Signal and the noise

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T: +44(4)387 5031

E: soojin.kim@ae.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

T: +44(0)20 577 1968

E: lee.hardman@uk.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Macro focus

There is no shortage of noise impacting emerging markets lately when listening to the frequent geopolitical decibels of debate. This is creating fatigue and confusing signals for emerging market cross-assets. Honing in on the EMEA region, the emerging market outlook is overshadowed by three major risks – one potentially beneficial for global markets, and two potentially unfavourable. First, speculation around a possible ceasefire deal in Ukraine, which could lower global energy costs, reduce regional risk premia, and affect fiscal policy, labour supply and capital account restrictions. Second, the threat of US tariff increases and the potential escalation of a trade war, posing a risk to global growth. Third, heightened (at face value) uncertainty in the Middle East, following President Trump’s proposal that the US may take control of the post-war administration of Gaza. These three risks are likely to be key in shaping the emerging market outlook across EMEA (and beyond) from the region of 2025.

FX views

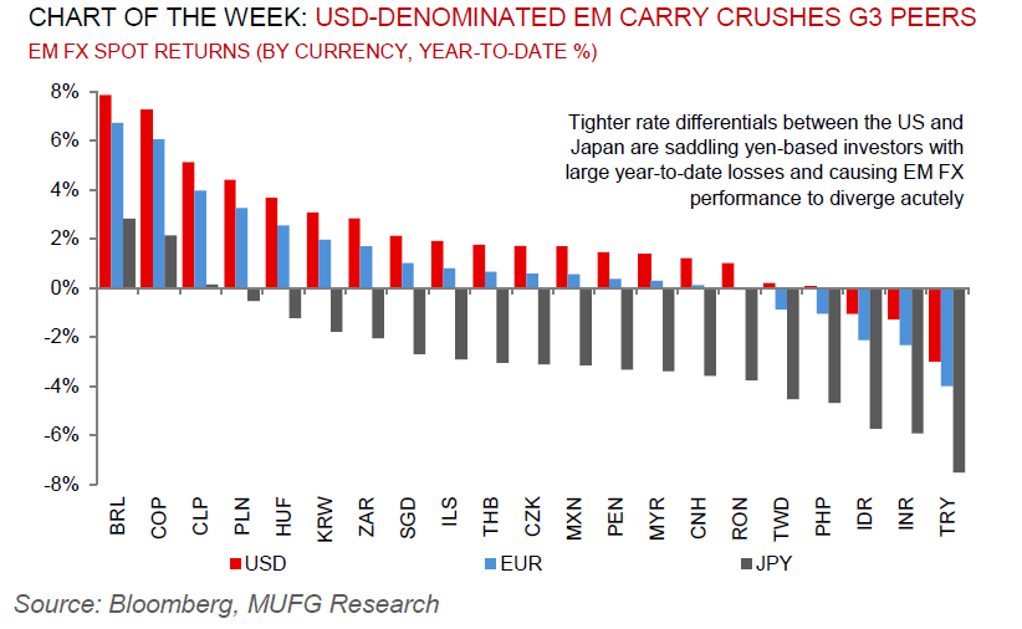

Emerging market currencies weakened over the past week against the USD giving back some of their strong gains recorded at the start of this year. Softer US activity data and Trump tariff threats on Canada, China and Mexico trigger near-term growth scare weighing on LatAm FX. MXN remains resilient reflecting ongoing scepticism over 25% tariff hike implementation. US encouraging Canada and Mexico to hike tariffs on China posing downside risks to CNY and Asia FX alongside further US 10% tariff hike on China this week.

Week in review

Saudi Arabia tapped international debt capital markets once again this year, this time the Kingdom issued two Euro international bonds including its first ever green-bond – the two bonds were worth EUR2.25bn with the 7 year green bond raising EUR1.5bn. The Bank of Israel (BoI) kept its policy rate unchanged at 4.50% with the accompanying press release including no new guidance compared to the January Monetary Policy Committee (MPC). The National Bank of Hungary (MNB) kept its policy rate at 6.50% in line with our (and consensus) expectations with policymakers signalling a cautious and stability-focused approach. Headline inflation in South Africa edged higher from 3.0% y/y in December to 3.2% y/y in January, lower than our forecasts but in line with the consensus. Turkey’s Q4 2024 GDP increased from 2.1% y/y in Q3 2024 to 3.0% y/y in Q4 2024, above our (and consensus) expectations of 2.5% y/y

Week ahead

In the week ahead, we will have the interest rate decision in Turkey (MUFG and consensus: -250bp to 42.50%). CPI data for January will be released in the Czech Republic (MUFG and consensus: -0.1ppt to 2.7% y/y). Finally, PMIs will be released across the EM EMEA region for the month of February.

Forecasts at a glance

The external backdrop for EM has shifted abruptly – the soft-landing pro-risk environment and pricing of non-recessionary Fed cuts has given way to concerns around tariff risks (and likely retaliatory action), higher-for-longer US rates and a strong US dollar. This sets the stage for a challenging EM backdrop in 2025. There are dimensions that could make Trump 2.0 less disruptive. Given the reduced direct trade exposure of the Chinese economy to the US and expectations that there will be a monetary and fiscal response by Chinese policymakers to offset the tariff growth shock, the economic and financial market disruptions will, on aggregate, be less severe than Trump 1.0.

Core indicators

The latest weekly IIF flow data signalled that EM securities witnessed outflows of USD3.8bn in the week ending 28 February. The breakdown suggests that equities drove the outflows (USD3.8bn), while debt market saw modest inflows (USD0.1bn).