To read the full report, please download the PDF above.

Prospects for emerging markets in the last quarter of 2024

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T: +44(4)387 5031

E: soojin.kim@ae.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

T: +44(0)20 577 1968

E: lee.hardman@uk.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Macro focus

As we embark on the last quarter of 2024, EMs are feeling the rush from the Fed’s commencement of its easing cycle and that China’s policy stimulus will be suffice to stabilise growth. There is a hunger for more gains given the entrenched belief that sizeable rate cuts can be delivered over the coming quarters whilst there is a burgeoning fixation that policy easing may no longer be piecemeal in China. Yet EMs’ quick burst of energy is at risk of burning off give the uncertainties for the global economy and the US election risks ahead. For now, EM growth continues at a steady pace, inflation has receded further and interest rate cuts are broadening further. All in, the sugar rush has hit hard and fast, and yet the problem with a sugar rush is that it is prone to wearing off (and potentially precipitously).

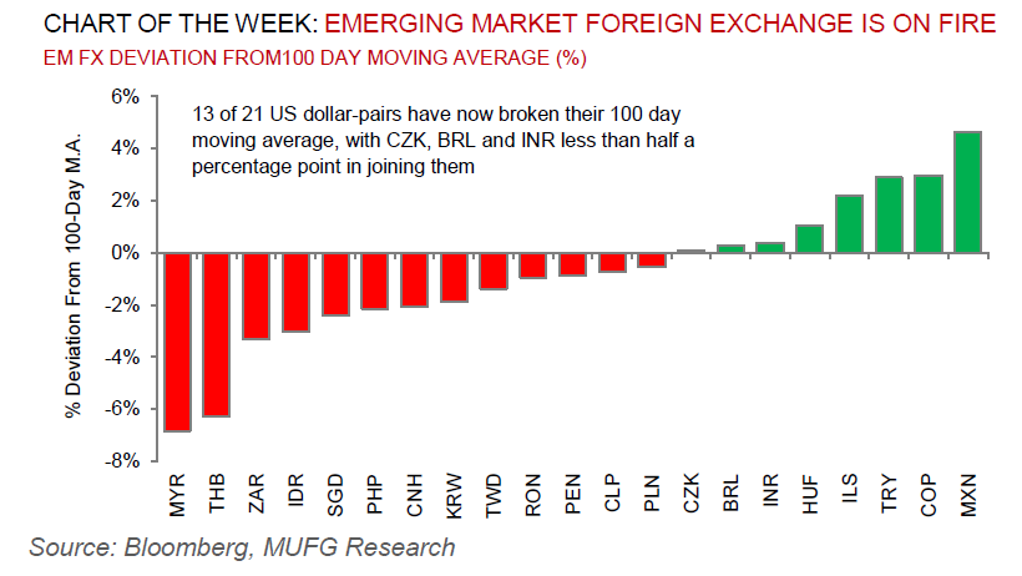

FX views

Emerging market currencies have suffered a setback over the past week as the USD staged a powerful rebound from year to date lows. The USD has staged its strongest rebound since the current bearish trend started in July. Firstly, the USD has been supported by the significant step-up in Middle East geopolitical risks over the past week. Secondly, the USD is deriving support from the hawkish repricing of Fed policy expectations. At the same time, the USD has benefitted from recent dovish signals from central banks outside of the US. Furthermore, Central European currencies weakening against both USD and EUR. NBP Governor Glapinksi begins to talk up possibility of earlier rate cuts.

Week in review

The Saudi Ministry of Finance published its pre-budget 2025 statement with deficit target of 2.3% of GDP in 2025, with deficits then expected to widen toward ~3% in 2026-27 due to lower revenue projections. Egypt’s current account recorded a deficit of USD3.7bn in Q2 2024 as a large portion of the Ras al Hikma proceeds went towards reducing external leverage. Turkey’s headline inflation fell to 48.3% y/y in September from 52.0% y/y in August, driven by base effects with sequential headline inflation increasing from 2.5% m/m to 3.0% m/m. Poland and Romania kept its policy rate at 5.75% and 6.50% respectively in line with our forecast (as well as consensus) expectations. Lastly, China’s recently announced stimulus measures took markets by surprise with investors endeavouring to decipher whether the current round of China stimulus is as large as the 2015-16 and the 2020 easing.

Week ahead

In the week ahead, there will be a rate meetings in Israel (MUFG and consensus: on hold at 4.50%). Elsewhere, we will get a host of inflation prints across EM EMEA – Czech Republic, Egypt, Hungary, Romania and Russia. Separately, the 8 October press conference given by China’s National Development and Reform Commission (NDRC) will be a key watchpoint on the trajectory of the country’s stimulus cycle.

Forecasts at a glance

Growth across the EM universe is set to stabilise as domestic fundamentals offset external drags, with some rotation from the largest to smaller EMs. Inflation and interest rates are both “over the hump” – disinflation is progressing, and the decline in rates will continue and broaden for the remainder of 2024.

Core indicators

The latest weekly IIF flow data signalled that EM securities witnessed USD11.1bn of inflows in the week ending 27 September. We reiterate that the relationship between EM currencies and Fed decisions are crucial – higher rates normally strengthens the US dollar, diminishing the appeal of EM currencies, which can lead to capital outflows and increased borrowing costs for EM.