- US election: It’s unclear to what extent Trump’s campaign rhetoric will translate into actual policy but our current base case is that the US will go ahead with tariffs on EU goods in some form by mid-2025. The direct impact on the euro area economy would likely be small but heightened uncertainty is set to weigh on confidence. Our initial estimates point to a 0.4pp impact on growth.

- German politics: The collapse of the German governing coalition has paved the way for early elections and a period of uncertainty around the turn of the year. Given that recent economic stagnation has coincided with a fraught political environment and ineffective policy direction, any subsequent return to some stability and a functioning government (we stress this is not guaranteed) would be net positive for the outlook. A radical reset on government fiscal support or EU integration still looks unlikely despite the range of long-term structural challenges.

- Bank of England: With another cut yesterday, the BoE seems to be following a default path of rate cuts at its quarterly projection meetings. The MPC would likely be divided around any acceleration in easing, even if wage growth continues to ease as we expect. Policymakers are still digesting the full inflationary implications of both the UK Budget last week and the US election which increases uncertainty.

The euro area economy and Trump – our initial thoughts

Trump’s re-election clearly poses downside risks to euro area growth. As we set out in our pre-election note on the implications for Europe from Trump 2.0 (here), the most significant channel is tariffs and trade uncertainty.

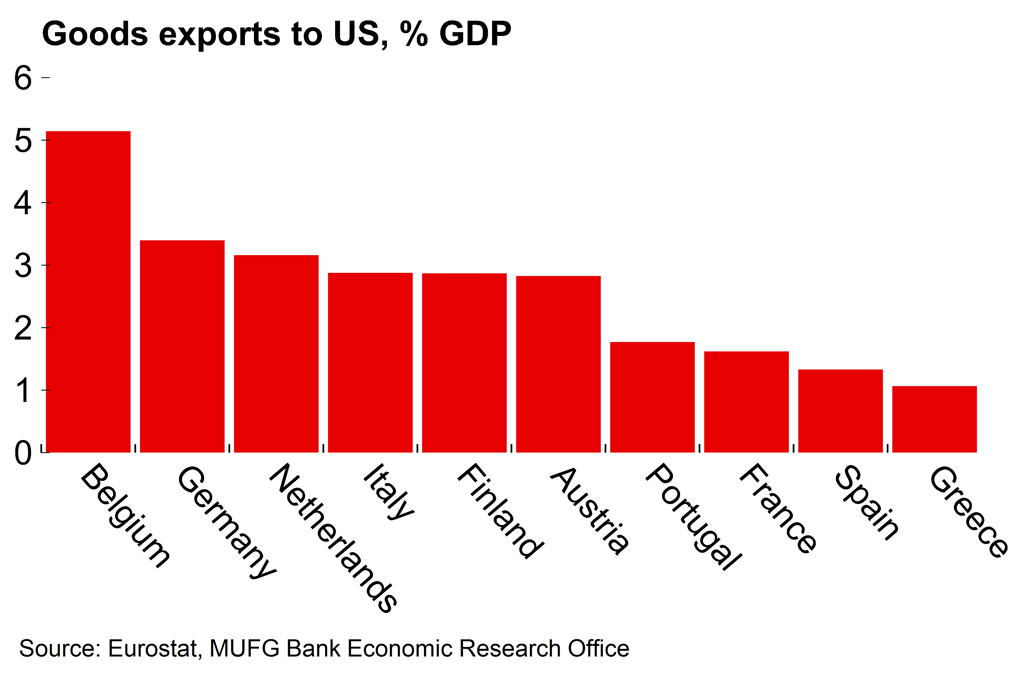

It is unclear to what extent Trump’s campaign rhetoric will translate into actual policy. Our base case is that the US will go ahead with tariffs in some form by mid-2025. We see no reason why Europe would escape the crosshairs – and indeed the EU, with its widening goods surplus with the US, may well be the most significant target after China and Mexico. The EU would likely respond swiftly and proportionately while working to avoid further escalation.

We estimate that the direct, static effect from limited US tariffs on the euro area economy would be small. But it is highly likely that the majority European manufacturers would remain wary of a shift towards higher tariffs, which would continue to weigh on sentiment. There are a wide range of sub-scenarios which include a global rise in tariffs between the US, EU and China and a sharp increase in uncertainty around global protectionism is certainly significant. We also expect that heightened geopolitical uncertainty will weigh on sentiment given ambiguities around future US foreign policy. While Trump has said that he could swiftly broker a settlement between Russia and Ukraine, any deal would need to be credible and durable to see any boost to confidence.

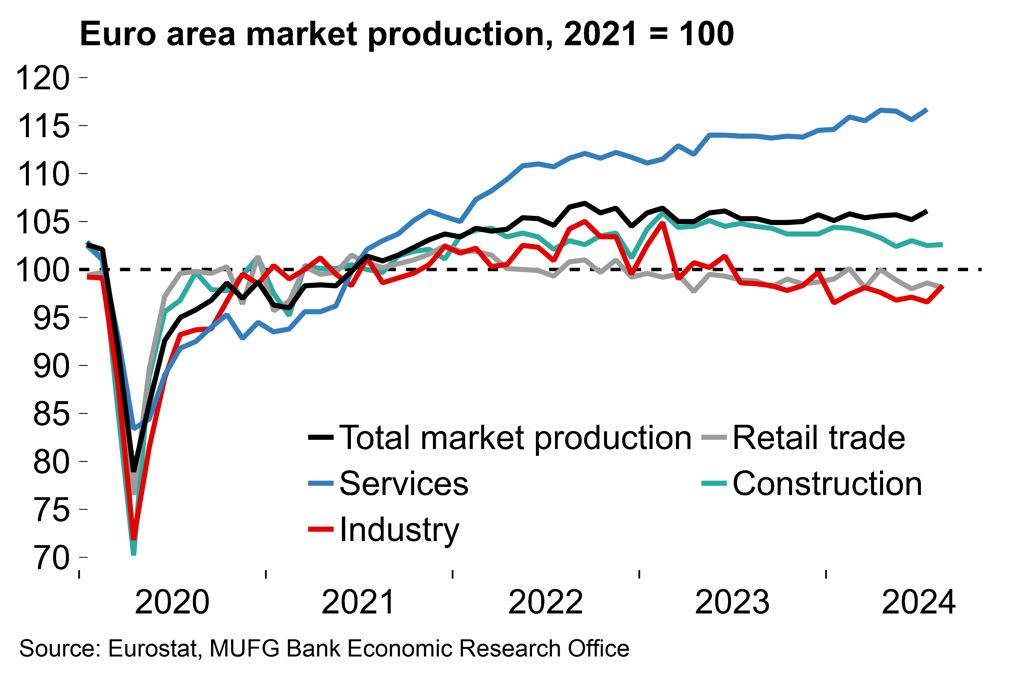

As we set out last week, we may be seeing early signs of cyclical improvement in Europe (see here), but it is a fragile recovery and manufacturing sentiment remains particularly weak. Germany, with its open and manufacturing-orientated economy, is especially vulnerable to second-round effects. The labour market has been broadly resilient to the multi-year industrial slowdown. With difficulties in recruiting appropriately skilled workers, it is likely that German manufacturing firms have ‘hoarded’ labour and avoided redundancies in the hope that demand conditions will eventually turn around. US tariffs could be the trigger for firms to push ahead with lay-offs – the decision taken by Volkswagen last week to close factories and reduce headcount looks ominous in that regard – and, in turn, that could tip the German economy into a more serious slowdown. Yesterday’s industrial production figures for September were not encouraging (-2.5% M/M).

So, despite the limited direct effects of tariffs we think that the second-round effects on confidence and the labour market will be significant. We are in the process of revising our GDP forecasts but our initial estimates point to a possible impact on euro area growth of around 0.4pp next year. However, our current forecast of 0.7% for 2024, which we’ve held since last December, still looks valid following the upside surprise in Q3 which will work to offset likely weakness in the last quarter of the year.

Chart 1: A wide range of exposure to US trade by country

Chart 2: Euro area industry is stuck in the doldrums

An early election in Germany looks net positive provided that a government can be formed quickly

Germany’s centre-left traffic light coalition has blinked to a halt. Chancellor Scholz dismissed Christian Lindner, the finance minister from the liberal FDP party, after a dispute over a shortfall in next year’s budget. Scholz’s SPD party aims to continue to work with the Greens in a minority government until a confidence vote in January. That is likely to fail. Unless a majority can be found for an alternative chancellor, it would set up a snap election by late March 2025 (the next election is otherwise scheduled to be held in September 2025).

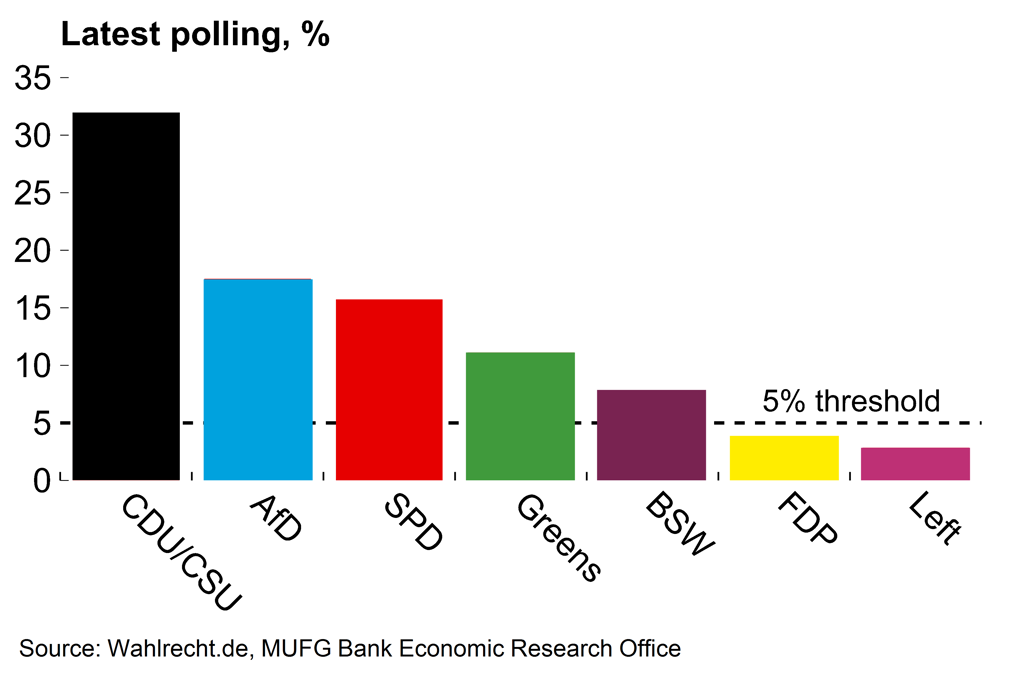

On current polling, a grand coalition (CDU/CSU & SPD), which has many precedents, looks the most plausible outcome. CDU/CSU has around a third of the vote share and as it stands CDU leader Friedrich Merz looks well set to be the next Chancellor. His party has ruled out working with the hard-right AfD party, which is on around 17%, while both the FDP and the Left look set to fall short of the required 5% for seats on current polling. That means that the CDU/CSU and the SPD (~15% currently) would together reach the threshold for a majority. However, we’d stress that uncertainty is high following the sudden collapse of the government and subsequent recriminations, and there could be a shift in polling prior to a vote. The government formation process may prove to be slow which would further weigh on already-weak business confidence.

Taking a wider view, it’s clear that the governing coalition had struggled to contend with clear divisions and weak popularity. The fraught political environment and ineffective policy direction has coincided with a period of economic stagnation. Given the emergence of long-term structural issues, especially in industry, the policy vacuum has been suboptimal. A functioning government and increased political stability would clearly be positive in that regard (but to be clear, this is not guaranteed – it is plausible that a three-party coalition would be required again for a majority, which could be inherently unstable and fractious).

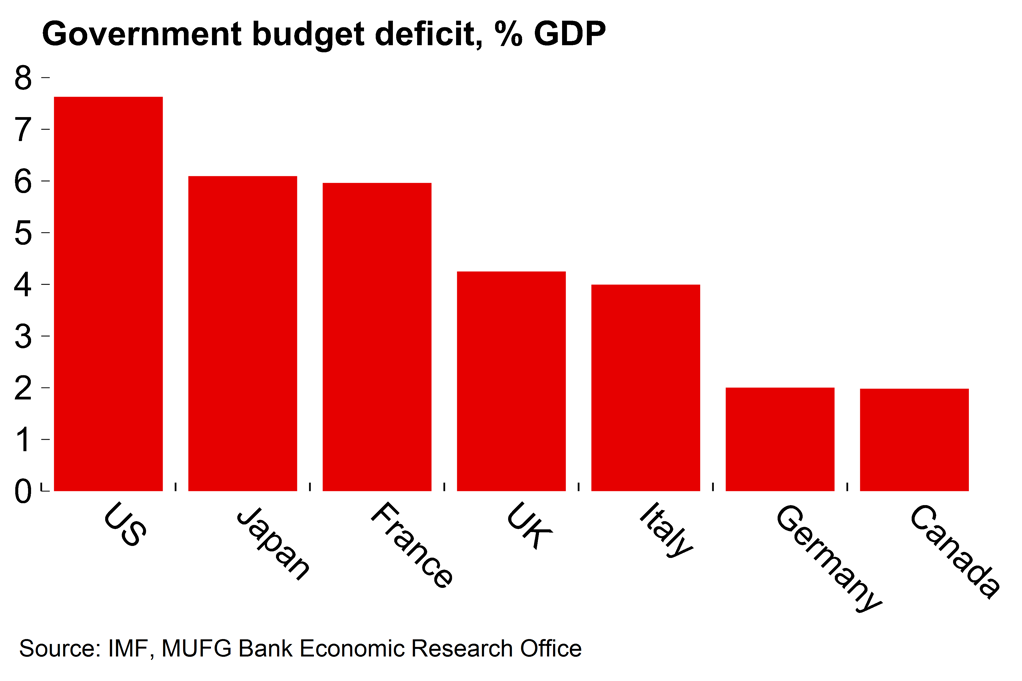

A new government with a mandate would also offer the opportunity for a policy reset and stronger leadership, both of Germany and within the EU. However, Merz is unlikely to push for significantly deeper EU integration. He is also vehemently opposed to the issuance of further joint EU debt, which had been suggested in the Draghi report. Domestically, we doubt that there would be any meaningful relaxation of the debt brake (which limits new borrowing) under a CDU/CSU-led government, reducing the scope for more active support for industry. Merz has said that he favours more military support for Ukraine, which may be significant following the US election result, but a meaningful increase in defence spending would be hard to achieve in a constrained fiscal backdrop.

All told, we believe that a period of uncertainty around the turn of the year is preferable to the alternative of weak government and inertia through most of next year, provided that a government can be formed relatively quickly. A radical policy reset seems unlikely – but a return to political stability and functioning government, if that is indeed that follows the election, would still be positive for the outlook.

Chart 3: The CDU/CSU looks set to lead the next government

Chart 4: Germany has clear scope to increase fiscal support

Bank of England review: Business as usual, for now

The Bank of England cut rates by 25bp to 4.75%, as expected. The statement noted “continued progress in disinflation” and that the “labour market continues to loosen”. The guidance was mostly unchanged: “a gradual approach to removing policy restraint remains appropriate”. Governor Bailey also said that “it is likely that interest rates will continue to fall gradually from here”.

The key word is ‘gradual’. The BoE seems to be following a default path of rate cuts at its quarterly projection meetings. There is a sense that policymakers are still digesting the full inflationary implications of both the UK Budget last week and the US election. Against that background, a back-to-back move in December looks unlikely, but the BoE has left itself some flexibility to act if data over coming weeks were to surprise significantly on the downside.

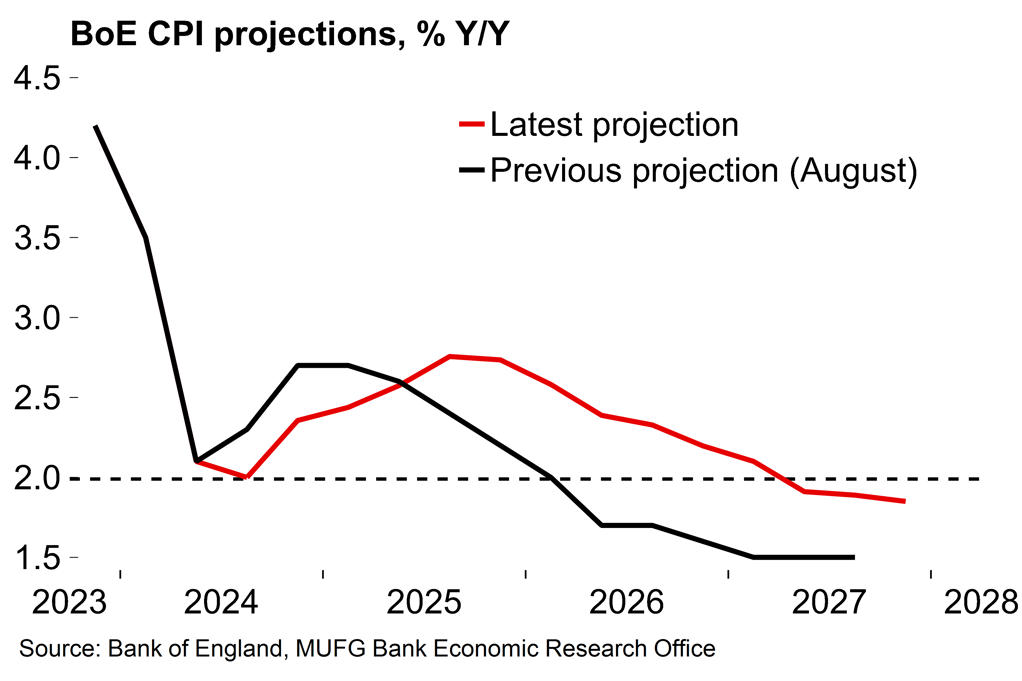

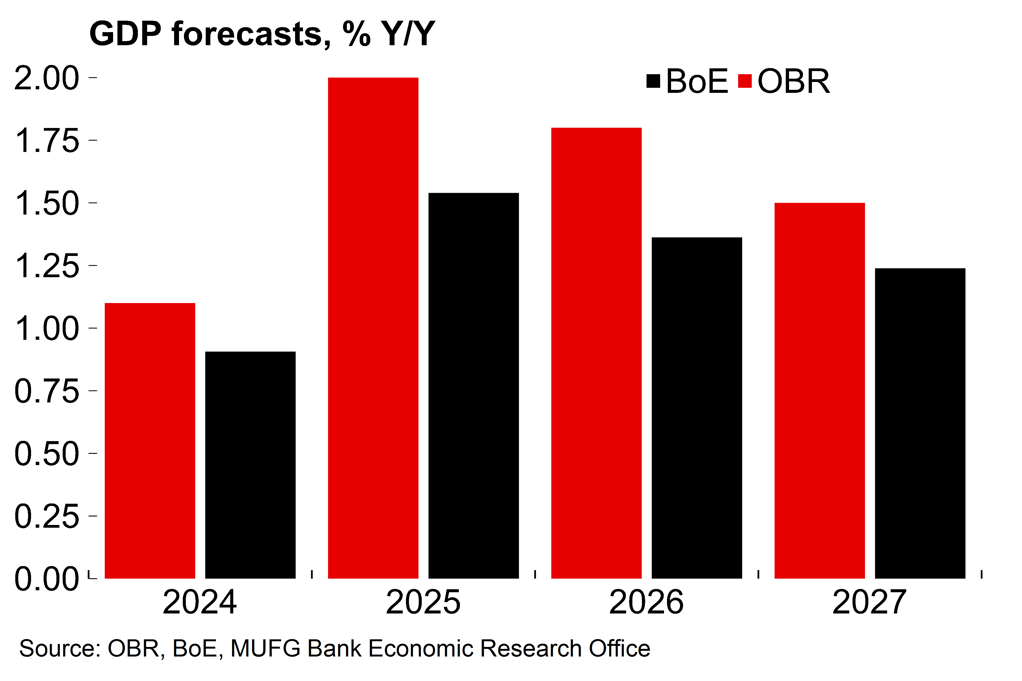

The updated projections consider the government’s new fiscal measures (see here) and suggest that the BoE broadly shares the OBR’s assessment of the inflationary consequences of the Budget. The BoE has revised up the 2025 CPI forecast by 0.5pp relative to the August numbers, to 2.75%. However, that takes into account a lower starting point after recent downside surprises on inflation. More importantly, the forecast is conditioned on the market profile for rates from before the Budget announced and subsequent market repricing. This implies that the BoE would now estimate a lower profile for inflation. The BoE has also revised its GDP forecast higher (1.5% in 2025) but is less optimistic on growth than the OBR across its projection horizon.

Chart 5: New BoE projections reflect better near-term news on inflation but front-loaded fiscal stimulus ahead

Chart 6: The BoE is less optimistic on growth than the OBR

The BoE emphasised that there is uncertainty around the impact of the government’s new fiscal measures. As we noted in our preview, the most significant tax shift (the increase in employer national insurance contributions) could result in higher prices charged (i.e. higher inflation), or it could result in lower profit margins, lower private sector wage growth and lower employment – all of which would have a dovish impact on the monetary policy outlook. The BoE is holding back from making a firm interpretation for now.

However, at look at recent communications confirms that the BoE is treading carefully. Just two weeks after the BoE’s decision to remain on hold in September, which came with unchanged guidance for “gradual” easing, Bailey talked about the possibility of more a “activist” and “aggressive” approach. There was no suggestion of any such shift at yesterday’s meeting – with the implication being that the front-loaded increase in government spending announced last week may have blindsided policymakers to an extent.

Turning to the US election, tariffs were not mentioned in the statement or the monetary policy report and Bailey said that the BoE would not respond until policies are announced. As we note in our discussion on Trump and the euro area above, we believe that new US tariffs on European goods in some form are more likely than not. The EU may well be third on the target list after China and Mexico. In what would be a rare Brexit benefit, there is at least some chance that UK goods might escape new tariffs if measures are targeted rather than universal. At any rate, the UK’s relatively high share of services exports to the US (around two-thirds) means that the economy is less directly vulnerable to US goods tariffs than manufacturing-orientated.

On the policy outlook, it seems to be a case of ‘business as usual’ for now at least. The vote split was 8-1 and we think there is a broad consensus to continue with the current, gradual pace of easing. Decision-making may well become more complicated over the coming year and the MPC would likely be divided around any deviation from what looks like a default path of quarterly cuts, even if wage growth numbers continues to fall as we expect and the underlying disinflation process remains intact. The Budget will certainly provide more ammunition for the hawks who will fear the effects of fiscal loosening in an economy with little spare capacity.

Further ahead, there’s also likely to be a wide range of views about the ‘neutral’ rate (and the uptick in government investment has added more uncertainty to this). We continue to expect that rates will fall below 4% next year but decisions the vote split is likely to be narrower as we approach that mark.