Will emerging markets continue thriving amidst global uncertainty?

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T: +44(4)387 5031

E: soojin.kim@ae.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

T: +44(0)20 577 1968

E: lee.hardman@uk.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Macro focus

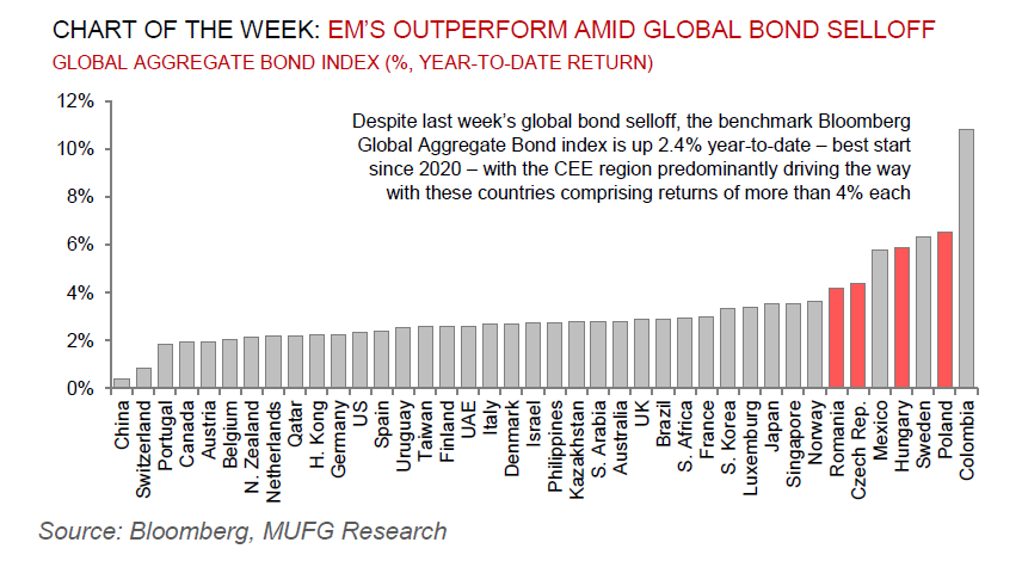

Over recent weeks, the market has traded worsening US growth expectations following a streak of soft US activity data, and, more recently, the imposition of tariffs by the US on imports from Mexico and Canada, alongside further tariff increases for imports from China. This has put pressure on risk assets, especially in the US, and has put downward pressure on US yields. EM cross-assets have also largely rallied, but in contrast to earlier in the year when they outperformed during the global rate selloff, the rally in US rates has been in the driving seat. Meanwhile, the potential for a large fiscal shift in Europe, coupled with some hawkish idiosyncratic developments, has seen renewed selling pressure in Brazil, the CEE region and South Africa. Though, domestic EM rates have been able to outperform in a few places, with a surprise rate cut in Thailand adding more rate relief, and the rally in Mexico continuing through the month. Looking ahead, for EM assets to outperform further, we view the negative growth repricing would need to be met with more dovish policy signals from the Fed, but these might be harder to come by than last year given inflationary implications from tariffs.

FX views

Emerging market currencies have continued to rebound against the USD over the past week rising back up to levels that were in place prior to President Trump’s election victory in early November. Central European FX benefit from positive growth shock to demand in Germany from fiscal plans although legislation still needs to be passed. Investor optimism on German fiscal policy has helped to put a dampener on concerns over downside risks to global growth and trade from President Trump’s tariff plans. Still the underperformance of Asian currencies over the past week highlights that the escalating trade tensions between the US and China is having a negative impact.

Week in review

All MENA regional purchasing managers index (PMI) readings were expansionary in the month of February – Saudi Arabia’s headline PMI score remained the highest, led by year-ahead output expectations. The Central Bank of Turkey (CBRT) cut the one-week repo rate by 250bps to 42.50%, in line with our (and consensus) expectations. Inflation in Dubai rose from 2.9% y/y in December 2024 to 3.2% y/y in January – the subcomponent breakdown signalled an unchanged picture with the key pressure point being linked to the rental segment. The flash inflation release in the Czech Republic edged lower to 2.7% y/y in February from 2.8% y/y in January, in line with our (and consensus) expectations, though slightly above the Czech National Bank’s (CNB) target (2.6% y/y). Finally, after reaching a staff level agreement in December 2024, the IMF board has now scheduled March 10 2025 to consider Egypt’s 2025 Article IV consultation, the fourth review of the Extended Fund Facility (EFF) as well as requests for an arrangement under the Resilience and Sustainability Facility (RSF).

Week ahead

This week will be a busy schedule across EM EMEA. The National Bank of Poland will meet on 12 March (MUFG and consensus on hold at 5.75%). February CPI data will be released in Ukraine (10 March), Egypt (10 March), Hungary (11 March), Russia (12 March), Romania (13 March), Poland (14 March) and Israel (14 March). Government budgets will be presented in Ghana (11 March) and South Africa (12 March). Finally, January balance of payments (BoP) data will be released in Turkey (12 March) and the final February CPI print will be released in the Czech Republic (11 March).

Forecasts at a glance

The external backdrop for EM has shifted abruptly – the soft-landing pro-risk environment and pricing of non-recessionary Fed cuts has given way to concerns around tariff risks (and likely retaliatory action), higher-for-longer US rates and a strong US dollar. This sets the stage for a challenging EM backdrop in 2025. There are dimensions that could make Trump 2.0 less disruptive. Given the reduced direct trade exposure of the Chinese economy to the US and expectations that there will be a monetary and fiscal response by Chinese policymakers to offset the tariff growth shock, the economic and financial market disruptions will, on aggregate, be less severe than Trump 1.0.

Core indicators

The latest weekly IIF flow data signalled that EM securities witnessed outflows of USD12.6bn in the week ending 7 March. The breakdown suggests that equities drove the outflows (USD12.2bn), while debt market saw slight outflows (USD0.4bn).