Key Points

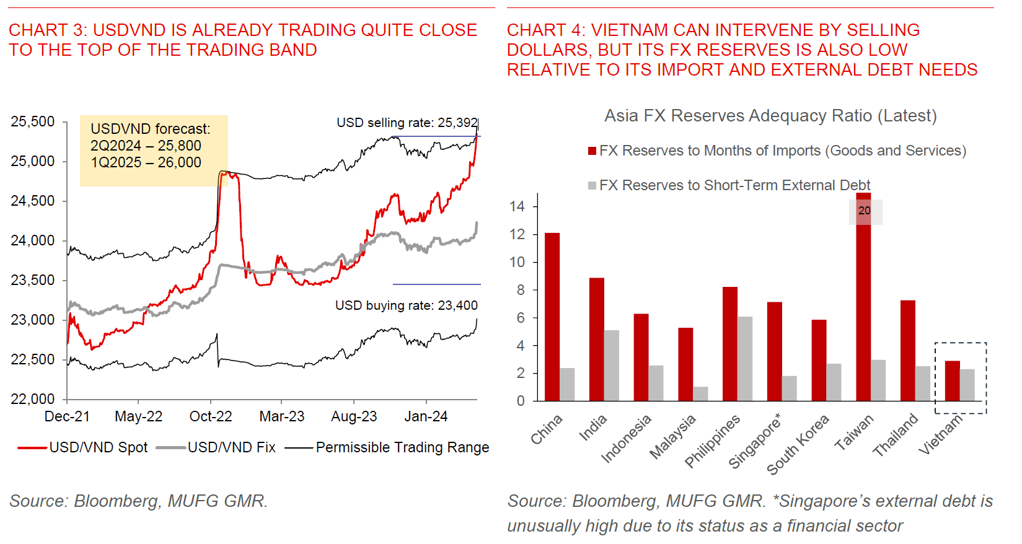

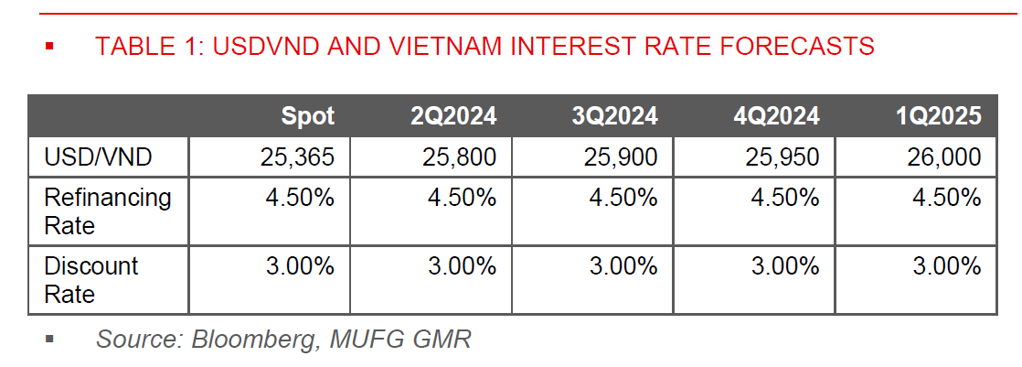

- Summary: We revise up our USDVND forecasts to 25,800 for 2Q2024, and 26,000 for 1Q2025 (up from 24,800 previously) given our expectation for a stronger Dollar near-term, coupled with more persistent than expected domestic capital outflows. Our forecasts imply front-loaded VND weakness and underperformance against other Asian currencies. The bias of risk is tilted towards VND weakness, especially if the State Bank of Vietnam chooses to adjust the ceiling of the trading band upwards, which we stress is not our base case right now.

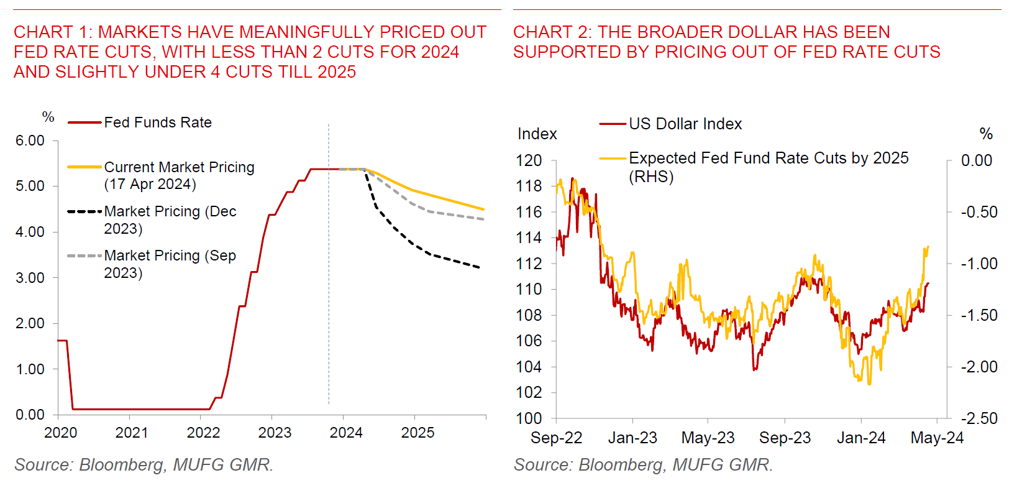

- Part of the forecast change stems from global factors and our Dollar and Fed view. While we had assumed that the Fed begins its rate cut cycle over the next few months, recent macro developments including the hotter than expected US inflation numbers have raised the spectre of the Fed keeping rates high for longer. In contrast, other G10 central banks such as ECB have moved in the opposite direction by communicating more clearly on the starting path for rate cuts. Increasing geopolitical tensions in the Middle East coupled with rising oil prices have also led to a sharp rise in equity volatility, impacting Asian currencies including VND.

- Our global team thinks that the Dollar has scope to rise further over the next one to two months with EURUSD possibly trading towards 1.050, although they stress this window for Dollar strength will likely close in 2H2024 especially given that markets have already meaningfully priced out Fed rate cuts into 2025 (see FX Weekly – USD has scope for further gains , FX Daily, and Chart 1 below).

- Our FX forecast change also reflects domestic factors specific to Vietnam.

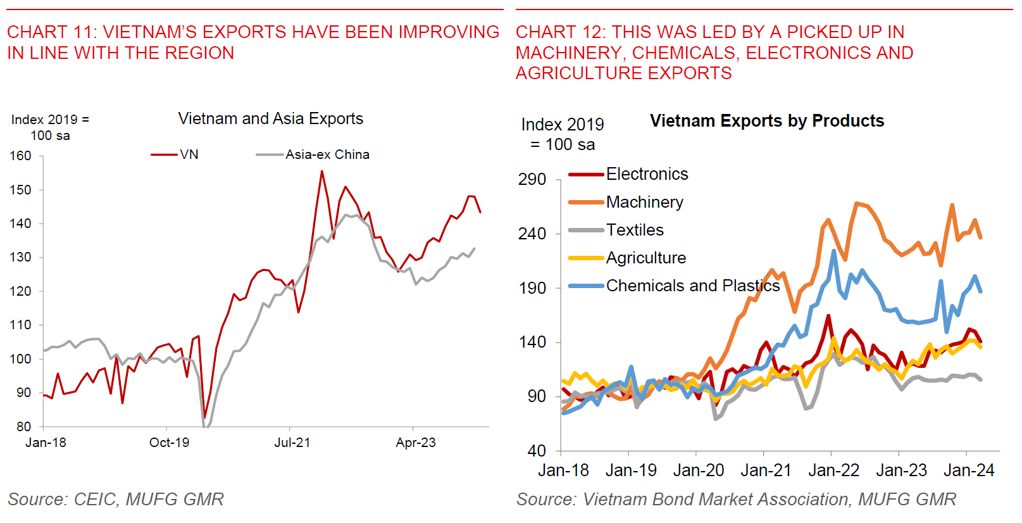

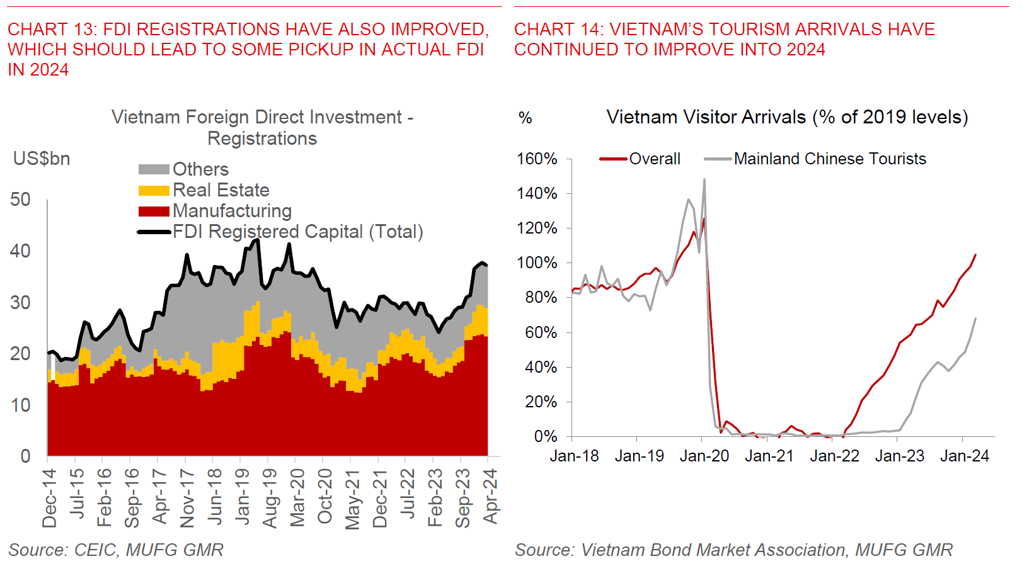

- We entered into this year thinking that there are some emerging green shoots in Vietnam’s economy, which could also support the currency (see Asia FX Outlook 2Q2024 – Light at the end of the tunnel). On the external front, these positives include an improvement in exports led by a turn in the global manufacturing and tech cycle. Tourism also continues to improve, helped by e-visa relaxation policies implemented last year. Exports and tourism should also have some gradual indirect positive spillovers into employment and ultimately consumption spending. FDI registrations have also picked up, which will likely lead to a rise in actual FDI moving forward in 2024.

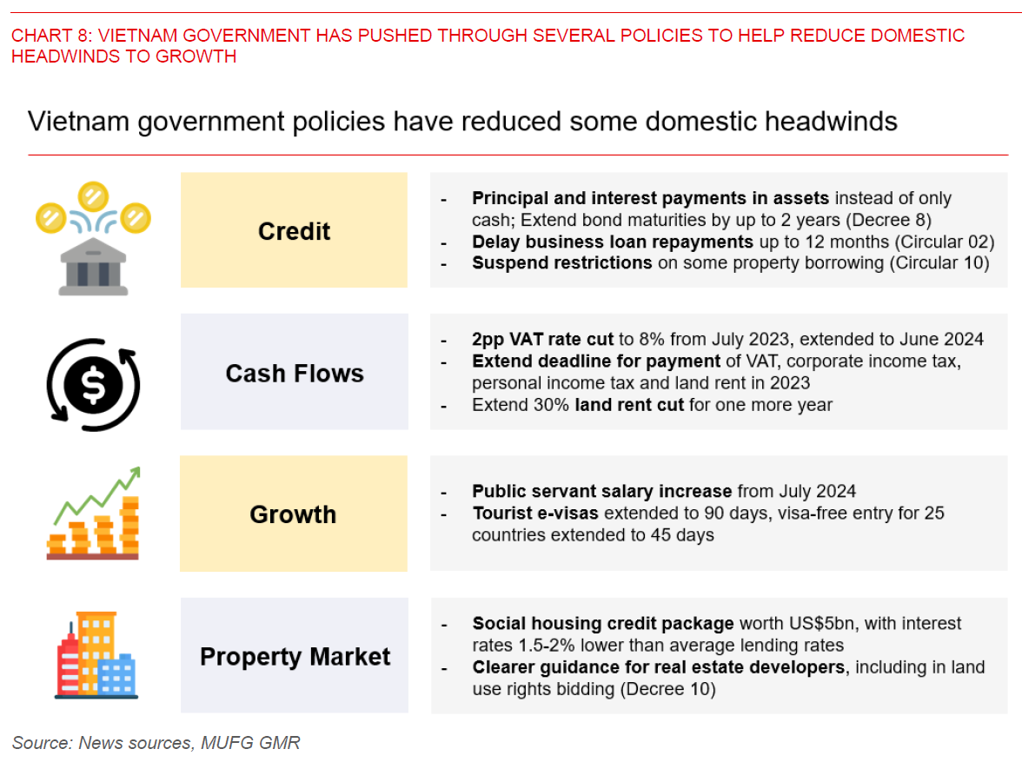

- On the domestic front, we were also expecting the myriad of government policies implemented to help improve credit availability, cash flows and the property market, generating some gradual improvement in domestic demand, notwithstanding continued domestic policy uncertainty.

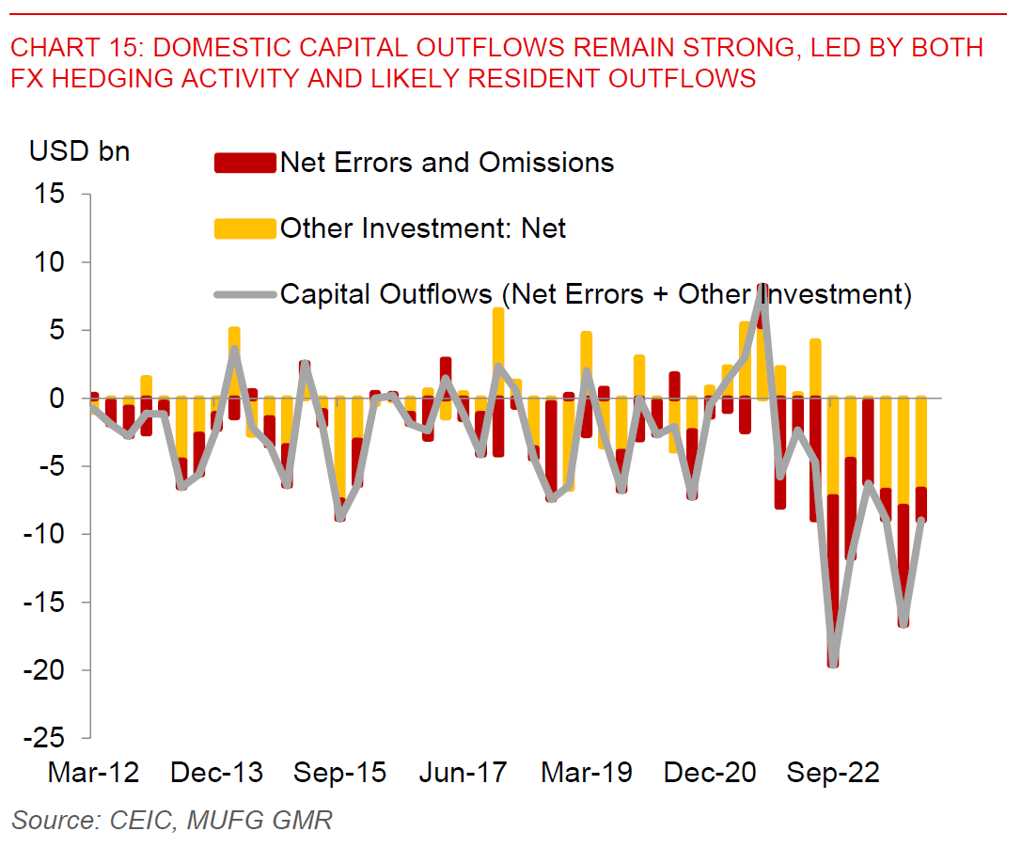

- Nonetheless, domestic capital outflows have been much more persistent than what we had initially assumed. We think the fundamental factors driving these outflows is a wide gap between US rates and domestic rates, coupled with high domestic policy uncertainty. These factors driving outflows are unlikely to turn for the better unless we see a meaningfully lower level of US rates and/or a sharp rise in domestic rates for instance.

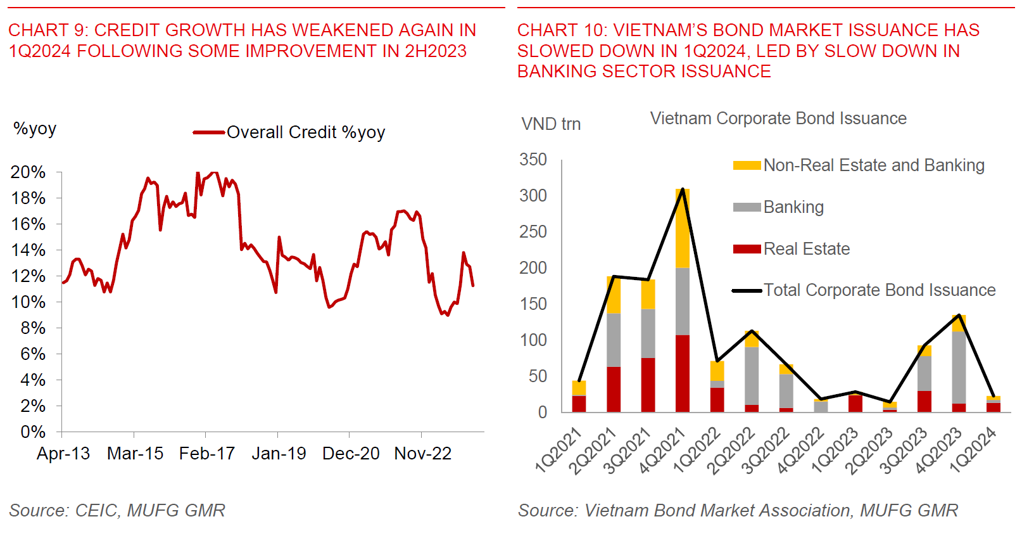

- Meanwhile, credit growth and bond market issuance have also taken a leg down in 1Q2024 following some thawing in sentiment in 4Q2023. This has led to renewed concerns about the health and sustainability of rebound in the domestic economy.

- As such, we think the path of least resistance is still for State Bank of Vietnam to keep the official policy rates unchanged with the refinancing rate at 4.50% and discount rate at 3.00% in 1Q2025. The Vietnam government’s bias is still to support growth, coupled with still high refinancing needs in the corporate bond market this year (including for real estate companies).

- USDVND is certainly caught between a rock and a hard place with these push and pull forces domestically and globally, including on the Fed and the Dollar. USDVND is already trading close to the ceiling of its trading band.

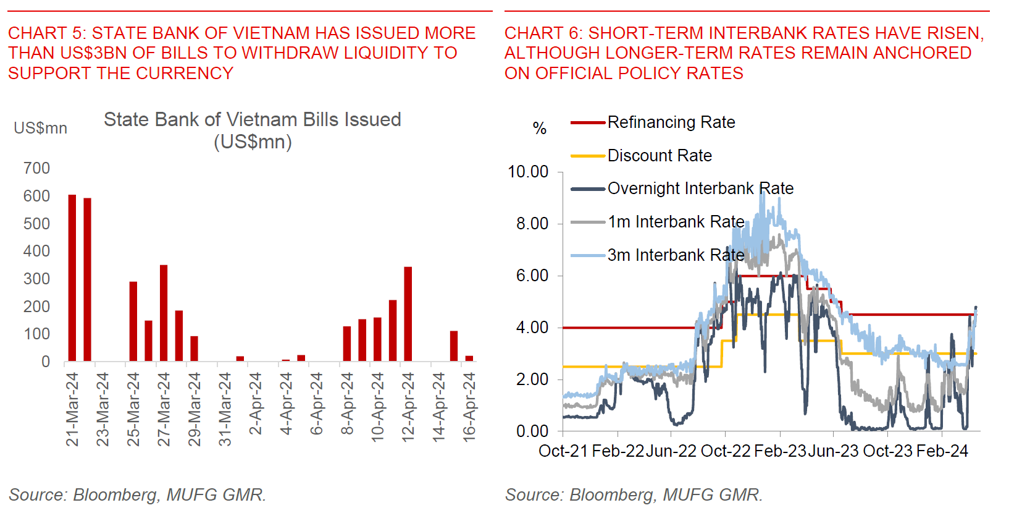

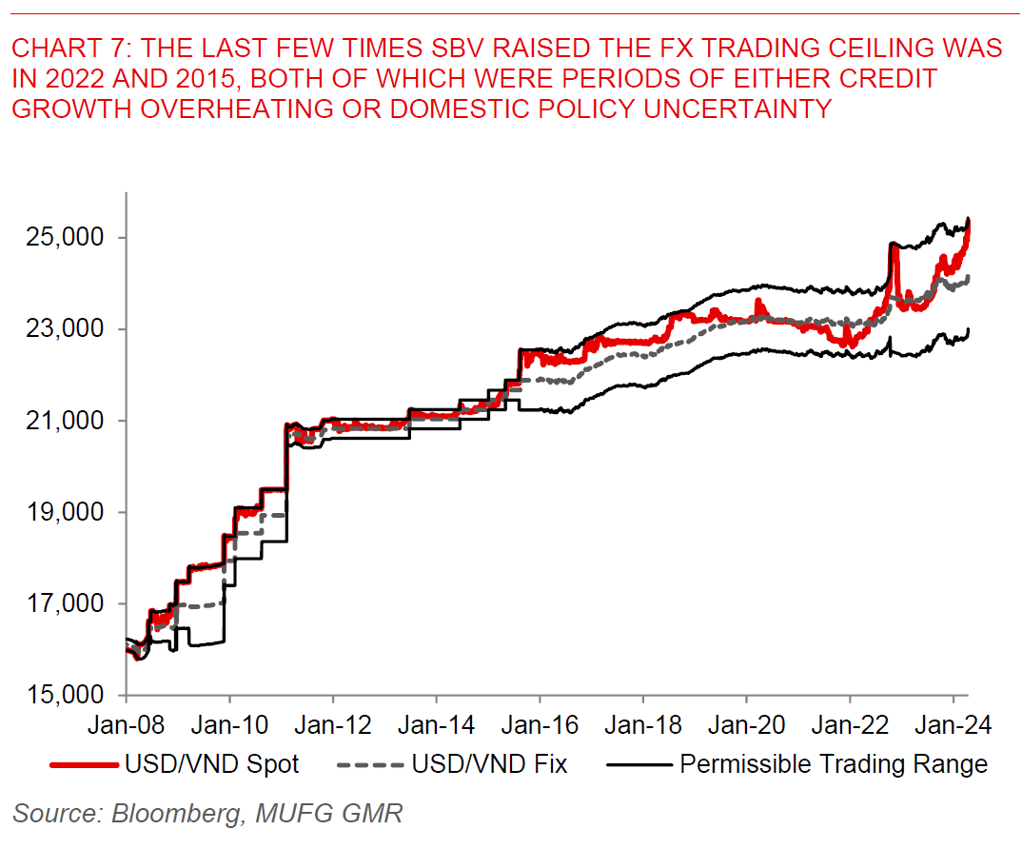

- We think that as a 1st step, State Bank of Vietnam will sell dollars from its FX reserves to support the Vietnam Dong, together with issuing more bills to withdraw domestic liquidity thereby pushing up short-term rates and raising the cost of FX hedging. Only when these steps fail will SBV adjust its trading band by shifting the ceiling up. The last few times when this happened was in 2H2022 and in 2015.