To read the full report, please download the PDF above.

Navigating US rates and EM resilience

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

T: +44(0)20 577 1968

E: lee.hardman@uk.mufg.jp

PAUL FAWDRY

Head of Emerging Markets FX Desk

Emerging Markets Trading Desk

T: +44(0)20 577 1804

E: paul.fawdry@uk.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Macro focus

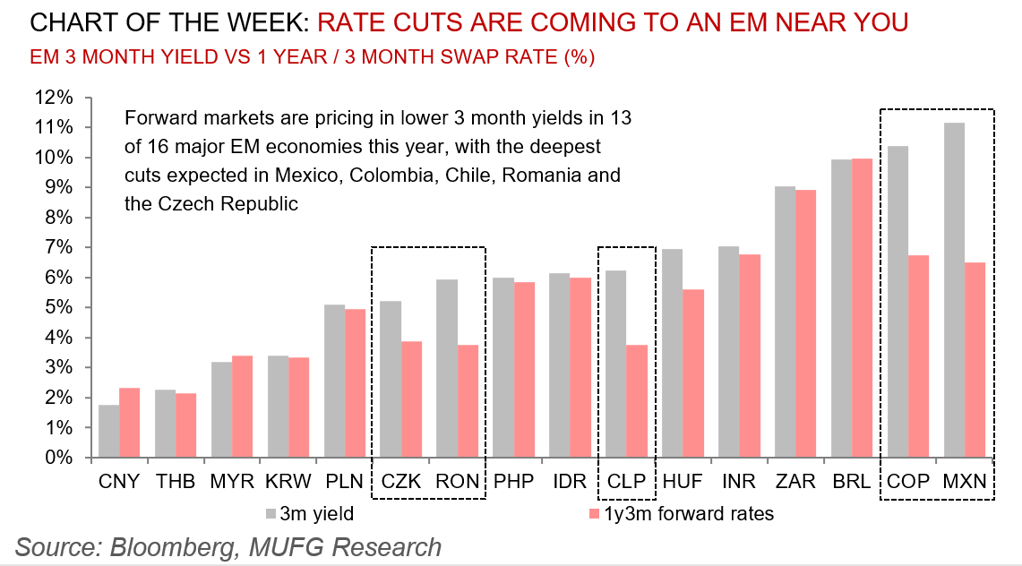

A cautious Fed, strong US labour market data and a higher-than-expected January CPI reading have brought renewed hawkish pressures on EM local rates at the start of the year. Amid this, EMs remain supported by broader positive risk sentiment and year-to-date domestic developments have remained largely more dovish and benign, with continued progress on the disinflation front and a number of more forceful dovish pivots by EM central banks. All in, the dynamic facing EM assets is a combination of fading external pressures but fairly uncompelling valuations. The three major sources of pressure on EMs – higher US interest rates, a strong US dollar, and slower China – have, individually or collectively, been in focus during the course of 2023, but our year-ahead forecasts suggest a more benign backdrop ahead. Accordingly, prospects for EM cross assets point to better returns in 2024 compared with 2023, though with balanced expectations.

FX views

EM FX falls back to last year’s autumn lows vs. USD - US economic resilience and firmer inflation at start of this year creating more challenging external backdrop. Meanwhile, CZK weakens on back of CNB rate cut speculation although currency weakness may slow further easing.

Trading views

The problem for EM is that now we have to wait a month before deciding if the rate repricing on this month’s data is correct or not. We are once again at levels where CBs could be seen leaning against USD strength.

Week in review

Central banks in Romania (7.00%) and Russia (16.00%) kept rates on hold, as expected. January inflation slowed in Czech Republic, Poland, while Romania, Russia and Saudi Arabia saw an uptick. Q4 2023 GDP data came in at 1.0% y/y for Poland and 0.0% y/y for Hungary.

Week ahead

Central Bank of the Republic of Turkey (CBRT) is likely to keep its one-week repo rate on hold at 45.00%. January inflation data is expected in South Africa, while Israel’s Q4 2023 GDP data is also expected.

Forecasts at a glance

Growth across the EM universe is set to stabilise as domestic fundamentals offset external drags, with some rotation from the largest to smaller EMs. Inflation and interest rates are both “over the hump” – disinflation is progressing, and the decline in rates will continue and broaden in 2024 (see here).

Core indicators

EM securities attracted around USD35.7bn in January 2024 - equity and debt flows were -USD6.9bn and +USD42.7 bn, respectively.