To read the full report, please download the PDF above.

New central bank governor in Turkey but orthodox policy to continue

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

T: +44(0)20 577 1968

E: lee.hardman@uk.mufg.jp

PAUL FAWDRY

Head of Emerging Markets FX Desk

Emerging Markets Trading Desk

T: +44(0)20 577 1804

E: paul.fawdry@uk.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Macro focus

Hafize Gaye Erkan resigned from her post as the governor of the Central Bank of Turkey (CBRT) on 2 February only nine months into the role, citing personal reasons. Fatih Karahan, who was appointed as vice governor in July 2023, will replace Erkan as governor. As Ms Erkan has resigned for personal reasons, and with Karahan stepping up from being vice governor, we expect policy continuity and not a signal for a preference for lower interest rates. Reinforcing our view, Minister of Treasury and Finance Mehmet Simsek also made a statement on 2 February to suggest that the government’s broader economic programme implemented since June last year will proceed as planned. The resignation also comes at a time when there is less uncertainty regarding the near-term direction of interest rates. We view that the tightening cycle, which saw the policy rate rise from 8.5% to 45%, ended last month and expect the key rate to remain on hold throughout this year (see here). On net, we believe this development is ESG – it demonstrates transparency and accountability at the CBRT, fortifying investor and credit ratings confidence in credible decision-making.

FX views

EM FX weakened further at start of 2024 driven by resilience of US economy. HUF & PLN outperform amongst EMEA FX. New CBRT governor’s commitment to tight policy is critical for slower pace of TRY depreciation this year.

Week in review

Egypt surprised the market with a 200bp rate hike to 21.75%, while in Hungary, the NBH reduced key rates by 75bp to 10.00%. Meanwhile, in Turkey, inflation stalled just below 65% in January amid favourable base effects. Annual GDP in Poland for 2023 came in at 0.2% y/y, slower than expected.

Week ahead

EM interest rate decisions are expected from Czech Republic (MUFG and consensus: 25bp rate cut to 6.50%) and Poland (MUFG and consensus: on hold at 5.75%).

Forecasts at a glance

Growth across the EM universe is set to stabilise as domestic fundamentals offset external drags, with some rotation from the largest to smaller EMs. Inflation and interest rates are both “over the hump” – disinflation is progressing, and the decline in rates will continue and broaden in 2024 (see here).

Core indicators

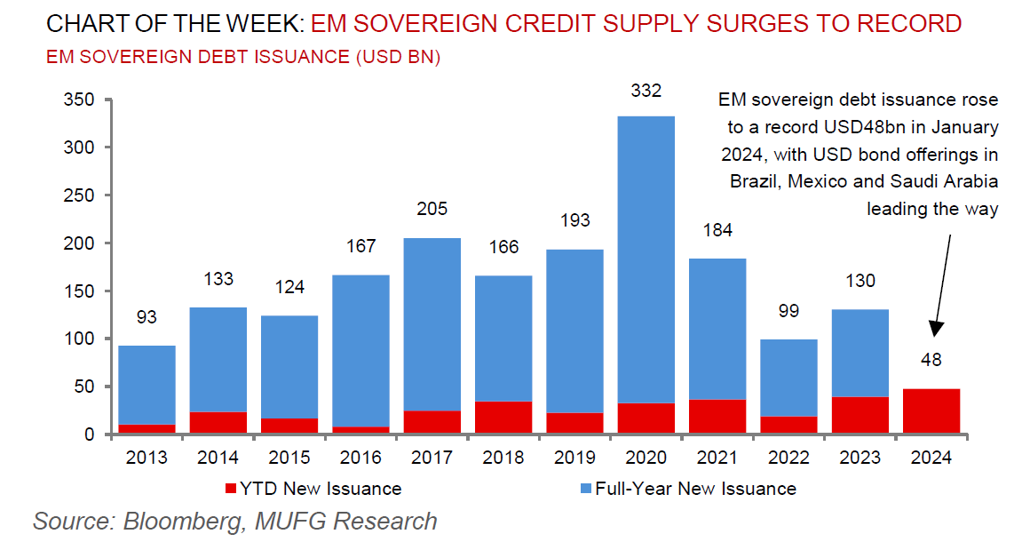

EM funds saw net weekly inflows worth USD4.7bn in the week ending 02 February – equities and bonds at USD4.9bn and USD-0.2bn, respectively.