Reconfiguration of the global trade order and the role of EMs

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T: +44(4)387 5031

E: soojin.kim@ae.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

T: +44(0)20 577 1968

E: lee.hardman@uk.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Macro focus

The week-long tit-for-tat trade war escalation between the US and China reached new heights as President Trump raised tariffs on Chinese imports to 125% – a dramatic escalation that China matched only one day after by imposing equivalent 125% tariffs on US goods (for a cumulative total of 144%). However, the US softened its stance on 12 April with additional “reciprocal” tariff exclusions covering ~23% of Chinese exports to the US (20 types of electronic products and components), which lowered the average tariff rate on Chinese goods by 17pp to 107%. Standard economic theory suggests that consumers will shift demand from higher-priced goods to lower-priced alternatives, but the ease with which US importers can substitute away from Chinese suppliers remains a question. To further cloud the current state of affairs, President Trump has since downplayed the exemptions as temporary and that a different semiconductor tariff will be announced this week. Less than a week ago, any sort of “put” for markets seemed a distant prospect. Within four days, however, we have now seen two major policy U-turns. Yet, despite these U-turns, the downside risks to the global economy are growing amid a reconfiguration of the global trade order. In such an environment we ask where to play to win (and hide)? The list of EMs is not long, in our view.

FX views

The design and implementation of tariffs are imposing a negative impact on the US dollar as they have contributed to eroding consumer and business confidence, and the broad tariff enactment makes it more likely that US business and consumers will become price-takers. From an EM FX perspective, performance has been highly volatile since the “Liberation Day” tariff announcements on 2 April. Some relief was initially priced in less-tariffed LatAm, but that swiftly reversed as risk sentiment took a larger hit. From this, EM currencies jumped on the 90 day delay announcement, but have since given back some of those gains. Looking ahead, we view that the relative skew for spot returns between G9 and EM FX favours more clearly G9 FX. After an extended period of EM FX total return outperformance, we think that declining US exceptionalism and safe-haven demand have a more positive impact for G9 FX, whereas a trade war and growing downside risks to global growth present a challenging backdrop for the more cyclical EM FX.

Week in review

S&P revised Egypt’s outlook to stable from positive and affirmed its B-/B ratings, citing “elevated external and domestic financing requirements make it susceptible to current global financial market headwinds. The Bank of Israel (BoI) held its policy rate at 4.50% in line with our (as well as consensus) expectations. Saudi Arabia’s foreign reserves increased by a notable USD21bn to USD454bn last month – the largest increase since March last year (USD23bn). The National Bank of Romania (NBR) kept its interest rate at 6.5%, for the fifth consecutive time, in line with our (and consensus) expectations. Finally, a host of inflation readings for March were released in Egypt, Hungary, Russia and Romania.

Week ahead

This will be another busy event schedule in EM EMEA this week. There will be interest rate meetings in Turkey (MUFG and consensus: on hold at 42.50%) and Egypt (MUFG: -225bps to 25.00%; consensus: -125bps to 26.50%). CPI data will be released in Israel (MUFG and consensus: -0.2ppts to 3.2% y/y).

Forecasts at a glance

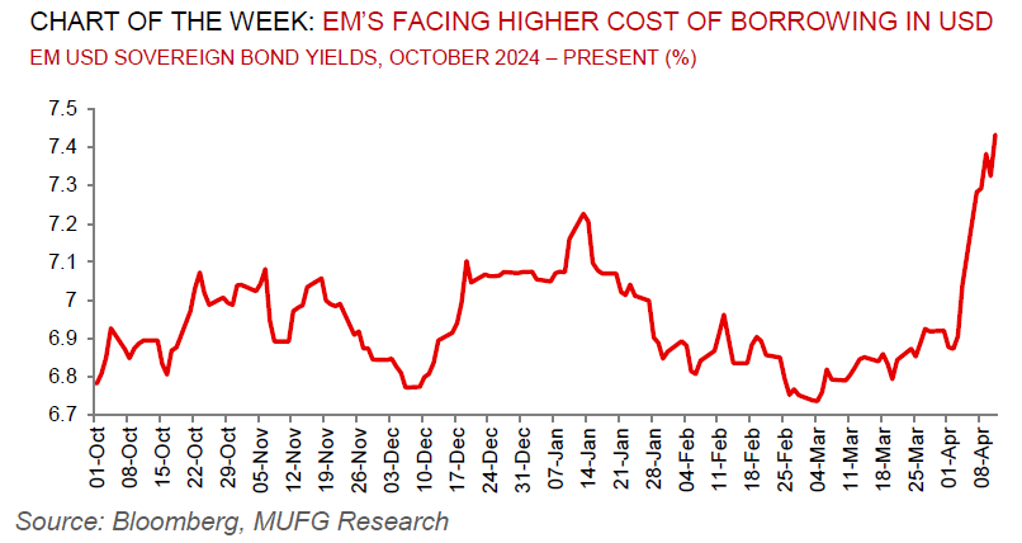

The external backdrop for EM has shifted abruptly – the soft-landing pro-risk environment and pricing of non-recessionary Fed cuts has given way to concerns around tariff risks (and likely retaliatory action), higher-for-longer US rates and a strong US dollar. This sets the stage for a challenging EM backdrop in 2025. There are dimensions that could make Trump 2.0 less disruptive. Given the reduced direct trade exposure of the Chinese economy to the US and expectations that there will be a monetary and fiscal response by Chinese policymakers to offset the tariff growth shock, the economic and financial market disruptions will, on aggregate, be less severe than Trump 1.0.

Core indicators

The latest monthly IIF flow data signalled that EM securities attracted USD17.1bn in March 2025 driven by USD12.4bn into equity markets, and debt markets faced USD4.8bn in outflows.