Gauging stronger US dollar / higher-for-longer US rates and EM fiscal sustainability

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T: +44(4)387 5031

E: soojin.kim@ae.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

T: +44(0)20 577 1968

E: lee.hardman@uk.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Macro focus

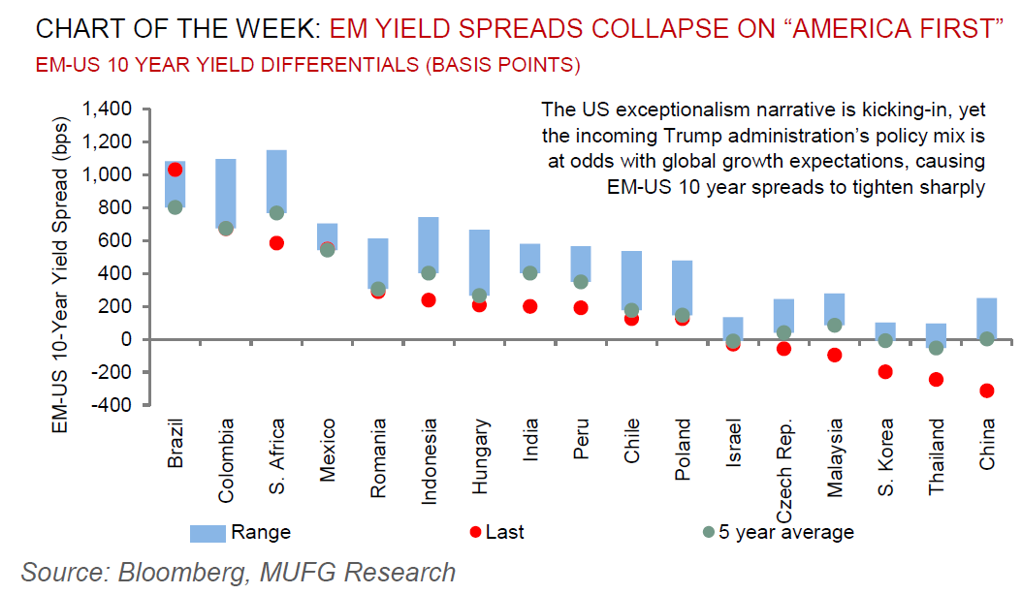

The US Treasury market saw a notable rise in 10yr yields by over 100bps since September 2024 before rallying post CPI data last week. We view the rise can be compartmentalised into two dimensions – (i) expectations of future short-term rates; and (ii) a term premium which reflects the compensation investors demand for holding longer dated bonds. While EMs may have gained some flexibility to diverge from a stalling Fed cycle, the rise in the US term premium does increase the risk of EM fiscal slippage. We observe how fiscally vulnerable EM countries are to a tighter global funding environment through a cross-examination of debt-to-GDP ratios on top of how they are financed.

Week in review

The National Bank of Poland (NBP) held rates steady at 5.75% in line with our (as well as consensus) expectations, with hawkish adjustments in the statement. The National Bank of Romania (NBR) kept its base rate at 6.50%, in line with our forecast (as well as consensus) expectations, with the emphasis on heightened risks. Finally a host of inflation readings for December were released across EM EMEA.

Week ahead

There will be interest rate meeting in Turkey on 23 January and we expect CBRT to cut the rate by 250bps to 45.00%. South Africa’s inflation (2.9% y/y to 3.2% y/y) and core inflation (4.7% y/y to 3.8% y/y will be released on 22 January.

Forecasts at a glance

The external backdrop for EM has shifted abruptly – the soft-landing pro-risk environment and pricing of non-recessionary Fed cuts has given way to concerns around tariff risks (and likely retaliatory action), higher-for-longer US rates and a strong US dollar. This sets the stage for a challenging EM backdrop in 2025. There are dimensions that could make Trump 2.0 less disruptive. Given the reduced direct trade exposure of the Chinese economy to the US and expectations that there will be a monetary and fiscal response by Chinese policymakers to offset the tariff growth shock, the economic and financial market disruptions will, on aggregate, be less severe than Trump 1.0.

Core indicators

The latest weekly IIF flow data signalled that EM securities witnessed outflows of USD5.3bn in the week ending 17 January. The breakdown suggests that equities drove the outflows (USD4.5bn), while debt outflows (USD0.8bn) were relatively modest.