To read the full report, please download the PDF above.

The economic consequences of a second Trump presidency for emerging markets

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T: +44(4)387 5031

E: soojin.kim@uk.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

T: +44(0)20 577 1968

E: lee.hardman@uk.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Macro focus

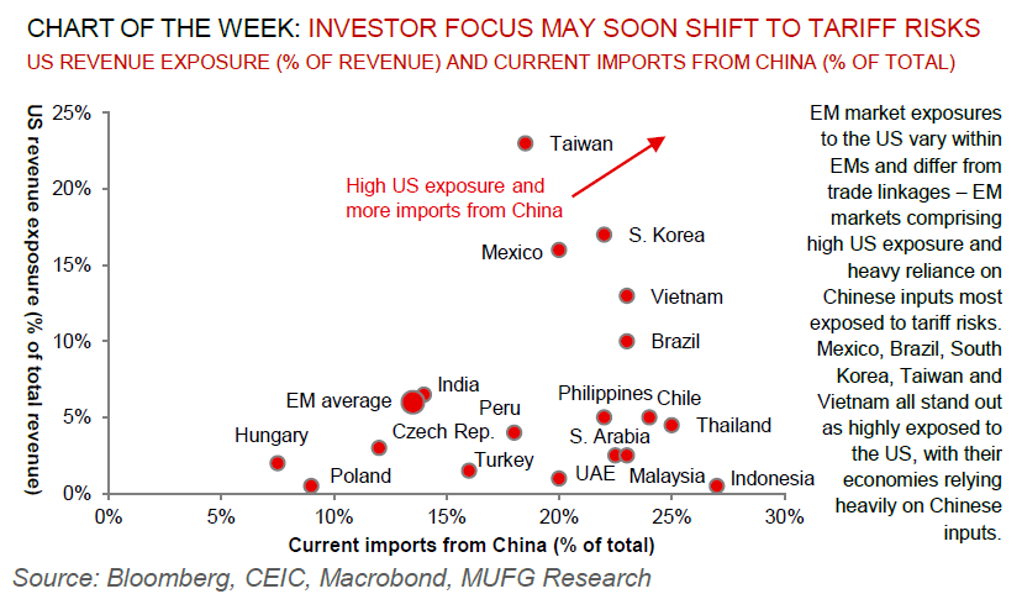

With market-implied probabilities of a second Trump term rising, we take a first look at the potential reverberations for EMs. Trump made it a strategy of his first term to reshape global trade in the US’s interests, and we view tariff policy as comprising the clearest transmission channel hampering the EM complex. Trump tends to view trade as a zero-sum game where the US loses against countries it imports from, and thus a favoured Trump metric is the US trade balance. In this context, he has pledged to impose an across-the-board 10% tariff on all US imports – elevating trade volatility as it did in 2018-19. Being the largest source of the US trade deficit, China will be the top EM target of the most punitive trade measures (Trump has publicly floated a 60% tariff on Chinese imports). Other EM contenders that may witness a greater push to restrict China rerouting US trade may include Mexico, Brazil, South Korea, Taiwan and Vietnam – all comprising a sizable import share in the US as well as encompassing significant supply chain linkages with China. In contrast, the structural idiosyncrasies across both the MENA and CEE regions as well as India suggest they are relatively more insulated against US tariff risks.

FX views

Emerging market currencies have continued to rebound against the USD over the past week. The main trigger from improving conditions for carry trades heading into the summer are building expectations for the Fed to begin cutting rates in response to slowing US inflation. It has helped to put a dampener on financial market volatility and encouraged risk seeking behaviour amongst market participants. The ongoing drop in short-term US yields is providing a headwind for USD performance in the near-term. Even the rising probability of Donald Trump being re-elected as President for a second term later this year has failed to trigger a reversal of the USD’s recent weakening trend.

Week in review

The Central Bank of Israel (BoI) kept its benchmark rates on hold at 4.50%, in line with our (and consensus) expectations. The current account deficit in Turkey narrowed from USD5.4bn in April to USD1.2bn in May, lower than our (and consensus) expectation of USD1.5bn. In June, inflation across CEE region was within central banks’ target ranges. After raising USD1bn between March and April, Sharjah issued a EUR500m 6.5 years sustainable bond. Finally, Recent events in Kenya have raised the risk that the IMF takes longer to approve the seventh review, though the IMF board may be sympathetic to social tensions.

Week ahead

This week, interest rate meetings will be held in South Africa and Egypt on 18 July – we expect both to keep benchmark rates on hold. Meanwhile, CPI data for June will be published in Israel (where we expect inflation to peak at 3.0% y/y).

Forecasts at a glance

Growth across the EM universe is set to stabilise as domestic fundamentals offset external drags, with some rotation from the largest to smaller EMs. Inflation and interest rates are both “over the hump” – disinflation is progressing, and the decline in rates will continue and broaden in 2024 (see here).

Core indicators

IIF flow data signals that EM securities attracted USD16.1bn in June 2024. The compositional breakdown suggests that the largest inflows stemmed from EM Asia (USD15.1bn), with all other regions seeing marginal moves.