital wallet program (which we estimate it would add 0.2ppt to 2024 growth and 0.4ppt to 2025 growth) and further tourism recovery. We thus forecast Thailand’s GDP will grow 2.9% this year and 3.1% in 2025. As such, Thailand’s growth outperformance relative to the US should bode well for the Thai baht.

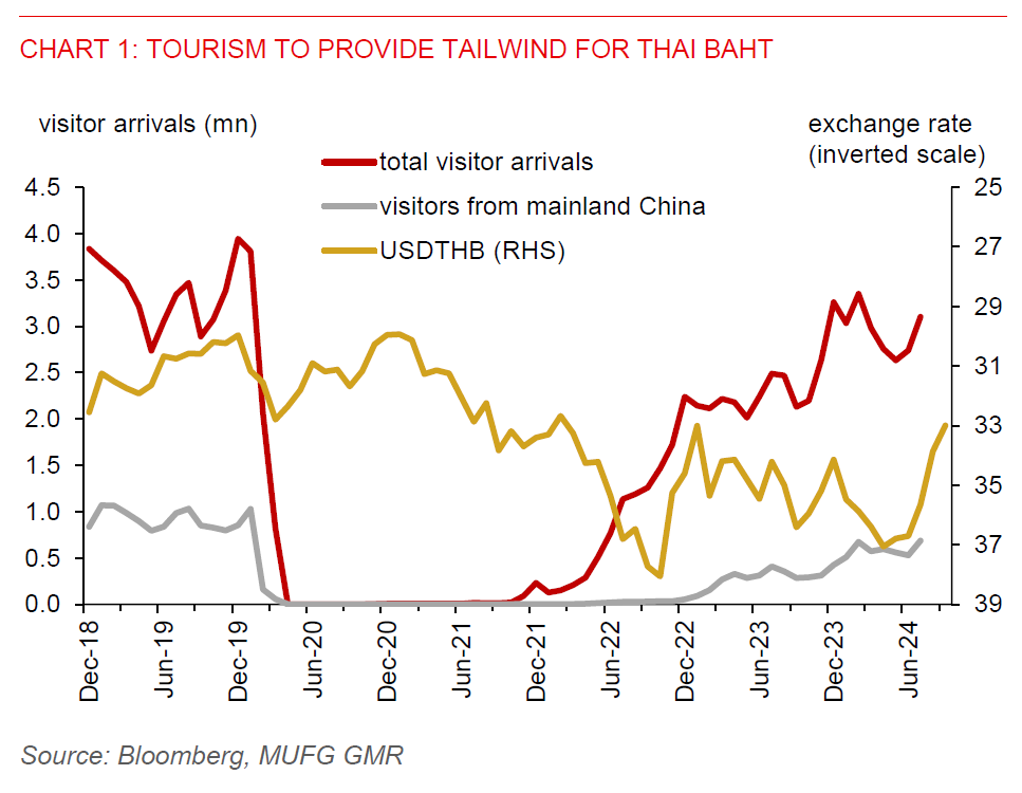

- Thailand’s improving current account surplus will provide additional tailwind for the currency and keep it relatively resilient against a potential rise in volatility from the upcoming US presidential election. Moreover, the tourism recovery should gather pace as peak tourism season returns in Q4.

- Recent domestic political uncertainty has notably been short-lived, with limited impact on Thai markets. New Prime Minister Paetongtarn has succeeded ousted ex-PM Srettha and retained Finance Chief Pichai, which should help ensure budget disbursement in FY2025 (beginning in October) will be timely.

- We expect BoT will keep policy rates neutral at 2.50% this year, before cutting 50bps in 2025. But with the Fed set to bring down US rates by much more, Thailand’s unfavourable yield differential versus US rates will narrow sharply, shoring up the attractiveness of Thai equities.

- Key downside risks will stem from an escalation of Middle East tensions, which would drive up oil prices, and onerous tariffs being imposed on China and globally should Trump win the November presidential election.