Key Points

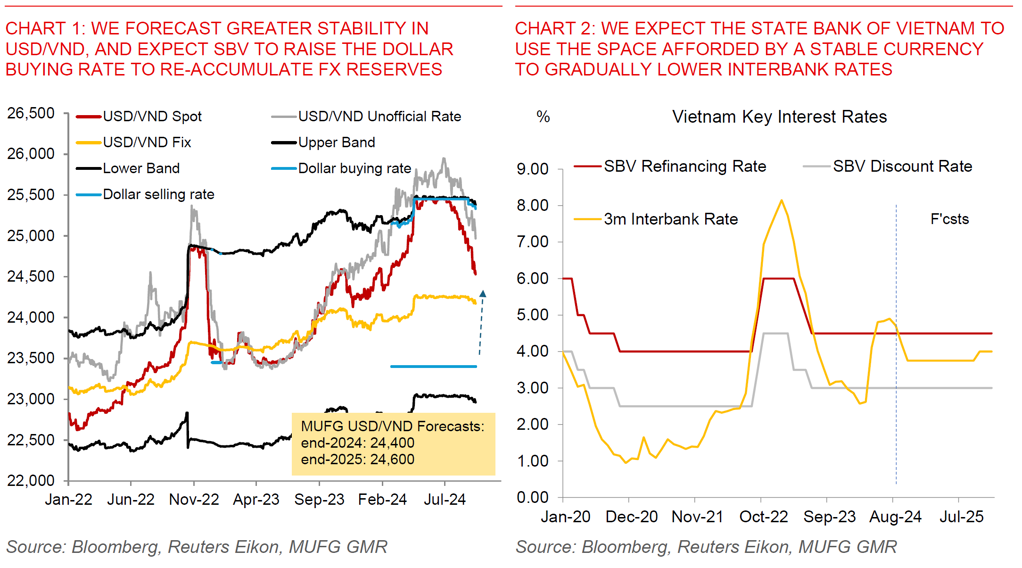

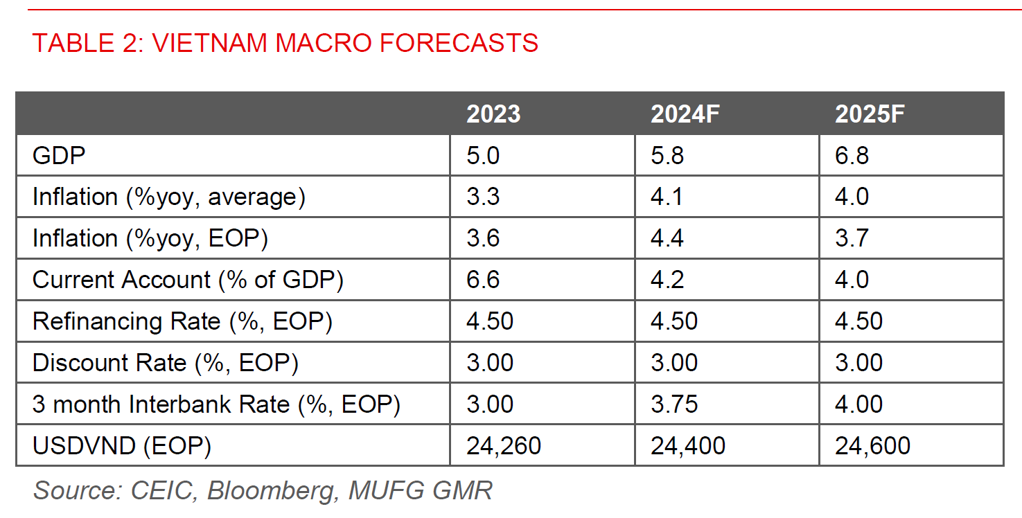

- We forecast greater stability in USD/VND and now expect the FX pair to end 2024 at 24,400 and 2025 at 24,600. This will be helped by US rate cuts, strong inflows from FDI and a trade surplus, supportive government policies, nascent domestic demand recovery, coupled with a reduction in capital outflows.

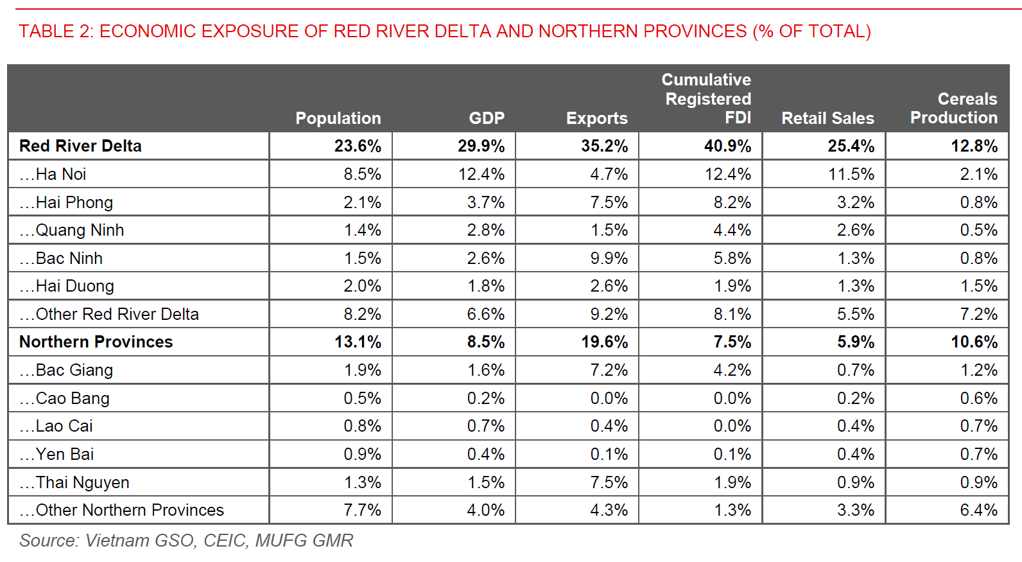

- Importantly, we think a strong rebound in the Vietnam Dong is unlikely. The negative impact of Typhoon Yagi is a key factor, which may reduce 2024 GDP growth by between 0.2% to 0.5%, but with a corresponding improvement in 2025 as activity bounces back. The areas that bore the brunt of direct damage from the Typhoon include key manufacturing and tourism hubs such as Hai Phong and Quang Ninh (Ha Long Bay), while the subsequent flooding also affected export centers such as Bac Ninh, Bac Giang, and Thai Nguyen to some extent. Our base case is that the bulk of the disruptions should resolve within 2-3 months, even as the rebuilding and replacement of assets are likely to take some time. Nonetheless, the economic importance of the broader Red River Delta and Northern regions pose downside risks to our views, especially if the weather and flooding takes a turn for the worse. As an initial assessment, we lower our 2024 GDP growth forecast to 5.8% (from 6.1% previously) with a rebound to 6.8% in 2025 (from 6.5%).

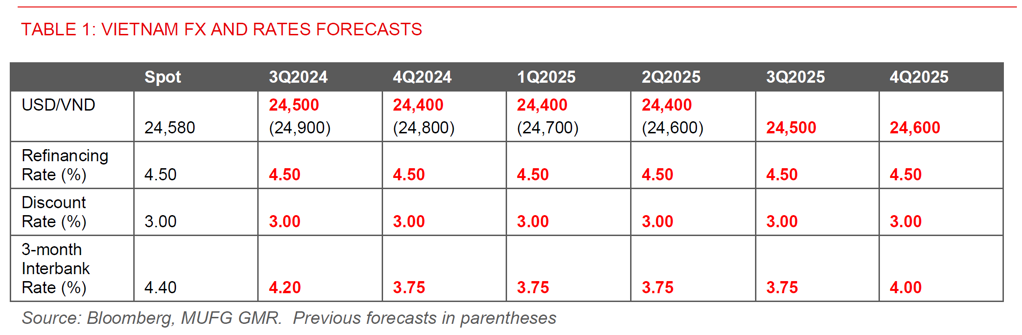

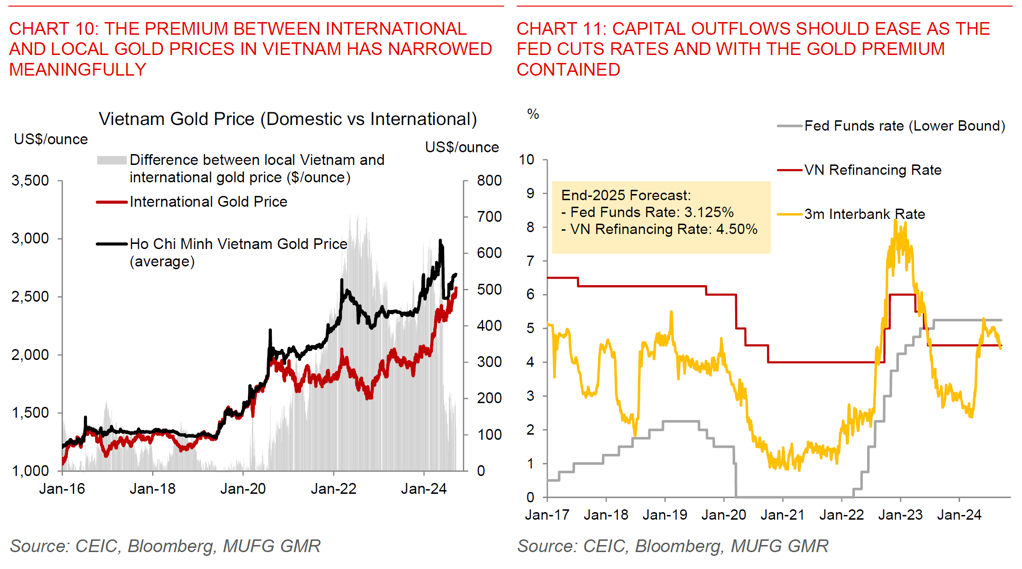

- Correspondingly, we forecast the State Bank of Vietnam to turn more dovish by lowering the 3m interbank rates to 3.75% by end-2024 (from 4.40% currently), coupled with a good chance that SBV will raise the Dollar buying rate fairly soon to accumulate FX reserves and hence put a floor to USD/VND. In effect, what we are forecasting is for the central bank to use the policy space afforded by currency stability to support the economy, especially amidst uncertainty around the economic impact of Typhoon Yagi. If we are right about the above, VND bank deposit and lending rates are likely to come off gradually, while USD/VND FX forward points should rise only modestly over time.

Vietnam’s economy and the Dong remain on a road to recovery notwithstanding Typhoon Yagi

There are a couple of reasons why Vietnam’s economy and also the currency should remain on a road to recovery, putting aside the uncertainty surrounding the negative impact of Typhoon Yagi.

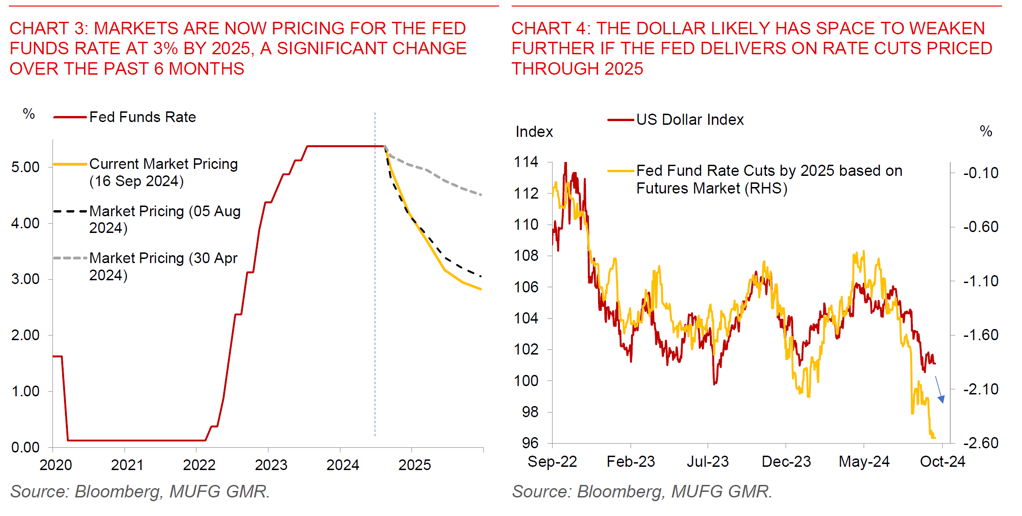

First, we expect external factors such as Fed rate cuts, a weaker Dollar, together with stronger Asian currencies to continue into 2025, as such combining to put less pressure on the Vietnam Dong moving forward: With markets moving in a significant fashion to price in more Fed Fund rate cuts over the past six months, the USD/VND rate has also seen less upward pressure. The Fed Funds futures market is now expecting the Fed Funds rate to fall below 3% by end-2025, which is a significant change relative to the 4.5% expectation at the start of April 2024. We note our Global FX and US rates strategy teams have been ahead of the curve in calling for more US rate cuts and a weaker Dollar, and markets have moved more in line with their views (see Global FX Monthly and Jackson Hole recap). Importantly, our expectation is that the US is able to achieve a “soft” landing into 2025 and not a meaningful recession, and as such, this does not result in negative global spillovers to Vietnam’s exports and/or a flight to safety out of emerging market assets. Overall, our global team expects the Dollar to have space to weaken further as the Fed delivers on rate cuts priced through 2025. Moreover, our global team’s bullish view on the Japanese Yen will also have positive spillover impact to Asian currencies especially for those with strong trade linkages with Japan, including the Vietnam Dong.

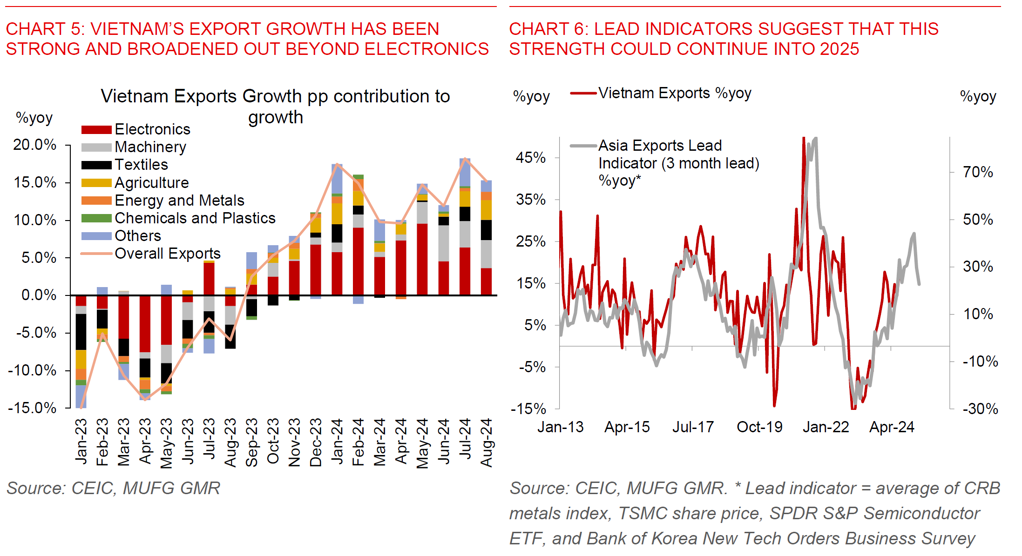

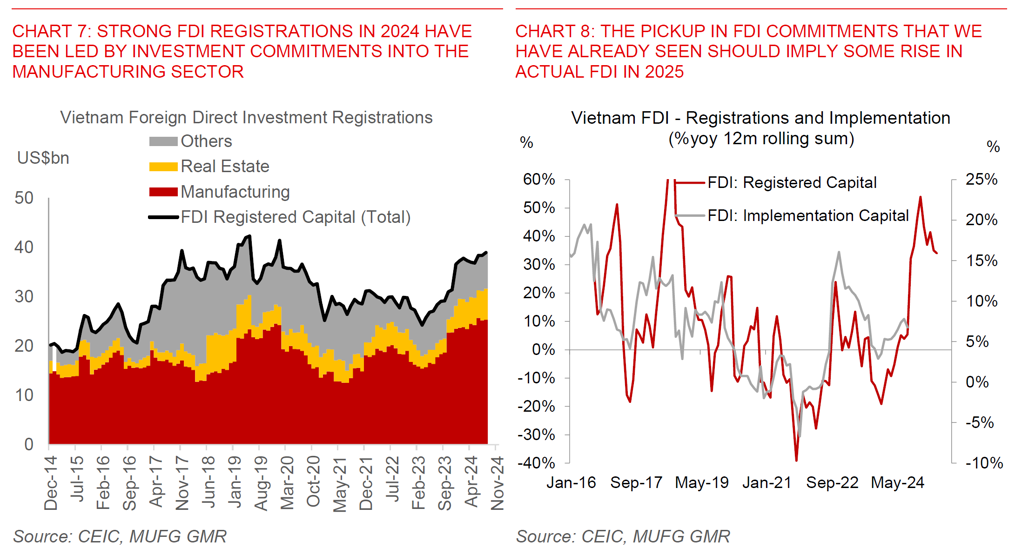

Second, what’s also key for Vietnam is its strength in exports and FDI inflows, which should continue into 2025 notwithstanding the left tail risks of Typhoon Yagi on key economic hubs in the North: Vietnam’s latest export growth has remained robust around 15%yoy as of August, with the details showing the strength has broadened out beyond just electronics, towards other sectors such as agriculture, machinery, and textiles (see Chart 5 below). More importantly, the best leading indicators for Asia and Vietnam’s exports we like to track such as metal prices, semiconductor share price and the Bank of Korea’s business survey suggest that Vietnam’s exports may have some space to improve further, before taking a modest step down in 2025 (see Chart 6). Vietnam has also been gaining export market share and as such outperforming its Asian peers in export growth and supporting USD inflows. This is also reflected by the continued strong pick up in Foreign Direct Investment registrations, which are now close to all-time highs led by the manufacturing sector. As such, further improvement in actual FDI disbursement is likely reflecting the rise in foreign investment commitments that we have already seen, all of which should combine to help support the Vietnam Dong (see Chart 7).

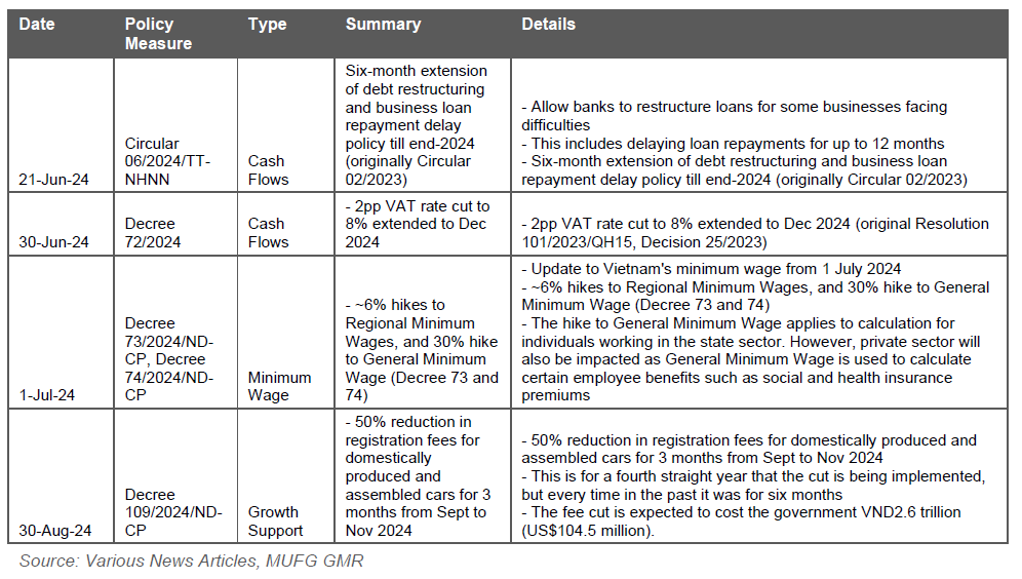

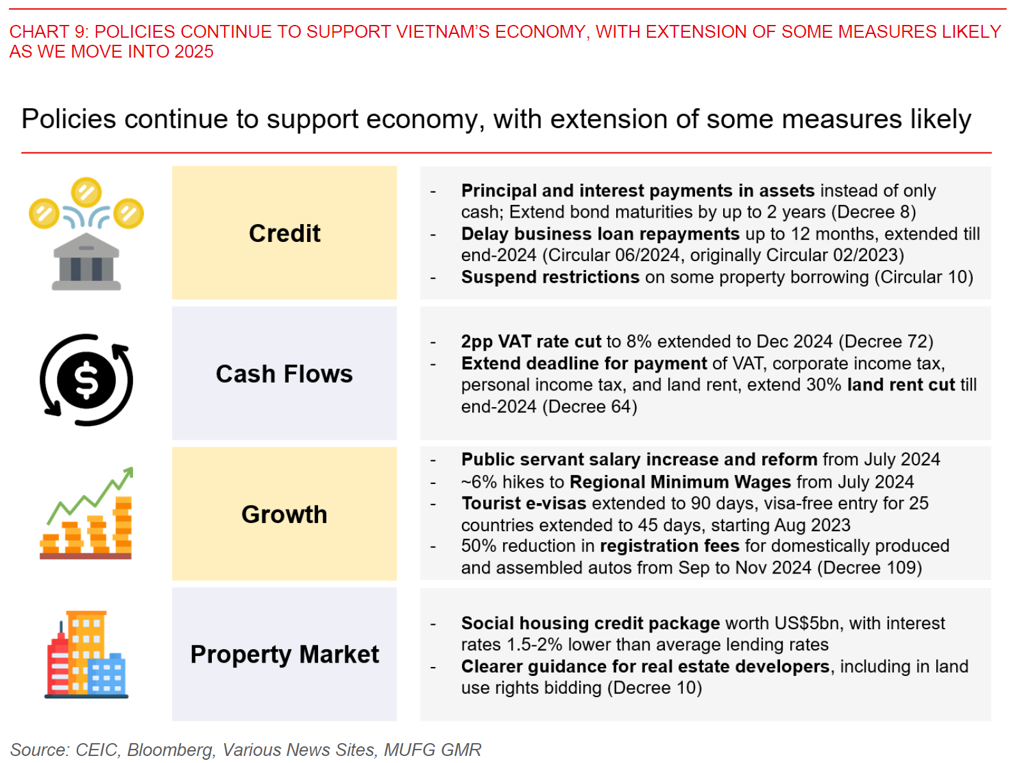

Third, domestic demand should continue its nascent recovery with reasonably supportive government policies to boost credit availability, cash flows, growth and the property market. The government has been implementing many measures to support the economy since the sharp slowdown in the real estate market and run on Saigon Commercial Bank in 4Q2022. These measures include allowing easier credit repayment terms, encouraging bond restructuring, cutting the VAT rate temporarily by 2pp to 8%, delaying payments for taxes, cutting land rents, coupled with providing easier credit terms for social housing developments. Several of these measures including the VAT rate cut have since been extended till the end of 2024, and it’s possible that these are extended again come 2025. In addition, the government has more recently raised Regional Minimum Wages by around 6%, with also increases to statutory social and health insurance premiums, together with a 50% reduction in registration fees for domestically produced and assembled autos from September to November 2024 (see Chart 9 below and Appendix). Overall, the cumulative impact of these policies, combined with a gradual recovery in credit growth and the spillover impact of better exports to manufacturing employment should imply better days ahead for the economy and also the Vietnam Dong.

Fourth, domestic capital outflows are becoming less acute, and should ease further given better stability in the local gold market, lower US rates, and manageable domestic inflation pressures. We had previously placed more weight on our expectations for continued large resident capital outflows from Vietnam in making our FX and rates forecasts, and that has proved incorrect over the past few months. Among other factors, the steps that authorities have taken to achieve better balance between demand and supply in the local gold market seemed to have helped to reduce outflow pressure through the local gold market, as evidenced in the narrowing premium between local and international gold prices (see Chart 10 below). In addition, lowering of US rates should also reduce the domestic capital outflow pressure and narrow the yield spread with Vietnam, notwithstanding our expectation for SBV to keep rates reasonably low as well to support growth moving forward.

Last but not least, some of the longer-term structural reforms such as amendments to the Land Law, Housing Law and Real Estate Business Laws may also help the real estate sector and boost inflows, thereby helping the currency as well in 2025. There are 3 big picture aspects to these law changes based on our understanding. First, the relaxation of foreign investment restrictions in real estate. Most notably, real estate companies with less than 50% foreign ownership will now be entitled to the same rights as local companies based on the new laws. Previously, there was no explicit definition. Second, the improvement of land use rights and transparency in the property market, including annual updates of land prices. Third, improvement of property rights of homeowners and ensuring property developer strength, including limiting presales deposits to no more than 5%.

Typhoon Yagi impact a key downside risk

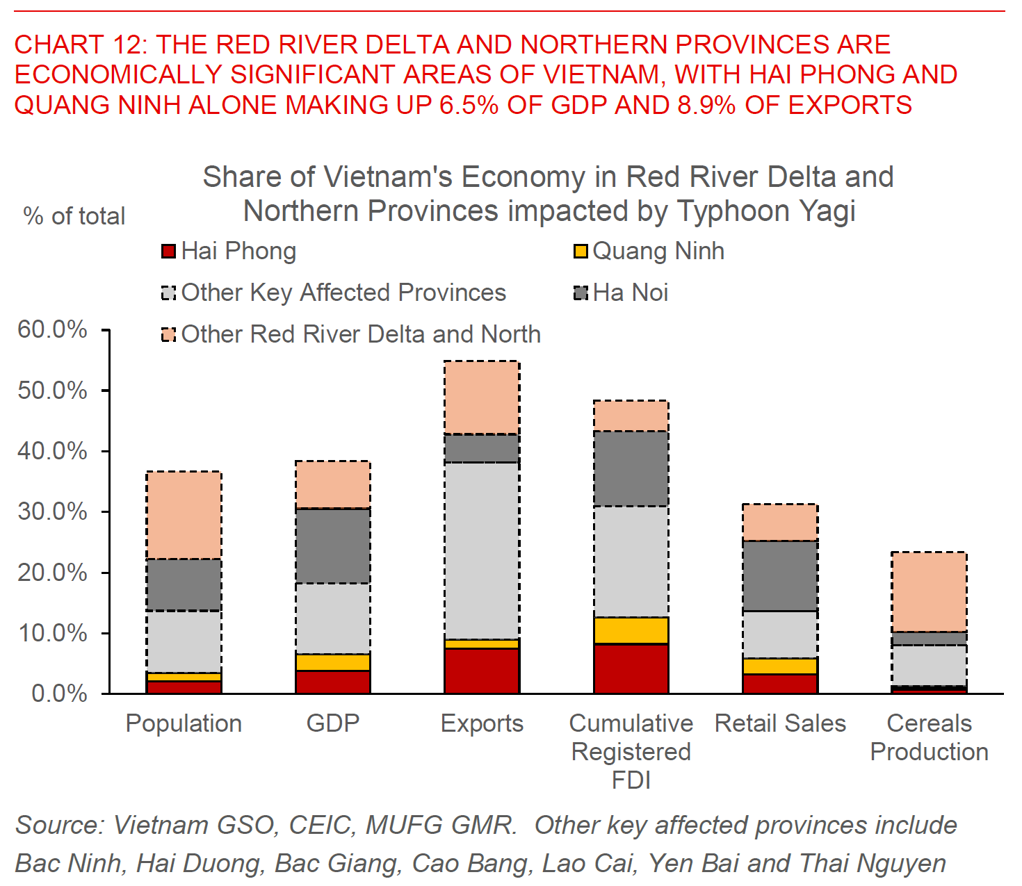

All these above rest crucially on our assumptions of how the negative impact of Typhoon Yagi may play out. We note that the Red River Delta and Northern Provinces where the Typhoon hit are certainly economically significant areas of Vietnam. The two provinces bearing the direct brunt of the Typhoon’s immediate impact – Hai Phong and Quang Ninh (where Ha Long Bay is located) - make up 6.5% of GDP, 8.9% of exports, 12.6% of cumulative registered FDI since 2018, coupled with 5.9% of total retail sales. The subsequent rains and flooding from the Red River that came after it also affected other key manufacturing and export related provinces such as Bac Ninh, Bac Giang and Thai Nguyen to varying degrees, which combine to make up 12% of GDP and 29% of exports. All together, the Red River Delta and North Provinces region collectively make up 38% of GDP and 55% of exports (see Chart 12 below and also Appendix).

Initial assessments by the government suggest that the Typhoon may reduce 2024 GDP by 0.15%. Vietnam News Agency quoted the Planning and Investment Minister Nguyen Chi Dung as saying that GDP growth in the third quarter and fourth quarter could decrease by 0.35% and 0.22% respectively, with around 40 trillion dong (US$1.63bn) in damage to fixed assets such as infrastructure and factories (see link). Separate news reports also suggest that the Typhoon had severely damaged factories with many roofs blown off and walls torn and collapsed in key industrial zones such as Hai Phong, and that fully getting production back on track may take weeks or months even as companies are busy rebuilding (see link). In addition, there were also reports of flooding in other provinces such as Bac Ninh (see link), even as most articles suggest that industrial parks in Bac Ninh, Bac Giang and Thai Nguyen are generally operating normally (see link). News articles suggest that Ha Long Bay in Quang Ninh has reopened for tourism, and that efforts are intensifying to clean up the iconic site (see link). Nonetheless, tourism more broadly into the Northern areas could take a hit in the near-term given uncertainty around possible landslides and safety concerns.

Our base case is for the bulk of the disruptions to resolve within 2-3 months, even as the rebuilding and replacement of assets are likely to take some time. Nonetheless, there are significant downside risks to these assumptions depending on the severity of disruptions and how prolonged they prove. As a scenario analysis, we did some back of the envelope calculations of how GDP may be impacted depending on various assumptions. In scenarios where the disruption is largely concentrated in Hai Phong, Quang Ninh and several other key provinces over 3 months, the impact to GDP could range around 0.16% to 0.45% - which is in line with the government’s current estimate (see Chart 13 above). Nonetheless, if we assume that the impact is prolonged beyond 3 months and also spreads out more broadly perhaps due to intensification of flooding, the impact to GDP could rise closer to 0.9% to 1.5% (see Chart 13 above).

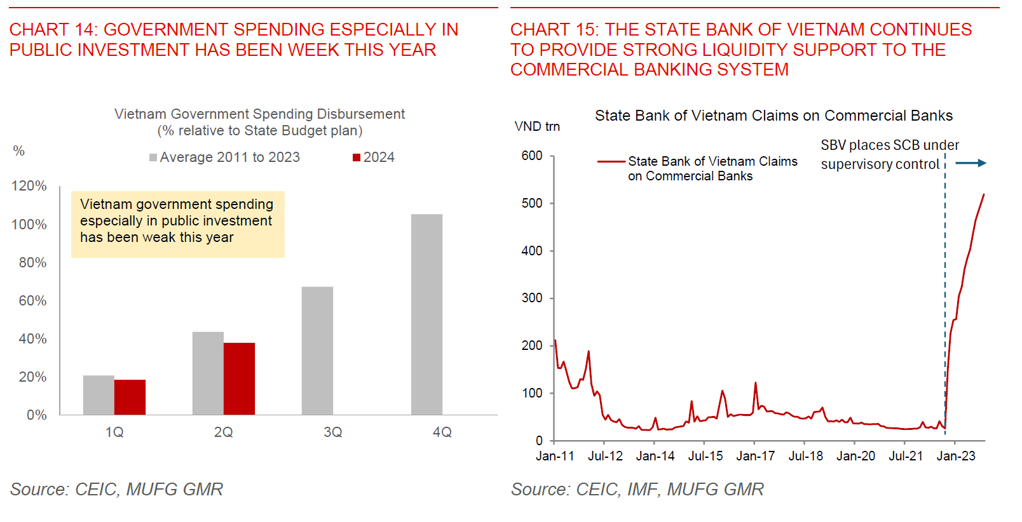

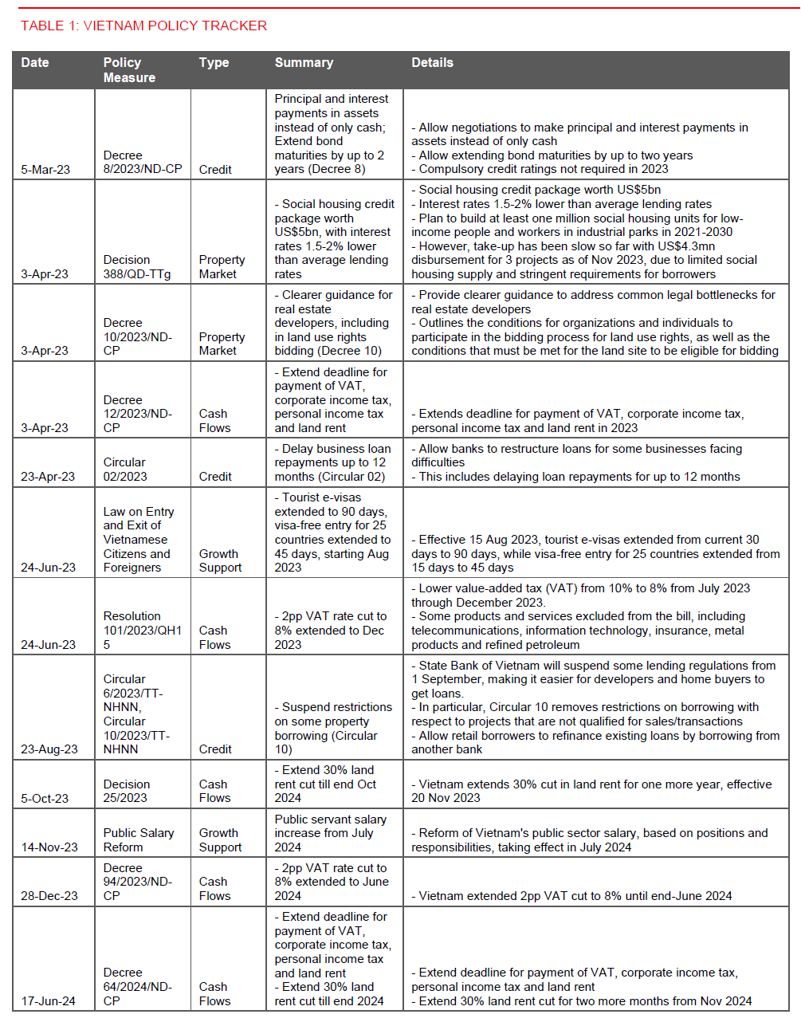

Overall, we think that a strong rebound in VND is unlikely moving forward in our base case: Beyond the Typhoon, we expect the central bank to also turn more dovish and lower interest rates to support the economy, while possibly also raising the Dollar buying rate to re-accumulate FX reserves, and as such also putting a floor to USD/VND. In addition, we note that domestic policy uncertainty remains reasonably high, with still weak government spending, slow disbursements especially in public investment projects, coupled with still high liquidity support by the central bank to the banking system (see Charts 14 and 15).