To read the full report, please download the PDF above.

Inflation dispersion lingers across EM EMEA

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

T: +44(0)20 577 1968

E: lee.hardman@uk.mufg.jp

PAUL FAWDRY

Head of Emerging Markets FX Desk

Emerging Markets Trading Desk

T: +44(0)20 577 1804

E: paul.fawdry@uk.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Macro focus

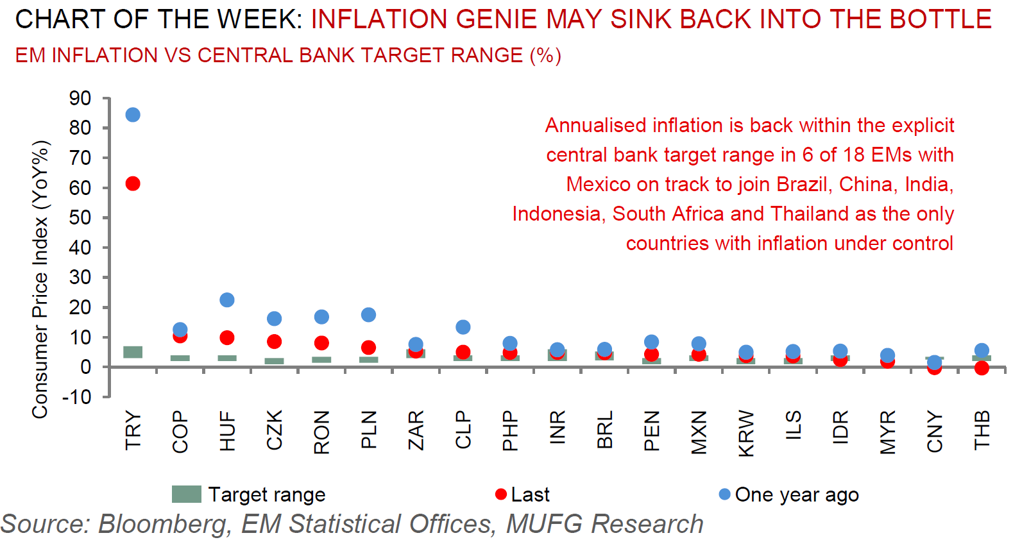

The latest monthly CPI releases continue to display dispersion of inflation trends across EM EMEA. Whilst inflation declined considerably in the CEE countries (and remains subdued across the GCC states), it is picking up in Russia and parts of the SSA region. While part of these dynamics was driven by large FX divergence in H1 2023, exchange rates have now been more stable since then, and relative domestic dynamics have taken over as the driving force of higher inflation in some economies (notably, Turkey and Russia). Meanwhile, core inflation continues to run below headline rates across most of EM EMEA, with signs that further declines are anticipated in the months ahead. Encouragingly, core momentum continues to move within or close to central banks' target ranges in the CEE countries, Ukraine, Israel and South Africa. Looking ahead, our 2024 forecasts imply continued dispersion of inflation trends across EM EMEA, and against this backdrop we expect a significant divergence in policy rates, with acute cuts in the CEE countries, gradual cuts in South Africa starting in Q2 2024, and further tightening in Turkey and Russia.

FX views

Emerging market currencies have lost upward momentum against the USD over the past week with the composition being more mixed across the EM space. Of note, last week’s decision from the CBRT to deliver a larger than expected 5.0 percentage point hike has not altered the recent weakening tend for the TRY.

Week in review

The CBRT hiked rates higher than expected, by 500bps to 40%, in contrast to the SARB, who was on hold and, NBH, who delivered a second 75bp rate cut to 11.50%. Meanwhile, Saudi raised USD11bn loan to finance its deficit.

Week ahead

Worldwide manufacturing PMI and US ISM will be due this week. In EM, we expect Bank of Israel to remain on hold, the Poland’s CPI to come in at 6.5% y/y and Turkey’s Q3 GDP data to come in at 4.1% y/y.

Forecasts at a glance

In a world of tightening global financial conditions and questions about the liquidity implications of the now-finalised US debt ceiling, we see a degree of macro risks for EM economies in H2 2023, with external funding requirements the central concern. We expect EM growth to trough this year but remain below potential in the 2024 recovery. The silver lining is that subdued growth should cap inflation, facilitating monetary policy easing where external balances allow.

Core indicators

EM inflows totalled USD2.0bn in the week ended 24 November, with inflows into equities and bonds at USD1.7bn and USD0.3bn, respectively.