To read the full report, please download the PDF above.

Balancing an accommodative Fed and a complex US election across emerging markets

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T: +44(4)387 5031

E: soojin.kim@uk.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

T: +44(0)20 577 1968

E: lee.hardman@uk.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Macro focus

Global markets normally anchor their attention on one predominant theme at a time. However, currently they are having to look at the reverberations of US growth and inflation readings for the Fed in the near-term, alongside approaching US election risks as we head deeper into H2 2024. Over the last seven weeks, the outlook for the Fed has become more supportive with favourable inflation and labour prints that has led to the pricing of over three rate cuts by January 2025. Yet, equally the odds of a Republican “red wave” have increased in polling data following events starting with the US Presidential debate on 27 June. We expect EM growth will be relatively resilient as the Fed soft lands the economy with our examination suggesting that, absent a recession, growth differentials are more supportive of portfolio flows into EMs. Though, rising risks of Trump 2.0 points to a larger challenge for EMs to circumnavigate, notably on tariffs, migration curbs and an extension of tax cuts (which may steepen the US curve and drive the US stronger dollar).

FX views

Latam FX underperforms while Central & Eastern European FX outperforms. Carry trade unwind weighs on Latam FX alongside fiscal concerns in Brazil. US election risk is an additional headwind. Slowing growth in China prompts PBoC rate cut encouraging further currency weakness.

Week in review

Inflation in Israel rose 0.1ppts to 2.9% y/y in June amid rising housing and travel costs. The South African Reserve Bank (SARB) kept its policy repo rate at 8.25% for the sixth consecutive meeting, in line with our (and consensus) expectations, though we anticipate rates to ease by 25bps in September. The Central Bank of Egypt (CBE) kept its deposit and lending rates on hold at 27.25% and 28.25%, respectively, in line with our (and consensus) expectations, but we price in 100bps in easing at the next MPC in early September. Poland’s final June inflation estimate confirmed the preliminary release, which showed inflation rising marginally by 0.1ppts above the National Bank of Poland’s (NBP) target to 2.6% y/y (in line with consensus). Finally, Oman’s fiscal balance remained in surplus in the first five months of 2024, printing at USD0.9bn, down from USD1.5bn in the first five months of 2023.

Week ahead

This week, rates meetings will be held in Turkey (MUFG and consensus: on hold at 50.00%), Hungary (MUFG and consensus: -25bps cut to 6.75%), Nigeria (MUFG and consensus: +75bps hike to 27.00%) and Russia (MUFG and consensus: +200bps hike to 18.00%). In addition, inflation for South Africa for June will be released (MUFG: 4.9% y/y; consensus 5.1% y/y).

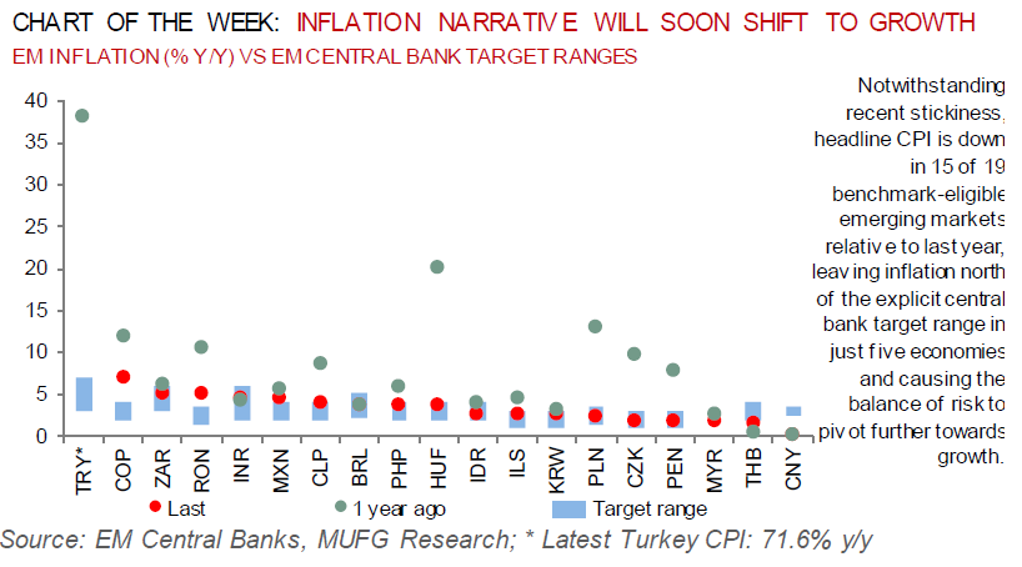

Forecasts at a glance

Growth across the EM universe is set to stabilise as domestic fundamentals offset external drags, with some rotation from the largest to smaller EMs. Inflation and interest rates are both “over the hump” – disinflation is progressing, and the decline in rates will continue and broaden in 2024.

Core indicators

The latest weekly IIF flow data signalled that EM securities witnessed outflows of USD1.1bn in the week ending 19 July.