Evaluating the implications for EM EMEA from US tariffs

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T: +44(4)387 5031

E: soojin.kim@ae.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

T: +44(0)20 577 1968

E: lee.hardman@uk.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Macro focus

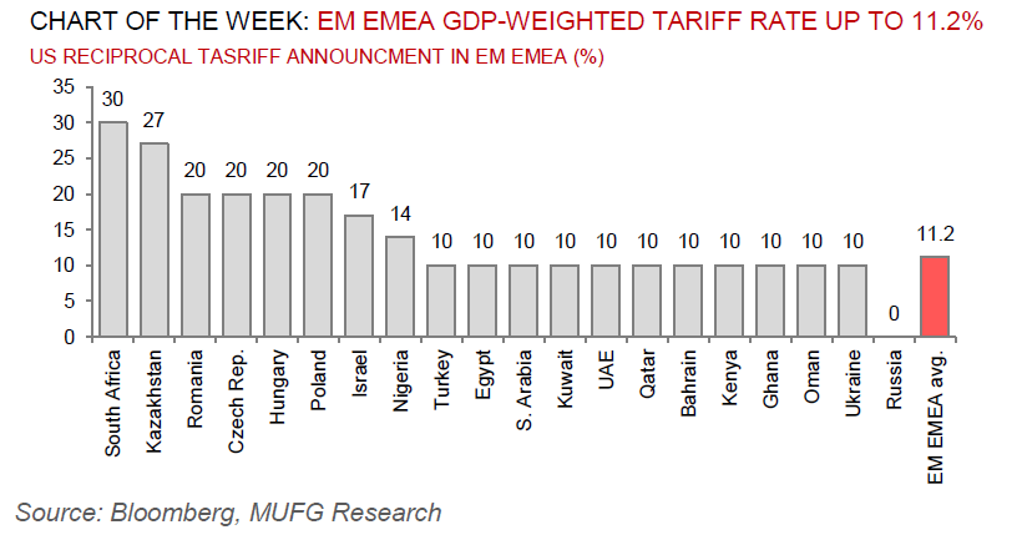

Notwithstanding the magnitude of the shocks that shifting US policy priorities have brought to the global economy, it is salient how relatively unaffected the EM EMEA region remains. President Trump announced a “reciprocal” tariff plan on 2 April that consists of two parts. First, a 10% baseline tariff would apply to imports from all countries excluding Canada and Mexico – effective 5 April. Second, most major trading partners excluding Canada and Mexico would face an additional tariff that equals half the ratio of the US bilateral trade deficit with the country divided by US imports from that country – effective 9 April. Most countries within EM EMEA will receive the former, 10% tariff increase – and we estimate the GDP weighted average tariff increase to be only 11.2%. To a large extent, this represents the negligible importance of the region’s trade relations with the US, accounting for just 3.4% of exports in 2024, and 4% of total trade – limited as compared to the direct exposure of much of the rest of the world to a US economy that digests ~13% of global imports. However, we recognise that certain EM EMEA jurisdictions – South Africa, Kazakhstan, the CEE region and Israel – do comprise more (explicit and implicit) exposure to US trade through integration into cross-country supply chains. Yet, taken as a collective group, we are relatively untroubled by the reverberations of the assertive nature of US trade policy (thus far) on the EM EMEA region but acknowledge that second round effects (weaker sentiment, lower commodity prices and capital outflows) are rising.

FX views

Emerging market currencies have correctly sharply lower over the past week triggered by President Trump’s plans for “reciprocal tariffs” that have fuelled fears over a sharper slowdown/recession for the global economy. Asia to be hit by highest tariffs while LatAm got off relatively lightly. China retaliates strongly and is considering plans to bring forward stimulus. CNY devaluation risks have increased. Global growth fears weigh heavily on commodity-related EM FX including LatAm FX & ZAR. Domestic policy risks also weigh on ZAR, while dovish shift in NBP communication reinforces PLN sell-off.

Week in review

Inflation in Turkey fell to 38.1% y/y in March from 39.1% y/y in February and we maintain our forecast for the Central Bank of Turkey (CBRT) to maintain rates on hold at the next policy meeting in April, despite recent reserve losses. Saudi Arabia recorded a current account deficit of USD7.4bn in Q4 2024. The National Bank of Poland (NBP) kept its key policy rate unchanged at 5.75%. Egypt’s banking sector net foreign assets (NFA) improved in February 2025, increasing by USD1.5bn to USD10.2bn – the highest since September 2024. The flash inflation release in the Czech Republic held steady at 2.7% y/y in March, higher than the consensus of 2.6% y/y. Finally, Bahraini authorities have approved the two year central government budget for 2025/26, which expects a deficit of ~8% and ~6%, respectively.

Week ahead

There is a busy event schedule in EM EMEA this week. There will be rates meetings in Israel (MUFG and consensus: on hold at 4.50%) and Romania (MUFG and consensus: on hold at 6.50%). Inflation prints for March will be released in Hungary (8 April), Egypt (10 April), Romania (11 April) and Russia (11 April).

Forecasts at a glance

The external backdrop for EM has shifted abruptly – the soft-landing pro-risk environment and pricing of non-recessionary Fed cuts has given way to concerns around tariff risks (and likely retaliatory action), higher-for-longer US rates and a strong US dollar. This sets the stage for a challenging EM backdrop in 2025. There are dimensions that could make Trump 2.0 less disruptive. Given the reduced direct trade exposure of the Chinese economy to the US and expectations that there will be a monetary and fiscal response by Chinese policymakers to offset the tariff growth shock, the economic and financial market disruptions will, on aggregate, be less severe than Trump 1.0.

Core indicators

The latest weekly IIF flow data signalled that EM securities witnessed outflows of USD4.0bn in the week ending 4 April. The breakdown suggests that equities drove the outflows (USD3.1bn), while debt market saw slight outflows (USD0.9bn).