- The euro area economy expanded by 0.3% Q/Q in the first quarter of the year, with all the major national economies growing at a faster-than-expected rate. This may well mark the end of a difficult period – we expect that growth conditions will continue to improve over coming months as real incomes recover and the ECB starts to ease policy. However, it’s likely to be a case of moderate recovery this year rather than a rapid rebound with the overall monetary policy stance set to remain restrictive.

- While headline inflation remained unchanged in April at 2.4%, it is notable that the services rate has now started to decrease. This is encouraging and we are still confident that the overall disinflation process has further ground to run despite the good news on growth.

The recovery has started – and it should have legs

The latest national accounts releases have confirmed the recent survey signals suggesting that the euro area economy has started the year on a much firmer footing. The preliminary estimate of Q1 GDP growth came in at 0.3% Q/Q, above both the consensus (0.1%) and our own expectations (0.2% – see here). It was good news across the board with the euro area’s four largest economies all posting growth of at least 0.2% (see below for individual comments on each).

Our view on the European economy this year has been fairly upbeat (see here). We think that growth conditions are set to continue to improve over coming quarters as households’ real purchasing power recovers and the ECB starts to ease policy. Indeed, consumer and business sentiment indicators have generally picked up at the start of Q2. That means that these Q1 GDP figures could well be an inflection point. After an extended period of stagnation after post-pandemic rebound effects faded, the worst now looks to be over. The euro area economy has managed to navigate the energy crisis and period of rapid monetary tightening without experiencing a sharp, protracted downturn.

Chart 1: Growth across the board

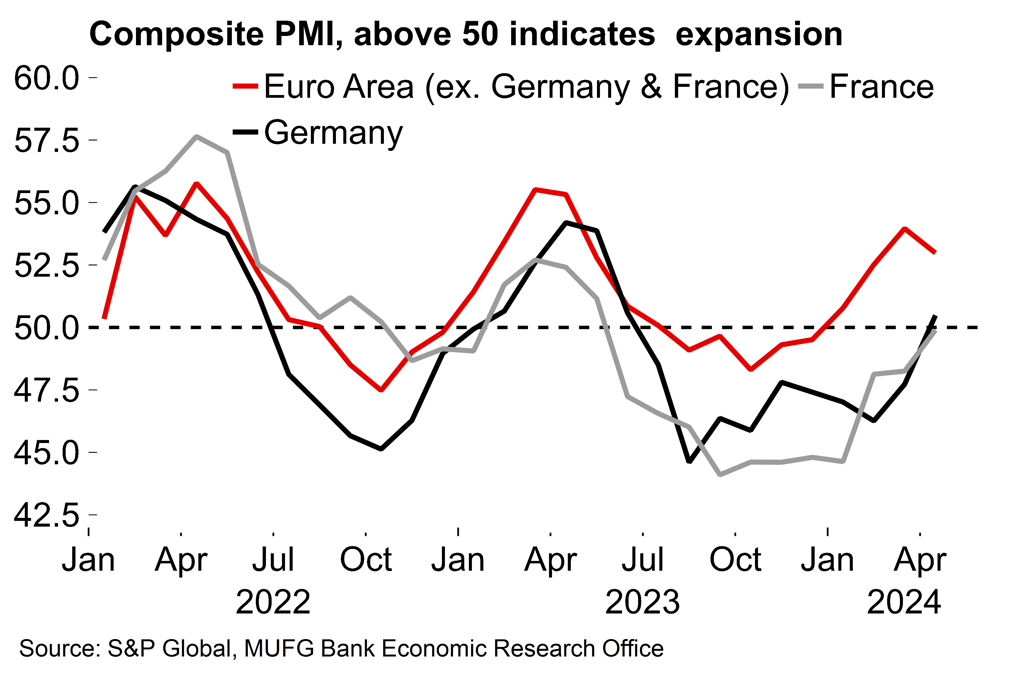

Chart 2: Surveys suggest momentum will be maintained

Not hot enough to derail the disinflation process

That said, we’d stress that the overall picture is likely to be one of moderate growth from here rather than a rapid recovery. We don’t see much scope for growth to sustainably exceed potential. Monetary policy will remain restrictive even if policymakers start to cut rates and there is pressure on some governments to implement a degree of fiscal consolidation after support measures shielded households and firms from the energy shock. Meanwhile, there are also longer-term, structural issues (see e.g. comment on Germany below) that should continue to weigh on European industry. External conditions may change too: despite the strength of recent data, our US economist notes that high interest rates, depleted household savings and deteriorating credit conditions suggest that US growth is on course to slow later this year.

All told, the risks of an ‘overheating’ European economy still seem limited. This is significant for the disinflation process. Data released today also showed that headline euro area inflation remained at 2.4% in April, with the drag from energy moderating. However, core inflation decreased from 2.9% to 2.7% and, significantly, the services component eased to 3.7% after five consecutive months stuck at 4.0%. The path for headline rates could be a little bumpy over coming months with various distortions at play (such as the introduction of the national travel pass in Germany in May last year). Nonetheless we remain confident in the overall disinflation process and suspect that headline inflation may dip below the ECB’s target in H2 this year.

Country-by-country: Good news across the board

Germany – The consumer rebound is still to come

The German economy comfortably avoided recession after with 0.2% Q/Q growth in Q1 (cons: 0.1%). The expenditure breakdown is not yet available, but the release stated that growth was driven by construction investment (probably helped by the mild winter) and exports. It was also noted that there was a decline in household consumption, but we expect that will change over coming quarters. Today’s retail sales release for March showed stronger momentum at the end of Q1 (+1.8% M/M) and consumer confidence rose sharply in April to a 26-month high. As with the euro area as a whole, we expect consumer spending will be the key growth driver this year in Germany over coming quarters.

There have also been encouraging signs of some cyclical improvement in the industrial sector in both hard data and more recent survey evidence. That said, longer-term, structural challenges will remain: fierce global competition, uncertainty related to the war in Ukraine, relatively higher energy costs and limited supply of skilled workers. We expect that these factors will contribute to the German recovery continuing to lag behind that of the euro area as a whole.

France – Better news on domestic demand, but fiscal pressures remain

The French economy also expanded by 0.2% Q/Q (cons: 0.1%). The expenditure breakdown showed solid household consumption growth (0.4% Q/Q) and decent investment (0.3% Q/Q), but a flat contribution from net trade. Recent survey evidence does not point to acceleration in Q2, but the pattern of muted growth overall is set to continue.

One area of concern is the budget deficit (5.5% of GDP in 2023) after widespread measures to limit the effects of the energy crisis. The government has indicated that it will implement spending cuts so that the deficit will fall to the EU 3% target. So, while the economy looks in reasonable shape at the start of the year, fiscal tightening is set to become a drag on activity further down the line.

Italy – Export-driven growth in Q1 but construction may become a drag

Growth in Italy came in at 0.3% (cons: 0.1%). The brief release noted that net exports contributed positively but there was a drag from inventories. Looking ahead, better household income conditions should help support consumer spending and overall growth over coming quarters, and, as with Germany, we expect some cyclical improvement in the industrial sector. The EU’s recovery fund will also continue to support the Italian economy. However, there is likely to be a drag from construction after the phasing out of the ‘superbonus’ scheme of tax credits for home renovations. That was a costly programme for the government and contributed to a budget deficit of 7.4% of GDP in 2023. Better growth in Q1 gives the government more leeway but difficult decisions on spending may have to be taken later on.

Spain – Still a bright light in the euro area economy

The Spanish economy continues to motor along with growth of 0.7% Q/Q. This was largely driven by external demand. Monthly tourist arrivals have now surpassed the pre-pandemic averages – and there’s scope for further gains as real income growth continues to recover elsewhere in Europe. Domestically, consumer spending expanded by a more moderate 0.3% Q/Q but we expect better figures over coming quarters. The Spanish economy, which was less exposed to the energy shock and is benefitting from spending related to the EU recovery fund, is set to continue to outperform the euro area as a whole, although the gap could close a little. Risks related to political uncertainty have also decreased after PM Sanchez announced yesterday that he will remain in his post after having raised the possibility that he could resign.