- There’s still no clear evidence of stronger euro area growth since the turn of the year. With survey data remaining subdued, the recovery looks likely to materialise more slowly than previously expected. We have revised our 2024 GDP growth forecast down to 0.4%.

- Euro area inflation fell from 2.8% to 2.6% in February. This was a smaller decrease than expected amid some worrying signs of stickiness in the services component.

- The ECB will look to retain the current flexible, data-dependent setting at next week’s policy meeting. While there hasn’t been much in the data in recent weeks to support the case for earlier easing we are still confident that the path to rate cuts should clear by mid-year as evidence of easing wage growth is set to build.

- Next week will also see the UK Budget event. Some cuts to personal income tax rates are likely, but the bigger picture remains one of a rising tax burden in the UK due to fiscal drag.

Evidence continues to point to subdued activity at the start of the year

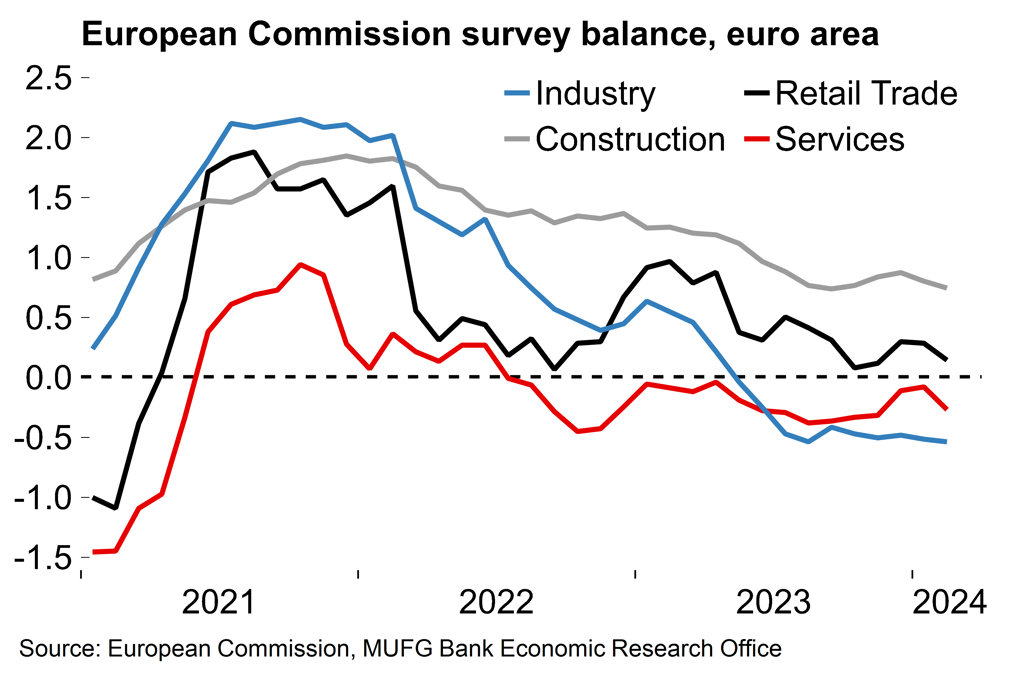

While there was slightly better news for the services sector in last week’s flash PMI release, our overall take was that evidence for any imminent rebound in the euro area activity remains limited (see here). Data this week continued to support that view with the European Commission’s overall economic sentiment indicator softening in February. Confidence in the services component deteriorated, marking a contrast to the signal from the PMIs, but weakness was broad-based with deterioration in sentiment in industry, retail and construction as well. Consumer confidence edged higher but remains at a weak level overall.

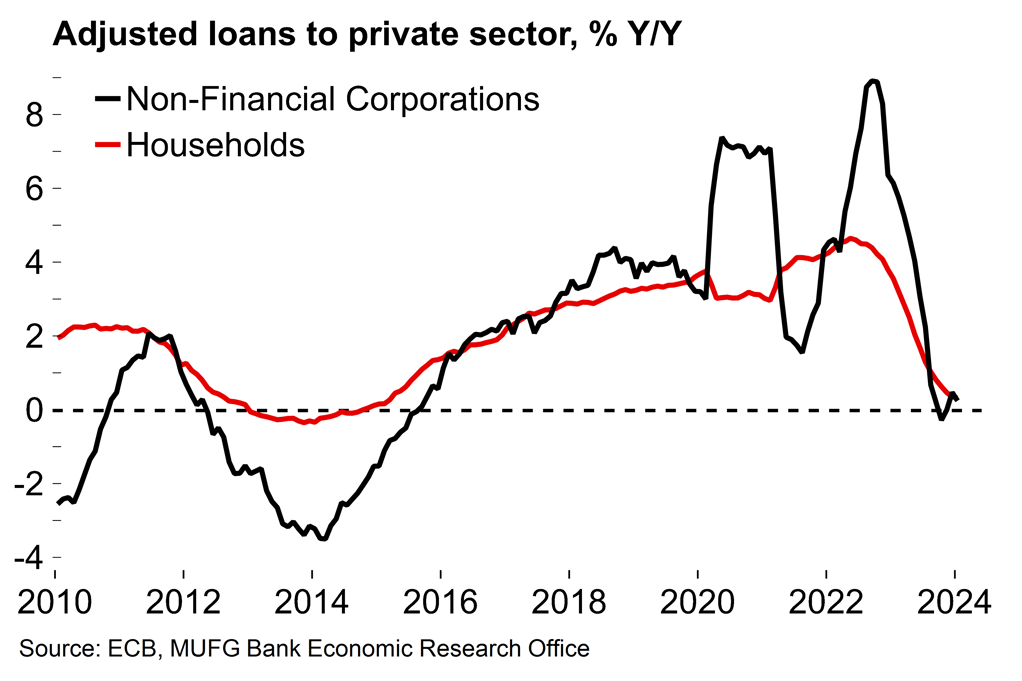

There is also the risk that changing expectations for monetary easing could become a headwind to improving sentiment in the euro area. Market participants are now pricing in fewer than four ECB rate cuts in 2024 – that’s down from six and half at the start of the year. Past tightening continues to dampen loan growth with this week’s credit data showing that lending remains broadly flat to both firms and households. The latest ECB bank lending survey (here) suggested that banks will continue to tighten credit standards in Q1 this year.

Releases this week also showed that German retail sales fell by 0.4% M/M in January (after a similar fall in December) and consumer spending in France also contracted at the start of the year. The German labour market continues to ease with the claims rate rising again in February, to 5.9%.

Despite these latest figures, we remain of the view that consumer spending will drive better quarterly growth figures later in the year as real household disposable incomes recover. There may be better news for the beleaguered manufacturing sector as the inventory cycle turns. But evidence for any immediate recovery remains limited as it stands. The euro area economy may have dodged technical recession in Q4, but the overall picture remains one of stagnation – and that seems likely to have remained the case at the start of 2024.

So it seems that the euro area recovery could be more muted and slower to materialise than previously thought. We are tracking GDP growth at 0.0% Q/Q again in Q1 this year before activity picks up more meaningfully in H2. Our current forecast for annual average growth in 2024 is 0.4%, which we have revised down from the 0.7% we had in our previous quarterly update in December.

Chart 1: The ESI deteriorated in February

Chart 2: Loan growth is broadly flat

The disinflation process has slowed with worrying stickiness in the services component

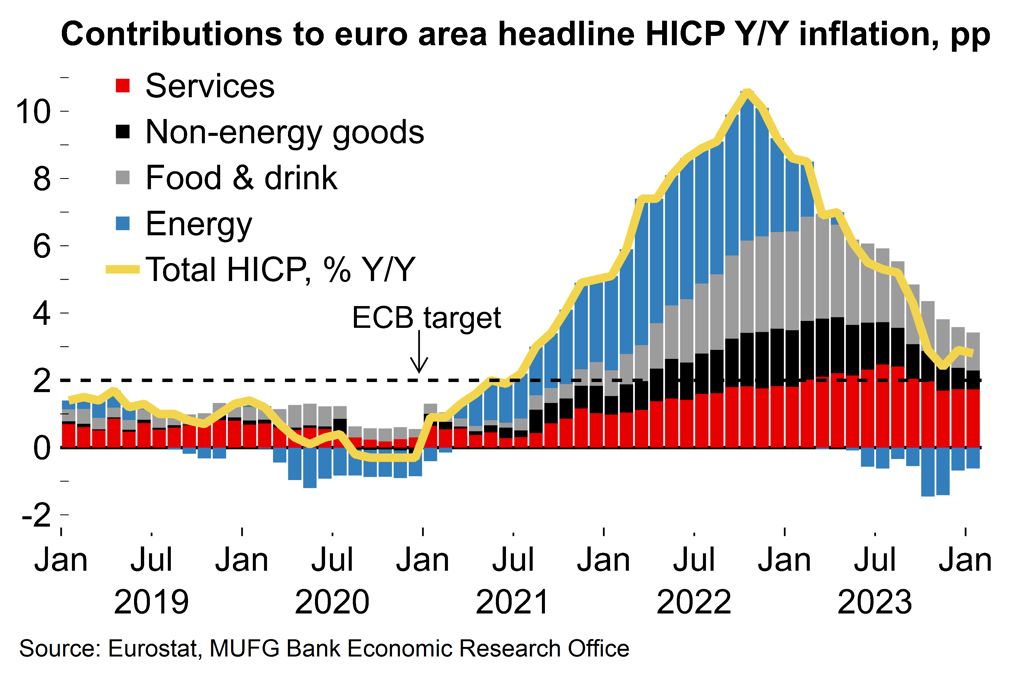

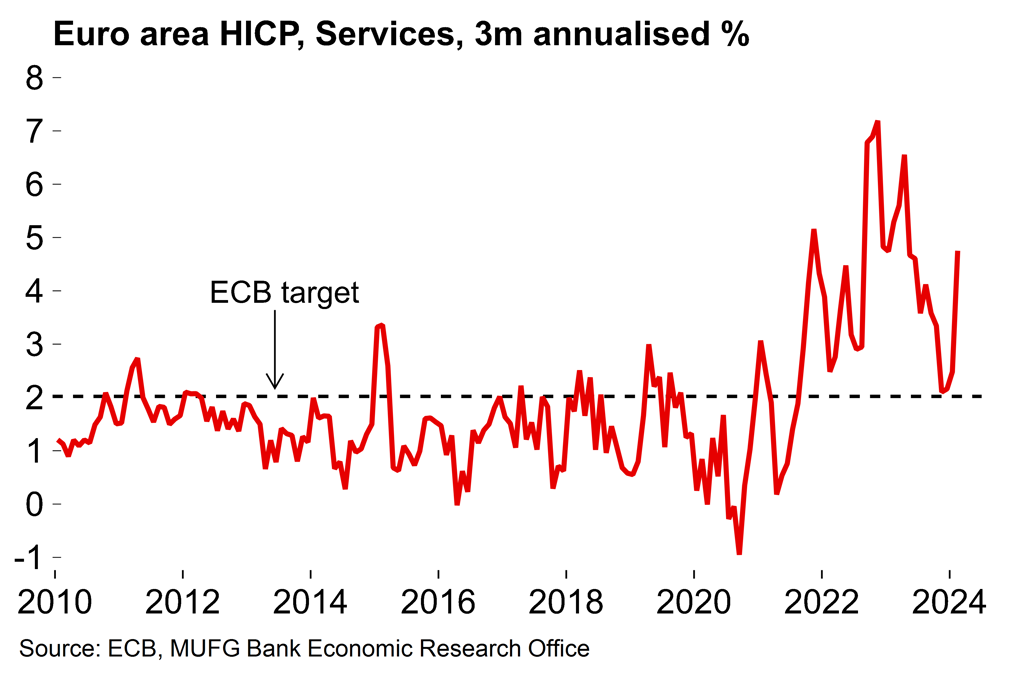

Today’s flash HICP release showed that euro area headline inflation fell from 2.8% to 2.6% in February, while the core metric fell from 3.3% to 3.1%. The consensus was for a stronger decline in both so the print will raise concerns about the persistence of underlying inflation pressures. While the non-energy industrial goods component decreased from 2.0% to 1.6%, there was little to allay concerns about sticky services inflation – the rate only ticked down to 3.9%. On a 3-month annualised basis, services inflation rose sharply to a nasty-looking 4.8% (ECB’s seasonal adjustment).

Looking ahead, we retain our view that the overall disinflation process will continue, albeit at a slower pace than last year. There was some more encouraging news in the European Commission’s economic sentiment release mentioned above. After having increased since September, selling price expectations in the services component fell back in February. The industry equivalent remained broadly unchanged providing further evidence that the effect of disruption in the Red Sea on prices in Europe remains limited. Meanwhile, input price data suggests that the contribution from the food component to overall HICP inflation will to continue to fade. All told, we expect headline euro area inflation will average around 2.2% this year.

Chart 3: The disinflation process has hit a stumbling block

Chart 4: Services inflation looks sticky

ECB preview – Still in ‘wait-and-see’ mode

The minutes of the previous ECB meeting noted that “the disinflationary process was well on track” but “the pace of wage growth remained elevated”. The overall picture is essentially one of a central bank that seems quietly confident that its policy is working, but is looking to err on the side of caution before saying ‘job done’ on inflation.

A significant change in tone seems unlikely at next week’s policy meeting. Last time out Lagarde emphasised that the central bank will be “data dependent” rather than “date dependent”. The news has since been mixed. Negotiated wage growth eased slightly in Q4, to 4.5% Y/Y, and headline inflation has edged lower. On the other hand, there was an ugly services inflation print (as noted above) with the 3m annualised rate increasing sharply to 4.8% in February. But, overall, the data flow since January hasn’t produced any significant shocks – there hasn’t been anything that notably increases the chances of an imminent rate cut. This means that the ECB can maintain its current holding pattern and ‘wait-and-see’ approach.

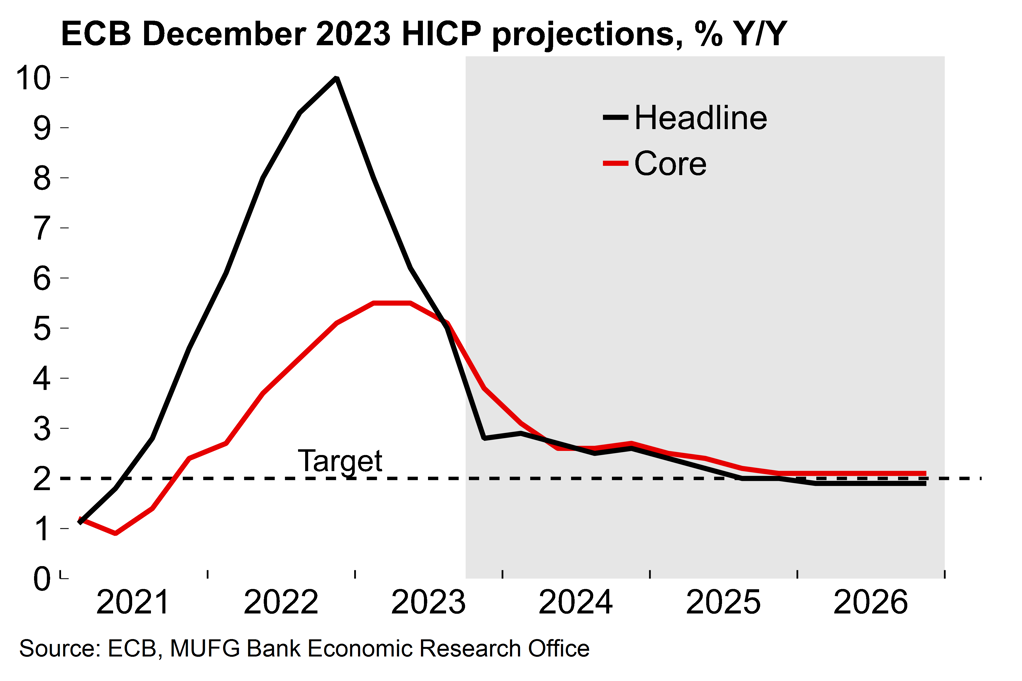

Chart 5: The ECB will likely revise its 2024 HICP inflation projections lower

Chart 6: Market expectations have shifted significantly since the last ECB policy meeting

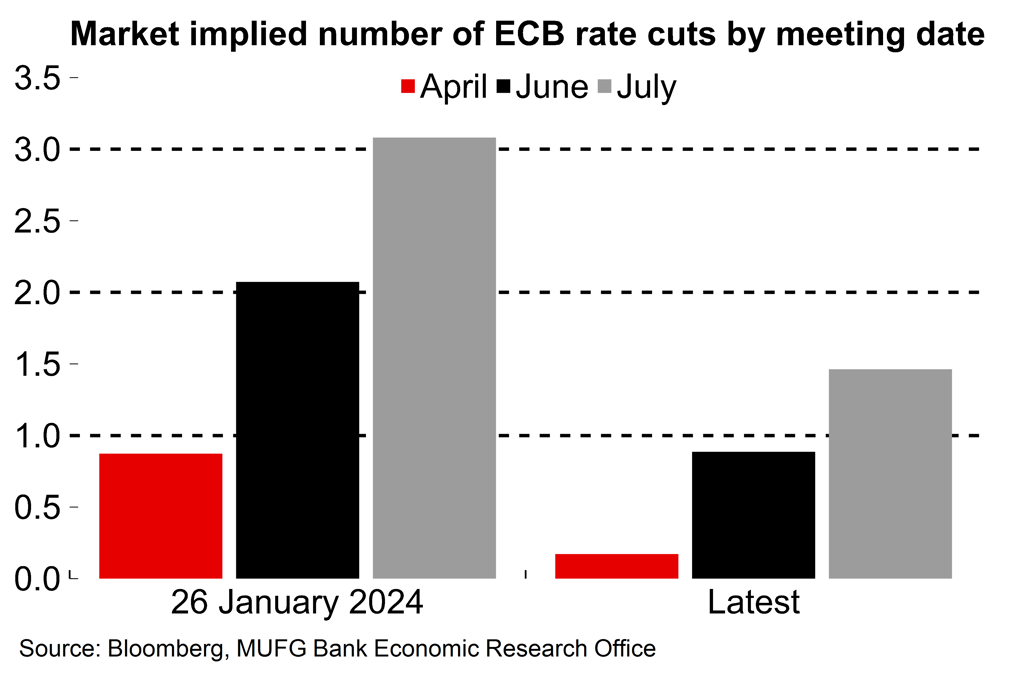

Against that background market participants are now pricing in around three and a half rate cuts in 2024, which is roughly two fewer than at the time of the previous policy ECB meeting. We suspect that most ECB policymakers will be satisfied with the shift in market expectations for less in the way of easing this year and will be keen not to jeopardise it with any substantial shift in communication.

In terms of timings, market participants now see June as the most likely point for an initial rate cut. We noted previously how ECB chief economist Philip Lane had highlighted that there will be “important data” on wage growth available to the central bank by June – and that this mention a specific month felt like a significant intervention (see here). If wage pressures continue to ease (as seems likely based on available national data) and services inflation starts to move more decidedly in the right direction (which we still assume will be the case) then the path to an initial cut in June would seem clear. An earlier move, i.e. in April, would probably now require a range of data to move considerably in the right direction.

Next week’s meeting will also see a fresh batch of ECB GDP and CPI projections, and we expect lower 2024 numbers for both. The ECB’s December update had GDP growth of 0.8%. With momentum remaining weak at the start of the year (see above), we currently look for 0.4%. On HICP, the ECB projection was for 2.7% in 2024. Since December there has been better news on wholesale energy prices and, while the February HICP number was a little higher than expected it is still consistent with headline inflation considerably undershooting the ECB’s previous forecast (note that the cut-off date for the projections was before the February HICP release). We currently look for an average euro area HICP rate of 2.2% in 2024.

Again, these likely downward changes to the GDP and CPI projections probably wouldn’t change too much in terms of the policy outlook. The focus remains on underlying inflation pressures and shifts in energy prices will be discounted to a large extent. Meanwhile, the fact that the economy avoided the expected technical recession in Q4 last year probably reduces pressure from some quarters on policymakers to ease policy and may give the central bank a bit more scope to continue its ‘wait-and-see’ approach for a while longer. Further ahead, in the absence of a negative shock, we continue to expect a relatively cautious/moderate pace of monetary easing from the ECB given the backdrop of a still-tight labour market.

Next week – Fiscal giveaways in the UK with an election on the horizon

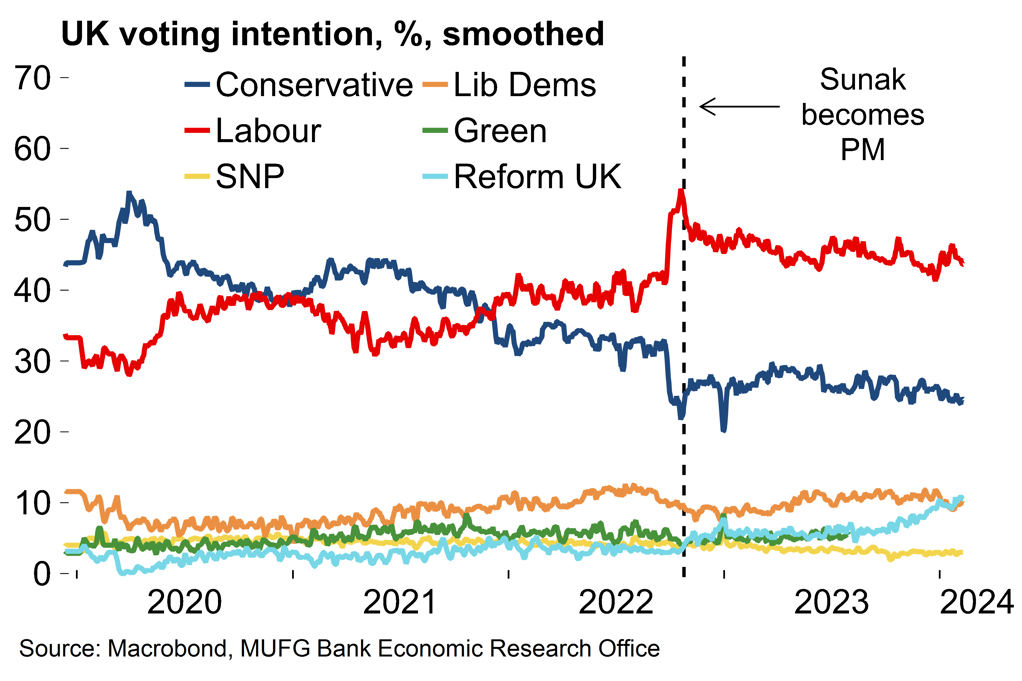

As well as the ECB meeting next week’s focus will be on the UK Spring Budget event. The governing Conservative party is trailing in the polls and the next election must be held by January 2025 (but autumn this year remains the most likely timing to our minds). Against that background, some personal income tax cuts were announced in November last year, and the indications are that there’s more to come next week. The government has limited fiscal leeway but there is still scope for another decrease, probably via the national insurance rate.

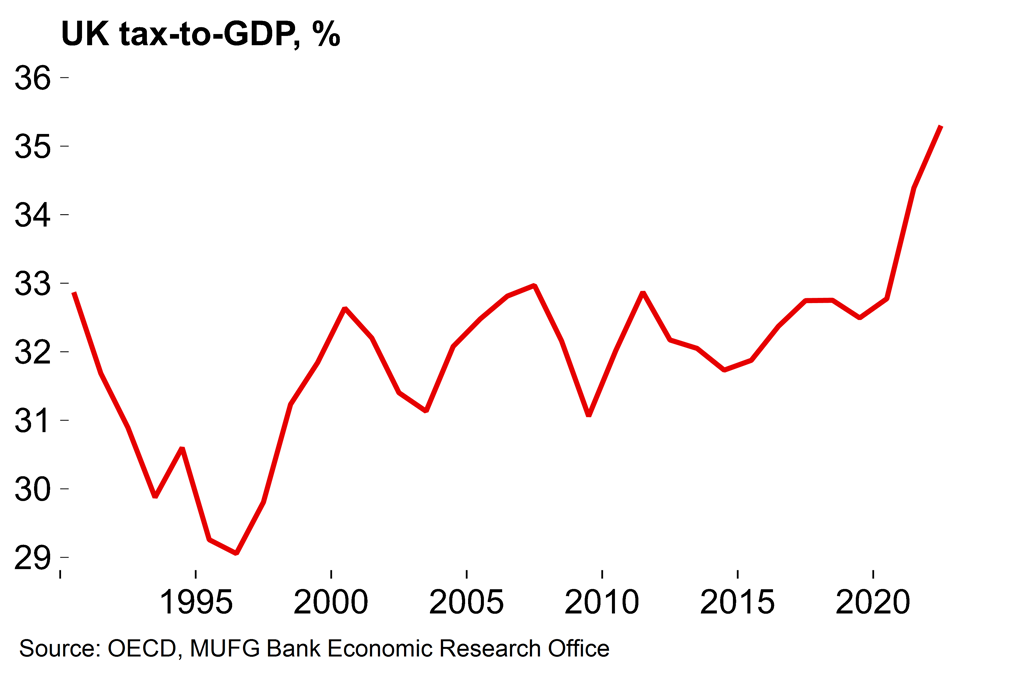

This would be positive for UK growth at the margin and is factored into our expectations for better quarterly growth rates later in the year. However, the bigger picture is that the tax-to-GDP ratio in the UK has risen sharply as payment thresholds have been frozen rather than uprated with inflation and more taxpayers have been dragged into higher rate brackets (i.e. fiscal drag). With thresholds set to remain frozen, the tax burden will likely rise further in coming years even if some decreases to some rates are announced next week.

Chart 7: The UK tax burden has surged in recent years as payment thresholds have been frozen

Chart 8: No clear sign of strengthening support for the governing Conservatives

Key data releases and events (week commencing Monday 4 March)